Did you know that your business address matters when it comes to starting business credit? Your address matters. And there are other things that can make a difference. Here’s how you can start off on the right foot when it comes to business credit. Your Business Address, and 5 Other Things You Didn’t Know Make … Continue reading Starting Business Credit – Why Your Business Address Matters

Tag: Business

Starting Business Credit – Why Your Business Address Matters

Did you know that your business address matters when it comes to starting business credit? Your address matters. And there are other things that can make a difference. Here’s how you can start off on the right foot when it comes to business credit.

Your Business Address, and 5 Other Things You Didn’t Know Make a Difference When Starting Business Credit

When you first start a business, you may not be thinking about anything other than how to pay for it and how to get customers. Many businesses start small from home. They operate in either an extremely intimate area, or they work mostly online. Social media-based businesses have exploded in recent years.

That being the case, new business owners often simply use their home address as their business address. It’s the easiest thing to do, and makes sense after all. I mean, if you are running your business out of your house, why wouldn’t you use your home address?

What frustrates you the most about funding your business? Check out how our free guide can help.

Looking into the future however, you are going to need to build business credit. For that, your business needs its own address, separate from your personal address.

Why Is Starting Business Credit Important?

If you have great personal credit, business credit probably never even crossed your mind. You just figure you can get all the funding you need based on the merits of your personal credit score. If your personal score isn’t the best, you may have explored other options and realize that business credit is a thing.

Here is what you may not know, either way. You cannot just apply for credit in your business name and assume that any credit you get is business credit. Unless you set up your business in a very specific way and follow a very intentional process, those accounts are going to report to your personal credit. This is true even if you apply with your business name.

Why does this matter? There are a few reasons actually. First, personal credit simply cannot handle the spending necessary to run a business. You will either exceed your limits continually or consistently hover near them. Even if you pay off your cards each month, staying near limits can affect your score negatively. It results in a high debt-to-credit ratio, and that will cause your personal score to drop.

Conversely, cards obtained on the merits of your business credit will usually have higher limits. That means more spending power. Not only that, but if there is and issue with your business debt, your personal credit will be protected because those accounts will not be on your personal credit report.

How to Get a Business Address

Now that you know why you need business credit, you need to know how to get it. Like I said, there is more to it than just applying for credit using your business name. Your business has to be set up a certain way. You also have to be intentional about getting accounts that report to business credit rather than personal credit.

For your business to be set up in a way that is conducive to building business credit, it needs to be easily recognizable as a fundable entity separate from the owner. One of the first steps toward accomplishing that is for the business to have an address different than the owner’s personal address.

The question that most business owners ask about this is, how do you get a business address that isn’t your home address if your business is in your house? Well, the obvious first option is to get a P.O. Box. That works for some things, but some lenders want to see a physical address.

Of course, if you are running a business online or from your home, you are wondering how you can do that. The answer is a virtual office.

What frustrates you the most about funding your business? Check out how our free guide can help.

What is a Virtual Office and How Does it Work?

According to Investopedia, “A virtual office gives businesses a physical address and office-related services without the overhead of a long lease and administrative staff. With a virtual office, employees can work from anywhere but still have things like a mailing address, phone answering services, meeting rooms, and videoconferencing.”

Basically, virtual offices operate as a single unit. Sometimes there is a physical location that has meeting rooms and such available as needed. However, more often it is operated solely online with a physical mailing address and other services you can use, as mentioned above. These services are ideal for those that need a physical address but do not need an actual office.

3 Stellar Options for Virtual Offices

If You think a virtual office space is best for your business, here are three top options to help get you started.

Davinci

Davinci offers a prime business address with options to hire a receptionist, book meeting space, and live chat. Prices are variable. Call for a quote or go here to learn more.

Alliance Virtual Offices

Alliance offers a physical address, office space, mail services, and phone answering services starting at $125. Go here to learn more.

Regus

In addition to virtual office services, Regus has options for meeting rooms and more. Find out more here.

What Else Matters: 5 Other Things You Didn’t Know Make a different When Starting Business Credit

Separating your business from yourself for the purpose of starting business credit takes more than having a separate business address. Here are some other steps that you must take to make your business appear fundable on its own to lenders.

You Need a Business Phone Number Before Starting Business Credit

This is for pretty much the same reason that you need a business address that is different from your own. Your address and phone number are both identifying factors that point back to your personal credit report. If you associate them with your business, you run the risk of business accounts reporting on personal credit.

Your business phone number should be toll-free, and it needs to be listed in the business directories. You can handle this at: http://www.listyourself.net/ListYourself/

You Need a Professional Business Website Before Starting Business Credit

Think about it. In today’s world, if you aren’t online do you really even exist? The first place anyone looks for anything is online. Having a business website is a must. You can’t just throw something together though. It is essential that the website be user friendly and well put together. It is almost always worth it to pay a professional to handle this. Oh, and don’t use a free hosting service. That does not look professional. Pay for hosting through a service like GoDaddy.

You Need a Dedicated Business Email Address Before Starting Business Credit

This goes along with the other separate business contact information. Don’t use your personal email address as your business email. Also, make sure your business email has the same URL as your website. A free email service such as Yahoo or Gmail will not serve you as well.

Your Business Needs to Formally Incorporate Before Building Business Credit

If you operate as a sole proprietor or a partnership, there will never be enough separation between you and your business to build separate business credit. You need to formally incorporate as either a corporation, an S-corp, or an LLC. Here is a little more information about each of these options.

Corporation

This is the most expensive option, but it also offers the most protection from liability. There is a double taxation caveat with this option that is a turn off for most. Owners pay tax at both the business level and the shareholder level. In some cases, this is the best option anyway.

S-Corp

S-Corps are very similar to corporations, but double taxation isn’t an issue. There are also limits on the number of shareholders allowed among other restrictions set forth by the IRS.

LLC

An LLC, or a limited liability corporation, is the least expensive option. It still offers some liability protection, and has fewer restrictions than an S-corp.

Each of these options serves the purpose of further separating the business from the owner when you are looking to start a business credit profile. The option you choose should be the one that best suits your needs for tax purposes.

You Need a Business Bank Account to Start Business Credit Building

Another common practice of small business owners is to use their personal bank account for business funds. While in the beginning this seems like the best option simply because it is easy, it further mingles your personal information with your business information. Not only that, but it makes separating business expenses from personal expenses at tax time very hard.

You need a separate business account. When it comes to starting business credit, this helps in two ways. First, it helps to separate the business from the owner. Also, so lenders want to see a certain balance in a business bank account before approving credit.

Other Things You Need to Know Before Starting Business Credit

In addition to the things mentioned above, there are a few other steps you need to take to set up your business for starting business credit.

The EIN Wins in the Battle of EIN vs. SSN When Starting Business Credit

And EIN is the business equivalent of a social security number. If you use your SSN to apply for credit for your business, your personal credit will get involved. By using a unique identification number specifically for the business, you ensure that your business is separate from your SSN. You can get an EIN for free here.

You Have to Have a D-U-N-S Number to Have Business Credit

Here’s why. Dun & Bradstreet is the largest and most commonly used business credit reporting agency. If you do no have a D-U-N-S number, you cannot have a business credit file with them. You definitely need a business credit profile with D & B.

Choose Creditors that Work with the SBFE

The SBFE is a not-for-profit entity that gathers data on small businesses from its members. The data is then used to compile comprehensive credit information. Lenders that are SBFE members have access to this information. They use this information to make credit decisions.

The Small Business Finance Exchange does not lend money. It also does not create or distribute credit reports. What is does do is collect information from lender members on their borrowers. That information is then passed to D&B and Equifax. This means if you are doing business with SBFE members, you know your credit information is being reported, at least to those lenders that are members of the SBFE. Find out more about the SBFE here.

What frustrates you the most about funding your business? Check out how our free guide can help.

Other Ways to Get Accounts Reporting To Your Business Credit Report

Once you have your business set up properly, you can start to build business credit. If you do not already have strong business credit, you will have to start at the bottom credit tier, known as the vendor credit tier. These are starter vendors that will offer net terms on invoices without checking your credit. Then they will report your payments to the credit reporting agencies. However, they will often want to see an EIN, business bank account, or a listing in the business directories along with a certain amount of time in business or annual revenue. This is just one reason why setting up your business properly is so important.

After you get a few of these accounts reporting, you can apply for credit in the next tier, which is the retail credit tier. These are cards that you can only use in the stores that issue them, like a Best Buy card or an Office Depot card.

Once you have several of these accounts reporting positive payment history, you can apply for cards in the fleet credit tier. Those are cards from companies like Shell or Fuelman that can only be used for fuel and auto repair and maintenance.

Get enough cards from the fleet credit tier, and you can move on up to the cash credit tier. These are the cards that do not have limits on where you can use them or what types of expenses you can use them to pay. This is the top tier, and once you hit it you will see your business credit score start to grow like a snowball rolling downhill. That is, of course, if you handle your credit responsibly.

Not Having a Business Address can Kill Your Chances of Starting Business Credit

There is so much more to getting business credit than having a separate business address. However, if you have everything you need and you do not have a business address, that lack could definitely throw a kink in the process. Remember, you don’t have to have a separate location, just a separate address. Then make sure everything else is set up to separate your business from yourself. After that, you can start building strong business credit. The funding you need to run and grow your business will be right there when you need it.

The post Starting Business Credit – Why Your Business Address Matters appeared first on Credit Suite.

You Can Have My Old Business That Makes $381,722 a Month

I was talking with my friend who works at Keap (formally known as Infusionsoft) and he was breaking down how people still make millions of dollars selling info products and ebooks.

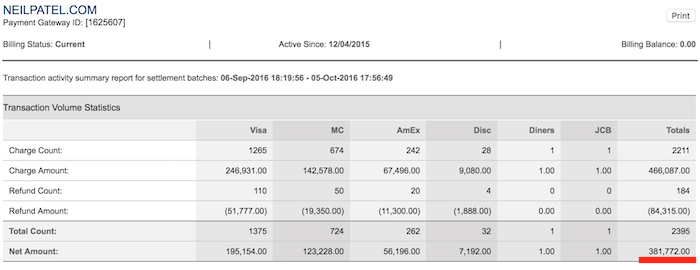

Now, I don’t sell info products as heavily as I used to, but when I focused on it 100% of the time, my numbers were great.

Just look at the screenshot above. It’s my revenue on a bad

month of selling info products.

So today, I thought I would do something different.

Instead of just blogging about marketing tactics, I thought I would share my old business model with you and give you the exact emails, power points, and everything you need so that way you can replicate my results.

Are you ready?

Step #1: Figure out what you want to sell

Don’t worry about traffic. Instead, I want you to figure out what you want to sell.

Whatever it may be, it needs to solve a problem for people.

For example, I’ve sold marketing courses that teach people

how to get more traffic. This is a problem businesses have as they need traffic

in order to generate sales.

You can literally sell almost anything online, just make sure you are passionate about it and know that subject well.

For example, Grant Cardone sells sales training. Sam Ovens teaches you how to make money through consulting. Ezra Firestone teaches you how to create an ecommerce business.

Step #2: Start creating your product

Once you figure out what you want to sell, you need to

create it. You don’t have to finish creating it, you can do that as you generate

sales.

Before you start creating anything though I want you to read

this guide by Kajabi, which specializes in online courses…

Mega-Guide

to Creating an Online Course

Here are some general rules I’ve learned about creating a handful of info products:

- People want course material in video format. Don’t

waste your time with too text-based documents or audio files. - Your videos need to be short and to the point.

People are strapped for time. - Your course should be completed within 2 or 3

months at the latest. Ideally within 6 weeks. - Include workbooks, cheat sheets and quizzes

throughout your course. You can easily create these in Kajabi.

Step #3: Create a presentation

You need to create a presentation that helps you sell your

product.

The presentation should look something like this:

If you want, you can just use my slides and modify them to

whatever product or service you are selling. You can download

my slides here.

I know looking at slides can be a bit confusing but watching

this video may also help as it breaks down the process.

Once you have created your PowerPoint, you’ll need to use a software like Webinar Jam to present to people who are potential customers (don’t worry, I’ll teach you how to get traffic in a bit).

What Webinar Jam does is make it easy for you to create a

Webinar that people can join and you can then sell them through it. That’s what

almost all of us do to sell info products… it works really well.

Step #4: Create emails and set up your CRM

Emails are key to generating income through info products.

And in order to succeed with email marketing when it comes to selling digital products, the right CRM will make all the difference in the world.

Without the right emails, you won’t do well. It’s really that simple.

There are 8 types of emails that you need to create:

- Invite sequence – these are a series of emails that invite people to watch your webinar. (here are my invite emails)

- Indoctrination – you need to build a connection with people. People are more likely to convert if they know more about you and trust you. (here are my indoctrination emails)

- No shows – just because someone signs up to watch your webinar, it doesn’t mean they will attend. For everyone who doesn’t attend, you’ll want to email them and get them to watch the replay. (here are my no show emails)

- Encore – not everyone will watch your whole webinar. If they don’t stick to the end they won’t see your offer. You’ll want a few emails that push the replay. (here are my encore emails)

- Objection handler – there are a handful of reasons someone may not buy. You’ll want to answer each of those objections through email. (here are my objection handler emails)

- Countdown sequence – you’ll want to close off your course. Letting people know that they only have a few days left to buy is a really effective way to generate sales. These emails will roughly make up 1/3 to half of your sales. (here are my countdown emails)

- Last chance email – on the last day you’ll want to send a few emails letting people know it is about to close. (here are my last chance emails)

- Free trial offer – the majority of people won’t buy from you. Offering the last chance free trial offer is a great way to roughly get 15% more sales. (here are my free trial emails)

I know that sounds like a lot of emails to create and it is, but don’t worry, just click the links above that contain the emails I used and just modify them for your product. 🙂

The key with the emails is to just not mail them out, but it’s to use automation. You can easily set that up with Keap.

The reason most of us marketers use Keap (aside from being a great and efficient tool) is because it connects with other tools that help us maximize our email revenue while also providing the most flexibility.

The flexibility you’ll gain by using Keap will help you make more money. Here’s what I mean:

- PicSnippets – for you invite sequence emails you’ll want to use a customized image that has someone’s name in it. Just like how the image above has “Ben’s” name in it. And it dynamically changes to the person’s name.

- Plus This – during the objection handler sequence I typically text everyone who watched the webinar with their “first name?”. Plus This automatically does this and what you’ll find is when you text someone their first name they will usually text back with “who is this?”. That’s when Plus This automatically responds with “Hey this is Neil Patel, I just wanted to thank you for watching my webinar. I wanted to follow up and see if you had any questions or if I can help answer anything for you.”. You’ll find that a lot of people will text back with questions, all you have to do is answer them and you’ll generate more sales.

- Plus This – I know I mentioned Plus This above, but you will also need it for emails related to your countdown sequence, last chance emails, and free trial offer. You want to use a countdown timer within those emails. The time should adjust based on when you send each email off and the time zone the individual is in. Plus This does all of it for you automatically.

- Collect payments – I also use Keap to collect payments. So, once I email someone, they can click a button and buy through pre-made payment pages that Keap provides you.

Step #5: Drive traffic

One of the key ingredients to making money through info products

is to have traffic.

And I know what you are thinking to… “Neil you did well because

you have a ton of traffic”.

Well, people like Sam Ovens and Grant Cardone don’t rank well on Google, yet they make 8 figures a year. They profitably sell info products through ads.

If you want to grow your traffic, go through the following

steps:

- Run your URL through Ubersuggest. Click on the “site audit” report as it will show you what to fix in order to maximize your revenue.

- Follow these 19 advanced SEO techniques.

- If you want to generate sales through Instagram like Grant Cardone, follow this article on generating 1290 followers a week.

- And if you want to generate sales through Facebook ads like Sam Ovens, this guide will give you an overview of how Facebook ads work, and here is a beginner’s guide to Facebook ads, and here are 22 ways to make your ads perform better.

- To generate info products sales through content marketing as I did, check out this beginner’s guide, here’s how to get started without spending money and here are my favorite 21 content hacks.

You now have a handful of ways to generate sales. Facebook ads are probably the quickest way to generate sales and usually, for every dollar, you spend you should generate at least 2 dollars in revenue.

If you want a longer-term approach, consider SEO and content

marketing.

And a good mid-term approach is leveraging Instagram and

building a personal brand.

Or if you really want to see your numbers grow, consider

doing all of them. 😉

Conclusion

I know everything I broke down may seem overwhelming, but it

shouldn’t be. Just take one step at a time.

Plus there are a lot of tools that make your life easy and do most of the hard work. I pretty much mentioned them all above and you can get them to play nice by using Zapier, which can connect them easily if you aren’t able to figure it out.

And if you are wondering why I stopped focus most of my efforts on info products it isn’t because it was bad business.

It’s the opposite. It’s a good business… but to scale it to

millions a month in revenue is tough and you’ll find that your profit will

drastically drop.

In other words, your upside is limited and it’s not hard to

make a few million a year in profit, but anything above that gets really tough.

So, what are you going to do with the information above?

Are you going to try and sell info products?

The post You Can Have My Old Business That Makes $381,722 a Month appeared first on Neil Patel.

How to Get a Loan for a Business: A Step By Step Plan of Action

When a business already exists, loans are often needed to help it grow. How to get a loan for a business growth is a little different than when you first get a loan to start your business. In some ways, it is easier. In others, it is more complicated. For example, you already have your business plan and market research. You do not have to do all the original projections, and you do not have to convince a lender you have a winning idea. There are other steps in how to get a loan for a business however.

If you need to know how to get a loan for a business that already exists, you will have to convince a lender that it has potential for growth. In addition, they will want to see proof of financial success, and you will need to provide them with a plan for how you plan to use the money to aid growth and expansion.

Find out why so many companies use our proven methods to get business loans.

A Step by Step Plan for How to Get a Loan for a Business

It can sound overwhelming, but if you follow the steps, most of the hard work will be done before you ever talk to a lender. The key is to know which type of lender and what type of loan will work best for your needs. Once you know those two things, you can prepare specifically for that. Then, when the lender starts asking questions you will be ready. This will make the process of how to get a loan for a business much faster, and likely it will go much more smoothly.

How to Get a Loan for a Business: Step One: Choose the Type of Loan You Need

First, consider the type of loan you need in light of what you actually qualify for.

Traditional Loans

These are the standard loans that disperse a set amount of funds, with the borrower repaying over a certain period of time. The payment is the same each month, and they can be either secured or unsecured. Unsecured small business loan options usually have higher interest rates.

Line of Credit

This is revolving debt similar to credit cards. Borrowers are given a maximum limit of the amount of funds they can use, but only pay back the amount that they actually use. For example, a borrower may have a $10,000 line of credit and use $5,000 to buy a new commercial oven. They will only pay back to $5,000, until the time comes that they choose to use more. Lines of credit can also be secured or unsecured.

Invoice Factoring

Factoring invoices is an option if you have receivables. The lender basically buys unpaid invoices from you at a premium, meaning you do not get full value. You then have immediate cash however, for those open invoices. The lender collects from the consumer directly at full value. The older the invoice, the higher the premium. This is due to the fact that the likelihood of collecting on the invoice goes down the older the invoice gets. These are an option for fast cash.

Merchant Cash Advance

If you accept credit card payments, a merchant cash advance can help you out in a cash pinch. It is basically just what is says. It’s a cash advance on predicted credit card sales. They base the amount of the loan off of average daily credit card sales, and then take payment from future credit card sales. This usually happens electronically. Most often, the process is automatic. The draw is that you get the funds fast, and there are usually more flexible options for repayment terms depending on your eligibility. This is another great option if you need cash quickly.

Which one of these will work best for your needs? Well, if you are looking to grow, then you likely have a plan for what that will take. In general, a traditional type of loan or a line of credit works best for growth.

Find out why so many companies use our proven methods to get business loans.

How to Get a Loan for a Business: Step Two: Choose the Type of Lender

A lot of business owners think that a bank is their only option. There are a few different types of lenders to consider in how to get a loan for a business already running however.

Large Commercial Banks

These include those nation-wide institutions like J.P. Morgan Chase and Wells Fargo. As a general rule, they are small business friendly. There is nothing specific that they hold against smaller businesses. It is simply that these businesses do not generally meet the requirements for borrowing from large banks.

Community Banks

Community banks are the smaller, local financial institutions. Sometimes they are called hometown banks. They are typically more friendly toward small businesses. Often, they are able to look a little deeper and see a tad bit more than the numbers. Their small business loan options may have less strict eligibility requirements as well. Still, the numbers make a difference. Whether credit score, annual income, years in business, or some combination, you will have to have meet eligibility.

Credit Unions

The main thing to remember with a credit union is that you must be a member to get a loan from them. They usually offer more favorable interest rates however. If you are a member of one, be sure to ask about what they offer as far as business loans.

Private Lenders

These are alternative lenders that usually function online, though some do have brick and mortar locations as well. The benefit with private lenders is that they offer small business loan options to those that may not qualify with traditional lenders. Their credit score requirements are lower. They may or may not require a certain amount of time in business or minimum revenue amounts. However, their small business loan options typically have higher interest rates.

If you think this may be the route you need to take, here are a few options to consider.

Upstart

Upstart is a fairly new online lender. They question whether financial data and credit score alone can really determine the risk associated with a specific borrower. Instead, they use a combination of AI and machine learning to gather alternative information. They then use this information to aid in credit decision making.

This alternative information may include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. Software from the company actually learns and improves on its own.

They offer various types of financing products to fit a broad range of needs. This includes debt consolidation and personal loans, as well as business loans.

You can get a quote on a loan to start or expand a business. Quotes are available online in a matter of minutes. Learn more here in our comprehensive review.

StreetShares

StreetShares began as a service to veterans. Now, they offer term loans, lines of credit, and contract financing. In addition, they now offer small business loan investment options. The maximum loan amount is $250,000.

To be eligible, you must be in business for at least 12 months with annual revenue of $25,000. Exceptions are possible, with loans to companies in business for at least 6 months having higher earnings happening on a case by case basis. The borrower’s credit score must be at least 620. For more on StreetShares, see our in-depth review.

Kabbage

Kabbage is a well know online lender. They offer a small business line of credit that can help businesses accomplish goals quickly. The minimum loan amount is $500 and the maximum is $250,000. They require you to be in business for at least one year and have $50,000 or more in annual revenue, or $4,200 or more in monthly revenue, over the previous 3 months.

They have a non-traditional approach that puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Find out why so many companies use our proven methods to get business loans.

Fundation

Fundation provides both term business loans online and lines of credit. It is most known for its working capital funding options. These are funds meant to help cover the day-to-day costs of running a business rather than larger projects. Typically, these funds come in the form of a line-of-credit.

The minimum loan amount they offer is $20,000 while the maximum is $500,000. They require you to be in business for at least 12 months and have annual revenue of at least $100,000. To be eligible, your personal credit score can’t be less than 600. Additionally, you must have at least 3 full time employees. However, that can include you. Business owners cannot live or operate their business in North Dakota, South Dakota, or Nevada.

SmartBiz

If you want the convenience of online lending but need to look toward products offered by the SBA, then SmartBiz is what you are looking for.

With the help of the Small Business Administration, SmartBiz offers loans that are government backed. While SBA loans usually take a lot of time and paperwork, SmartBiz streamlines and speeds up the process. This makes getting loans through the Small Business Administration easier than ever. The minimum loan amount is $30,000 and the maximum is $5,000,000.

How to Get a Loan for a Business: A Word About SBA Loans

Speaking of SBA loans, you cannot talk about how to get a loan for a business without some discussion on the SBA. While they do not lend funds themselves, they do administer a number of loan programs that help small businesses get the funds they need through partner lenders.

7(a) Loans

This is the Small Business Administration’s most known program. It provides federally funded term loans up to $5 million. The funds can be used for a number of purposes. These include expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds.

504 Loans

504 loans are also available up to $5 million and can buy machinery, facilities, or land. Typically, they are used for expansion. They work especially well for commercial real estate purchases.

Microloans

These are $50,000 or less. They work well for starting a business, purchasing equipment, buying inventory, or general working capital.

SBA disaster loans

This is a program for businesses that are victims of natural disasters. These loans are different because, unlike the others, the SBA actually processes them directly rather than using partner lenders.

SBA Express Loans

These are fast turnaround loans, with the SBA taking up to only 36 hours to give a decision. There is less paper work as well, which is part of what makes express loans great if you qualify.

SBA CAPlines

There are 4 different CAPline programs. They differ mostly in how the funds can be used. The maximum on each is $5 million. It can take 45 to 90 days for the funding on the CAPlines to come through.

SBA Community Advantage Loans

This is a pilot program. It will either expire, or the SBA will extend it in 2020. Its purpose is to promote economic growth in underserved areas and markets. Decision makers look past such things as poor credit or low revenue if the business has the potential to create jobs or promote economic growth in underserved areas.

These are some of their most popular programs. The Small Business Administration does so much more for small businesses in addition to these. Get more details on the SBA, these loan programs, partner lenders, and additional resources offered by the Small Business Administration here.

How to Get a Loan for a Business: Step Three: Build an Application Packet

This step mostly applies for traditional lenders, traditional loans, and SBA Loans. Most private lenders just have you fill out an application online. The idea is to anticipate what lenders will need to see and have all the information already pulled together for them. For example, most all of them will want to see financial statements or tax returns for the past 3 years or so. They will also want to see a plan for how you will use the funds, and what results you anticipate.

If you are thinking about how to get a loan for a business to grow, you are going to need to show them how you will use the funds to help it do that. They will also likely want to see that you have market research that supports the idea that the market will support growth. You may be able to simply update the business plan you used when you applied for startup financing.

How to Get a Loan for a Business: Do Your Research and Be Prepared

These really are the two best bits of advice when it comes to how to get a loan for a business. Consider what your options are, based on your specific needs and situation. Then, research what lenders will need to approve you for whatever type of loan you need, and prepare with that in mind before you ever walk in.

The post How to Get a Loan for a Business: A Step By Step Plan of Action appeared first on Credit Suite.

You Can Have My Old Business That Makes $381,722 a Month

I was talking with my friend who works at Keap (formally known as Infusionsoft) and he was breaking down how people still make millions of dollars selling info products and ebooks. Now, I don’t sell info products as heavily as I used to, but when I focused on it 100% of the time, my numbers …

How to Get Your Business Google Knowledge Graph for Free?

As a business, you know you need to be on Google Knowledge Graph, at least that’s what we often hear. However, do you really need to get a knowledge graph on Google and if yes, how do you get it? Here’s everything you need to know about Google Knowledge Graph for businesses. What is Google …

Improve Your Business and Avoid Workplace Drama and More –10 Brilliant Business Tips of the Week

Office interpersonal relationships got you down? Watching your employees snipe at each other? Is the gossip train speeding through your company? Then it’s time to avoid workplace drama. Plus, nine other excellent tips to get you going in this new year.

The Hottest and Most Brilliant Business Tips for YOU – Avoid Workplace Drama and More

Our research ninjas at Credit Suite smuggled out ten amazing business tips for you! Be fierce and score in business with the best tips around the web. You can use them today and see fast results. You can take that to the bank – these are foolproof! It’s time to avoid workplace drama and take your business to the next level.

Stop making stupid decisions and start powering up your business. Demolish your business nightmares and start celebrating as your business fulfills its promise.

And these brilliant business tips are all here for free! So, settle in and scoop up these tantalizing goodies before your competition does!

#10. Take Your Customers on a Journey

Our first jaw-dropping tip is all about a new process to close sales. G2 says your sales process is a kind of roadmap. It pulls your salespeople along from prospect to consideration to sale to after-sale nurturing. But your sales methodology is the ‘how’. Your sales methodology shows you several ways to go through the steps in your sales process. It is your company’s philosophy of how a sale should be carried out.

We really liked this article because it carefully lays out the various steps in a standard sales process. As a result, we highly recommend reading the article in its entirety.

In particular, we draw your attention to the section on after-sales nurturing. The word ‘yes’ isn’t the end. It is just the beginning.

#9. I Pledge Allegiance to the One, Unique Product – Yours

The next awesome tip is about making your product stand out. The Self Employed notes there are a number of ways to showcase your uniqueness. And, yes, you can do this even if your product is toothpaste or your service (yes, services can benefit from this article) is dog walking.

We truly loved the concept of, essentially, being human. Seriously, how many times have you read a company blog or About Us page which was just so much jargon?

So, be human and be approachable. It’s perhaps a little concerning that being human is a unique sales proposition. But there you have it.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Avoid workplace drama and be more productive – and more!

#8. Kick Your Sales into High Gear

Our following life-changing tip concerns creating the ultimate sales kickoff. LinkedIn lays it all out for us.

Did you know that a good 29% of attendees rate their company’s sales kickoffs at a C or below?

Ouch.

A smart way to get your sales kickoffs out of the doldrums is to consider the ultimate goal. It’s to inspire people, right? And it’s also about getting everyone on the same page.

So, does that have to happen via a PowerPoint presentation where the presenter drones on and on while everyone checks their phone, or wishes they were?

Our favorite tip was to continue with learning after the kickoff is done. And that makes a lot of sense to us – reinforce what was said so it sticks!

#7. Time to Focus Like a Laser on Your Customers

For our next sensational tip, we looked at focusing on your customers. Startup Professionals says that customer expectations have changed radically in the past few years.

Some of this may be generationally driven, as Generation Z (born after 1996) is now outnumbering the millennials. Millennials are born after 1981.

But it’s also just a function of how markets have been changing. As customers demand more and more personalization and attention, they get it. And then, because they like it, they want more.

It is, without a doubt, a self-perpetuating cycle.

Analytics FTW

Oh, we do so love analysis. For the bottom line is, without measurements, we have no idea how anything is doing. Analytics are also great because they push us to create goals and attempt to achieve them. If the goal is for 5% more sales during the quarter, and we know how many sales were closed in the past quarter, then we know what’s expected for the current quarter. We know what success looks like. And that is very powerful.

There’s another aspect of this article we really liked.

Ask What Your Customers Want

What is the easiest way to find out what people want?

C’mon, this is not rocket science.

You ask.

So, ask.

#6. Save Your Money on Ads (for the most part)

This tip is so cool, and it works! Succeed as Your Own Boss tells us all about attracting customers without having to pay for advertising.

This is a great article and it really should be read in its entirety. Here’s our fave takeaway.

Don’t Just Throw Jell-O Against the Wall, Hoping It’ll Stick

Well, that’s not exactly how Melinda Emerson put it. This is actually a combo of two tips. One is to know your audience. And the other is to measure (our fave!).

Reading between the lines, this advice is virtually identical to what you should be doing with paid advertising.

The conclusion we draw from this is, treat free advertising like paid. That is, be intentional about it. And be organized so you’re not just playing around. Make every move count.

#5. It’s Time to Get Out of Middle School and Avoid Workplace Drama

Grab this mind-blowing tip while it’s hot!

It’s time to avoid workplace drama and get down to business.

Young Upstarts says there are a number of ways to derail the gossip train and avoid workplace drama.

We are so listening.

Model the Behavior You Wish to See

Also known as – be the change you wish to see in the world. Or, at least, at the office. You can avoid workplace drama by not encouraging it. And you can also avoid workplace drama by not spreading rumors.

We really loved this tip because it’s all about leadership. And, the truth is, anyone can do it. From the CEO to the cleaning crew, everyone can avoid workplace drama simply by stopping it and cutting it off at its knees.

Transparency Looks Good on You

This tip also really spoke directly to us, and it’s all because of something your intrepid blog writer remembers from, egad, a good 30+ years ago. So, it’s story time.

True Story

Drama, drama, drama.

There never seemed to be so much of it in my life until I worked for a certain firm. This was the 1980s, so it was back when there was a clerical pool.

There never seemed to be so much of it in my life until I worked for a certain firm. This was the 1980s, so it was back when there was a clerical pool.

The firm did something which, in my opinion, was a disaster.

While hiring a clerical office manager is often a great idea, the person who was hired was just plain awful. They were, among other things, overly and unnecessarily secretive. Compounding problems was the fact that things were allowed to deteriorate for a long time.

As a result, secretaries left. In droves. It was hard to keep anyone on staff who could actually type.

Don’t laugh – this was a big, big deal back in the day.

So, this office manager once asked me – what do you hear about me? And yes, I heard stuff on occasion. But I said nothing. Why? It wasn’t because I disliked this person, although I did. It was more because the request was an improper one. I wasn’t in charge of anything. So, asking me about what the rumor mill said was just plain nuts.

It would have perpetuated the problem instead of being a way to avoid workplace drama.

I don’t recall anyone telling this person, although it’s been over three decades, so my memory may not be perfect. Perhaps someone else did. But either way, the inquiry didn’t help this person. Instead of trying to avoid workplace drama, they were fueling it. And instead of being open and transparent, they hid.

They were let go not too long after that. And so much of it had to do with not being transparent. Which leads me to ….

Encourage People to Carry Their Own Messages

This one also really resonated. Some of this relates to the above story. Essentially, instead of asking me what others were saying, this office manager should have asked people directly. Now, it’s entirely possible they wouldn’t have been truthful. But they should have asked. Having me carry water for her was an absurd notion. She was the boss and should have been confident enough to speak directly to the clerical staff.

Instead, by trying to use a go-between, she perpetuated the problem.

Talk directly to people. Even if it’s unpleasant or uncomfortable. You’re the boss if not the owner. This is why they pay you the big bucks.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Avoid workplace drama and be more productive – and more!

#4. Overworking is no Good for You or Your Business

Check out this spectacular tip, all about avoiding becoming overworked. Work It Daily notes that overworking makes you a less effective worker.

But it can be easier to say you’ll stop overworking than to do it.

And the article smartly acknowledges there are people with financial goals who take on a side gig because they need cash in the short term. Plus, they may be trying to start a business. You may be one of those people or have been.

But then there’s another reason for overworking.

Time Management Matters

Quick true story here.

In the 90s, your intrepid blog writer worked for a person who. Could. Not. Stop. Yapping.

All the livelong day, they would talk to this one or that one. And it turned out to be fortunate that this boss didn’t like me. I was left alone!

As a result, I got my work done on time and left at 5, 5:30 most nights.

This person and their coterie did not.

They also complained (as a part of their constant gabfest) about being overworked.

Whatever this person wanted to do with their life, whatever goals they had for themselves outside of work – those were all sacrificed at the almighty altar of incessantly chattering.

Don’t be that person – and you won’t be overworked.

#3. Throw Some Water on Your Burnout

To go along with tip #4, it’s not your imagination: this winning tip can help you avoid burning out. Acorns tells us it’s all about four D’s.

Delete

Is the task really worth the time and money you’re putting into it? Not?

Then why the hell are you doing it?

Delay

You probably don’t have to do everything at once, the very moment you’re asked to. If so, then you have got to ask about priorities. Once you have the priorities down, guess what? You know what you can put off. And keep that in mind for the future. If that task comes up again, you just may be able to defer is again.

Diminish

You can diminish tasks by finding a shortcut to get them done. Even if it just saves you a keystroke, that will pay off if you have to perform a similar task over and over again.

Your intrepid blog writer firmly believes laziness is an evolutionary advantage. The basics of it are not to sit around and do absolutely nothing, though. Rather, the idea is to find faster and easier ways to do nearly anything.

After all, many of us have dishwashers. Are we lazy for not washing and drying our dishes by hand? Of course not! And by having a machine perform this task, that frees us up for all sorts of things. Those things can be everything from a task which cannot be performed by a machine (yet) to working on our relationships. Or binge-watching Netflix.

So, when you have a moment, consider what you do at work which takes a lot of time or feels repetitive. You just may be able to find a faster way of doing it.

Delegate

This one, we hope, is self-explanatory. You do not have to do everything. That way lies madness.

#2. Ready, Aim, Customer!

Our second to last unbeatable tip can give you a new perspective on how to reach your target audience. Noobpreneur reveals all about determining your target audience and how to best and most effectively reach them.

Target audience? Say what? But won’t everyone love, love, love my product or service?

Get real.

Sorry, that was harsh.

But consider this. Even water isn’t sold to everyone. And it’s branded, anyway. Some waters are flavored to appeal to dieters or to fitness enthusiasts. Others have snob appeal. And then there are folks (me, I’m guilty) who just open the tap and wonder why the heck anyone would want to pay for H2O if they didn’t have to, beyond paying for utilities.

But I digress.

Reaching an audience means defining that audience.

#1. Start Mastering Digital Marketing

We saved the best for last. For our favorite remarkable tip, we focused on digital marketing tips for you to win social, email, and search. Nextiva says the most underrated digital marketing is email. Yeah, good old email!

But let’s look at something kind of disturbing.

Google, Thy Name is Legion – and Maybe a Monopoly?

Let’s think about Google search for just a moment. And I mean Google, not search in general.

Google’s basic mission is to serve seekers what they are looking for. The first time, every time. And with the enormous number of webpages (that figure is in the trillions if not the quadrillions by now, folks) and the exceptional competition out there, Google has to make decisions every picosecond about what’s better and what’s best. Because it’s impossible for human beings to do this, it’s all done via algorithms.

Ya with me so far?

Here’s where it gets tricky.

Google says they don’t suppress results. And maybe they don’t. Let’s operate under the assumption that they don’t. After all, for Google, what does it matter if Coke or Pepsi gets the top search spot when someone searches for best cola?

But What If Google Gets into a Side Business?

Google could enter a market like hospitality or music or food service, let’s say.

What’s to stop Google from giving more credence to their own ridesharing service, or music streaming platform, or string of restaurants? Or whatever they decide to try their hand at?

Let’s even say everyone is 100% ethical and above-board.

What’s to stop Google’s search division from sharing inside information to another division of the company? Maybe even inadvertently? How many times do you get misdirected internal mail? I do, every single month.

Or what’s to stop Google from bending their algorithms to better serve how their side gigs have their webpages set up?

One thing the article doesn’t mention, but should, is that this is bound to draw the attention of the fine people at the Federal Trade Commission. And they won’t take so kindly to allowing this.

Before you say the government would never want or need to break up Google, think again. People said that about AT&T, over 35 years ago.

It’ll be fascinating to watch as this unfolds in the future.

And do check out the article for some more insights into digital marketing.

So, which one of our brilliant business tips was your favorite? And which one will you be implementing now?

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Avoid workplace drama and be more productive – and more!

The post Improve Your Business and Avoid Workplace Drama and More –10 Brilliant Business Tips of the Week appeared first on Credit Suite.

How to Get a Loan for New Business Endeavors

It can be tricky to get a loan for new business endeavors. You do not yet have the benefit of a long time in business, profitability, or positive business credit history. As a result, you have to rely on a killer business plan, a fundable foundation, and your personal credit.

What You Need to Know About How to Get a Loan for New Business Endeavors

When you need a loan for new business, there are several things to consider. Most business owners understand the personal credit piece. If you have a high enough credit score lenders will lend you money with pretty much no questions asked. However, what if your credit score is just okay? Can you still get a loan? What if your credit score is great but you have a poorly written business plan? Do you even know how to set up your new business to be fundable? Here’s what you need to know.

Find out why so many companies use our proven methods to get business loans.

How to Get a Loan for New Business Endeavors: You’ll Probably Need Collateral

If your credit score is high enough, you can sometimes get a loan for new business without security, also known as collateral. However, regardless of how great your score is, you can almost always get more money with a better rate and terms if you have collateral.

Security could be your business, but often it is necessary to use personal assets such as land or a home. While this can be scary, it is the best way to show a lender you have faith that your business will be profitable. If you aren’t willing to take a risk, why should they?

However, the better your credit is, the more professional and complete your business plan, and the more fundable your foundation, the less collateral you may be able to get away with.

How to Get a Loan for New Business Endeavors: Write a Killer Business Plan

Your business plan is the first impression a lender gets of your business. This is especially true if you are trying to get a loan for new business startup. Consequently, your business plan must be complete and professionally put together.

Honestly, it is best to hire a professional business plan writer if possible. A professional business plan writer can help you gather all the necessary information. Then, he or she can compile it into the traditional, acceptable format.

If you cannot hire a business plan writer, there are a number of options. For example, The Small Business Administration offers a template, and your local small business development center can help as well.

For a business plan to be taken seriously by a lender, it needs to include the following:

Opening

An Executive Summary

This is a complete summary of the business idea.

Description

The description goes into more detail than the summary, describing the business. What type of business is it? What will it offer? This is where you get others excited about what you are doing.

Strategies

Layout your plan for getting things up and running. Do you have a marketing plan? Is there a location you have in mind? How many employees you will start with? What is your ramp up plan?

Research

Writing a complete business plan requires a ton of research. Not only must you do market research to ensure your product is needed and want, but also that your location and market coincide. In addition, you need to know that the market can support your business.

Research on any competitors is also necessary.

Market Analysis

This actually includes two parts, the analysis of audience and the competitive analysis.

-

Analysis of audience

What need will your business fill, and for who? Will your business fulfill a childcare need for working parents? Are you a restaurant filling a need for those working downtown to have easy access to fast, healthy lunch options? How will your business fill those needs? Include all of this in the analysis of audience section.

-

Competitive Analysis

Is there a business currently working to fill this need? Is there room for more? How do you plan to be the best?

Strategy

This is the way you plan to run your business moving forwards. Put another way, it is how you plan to put into action what you learned in the research phase.

Plan for Design and Development

How is all of this going to play out? From start to finish, what steps are you going to take? This section includes more detailed than the strategies section.

Plan for Operation and Management

How will ownership be structured, and who will handle the day to day running of the business? This could be as simple as stating that you are the sole owner and operator. In contrast, it could mean laying out a complete partnership plan or board or directors’ format. It just depends on how your play for your business to work.

Financials

While all parts of the business plan are important, this is where lenders really sit up and pay attention. even of the whole rest of the plan is fabulous, it will not matter if the financial section isn’t in order.

Financial Information

This section includes current financials, projections, and a plan for the loan funds you are asking for. Lenders need to see that you know how to handle the funds you get, and that you have a plan for paying them back.

How to Get a Loan for New Business Endeavors: A Fundable Foundation

When you apply to get a loan for new business endeavors, having a fundable foundation can make all the difference. What’s a fundable foundation? It’s basically how your business is set up. It has to appear to be a fundable entity separate from you, the owner. Like any foundation, it is best to start at the beginning.

Contact Information

The first step in setting up a fundable foundation is getting your business its own phone number, fax number, and address. That’s not to say you have to get a separate phone line, or even a separate location. You can still run your business out of your home or on your computer if you want to. You don’t even need a fax machine.

In fact, you can get a business phone number and fax number that will work over the internet instead of phone lines. Also, the phone number will forward to any phone you want, so you can simply use your personal cell phone or landline to take calls.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This may seem outdated, but it does help solidify legitimacy with lenders.

You can use a virtual office for a business address. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to hold a face-to-face meeting. If you are not going to have a physical location other than your home, this is going to be your best option. A post office box is not ideal when you want to get a loan for new business endeavors.

Find out why so many companies use our proven methods to get business loans.

EIN

The next thing you need to do is get an EIN. An EIN is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners use their SSN for their business. However, it really doesn’t look professional to lenders. Also, it can cause your personal and business credit to get all mixed up when you get to that point. When it comes to building a fundable foundation, you need to apply for and use an EIN. You can get one for free from the IRS.

Incorporate

This is the most important step in fundability thus far. Incorporating your business as an LLC, S-corp, or corporation is necessary for fundability. Not only does it lend credence to your business as one that is legitimate, but it also offers some protection from liability.

For the purpose of fundability, it does not matter which one you choose. Choose the option that works best for your budget and liability protection needs. The best thing to do is talk to your attorney or a tax professional. If you do not do this now and instead choose to begin operating as a sole proprietorship or partnership, you will lose fundability in the future. This is because when you incorporate, you become a new entity. This means that at that point, you will lose any time in business and positive payment history you may have accumulated. You need both of those for fundability, so best to just go ahead and incorporate now.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit cards payments. Studies show consumers tend to spend more when they can pay by credit card.

Licenses

For a lender to see you as fundable, you need to have all the licenses necessary to run. If you aren’t there yet, at least let them know you know what you need and how to get it.

Website

I am sure you are wondering how a business website can affect you ability to get funding. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

How to Get a Loan for New Business Endeavors: The Application Process

You’re probably thinking that after all this work, the application process should be a breeze. It could be, but there will still be some work to be done. For one, you will need to take some time to consider your options when it comes to choosing a lender and a type of loan. Do you want to go with a traditional lender or a private lender? Is a commercial bank or a community bank better for your needs? Can you apply for a secured loan, or do you need to look for an unsecured option? Would a line of credit be better?

Applying for the right loan with the right lender from the beginning can make a huge difference in your chances for approval.

You Can Get a Loan for New Business Endeavors

Being prepared when you apply for a business loan can mean the difference between approval and denial. A poorly put together business plan or a kink in the fundable foundation chain can throw a wrench in the entire system.

Find out why so many companies use our proven methods to get business loans.

Spending the time and money necessary to get these things in order, as well as doing a little research to make sure you are applying for the right loan with the right lender for your needs, can make all the difference. It will be worth it. Not only will you be able to get a loan for new business, but you will also be able to get the funding you need to grow and thrive long into the future.

In the end, it really is all about preparation and knowledge. Knowing what lenders want to see and giving them what they want can open doors for your business that you never imagined.

The post How to Get a Loan for New Business Endeavors appeared first on Credit Suite.

How Your Experian Financial Profile Can Affect Business Fundability

There are so many factors that affect the fundability of your business. Truthfully, your Experian profile is just one link in a very long fundability chain. However, that does not mean it isn’t important. As you know, it only takes one weak link to break a chain. As a business owner, it is important to understand your Experian financial profile.

Your Experian Financial Profile Can Affect the Fundability of Your Business

What does your Experian profile have to do with the fundability of your business? A lot actually. In fact, not only does your Experian business profile impact fundability, but your personal Experian profile does as well.

Experian Financial Profile and Fundability: What is Fundability?

Simply put, fundability is the ability to get funding for your business. If you are fundable, lenders see your business as one that can and will pay its debt. Since lenders are in it to make money, they see a fundable business as one that will offer a return on investment. That part is easy. The real question is, how does a business become fundable?

Keep your business protected with our professional business credit monitoring.

Sadly, the answer to that question is not quite as simple. Sure, a great business credit score is important. In addition, many of the things that are important for a strong business credit score are necessary for fundability as well.

The thing is, there is a lot more to fundability than credit score. You can find out more about that here. For now, let’s talk about the role the Experian plays in the fundability of your business.

Experian Financial Profile: What Does it Have to Do with Fundability?

First, you should know that Experian keeps files on both your personal and your business finances. Consequently, if you own a business, you have a business profile with them as well as a personal profile. In most cases, a personal and business credit profile is totally separate. However, with Experian, that isn’t always the case. While they do keep the two separates if you set things up that way, they also issue a combined report that incorporates your personal credit as a piece of business credit for lenders making decisions.

For you, that means that at least as far as your Experian profile is concerned, your personal credit history can actually affect the fundability of your business.

You can see your personal Experian financial profile here.

Experian Financial Profile: What about Business Credit?

Of course, it’s pretty obvious how Experian business credit can affect fundability. The big questions still remain however. What do you Experian reports tell lenders? Where do they get their information? How do they calculate their business credit score, and what does it mean?

Experian keeps business credit profiles on 99.9% of all United States companies. In addition, it claims to have the credit industry’s most broad data on small and mid-sized businesses. That’s why, if you own a business, it likely has a business Experian file.

According to Experian, all their information stems from third party sources. That means you cannot add anything to your profile. Still, you can check your profile and let them know about any inaccuracies. As a result, you have to know what that report is telling lenders about you and your business to stay ahead of the game. Also, you need to know where the information comes from, and what you can do about it.

Business Experian Financial Profile: What’s on there?

First, there isn’t just one score. On the contrary, your complete business Experian profile consists of a number of reports and scores. Lenders can choose to use any or all of them. Each one tells them something different. It takes all the scores put together to get a complete credit picture, but not all lenders look at all scores.

Intelliscore Plus

Quite simply, the Intelliscore Plus credit score shows credit risk based on statistics. It is a highly predictive score. As such, its main purpose is to assist users in making well informed credit decisions.

The Intelliscore scores range from 1 to 100. The higher your score, the lower your risk class. The opposite is true as well. Meaning, the lower your score, the higher your risk class.

Score Range Risk Class

76 — 100 Low

51 — 75 Low — Medium

26 — 50 Medium

11 — 25 High — Medium

1 — 10 High

How Do They Calculate the Intelliscore Plus Score?

One of the things Intelliscore is most known for is the identification of key factors that can indicate how likely a business is to pay their debt. There are over 800 commercial and owner variables used to calculate an Intelliscore Plus credit score. They can be broken down like this:

Payment History

This is just your current payment status. It’s how many times accounts have become delinquent. Additionally, it shows how many accounts are currently delinquent and overall trade balance.

Keep your business protected with our professional business credit monitoring.

Frequency

The frequency factor shows how many times your accounts have been sent to collections. It also notes the number of liens and judgments you may have. Any bankruptcies related to your business or personal accounts are in the part as well.

In addition, frequency includes data regarding your payment patterns. Were you regularly slow or late with payment? Did you decrease the number of late payments over time? As you can imagine, those things make a difference.

Monetary

This specific factor focuses on how you use your credit. For example, how much of your available credit are you using right now? Do you have a high ratio of late balances when compared with your credit limits?

Of course, if you are a new business owner, a lot of this information will not exist yet. Intelliscore Plus handles this by using a “blended model” to identify your score. That means that they take your personal consumer credit score into account when determining your business’s credit score.

The Experian Financial Stability Risk Score (FSR)

FSR predicts the potential of a business going bankrupt or not paying its debts. The score identifies the highest risk businesses by making use of payment and public records. These records include all of the following and more.

- high use of credit lines

- severely late payments

- tax liens

- judgments

- collection accounts

- risk industries

- length of time in business

Experian’s Blended Score

This is a one-page report that provides a summary of the business and its owner. A combined business-owner credit scoring model is more comprehensive than a business only or consumer only model. Blended scores have been found to outperform consumer or business alone by 10 – 20%.

Business Experian Financial Profile: How to Know What Yours Is Telling Lenders

Experian sells a number of products which can be used to monitor your business’s credit with them.

Business Credit Advantage Plan

This option is $149 per month and incorporates mobile-friendly alerts and score improvement recommendations.

Profile Plus Report

This report costs $49.95 and includes in-depth financial payment details. Also, it offers predictive information on payment behavior.

Credit Score Report

A cheaper option at $39.95, this report contains details on the company, credit information, and a summary of financial payment information.

Valuation Report

The valuation report costs $99. It shows the market value of your small business and features key performance indicators. It also displays your company’s fair market value.

Premium Corporate Profiles

Experian also sells premium corporate profiles. These are enhanced profiles that contain extra information. For example, sales figures, size, contact details, products and operations, credit summary, and any Uniform Commercial Code (UCC) filings will show up here. This report also includes fictitious business names, payment history, and collections history.

In addition, you can subscribe to business credit alerts through Experian’s Business Credit Advantage program. This is a self-monitoring service that offers limitless access to your company’s business credit report and score. It allows business owners to proactively manage small business credit. Alerts are sent when:

– Company address changes

– Business credit score changes

– Credit inquiries show up

– Newly-opened credit tradelines are added

– Any USS filings open

– Collection filings open

– Any public record filings pop up. This includes liens, bankruptcies, and judgments.

Despite all that business Experian credit monitoring offers, it is pricey. Monitor your business credit at Experian and Dun & Bradstreet here for much less.

Keep your business protected with our professional business credit monitoring.

Experian Financial Profile: How to Make a Positive Change

Since both your personal and your business Experian profiles affect the fundability of your business, it is important to understand how to make positive changes if you need to.

While you may not be able to do anything to make a big score increase happen all at once, you can definitely do some things that will make a positive difference over time.

Make On-time, Consistent Payments

This is number one. Over time, paying your bills on time will help establish your company as one that pays their debts. This will definitely help push your score up and show other firms that you are a low credit risk.

Handle Your Credit Responsibly

The more debt you have, the more monthly bills you have. As a result, you have less of your income available to spend. If your overall debt is close to or even over your income, it will look like you are a high credit risk.

Keep your debts in check and consistently pay them down or off to keep a good balance between what you make and what you owe.

You Have to Use Credit to Increase Your Credit Score

Keeping your debts low is good advice, but you have to use the business credit accounts you have. You make payments on accounts for your score to grow. Having a ton of credit and not using it at all doesn’t really help. Again, balance is key.

There is no need to buy things you do not need however. Even if you can pay cash, use credit for the things you would be buying regularly for your business regardless. Then, use the cash to pay the credit account.

Pay Attention to Both Business and Personal Credit

By now, you’re aware that personal credit is fair game when it comes to your Intelliscore Plus score. But don’t fall into the trap of thinking your personal credit doesn’t matter. If it is bad, there are options for working around it. However, it is much better to just keep it strong. Making certain you stay on top of your monthly bills is the number one way to keep your personal score healthy. Avoid unneeded credit inquiries, and refrain from compromising your personal credit for business needs.

This means setting things up in a way to actually have separate personal and business credit. Find more about how to do that here.

Make Use of Monitoring Options

No matter what your credit score is, it is crucial that you continue to be diligent and review your personal and business credit reports. This can help you spot possible errors and stay on top of your Experian financial profile.

For personal credit this is easy and free. Not only can you get a free copy of your personal credit reports annually, but there are a number of free services that offer you a peek at your personal credit score throughout the year.

As mentioned above, keeping track of your business credit will cost you. The good thing is, there are options to fit most budgets.

Experian Financial Profile: It Definitely Matters

Experian is well known in the personal credit world, but when it comes to business credit, Dun & Bradstreet often gets all the glory. Your business Experian financial profile can definitely affect fundability however. Throw in the fact that Intelliscore has a personal credit aspect, and you can see just how much your Experian reports can matter.

Keep monitoring all your credit reports and make changes when needed. Work hard to ensure only positive information is reported to all credit reporting agencies. Also, take the time to do a fundability analysis on your business. So take action where needed. If you do these things, you should be able to get funding for your business whenever you need it. Whether you want credit cards, loans, lines of credit, or some combination, you shouldn’t have a problem.

The post How Your Experian Financial Profile Can Affect Business Fundability appeared first on Credit Suite.

How to Supplement Funding with Minority Business Grants

While it’s almost impossible to fully fund a business on grants alone, minority business grants are a great way to supplement other types of funding. For example, if you win a grant, you can use it to reduce the amount of debt you need to take on. You could use the funds to reduce the amount of cash on hand you have to use. In turn, this would reduce the need to take on debt in the future. Grants can be a great funding option for minority owned business.

Minority Business Grants are a Great Way to Supplement Funding