How Hard is it to Establish Business Credit in a Recession?

Do you know? How hard is it to Establish Business Credit in a Recession?

It’s a brilliant question. How hard is it to establish business credit in a recession? Is business credit building impossible? Or is it just some nightmare? And what happens in an economic downturn?

I assure you it is not only possible, it is downright sure-fire. And business credit is all but recession-proof!

Business credit is credit in a business’s name. It doesn’t link to an owner’s personal credit, not even if the owner is a sole proprietor and the solitary employee of the corporation. Because of this, an entrepreneur’s business and consumer credit scores can be very different.

The Advantages

Because business credit is distinct from individual, it helps to safeguard a business owner’s personal assets, in the event of court action or business insolvency. Also, with two separate credit scores, an entrepreneur can get two separate cards from the same merchant.

This effectively doubles buying power.

Another benefit is that even startups can do this. Visiting a bank for a business loan can be a formula for frustration. But building small business credit, when done right, is a plan for success.

Individual credit scores are dependent on payments but also additional considerations like credit usage percentages. But for small business credit, the scores actually merely depend on whether a corporation pays its invoices timely.

How Hard is it to Establish Business Credit in a Recession: The Process

Establishing business credit is a process, and it does not occur automatically. A corporation will need to proactively work to build business credit. Nonetheless, it can be done readily and quickly, and it is much swifter than developing individual credit scores.

Merchants are a big component of this process.

Doing the steps out of sequence will cause repetitive rejections. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do you’ll get a rejection 100% of the time.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How Hard is it to Establish Business Credit in a Recession: Company Fundability

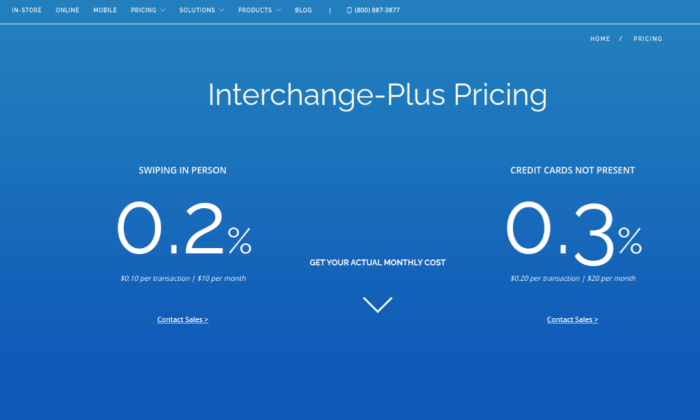

A business has to be authentic to lenders and vendors. As a result, a company will need a professional-looking website and email address, with website hosting from a company like GoDaddy. Additionally business phone and fax numbers need to have a listing on ListYourself.net.

At the same time the company telephone number should be toll-free (800 exchange or the like).

A company will also need a bank account dedicated strictly to it, and it must have every one of the licenses essential for running. These licenses all must be in the accurate, accurate name of the company, with the same business address and phone numbers.

Keep in mind that this means not just state licenses, but potentially also city licenses.

How Hard is it to Establish Business Credit in a Recession: Dealing with the Internal Revenue Service

Visit the IRS web site and obtain an EIN for the small business. They’re free of charge. Select a business entity like corporation, LLC, etc.

A small business can start off as a sole proprietor. But will most likely wish to switch to a form of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it concerns tax obligations and liability in the event of litigation. A sole proprietorship means the owner is it when it comes to liability and tax obligations. No one else is responsible.

If you run a company as a sole proprietor, then at least be sure to file for a DBA (‘doing business as’) status.

If you do not, then your personal name is the same as the small business name. Therefore, you can find yourself being directly responsible for all company debts.

And also, per the IRS, with this structure there is a 1 in 7 probability of an IRS audit. There is a 1 in 50 chance for corporations! Prevent confusion and drastically lower the odds of an Internal Revenue Service audit as well.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How Hard is it to Establish Business Credit in a Recession: Starting off the Business Credit Reporting Process

Begin at the D&B website and obtain a cost-free DUNS number. A DUNS number is how D&B gets a corporation into their system, to produce a PAYDEX score. If there is no DUNS number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at https://www.creditsuite.com/reports/. If there is a record with them, check it for accuracy and completeness.

If there are no records with them, go to the next step in the process. By doing this, Experian and Equifax will have something to report on.

Trade Lines

First you must build trade lines that report. This is also known as vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can start obtaining revolving store and cash credit.

These kinds of accounts have the tendency to be for the things bought all the time, like shipping boxes, outdoor work wear, ink and toner, and office furniture.

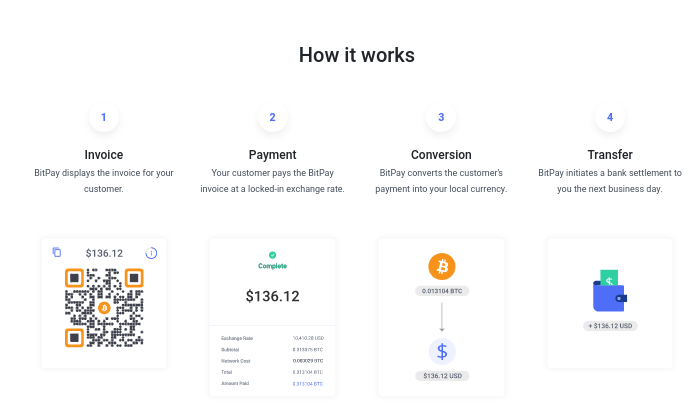

But first of all, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are oftentimes Net 30, instead of revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, like within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts need to be paid in full within 60 days. Compared to with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To begin your business credit profile the right way, you should get approval for vendor accounts that report to the business credit reporting agencies. As soon as that’s done, you can then make use of the credit.

Then repay what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with very little effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

And Continue…

So get 3 of these to move onto the next step, which is revolving store credit.

1. Uline Shipping Supplies

Uline Shipping Supplies is a true starter vendor. Find them online at https://www.uline.com/. They offer shipping, packing, and industrial supplies, and they report to D&B and Experian.

You need to have a DUNS number. They will ask for 2 references and a bank reference. The initial few orders may need to be paid in advance to initially get approval for Net 30 terms. Also, you may need to buy some things you do not need.

2. Crown Office Supplies

Crown Office Supplies is another true starter vendor. Find them online at https://crownofficesupplies.com.

They sell a variety of office supplies and take helping clients seriously. They say, “just starting your business, or maybe have an existing business, but you have a question regarding office supplies… we are here to help!” And they report to Dun and Bradstreet, Experian, and Equifax.

There is a $99.00 yearly fee, though they do report that fee to the business credit reporting agencies. For other purchases to report, the purchase must be at least $30.00. Terms are Net 30.

3. Grainger Industrial Supply

Grainger Industrial Supply is also a true starter vendor. Find them online at https://www.grainger.com/. They sell safety equipment, plumbing supplies, and more, and they report to D&B. You will need a business license, EIN, and a DUNS number.

For less than $1000 credit limit they will approve virtually anybody with a business license.

Accounts That Don’t Report

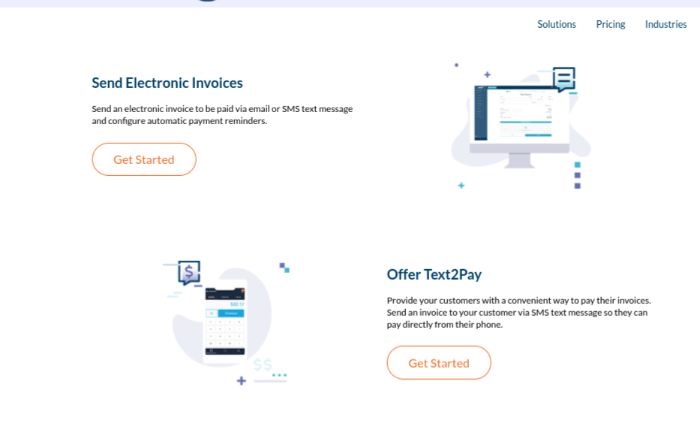

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to at the very least one of the CRAs, a trade account which does not report can yet be of some worth. You can always ask non-reporting accounts for trade references.

Also credit accounts of any sort will help you to better even out business expenditures, consequently making financial planning simpler. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Revolving Store Credit

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs move to revolving store credit.

Use the corporation’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then progress to fleet credit. These are companies like BP and Conoco. Use this credit to buy, repair, and take care of vehicles. Make certain to apply using the business’s EIN.

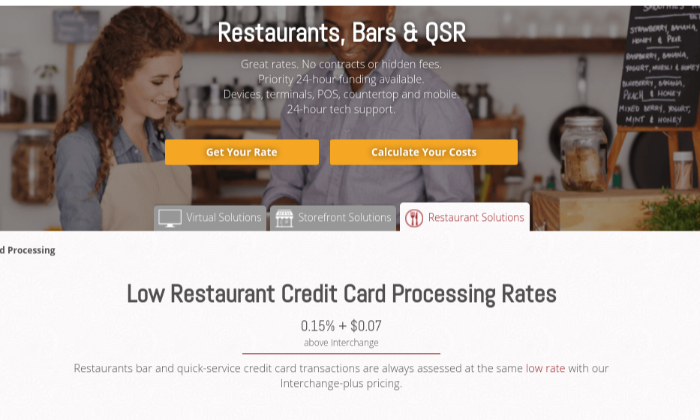

Cash Credit

Have you been sensibly managing the credit you’ve gotten up to this point? Then move onto more universal cash credit. These are service providers such as Visa and MasterCard. Keep your SSN off these applications; use your EIN instead.

These are typically MasterCard credit cards. If you have more trade accounts reporting, then these are doable.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

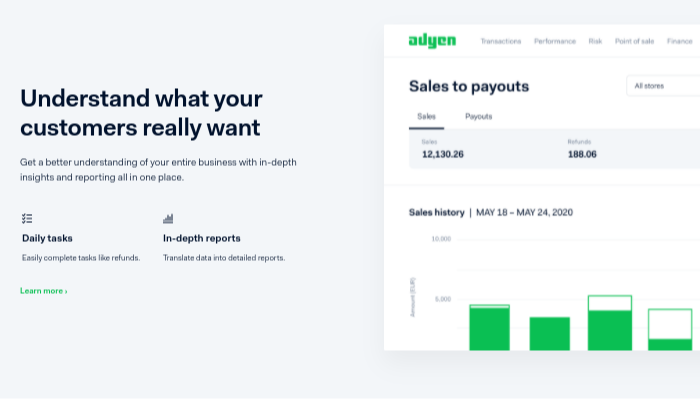

How Hard is it to Establish Business Credit in a Recession: Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and fix any inaccuracies ASAP. Get in the practice of checking credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian and D&B for $90 less. Update the relevant information if there are errors or the details is incomplete.

Disputing Mistakes

So, what’s all this monitoring for? It’s to challenge any mistakes in your records. Errors in your credit report(s) can be taken care of. But the CRAs typically want you to dispute in a particular way.

Disputing credit report inaccuracies usually means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always send copies and retain the originals.

Disputing credit report inaccuracies also means you specifically detail any charges you challenge. Make your dispute letter as clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you mailed in your dispute.

How Hard is it to Establish Business Credit in a Recession: A Word about Business Credit Building

So always use credit sensibly! Don’t borrow beyond what you can pay off. Monitor balances and deadlines for payments. Paying on time and fully will do more to boost business credit scores than virtually anything else.

Establishing corporate credit pays. Good business credit scores help a company get loans. Your credit issuer knows the corporation can pay its financial obligations.

They know the corporation is authentic. And the business’s EIN connects to high scores, and credit issuers won’t feel the need to require a personal guarantee.

How Hard is it to Establish Business Credit in a Recession: Takeaway

Business credit is an asset which can help your small business for years to come.

Obtaining merchant accounts for business credit means that you are on your way to getting good business credit.

These three should conveniently get you going. How hard is it to establish business credit in a recession? Pretty easy! So go out there and clobber it! Learn more here and get started toward establishing business credit.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Credit Suite.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Business Marketplace Product Reviews.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Buy It At A Bargain – Deals And Reviews.