As a savvy internet user, you might think no one clicks on Facebook ads. You’d be wrong. Facebook is on track to make over $60 billion in revenue this year from advertising. Someone’s clicking. How do you get them to click your Facebook ads? More importantly, how do you get them to buy your product or sign up for … Continue reading A Deep Dive Into Facebook Ads: How to Create, Optimize, and Test Facebook Ads

Tag: Into

Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

The COVID-19 pandemic caught the world by surprise. The economy is upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 relief options. Beyond that, check out what we found out about Lima One Recession Funding. Note: The changing economic environment means nothing stays the same long. This information is accurate as of the time of this writing, but lenders are making changes frequently. Check Lima One Capital for updates.

Our Honest Review of Lima One Recession Funding

When it comes to real estate investments in a recession, there are a few options. You can flip houses, manage rental property, or some combination of both. One thing is for sure however, and that is that you almost always need financing. Lima One recession funding could help.

In recent years a ton of online real estate investment lending institutions have popped up. These differ from the tons of alternative lenders that have broken digital ground. Instead of business loans, they deal only in real estate lending. In addition, though most of the hard stuff is available to deal with online, there are brick and mortar offices.

They are similar to online lenders in many ways. As already mentioned, most of the forms are available online. Both application and approval can often happen with an online form. Also, Lima One recession financing may also allow for a lower credit score than a traditional bank would require for approval.

The main difference is that these companies, including Lima One, deal only in real estate investments. As such, there are certain things that cannot happen online, such as inspections and appraisals. If you are considering real estate investment, or if you are already in the business but looking for a new lender, Lima One recession financing could be the answer to all you seek.

In an effort to help you make an informed decision about Lima One recession financing, we took an in-depth look at their mission, policies, and products. Our research for this should help you decide if it will work for you. Before you can figure that out, especially if you are new to real estate investment, it may be helpful to have a quick reminder of how the process works.

What are Real Estate Investments?

When you get down to the nitty gritty, real estate investment is simply purchasing real estate for the purpose of generating profit. It can happen in a couple of different ways though.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Flipping Houses

This is the main topic of many television shows. You buy a house for almost nothing, fix it up, and resell it for a profit. It sounds simple enough, and even fun. There is much more to it however. The first roadblock is almost always funding. You have to have the money to buy the house in the first place.

Usually, house flipping financing is short-term, like 13 to 24 months. That isn’t a ton of time to fix it up and get it sold, and you are at the mercy of the contractor’s time table. It is very profitable for a lot of people, but there is a healthy dose of luck involved as well.

The greatest hurdle seen in many house flips is location. You can buy a great house at a great price and fix it up to an even better house that should sell for much more, but if it isn’t located in a place where people want to live, you are going to end up with a house that won’t turn a profit. Worse yet, it may not sell at all.

When looking at a home purchase for a flip, you have to consider location. Not doing so could be extremely detrimental.

Rental Properties

There are a couple of different options here as well, but when most folks think of rentals, they are thinking about buying houses to rent out to others. It can be pretty lucrative if you play your cards right.

Every town needs rental property, but the type of rental property needed may differ vastly. For example, a college town is going to need property that is clean, livable, and able to sleep several roommates to maximize cost effectiveness.

A large city will need a good mix of rental properties for professional young people and young families coming to the area for work. The singles will want something trendy and close to the action, while the families will be looking for size, stability, and something a little lower key. This would be the difference between a downtown loft and a three-bedroom two bath in the suburbs.

In the college town, smaller sized homes and duplexes are going to be vital. If you own a ton of family homes, you may run into issues. If you are in a town that a lot of families are moving to however, those rentals that will hold them could be a gold mine.

Location, Location, Location

Location really is huge.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Apartments are also a good bet if you want to get into rentals, but you still have to exercise caution. You want a complex that already generates a profit on the front end. Do not ignore the need for upkeep or maintenance either. Both are vital regardless of what type of rental you own, but apartments can be a little more difficult to manage due simply to the number of tenants you have to juggle.

Financing Options for Lima One Recession Funding

Different financing options are available for the various types of real estate investments. Your specific business situation can make a difference as well. Here is what is available as far as Lime One recession funding.

Fix N Flip

This is the house flipping loan available through Lima One Capital. It is a 13-month term loan up to 75% of ARV for 90% of purchase or rehab. There is no prepay penalty, and the minimum credit score necessary for approval is 600. This is pretty low, meaning your credit doesn’t have to be perfect to get started.

While this type of Lima One recession funding can open up a lot of opportunities, remember that there are some major risks involved with flipping houses. It is important to take this and the short loan term into consideration on the front end.

This is why it is important to remember that location is just as important as other factors when house flipping. If you have a great house and your budget is on point, but the house is in a part of town that no one is buying in, you are going to have issues.

Bridge Plus

The Bridge Plus loan is available to those who have 5 or more successful home flips in the past 2 years. It is a lower interest option for Lima One recession funding if you need a quick purchase or refinance for resale. The term is still 13 months, but the funds are more readily available and again, lower interest, due to the previous experience requirements.

Lima One Recession Funding: Construction Loans

If you are planning to do major work or build a structure for residential rental, this is the Lima One recession funding you need. You must already own the investment property or lot, and it is a 70% ARV with a 13-month term.

Cash Out Loan: Lima One Recession Funding at Its Finest

This loan is for those that already own property and want to leverage it. It is 0% down, with a 50% loan to “as-is” value. The term is 13 months.

Rental Financing: Another Form of Lima One Recession Funding

If you are looking at investment property to run as a rental rather than resale, Lima One recession funding has several options.

Rental 30

This option is open to all experience levels for purchase, refinance, or cash out. It is a 30-year term with interest ranging from 5.75% to 8.025%. The minimum amount available is $50,000 and the maximum is $1,000,000. There is no debt to income requirement for the borrower, and the minimum credit score required is 660.

Rental Premium

The Rental Premium product is a loan available with a 30-year term or with a 5/1 or 10/1 loan option. And the property has to have a value of at least $60,000. The minimum credit score for eligibility is 660.

Rental 2-1

This is a loan for rental property with a 2-year term and the option for a 1-year extension. The minimum loan amount is $50,000, and the maximum is $2.5M. The 660 minimum credit score still applies here.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Multi Family Loan Overview

If you are going to buy multifamily rental property, this loan could be Lima One recession funding you need. A 2-year term with no prepayment penalty highlights the offering. Interest ranges from 8.99% to 10%. The fund amounts are variable between $250,000 to 5,000,000.

With most of these loans you also have the potential to cross-collateralize any property you already own or have under an existing loan with Lima One Capital.

Lima One Capital Recession Funding: What Are People Saying?

We can’t research Lima One recession funding without checking out the company on the Better Business Bureau website. According to the BBB, Lima One has been in business since 2010. They do have 5 complaints on file, but over 8 years that’s not too bad. Most of the complaints relate to issues dealing with individual staff members. They are not related to company policy or habitual ways of doing business. They have an A+ rating.

In addition, they made the top real estate lenders as issued by Fit Small Business in June of 2018.

They offer loans in 40 states.

What Else do You Need to Know about Lima One Recession Funding?

Most real estate loans, regardless of the lender, require 20% down. That can be a stretch during a recession. It can come from multiple sources, including loans from other lenders, leveraging properties you already own, gifts, or personal funds.

Location matters. I have mentioned this already, but you just can’t expect to buy cheap property to flip without thinking about why it is cheap. The same goes for rentals. What kind of renters will you get in the area? Will they pay? Location is an important element that you should pay attention to.

When you have a construction loan, it may cost you to make draws. Sometimes it can cost as much as $200 per construction draw. This is standard, but you need to be sure to add it to your budget, and be careful to manage your construction draws accordingly.

Budgets are important. That will go without saying to many, but just in case you weren’t sure, you need to have a budget and stick to it. It will pay off in the end.

Don’t over improve. You want to increase the value of the property, but stay aware of what your market can handle. Custom cabinets and marble counters are fabulous, but if those buying in that area cannot afford them, you are only going to lose money. Pay attention to the market in a particular location and what it can handle.

Along those lines, consider whether you are selling versus renting. If you are improving a property for rent, you need to pay closer attention to the durability of the materials you use.

Lima One Recession Funding: Conclusion

Finding funding of any kind during a recession is hard. There is no doubt about it. It is important to stay on top of your finances and do your research so that you can find the right sources to fit your needs. It is much easier to slide down a slippery slope. A good funding source could be the traction you need.

Overall, Lima One recession funding is solid. They know their business and generally offer great customer service. The only issue is that there may be, on occasion, a glitch in company-wide communication. However, the company addresses each complaint on the BBB website in a timely manner, and there are not a lot of those complaints. If you are looking at real estate investments, Lima One Capital isn’t a bad place to start.

Armed with this information, you should be able to make a more informed decision about a lender. If you are serious about breaking into real estate investment, or if you are an established investor looking for more funding options during the recession, we would love to help. Find out more here.

The post Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into appeared first on Credit Suite.

Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

The COVID-19 pandemic caught the world by surprise. The economy is upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 … Continue reading Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

How Does Business Credit Fit into The Big Picture of Fundability?

The terms “business credit” and “fundability” get thrown around a lot. The truth is, a lot of people think they are interchangeable. In fact, they are not. Think of fundability as a puzzle, and all the pieces are different sizes. Business credit is a huge puzzle piece that goes right in the center.

You Can’t Have Complete Business Fundability without Business Credit

Think about the puzzle analogy and you can see how it isn’t really possible to have complete fundability without business credit. A huge piece of the picture would be missing. On the other hand, you could get a good idea of what the picture is if you have credit in your business name but not all the other pieces of the fundability puzzle. That is how big this piece is. It is huge. You just wouldn’t have all the funding options that you would if you had all the puzzle pieces. Before we can go further, you need to understand what fundability is, and what business credit it.

Keep your business protected with our professional business credit monitoring.

What is Fundability?

Basically, fundability is the ability of your business to get funding. When lenders consider releasing funds for your business, does it appear to them to be a good idea to make the loan? What do they look at to make that decision?

When a lender considers lending to your business, they are wondering if you are high risk? Do you seem like a business that can and will pay back the debt? Lenders are in it for the money. They need to feel like they are making a good investment. A high credit risk is not a wise lending choice.

The harder question is how does a business get fundability? This is hard, because so many things affect fundability. Sure, a great credit score for your business is important. In addition, many of the aspects necessary for a strong business credit score are necessary for fundability as well.

A potential creditor needs to see that your business is legitimate and profitable. Many loan applications are denied approval due to fraud concerns. Others, simply because something didn’t match up and threw up a warning signal. Maybe the addresses or phone numbers didn’t match on a couple of reports and it just looks unprofessional.

What is Business Credit and Why Do You Need It ?

Why do you need separate credit for your business? First, if something bad happens and your personal credit goes down, you need to be able to continue to run and grow your business. If your business has its own strong credit, you can still do that regardless of what is happening with your personal credit.

Why do you need separate credit for your business? First, if something bad happens and your personal credit goes down, you need to be able to continue to run and grow your business. If your business has its own strong credit, you can still do that regardless of what is happening with your personal credit.

While it is true a new business will not have any credit of its own, it doesn’t have to be that way forever. There are ways to build credit for your business quickly so that when the time comes, you can keep your personal credit separate and finance business growth using your business credit. Learning all you can about business credit is the first step in building it.

The great thing is, building credit for your business and building fundability both start the same way, with the foundation.

The Setup Affects Both Business Credit and Fundability

You have to set up your business properly. It has to have a fundable foundation to build separate credit and to build fundability as a whole. What makes up a fundable foundation?

Separate Contact Information

The first step in setting for fundability is to ensure your business has its own phone number, fax number, and address. That’s not to say you have to get a separate phone line, or even a separate location. You can run your business from your home or on your computer. You don’t even have to have a fax machine.

In fact, you can get a business phone number and fax number pretty easily. They will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This part may seem outdated, but it does help your business appear legitimate to lenders.

You can use a virtual office for a business address. This doesn’t play out how you may think. This is a business that offers a physical address for a cost. Sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

Get an EIN

The next thing you need to do is get an EIN. It is an identifying number for your business that works similar to how your SSN works for you personally. You can get one for free from the IRS.

Incorporate

Incorporating your business as an LLC, S-corp, or corporation is vital to fundability. It helps your business appear legitimate, and also offers some protection from liability.

You can incorporate as an LLC, S-corp, or full blown corporation. Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. The best thing to do is talk to your tax person and your attorney. You are going to lose any time in business that you have. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated as well.

This is why you have to incorporate as soon as possible. Not only is it necessary for fundability and for building credit for your business, but so is how long you have been in business. The longer you have been in business the more fundable you appear to be. Time in business begins on the date of incorporation, regardless of when you actually started doing business.

Keep your business protected with our professional business credit monitoring.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of finances. It will also help you keep them separate from personal finances. This is necessary for tax purposes anyway.

In addition, there are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. Also, you cannot get a merchant account without a business bank account. Consequently, you cannot take credit card payments. Studies show consumers tend to spend more when they can use a credit card.

Licenses

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, warning signs are going to go up everywhere. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Website

I am sure you are wondering how a business website can affect fundability. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend what you need to in an effort to make sure your website is professionally designed and works. Also, pay for hosting. Don’t use a free service. Along these same lines, your business needs a separate business email address. It should have the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

What does all of this have to do with separate credit for your business? Before your business can have its own credit, it has to be set up as an entity separate from the owner. The fundable foundation is how you make that happen.

How Does Business Credit Fit in to Fundability?

Now that you know what fundability is and how to set up your business to be fundable, you need to know how business credit fits in.

Credit Reports

Business credit agencies issue reports much like your consumer credit report. They detail the credit history of your business. It helps lenders determine the creditworthiness of your business.

Where do these reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

Other Business Data Agencies

In addition to the reporting agencies that directly calculate and put out credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

Identification Numbers

In addition to the EIN, there are identifying numbers that go along with your business’s credit reports. You need to be aware that these numbers exist. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Business Credit History

Your credit history is the main piece of your credit score. In turn, your credit score is a huge factor in the fundability of your business.

Your credit history consists of a number of things including:

- How many accounts are reporting payments?

- How long have you had each account?

- What type of accounts are they?

- How much credit are you using on each account versus how much is available?

- Are you making your payments on these accounts consistently on-time?

The more accounts you have reporting on-time payments, the stronger your credit score will be.

Keep your business protected with our professional business credit monitoring.

Business Information

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks.

This is a problem because a ton of loan applications are turned down each year due to fraud concerns simply because things do not match up. Maybe your business licenses have your personal address but now you have a business address. You have to change it. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

The key to this piece of the business fundability is to monitor your reports frequently. This way, you can see if any mistakes are affecting your credit, and get them fixed.

Fundability is to Business Credit as Turkey Is to a Turkey Sandwich

I know, I know, another analogy might be overdoing it. But think about it, you can have a sandwich without turkey, but it’s not a turkey sandwich. It’s something else. You can have all the pieces of fundability without business credit, but it won’t hit the spot.

Without true business credit, even if every other part of fundability is in place, you’ll still be missing out on a ton of funding opportunities. Definitely work on building strong credit for your business. It’s a huge part of fundability. However, don’t let the other facets of fundability slip. You need the whole puzzle to see the big picture and get the big money.

The post How Does Business Credit Fit into The Big Picture of Fundability? appeared first on Credit Suite.

Loan Consolidation Loans: Consolidate all financial obligations right into one

Loan Consolidation Loans: Consolidate all financial obligations right into one

Paying various financial debts is an extremely typical issue that many of us encounter extremely usually. Exactly how can we come out of these financial debt problems? And also the response is, combining all financial debts right into one- choose for combination finances.

Debt consolidation finances are fundings that settle all your fundings right into one that is easier to pay off. You have actually taken car loans from 3 various financial institutions at 3 various passion prices. Currently, with combination finances, you will certainly have the ability to integrate all lendings right into a solitary lending with a fairly reduced rate of interest.

There are 2 type of combination finances- protected debt consolidation lendings and also unprotected combination fundings. Like various other guaranteed car loans, safeguarded debt consolidation fundings are offered versus a security.

Unlike guaranteed car loans, no security is needed for unprotected debt consolidation car loans. Like various other unprotected financings, unprotected debt consolidation finances lug high price of passion.

Combining financial debts, debt consolidation fundings are adorned with great deals of advantages. Like, with debt consolidation financings, month-to-month settlement quantity is smaller sized as well as you will certainly obtain remedy for all bothering as well as unfortunate telephone calls of loan providers.

If you have a poor credit rating, financial obligations, personal bankruptcy, CCJ, still you can make use of loan consolidation fundings. In this instance, loan providers will certainly bill greater passion price as the danger entailed greater.

Prior to using for combination financings, some initiatives are demanded. In the beginning, you will certainly need to approximate your economic demands. See just how much of overall financial obligations can you pay immediately to minimize the concern.

Apart from typical loan providers, like financial institution, economic companies, you can choose for on-line combination financings. It is instead simple to discover on-line loan consolidation fundings with wonderful passion prices.

Loan consolidation fundings are the best manner in which will certainly assist you to do away with debt-danger. As opposed to several repayments, just with a solitary settlement you can appear of all debt-related stress.

Debt consolidation fundings are lendings that combine all your fundings right into one that is extra hassle-free to settle. Currently, with debt consolidation finances, you will certainly be able to integrate all lendings right into a solitary funding with a fairly reduced passion price.

There are 2 kind of loan consolidation finances- protected debt consolidation car loans and also unprotected debt consolidation car loans. Unlike protected car loans, no security is needed for unprotected combination car loans. Like various other unsafe fundings, unsafe combination financings bring high price of passion.

The post Loan Consolidation Loans: Consolidate all financial obligations right into one appeared first on ROI Credit Builders.

Loan Consolidation Loans: Consolidate all financial obligations right into one

Loan Consolidation Loans: Consolidate all financial obligations right into one

Paying various financial debts is an extremely typical issue that many of us encounter extremely usually. Exactly how can we come out of these financial debt problems? And also the response is, combining all financial debts right into one- choose for combination finances.

Debt consolidation finances are fundings that settle all your fundings right into one that is easier to pay off. You have actually taken car loans from 3 various financial institutions at 3 various passion prices. Currently, with combination finances, you will certainly have the ability to integrate all lendings right into a solitary lending with a fairly reduced rate of interest.

There are 2 type of combination finances- protected debt consolidation lendings and also unprotected combination fundings. Like various other guaranteed car loans, safeguarded debt consolidation fundings are offered versus a security.

Unlike guaranteed car loans, no security is needed for unprotected debt consolidation car loans. Like various other unprotected financings, unprotected debt consolidation finances lug high price of passion.

Combining financial debts, debt consolidation fundings are adorned with great deals of advantages. Like, with debt consolidation financings, month-to-month settlement quantity is smaller sized as well as you will certainly obtain remedy for all bothering as well as unfortunate telephone calls of loan providers.

If you have a poor credit rating, financial obligations, personal bankruptcy, CCJ, still you can make use of loan consolidation fundings. In this instance, loan providers will certainly bill greater passion price as the danger entailed greater.

Prior to using for combination financings, some initiatives are demanded. In the beginning, you will certainly need to approximate your economic demands. See just how much of overall financial obligations can you pay immediately to minimize the concern.

Apart from typical loan providers, like financial institution, economic companies, you can choose for on-line combination financings. It is instead simple to discover on-line loan consolidation fundings with wonderful passion prices.

Loan consolidation fundings are the best manner in which will certainly assist you to do away with debt-danger. As opposed to several repayments, just with a solitary settlement you can appear of all debt-related stress.

Debt consolidation fundings are lendings that combine all your fundings right into one that is extra hassle-free to settle. Currently, with debt consolidation finances, you will certainly be able to integrate all lendings right into a solitary funding with a fairly reduced passion price.

There are 2 kind of loan consolidation finances- protected debt consolidation car loans and also unprotected debt consolidation car loans. Unlike protected car loans, no security is needed for unprotected combination car loans. Like various other unsafe fundings, unsafe combination financings bring high price of passion.

The post Loan Consolidation Loans: Consolidate all financial obligations right into one appeared first on ROI Credit Builders.

Vulture Investors Swoop Into China to Feast on Soured Loans

How to Turn Your Site into an Automated Sales Machine

Want to make more sales? Of course you do.

Maybe you’re not hitting the kind of figures you want, or maybe you haven’t even made a single sale yet. Either way, you’re not selling as much as you want to be.

But why aren’t you?

There are tons of possible reasons here, but I’m willing to bet it’s your website. Even if you have an expertly designed site, it could still be the culprit that’s stealing all your sales.

I learned this the hard way. My websites used to flat out suck and I barely got any sales. Once I started putting serious effort into my sites, my sales skyrocketed.

I tried everything. Some stuff was a huge waste. Some techniques ticked off my users.

But I was able to find some serious long-term winners.

While there’s no magic formula that will 10x your sales overnight, there are some best practices that will help you optimize your website to pull in the maximum amount of sales possible.

In short, you want to turn your site into an automated sales machine.

And I’m going to show you exactly how to do that.

Ready?

Setting Up Behind the Scenes With a CRM

The first thing you need is great customer relationship management (CRM) software.

A CRM helps you manage all of your current customers and leads in one place. You can communicate, track progress, and oversee all interactions without having to leave the CRM.

The reason you want to use a CRM is that it will help you generate the most amount of money out of your customers. And this is a lot easier to do than it is to acquire new customers.

When my friends at Keap reached out to let me know about their rebranding, I realized it had been a long time since I talked about how important their tool is in my arsenal.

Now, throughout the rest of this article, I’ll show you how I use Keap to grow NeilPatel.com.

But first, let me go into what it does… that way whatever solution you decide to choose, just make sure it has these features.

All-in-one Client Management

A good CRM should provide everything you need to manage your customers. You shouldn’t have to use extra software or apps to fill in the cracks.

That means your CRM should allow you to manage every interaction between you and your customers. You should be able to look at your CRM and know exactly where you are with any given client.

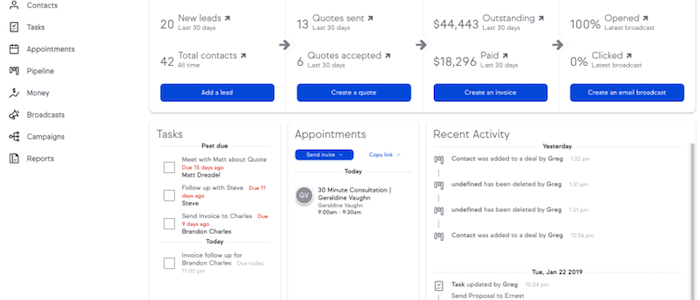

Here’s what it looks like when you first view your dashboard:

Having a simple, minimalistic design like this really helps cut down on the confusion that comes with managing tons of clients. There’s no second-guessing.

Take a look at the menu on the left-hand side:

Keap has taken all the ways you interact with your customers and broken them down into nine intuitive categories.

By clicking on the Contacts tab, you can see all of your clients:

By clicking on a particular client, you can see a summary of your activity with that person, including email conversations and invoice history.

This is important for me and my team as we offer multiple products and this view helps us understand where people are.

Remember, by having multiple products you can maximize your lifetime value, which then allows you to spend more money on marketing.

There’s also a separate message function that you can access by clicking on the Messages tab:

Here you can see all of your correspondence with each client. You’ll need to connect your mobile phone with the Keap app. This allows you to seamlessly switch between mobile and desktop for an efficient messaging experience.

The Tasks tab gives you a rundown of your to-do list for your clients:

You can check off each task here and easily add more by clicking the blue “Add a task” button at the top right. This way, you’ll never lose track of what you need to do.

Next is the Appointments tab, where you can set up a custom booking link to allow clients to schedule appointments with you. You choose your own availability so that clients always choose times that work for you.

This is great if you regularly have face-to-face interactions with your clients for example.

The Money tab is your one-stop-shop for all things finances. You can connect your bank to get paid in a flash and you can also manage all your invoices without any fuss.

You’re always aware of who’s paid and who hasn’t, so you don’t have to go chasing down clients one by one. You can simply send them a reminder within the interface by clicking on the specific invoice and scrolling to the bottom where there’s a reminder option:

The Broadcasts tab allows you to send out emails to your list.

Even though this isn’t standalone email software, you can still see a ton of helpful metrics by clicking on each campaign:

This feature is especially helpful for sending out emails to specific groups, like new leads or existing customers.

Next, you’ll see the Pipeline tab. This is where you build the core of your customer journey.

Once you click on the Pipeline tab, you’ll see four basic panels: new, qualifying, contacting, and negotiating. These are the stages that you’ll go through when converting a new prospect.

This is also where a lot of the automation happens that will save you tons of time and money. I’ll go into detail on this later on in the article, but for now, just remember this pipeline structure.

The Campaigns tab is a full-featured campaign manager that allows you to follow up with leads, track unpaid invoices, simplify scheduling, and much more. (You can also automate a lot of things here.)

Finally, the Reports tab helps you stay on top of your sales. Here you can also track important metrics like email engagement and campaign progression.

Take another look at all of these features. This is what I mean by all-in-one. A CRM should allow you to interact with your clients in any way you need to. You shouldn’t have to jump from software to software to create a great experience for your clients.

Now that we’ve looked at some basic elements of a good CRM, let’s look at one of the must-haves: automation.

Automation

Automation is hands down one of the most important features I look for in a CRM.

Why?

Because running a business is a lot of work, and the more you can automate, the better.

Automating is usually straightforward, but when it comes to automating client interactions, you have to be careful.

People love personal interactions, and that’s why you should do your best to deliver. If your automation is dry and corporate, your clients will notice.

So what do you do?

The trick is to personalize your automation as much as possible.

In other words, your automation should have a human touch.

If this sounds counterintuitive, I totally understand. “Personalized automation” seems like an oxymoron.

But it’s not. In fact, it works pretty well.

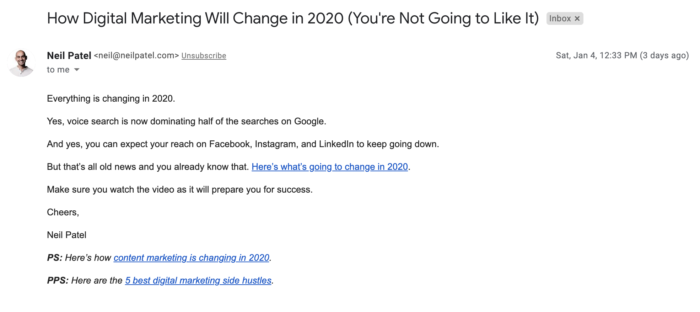

Take a look at this email I recently sent:

Believe it or not, this is a template.

The reason this works so well is that it doesn’t read like a template. It reads like an email I sat down and wrote myself.

Of course, you can automate way more than just emails.

Most automation actually happens behind the scenes, so you need a CRM that’s capable of seamlessly automating everything from client data to scheduling and beyond.

Let’s say I want to email a lead when they move from stage to stage in my pipeline. This is a great technique to keep leads engaged but often you have to do it manually.

With Keap, it’s simple. First I head to the Pipeline tab and find the specific lead. Then I click the gear icon and select “Configure automation.”

I now select when I want the email to trigger: either moving into or out of a stage. For this example, I’ll have it trigger when the lead moves out of the qualifying stage (where the lead currently is).

Then I select “send email” from the drop-down menu.

Now all I have to do is write the email.

Of course, you can use personalized templates here to maximize your efficiency even more. You can even personalize the email with this form by clicking on the pound sign on the right to open up the merge fields drop-down menu.

This all takes just a couple of minutes and it’s all completely contained within Keap.

See why automation is so important? It’s one of those features I can’t go without.

And I like easy automation. I’m super busy, so the easier something is, the better. I don’t want to have to go through a million menus just to shoot an email.

All of this said, there are definitely right and wrong ways to automate. You want your automation to make your business as efficient as possible and that means creating dependable processes that you can repeat without even thinking about it.

Creating Processes With a CRM

CRMs are useful for a lot of things from qualifying leads to creating entire marketing campaigns.

But there’s a common thread that runs through all of these features: the ability to create processes.

Processes are invaluable because they save you time, effort, and often money.

They also help your business operate more smoothly. Relying on processes is much easier than having to do everything manually.

That begs the question: What kinds of processes should you create?

The short answer is that you should have a process for everything. And I mean everything.

Responding to client emails? Make a process for it. Dealing with new leads? Set up a workflow for qualifying them. You get the picture.

This is critical. If you want to increase your sales, you have to be able to handle increased sales in the first place. Having processes to depend upon will allow you to take on more volume without any unnecessary friction.

As a rule of thumb, if you can automate something in your business, you probably should.

The exception (like I mentioned above) is anything based around human interaction. It’s best to stay as hands-on as possible when it comes to this.

The idea is to make your business run like clockwork so you can pay more attention to your clients and deliver a better experience.

And that’s a win-win for everyone involved.

But let’s get specific and talk about certain processes that you should make sure you have.

Lead Flow

This is a big one.

A lot of marketers focus on lead generation but not enough people talk about what should happen after you’ve got a lead.

If you don’t move your lead forward, your efforts are as good as wasted.

That’s why automating your lead flow process is critical. You don’t want to be doing this by hand––that takes hours.

Instead, let your CRM do it for you.

Create multiple stages along your pipeline and trigger unique email sequences for each stage. This means that you can keep your lead moving forward at all times.

This way, you won’t overlook anything. You don’t have to worry about forgetting to follow up or missing an important email.

So let the CRM do the heavy lifting so you can focus on providing a better service for your customers.

Marketing Emails

With a CRM, it’s possible to automate all of your marketing emails, and in my opinion, this should be one of the first things you automate.

Why? Because emails can take up lots of time without you even noticing.

According to the Litmus 2017 State of Email report, more than 68% of businesses spend a week or more on the production of just one email.

Automation allows you to cut back on that time so you’re not working on the same task for days on end. You’re able to spread out your time and attention on other things that need to be handled.

And by automating your email, you’re making your email work for you instead of the other way around.

For example, whenever you get a new lead, you need to take action as swiftly as possible.

With the right CRM, this is a snap. All you need to do is automate it so that a new lead receives an email as soon as they sign up.

That way, you’re able to contact a warm lead immediately and you don’t have to do anything manually.

You can track them right from the Broadcasts tab:

This means you can also create autoresponder campaigns to get more clients in the door.

You can then move them down your pipeline, which brings me to the next thing you need to do: build a robust pipeline.

Building a Streamlined Sales Pipeline

If you’ve ever wondered what’s stopping your site from raking in the sales, chances are it’s probably your pipeline.

Now, I could talk for hours about building an effective pipeline, but for the purposes of this article, I’m going to condense the information down to the essentials.

So here’s everything you need to know about pipelines.

Common Pipeline Mistakes

Most pipeline errors that cost you precious time and money are easily preventable, which is why you should take the time now to make sure your pipeline is seamless from start to finish.

Ironically, one of the most common pipeline mistakes is simply not spending enough time on your building it out initially.

Your pipeline is the lifeblood of your business. It’s what helps you turn leads into clients. So if it’s not optimal, your sales won’t be either.

Another mistake is not moving leads quickly enough.

The data shows that the sooner you nurture your leads, the better. Wait too long, and your leads will turn cold, which could cost you a sale.

Did you know that as much as 50% of sales go to the first vendor?

Every second matters when you get a new lead.

By baking automation into your pipeline, you can nurture a new lead immediately. The software will take care of that for you, and you’ll be one step closer to making a sale.

Likewise, it’s important to keep this engagement steady throughout your pipeline. Being present at every step will greatly increase your chances of closing the sale.

The best way to do this? Surprise––it’s CRM automation.

But no matter what CRM you’re using, don’t make these costly mistakes.

Organizing Your Pipeline

Now that I’ve talked about what not to do, I’ll tell you what you should do.

First, make sure you have your priorities right at each touchpoint.

To put it another way, your pipeline needs to be doing the right things at the right time.

For example, when you first get a lead, your top priority should be nurturing that lead. You don’t want to hit them over the head with a big sales pitch––you just want to increase brand awareness.

Also, remember that a pipeline is essentially a bunch of leads going through a sales funnel. Use that framework to create your process and automations.

Your CRM can help you create a cohesive pipeline that keeps leads moving through your funnel and ensures that the appropriate actions are taken when necessary.

First of all, the four stock categories that Keap starts you out with (new, qualifying, contacting, negotiating) are great, but you can always add more if you need to.

Just scroll all the way to the right and click the “Add a stage” text field:

For instance, you could add a Completed stage for leads that you’ve successfully converted and are moving forward with.

The way you organize your pipeline might take some trial and error, as most companies have unique workflows.

However, I would recommend having at least three different stages so you can engage your lead at the beginning, middle, and end of your pipeline.

Next, the key is to use automation to make your pipeline as hands-off as possible.

Start by automating your email sequences as I showed above to help move your leads from stage to stage and keep them engaged. Again, these emails need to be personalized. There’s no point in using boilerplate templates that are stiff and boring. Take the time to make each email feel personal.

Next, add automation to your campaigns. This will ensure specific actions are taking within your CRM as leads move from stage to stage. These step-by-step tutorials on automation can help you get up and running.

Now, I won’t lie to you––this is going to take some trial and error. You aren’t going to have a perfect pipeline on day one.

So be sure to test your pipeline before you take it out in the real world.

Plug some fake clients and numbers into your CRM and use a few burner emails to test out your CRM’s capabilities. This will give you the chance to identify and remedy problems before you go live.

This extra step goes a long way. Sure, your pipeline still might have some errors once you start using it for actual clients, but you’ll have minimized the risk involved.

Conclusion

You’re almost at the finish line! It won’t be long until you’re putting your shiny new pipeline to good use.

But first, we have to put all the pieces together, so let’s recap what we’ve gone over.

1. The importance of a robust CRM. You want software that will allow you to manage all of your customers in one place, automate your business process, and track important metrics and interactions.

2. Putting processes in place. Having processes to depend upon is crucial for every business. Doing everything by the seat of your pants leads to inconsistency and often costs you.

3. Automation. If you can automate an internal process, you probably should. You can also automate a fair amount of client interactions without losing a human touch.

The final step is to synthesize all of these steps into one unified approach.

Remember, you’re doing all this to optimize your site for sales. You’re building a strong foundation that will support you as you scale.

After all, your site is the sum of its parts, so make those parts awesome.

Choose a CRM that meets your needs and that’s flexible so it will grow with you. Then create processes that will take the weight off your shoulders––and don’t be afraid to change these processes over time as your business evolves.

And there you have it — everything you need to start turning your site into an automation workhorse.

Before you know it, you’ll be seeing some of the amazing effects of automation and hopefully bringing in more sales than ever before.

Do you use a CRM that has helped turn your website into a sales machine?

The post How to Turn Your Site into an Automated Sales Machine appeared first on Neil Patel.

Mux (YC W16) is looking for a solutions engineer to help turn customers into fans

Article URL: https://mux.com/jobs?hnj=10 Comments URL: https://news.ycombinator.com/item?id=21950884 Points: 1 # Comments: 0

Mux (YC W16) is looking for a solutions engineer to help turn customers into fans

Article URL: https://mux.com/jobs?hnj=10 Comments URL: https://news.ycombinator.com/item?id=21950884 Points: 1 # Comments: 0