Your Personal Credit Score Can Make a Difference When You Apply for a Business Loan If you’re a small business owner, don’t assume your business credit is separate from your personal. If you apply for a loan, lenders will consider it on your personal credit, not your business credit. Your business credit score is considered … Continue reading Why do Lenders Prefer Using a Personal Credit Score to Approve a Business Loan?

Tag: personal

Why do Lenders Prefer Using a Personal Credit Score to Approve a Business Loan?

Your Personal Credit Score Can Make a Difference When You Apply for a Business Loan

If you’re a small business owner, don’t assume your business credit is separate from your personal. If you apply for a loan, lenders will consider it on your personal credit, not your business credit. Your business credit score is considered on its own only if your company generates millions in annual income. Otherwise, assume that your personal credit score will matter.

Solid personal credit is a necessity. The need to build and maintain it never goes away for most small company owners.

Some lenders (like banks) place more importance on personal scores. This is for checking business loan applications.

To establish your business’ creditworthiness, most lenders first analyze your personal credit score. This happens with organizations in operation for only a few years. It also happens with businesses seeking their first business loan.

So, small business owners must focus on creating a solid business credit profile. This is along with building a good personal credit score.

What is the Difference Between Business Credit Score and Personal Credit Score?

Here are the main variations between company personal credit scores:

- Business credit reports use Employer Identification Numbers (EINs). Personal credit reports use Social Security numbers (SSNs).

- The ranges of personal and business credit scores are very different. Business scores tend to vary from 0 to 100. The range of personal credit scores is 300 to 850.

- Experian manages both business and personal credit. They use separate databases and departments if you have both kinds of credit.

- You can freeze or lock personal credit reports. But business credit reports cannot be locked or go under security freeze.

- Different rules apply to data used in business and personal credit reports.

- Anyone can examine your business scores (they must buy the report and scores). But only you and others who have your authorization can access your personal scores.

Demolish your funding problems with 27 killer ways to get cash for your business.

When do Lenders Consider a Personal Credit Score for Approving Business Loans?

When reviewing creditworthiness for a business loan, most lenders check personal credit history.

But some lenders will give your personal credit score less weight than others. Lenders may pay less attention to a poor personal credit score if you already have a track record of solid business credit.

Your personal credit will matter more for a business loan when any (or all) of the following are true:

a. If You’re Seeking a Loan from a Bank or Other Conventional Lender

You should assume banks have strict lending rules and often aren’t too flexible. But private lenders offer financial help. It’s in the form of business loans with low credit requirements. They provide funds considering a business owners’ personal score. This is even if the business score is low. Here, conventional lenders may check personal credit scores to offer you a business loan with flexible terms.

b. If Your Business is a Startup or Small in Nature

If your business score does not have enough info for lenders to check credibility, they will place a higher value on personal scores.

This can be the case with sole proprietorships or small businesses with few employees. Here, it may be hard for a conventional lender to distinguish between your business credit report and personal credit reports.

c. Your Personal Credit Score is Relatively Low

Even if you have a few old negative entries on your personal credit report, getting a business loan shouldn’t be tough. If your business’s credit history is excellent, then it shouldn’t be a problem.

But too many negative items on your personal credit history may damage your score. A low personal credit score is something a lender will notice and consider as a risk.

Your personal credit score reflects how you manage your personal credit liabilities. But some may argue that your personal credit score has nothing to do with how your business operates its business credit liabilities.

As a business owner, understand how your credit score is calculated, and how it’s used when you apply for a credit. And understand what you should do to improve it.

Demolish your funding problems with 27 killer ways to get cash for your business.

How is a Personal Credit Score Calculated?

The Federal Government improved credit reporting quality with the Fair Credit Reporting Act in 1970.

The consumer credit bureaus collect information from a consumer’s credit profiles to create FICO scores. Experian, Transunion, and Equifax are the three largest credit bureaus. These three major credit bureaus maintain the same basic formula to rate your credit. A personal credit score ranges from 300 to 850 and is rarely identical.

They calculate your FICO score using this basic, widely used formula:

Payment History (35%)

Late payments, judgments, and bankruptcies are problematic. So are debt settlements, repossessions, charge-offs, and liens in your credit report. They will lower your personal credit score.

Debt Owed (30%)

Your personal credit score also depends on your debt-to-credit limit ratio. And it depends on the number of credit accounts, the total amount of credit balances, and the amount paid off on installment loans.

Credit History (15%)

Your credit history plays an integral part in building your credit score. The average age of the accounts and the length of your oldest credit account are the two most important criteria. The longer (or older) the file is, the better. This is because the score tries to forecast future creditworthiness based on past credit history.

Credit Types (10%)

Having different types of credit shows your ability to handle many credit accounts. These types include revolving, installment, and mortgage credit. It will definitely have a positive impact on your credit score.

New Credit Accounts (10%)

Each new “hard” inquiry on your credit report may have an adverse effect and may lower your score by 10%. Per Experian, these inquiries may stay on your report for a few years. But they will have no impact on your credit score after the initial year.

How Does This Information Build Your Credit Score?

Credit bureaus collect personal information like your name, date of birth, location, occupation, and more. They’ll also prepare a list of information that the creditors provide. Other information, like judgments or bankruptcy, will appear on your credit reports. It becomes part of your personal credit score. When you apply for new credit, your creditor will see all that info in your credit report and check your score.

If you find any inaccurate data reported, the credit bureaus have procedures in place to correct verifiable mistakes. Amendments to the Fair Credit Reporting Act in 1996 allow you to put a 100-word statement on any report that includes an item you dispute.

A range of factors can drive a bad credit score, including a divorce, severe illness, or loss of employment. This allows you to ensure that potential creditors are aware of the information.

Here’s what a potential creditor sees when they look at your score:

800-850 (Exceptional)

You should expect lenders to treat you like a king! With a credit score above 800, you can choose the best credit alternatives for your needs, and the best interest rates, from any lender you choose..

740-799 (Very Good)

If you have a credit score inside this range, lenders will treat you as a low-risk borrower. You can get a loan from almost any big lender with affordable rates. With this credit score, you can choose the best business loan that fits your business needs.

670-739 (Good)

This is a good score, and many people in the United States fall into this category. With this score, a borrower can hope to have more choices and approvals from various lenders.

580-669 (Fair)

This is a score that indicates a significant level of risk. A small business loan is feasible, but the interest rates will often be higher. If your score is in this range, you will have fewer possibilities than those with a higher level.

Most conventional lenders will not consider borrowers in this group for a small business loan. A personal credit score of 660 is the lowest that the SBA will typically consider.

300-579 (Very Poor)

Borrowers with this credit score can access some credit. But it’s considered a high-risk credit score. So there will likely be fewer possibilities and higher interest rates. If your score falls in this range and you want to get a business loan, consider offering some collateral.

Demolish your funding problems with 27 killer ways to get cash for your business.

How To Improve Your Personal Credit Score?

There is no simple solution to fix your personal credit score issues. But that doesn’t imply you can’t increase your score with time and effort. Here are six strategies to improve your personal credit score:

Analyze Your Score

You are entitled to get a free credit report once a year from annualcreditreport.com. You can get your credit report as many times as you want from all three major credit reporting agencies. These bureaus provide credit monitoring services for an affordable fee. Get your report from them and analyze it properly.

Make Good Use of Credit

This may sound oversimplified, but it’s critical. Resist the urge to use all your credit limits all the time. This is so even if you pay off the total outstanding debt balance every month through credit card debt consolidation. Using all the available credit further can damage your credit score.

Keep credit usage to roughly 15% of your available credit limit to increase your credit score.

Make Your Payments On Time

This is most likely the best and most successful strategy to improve your score. How fast you make payments and satisfy your liabilities makes up 35% of your score. A single late payment can significantly reduce your credit score.

Do Not Apply for Excess Credit

Applying for unnecessary credit reduces your credit score. So if you’re attempting to raise your score, it’s not a good idea.

Don’t Transfer Balances Too Often

Transferring balances from one credit card to another does not affect your credit score. But, it’s generally known as a wrong financial move that could harm your personal credit. Frequently transferring balances can put a bad impression on your future creditors.

Have Patience and Keep Trying

Improving your credit score requires strong determination and hard work. Your constant effort over six months or even a year can make a significant difference. But missing a payment or two will almost certainly lower your credit score fast.

About the Author:

Lyle Solomon has considerable litigation experience. He has substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California. He now serves as a principal attorney for the Oak View Law Group in California.

Lyle Solomon has considerable litigation experience. He has substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California. He now serves as a principal attorney for the Oak View Law Group in California.

The post Why do Lenders Prefer Using a Personal Credit Score to Approve a Business Loan? appeared first on Credit Suite.

How to Create Your Personal Brand’s Visual Identity

Visual branding is the most effective way to create a powerful online presence. If you don’t believe me, check out this article on why visuals are important in marketing: When half of the human brain …

The post How to Create Your Personal Brand’s Visual Identity appeared first on Paper.li blog.

The Truth About Business Funding With No Personal Guarantee Credit

Does business funding with no personal guarantee credit exist? The simple answer is yes. How do you get it, and do you even need it? Those are harder questions to answer.

What’s the Real Story Behind Business Business Funding With No Personal Guarantee Credit?

To some, it may seem like a mythical idea, a unicorn if you will. Even if you have strong business credit, many lenders will ask for a personal guarantee on a business loan. So, what are companies talking about when they say you can fund a business with no personal guarantee credit? Let’s find out.

What is Business Credit?

Before we can talk about no personal guarantee credit for business funding,we need to define a few terms.

First, we’ll define business credit. Business credit is credit, like a credit card or other type of credit account, in the name of your business rather than in your name personally. When you apply, you use your business name, your business contact information, and your EIN instead of your social security number.

What frustrates you the most about funding your business? Check out how our free guide can help.

Then, the business is responsible for repayment. Sometimes, the account does not report to your personal credit report. Meaning, your personal credit scores will not be affected by your business credit accounts.

Business Credit vs. Business Credit Report

Now, let’s talk about your business credit report. This is a report, like your personal credit report. Lenders use it to evaluate the creditworthiness of the business. It consists of the credit history of the business, the business credit score, and other data. The business credit score is made up of the payment history of those business credit accounts that actually report to the business credit reporting agencies.

Not all business accounts will do that. But those that do, are the ones that make up the score on the business credit report.

Personal Guarantee

To understand what no personal guarantee credit is, you have to know what a personal guarantee is. If you get a credit account with a personal guarantee, you are responsible for repayment. By definition, all personal credit accounts have a personal guarantee.

This could mean a hard pull on your personal credit, which can lower your personal credit score. However, in theory, if your business has an account in its own name and it is set up to be a separate entity from you, the owner, it is responsible for its own debt.

Still, many companies require a personal guarantee from the business owner before extending business credit, especially small businesses. This is due to many factors, including data from the Bureau of Labor statistics that states 20% of new businesses fail within the first year, 45% within the first 5 years, and 65% in the first 10 years. In fact, only 25% of new businesses make it 15 years or more.

It’s easy to see why lenders and credit card companies would ask for a personal guarantee from business owners when it comes to business credit.

What frustrates you the most about funding your business? Check out how our free guide can help.

Can You Get No Personal Guarantee Credit for Business Funding?

The short answer to this is yes, but it is not that simple. First, most business accounts that do not require a personal guarantee are designed for larger businesses or older businesses.

There is very little out there when it comes to no personal guarantee credit for small, newer businesses. There are some vendors that will extend net terms without a personal guarantee if your business meets certain requirements.

Requirements may include a certain minimum time in business, a minimum average balance in a business bank account, specific annual revenue, and more. Other than that, there are a couple of business charge cards you can get without a personal guarantee. For example, Brex and Divvy both offer this type of product.

The catch is, these are charge cards, not credit cards. So you have to pay the balance off each month. Basically, it’s like a card that you can use anywhere and you have net 3o terms on the balance. It’s similar to a vendor account, but more flexible.

There are also business credit cards available without a personal guarantee, but only if your business credit is strong enough. In general, your business needs to be earning millions in annual revenue to qualify for these cards.

What’s so Bad About a Personal Guarantee?

Why try to avoid a personal guarantee? No one likes risk. That’s why businesses require a personal guarantee and why business owners don’t love to give one. However, if you have true business credit that requires a personal guarantee, the business will have to pay first. You will be personally liable for anything that the business cannot cover. Still, you will not be first in line for all of it.

A Personal Guarantee can Accelerate Your Business Growth

A better option is to realize that if your business is small and young, you are likely going to need a personal guarantee for much of the funding. Yet, you can work to reduce your liability in a number of ways. The first way to do that is to incorporate your business as a corporation, S-corp, or LLC. Your business attorney or accounting professional can help you with that.

Next, you can look at funding options that do not require credit at all. Does this debt-free funding even exist? Sure it does.

Grants, Crowdfunding, Angel Investors, ROBS, and more can be used to get as much funding as possible without any repayment.

Work on Building Business Credit

Then, you can work on building a strong business credit profile for your business, including a strong business credit score. This will help you be able to get funding for your business without as much reliance on a personal guarantee. Basically, the stronger the business credit, the less the lender feels the need to rely on the owner’s creditworthiness.

The key to this is to look for creditors who will report positive payment history to your business credit profile. Even some lenders that require a personal guarantee may report payments to your business credit report and not your personal credit report.

Stop worrying about the personal guarantee and worry more about building business credit so you can reduce the amount of personal guarantee required to get the funding you need.

Get Funding While Building Business Credit

If you cannot get all of the funding you need for your business with non-debt options, and your business is young and small, you may very well have to use a personal guarantee to get the funding you need in the beginning. That is okay.

What frustrates you the most about funding your business? Check out how our free guide can help.

The key is to know exactly what you are getting. Definitely make sure you apply with your business name, EIN, and contact information. Then find out what credit agencies they report to. If they report to the business credit agencies like Dun & Bradstreet, Experian Business, or Equifax (Business), that is a good thing. It will help you reach your goal of building business credit faster.

If they report to personal credit, so be it. Just keep working through the process of building your business credit profile as quickly as possible. Then, you can tip the scales away from your personal liability as much and as quickly as possible.

Debt-Free Funding

If you really want to stay away from a personal guarantee, you can try one of these debt-free funding options. Just remember, debt-free doesn’t mean cost-free. There are always some costs associated with funding.

Rollover for Business Startups (ROBS)

This is a 401(k) Rollover for Working Capital program. It’s also known as a Rollover for Business Startups (ROBS). Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan owns the business through its company stock investments, rather than the individual.

This type of financing isn’t a loan against your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian. The plan has to be a plan from an employer you no longer work for, and you can no longer be contributing.

Crowdfunding

Crowdfunding is a way of getting multiple smaller donations from a lot of individuals. Hence the term “crowd” in crowdfunding. There are many options for crowdfunding platforms, but be sure you know what you are getting into. Many crowdfunding platforms make you give all of the funding back if you do not make your goal by the end of the campaign.

They will take a percentage of the donations. That’s how they make their money. In addition, they may push to have you deliver on your promises. Crowdfunding tends to work best when donors can personally connect with a product or service . Straightforward businesses may not do so well.

The kinds of businesses which do the best often associate with products not quite on the shelves yet or artistic endeavors.

Angel Investors

While there are “professional” angel investors out there, an angel investor can be pretty much anyone. It could be a friend or family member sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you may not know so well.

What frustrates you the most about funding your business? Check out how our free guide can help.

Grants

There are some grant options available, and of course those do not have to be repaid. However, they are highly competitive, and it is unlikely it will be enough to fully fund your business. Also, grants will require time on your part to prepare all necessary paperwork. Some even require an application fee.

Other Funding Options

No personal guarantee credit for business funding is great to have. Still, chances are you are going to need a personal guarantee to get funding at some point. There are a lot of good options out there. In fact, SBA loans are a great option. You can also look into alternative lenders like Fundbox and OnDeck or Accion.

Using a personal guarantee to get the ball rolling while you work on building your business credit profile is a valid option. It is what most business owners have to do. But, you need to build a strong business credit score so lenders can start to rely more on the credit worthiness of your business than you personally. Credit Suite has a whole program designed to help do just that. Find out more about the Business Credit Builder now.

The post The Truth About Business Funding With No Personal Guarantee Credit appeared first on Credit Suite.

Should You Get a Personal Loan? Here’s What You Need To Know

Did you recently have an unexpected expense pop up? Are you unsure about how you’re going to pay for it? No matter how well we plan our lives out, sometimes we find ourselves in financial pickles that leave us strapped for cash. Don’t sweat it too much, though. You definitely have a few options available…

The post Should You Get a Personal Loan? Here’s What You Need To Know appeared first on MoneyTips.

The post Should You Get a Personal Loan? Here’s What You Need To Know appeared first on Buy It At A Bargain – Deals And Reviews.

WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps …

Do business credit cards affect personal credit? They can, and in fact most do. But, they don’t have to. There are steps you can take to make sure they don’t. The key is to build your business credit score, and choose the right business credit cards.

Do Business Credit Cards Affect Personal Credit? It Depends

If you are asking yourself “Do business credit cards affect personal credit?” you are obviously trying to fund a business. And yes, most high limit business credit cards report to your consumer credit report. In fact, some report to both your personal credit and your consumer credit. There are even some business cards that will report negative payment information, but will not report anything if the account is in good standing. If you are trying to keep your business accounts from affecting your personal credit score, you need cards that will not report to personal credit bureaus.

Do Business Credit Cards Affect Personal Credit? Does it Even Matter?

Yes, it matters. Here’s why. You know that if an account, business or personal, is not in good standing, it can be detrimental to your personal credit if reported. Yet, did you know that even if an account is in good standing, it is possible that it may still damage personal credit.

Check out how our reliable process will help your business get the best business credit cards.

This is due to one of the fundamental differences in business credit vs. personal credit. Your personal credit score is affected by your debt-to-credit ratio. That’s a measure of how much debt you have, relative to how much credit you have available. A high debt-to-credit ratio can negatively impact your personal credit score. This is further complicated by the fact that many business credit cards stay at or near their limit, even if you are making regular payments. It is a function of the fact that business expenses are typically much higher than personal expenses.

As a result, if those accounts are on your personal report, they can bring your credit score down even if they are not delinquent. The question then becomes, how do you make sure this doesn’t happen? There are two key parts to this.

Do Business Credit Cards Affect Personal Credit? Make Sure They Don’t

First, if you are getting business credit cards with a personal guarantee, you have to make sure they will not report to your personal credit report. There are a handful that will not, even though they do ask for a personal guarantee. It is important to note that a personal guarantee means there will be a personal credit check. That will create an inquiry that may affect your personal credit for a bit. However, if the account does not report payment information to your personal credit report, the impact will be minimal.

A Few Examples of Business Credit Cards that Will Not Report to Personal Credit

If you have bad personal credit, the Wells Fargo Business Secured Credit Card is a good option.

You can get approved with a credit score as low as 580 currently, but that can change of course.

You do have to make at least a $500 deposit. Also, they do not report to consumer credit agencies, but they DO report to Dun & Bradstreet. That is, assuming you have your D-U-N-S number.

That means it can help you build business credit even with a bad personal credit score. They also report to the Small Business Finance Exchange. While the SBFE does not issue credit reports, they do share information with certain lenders, vendors, and credit agencies.

Wells Fargo will review your account periodically, and they may move you up to an unsecured account if you are eligible, based on a number of factors, including FICO.

If you have good credit, you have even more options for credit cards that will not report to personal credit. A few include:

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Costco Anywhere Visa® Business Card (have to be a Costco member)

Wells Fargo Business Platinum Credit Card

Remember, even though these cards do not report to your personal credit report, they do require a personal guarantee. That means they will do a personal credit check, and that inquiry will affect your score for a bit.

Do Business Credit Cards Affect Personal Credit? Business Credit Cards That Will Not Affect Personal Credit Scores Without a Personal Guarantee

Using a personal guarantee to begin building your credit portfolio is okay to start with. The goal, however, is to get as much as you can without a personal guarantee. To do this, you need to lay the groundwork before you apply for any cards. After all, they cannot report to your business credit profile if there is not one to report to.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Do if You Do Not Establish a Business Credit Profile

In contrast to a personal credit profile, you have to intentionally build a business credit profile. While a personal credit builds passively, business credit scores do not. With consumer credit, all you have to do is get credit accounts and they almost all end up on your consumer credit report.

How Do You Establish a Business Credit Profile?

First, you have your business up to be fundable. This includes a number of factors, some of which include:

- A business name that does not indicate you are in a high risk industry

- A physical business address, not a P.O. Box or UPS box

- Business phone number listed with 411

- A business bank account

- An EIN and a D-U-N-S number

You can get your EIN on the IRS website for free, and apply for the D-U-N-S number on the Dun & Bradstreet website, also for free. This is vital, because if you do not have that D-U-N-S number, accounts will not be able to report your payments to Dun & Bradstreet, because you will not have a profile there for them to report to.

The EIN is what you will use when you apply for business credit instead of your social security number. You may have to provide your SSN for identification purposes, but it will not be used to determine approval. This is one way you ensure your business credit accounts are not reporting to your personal credit report.

Do Business Credit Cards Affect Personal Credit? How to Get Business Credit Cards That Do Not Affect Personal Credit

Once your business is set up in the right way so that you have a business credit profile, you need accounts that report to that profile. However, if you start applying for high limit credit cards using your business credit profile right away, you are going to get denied.

You have to find accounts that will extend credit to your business without any sort of credit check. You don’t yet have a business credit score, and you are trying to avoid personal credit all together. To do this, you start with starter vendors.

These are accounts that will extend net terms and report payments, but they will approve you based on factors other than your credit score. These factors may include time in business, revenue, average balance in your business bank account, or other factors.

How to Find Starter Vendors

The trick is, these types of vendors are not easy to find. They do not advertise themselves as “starter vendors.” They do not make it easy to find out whether or not they report payments to business credit profiles. Business owners need help finding this information.

Here are a few options to get you started:

Grainger

Uline

Marathon

Still, you need more accounts than this reporting before you can build a strong enough business credit score to apply for higher limit accounts.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Don’t Have To

How to Build a Strong Business Credit Portfolio With Minimal Effect on Personal Credit

The secret to building a strong business credit profile as fast as possible and with minimal effect on your personal credit, is to work with a business credit expert. A business credit expert makes this whole process faster and easier.

They can help ensure you have your business set up the right way, and guide you toward those starter vendor accounts that will help you initially build your business credit score. They will help you know when you have enough accounts reporting to start applying for higher limit accounts and be approved.

In addition, our business credit experts have the knowledge and expertise to help you find the best accounts to flesh out your business credit portfolio. There is more to this than just building strong business credit with accounts that report. An expert can guide you toward the best vendor accounts for your specific business, whether they report or not.

The best way to start this process with no risk is to have a free consultation with a business credit expert. They can help you figure out where you stand now, and where you need to start so that you can build your business credit portfolio in the most effective and efficient way possible.

The post WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps … appeared first on Credit Suite.

How to Create Your Personal Brand’s Visual Identity

Visual branding is the most effective way to create a powerful online presence. If you don’t believe me, check out this article on why visuals are important in marketing: When half of the human brain …

The post How to Create Your Personal Brand’s Visual Identity appeared first on Paper.li blog.

Personal Branding: How to Go from Zero to Hero in No Time

Do you remember when only celebrities and major companies had personal brands? Actors, musicians, Fortune 100 businesses, and athletes got all the attention and dominated the airwaves.

Now, nearly anyone willing to put in the time and effort can become a “thought leader” in a specific niche. It won’t happen overnight, of course.

You only need to do a quick Google search to see that ordinary people from all over the world are using new personal branding tools, particularly social media, to craft personal brands that attract countless people to their websites and social media accounts.

Personal branding is what separates you from the rest of the people trying to make it in your field. Building a personal brand allows you to become a standout figure that people know, like, and trust.

Follow these seven simple steps below to become the go-to expert in your space.

Step #1. Start By Finding Your Niche

There’s a saying about SEO traffic that highlights something most people miss.

You can’t create search demand. You can only harvest it.

That means you can’t force people to search for a specific keyword. They either already do or they’re searching for something else.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

Your job in SEO is to recognize that and work on getting as much traffic you can from words that are already popular on their own.

Personal branding is similar, believe it or not.

For example, being the best CrossFit pug breeder in the world is worthless if there isn’t already a market or niche for that. (Seriously, is there?!)

The niche selection process is really important! You don’t want to spend all your time and energy linking your brand to a niche that’s not growing.

Where should you start when picking a niche?

That’s a good question because there’s no right answer necessarily, but here’s where I think you should start.

Pick something specific that you can do better than 90% of the world.

Why is that so specific? Because you can probably do a lot of things well, but that doesn’t mean you’re an expert in every single one of them.

The only way to create a personal brand is by becoming the go-to, recognized authority on a specific topic.

If you’re not an expert on it, someone else will be. Don’t be afraid to go small or narrow to dominate a topic.

The “online marketing” space, for example, is massive, and it’s taken the better part of a decade for me to become a recognized authority.

Take someone like Brian Dean, who decided to go deep on a particular topic instead of biting off more than he could chew.

Notice how he perfectly positions his personal brand. It’s all about backlinks and rankings for SEO.

Then the site’s graphics, design, and testimonials all reinforce those points.

There’s another important ingredient for a successful personal brand, though. One that deals more with your own style and point of view on this topic.

Step #2. Inject Personality Into Your Personal Brand

The first step (finding your niche) is about your own skills and potential market value.

The second step is about what you personally bring to the table. It’s your point of view or your “tone” that will help differentiate you from everyone else who talks about the same topics as you.

For example, I want to be seen as personable and down-to-earth.

That’s why I often use slang when writing. We might be talking about a technical topic, but I want to help you understand it in an easy-to-digest format.

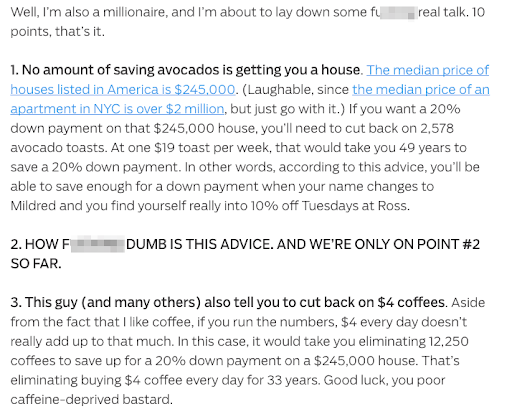

A similar example is Ramit Sethi from I Will Teach You To Be Rich.

He works in the personal finance space, which is full of questionable people that give suspicious recommendations.

Ramit takes the opposite approach, using casual language, inside jokes, and F-bombs to show you that he’s being honest and holding nothing back.

My favorite post of his is on avocado toast, in which he completely debunks terrible “advice” from another personal finance columnist.

Ash Ambirge at The Middle Finger Project also uses strong language and a no-B.S. attitude that gets people to sit up and take notice.

Being polarizing like this might turn some people off, but it can also help you create raving fans who might feel like being politically correct with the same material comes off as disingenuous.

Now, contrast that example with someone who talks about similar topics, but in a completely different style and tone: Marie Forleo.

They might both cover similar topics, but Marie’s personality (and therefore, content, design, and other branding elements) are polar opposites.

If Ash sometimes slips between PG-13 and rated R, Marie is firmly rated G.

What you’re saying is important, yes. But how you’re saying it can be equally so. Make sure you choose a tone that is authentic to you and port

Step #3. Create Your Brand Identity

Have you noticed a trend with the past few people mentioned?

From my own website to Ramit, Ash, and then Marie?

Go back and look at their websites. What do you notice?

The design is impeccable.

They each have custom sites, beautiful photography, and even their logos are easily identifiable.

Why the heavy investment in the look and feel of these sites?

Because according to one academic study, 94% of the time someone’s first impression is based on design, and it only takes 50 milliseconds for that split-second decision to get made.

A massive part of creating a personal brand is looking the part. There’s a secondary benefit as well.

Consistent design helps them become recognizable no matter where they decide to post or interact online, from their websites to media sites like Entrepreneur.com or even Facebook and Twitter.

The first step to accomplish that is creating your brand’s mark or logo. Here are some of my favorite resources to make it happen.

99designs crowdsources design samples from people all over the world. So you can set a budget and explain what you’re looking for, then sit back and watch designers start submitting ideas.

Then you can decide which ones are on the right track, give them feedback to further revise the logo, and disqualify the rest.

Best of all, if you’re unsatisfied with the options, you’re not locked into paying.

If you don’t think the design examples you received are up to snuff, you can simply use the company’s 100% money-back guarantee to get your funds back.

Another less expensive alternative is LogoNerds, which is ideal if you’re on a budget. These logos start for as little as $27!

Many times, you can even have LogoNerds create a few samples to get ideas, and then take those off to a more seasoned designer to show them the direction you like or don’t like.

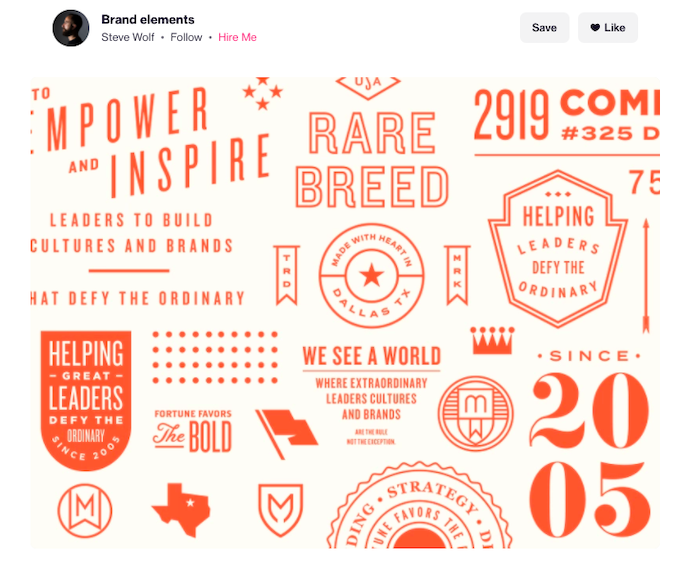

Once you’re ready for the big leagues (with a budget to match), you can find amazing designers to work with personally on Dribbble.

The best designers will use Dribbble as a way to showcase their work and latest projects so that you can get a sense of their style.

Many will also show off brand concepts or logo ideas, like these Brand Elements from Steve Wolf, so you can get a feel for what your own might look like.

Professional design is often what separates the ‘real’ experts from everyone else.

Start small with a logo to establish that working relationship with a designer you like, because they’re going to be worth their weight in gold when it comes time to redesign your website.

Step #4. Create and Redesign Your Own Personal Site

Look: there’s a TON of noise out there.

You’ve probably already heard all the statistics. Like the one that says there are five million blog posts published daily.

This means not only does your content need to be great, it means it also needs to be published frequently(like several times a week at least).

Continually putting out good stuff under your own name starts to create that connection between you and the topic target you’re aiming at.

Here’s what I mean.

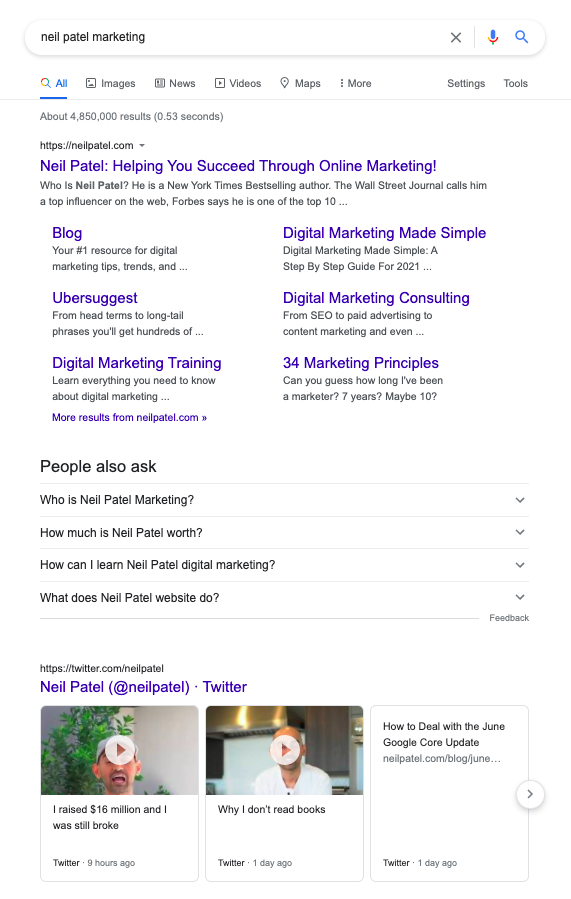

Google “Neil Patel marketing.”

My content shows up all over the place, from Entrepreneur.com to Inc. and beyond.

Those sites are so big that they’re often ranked at the top of the search engines. So imagine you work hard to become an expert on a topic, but then when people Google you, they end up going to a different website instead of your own.

Frustrating, right?!

That’s why having your own site, and then working hard to raise its profile, can be an invaluable part of reinforcing your own personal brand.

See! I own and control almost every site on the first page of the SERPs for my name.

If anyone is looking for more information about me, they go to one of my websites instead of someone else’s.

That means I’m able to convert a much higher percentage of people into new, interested leads each month.

My content and social strategies are among the main reasons that my sites rank above those other mainstream media sites.

Step #5. Carve Out a Content and Social Strategy

Content marketing “costs 62% less than traditional marketing and generates about three times as many leads.”

That stat says about all there is to say!

Look back at the SERP example in the last step.

The reason all my websites rank highly for my name is because of all the quality content I’ve published for over many years.

There’s no secret:just a lot of consistent hard work.

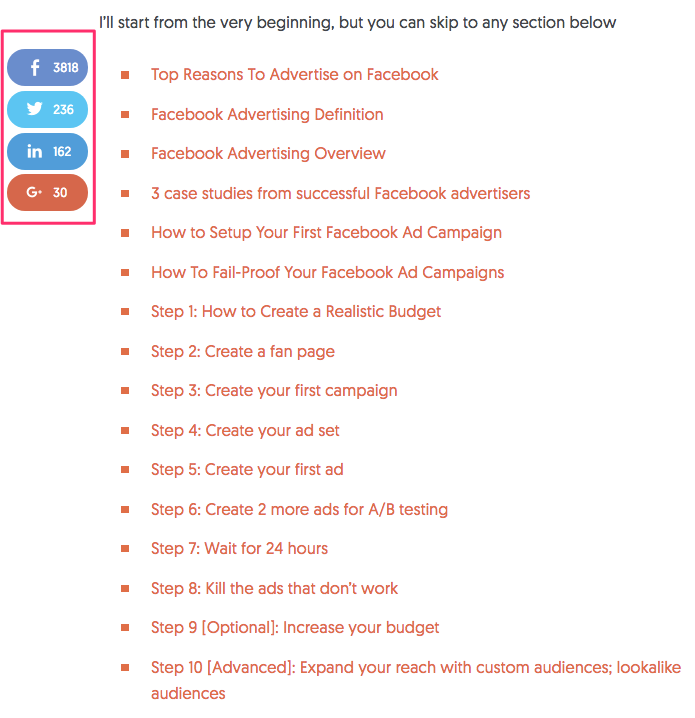

Personally, I find long, in-depth content works the best for generating leads and ranking well. For example, some of my posts are over 10,000 words and require a full table of contents!

Look at those social share numbers though!

My readers love long-form content (the stats back it up), so I keep delivering.

The same goes for my advanced guides, which in addition to being in-depth, are also beautifully designed.

The trick is to figure out what kind of content works best for you and your readers.

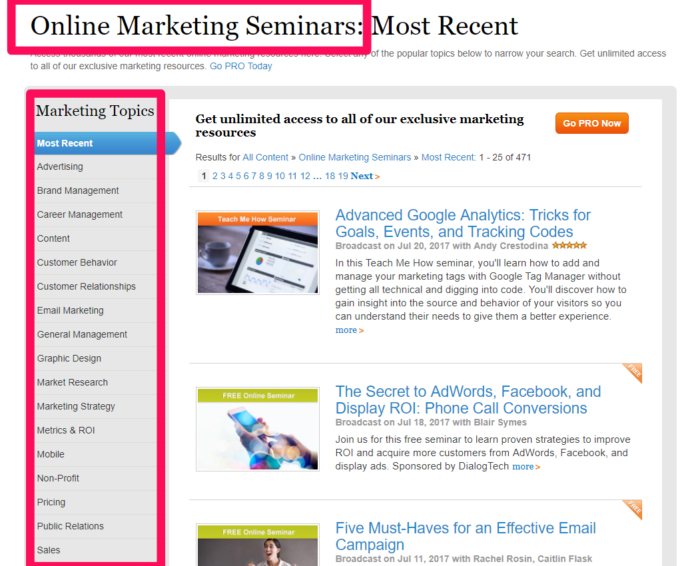

For example, MarketingProfs is another big website catering to marketing professionals. However, its content is totally different from mine.

MarketingProfs focuses on seminars, webinars, and other data as opposed to in-depth guides. So there’s no “right” answer, necessarily.

Your content strategy should also extend to your social media channels.

But keep in mind you shouldn’t necessarily be on every single social platform.

Spreading yourself too thin (and then not updating each frequently enough) is almost worse than not being on any social platforms at all.

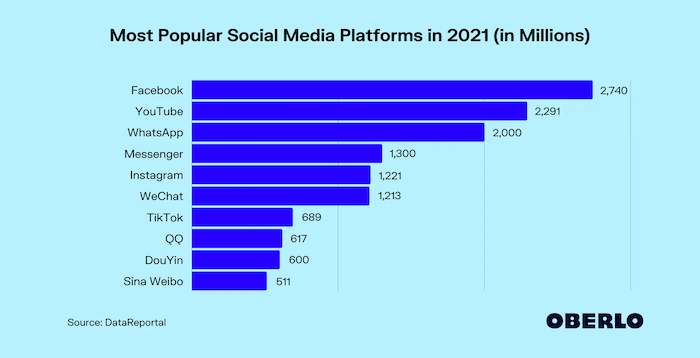

So once again, go back to your own audience. Where are they?

For example, here are the biggest social sites right now based on audience size.

Your own product or service plays a key role, too. For example, a wedding planner might not gain much traction on Twitter. However, if said wedding planner switches their focus to an image-focused social platform, like Pinterest or Instagram, they’re in business!

Step #6. Guest Blog to Promote Your Brand

In the early days, nobody will really know who you are.

That’s OK! It’s just critical that you realize this early before it’s too late.

If you spend all of your time initially only putting out good content on your own site, you’re unfortunately going to be wasting your time.

Instead, you should almost spend more time trying to get on other sites first.

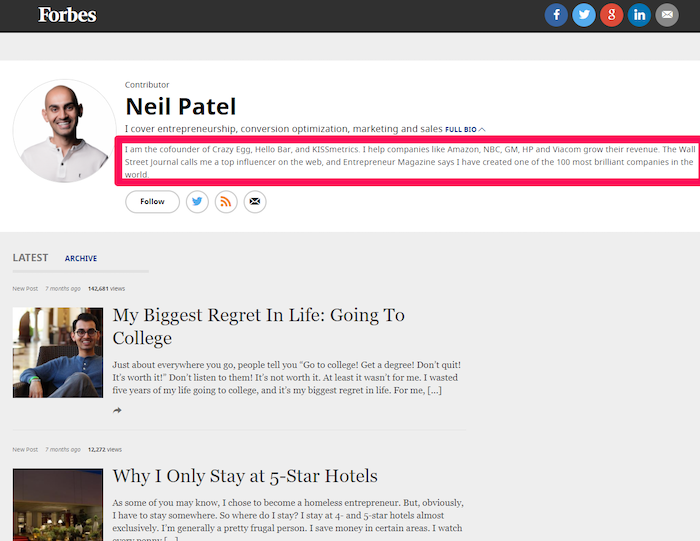

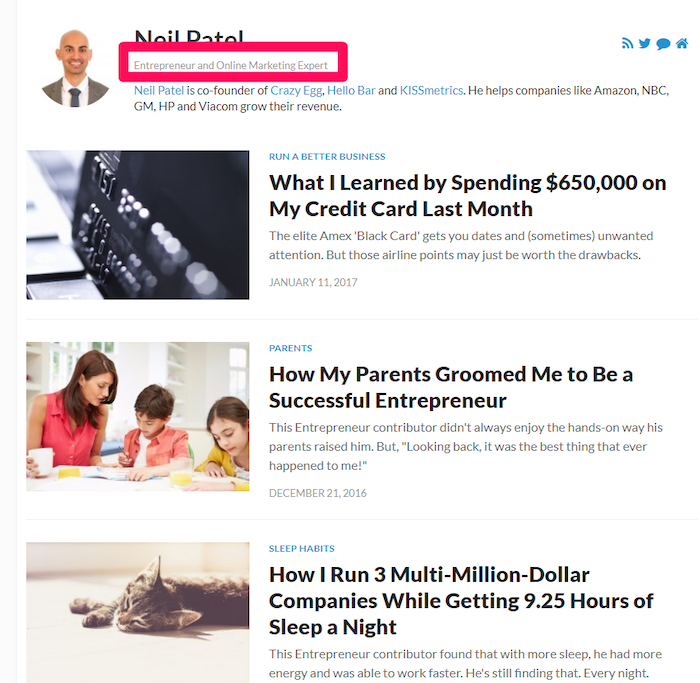

Focus on sites that already have the traffic and audience numbers you’re targeting. For example, becoming a regular on a huge site like Forbes suddenly gives you a presence in the industry.

Now you can leverage that traffic to drive people back to your own site when they start looking for more information about you.

Many times, these sites will allow you to add your own bio and title, too.

So instead of the generic “Founder of a Company That Nobody’s Ever Heard From,” you can use that valuable real estate to start planting the seed for your personal brand. Incorporate your niche and bring in elements of your personality.

Step #7. Seek Out Mentors

There’s no such thing as a “self-made” successful person.

They had to have help from someone, somewhere, at some time in their life.

Similarly, becoming a recognized expert in a field can be incredibly challenging at first.

You’ll eventually need other big-name players in the industry to recognize you as an expert, which will boost your brand to help you reach the top of your chosen niche.

Even Tiger Woods, arguably the most successful golfer of all time, worked with a swing coach for almost his entire career.

Think about that.

The guy arguably didn’t need to listen to anyone; and yet, he used mentors to help him sharpen his game.

80% of CEOs surveyed in one study said they had a mentor to help them early in their careers.

Almost all successful entrepreneurs I know have had mentors help them become the recognized experts they are today.

Personal Branding FAQs

Personal branding is reputation building by finding what makes you unique. This is how your brand communicates and how your brand presents itself visually.

Specifying your niche will allow you to find what makes you unique. This also means you’ll be able to tap into the audience that is looking for what you can do to help them.

Great design is easy on the eyes and captures attention. It’s also easy for people to identify common design elements so reinforcing your brand is easier. This makes you instantly recognizable online.

Creating and promoting content on other websites and blogs will help you connect with existing audiences and build awareness about you. Guest posts on blogs can help you build a digital presence.

Personal Branding Conclusion

Becoming the go-to, recognized expert in your industry isn’t an overnight proposition.

It’s going to take a lot of hard work and effort to reach the top, but it’s also one of the highest ROI activities you can pursue.

Not at first, of course. You have to invest the time, money, and work to slowly break through in your industry.

You’re going to have to look the part, put out content at an intense pace, and constantly meet new people. Finding a mentor can help you to avoid many of the same mistakes that have plagued the people before you.

Ultimately, becoming a recognized authority in your niche is definitely doable as long as you put in the work.

What’s your best personal branding tip to break through a crowded space?

How to Create Your Personal Brand’s Visual Identity

Visual branding is the most effective way to create a powerful online presence. If you don’t believe me, check out this article on why visuals are important in marketing: When half of the human brain …

The post How to Create Your Personal Brand’s Visual Identity appeared first on Paper.li blog.

How to Create Your Personal Brand’s Visual Identity

Visual branding is the most effective way to create a powerful online presence. If you don’t believe me, check out this article on why visuals are important in marketing: When half of the human brain … The post How to Create Your Personal Brand’s Visual Identity appeared first on Paper.li blog.

The post How to Create Your Personal Brand’s Visual Identity first appeared on Online Web Store Site.