Brittney Griner will be starting in the WNBA All-Star Game a year after she was an honorary choice by the league while she was being detained in Russia. The Phoenix Mercury’s center was chosen by fans, media and players Sunday for her ninth All-Star game. Last season all the players wore Griner No. 42 jerseys … Continue reading Brittney Griner named as starter in WNBA All-Star game

Tag: Starter

Establish and Maintain Rock-Solid Business Credit When You Have No Business Credit. Check Out 3 Well-Known Starter Vendors for Business Credit That Will Happily Extend Credit to New and Established Businesses

Building The Perfect Business Credit Portfolio with Starter Vendors for Business Credit

A perfect business credit portfolio means working with starter vendors for business credit. Starting with vendor credit accounts is a proven way to start building business credit. But we don’t include vendors just because they report to the business credit reporting agencies. We include them and we talk about them because they have quality products that you can use, and great customer service. They are not just a means to an end!

Vendor Credit Cards

Vendor credit cards will kick off business credit building for your business. First, add payment experiences from three vendors. Then they must report to business CRAs like Dun & Bradstreet. And then you can start qualifying for store credit, and fleet credit as well. Make sure business credit cards don’t report on your personal credit.

Every step and every credit provider works to help your business. The idea is to help you qualify for business credit cards that you will actually use. This isn’t building for the sake of building, and it isn’t just to increase a number. These credit providers are going to have what your business needs to succeed.

Business Credit with Starter Vendors for Business Credit

Keep in mind, business credit is independent of personal. Applying for it won’t harm your personal credit scores. Building this asset can only help your business. You can help your future business right now.

Business credit doesn’t just happen. You have to actively build it. It all starts with starter vendors. They will approve your business for credit with little fuss.

Use your credit. Pay on time, just like you should with personal credit. These vendors will report to the business credit reporting agencies. And you’ll build a good business credit score.

How to Build Business Credit

Having an EIN doesn’t mean you have established credit. If you go to a bank to try and get bank credit cards using your EIN with no credit established, you’ll get denials. That is unless you have good personal credit and use it to get approvals while supplying your personal guarantee. But it doesn’t have to be that way.

You can’t start with high limits. First you must build starter trade lines that report (vendor credit). Then you’ll have an established credit profile. Then you’ll get a business credit score. With an established business credit profile and score you can start getting high credit limits.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines

What is Starter Vendor Credit?

These trade lines are creditors who will give you initial credit when you have none now. These vendors typically offer terms such as Net 30, instead of revolving. So if you get approval for $1,000 in vendor credit and use it all, you must pay that money back in a set term. That is, within 30 days on a Net 30 account. But there are some revolving accounts which we still consider to be starter vendors.

You must pay net 30 accounts in full within 30 days. And you must pay net 60 accounts in full within 60 days. Unlike with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you used.

Getting Started

To start your business credit profile the RIGHT way, get approval for vendor accounts that report to business CRAs. Once accomplished, you can then use the credit. Pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Once reported, then you have trade lines, an established credit profile, and an established credit score. Using a newly established business credit profile and score, you can then get approval for more credit under your EIN. For vendor credit, you can leave your SSN off the application. Then the credit issuer then pulls your EIN credit, sees a solid profile and score. They can then approve you for more credit.

Building Business Credit – What You Really Need to Know

Not ALL retailers will approve you just because of your credit profile and score. Some sources can also have a time in business requirement. You may need to be in business 1-3 years to get credit not requiring a personal guarantee. Some sources might require you meet certain revenue requirements for as well. But many starter vendors will approve you without these requirements.

But Keep in Mind

You won’t get a Visa or a MasterCard (bank credit cards) right away. And you need to have credit to get more credit. You need to start building trade lines to get the big payoff. Getting initial credit is the hardest part. Over 97% of trade vendors who issue credit don’t report it to the business reporting agencies. So, you MUST find sources which actually report.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

There are Benefits to Starter Vendors for Business Credit

Vendor credit is an important step in building business credit. Vendor credit is easier to get than retail or fleet credit. It can lead to more retail and fleet credit. Establishing credit will lead to lenders approving you. And best of all, this process is PROVEN to work! Just like for all credit, be responsible and pay on time.

More Benefits of Starter Vendors for Business Credit

You MUST have 3 or more vendor accounts reporting to move onto retail credit, and more are even better. It will take 30-90 days for those accounts to report. It’s 60 days on average. Do NOT apply for retail credit without having 3 or more accounts first.

Getting Starter Vendors for Business Credit to Pull Credit Under your EIN

There is no Social Security requirement for starter vendor credit. This is unlike bank loans and bank cards. So leave the field blank. Don’t fill in any other number, as that’s a violation of two Federal laws. A blank field will force them to pull your business credit under your EIN. Also, if there is a credit check, then it is perfectly permissible to provide the company’s EIN. You can use an EIN, rather than your Social Security Number and date of birth.

Using Business Credit

Check out FOUR of our favorite starter vendors for business credit:

- Grainger

- Uline

- Marathon

- Supply Works

Grainger Industrial Supply

They sell hardware, power tools, pumps and more. They also do fleet maintenance

Grainger will report to Dun and Bradstreet. If a business doesn’t have established credit, they will want to see more documents. These include accounts payable, income statement, balance sheets, etc. Terms are Net 30, Net 45, Net 60, or Net 90.

Qualifying for Grainger Industrial Supply

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And your business must be registered to Secretary of State (SOS) for at least 60 days

Apply online or over the phone.

Uline

They sell shipping, packing and industrial supplies. They report to Dun & Bradstreet and Experian. You MUST create an account with Uline before starting to build business credit with them. Terms are Net 30.

Qualifying for Uline

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And a business phone number listed in 411

- You must have a D&B PAYDEX score of 80 or better

Application may get approval for net 30 at time of order. Upon final review, Credit Department may change to a few prepaid orders, before granting Net 30.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Marathon

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products throughout the United States. Their product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet and Experian. Before applying for more than one account with WEX Fleet cards, make sure to have enough time between applying. This is so they don’t red-flag your account for fraud.

Qualifying for Marathon

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere.

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Business phone number listed on 411

Your SSN is necessary for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee, if in business less than a year. Apply online or over the phone. Terms are Net 15.

Supply Works

Supply Works is a part of Home Depot. They offer integrated facility maintenance supplies. But they will not accept virtual addresses. They will report to Experian. Terms are Net 30. Apply online or over the phone.

Qualifying for Supply Works

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- Trade/Bank references

- There is no minimal time in business requirement

Extra BONUS Vendor: Wex Fleet

They report to Experian and D&B. They offer universal fleet cards, heavy truck cards, and universally accepted business fleet cards. Their cards have features supporting a small business. This includes a rewards program. Before applying for more than one account with WEX Fleet cards, make sure to have enough time between applying. This is so they don’t red flag your account for fraud.

If you don’t get an approval on the basis of business credit history, or been in business 1 year, then a $500 deposit is necessary or a Personal Guarantee. You can apply online or over the phone. Terms are Net 15 (Wex Fleet Card), Net 22, or revolving (Wex FlexCard).

Qualifying for Wex Fleet

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And a Business Phone Number Listed in 411

Starter Vendors for Business Credit: Takeaways

Starter vendors are a PROVEN way to get the business credit ball rolling. They will approve you with minimal fuss. Certain requirements repeat. These include needing to have EIN and D-U-N-S numbers. And having proper licensing (if your industry requires that). Hence getting those details squared away is a smart step to take first. Want more help with building business credit? Ask us how we can help you – including our access to literally HUNDREDS of vendors. Let’s take the next steps together

The post Establish and Maintain Rock-Solid Business Credit When You Have No Business Credit. Check Out 3 Well-Known Starter Vendors for Business Credit That Will Happily Extend Credit to New and Established Businesses appeared first on Credit Suite.

A Starter Guide to Google Ads Manager Accounts

If your business has complex advertising needs, there’s a good chance Google Ads Manager can help.

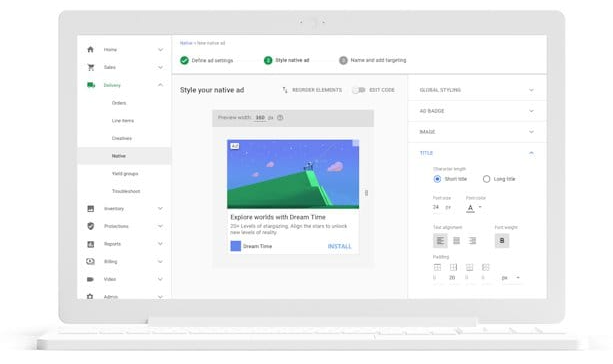

Rather than having your PPC spread out across several separate Google Ads accounts, Google Ads Manager brings all of your paid ads together in one place. This makes managing your campaigns much more efficient and allows you to maximize return on ad spend.

Setting up a Google Ads Manager account is simple and can quickly change the way you run your paid ads. Ready to give it a try? Here’s how to get started.

What Are Google Ads Manager Accounts?

Google Ads Manager accounts are dashboards that allow you to manage multiple Google Ad accounts all in one place.

Rather than logging in to lots of different ad accounts with separate usernames and passwords, Google Ads Manager puts everything in one place, making it more convenient to manage your ads.

Originally called My Client Center, Google Ads Manager provides many benefits to organizations with complex marketing needs. You can:

- Manage all your ads in one place

- Access campaigns across different accounts

- Control who has access to different accounts

- Quickly monitor and compare performance across separate accounts

- Consolidate billing to better understand your costs

If your business needs to access many different Google Ad accounts, then a Manager account might save you a ton of time and allow you to work far more efficiently.

Why You Should Use Google Ads Manager Accounts

If your business requires access to multiple Google Ad accounts, then a Google Ads Manager account can significantly boost your efficiency. Here’s a few benefits of using this tool:

Save Time

Logging in and out of accounts takes time and it also means you don’t get a complete picture of the data. The more information you have at your disposal, the easier it is to optimize your ads, and with a Google Ads Manager account, you bring all of this data together in one central place.

Improve ROI

Running paid ads is all about return on investment. If you’re not getting the right return, then there are other digital marketing strategies you could be focusing on. According to WebFX, the average small and medium-sized business spends between $108,000 and $120,000 per year on PPC. Google Ads Manager can ensure you’re making the most of your ad dollars.

Who Should Use Google Ads Manager Accounts?

Google Ads Manager accounts are ideal for businesses that run multiple ad accounts. The most obvious example is advertising agencies, but this also applies to businesses of all sizes that do a lot of PPC.

Ads Manager Accounts are particularly useful for marketing agencies because you can seamlessly integrate with client’s accounts.

For example, my agency works with clients from all over the world, so it’s just not feasible to log in to each client’s account with a separate username and password. Instead, through Google Ads Manager Accounts, we can manage up to 85,000 accounts (depending on ad spend) all in one place.

This makes life easier, but it also makes the data much more powerful. If you have all the insights from 100 clients in the same industry all together in one place, it’s much easier to identify where campaigns are going well or where there’s room for improvement.

Plus, this type of account enables clients to share access to their Ad accounts securely. The client doesn’t have to share their passwords or bank details, and they’re still able to make changes to the account or unlink from the manager account if they wish.

While marketing agencies are most likely to be running paid ads on a scale where they benefit from Google Ads Manager Accounts, there are also plenty of other companies that run multiple ad accounts.

Large companies with multiple departments may have separate marketing teams running their own Google Ad Accounts. Although it’s important to make your marketing specific and targeted, which the multiple ad accounts allow for, you also need to have a clear view of the big picture.

Bringing your accounts together under Google Ads Manager allows you to combine the individuality of segmented marketing with the benefits of greater oversight and analysis.

How Many Ad Campaigns Can Be Used in Google Ads Manager Accounts?

The more Google Ad accounts you need to manage, the more Google Ads Manager becomes beneficial. While you can have up to 20 Ad accounts on one email, Google Ads Manager makes them much easier to manage, and beyond 20 accounts is almost a necessity.

No matter what type of campaigns you’re running, you need to have oversight, so Google Ads Manager can be beneficial.

Here are some campaigns where Google Ads Manager can make a difference:

Google Ad Campaigns With Multiple Collaborators

Large paid advertising campaigns often have multiple collaborators, including managers, paid ad experts, and team leads. All of these people need access to the account, but you don’t want to share passwords and grant unlimited access.

If you’ve got hundreds of campaigns, you want people to have easy access to the parts they need without having to share sensitive non-essential details.

While a regular Google Ads account allows you to do this, it’s very time-consuming to update permissions on multiple accounts constantly. Instead, Google Ad Manager will enable you to share access securely from a central point.

When you manage multiple ad campaigns and have multiple stakeholders, Google Ads Manager is a great way to smooth out the process.

Google Ad Campaigns Targeting People at Different Points in the Sales Funnel

One of the main benefits of paid ads is the ability to target very specific groups of people. When you run an ad on Google, you’re not just putting it out there and hoping the right people find it; you set specific parameters that ensure your message reaches the right people.

For example, you might segment your audience based on where they are in the sales funnel. When you do this, though, you’ve got to be highly organized to optimize each stage of the funnel.

When data is spread out across lots of different accounts, it’s almost impossible to keep track of performance across segments. You need to quickly access all your campaign data and make changes based on specific insights. To do this, you need everything to be in one place.

This offers a huge opportunity to stand out as 76% of marketers aren’t using behavioral data to target customers with relevant ads.

Google Ad Campaigns Where Analytics Overlap

The key to optimization is in the analytics, and when you have the data from hundreds of campaigns all in one place, you’re much more likely to get those crucial insights you need.

Most of your ad campaigns will have some similarities. Maybe they target the same audience, they’re in the same niche, or they target the same point in the sales funnel.

While every campaign should be unique, there’s also a lot you can learn from comparing similar campaigns.

When you have all your analytics in one place, you can use them to spot trends you otherwise wouldn’t be able to see.

For example, you might have 20 different campaigns all targeting people at the decision stage of the sales funnel, and one is performing particularly well. Even if your campaigns are in completely different industries, you can use the data to isolate why that one campaign is doing so well and find ways to implement it in other markets.

The more data you have, the more useful it becomes, and Google Ads Manager allows you to bring all your analytics together in one place.

Google Retargeting Ad Campaigns

Retargeting is an incredibly useful tool for marketers, and Google Ads Manager makes retargeting even more powerful.

When people click on your ads and visit your website, they’re added to your remarketing audience through browser cookies, allowing you to target them with very precise ads. People who have already visited your site are more likely to become customers, which might be a great way of boosting your ROAS (return on ad spend).

Need help setting up retargeting ads? Here’s my A to Z on setting up your retargeting with Google.

Google Ads Manager helps you better use retargeting data by allowing you to piggyback off all the hard work you’ve done on other campaigns. For example, if one specific type of audience or ad works well in one vertical, you can test it in others.

How to Set Up and Use Google Ads Manager Accounts

Setting up a Google Ads Manager account and linking all your ad accounts is simple, and it might make your life a lot easier.

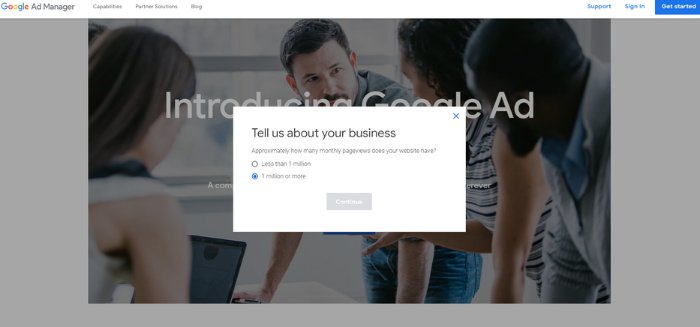

- head to the main Google Ads Manager page and click “Get Started”

- answer a couple of quick questions about the number of page views your website gets and whether or not you have an AdSense account

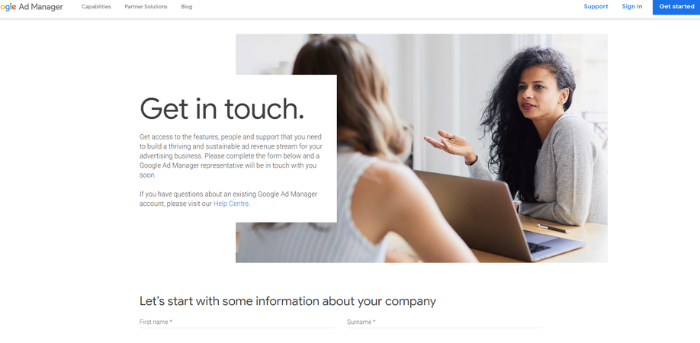

If your website has more than one million page views per month, you’ll be directed to get in touch.

- Fill out the contact form with information about your business.

- A Google representative will contact you and help you with your setup.

If your website has less than one million page views per month:

- Create a new AdSense account or sign in to your existing one

- Name your account

- Select what you’re using your account for

- Choose a timezone

- Select the currency you want to use for your campaigns

- Accept the terms and conditions

- Click on save, and you’re ready to go

Once your Google Ads Manager account is ready, you can start to link your ad accounts or those of your clients:

- Click link existing account (next to create an account).

- Enter the client account’s Google Ads ID (this is the ten-digit number in the top-right corner).

- The client account will receive a request to link to the Ads Manager in its account.

- The client account needs to accept the request.

- The client account chooses the level of access it grants: administrative, edit, or view.

- Once the client accepts the request and grants you administrative access, you can manage that Google Ad account.

It only takes a few minutes to set up a Google Ads Manager account and link as many Google Ad accounts as you wish, but it can save you a whole lot of time when it comes to managing your paid ads.

Conclusion

If you have complex PPC campaigns spread out over several Google Ads accounts, then Google Ads Manager could make a huge difference to your operations.

To maximize your return, all your campaigns should work in unison, allowing you to target particular groups and make use of all the data available to you. This is very difficult to do if you’re running campaigns through different accounts.

When you create a Google Ads Manager, you bring all your pay-per-click advertising together in one place, improving efficiency. Rather than logging into multiple different accounts and trying to piece together lots of different analytics, set up your Ads Manager account and get more out of your PPC.

Are you set up with Google Ads Manager yet?

A Starter Guide to Amazon Vendor Central

Becoming a third-party seller isn’t the only way to make money on Amazon. What if I told you there’s a way to get rid of the bulk of your seller admin and focus solely on helping a single customer who will sell your products for you? Well, that’s what you can expect from Amazon’s Vendor …

The post A Starter Guide to Amazon Vendor Central first appeared on Online Web Store Site.

Getting started with Paper.li Starter

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS …

The post Getting started with Paper.li Starter appeared first on Paper.li blog.

Getting started with Paper.li Starter

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS … The post Getting started with Paper.li Starter appeared first on Paper.li blog.