Vinh Nguyen, 37, was arrested Tuesday in connection to the attempted kidnapping of a child that was caught on video, authorities said.

Tag: There

How to Spot the Best Business Rewards Credit Card Out There

What is the Best Business Rewards Credit Card Out There?

Are you looking for business credit card rewards? Did you know there are a ton of different kinds? Get points, travel rewards, a low APR, and more! The best business rewards credit card for you is out there.

Rewards Business Credit Cards

Business credit cards may offer rewards in the form of rebates or statement credits or other perks. Some perks may include waiving a first late payment fee or a free cell phone protection plan. You may also get bonus points by spending a certain amount within an amount of time. This period tends to be right after you first get such a credit card.

Travel Rewards Business Credit Cards

Travel rewards are usually calculated in miles rather than points. Rewards may tie to a particular airline or hotel chain. Travel rewards may also come in the form of discounts on car rentals or hotel stays. They can even come in the form of added miles for filling up using certain gasoline brands. Some cards offer a reward in the form of free TSA PreCheck®, which currently costs $85.

Caveats When it Comes to the Best Business Rewards Credit Card

Rewards can seem tempting and easy to get. But always look at annual fees (if any) and APR. Also, make sure you know exactly what you can redeem for points or miles. Learn how many points or miles you need, and how much you have to spend to get them. And read the fine print to find out if your rewards ever expire. A generous program with points that expire fast that you can only trade in for stuff you don’t want or need is no bargain.

Get a Low APR

Can you get business credit card rewards and still enjoy a low annual percentage rate? Sure you can.

Alpine Bank Visa Platinum Rewards

Check out the Alpine Bank Visa Platinum Rewards card. Pay no annual fee. Get one point per dollar spent. Bonus points: 5,000 for first $3,000 spent in first four billing cycles. The APR for purchases is Prime + 8.74—14.74%. This is a good card for APR, and the amount you need to spend for a bonus is somewhat low.

Frost Bank Business Rewards Credit Card

Take a look at the Frost Bank Business Rewards Credit Card. Pay no annual fee. Get a revolving balance option for credit lines of $50,000 and under. Pay an APR of 9.9% + prime. The monthly credit limit cap is $25,000 if you apply online, for current Frost customers only. But it’s $100,000 if you apply by mail.

The revolving balance option is attractive, and the APR is excellent and doesn’t expire. The monthly credit limit cap is lower for applying online. Making a distinction between online and mail applications seems backwards.

PNC Travel Rewards Visa Business Credit Card

Take a look at the PNC Travel Rewards Visa Business Credit Card. Get one mile per dollar in eligible net purchases. Earn double miles on the first $2,500 in eligible net purchases. You can book your own travel and then redeem miles for a statement credit. There are no foreign transaction fees on purchases outside US. Pay no annual fee. There’s a variable APR, currently 10.99—19.99%, per creditworthiness.

The APR is good if your credit makes you eligible for the lower end of the spectrum. A statement credit for acting as your own travel agent is good, if you have the time to book your own travel. Double miles are welcome but it’s easy for a business owner to exceed the cap.

Rewards Business Credit Cards with Low Minimum Spend to Get a Bonus

What if you want business credit card rewards where you don’t have to spend a lot to get a bonus?

Bremer Bank Visa Smart Business Rewards

Check out the Bremer Bank Visa Smart Business Rewards card. There’s a $0 annual fee for the first twelve months. Then pay $95 every year after. Pay $95 for Account Owners, and $0 for Authorized Employees. Get double points per dollar spent in your top two spend categories each month. And get one point monthly per dollar spent on other eligible purchases. Earn 20,000 bonus reward points after spending $500 in the first 90 days. Pay a 15.99—20.99% APR per creditworthiness.

The bonus reward points offer is generous, and the spend should be a snap for most businesses to meet. The annual fee for account owners is somewhat high. But no annual fee for authorized employees means you can use this card with a large number of employees.

Mechanics Bank Smart Business Rewards Visa

Take a look at the Mechanics Bank Smart Business Rewards Visa. Pay a $0 introductory annual fee for the first twelve months. Then pay $95 every year after. Pay $95 for Account Owners, and $0 for Authorized Employees.

Get double points per dollar spent in top two spend categories per month. Earn 20,000 bonus rewards points if you spend $500 in the first 90 days. The APR for purchases and balance transfers is 15.99—20.99%, per creditworthiness. This is a very generous bonus for such a low spend!

Bank of Hope Business Rewards Visa® Credit Card

Get a good look at the Bank of Hope Business Rewards Visa® Credit Card. You pay no annual fee. Earn 5,000 bonus points after spending $1,000 in the first three months. Earn triple points on gas. Get double points on travel and dining. And earn one point per dollar on all other purchases. Pay a 0% introductory APR for nine months. Then pay a variable APR 12.49%, 16.49% or 20.49% per creditworthiness after the introductory period ends.

It should be easy for most entrepreneurs to meet the spend required for the points bonus. Triple points on gas are particularly helpful if yours is a business requiring a lot of time on the road. Say, trucking. If your credit is good enough to get the lowest APR after the introductory period ends, this could be a great card.

Mechanics Bank Visa Business Real Rewards

Check out the Mechanics Bank Visa Business Real Rewards card. You pay no annual fee. Get 1.5 points per month per dollar. You can get a 2,500 bonus rewards points after first purchase. Pay a 0% introductory APR for purchases and balance transfers for the first six billing cycles. Then pay 13.99—22.99% per creditworthiness. The bonus is decent, and there’s no minimum spend.

Get a Generous Bonus After Minimum Spend

How about generous bonuses for your business credit card rewards?

Union Bank Business Preferred Rewards Visa Credit Card

Get a look at the Union Bank Business Preferred Rewards Visa Credit Card. Earn a 50,000 introductory reward points bonus when you spend $5,000 in the first three months. Get quintuple points per dollar spent to $25,000 annually on select business expenses. These are office supplies, utility bills, telecom services. And get one point per dollar spent above that. Earn double points for each dollar spent up to $25,000 annually on gas stations and restaurants. And get one point per dollar spent above that. Plus, get one point per dollar spent on everything else.

Pay a 0% introductory APR for the first six months. Then pay an 11.99—20.99% variable APR. Pay no annual fee. This card has a great introductory points offer and the amount you have to spend to get it isn’t bad.

Business Credit Card Rewards with Generous Point Multipliers

Want some serious point multipliers? Then look no further.

Synovus Business Travel Rewards Visa Credit Card

Take a look at what the Synovus Business Travel Rewards Visa Credit Card is all about. Enjoy a 0% APR for the first six months, for purchases, balance transfers, and overdraft protection. Pay a $0 membership fee for the first year; then pay $50 per year.

Get quintuple points on up to $5,000 per year spent on travel purchases. This includes hotel, airlines, car rental, vacation packages, and more. Earn triple points on up to $3,000 spent quarterly for purchases in category of choice. And get one point per dollar on all eligible purchases, with no limit on points.

You can pay for purchases with points (there are some restrictions).Points are worth 20% more for travel redemption. Pay no foreign transaction fee. If you travel a lot, this card’s perks make it worthwhile.

Get the Best Business Rewards Credit Card with No Cap on Cash Back Earned

If you spend a lot, you might want a card where there’s no cap on the cash back you can earn.

Mastercard Business Cash Rewards Credit Card from Republic Bank

With the Mastercard Business Cash Rewards Credit Card, earn 1.25% cash back on all purchases. Get automatic rebates on eligible purchases with Mastercard Easy Savings. Pay a $35 annual fee per card. Pay a 0% introductory APR for nine months; then pay 17.45%.

Rebates via Mastercard Easy Savings are not too generous. For example, 4% off Budget Rent a Car doesn’t amount to much when an economy car can cost over $100 per day. The annual fee is also somewhat concerning. Hence this is not a good card for a large number of employees.

Get Varied Travel Benefits

Need travel benefits? If your business travel is local, this is great card.

First Hawaiian Bank MasterCard Cash Rewards Business Credit Card

With the First Hawaiian Bank MasterCard Cash Rewards Business Credit Card, get 3% unlimited cash back on gas and dining. And get 2% unlimited cash back on utilities. Earn 1% unlimited cash back on everything else. There’s no annual fee.

Pay a 15.49% APR. Earn a $200 credit with a $2,000 spend in the first 3 months from account opening. With its somewhat low spend, no annual fee, and decent (but not exceptional) APR, this can be a good card. If your business requires you to travel by car and entertain clients on the road, it’s a great card.

Get the Best Business Rewards Credit Card For Startups

Yes, startups can get in on the business credit card rewards action!

Mercury Bank MasterCard (personal)

Mercury is an angel-funded bank serving startups. Pay a $0 or $79 annual fee for a Mercury Bank MasterCard. There are cashback rewards but they are not specified on the bank’s website. The transfer APR is $5 or 4% of amount of each transfer, whichever is more. Pay 26.99—29.99% APR.

This could turn out to be a good card for startups. But interest rates are high, so be sure you can pay on time before charging. It also seems to be a personal card. Improving personal credit will help raise your Experian business credit scores. So a good payment history with this one could be worth your time.

Get Merchant Rebates

You can even get merchant rebates if you prefer.

Banner Bank Commercial Rewards Mastercard

For merchant rebates, consider the Banner Bank Commercial Rewards Mastercard. Pay a $19/card annual fee. There is a 11.99% APR for purchases. Get 1% cash back.

Get three TruRewards points per dollar of net retail, internet, phone, or mail order purchases. Redeem TruRewards points for cash back, travel, gift cards or merchandise. Use TruRewards with merchants like Starbucks, the Fairmont Hotel, and Cuisinart.

TruRewards offers (for example) a $100 travel voucher with Budget Rent a Car if you redeem 43,300 points. Even with three points per dollar, that still comes to spending over $14,000 to get $100 off! And it can cost over $100 per day to rent a compact car from Budget. The APR is decent although the annual fee is concerning—particularly as there is no introductory waiving of the annual fee.

Takeaways for the Best Business Rewards Credit Card

Rewards business credit cards have varying pros and cons. Your best choice will depend upon factors such as if you’re likely to keep up with payments. Also, how much (and how fast) you can spend to meet a minimum, the APR, annual fees, and if the rewards are useful to you.

The post How to Spot the Best Business Rewards Credit Card Out There appeared first on Credit Suite.

Sen. Sanders: ‘There is a real danger’ infrastructure, reconciliation bills will fail over Dem infighting

Sen. Bernie Sanders, I-Vt., said Sunday “there is a real danger” congressional Democrats could fail to deliver on two major pieces of legislation furthering President Biden’s domestic agenda if moderates like Sen. Joe Manchin, D-W.Va., can’t agree on the price tag.

Check Out all the Grants for Black Business Owners Out There!

Business Grants for Black Business Owners and So Much More

Are you one of the millions of black business owners in the US? Or are you starting a business? Money is always going to be an issue. What if you could get what is essentially free money? That’s what grants are (for the most part).

Looking for Grants for Black Business Owners – and Other Options

How do you find the best options for you? How do you know if you need to be looking for grants or business loans? We recommend that you explore every option. This is because it will probably take a combination of funding options to fully fund your business.

Funding and Grants for Black Business Owners

There are grants for black business owners, but not necessarily for them exclusively. Still, there are other funding choices out there. Loans, crowdfunding, and even angel investors are all viable options. More on those later.

Business Grants for Black Business Owners

The government and private organizations want to GIVE you money! They are highly competitive and rarely enough to fund a business on their own. Still, grants are a great way to supplement other business funding. Also, they are still worth the effort to apply. There really isn’t anything to lose except time – it’s free money. So here are a few you can start with.

The Minority Business Development Agency

The Minority Business Development Agency (MBDA) is operated by the US Department of Commerce. It is dedicated to helping minority-owned businesses access the resources they need to grow and succeed. The MBDA is for both men and women. Grant competitions are regularly changing.

Visit the MBDA’s website for information on all current opportunities. Currently, the MBDA helps its members apply for grants via Grants.gov. This involves help with how to apply for government grants. See also mbda.gov/grants.

Enterprising Women of Color Initiative

The MBDA oversees the Enterprising Women of Color (EWOC) Initiative. The initiative focuses on the fast-expanding minority women entrepreneur population as a revenue generators for families, communities, and the nation. Minority women are the fastest growing population of entrepreneurs. While many women are making tremendous strides in the business world, they still face obstacles as entrepreneurs.

MBDA serves as an advocate for women’s economic empowerment. They do so by supporting efforts to advance women’s equality and promote women economic advancement programming. The vision of EWOC is to ensure women worldwide to reach their economic potential. See also mbda.gov.

The Verizon Small Business Recovery Fund

The Verizon Small Business Recovery Fund is new. It was established in response to the COVID-19 pandemic. The fund offers $10,000 to successful applicants. The fund is specifically focused on providing grants to business owners of color, women-owned businesses, and other underrepresented entrepreneurs. See also lisc.org/covid-19/small-business-assistance/small-business-relief-grants/verizon-small-business-recovery-fund

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The association states its purpose is to help newer businesses that have an African American ownership. This is a pitch competition for startup businesses. See also nbmbaa.org/scale-up-pitch-challenge.

Demolish your funding problems with 27 killer ways to get cash for your business.

Amber Grant

Black businesswomen have even more options open to them. The Amber Grant awards one prize of $10,000 per month to a woman-owned business. One of the recipients also receives an extra $25,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee. See also ambergrantsforwomen.com/get-an-amber-grant/apply-now

Cartier Women’s Initiative Award

Black businesswomen can also try for a Cartier award. This award is for women and there’s no specification that a woman be a member of a minority group. The Cartier Women’s Initiative Award has a regional category award and a science and technology award. The regional award is $100,000 for first place, with $30,000 for second and third place.

The award goes to three women from each of seven international regions. So this award is a grant to 21 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information. See also cartierwomensinitiative.com/about-us

Cartier Science and Technology Pioneer Award and Fellowship

The Cartier Science and Technology Pioneer award is new as of 2021. With this award, three more women impact entrepreneurs at the forefront of scientific and technological innovation will be recognized for a new thematic award. Open to women entrepreneurs from any country and sector, this award will highlight disruptive solutions built around unique, protected, or hard-to-reproduce technological or scientific advances.

The laureate will be awarded a $100,000 grant. Each of the two remaining finalists will receive a $30,000 grant.

Cartier also offers a fellowship program. The fellowship is an educational program geared towards the 24 fellows selected each year. This program aims to equip the fellows with the necessary skills to grow their business. Also, it helps them to build their leadership capacity by drawing upon the experience and expertise of an array of academics, practitioners, industry experts, and entrepreneurs.

The fellowship isn’t exactly a grant. But while it’s not a monetary award, the mentoring and networking opportunities could be worthwhile to apply for. See also cartierwomensinitiative.com/fellowship-programme.

Demolish your funding problems with 27 killer ways to get cash for your business.

The Native American Business Development Institute (NABDI) Grant

Are you also part Native American? Then check out this grant.

The NABDI Grant is funded by the US Department of the Interior’s Bureau of Indian Affairs. It provides funding to business owners of Native American or Alaskan Native descent. In 2019, it gave over $727,000 to 21 indigenous tribes. So this was to support economic feasibility studies for specific economic development projects or startups.

For 2020, NABDI planned to award 20-25 grants. There is no minimum or maximum amount of funding you can request. But most awards range from $25,000-$75,000. They only fund projects for one year at a time. So this is when they expect projects to be completed. To apply for a NABDI grant for your proposed economic development feasibility study, go to bia.gov/service/grants/tedc/apply-nabdi-grant.

Indian Affairs

For black business owners also with Native American heritage, it doesn’t stop there. There is more available via the Bureau of Indian Affairs. You can get financing from the federal government through the Indian Affairs branch. A person can fill out an application for up to $500,000. But business entities and tribal enterprises may apply for more.

Potential borrowers can apply with any lending institution. They just have to use the application for Indian Affairs. There are more requirements if you use the funds for construction, renovation, or refinancing. In general, you must supply a list of collateral, a credit report, and an analysis of business operations. See also bia.gov/as-ia/ieed/loan-guaranty-insurance-and-interest-subsidy-program.

The South Asian Arts Resiliency Fund

If your business is in the arts, and you’re also of South Asian descent, then check out this fund. The fund is run by the India Center Foundation. It supports US-based South Asian arts workers impacted by the COVID-19 pandemic.

The fund will disburse grants up to $2,000, depending on financial need to US-based arts workers of South Asian descent. This includes those in the performing arts, film, visual arts, and literature. Also, you must have heritage from Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Initial funding for the program is $20,000, but the India Center Foundation is soliciting donations to expand the grant program.

Eligibility for The South Asian Arts Resiliency Fund

To be eligible, applicants must be of South Asian descent. Also, they must work in the arts and demonstrate loss of income due to COVID-19. Also, applicants must be:

- at least 21 years old

- not enrolled in a degree program, and

- can receive taxable income in the US

You can put grant funding toward any artistic project you can develop, create, and present within 4-6 weeks of funding. See also theindiacenter.us/artsfund.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grants from the Federal Government

Grants.gov is a running list of over 1,000 available federal government grants. The website compiles grants from over two dozen government agencies. These include the SBA, USDA, and the US Department of Commerce. To find a grant right for your business, use the Search Grants tool on the website. You can sort through the list by keyword or opportunity number.

First, locate the grant you wish to apply for. Then click the opportunity number for more detail. There, you will find more information about the specific grant plus any documentation you need. To apply for a grant through Grants.gov, first register. Then, download an application package for the grant you want. Be ready for a lengthy process. See also grants.gov.

An Alternative to Grants for Black Business Owners: Crowdfunding

If you would rather not rely on grants so much to fund your business, crowdfunding is a viable option. Keep in mind, not everyone with a campaign on a crowdfunding site succeeds. More unique products and services tend to do better. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. Some platforms may have higher success rates.

An Alternative to Grants for Black Business Owners: Angel Investors

Angel investors are informal investors. Essentially, you sell a part of your business to them. But they tend to not want too much of your business. Also, they won’t pass by more conventional businesses, like crowdfunding and venture capital. Hence they can also supplement or replace grants.

An Alternative to Grants for Black Business Owners: Loans

If grants aren’t an option, loans might also work.

Business Center for New Americans

Also an immigrant? Then try the Business Center for New Americans. They offer a pilot program for microloans up to $75,000. They work with immigrants, refugees, women, and other minority entrepreneurs. The goal is to help minority business owners who have not been able to get traditional financing. Terms are 3% interest. Loan repayment term goes up to a year. See also accompanycapital.org.

Grants for Black Business Owners: Takeaways

There are several options for grants for minority business owners. Black entrepreneurs should apply for whichever grants they feel they are most likely to get. Other options for funding include crowdfunding, angel investors, and loans. Credit Suite can help you get the funding you need.

The post Check Out all the Grants for Black Business Owners Out There! appeared first on Credit Suite.

There are Terrific Grant Funding Opportunities Out There for Small Businesses

Check Out Exceptional Grant Funding Opportunities

Are you looking for grant funding opportunities? Grants are exceptionally competitive, and they often require filling out a lot of paperwork. Still, if you can get them, they are essentially free money. So, if you feel you have a better than 50% chance, then it makes sense to go after appropriate grants.

It tends to help if you are a member of a minority or a protected class. Also, it can help if you are bringing in something new to an area that needs it. For example, rural electrification grants seem to always be available.

Let’s start with entrepreneurs who are members of minorities and protected classes.

Business Grant Funding Opportunities for Women

As female entrepreneurs continue to come into their own, the government and private ventures offer more grant funding opportunities. Here are a few to get you going.

Amber Grant

Women have some great grants open to them. The Amber Grant awards one prize of $10,000 per month to a woman-owned business. One of the recipients also receives an additional $25,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee. See ambergrantsforwomen.com/get-an-amber-grant/apply-now

Cartier Women’s Initiative Award

Businesswomen can also try for a Cartier award. This award is for women of all classes and groups. The Cartier Women’s Initiative Award has a regional category award and a science and technology award. The regional award is $100,000 for first place, with $30,000 for second and third place.

The award goes to three women from each of seven international regions. This award is a grant to 21 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information. See cartierwomensinitiative.com/about-us

Cartier Science and Technology Pioneer Award and Fellowship

The Cartier Science and Technology Pioneer award is new as of 2021. With this award, three more women impact entrepreneurs at the forefront of scientific and technological innovation will be recognized for a new thematic award. Open to women entrepreneurs from any country and sector, this award will highlight disruptive solutions built around unique, protected, or hard-to-reproduce technological or scientific advances.

The laureate will be awarded a $100,000 grant. Each of the two remaining finalists will receive a $30,000 grant.

Cartier also offers a fellowship program. The fellowship is an educational program geared towards the 24 fellows selected each year. This program aims to equip the fellows with the necessary skills to grow their business. Also, it helps them to build their leadership capacity by drawing upon the experience and expertise of an array of academics, practitioners, industry experts, and entrepreneurs.

The fellowship isn’t exactly a grant. But while it’s not a monetary award, the mentoring and networking opportunities could be worthwhile to apply for. See cartierwomensinitiative.com/fellowship-programme.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for Black Business Owners

Entrepreneurs who are African American have other choices when it comes to grants. And for persons who are members of more than one minority – such as black women or people who are both Asian and Native American – there are more choices.

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The association states its purpose is to help newer businesses that have an African American ownership. This is a pitch competition for startup businesses. See nbmbaa.org/scale-up-pitch-challenge.

The Minority Business Development Agency

The Minority Business Development Agency (MBDA) is operated by the US Department of Commerce. It is dedicated to helping minority-owned businesses access the resources they need to grow and succeed. The MBDA is for both men and women. Grant competitions are regularly changing.

Visit the MBDA’s website for information on all current opportunities. Currently, the MBDA helps its members apply for grants via Grants.gov. This involves help with how to apply for government grants. See mbda.gov/grants.

Enterprising Women of Color Initiative

The MBDA oversees the Enterprising Women of Color (EWOC) Initiative. The initiative works to focus on the fast-expanding minority women entrepreneur population as a revenue generators for families, communities, and the nation. Minority women are the fastest growing population of entrepreneurs. While many women are making tremendous strides in the business world, they still face obstacles as entrepreneurs.

MBDA serves as an advocate for women’s economic empowerment, by supporting efforts to advance women’s equality and promote women economic advancement programming. The vision of EWOC is to ensure women worldwide to reach their economic potential. See mbda.gov.

Grant Funding Opportunities for Native American Entrepreneurs

The Native American Business Development Institute (NABDI) Grant

Are you all or part Native American? Then check out this grant.

The NABDI Grant is funded by the US Department of the Interior’s Bureau of Indian Affairs. It provides funding to business owners of Native American or Alaskan Native descent. In 2019, the program provided more than $727,000 to 21 indigenous tribes, to support economic feasibility studies for specific economic development projects or business startups.

For 2020, NABDI planned to award 20-25 grants. There is no minimum or maximum amount of funding that can be requested, but most awards range in value from $25,000 to $75,000. They only fund projects for one year at a time, which is when they expect projects to be completed. To apply for a NABDI grant for your proposed economic development feasibility study, go to bia.gov/service/grants/tedc/apply-nabdi-grant.

Indian Affairs

For business owners with Native American heritage, there is more available via the Bureau of Indian Affairs. Businesses owned by Native Americans can get financing from the federal government through the Indian Affairs branch. An individual can fill out an application for up to $500,000, but business entities and tribal enterprises may apply for more.

Potential borrowers can apply with any lending institution, they just have to use the application for Indian Affairs. There are additional requirements if you use the funds for construction, renovation, or refinancing. In general, you must supply a list of collateral, a credit report, and an analysis of business operations. See bia.gov/as-ia/ieed/loan-guaranty-insurance-and-interest-subsidy-program.

First Nations Development Institute Grants

The mission of this group is to offer grants that help Alaska Natives, Native Hawaiians, and Native Americans. They help in the application process in addition to funds. First Nations also helps point individuals to appropriate grants offered by other organizations, including the US government. This includes help with writing grant proposals. See firstnations.org/grantmaking.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for South Asian Entrepreneurs

The South Asian Arts Resiliency Fund

If your business is in the arts, and you’re also of South Asian descent, then check out this fund. The fund is run by the India Center Foundation. It supports US-based South Asian arts workers impacted by the COVID-19 pandemic.

The fund will disburse grants up to $2,000, depending on financial need to US-based arts workers of South Asian descent. This includes those in the performing arts, film, visual arts, and literature with heritage from Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Initial funding for the program is $20,000, but the India Center Foundation is soliciting donations to expand the grant program.

Eligibility for The South Asian Arts Resiliency Fund

To be eligible, applicants must be of South Asian descent. Also, they must work in the arts and demonstrate loss of income due to COVID-19. Also, applicants must be:

- at least 21 years old

- not enrolled in a degree program, and

- able to receive taxable income in the US

You can put grant funding toward any artistic project you can develop, create, and present. It must be within four to six weeks of getting funding. See theindiacenter.us/artsfund.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for Science-Based Businesses

The National Science Foundation supports small businesses with contracts and grants. They award nearly $190 million annually to startups and small businesses. This is through the Small Business Innovation Research (SBIR)/Small Business Technology Transfer (STTR) program.

The idea is to support transforming scientific discovery into products and services with commercial and societal impact. These grants support R&D across almost all areas of science and technology. To learn more about SBIR/STTR, visit https://seedfund.nsf.gov. See also nsf.gov/funding/smallbusiness.jsp.

Grant Funding Opportunities in Response to the Pandemic

The Verizon Small Business Recovery Fund

The Verizon Small Business Recovery Fund is new. It was established in response to the COVID-19 pandemic. The fund offers $10,000 to successful applicants. The fund is specifically focused on providing grants to business owners of color, women-owned businesses, and other underrepresented entrepreneurs. See lisc.org/covid-19/small-business-assistance/small-business-relief-grants/verizon-small-business-recovery-fund

Grant Funding Opportunities from the US Government

Grants.gov

Grants.gov is a running list of more than 1,000 available federal government grants. The website compiles grants from over two dozen government agencies. Such as the SBA, USDA, and the US Department of Commerce. To find a grant right for your business, use the Search Grants tool on the website. You can sort through the list of grants by keyword or opportunity number.

The USDA is where those rural electrification grants are.

Once you have located the grant you wish to apply for, click the opportunity number for more detail. There, you will find more information about the specific grant as well as any associated documentation you may need. To apply for a grant through Grants.gov, you must first register. Then, you can download an application package for the grant you want to get. Be ready for a lengthy process. See grants.gov.

Alternatives to Grants: Crowdfunding

If you would rather not rely on grants so much to fund your business, crowdfunding is a viable option. Keep in mind, not everyone with a campaign on a crowdfunding site is successful. More unique products and services tend to do better. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. Some platforms may have higher success rates than others.

Alternatives to Grants: Angel Investors

Angel investors are informal investors. Essentially, you are selling a part of your business to them. They tend to not want a huge percentage of your business. Also, they won’t pass by more conventional businesses, like with crowdfunding and venture capital. Hence they can be another supplement or replacement for grants.

Alternatives to Grants: Loans

If grants aren’t an option, loans might work for you.

Business Center for New Americans

If you’re an immigrant, try the Business Center for New Americans. They offer a pilot program for microloans up to $75,000. They work with immigrants, refugees, women, and other minority entrepreneurs. The goal is to help minority business owners who have not been able to get traditional financing. Terms are 3% interest. Loan repayment term goes up to a year. See accompanycapital.org.

Grant Funding Opportunities: Takeaways

The government and private organizations want to GIVE you money! Grants are a great way to supplement other business funding. And they are still worth the effort to apply. So there really isn’t anything to lose except time – it’s free money.

There are several grant funding opportunities out there for entrepreneurs. Members of minorities and protected classes tend to get some preference. But all entrepreneurs should apply for whichever grants they feel they are most likely to get. Also, other options for funding include crowdfunding, angel investors, and loans. Credit Suite can help you get the funding you need.

The post There are Terrific Grant Funding Opportunities Out There for Small Businesses appeared first on Credit Suite.

Are There More Than 3 Business Credit Reporting Agencies?

There Are More than 3 Business Credit Reporting Agencies, but it All Comes Back to the Big Three

When most people think of business credit reporting agencies, they think if Dun & Bradstreet. It’s true, the Dun & Bradstreet PAYDEX is one of the scores most commonly used by lenders. In addition to D&B however, there is Experian and Equifax that are fairly commonly used.

Those aren’t the only three however. The FICO SBSS score is gaining popularity in the business credit world as an option for business credit scoring. There are actually a lot more business credit reporting agencies than that, but the one most commonly used outside of the big three of D & B, Experian, and Equifax, is the FICO SBSS.

Keep your business protected with our professional business credit monitoring.

Dun & Bradstreet is the Biggest of the Business Credit Reporting Agencies

There are six different Dun & Bradstreet reporting options, all measuring different areas of credit worthiness. The most commonly used and simplest to understand is the PAYDEX. Generally speaking, this is the most like the consumer FICO score. It measures the speed of payment. It ranges from 1 to 100. A 70 or higher is “good.” For example, a score of 100 means that the company makes payments in advance, and a score of 1 indicates that they pay 120 days late, or more.

What Other Scores Does Dun & Bradstreet Offer?

In addition to the PAYDEX, these other reporting options are available .

● Delinquency Predictor Score

The delinquency predictor score measures the likelihood the company will not pay, will be late paying, or will fall into bankruptcy. The scale is 1 to 5, and a 2 is considered good.

● Financial Stress Score

The financial stress score is a measurement of the pressure on a company’s balance sheet. That is, it indicates the likelihood of a shutdown within a year. It measures on a scale of 1 to 5, with a minimum of 5 and a maximum of 1. A business with a score of 2 is in good shape.

● Supplier Evaluation Risk Rating

This rating ranks the odds of a company making it for the next 12 months. The minimum score is 9 and the maximum is 1. A company with a score of 5 is good is doing okay.

● Credit Limit Recommendation

The credit limit recommendation shows a business’s borrowing capacity. It is a dollar amount recommendation for how much debt a company can handle. Typically, it is used by creditors to determine how much credit to extend.

● D&B Credit Rating

The credit rating is an estimation of overall business risk on a scale of 4 to 1. A two is good. It’s important to note, the rating is given in conjunction with letters. The combination of the letters and numbers relay the company’s net worth.

Even if there isn’t enough information on a business to assign a regular rating, Dun and Bradstreet will assign what they call a Credit Appraisal Score. Unlike a full credit score, this is based on number of employees. In addition, there is an alternative rating based on what data is actually available.

The letter portion of this rating cannot be assigned as good or bad since net worth is not necessarily an indicator of how stable a business is.

Keep your business protected with our professional business credit monitoring.

Experian Business Credit Score

Experian offers a number of different scores as well. Lenders can choose to use any or all of them. Of course, each one tells them something different. Consequently, it takes all the scores put together to get a complete credit picture from this business credit bureau. Still, not all lenders look at all the scores that are available.

Intelliscore Plus

The Intelliscore Plus credit score shows credit risk based on statistics. It is a highly predictive score. As such, its main purpose is to assist users in making well informed credit decisions.

The Intelliscore scores range from 1 to 100. The higher your score, the lower your risk class. The opposite is true as well, meaning the lower your score, the higher your risk class.

Score Range Risk Class

76 – 100 Low

51 – 752 Low – Medium

26 – 503 Medium

11 – 254 High – Medium

1 – 105 High

How Does Experian Business Credit Calculate the Intelliscore Plus Score?

One of the things Intelliscore is most known for is the identification of key factors that can indicate how likely a business is to pay their debt. There are over 800 commercial and owner variables used to calculate an Intelliscore Plus credit score. Here’s the breakdown:

● Payment History

This is just your current payment status. It’s how many times accounts have become delinquent. Additionally, It also shows how many accounts are currently delinquent, as well as your overall trade balance.

● Frequency

This one shows how many times your accounts have been sent to collections. It also notes the number of liens and judgments you may have. Bankruptcies related to your business or personal accounts are included as well.

Frequency can also incorporate information regarding your payment patterns. Were you regularly slow or late with payment? Did you decrease the number of late payments over time? That affects your score.

● Monetary

This specific factor focuses on how you make use of credit. For example, how much of your available credit are you using right now? Do you have a high ratio of late balances when compared with your credit limits?

Of course, if you are a new business owner, a lot of this information will not exist yet. Intelliscore Plus handles this by using a “blended model” to identify your score. That means that they take your personal consumer credit score into account when determining your business’s credit score.

The Experian Financial Stability Risk Score (FSR)

FSR predicts the potential of a business going bankrupt or not paying its debts. The score identifies the highest risk businesses by making use of payment and public records. These records include all of the following and more.

- high use of credit lines

- severely late payments

- tax liens

- judgments

- collection accounts

- risk industries

- length of time in business

Experian’s Blended Score

This is a one-page report that provides a summary of the business and its owner. A combined business-owner credit scoring model is more comprehensive than a business or consumer only model. Blended scores have been found to outperform consumer or business alone by 10 – 20%.

Equifax is Another One of the Bigger Business Credit Reporting Agencies

Equifax shows three distinct business determinations on its business credit reports. These are the Equifax payment index, your business’s credit risk score, and its business failure score.

Similar to the PAYDEX score, Equifax’s payment index, which is a measurement on a scale of 100, shows how many of your small business’s payments were made on time. These include both data from creditors and vendors.

Equifax Credit Risk Score

Equifax’s credit risk score checks how likely it is that your company will become severely delinquent on payments. Scores range from 101 to 992, and they evaluate:

- Available credit limit on revolving credit accounts, which includes credit cards

- Your company’s size

- Proof of any non-financial transactions (such as merchant invoices) which are late or were charged off for two or more billing cycles

- Length of time since the opening of the earliest financial account

Equifax Business Failure Score

Lastly, Equifax’s business failure score takes a look at the risk of your business shutting down. It runs from 1,000 to 1,600. And it judges these factors:

- Total balance to total current credit limit average utilization in the past three months

- The amount of time since the opening of the oldest financial account

- Your small business’s worst payment status on all trades in the last 24 months

- Documentation of any non-financial transactions (such as merchant invoices) which are late or are on a charge off for two or more billing cycles

For the credit risk and the business failure scores, a rating of 0 means bankruptcy.

Equifax Scores

A good Equifax score for your business is as follows:

- Payment Index 0 to 10

- Credit Risk score 892 to 992

- Business Failure score 1400 to 1600

Keep your business protected with our professional business credit monitoring.

FICO SBSS

The FICO SBSS, or FICO Liquid Credit Small Business Scoring Service, is the business version of your personal FICO credit score. It was becoming more and more common for lenders to use this score, rather than the Experian or even the D&B Paydex business credit score.

Unlike your personal FICO, the SBSS reports on a scale of 0 to 300. Of course, the higher the better. However, most lenders require a score of at least 160.

There are few reasons lenders favor this score. First, FICO uses business credit information from Dun & Bradstreet, Experian, and Equifax in their business credit score calculation. Second,they also take into account personal credit score. Lastly, they consider the lenders preferences for which factors are most important.

Why Rely on Other Credit Reporting Agencies, and How Do Lender Preferences Affect Your Score?

This is a huge difference from other business credit scoring models. The SBSS uses your business credit score from other business credit reporting agencies. They also use your personal credit score and other financial information such as business assets and revenue. The big change however, is they let the lender decide how much each factor actually affects the score. It is a total global financial picture rolled into one score, and the lender gets to choose which factors have the most impact.

This means you almost always go into a lender totally blind as to what your FICO SBSS credit score may be. Here is how it works.

How Lenders Get Your FICO SBSS Business Credit Score

- You turn in your application and all necessary financial documentation to the lender.

- The lender processes this information and sends it to FICO with a request for your SBSS score.

2.5. This is where it gets interesting. The lender can weight certain factors that make up your SBSS score. Your score can vary depending on how a lender weights each factor. For example, a lender can put more weight on your personal credit score or your business credit. It is their choice. This means your FICO SBSS can change from lender to lender even if you haven’t done anything to change it.

- FICO then searches business credit information from business credit agencies including D&B, Experian, and Equifax. Since these business credit reporting agencies have already scored the business side of things, the FICO SBSS just used the data from them for that piece of their calculation. If they cannot pull enough scoring information from one, they move on to the next. If there is not enough information from any of them, then it uses personal credit and business financials only.

- Using the lender’s weighting preferences, personal credit, business credit, and business financial data the system calculates the FICO SBSS score.

- You get either approval or denial based on your score.

SBA Credit Scoring

In 2012 the SBA began using credit scoring in the loan approval process. Since 2014, they have used it on all loans up to $350,000, not including the SBA Express and Export Express.

They use the FICO SBSS out of all the business credit reporting agencies for their scoring needs. This is likely because by doing so, they get information from the other major business credit reporting agencies plus some.

The information they receive from FICO SBSS helps them to expedite credit decisions. In fact, overall statistics on the $60 billion-plus portfolio at the Small Business Administration show that those businesses with scores at or above the 140 cut-off have had very good payment history.

While the minimum required credit score is 140, the SBA usually will not approve applications until the borrower’s score is 160 or higher. Some lenders would rather see even higher scores. An ideal minimum is 180.

There Are More Than Three Business Credit Reporting Agencies

The truth is, there are definitely more than three business credit reporting agencies. The FICO SBSS is just one that many do not know about. However, like many of the other business credit reporting agencies, they use information from the big three, D&B, Experian, and Equifax, in their calculations. What does this mean for your business? Pretty much regardless of which of the business credit reporting agencies your lender uses, the big three are likely still going to impact your score in some way. Also, it means you cannot ignore your personal credit score. It can make a difference on your ability to get funding even when using your business credit.

The post Are There More Than 3 Business Credit Reporting Agencies? appeared first on Credit Suite.

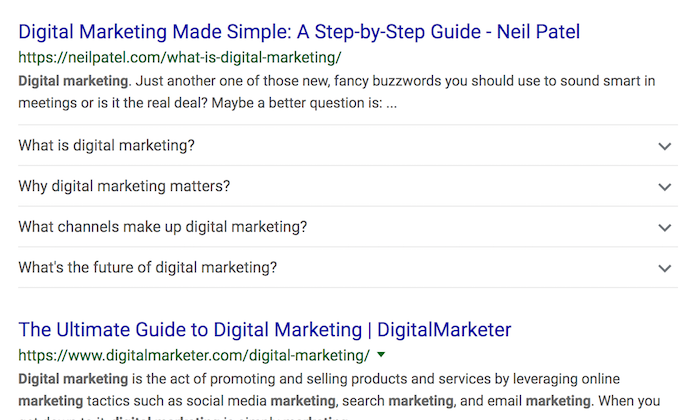

SEO Doesn’t Have to be a Long-Term Game: There Are Quicker Ways to Get Results

Everyone thinks SEO is a long-term game… that you have to wait months if not years to see results. And, maybe that was the case a few years ago when content was still king.

With Google making 3200 algorithm changes in just one year, their goal isn’t to make a website wait a year or two before they are able to achieve a top spot.

Instead, they want to show the user the right site as quick as possible. It doesn’t matter if the site has been around for 10 years, or 10 days.

How SEO has changed

It used to be that if you want to rank well, you would have to create tons of long-form content and build links.

Or have a really aged domain with history. But as Google has clearly stated, having an older domain or even a new domain won’t affect your rankings.

And sure, those things still matter today. But there are over 200 factors in Google’s algorithm.

In other words, there are other tactics that produce quick results.

For example, a few weeks I wrote a blog post about FAQ schema and how you can see the difference with your Google listing in 30 minutes.

Literally, 30 minutes.

That kind of stuff wasn’t possible before.

And SEO is no longer just a game of ranking on Google. There are tons of popular search engines like YouTube, in which you can get results in 24 hours.

Their algorithm is a bit different than Google’s in which if a video does really well in the first 24 hours of it being released, it will get shown more and rank higher.

In essence, you can take a top spot on YouTube in just days, no matter how competitive the term maybe.

You are full of it Neil?

Look, I’m not trying to say you can rank for “auto insurance” on Google within 24 hours or achieve unrealistic results, but you can drastically grow your search traffic in a reasonable time if you follow the right tactics.

It doesn’t matter if you have a new website or an old one.

So how do you get results faster? What’s the secret?

Well, I have a Master Class that will teach you how to double your traffic, but you’ll have to wait till Thursday.

I’m going to be introducing something new in which you can get more search traffic in 30 days.

All you have to do is take one simple action each day. And the action is so simple that it shouldn’t take you more than 30 minutes.

Stay tuned!

PS: Don’t forget to add the Master Class to your calendar. That way you’ll get notified on Thursday when it comes out.

The post SEO Doesn’t Have to be a Long-Term Game: There Are Quicker Ways to Get Results appeared first on Neil Patel.