15 Email Personalization Techniques That Work

As a marketer or business owner, you know email marketing is a powerful tool. Its popularity among consumers is climbing.

You might have already implemented email personalization to some extent, like addressing customers personally, but you can take it further.

This article looks at 15 email personalization techniques you can apply to your marketing.

Before we move onto that, though, let’s discuss whether email personalization works.

Does Email Personalization Work?

The short answer is a resounding “Yes.” According to HubSpot’s State of Marketing report, 78 percent of marketers have seen a recent increase in email engagement.

HubSpot’s report shows that 20 percent of e-commerce, retail, consumer goods, and service companies personalize emails based on specific demographics.

Email personalization, or the act of tailoring email content to address the recipient by name, interests, location, and other details can increase sales.

Email personalization offers multiple other benefits, too, such as:

- increased open and click-through rates

- decreased unsubscribe rates

- higher customer satisfaction.

- opportunities to re-engage customers

Additionally, 72 percent of consumers say they only engage with personalized messaging, and most customers expect brands to understand their unique needs.

Email personalization is also easy to implement. For instance, you could:

- Send an offer only if a recipient has recently brought an item.

- Change wording based on location or time zone.

- Personalize language and images.

However, like any other area of marketing, email personalization has its limitations. For example, some techniques like customer recommendations may not work for everyone.

You can also over-personalize and sound too familiar, which can, frankly, freak people out. Stick to critical areas, which we detail later.

Now you’ve got a picture of email personalization and its benefits, let’s move on to 15 techniques that work.

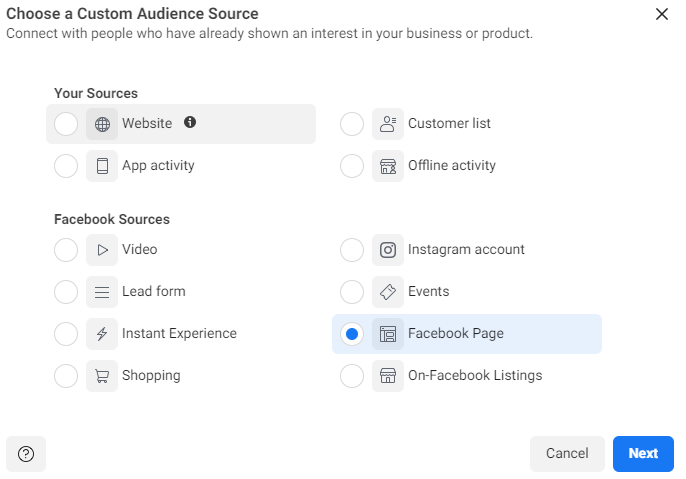

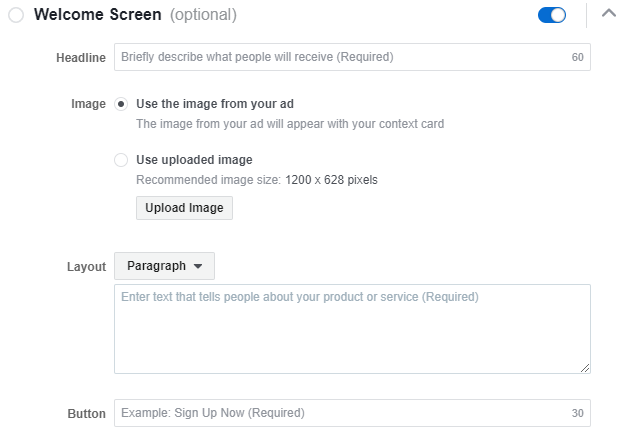

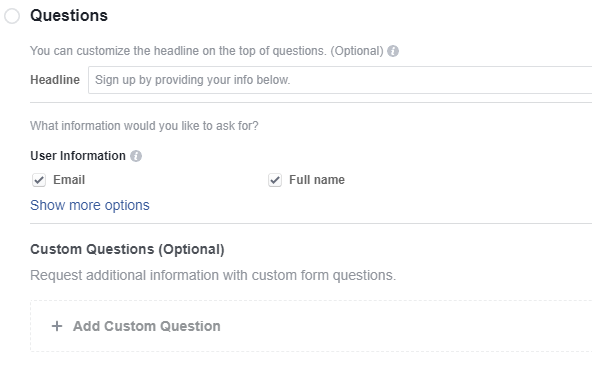

1. Collect the Right Data

If you’re not collecting the right kinds of information, you won’t have a good starting point for personalization.

That sounds simple enough, but where do you start? By collecting information from readers on sign-up forms.

When subscribers sign up to your email list, you can ask them some additional questions beyond the typical email address or name.

For instance, you could ask for their:

- location

- birthday

- interests

- occupation

Whatever information you ask for, keep it short and sweet, like this example:

Next, use integrations to gather even more data.

Integrations are perfect if you don’t have all the right resources to collect information.

Finally, you should create a subscriber preference center to find out what your readers want, like the one from Campaign Monitor.

Once you’ve started collecting the right kinds of data, you can personalize your subject lines.

2. Use Personalized Subject Lines

Subject lines have always been important in the world of email marketing, but they must be specific for the best results.

For example, they should differ from industry to industry, audience to audience, and so on.

You can run tests to find the most effective ones. With testing, you can modify the content of your subject lines based on all the data you’ve already collected about a subscriber’s wants, interests, age, location, and more.

Open rates and conversion rates are only up from there.

Once you’ve got subject lines down, you should focus on triggered emails.

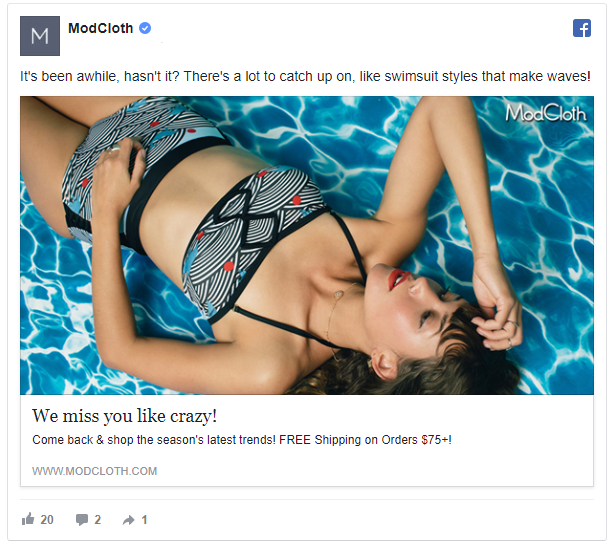

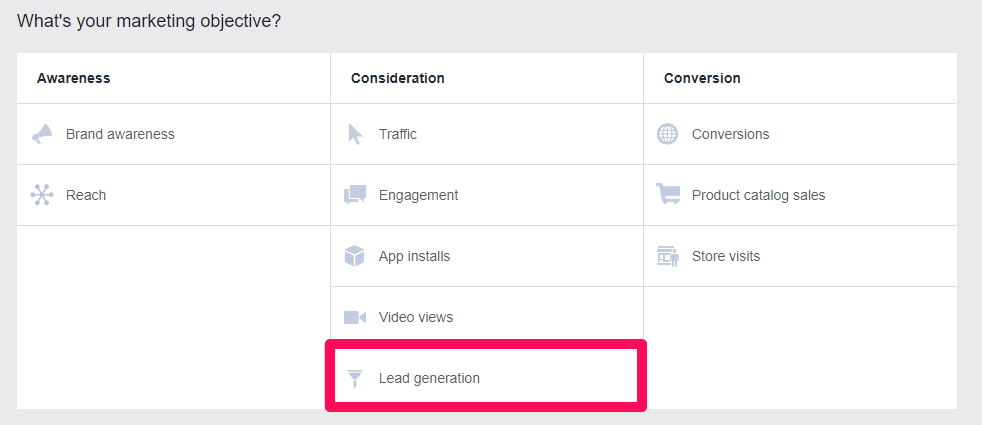

3. Use Behavior-Triggered Emails

Behavior-triggered emails are automated reactions to how customers are interacting with your products or services.

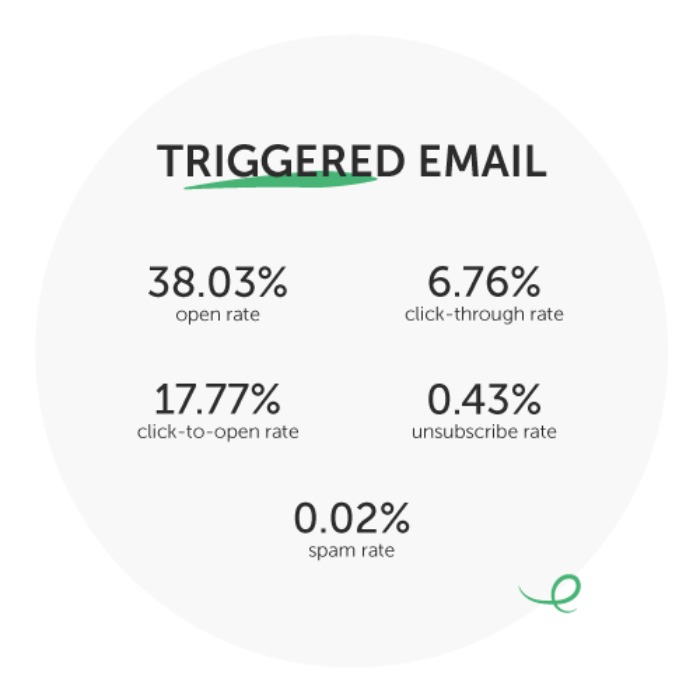

This is where the future of email marketing is heading, and triggered emails have a good open rate to boot.

These types of emails also allow you to make a personalized connection with customers.

Behavior-triggered emails can make connections less complicated. They let you communicate with customers without having to think about it, help you convert readers, and could extend the lifetime value of existing customers.

You might not always realize it, but you get these types of emails all the time.

You know when a website emails you because you haven’t logged in or made a purchase for a while? That’s a behavior-triggered email.

In addition, you can send out triggered emails for tons of reasons, such as to welcome readers, re-engage them, or upsell products or services.

Also, depending on your business, several tools for sending great trigger emails are available. For instance, there’s Intercom.io for B2B, GetVero.com for marketers, and Klaviyo for e-commerce.

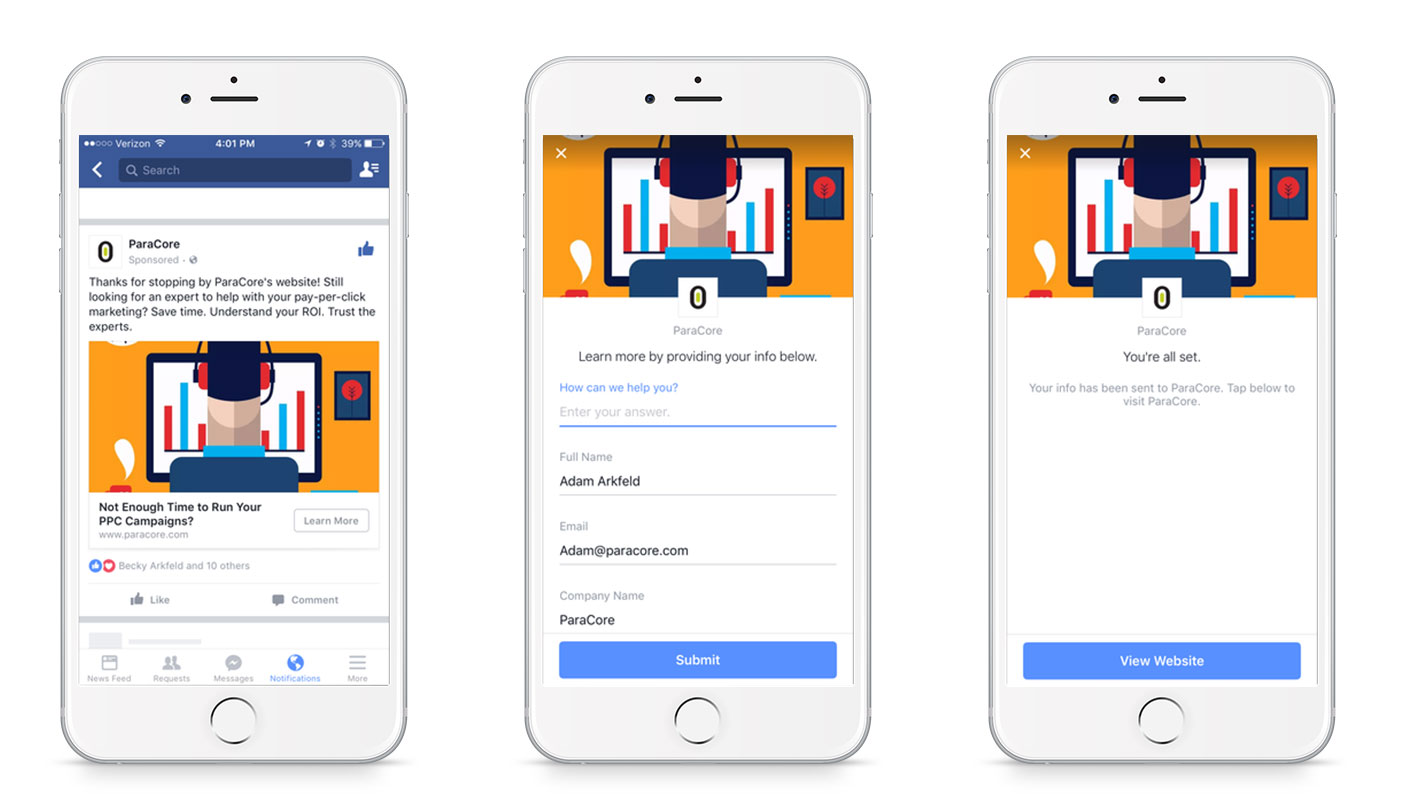

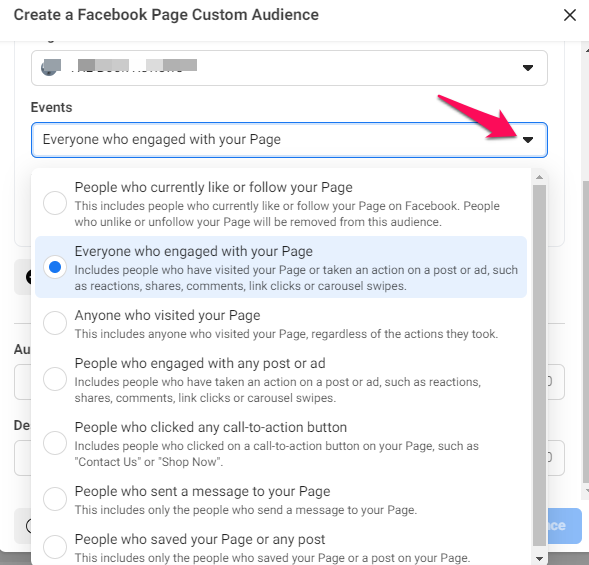

4. Use Subscriber Tags

Subscriber tags let you send personal CTAs in your email content and for triggering emails.

With this technique, you can tag subscribers based on their choices, like visiting a specific page on your site or clicking on a link.

Then, write out emails to recipients with matching tags.

This approach saves a ton of time because you can segment all your workflows through just one email.

Most mailing list providers such as ConvertKit offer this feature.

5. Ask the Right Questions

An easy way to start segmenting your audience is by asking them questions. It’s a pretty straightforward approach, but you must ask the correct ones.

For example, ask customers:

- What brought them to your website?

- Why did they start using your service?

- What do they need help with most?

These questions can help you find out what you’re doing right (or wrong) pretty quickly, and it makes targeted emails a breeze.

Don’t be too generic, though. To stand out, you can entice customers using emotional appeals, emojis, humor, and freebies.

Alternatively, ask opinion questions. People like to feel like you value their thoughts.

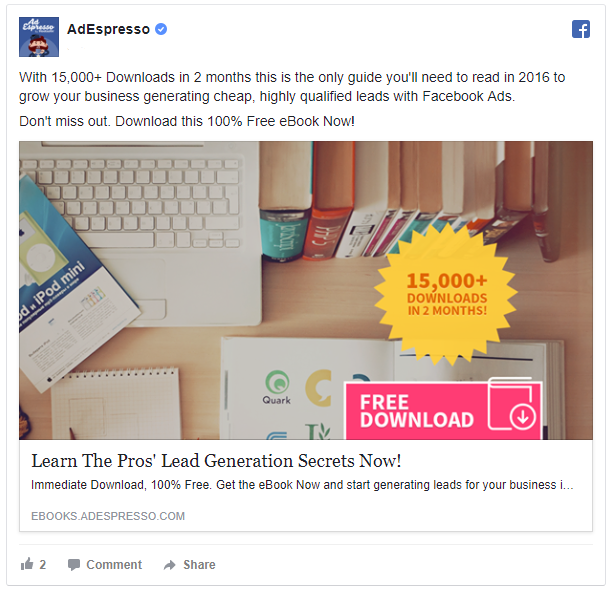

6. Add “Recommendations for You”

We’ve already talked about some email personalization techniques, and now it’s time to dig deeper.

Start personalizing your emails by recommending more purchases or actions according to a reader’s past ones.

Amazon is notorious for this with its “Frequently Brought Together” upsell feature, and Netflix uses a similar approach to encourage customers to view another movie.

It works because readers often appreciate the “recommendations” if they’ve liked similar previous purchases.

Rather than trying to reach all your readers with a single promotion, just send it to those who have shown interest in a related topic.

You can do this in any industry by suggesting related products and services. Perhaps offer a discount to encourage sales.

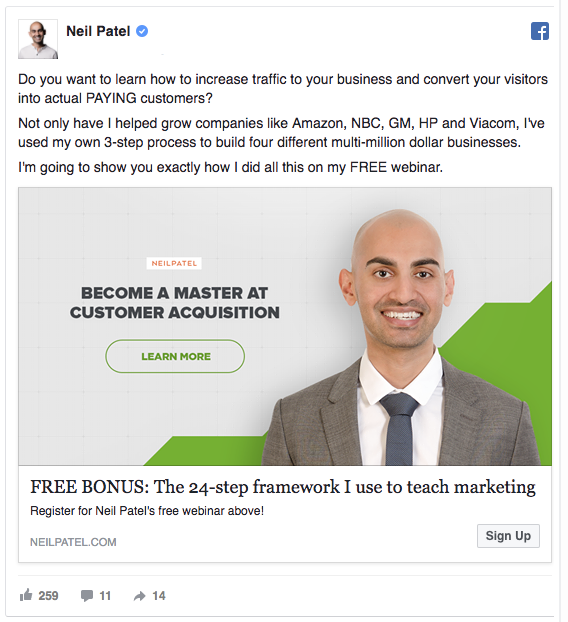

7. Use and Optimize Landing Pages

Yes, email personalization can boost your open rates. However, the ultimate goal is to convert readers into customers.

To achieve this, you must ensure the landing pages you link to match the ideas in messages you send.

Imagine if Amazon sent recommendation emails with no links to the actual products. It seems pointless, doesn’t it?

That’s why you must include relevant landing pages in as many emails as you can. You should also ensure the landing page relates to the customers you’re targeting and their current buying stage.

8. Add a Sense of Urgency

There are tons of tools to help you incorporate dates and times into your emails.

Doing this is the perfect approach for driving engagement because these limited-time offers focus on urgency to push people into action.

By creating a sense of urgency, you can build toward a paid offer. Just don’t let your customers forget or hesitate to order. That’s why creating a custom deadline is so effective.

Are you thinking of applying this approach? There are templates available, or your mailing list provider should have a tool.

You can also sync your emails with countdowns for sales, product launches, and giveaways.

9. Build Customer Personas

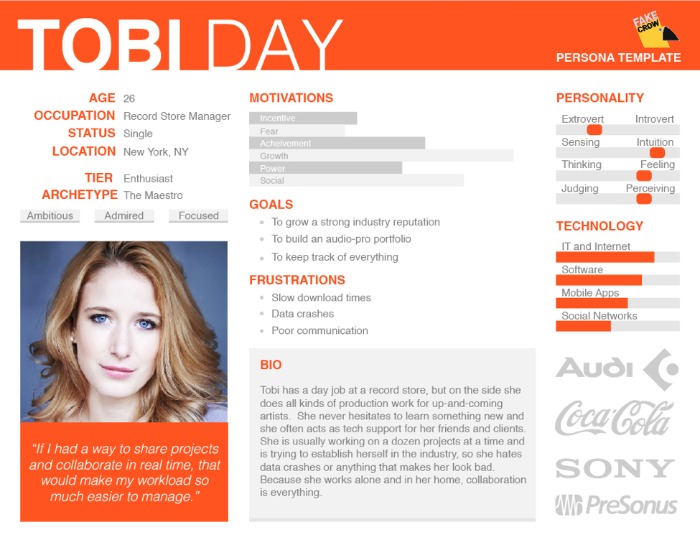

A customer persona is a representation of your ideal customer. Companies use them to identify the features of their perfect customer and their usual behavior.

The more specific you get with these personas, the better you will understand who your customers are and what they need from you. Ultimately, this enables you to improve your business and enhance email personalization by fulfilling their needs.

You create customer personas by using a multitude of data. Instead of asking a single question, you can group customers using a mix of attributes and actions they take.

Once complete, your personas might look something like this:

There are plenty of step-by-step guides on building personas to help you develop them per best practices, including:

- identifying your target audience

- seeing the world through your customers’ eyes

- understanding your customers’ needs and frustrations by doing research

- using data about your target audience’s online behavior, likes/dislikes, etc.

- implementing email personalization techniques to match your customers’ wants and needs

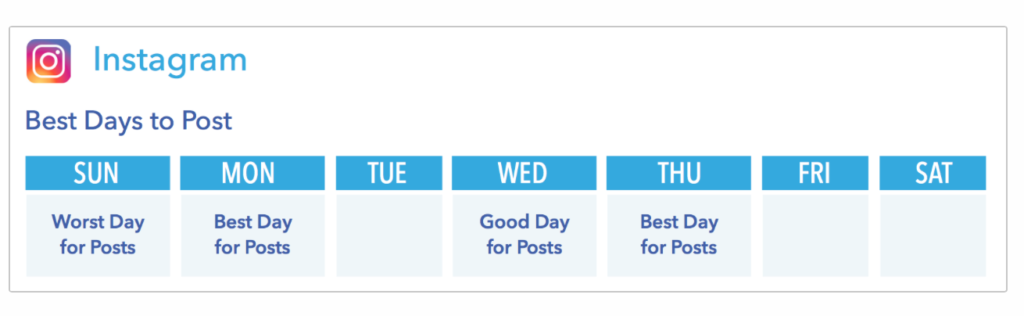

10. Use Location and Time Zones

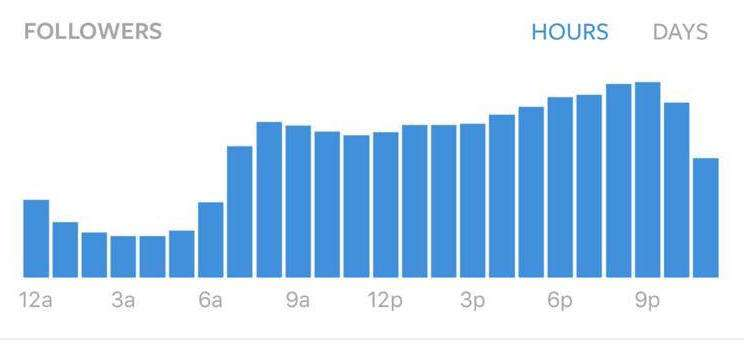

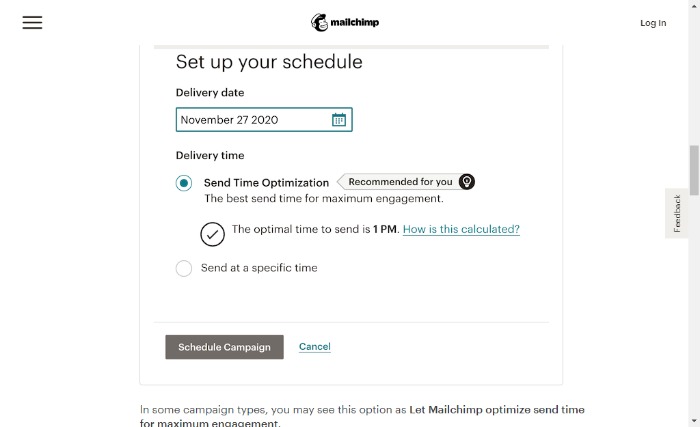

It’s no secret that certain times of day prove to be better than others when sending emails.

For example, your customers might love getting an email at 8:00 a.m., or they may respond better to getting one at 5:00 p.m.

However, chances are not all your customers are in one location. They may be all around the world, scattered across different time zones, and possibly receiving your emails at non-optimal times.

How do you overcome this? By using your customers’ data to send emails at the best times.

Send time personalization is easy to set up with a few clicks, and companies like MailChimp allow you to do this.

11. Personalize Your Business

Don’t limit email personalization to your customers’ data: You also can customize your brand.

Customization could make all the difference to your company’s success rate, and it’s not hard to implement. You only need to make some changes, and you can automate many of them.

If you’re searching for ideas, look no further than Nike. The brand sends out welcome messages and emails for:

- birthdays

- seasonal campaigns

- promotions

- order confirmations

- hot-this-week offers

Test aspects such as a conversational tone, words like “we” and “I,” and generally making your emails seem like they are from an actual human. Customers respond to it.

12. Mark Milestones

Marking customer milestones is another effective email personalization tool.

It shows your customers you’ve noticed their achievements and that your company appreciates them. In turn, this enhances customer engagement, making them feel valued.

Milestones worth marking include:

- your customer’s first anniversary

- a customer’s birthday

- the accumulation of a set number of points

- the completion of a course or similar

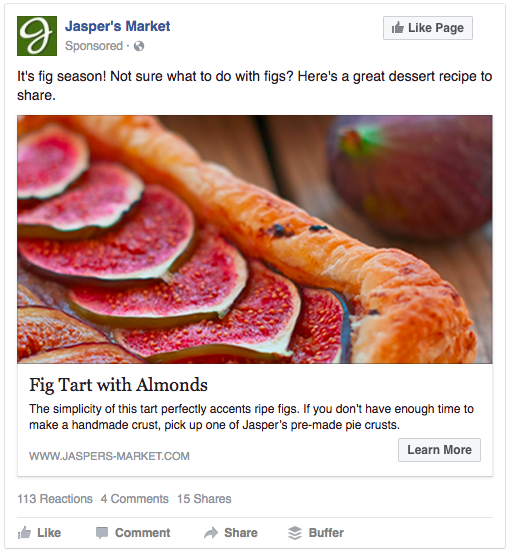

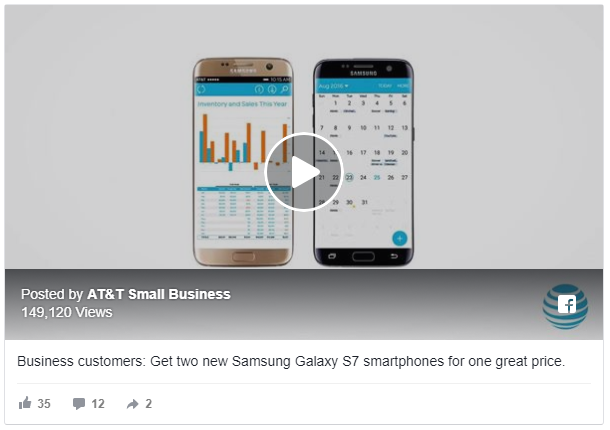

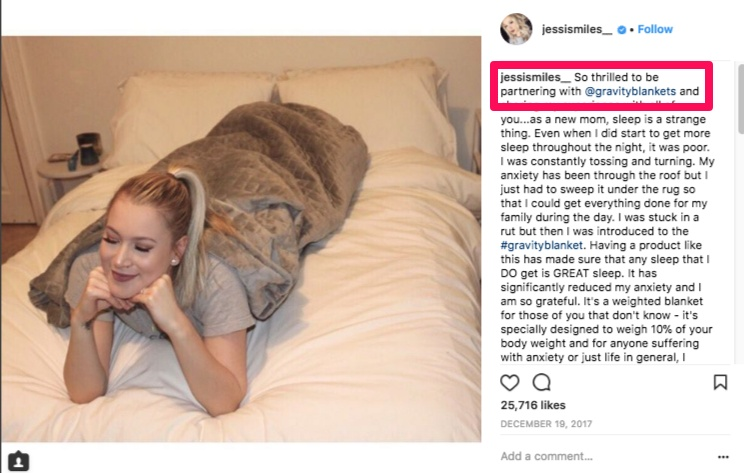

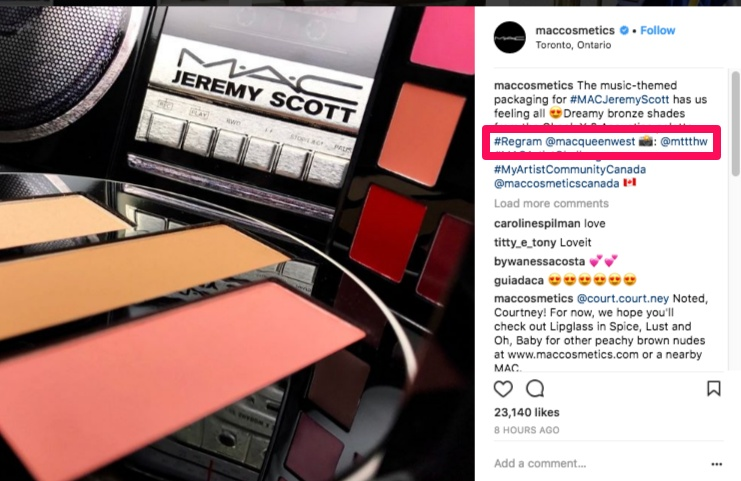

13. Imagery

They say a picture paints a thousand words. Or, to put it another way, a single image can express a thought much better than a heap of text.

Keeping your messages short is vital now as people tend to skim read emails on the go, but it’s not just about that. Imagery can impact your customers in other ways.

Email personalization with imagery allows marketers to build an emotional connection with their customers, driving them to take action and potentially influencing their buying decisions.

One of the other advantages of pictures is their flexibility.

You can use images in many ways, from showcasing products to illustrating the benefits of a particular product or just brightening a customer’s day.

There are just a few things to consider.

Images must be:

- eye-catching

- engaging

- relevant

Additionally, you can personalize images to specific customers by their data, preferences, and their location.

14. Reach Out to Customers

Cart abandonment, poor engagement, and lack of follow-up all affect your bottom line. However, you can overcome them with email personalization.

Reaching out to customers can get them back on track and keep them from abandoning their cart. For instance, you could send

- a coupon code in your abandoned cart emails

- an offer for something a customer looked at but didn’t buy

- an email asking why they left without buying and offering assistance

- a follow-up email three days after their visit

Next, engage.

Send out email tutorials or similar. You can personalize these messages by looking at your data to see how your customers use their purchases and where they most need your help.

Finally, follow up.

- Does your customer understand everything their purchase offers?

- Are there features they could be making more of?

- Anything specific about the product/service that can make a particular buyer’s life easier?

Yes? Then follow up and solve their problems!

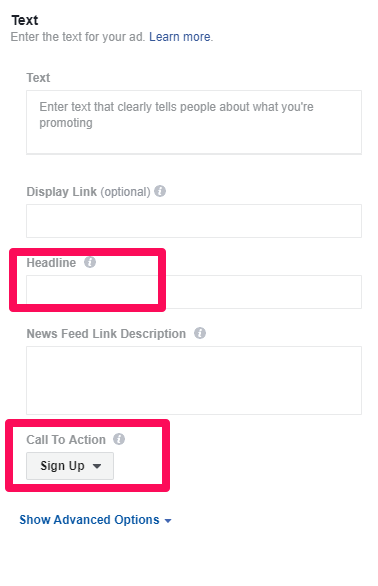

15. Pay Attention to the Small Details

Aside from the areas already discussed, you can use email personalization further by:

- A/B testing different versions of an email

- changing the copy of an email with each click based on customer data

- addressing any previous interactions

- including a call to action

- segmenting your audience into groups that share similar interests or use cases for your product

Email Personalization Frequently Asked Questions

Is email personalization effective?

Tailored emails are more effective than generic ones as they’re more likely to get read and resonate with your customers.

How much time does it take to personalize emails?

Customized emails can increase engagement and deliver a better user experience, so it’s worth taking some extra time.

How much does it cost to set up personalized emails?

The cost of setting up email personalization usually depends on two main factors: the number of emails you need to send and your plan.

What kinds of emails should you personalize?

You can personalize emails that are promotional or transactional.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Is email personalization effective?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Tailored emails are more effective than generic ones as they’re more likely to get read and resonate with your customers.

”

}

}

, {

“@type”: “Question”,

“name”: “How much time does it take to personalize emails?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Customized emails can increase engagement and deliver a better user experience, so it’s worth taking some extra time.

”

}

}

, {

“@type”: “Question”,

“name”: “How much does it cost to set up personalized emails? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The cost of setting up email personalization usually depends on two main factors: the number of emails you need to send and your plan.

”

}

}

, {

“@type”: “Question”,

“name”: “What kinds of emails should you personalize?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You can personalize emails that are promotional or transactional.

”

}

}

]

}

Email Personalization Conclusion

Email personalization is a strategy that can generate an improved ROI for businesses. It’s one of the most efficient marketing channels, and many small and medium-sized companies are using it to grow their businesses.

Additionally, this technique can increase customer loyalty and raise conversion rates.

However, if you’re not taking the right approach, you won’t get results.

If you want conversions, you need to take email personalization deeper than using a customer’s first name. This includes adapting to different time zones, addressing customers’ wants and needs, and using imagery.

In short, email personalization can make your customers feel valued—and people who feel valued are more likely to make purchases from you.

Do you use email personalization in your campaigns? Which techniques work well for you?