Article URL: https://etleap.com/careers/account-executive/

Comments URL: https://news.ycombinator.com/item?id=40006758

Points: 0

# Comments: 0

Article URL: https://etleap.com/careers/account-executive/

Comments URL: https://news.ycombinator.com/item?id=40006758

Points: 0

# Comments: 0

Column (https://column.com/) | Infrastructure Software Engineer, Techops Engineer | San Francisco, CA or Remote (for exceptional candidates) | Full Time

Column is the first nationally chartered bank built from the ground up for developers. We provide an API first, modern banking experience for our customers, replacing the bloated middleware and legacy software that currently powers most financial companies.

Started by the co-founder of Plaid, we are a team of 8 experienced engineers building the Column platform. Our #1 priority is hiring an experienced infra engineer (Go, Kubernetes, AWS) that can help us scale our systems. We all work on high impact, independently driven projects and support some of the largest and most sophisticated fintech customers.

Apply here: https://column.com/careers or read more about our hiring philosophy here: https://column.com/blog/hiring-at-column

Feel free to email me with any questions: praful@[put company name here].com

Article URL: https://www.aptible.com/culture-hub/careers

Comments URL: https://news.ycombinator.com/item?id=35531494

Points: 1

# Comments: 0

The Ringer’s Bill Simmons is joined by John Jastremski and Sean Fennessey to discuss the sliding Knicks, how to fix the roster, and the Nets’ quest for relevance in New York (2:12). They also discuss a sad state of affairs for New York football, whether the Giants or the Jets are in a better position for the 2022 season, and more (27:46). Then Bill talks with NFL Network’s Peter Schrager about Pro Bowl selections, the surging Colts, and MVP candidates (45:13), before making the Million-Dollar Picks for NFL Week 16 (1:02:37).

Host: Bill Simmons

Guests: John Jastremski, Sean Fennessey, and Peter Schrager

Producer: Kyle Crichton

Learn more about your ad choices. Visit podcastchoices.com/adchoices

The post Knicks vs. Nets, Giants vs. Jets and Million-Dollar Picks With Sean Fennessey, John Jastremski and Peter Schrager appeared first on Buy It At A Bargain – Deals And Reviews.

The People for Ethical Treatment of Animals said that the National Institutes of Health leadership should resign, including Dr. Anthony Fauci.

Are you looking for accounts receivable loans? Even though accounts receivable loans is based on receivables – more on that later – it still pays to look at fundability. Plus we are covering similar alternatives today.

This way in case it turns out that accounts receivable loans is off the table for you and your business, you would still be covered.

Fundability is the ability of a business to get funding. It essentially covers all the points a lender or credit provider will be looking at when they’re trying to figure out if you’ll pay back a loan or credit extended to you. These include factors you probably haven’t thought about or might think aren’t so important. But they are!

Does your business include the name of a high risk industry? Did you know it could be preventing you from getting funding? It doesn’t have to be this way. You don’t have to include the name of your industry in your business name. There’s nothing deceptive or illegal or otherwise wrong about calling a business Chico’s rather than Chico’s Bail Bonds.

Note: if you change your business name, be sure to change it everywhere. This means you change it in these places, among others: incorporation documents, licenses, and your records with the business CRAs (D&B, Experian, and Equifax)

It’s best to copy/paste this information. Do not chance making an error by typing it by hand. This is because differences will be interpreted as fraud by lenders and credit providers. Keep records of where your business name is, so, you can be sure you’ve caught everything.

You choose your business’s NAICS code. NAICS industry codes define businesses based on the activities they primarily do. The NAICS puts out a list of high-risk and high-cash industries. Higher risk industries include casinos, pawn shops, and liquor stores. If more than one code would apply, there is nothing deceptive, illegal, or wrong with using a less risky one.

The IRS, lenders, banks, insurance companies, and business CRAs use NAICS codes. They are trying to determine if your business is in a high-risk industry classification. So, you could get a denial for a loan or a business credit card based on your business classification. Some codes can trigger automatic turn-downs, higher premiums, and reduced credit limits for your business. See naics.com/search.

Demolish your funding problems with 27 killer ways to get cash for your business.

To get financing or credit for your business you must have a business entity. A corporation or LLC gives you more credibility in many cases. It also helps you reduce your liability. And it separates you from your business. It makes the business a separate legal entity. Make sure your entity is set up in the same state as your business address.

Your business must have a Federal Tax ID number (EIN). Just like you have a Social Security Number, your business has an EIN. Your Tax ID number is used to open a bank account and to build a business credit profile. Take the time to verify all agencies, banks, and trade credit vendors have your business listed with the same Tax ID number.

Your business address has to be a real brick and mortar building. It must be a deliverable physical address. For a retail establishment like a toy store, this should not be a residential address or a PO Box. Don’t use UPS mailing addresses. Some lenders will not approve and fund unless this criterion is met.

A cell or residence phone number as your main business line could get you flagged as un-established – but VOIP is okay. It’s better to not give a personal cell phone or residential phone as the business phone number. Your phone number must be listed with 411 for most credit issuers and lenders to approve you. Check your record to see if you’re listed and make sure your information is accurate. No record? Then use ListYourself.net to get a listing. Business phone number should be toll-free (800 exchange or comparable).

Make sure you have the proper licensing for your corporation. And make sure the address on your licenses is the same as all other documents. Contact State, County, and City Government offices, and see if there are any necessary licenses and permits to operate your type of business. Being licensed also builds credibility in your business, which can help you get more customers.

You need a company email address for your business. Email must be on the same domain as your website. This usually comes with a website domain provider such as GoDaddy or Host Gator. It is not just professional; it also greatly helps your chances of getting approval from a credit provider. Do not use Yahoo, AOL, Gmail, Hotmail, or similar kinds of email.

Demolish your funding problems with 27 killer ways to get cash for your business.

You can use outstanding account receivables as collateral for financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement. Receivables should be with the government or another business.

Use your outstanding account receivables for financing. Get as much as 80% of receivables advanced ongoing in less than 24 hours. Remainder of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%. you can get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

This is a company loan backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business, in a specific period. Cash flow financing (or a cash flow loan) uses generated cash flow as a means to pay back the loan.

Often you will need to have a few years in business. You may need to meet a certain minimum credit score requirement. You will need to prove historical cash flow, and present your accounts receivables and accounts payables, so the lender can determine how much to loan to your business.

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). You will not need to present any financials. And you can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

This is advanced to a business with a large purchase order or contract but cannot fulfill it. Lender then loans the funds necessary to complete the order and charges a percentage for the service. Then the company can fulfill its order or contract. The difference between purchase order and accounts receivable loans is:

Terms are for Credit Suite purchase order financing. For approval, lenders will typically review your outstanding purchase orders that need to be filled. If the purchase orders are valid and the suppliers you are dealing with are credible, you can get approval regardless of personal credit history. Rates typically range from 1-4%. In some instances, you can get 95% of your purchase order financed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Advances against anticipated inventory and accounts receivables, or in some cases associated increased labor costs. The idea behind it is to help seasonal businesses. It can be revolving or non-revolving.

Get loans to $5 million. Qualification requirements are the same as with other SBA programs. The maximum maturity on this CAPLine loan is 10 years. Holders of at least 20% ownership in the applicant business must guarantee the loan.

This is an enormous buffet of business funding choices! But how do you select the one(s) that’s best for your particular situation? This is where our Advisory Team comes in extremely handy. Or help yourself with our Business Credit Builder. It’s your choice. But it all starts with business credit.

There are all sorts of amazing ways to get business funding. Accounts receivable loans and similar funding types are just the tip of the iceberg. You can find the best financing which fits your circumstances, including your strengths in areas like:

The post Accounts Receivable Loans appeared first on Credit Suite.

Article URL: https://www.algolia.com/careers/senior-software-engineer-distributed-systems-paris/ Comments URL: https://news.ycombinator.com/item?id=26669523 Points: 1 # Comments: 0 The post Algolia (YC W14) is hiring to enhance its search engine appeared first on ROI Credit Builders.

The post Algolia (YC W14) is hiring to enhance its search engine first appeared on Online Web Store Site.

The post Algolia (YC W14) is hiring to enhance its search engine appeared first on ROI Credit Builders.

High risk NAICS codes can be the difference between getting business funding … or not. But what are they?

There are certain industries that are perceived by lenders as extra risky. If your business appears to be part of one of these industries, you could be looking at automatic denial. At the least, you may be subject to stricter underwriting, as well as higher rates and less favorable terms.

Lenders make a judgement of what industry your business is in based on a couple of things. First, they look at your business name. Then, they look at your business code. This could be either SIC or NAICS codes

So, your job becomes finding a way to keep from getting a denial automatically, based on your industry code or business name. Yet, you still have to be honest. Integrity is of the utmost importance and lack of it could cause future denials and even criminal charges.

The North American Industry Classification System (NAICS) is a somewhat recently instituted business classification system. It is used to classify business establishments, and collect , analyze, and publish statistical information related to the economy of the United States.

For each NAICS Code there may be multiple SIC codes, as SIC codes break down more specifically.

For example, there are over 30 SIC codes under the Engineering Services code of 8711. The NAICS code for Engineering Services is 541330. While the plan is to fully switch to the NAICS system, many industries still have the old SIC system deeply ingrained. For this reason, the switch hasn’t happened exactly as planned, and currently both systems are in place.

SIC (Standard Industrial Classification) is a part of a business classification system. It’s a four digit number that the US government assigns to businesses. It makes it easier to identify the primary activity of the business. Lenders and others use it as an indicator of the kind of business a company is in.

The Securities and Exchange Commission (SEC) developed the SIC Code system. The first four digits signify the general industry of a business. For example, 8711 refers to Engineering Services. Then, numbers add to the end of this 4 digit chain to add specificity.

For example, 817701 is Naval Architects, while 871103 is Engineers-Agriculture. And 871105 is Contractors- Engineering General. There are over 30 individual codes under the 8711 Engineering services code.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

You choose a SIC code to report to the IRS. They will use it to determine if your business tax returns are comparable to other businesses in your industry. If your deductions aren’t reasonable when compared to other businesses in your industry, as determined by SIC code, you could be audited. Therefore, choosing the right SIC code with the IRS is essential. NAICS codes are going to replace this system soon.

Certain codes are associated with industries posing more risk than others. If you happen to choose one of these high risk codes unnecessarily. You may get a funding denial. If you understand how the system works, you can choose the best code the first time.

Some examples of high risk industries include:

As with any business aspect, risk must be taken into consideration. Each industry code has its own inherent issues. Still, some industries are thought to be riskier than others by their very nature.

An industry may be seen as risky if there is a high chance of injury, either to workers or to customers. Or it may be considered risky if there is a high chance of theft. This is true despite how the business is doing, and despite its safety record or the accuracy and dependability of its security system. Even if a business is doing great, it could be seen as risky simply due to the nature of the industry.

So, if your SIC code or NAICS code indicates your business is part of a risky industry, what does that mean? The main issue is that it could make it difficult to get funding for your business. There are several industries that lenders are hesitant to lend to. Some of these industries are subject to stricter underwriting guidelines. And some cannot get funding at all.

In these cases, the business must seek out other funding options. These options could include:

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

It’s key to remember, you get to choose your SIC code. While you want to be honest, you can be general. You do not have to be more specific than necessary. For example, restaurants are risky, but if you also sell boutique items, you can use a SIC code related to that. If more than one SIC code can apply, be sure to choose the one that is the least risky in the eyes of lenders. There is nothing underhanded or unethical about doing so.

As already mentioned, your business name can indicate risk. That is, if it indicates you are part of a high risk industry. For example, auto sales is considered a risky industry. You do not have to name your business “Joe’s Used Auto Sales”. You can just name it “Joe’s” and be done. There is nothing unethical or underhanded in doing this, either.

Of course, choosing a SIC code and name that does not indicate risk isn’t a guarantee of funding. There are many other factors that go into a lender’s funding decision including fundability. However, if you choose the wrong code or business name, the lender may never see how fundable your business really is.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Currently, both codes are in use. Not by banks just to determine whether or not to lend. Other ways agencies use these codes include:

And they can be used by the SBA categorize your business. This is especially true when it comes to applying for government contracts. You must meet size standards for contracts, and the SBA assigns a specific size standard to each NAICS code. The SBA also uses NAICS codes to determine eligibility for the Women-Owned Small Business Federal Contracting program. They keep a list of qualifying codes.

Businesses need funding, but if your business is perceived to be a part of a risky industry, you may get a denial. SIC Codes, NAICS Codes, and Business Name all contribute to the risk perception of lenders. Choosing the wrong code or name for your business could get you an unnecessary automatic denial for funding.

The post High Risk NAICS Codes appeared first on Credit Suite.

980450_HowtoOptimizeYourAmazonStorefront_022521 Selling on Amazon can be incredibly profitable, but it’s also incredibly competitive. It’s important to take advantage of every bit of help Amazon offers. The first step to improve sales on Amazon is to get an Amazon Storefront. This gives your brand a customizable home on Amazon. It’s not enough just to have a …

The post How to Optimize Your Amazon Storefront first appeared on Online Web Store Site.

Your analytics should tell you everything.

Tools like Google Analytics are incredibly valuable for businesses. Once you’re setup, you’ll have everything you need to analyze your performance data properly. Instead, many companies have realized that their analytics tools have introduced a lot of unexpected problems.

They’re not getting the kind of value they need.

That’s the good news. Most companies think their data is clean; that they’re making good decisions with the data they have. Most of these companies are wrong; they just don’t know it yet. This is why companies need analytics consulting. They don’t know what they don’t know.

Today, I’ll show you how to find the right analytics consultant for your business.

Many companies make the wrong assumptions. Using a tool like Google Analytics, clients think all they have to do is drop the tracking code into their web pages, log into their account, and begin analyzing their data. It sounds easy, but it often isn’t.

There’s more to it than that.

This is why you need an analytics consultant. With the right consultant, you’ll have the education you need to grow your business. You’ll be able to pull insights out of your data using a variety of methods. Each of these strategies is important because they have a cumulative effect on your business.

Here are four ways analytics consulting can help you grow your business.

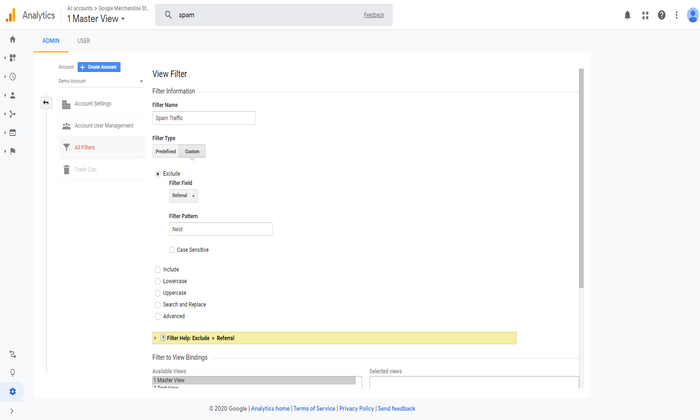

How much of your traffic comes from real visitors? How much of it comes from bots, scrapers, and spiders? According to Imperva, almost half of all internet traffic is non-human. In 2014, Google introduced an obscure setting that enables you to filter out bots and spiders listed in IAB’s Interactional Spiders and Bots list. This low-key setting is buried in Google Analytics, but it’s incredibly important; many small businesses still aren’t aware of this setting.

You’ll also need help to filter out referral spam.

Referral spam is basically fake website hits; these bots, scrapers, and spiders land in your site. Site owners send their spam to your site. They hope you’ll see these referrals in your Google Analytics account, clickthrough, and visit their site.

This junk traffic poisons your data.

It gives you false readings based on inaccurate data. Your site may be more or less profitable, depending on your visits-to-spam ratio on your site. This isn’t something many businesses watch for in their analytics reports.

A good analytics consultant will consistently filter the variations of spam traffic (e.g., direct spam traffic, referral spam traffic, etc.) out of your reports, so you get a clear picture of your marketing performance.

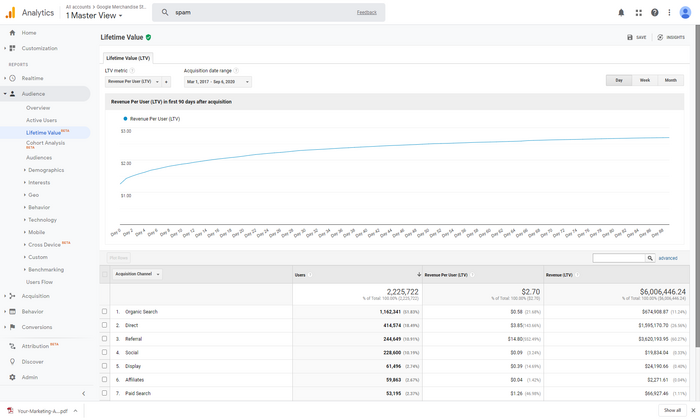

A lot of companies don’t know how to analyze their data properly. According to Forrester, between 60 and 73 percent of a company’s analytics data goes unused. Companies collect lots of data on customer activity, but they aren’t using it, why?

There are lots of reasons.

Think about it.

Right now, your company has valuable data about your customers. This is data you can use to attract more customers, lower expenses, grow faster, jump ahead of competitors, etc.

If you’re unaware of the data, you can’t use it.

A good analytics consultant will help you analyze your data properly, showing you what you have and how you can use it to grow your business.

Your data isn’t as valuable without context.

If you know the problem you’re trying to solve, you have a pretty good idea of the answers you’re looking for in your data.

That’s the problem though.

A lot of companies treat their analytics tools as a technology issue. They focus their attention on the obvious issues like hardware or software. They rarely treat their analytics as a question and answer tool. That’s exactly what it is, though.

Target had the right idea when they started their analysis with a problem/question.

Remember the story?

“If we wanted to figure out if a customer is pregnant, even if she didn’t want us to know, can you do that?” It’s a creepy story that shows the power of questions and problems. A great analytics consultant will help you discover the issues you’re trying to solve and the questions that need answers.

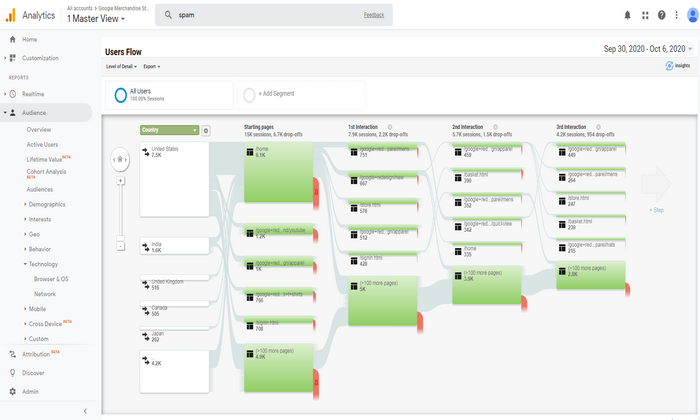

Analytics tells you what happened — what visitors did when they arrived on your site, the ads they responded to, what they read most often, etc. It doesn’t tell you why visitors do the things they do. Understanding what is important, but it’s more important to understand why something happens.

Focusing on the right metrics is the answer.

The right analytics consultant will help you answer the “what” — basically looking in the rearview mirror. But they’ll also help you look ahead; They’ll dig deeper, showing you the why behind visitor and customer behaviors.

Your analytics consultant should provide you with the education and support you need to squeeze more value out of your data.

Avinash Kaushik has a three-step framework he uses to help analytics consultants support their clients. He calls it Data Capture. Data Reporting. Data Analysis. The nice part about this framework is the fact that it’s easy for both clients and consultants.

Consultants can use each of these buckets to analyze your goals, objectives, and the results they want to accomplish with each.

You’re basically goal setting with this framework.

Here’s a closer look at each of these three buckets and the goals for each of these.

Here’s what this means for you.

You’ll want to find an analytics consultant or agency that can handle all three steps in this framework. This also means you’ll need a clear idea of problems you’re dealing with ahead of time.

Many companies don’t understand analytics.

If you don’t understand analytics, that’s okay; you just need to know whether you’re generating a return on your analytics investment. According to Nucleus Research, analytics returns $13.01 for every $1 invested.

Your consultant should be able to calculate your return on analytics investment.

This obviously much easier if your consultant is focused on the data analysis bucket. Suppose they’ve made several data-driven improvements to your site over three to six months. Their recommendations have lead to an increase in revenue, profit, or a return on investment for you. They should be able to verify your return on investment using the worksheet I’ve linked above.

The good news is the fact that analytics, as a discipline, is data-driven.

Choosing the right analytics consultant requires a very different set of skills. If you’re working with an independent analytics consultant, you’ll need to approach this in one of two ways.

Here’s a list of the skills needed for each of the three roles in your buckets. Avinash breaks these skills down in detail in his web analytics consulting framework post.

Here’s a quick summary.

If you’re working with an independent consultant, they should be an industry veteran with the skills I’ve listed above. If you’re working with an agency, they should have employees with the skills for each bucket. If you have implementation specialists, you can handle data capture and possibly reporting.

Just make sure they’re a fit for that role.

Many companies aren’t familiar with analytics consulting. They’re not entirely sure how analytics impacts their organization. That’s okay, as long as the ROI is there.

Using a tool like Google Analytics, many companies assume that all they need to do is customize the tracking code, drop it onto their web pages, log into their account, and begin analyzing their data. It should be that easy, but it isn’t.

There’s more to it than that.

With most companies, their analytics data goes unused, they collect lots of data on customer activity, but they don’t know how to squeeze value out of their data. Analytics consulting can help you evaluate your performance data properly. Choose the right team, and your data will tell you what you need to know.

The post Analytics Consulting appeared first on Neil Patel.