Article URL: https://onesignal.com/careers/09c46a1a-c29f-49e8-8691-07e27f292b97

Comments URL: https://news.ycombinator.com/item?id=30338277

Points: 1

# Comments: 0

Article URL: https://onesignal.com/careers/09c46a1a-c29f-49e8-8691-07e27f292b97

Comments URL: https://news.ycombinator.com/item?id=30338277

Points: 1

# Comments: 0

A top Chinese official said Thursday that the U.S. should not have “any illusions” when it comes to Taiwan and reiterated that Beijing will not compromise on the issue, according to a report.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission. WordPress popup plugins are one of the best ways to maximize your site’s effectiveness. Easy to use and implement, popups help to enhance your messaging and convert leads. You can use them in many …

The post Best WordPress Popup Plugins first appeared on Online Web Store Site.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Founded in 1996, DreamHost is one of the oldest web hosting services to date. Hosting over 1.5 million websites with 400,000 customers and 750,000 WordPress installations—I think DreamHost is one of the best web hosting services for most website owners.

With extensive product offerings that aren’t just limited to hosting plans, DreamHost can help you integrate domain names, website builders, and email hosting into your website efficiently and affordably.

It’s web hosting with a purpose and will make sure your site is fast, secure, and up to date for your visitors.

Compared to other web hosting services, DreamHost is a more well-rounded and inclusive option, with an extensive range of website hosting products for different needs.

DreamHost is my top pick for quick and responsive website changes because of its dedication to excel and adapt to new trends. Not only that, DreamHost also has a passion for privacy, security, and is employee-owned, so they have a strong focus on its users and their individual needs.

I reviewed dozens of different web hosting services and narrowed it down to the top eight options. I looked at each option to see who it’s best for, what options there are to choose from, and how to choose the right one.

See all of my top picks and get an in-depth analysis of each one to make the best buying decision for your website needs.

With its low price and high quality, DreamHost is an excellent option for most website owners. This may seem broad, but hear me out.

DreamHost is the most inclusive web hosting service for both small and large businesses working on different sized projects. This is because it has a high enough performance speed, customer support, and reliable uptime for most website owners.

Whether you’re in the blogging or site developing niche, DreamHost will offer sturdy and dependable hosting support at an affordable price.

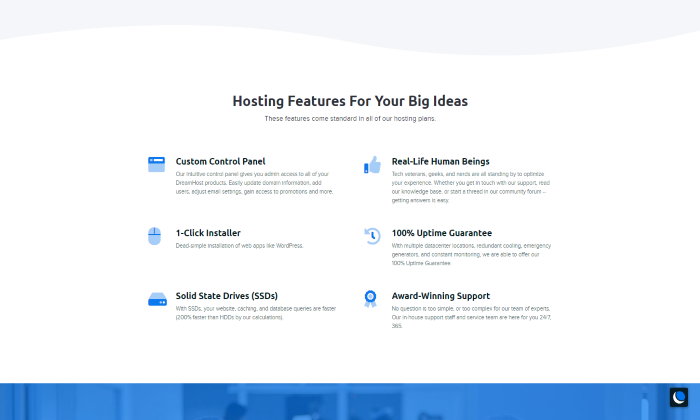

Because it supports SSDs and high-level technology, DreamHost makes it easy for users to customize their control panel with no issues.

From beginners to tech-savvy users, DreamHost knows that your website is your future, making it the best for most website owners who are looking for extra support and high-quality performance.

Even the best web hosting services have flaws, and it’s important to weigh up the pros and cons of a product before purchasing to make sure each element contributes to your preferences and the success of your site. Below is a list of the pros and cons for DreamHost.

Affordable pricing: DreamHost is one of the most affordable web hosting services on the market, which we will cover later on. To make it short and sweet, DreamHost offers a nice variety of pricing plans you can customize to pay for in either monthly or annual installments.

Monthly payments start at $4.95, whereas annual prices start at $3.95 per month, which means you save more by paying annually. This is a rarity for web hosting services, as many of its competitors seem to charge more for annual payment options.

Automated integrations: DreamHost offers automatic integration and one-click installation for a few CMS options, such as WordPress, MediaWiki, and Joomla.

This is a major advantage for most users because it gives them the option to choose a different website and transition with ease. It’s even easier for users who already use one of the supported CMS options because DreamHost will install it for you with one click.

The most popular CMS option DreamHost supports is WordPress, and you will have the easiest time integrating this specific option with your hosting provider. DreamHost also allows you to choose any WordPress theme or plugin for your website. Essentially, you will have full control of your website’s appearance, while DreamHost does all the nitty-gritty behind the scenes.

Extensive customer support: Another significant feature of DreamHost is its comprehensive customer support base. There are two main ways to contact them for free support via your control panel, including live chat and email support.

Live chat operates seven days a week from 5:30 am-9:30 pm Pacific Time, while the DreamHost support team strives to answer all emails within 24 hours. However, if you feel you need extra guidance for technical issues, DreamHost does offer a callback service for an additional fee.

Because callbacks aren’t included in your hosting package by default, you will have to add them. You can choose to add three callbacks per month for a nominal monthly fee or a one-time callback feature for a fee as well.

Not only does DreamHost offer those support services, but they also have dedicated pages for knowledge base questions, system status, tech support, and discussion forums.

High-quality performance and speed: DreamHost offers incredible performance and speed that will permanently transform your website’s quality.

For example, DreamHost specifically designs products to be compatible with WordPress for optimal performance. This ensures seamless and fluid integration between DreamHost and your WordPress website, making it run at peak speed.

Another great performance feature involves the use of SSDs. With DreamHost SSDs, your overall website, data, and caching are 200 percent faster than old HDDs. With lightning-fast speeds and a loading time of 2.35 seconds, your visitors can scroll your website without lag and won’t get caught up in unnecessary wait times.

DreamHost also guarantees 100% reliable uptime, so your site will always be online and functioning to its maximum potential. With emergency generators, constant monitoring, redundant cooling, and data center locations, your website will never operate as well as it does with DreamHost.

Additional fees for advanced features: If you’re looking for a more comprehensive web hosting service that offers advanced features and tools to transform your website, unfortunately, DreamHost lacks a little in this department.

In the beginning it’s possible to build your website for next to nothing—but there are some additional costs involved for those looking at extensive support. For example, DreamHost offers products outside of web hosting like website builders, G suite, design services, and marketing tools.

However, they all cost extra and can become quite pricey, as they aren’t included in your hosting package. If you do want additional support all from one platform for the added convenience, you’re looking at forking out an extra $2.95 per month for website building up to $1,499 for design services.

Even though a few of the features are quite affordable for monthly payments, if you want more professional services, it’s something you would want to re-evaluate and plan for in your budget.

The Shared Starter plan doesn’t include email hosting: Although email hosting costs an extra $1.67 per month per mailbox for the shared starter plan, which is still reasonably affordable—it’s also an additional cost for those who wish to purchase the starter plan as a complete beginner with little tech experience.

This is especially pertinent when it costs an extra $9 per month for the next plan with unlimited email hosting. This can be a disadvantage for website owners looking for a cheaper plan that aligns more with their budget.

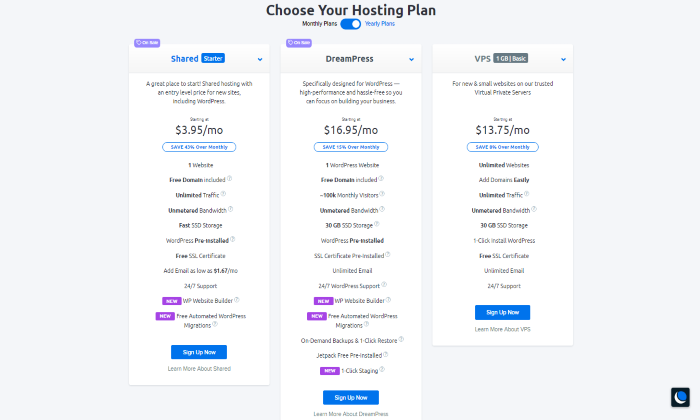

A major benefit when choosing DreamHost as your web hosting provider is the price. It is one of the most affordable products on the market when you weigh it up against the high-quality services it provides to its users. DreamHost offers three main hosting plans you can pay annually for a discount, including:

Each of these three plans, Shared, DreamPress, and VPS, have additional options within the plan.

For example, Shared Starter and Shared Unlimited, DreamPress, DreamPress plus, and DreamPress Pro. And then the VPS plan is broken down into amount of storage, from 30 GB SSD storage on VPS Basic to 240 DB SSD storage on VPS Enterprise. There are two additional VPS plan options between those.

Let’s begin with the Shared plan. The Shared Starter option is brilliant for beginners who have one new website and aren’t sure where to start. It offers the basic tools your website will need for hosting, like one WordPress website, a free domain, and unlimited bandwidth.

For $3.95 per month paid annually, users also get a bang for their buck with the WP website builder and free automated WordPress integrations. These usually start between $2.59-$9.95 per month, so having both included in the plan for free is an enormous value to your business.

DreamHost also offers the Shared Unlimited plan, which includes everything in the Shared Starter plan, plus unlimited emailing and websites for $9.95 per month paid annually. This would be a good plan for users that have multiple websites who need different email accounts.

The next main DreamHost pricing plan is DreamPress. You save 15 percent by paying annually at $16.95 per month. This plan includes everything the Shared Unlimited plan has and includes on-demand backups, jetpack free pre-installation, and one-click staging.

This plan is more suited for users who already have a WordPress website specifically, as it’s created to co-exist with this builder seamlessly.

There are two other DreamPress options, including:

These pricing plans are more suited to high-demanding WordPress websites that require comprehensive tools.

I will get into VPS hosting and options in the next section.

DreamHost has a few product offerings for web hosting that cater to most users. Below is an in-depth look at the different products DreamHost offer for web hosting services:

WordPress hosting is by far the most popular product that DreamHost offers to its users. DreamHost specifically optimized most of their tools and technology for WordPress compatibility, so it’s for a good reason that WordPress hosting is so popular.

WordPress hosting on DreamHost will completely transform your website with powerful features, add-ons, and 24/7 support. They do this by working closely with WordPress.org themselves, so you will always get the newest version and continuous updates to make sure your website is running and secure.

The easiest part about choosing WordPress hosting is the instant set up and installation process. If you select a plan that supports multiple websites, the one-click installer will do everything for you—offering seamless integration.

WordPress hosting starts at $2.59 per month for one website with a 36-month commitment.

By choosing WordPress hosting, your website will benefit from some key features, including:

WordPress hosting is an excellent option for those who own a WordPress website for the most effortless transitions and seamless integration into web hosting.

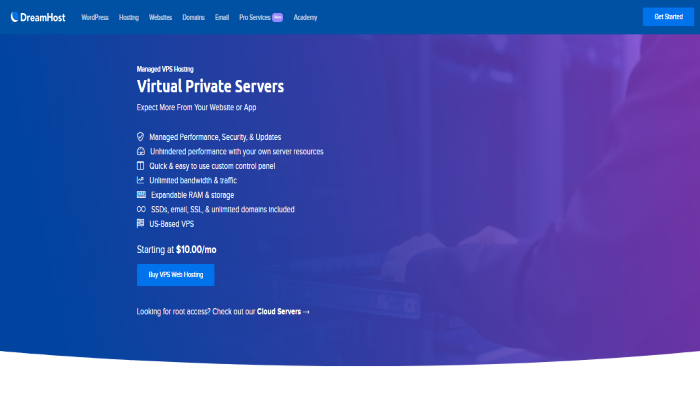

Virtual Private Server (VPS) hosting is another common hosting option that DreamHost manages and monitors very well. With performance and security updates, your website will be safest with the wide variety of tools and features of VPS at DreamHost.

A powerful feature DreamHost offers with VPS hosting is individual resources that only your website can use. This means dedicated resources will help your website create low latency and high performance.

With an intuitive control panel, VPS hosting has never been easier to manage. DreamHost also allows you to customize this control panel to your individual preferences. You also have the option to upgrade your RAM and storage in under 10 seconds, giving you that extra peace of mind for when your website inevitably grows.

The DreamHost VPS plans offer basic and advanced features for different goals, including:

Basic features:

Advanced features:

These features will work well for users looking for a more comprehensive hosting service on a private server.

VPS hosting offers four different pricing plans, including:

DreamHost makes sure there’s a pricing plan for every website owner looking at VPS hosting.

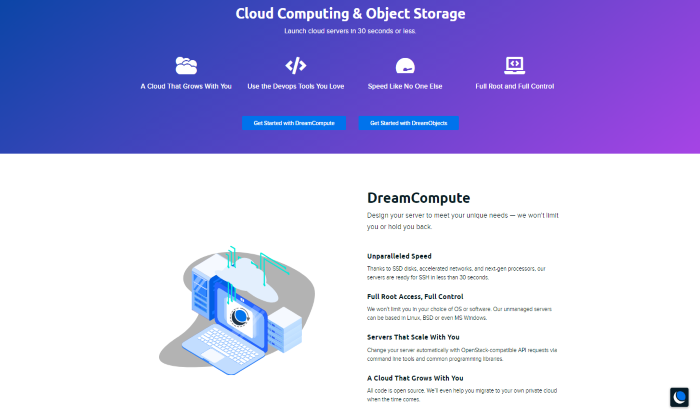

Lastly, DreamHost offers a unique service called cloud hosting with OpenStack. Cloud hosting, also known as DreamCompute, is a product that provides simple cloud servers to advanced network configurations.

Cloud hosting is an excellent option for users who are looking at hosting a website using software of their choice, are running their own server, for gaming purposes, or are running web-scale applications.

Like the other two product offerings, DreamHost always makes sure speed and performance are a top priority for all servers. Cloud hosting SSH is ready in 30 seconds because of next-gen processors and accelerated SSD disks.

Cloud hosting offers a few helpful features, like:

DreamCompute has three pricing plans with really flexible prices, including:

With the cloud hosting plans, DreamHost only charges users up to 600 hours in any given month. All plans come with 100GB of block storage and free bandwidth.

I’ve spent hours reviewing different web hosting services. You can check out my buying guide here.

Overall, DreamHost is an excellent web hosting service option for most website owners looking for high performance and quick adaptation at an affordable price.

With great pricing packages and product offerings like WordPress hosting, VPS hosting, and cloud hosting, there’s an option for everyone with different preferences.

The pros definitely outweigh the cons of DreamHost, and I think it’s worth looking into for website transformation and growth.

The post DreamHost Review appeared first on Neil Patel.

Did you know there are all kinds of ways you can wreck your recession bank credit score? It is, regrettably, pretty easy to run a power saw through your bank score.

However prior to going any further, do you know the distinction between recession bank credit scores and company credit?

Small business credit is the full and complete amount of cash that your company can obtain from all types of creditors. That means the banking system, credit unions, credit card companies, and also renting businesses. And it also means vendors, under what’s called trade credit or supplier credit or trade lines. That is, vendor credit.

But a recession bank credit score, on the other hand, is a measure of the full amount of borrowing capability which a business can receive from the banking system only.

The number of American banks and thrifts has been decreasing gradually for 25 years. This is from consolidation in the market along with deregulation in the 1990s, decreasing obstacles to interstate banking. See: fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets focused in ever‐larger banks is troublesome for small business owners. Big financial institutions are much less likely to make small loans. Economic declines imply banks become much more careful with lending. The good news is you can assure your bank by improving your recession bank credit score.

A small business can obtain more company credit promptly, so long as it has at the very least one bank reference and an average day-to-day account balance of at least $10,000 for the most recent three month time period. This setup will yield a bank credit score of a Low-5. So this means it is an Adjusted Debt Balance of from $5,000 to $30,000.

A lower score, like a High-4, or balance of $7,000 to $9,999 will not immediately decline the small company’s loan application. Nevertheless, it will slow down the approval process.

Have a look at our expert research on bank scores, the little-known reason you will – or won’t – get a bank loan for your small business.

A bank rating is a measure of the average minimum balance as kept in a business bank account over a 3 month long period. Therefore a $10,000 balance| will rate as a Low-5, a $5,000 balance will rate as a Mid-4, and a $999 balance will rank as a High-3, etc.

A business’s principal goal should always be to maintain a minimum Low-5 bank rating (or, an average $10,000 balance) for at the very least three months. This is because, without at least a Low-5 score, the majority of banks will operate under the assumption that the business has little to no capacity to pay off a loan or a business line of credit.

Yet there is one point to remember – you will never really see this number. The financial institution will simply keep this number in its back pocket.

It is vital, particularly in bad economic times, to do your best to raise your recession bank credit score.

The numbers work out to the following ranges:

To get a High-5 rating, your business will need to have an account balance of $70,000 to $99,999. For a Mid-5 score, your company must have an account balance of $40,000 to $69,999. And for a Low-5 rating, your company needs to keep an account balance of $10,000 to $39,000. So your small business needs this level bank score or better in order to get a bank loan.

For a High-4 score, your small business has to have an account balance of $7,000 to $9,999. And for a Mid-4 rating, your small business must maintain an account balance of $4,000 to $6,999. So for a Low-4 rating, your small business will need to have an account balance of $1,000 to $3,999.

And now, without further ado, right here are 7 ways you can leave your bank rating in tatters.

Don’t keep a minimum balance for a minimum of three months. Because every bank score cycle is based upon the previous 3 months, a continuously seesawing balance should harm your bank rating.

Don’t bother to guarantee that your company bank accounts are reported precisely the same way as every one of your company documents are, and also with the exact same physical address (no post office box) and contact number. Sow confusion here by changing one and not another, or not fixing an error if there is one.

Have a look at our expert research on bank scores, the little-known reason you will – or won’t – get a bank loan for your small business.

To go along with # 6, do not make certain that each and every credit bureau and trade credit vendor likewise lists the business name and address the precise same way. This is every keeper of financial documents, earnings and sales taxes, web addresses as well as e-mail addresses, directory assistance, and so on.

No lending institution is going to think of the myriad ways that a business might be listed, when they check out the business’s creditworthiness. Thus if they are not able to locate what they need easily, they will either deny an application or it won’t be reported to a business credit reporting agency such as Experian, Equifax or Dun & Bradstreet.

For that reason, if they are not able to locate what they require conveniently, they will simply reject the application. So ensure your records are a mess!

Never handle your bank account responsibly. This means that your small company ought to not prevent writing non-sufficient funds (NSF) checks at all costs, since those annihilate bank ratings. Non-sufficient-funds checks are something which no small business can afford to let happen.

Balancing checkbooks and accounts is so boring anyway. You’ve got adequate cash without even making sure, right?

To contribute to # 4, do not include overdraft protection to your bank account immediately, in order to avoid NSFs. Why bother thinking in advance or preparing for the future? Everything is going to| be excellent permanently, right?

Writing checks insufficient funds (NSFs) is a sure way to wreck your bank rating.

Don’t let your business show a positive cash flow. The cash coming in and leaving your firm’s bank account must reflect a positive free cash flow.

A positive free cash flow is the quantity of income left over after a company has paid every one of its expenses. According to Investopedia, it “represents the cash a company can generate after required investment to maintain or expand its asset base. It is a measurement of a company’s financial performance and health.”

When an account shows a positive cash flow it suggests your company is producing more profits than is used to run the business. That means the financial institution will feel your small business can pay its costs.

So if you actually intend to ravage your bank score, purchase whatever’s expensive for your company so your costs outstrip your earnings. Doesn’t every factory deserve deluxe carpets in the loading dock?

Have a look at our expert research on bank scores, the little-known reason you will – or won’t – get a bank loan for your small business.

Banks are extremely motivated to lend to a business with consistent deposits. And a business owner needs to also make regular deposits in order to keep a positive bank rating. The business owner has to make several consistent deposits, more than the withdrawals they are making, in order to have and preserve a great bank score. If they can do that, then they will have an excellent bank credit score.

Consistency is the hobgoblin of little minds, right? So be a free spirit!

You, the entrepreneur must never make consistent deposits. And these deposits should never be more than the withdrawals you are making, in order to destroy your bank credit rating.

If you can do these things, then your business will have a horrible bank credit score. And, in turn, a bad bank credit rating means your company is far less likely to obtain business loans.

So, where do you go from here?

Perhaps the most convenient way to achieve and maintain a great bank credit is to deposit at least $10,000 into your business bank account and keep it there for as much as six months. While you will still need to make regular deposits, this one simple step will aid in three ways. One, you will have kept a great minimum balance for a minimum of three months. 2, you will probably not overdraw with such a great balance. And 3, you will get to the magic minimum for a Low-5 bank credit rating. Hence you will be taking care of our # 4 and # 7, above.

And you may even have the ability to get around our # 3. However we still highly recommend overdraft protection.

A 2nd requirement is to see to it your small business account information correspond across the board, all over. While it may take some work order to ensure everything is right, you will be taking care of our # 5 as well as # 6, above.

A 3rd necessity is to make regular deposits, and make sure they are greater than the quantities you are withdrawing every month. This will take care of our # 1 and also # 2 conveniently.

Your bank rating is not to be trifled with. Despite the fact that the banks maintain a secret regarding them, failing to keep your bank credit score high will make it a great deal tougher to be successful in business.

The post Seven Ways You Can Destroy Your Recession Bank Credit appeared first on Credit Suite.

Startup crowdfunding is an awesome way to start a business for a few reasons. The top reason is likely the hope of starting a business without any debt. It rarely works out that way, but there have been a few lucky ducks that have blown goals out of the water and been able to use crowdfunding to totally fund their startup.

The problem comes in when you are not one of those lucky ducks. Of course, that doesn’t mean you shouldn’t try startup crowdfunding. It just meant that you need to have a plan, execute it, and have a backup plan in case it doesn’t work out exactly like you hope.

Crowdfunding sites allow you to pitch your business to thousands of micro investors. Anyone who wants can donate, if you will, to the cause.

Investors pledge amounts on a broad spectrum depending on the campaign and the platform in use. They may give $80, they may give $150, or they may give over $500. It might just be $5, but any amount helps.

Though not always necessary, most entrepreneurs offer rewards to investors for their generosity. Most often, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get your product A, and a $100 gift will get you an upgraded version of product A.

Find out why so many companies use our proven methods to get business loans.

This is not something that should be taken lightly. If you set your goal low, it won’t matter if you meet it or not. You still won’t have enough. If you set it too high, you may not get your money at all. That’s because some platforms will not release your funds until you meet your goal. There is a fine line you have to walk, and balance is necessary.

If you aren’t great with numbers, find someone who is to do some professional projections of how much you actually need to start your business.

There are a few different startup crowdfunding platforms out there. Some are more popular than others. The key is to find the one with the audience that best fits your business.

They are the largest crowdfunding platform. They have over 14 million backers and over 130,000 funded projects. Campaigns are for products and services such as:

A prototype is necessary. Projects cannot be for charity, although nonprofits can use Kickstarter. Equity cannot be offered as an incentive.

Taboo projects and perks include anything to do with:

There is a 5% fee on all funds which creators collect. Stripe, their payments processor, will also apply payment processing fees, which are roughly 3-5%. Campaigns that don’t make it don’t pay a fee. There are also fees of 3% + $0.20 per pledge. Pledges under $10 have to pay a discounted micropledge fee of 5% + $0.05 per pledge.

Indiegogo has over 9 million backers. Their minimum goal amount is $500. They charge 5% platform fees and 3% + 30¢ third-party credit card fees. Fees are deducted from the amount raised, not the goal. As a result, if you raise more than your goal, you will pay more in fees. They do not accept PayPal.

Indiegogo is notable because they offer both fixed and flexible funding. This means, if you don’t hit your goal and you chose the flexible funding option, you can at least hold onto what you have. It’s actually the opposite of how crowdfunding normally works.

You cannot change your fundraising structure once the campaign starts. They recommend fixed funding if you need a minimum amount for your project. In addition, regular communications with donors is recommended if you choose fixed funding.

RocketHub is more for entrepreneurs who want venture capital. They give you an ELEQUITY Funding Room. This is where you can pitch your idea and see if it stimulates any interest from donors.

The platform is specifically for business owners working on projects in these categories:

If you reach your fundraising goal, you will pay a fee of 4%. In addition, you’ll pay a 4% credit card handling fee. But if you do not reach your goal, that fee jumps up to 8% plus the credit card handling fee. Of course, that means RocketHub is best for companies that are more confident they will make their goals.

Find out why so many companies use our proven methods to get business loans.

CircleUp is only for businesses. Their aim is to help emerging brands and companies raise capital to grow. However, companies must apply and show revenue of at least $1 million to get a listing on the site. Still, they will sometimes make exceptions.

Due to its more thorough process, CircleUp can be good for entrepreneurs who already have a somewhat established business. These are business owners who want both funding and guidance in order to take their businesses to the next level.

If your business gets approval for listing on CircleUp, the fee percentage comes from the total amount you raise.

CircleUp says (in its FAQ): “Our commission is intended to be generally consistent with what companies pay to investment bankers in the offline world for similar size fundraising rounds.”

We can’t leave this one out because it is so well known. Truly, it’s probably not the best choice out there.

In general, GoFundMe is for individuals. Therefore, you might conceivably use it at the very beginning for startup crowdfunding. You will need to meet your fundraising goal in order to collect. The service charges 5% as a platform fee outside the United States. But there are no specific platform fees in America. Yet, there are payment processing charges of between 2 and 5%.

GoFundMe is often for personal causes, like people looking to cover their medical bills. Hence it may not be best for business funding. In addition, considering the large numbers of people who use GoFundMe for personal expenses, a business plea might get lost in the shuffle.

You’ve heard the adage “Plan to work and work your plan,” right? Well, it fits here perfectly. You have to have a campaign plan. Videos are popular but not necessary. Whatever ace you have up your sleeve, it has to make people want to support your business. They need to get excited.

Remember, your campaign has to match the personality of your audience. Does your main market fit in a certain generation? Maybe they are mostly 80s babies. Market to that with popular music and catch phrases from that era.

Are they an audience that loves campy, cheesy spoofs? Use that to your advantage! Specifically right now, if your business is going to help those affected by the pandemic, or the resulting economic downturn, play to that in your campaign!

Of course, no one really ever wants to give something for nothing. Those who are excited about your business are going to be more likely to show their excitement monetarily if you offer great incentives.

Physical incentives are a pain in the neck. However, people love them and they will stand out. Plus, if a perk is used frequently, it will help to keep your company relevant.

Still, you also have to ship anything physical that you promise. You may be an American company, but that doesn’t mean all of your investors will be in the United States. International shipping is costly, even for small items. Therefore, if you offer physical perks, be clear about whether you will allow international donor addresses.

Yet, even if everything has to be shipped in the US, you are still left with a database of names and addresses, and some of them might have misprints or be incomplete.

Also, most campaigns offer more than one option. Then you have to remember what each person wanted. What if it is lost or damaged in the mail? These are all reasons to consider digital incentives. For example, for a house flipping campaign you could record video footage about home design or repair. For a long-haul trucking company, you could offer PDFs with personal recommendations on what to see and do in certain cities you service. A nail salon could send digital coupons for a free month of manicure touch ups.

The options are endless, especially when you consider all the possibilities for digital gift cards.

Regardless of how awesome your campaign is and how fabulous your incentives are, you need a backup plan. Tons of great businesses fail to reach their crowdfunding goal each year. Even if you follow all of these tips, that is still a possibility. Especially in this time of economic uncertainty, you need a backup plan.

If startup crowdfunding doesn’t work out, or only partially works out, your next step will likely be a business loan. There are a few options, but for startup business loans, you are likely going to be choosing between only a couple.

These are the loans that you go to the bank to get. As a business, your business credit score can help you get some types of funding even if your personal score isn’t awesome. That isn’t necessarily the case with this type of funding however.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. This means they will check your personal credit. If your personal credit score isn’t in order, you will likely not get approval.

What kind of personal credit score do you need to have in order to qualify for a traditional term loan? If you have at least a 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be more inclined to be a little more flexible. However, your personal credit score will still weigh heavily on the terms and interest rate.

Of all of the loan types, this is the hardest to get. It is usually worth the trouble though if possible, because it typically offers the best rates and terms.

These are traditional bank loans, but they have a guarantee from the federal government. The Small Business Administration, or SBA, works with lenders to offer small businesses funding solutions that they may not be able to get otherwise for a number of reasons. Because of the government guarantee, lenders are able to relax a little on certain requirements.

In fact, it is possible to get an SBA microloan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

The trade-off with SBA loans is that the application progress is lengthy. There is a ton of red tape connected with these types of loans.

Find out why so many companies use our proven methods to get business loans.

Here’s a bonus for you. Startup crowdfunding is just one of many business funding options. The truth is, you are almost certainly going to need to use another option at some point. While your startup crowdfunding campaign is going, regardless of how successful it seems to be, work on fundability. This is the ability of your business to get funding. Even if you meet your goal, you are likely to need financing at some point in the future. By starting the work to make your business fundable, you help ensure you can get the financing your need to run and grow your business far into the future.

Startup crowdfunding is a legit option. However, it is impossible to tell if it will work or not. There are some things to do to increase the probability of a successful campaign. Still, it is best to know your options in case it doesn’t work. In the meantime, work on building fundability so that whatever type of funding you end up needing, you’ll be more likely to get it.

The post Startup Crowdfunding: Top Tips to Make it Work appeared first on Credit Suite.

Regardless of whether you are an existing business or a startup, your business needs its own credit. The problem is, a lot of owners are unsure of how to start building business credit. There are companies that help build business credit, but if you aren’t careful you will get scammed. You should always know what you are paying for, and if it is worth it, or not.

Lenders are becoming more picky and there are more automatic denials than ever before. Working with an insider familiar with the system can help tremendously. It can help everything go faster and it can minimize denials. Your time is money – working with a company to help build business credit can be a wise investment. But there are things you should know.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

First and foremost, you should always know exactly what services you are paying for. The truth is, some “services” just aren’t worth it. For example, you should never pay a company to report your payments to the business credit reporting agencies. There are plenty that will do that for free. However, they do not usually advertise that they do that, nor do they typically make public which companies they report to. Paying someone to help you find these companies? That is worth paying for.

There are a few reasons why it’s a good idea for your business to have credit separate from your personal credit. First is protection. If your business goes south, it will not directly affect your personal credit. You can still buy a home and a car other things you need to based on your personal credit.

There are a few reasons why it’s a good idea for your business to have credit separate from your personal credit. First is protection. If your business goes south, it will not directly affect your personal credit. You can still buy a home and a car other things you need to based on your personal credit.

Also, business credit almost always has higher limits. If you try to finance a business on personal credit cards, you will likely stay at or even go over the credit limits on your cards. This will affect your debt-to-credit ratio in a bad way. That, in turn, will negatively impact your personal credit.

We’ve established why you should not pay anyone to have your on-time payments reported. While no company has to do that, there are plenty that will, and they do it for free. Here are some other things you should never pay for.

The thing is, business credit doesn’t just happen in the same way that personal credit does. It has to be intentional, and there is a process to make it all come together. It is a complicated web, and before you can understand why certain things are worth paying for, you have to understand little about what it takes to build business credit and make it all work.

Your business needs to be set up in just the right way to be fundable. I like to call this the foundation of fundability. If you do not have a fundable foundation, payments may be reported, but there will be no record of your business with the business credit reporting agencies so they will not know how to apply it. Here is what it takes to have a fundable foundation.

The first step in setting up a foundation of fundability is to ensure your business has its own phone number, fax number, and address. That doesn’t mean you have to get a separate phone line, or even a separate location. In fact, you can still run your business from your home or on your computer if you want. You don’t even have to have a fax machine.

Actually, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can just use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service. That is, if anyone ever happens to actually fax you. This part seems outdated. However, it does help your business appear legitimate to credit providers.

You can use a virtual office for a business address unless like Supply Works, the credit issuer does not accept a virtual address. Many do accept them though. How do you get a virtual office? It’s not what you may think. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer space for face to face meetings.

The next thing you need to do is get an EIN. It’s an identifying number for your business that works like your SSN works for you personally. You can get one for free from the IRS.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Incorporating your business as an LLC, S-corp, or corporation is not negotiable. It lends credibility to your business as one that is legitimate, and also offers some protection from liability.

Which option you choose does not matter as much for getting a net 30 account with companies that help build business credit. What it does matter for is your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional. Fair warning, you’ll lose the time in business that you already have once you incorporate. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated before you incorporate.

For this reason, you have to incorporate as soon as possible. Not only is it necessary for fundability and for building business credit, but so is time in business. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Yu probably noticed that most of the companies above require one. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

I am sure you are wondering how a business website can affect your ability to get funding. These days, you don’t exist if you do not have a website. Yet, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Also, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

Here’s another reason why a website is important. Elsewhere on our blog, there is actually a comment about a company asking for a website to help make the decision to extend, or not extend, net30 terms.

You’ll notice many of these things are listed in the requirements of our list of companies that help build business credit. These are all things that you need for a variety of reasons, including to make your business more fundable.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

This is just the start. There are so many other factors that affect the fundability of your business and business credit that it can be completely overwhelming. This is why it can be very profitable in the long-term to pay a company to help you through the process. Most of the time they do not actually complete the steps for you, but they can help you get where you need to be and tell you what to do once you get there.

This is crucial. You don’t waste time with companies that don’t report, and you know what is reported is showing up in the right place. There is so much more though.

The lending world is changing fast since COVID-19 hit. Lending has been cut drastically, and more changes are happening everyday. Having someone who knows how to navigate the system and both current and future changes is priceless.

All of the things mentioned above are necessary, and many of them have to happen in the right order. If something gets out of whack, it can take even more time and money to fix it. Paying someone to help you get it right the first time, or help untangle a mess that is already there, is well worth it.

It’s more difficult than a simple Google search. You need to know which accounts will report that you are actually eligible for. Otherwise, you will spend a lot of time applying for accounts that you either cannot get, or that you can get but do not report.

A lot of companies will just give you a list of lenders with products they hope you qualify for. You have to fill out the applications on your own. Why would you pay for that? What’s worth paying for is a company that has a list of lenders for whom they know the underwriting requreiments. Then, as you work through the credit building program, they cross-reference so they know exactly where you pre-qualify and fill out the applcaitons for those lenders for you! Now that’s worth paying for!

Fundability doesn’t stop with how your business is set up. In fact, the overall fundablity of your business actually begins before you ever have a business. This is because a lot of personal stuff can affect your ability to get funding. That’s true even if you have separate business credit.

Building business credit doesn’t just happen. Unlike consumer credit, you have to intentionally work to start and build it. Having a partner come alongside you and show what to do at each step is priceless.

Lenders are buckling down and there are more automatic denials than ever before. You are more likely to get an automatic denial rather than an automatic approval. Having someone familiar with the system, an insider if you will, can help tremendously.

Unlike consumer credit reports, there is no way to know what your business credit report says about you or what your score is without paying. You can pay the credit reporting agencies directly, but it works much better to pay a monitoring service that can help you keep up with your business credit on an ongoing basis. We can help you monitor your credit at Experian and Dun & Bradstreet for less than it would cost you at those business CRAs.

The bottom line is, paying companies that help build business credit can be useful. They have more time, knowledge, and experience. It can save you a lot of time and money in the long run, if you know and understand exactly what it is you are paying them to do.

As you can see, it takes a little more work than just getting accounts reporting to build business credit. Your business has to be set up properly for the reporting to matter. Then, you have to keep a close eye on your business credit reports to ensure things are progressing.

It’s not a complicated process, but it takes time. The best thing to do is to set your business up to be fundable before you ever get started. Then, you should meet most of the requirements related licensure, business bank account, business address, and website. It can be extremely helpful to have guidance and help as you go through the process. Let us help you build business credit. Find out how.

The post Companies That Help Build Business Credit: What Should You Pay For, And What Should be Free appeared first on Credit Suite.

SEEKING WORK, worldwide. Full Stack Developer here (Development & Design) providing iOS/Android apps, Websites, Mobile/Web Games and more @ davidmott.com Hi HN! I am currently open for projects. I’m seeking for long-term projects and I’m also at present offering a 20% discount to those comfortable in me adding their finished product to my public portfolio … Continue reading New comment by davidmott in "Ask HN: Freelancer? Seeking Freelancer? (December 2019)"

What to Look for in a Financial Advisor

Proficient monetary consultants do not have a certain appearance concerning them, also if they assert to have evidence of their capacity. To shield on your own, it is very important to ask the type of inquiries that will certainly suggest whether the possible expert has the requisite degree of ability to manage your economic events, or whether you must look in other places. If the expert under analysis can actually assist with your economic events, the list below basic inquiries will certainly aid you establish.

Capability and also high quality with consultants comes in the type of a pertinent tertiary education and learning, specialist subscriptions of economic advising teams, and also certifications or more certifications that reveal continuous expert growth. It is likewise essential to ask regarding size of experience in the monetary market, and also in certain exactly how long the person has actually been functioning as an expert.

This inquiry is vital as economic coordinators can bill per hour, job for retainer and also some job on a compensation basis. Each of these settlement networks bring in varying charge degrees, as well as this info will certainly affect your option of monetary expert.

One more superb scale of success and also capacity is testimonies, as well as particularly references. , if the economic coordinator you are taking into consideration can not give recommendations you need to be skeptical concerning any type of cases concerning previous success they might make.. The viewpoints of previous customers are superb signs of the capability of a monetary organizer.

Ask for a strategy. Any type of economic expert worth their cost will gladly describe the extent of their solutions, inform you what info you require to give them, and also deal with you throughout all pertinent locations to create a prepare for you to reach your economic objectives.

Qualified economic consultants do not have a specific appearance regarding them, also if they declare to have evidence of their capacity. To safeguard on your own, it is crucial to ask the kind of concerns that will certainly show whether the prospective expert has the requisite degree of ability to manage your economic events, or whether you must look somewhere else. The list below straightforward concerns will certainly assist you figure out if the consultant under analysis can truly assist with your economic events.

The post What to Look for in a Financial Advisor appeared first on Automation For Your Email Marketing Sales Funnel.

The post What to Look for in a Financial Advisor appeared first on Buy It At A Bargain – Deals And Reviews.

Article URL: https://jobs.lever.co/taplytics

Comments URL: https://news.ycombinator.com/item?id=21026674

Points: 1

# Comments: 0