Web Site Security Rules Explained 2006-2007 has actually been the years that on-line purchasing has actually entered its very own with on the internet customers investing a document $65.1 billion in goods using the internet. A growing number of individuals are obtaining comfy with on the internet buying as well as are taking part in …

Author: John Fleetwood

Coronavirus live updates: Universal Studios extends park closures; US cases top 452,000

COVID-19 has infected more than 1,579,600 people around the world as of Thursday, killing at least 94,500 people. The post Coronavirus live updates: Universal Studios extends park closures; US cases top 452,000 appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND. The post Coronavirus live updates: Universal Studios extends park … Continue reading Coronavirus live updates: Universal Studios extends park closures; US cases top 452,000

How I Drove 231,608 Visitors to My Site Using This New Channel

Just like any marketer, we all fear what we can’t control. And sadly, for years, a lot of our future is being determined by algorithms. From social sites to search engines… they all have algorithms. Heck, you even have to deal with them with things like email. When you send marketing emails, you can bet …

What is Fundability? An In-Depth Look

As a business owner, you may be beginning to hear the word fundability a lot. It may come from lenders, various media platforms, or your own current creditors. What is fundability? Fundability, in the simplest terms, is the ability of your business to get funding. When lenders consider funding your business, does it appear to them to be a good idea to make the loan? What do they look at to make that determination?

What is Fundability and How Does a Business Become Fundable?

Okay, so if you know that fundability is the ability to get funding for your business, what does that actually mean. Furthermore, how does a business become fundable? First, what it means to have the ability to get funding is this. When a lender considers lending to your business, do they feel that you are high risk? Do you appear to be a business that can and will pay back the debt? Lenders are in it for the money, and they need to feel they will get a return on their investment. A high credit risk is not a wise lending choice.

The question of what is fundability is fairly easy to answer. The harder question is how does a business get fundability? Put another way, how does a business become fundable? What makes this answer more complicated is that there is so much the answer must encompass. Sure, a great business credit score is important. In addition, many of the aspects necessary for a strong business credit score are necessary for fundability as well. There are many more layers to peel back however.

A potential creditor needs to see that your business is legitimate and profitable. Many loan applications are denied approval due to fraud concerns. Others, simply because something didn’t match up and threw up a red flag. Maybe the addresses or phone numbers didn’t match on a couple of reports and it just looks unprofessional.

Keep your business protected with our professional business credit monitoring.

If you understand what fundability is and how to get it, you can shut down any such red flags before they cause you problems.

What Is Fundability? The Foundation of Fundability

The foundation of fundability is in how your business is set up. It has to be set up to appear to be a fundable entity separate from you, the owner. How do you accomplish this? Well, like any foundation, it is best to start at the beginning. It will be faster and easier if you do. However, if your business is already up and running, then you may not have that option. That’s okay, it’s never too late to start, but start now. For several reasons, the longer you wait the harder it will be.

Contact Information

The first step in setting up a foundation of fundability is to ensure your business has its own phone number, fax number, and address. Now don’t panic. That doesn’t mean you have to get a separate phone line, or even a separate location. You can still run your business from your home or on your computer if that is what you want. You do not even have to have a fax machine.

In fact, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This part may seem outdated, but it does help your business appear legitimate to lenders.

You can use a virtual office for a business address. How do you get a virtual office? What is that? It’s not what you may think. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

EIN

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners used their SSN for their business. This is what a lot of sole proprietorships and partnerships do. However, it really doesn’t look professional to lenders, and it can cause your personal and business credit to get all mixed up. When you are looking to increase fundability, you need to apply for and use an EIN. You can get one for free from the IRS.

Incorporate

This is the most important step in fundability thus far. Incorporating your business as an LLC, S-corp, or corporation is necessary to fundability. It lends credence to your business as one that is legitimate. It also offers some protection from liability.

Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional. What is going to happen is that you are going to lose the time in business that you have. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated as well.

This is why you have to incorporate as soon as possible. Not only is it necessary for fundability and for building business credit, but so is time in business. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit cards payments. Studies show consumers tend to spend more when they can pay by credit card.

Licenses

What is fundability? Among other things, it is being a legitimate business. For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Keep your business protected with our professional business credit monitoring.

Website

I am sure you are wondering how a business website can affect you ability to get funding. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

What is Fundability? Business Credit Reports

The next step in answering the question of what is fundability is to consider your business credit report. What is that you ask? That is the credit report, much like your consumer credit report, that details the credit history of your business. It is a tool to help lenders determine how credit worthy your business is.

Where do business credit reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

Other Business Data Agencies

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

Identification Numbers

In addition to the EIN, there are identifying numbers that go along with your business credit reports. When considering what is fundability, you need to be aware that these numbers exists. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

What is Fundability: Business Credit History

This is where the rubber meets the road when it comes to credit reports. Your credit history has everything to do with everything related to your credit score, which is a huge factor in the fundability of your business.

Your credit history consists of a number of things including:

- How many accounts are reporting payments?

- How long have you had each account?

- What type of accounts are they?

- How much credit are you using on each account versus how much is available?

- Are you making your payments on these accounts consistently on-time?

The more accounts you have reporting on-time payments, the stronger your credit score will be.

Business Information

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks.

This is a problem because a ton of loan applications are turned down each year due to fraud concerns simply because things do not match up. Maybe your business licenses have your personal address but now you have a business address. You have to change it. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

The key to this piece of the business fundability is to monitor your reports frequently. When it comes to business credit reports, you can monitor through the reporting agencies directly, or save money by going here.

What is Fundability? Financial Statements

This encompasses a broad spectrum of things. First, there is the obvious. Both your personal and business tax returns need to be in order. Not only that, but you need to be paying your taxes, both business and personal. However, there is yet another layer.

Business Financials

It is best to have an accounting professional prepare regular financial statements for your business. Having an accountant’s name on financial statements lends credence to the legitimacy of your business. If you cannot afford this monthly or quarterly, at least have professional statements prepared annually. Then, they are at the ready whenever you need to apply for a loan.

Personal Financials

Often tax returns for the previous three years will suffice. Get a tax professional to prepare them. This is the bare minimum you will need. Other information lenders may ask for include check stubs and bank statements, among other things.

Bureaus

There are several other agencies that hold information related to your personal finances that you need to know about. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. It really can affect business fundability and almost all traditional lenders will look at personal credit in addition to business credit.

In addition to FICO reporting personal credit, you have ChexSystems. In the simplest terms, this keeps up with bad check activity and makes a difference when it comes to your bank score. If you have too many bad checks, you will not be able to open a bank account. That will cause serious fundability issues.

For this point, everything comes into play. Have you ever been convicted of a crime? Do you have a bankruptcy or short sell on your record? How about liens or UCC filings? All of this can and will play into the fundability of your business.

Keep your business protected with our professional business credit monitoring.

Personal Credit History

Your personal credit score from Experian, Equifax, and Transunion all make a difference. You have to have your personal credit in order because it will definitely affect the fundability of your business. If it isn’t great right now, get to work on it. The number one way to get a strong personal credit score or improve a week one is to make payments consistently on time.

Also, make sure you monitor your personal credit regularly to ensure mistakes are corrected and that there are no fraudulent accounts being reported.

What is Fundability: the Application Process

So much plays into this that you may not even think about. First, consider the timing of the application. Is your business currently fundable? If not, do some work first to increase fundability. Next, ensure that your business name, business address, and ownership status are all verifiable. Lenders will check into it. Lastly, make sure you choose the right lending product for your business and your needs. Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference.

What is Fundability? It’s Everything!

The quick answer to what is fundability is simple. However, when you dig a little deeper there are so many layers that crisscross it can take some time to unravel.It’s more like a ball of yarn than an onion really. Everything is connected, everything matters, and one kink in the wires can mess up a lot of stuff. Now is the time to take a closer look at the fundability of your business do whatever you can to increase it.

The post What is Fundability? An In-Depth Look appeared first on Credit Suite.

The Real Secret to My Social Media Success

The other day I was recording a podcast episode with my

co-host Eric Siu and he wanted to discuss something in particular.

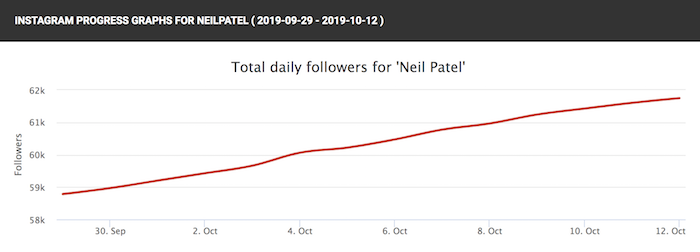

He wanted to talk about how I got to 62,000 Instagram followers in a very short period of time and without spending any money on ads or marketing.

Eric is a great marketer as well, and when it comes to

social media, he spends much more time than me on it and he even has people at

his ad agency dedicated to helping him grow his personal brand online.

And of writing this post, he has 4,056 followers.

It’s not just with Instagram either, I beat him on all

platforms.

Heck, he even does something that I don’t do, which is smart… he continually pays for advice. For example, he had his team jump on an hour call with Gary Vaynerchuk’s social media team so they could learn from them and grow his brand faster.

So, what’s the secret to my success?

Well, before I get into it, let me first start off by saying I love Eric to death and the point of this post isn’t to pick on him or talk crap… more so, I have a point to make and you’ll see it in a bit below.

Is it the fundamentals?

Everyone talks about strategies to grow your social following… from going live and posting frequently or talking about the type of content you should post and what you shouldn’t do.

I could even tell you that you need to respond to every comment and build up a relationship with your followers, which will help you grow your following and brand.

And although all of this is true, I dare you to try the fundamentals or the strategies that every marketing guru talks about doing. If you do, I bet this will happen…

It will be a lot of work and, if you are lucky, in the next 30 days you may get 10% more followers.

Sure, some of you will get much more growth, but you’ll find

that you can’t always replicate it and it won’t be consistent.

So, what is it then?

Is it luck?

Luck is part of some people’s success, but not most. The problem with luck is it doesn’t teach you much and it isn’t easy to replicate.

The reality is, some people will just get lucky and have tons of traction.

In other words, luck isn’t the secret. But if you do want to get “luckier”, then you can always become an early adopter which helps a bit.

How early is early?

When you jump onto a social network when it’s new, it’s

easier to grow and become popular.

For example, I got to over 30,000 Twitter followers

extremely fast when Twitter first came out.

At that time, I wasn’t as well known… it happened because of

a few reasons:

- Social algorithms are favorable early on – algorithms are typically favorable and most people will see your content. There aren’t many restrictions, hence it’s easier to grow. After a social network becomes popular, algorithms tighten up.

- Algorithms are easier to game early on – when you are early, you can use a lot of hacks to grow faster. For example, on Twitter, I would just follow tons of people a day and unfollow anyone who didn’t follow me back.

- First movers’ advantage – social networks want more users, that’s what they need to succeed. In the early stages of any platform, they want to help you gain more of a following so you will keep using their platform.

But here is the thing: even though being an early adopter helps, it’s not the secret to my success.

Just look at Instagram, I am really late to the game. But I started growing fast just this year as that is when we really started.

If you can get in early, you should do so, assuming you have

the time to invest. For example, this is the time to get in on Tiktok.

When you get in early, there is always the chance that the social network may end up flopping. But if it does take off, you’ll be ahead of your competition.

So what did I do?

Here was the secret to my growth… and it still works today. Eric Siu is even doing it with me right now.

It’s piggybacking on brands that are already popular.

When I first started, no one knew who I was. And I’m not saying everyone knows who I am today… by no means do I have a large brand like Tony Robbins.

What I did early on in my career was piggyback off of other popular brands.

For example, I hit up Pete Cashmore from Mashable, Michael Arrington from TechCrunch, Adrianna Huffington from Huffington Post, and so many other popular sites like ReadWriteWeb, Business Insider, Gawker Media, and GigaOm to name just a few.

I know some of them don’t exist anymore, but back then they were extremely popular. Anyone who was in tech, and even some who weren’t, knew about each of those sites.

So, when I got started as a marketer, I hit up all of those sites and offered all of them free marketing in exchange for promoting my brand and adding “Marketing done by Neil Patel” or “Marketing done by Pronet”, which was my ad agency back then.

Just look at the image above. TechCrunch used to link to my site on every page of their site… forget rich anchor text, it really is all about branding.

The hardest part is, I had to email and message these

influencers dozens of times just to convince them to let me help them for free.

And a lot of them ignored me or didn’t accept my offer.

But of a few said yes.

Pete from Mashable was one of the first to say yes. Once his traffic and rankings skyrocketed, his competition hit me up. Especially TechCrunch.

What was funny, though, is that I was constantly emailing TechCrunch and didn’t hear back. 6 months from my first email, they eventually accepted my offer.

I made a deal with Michael Arrington at the time in which once I boosted his traffic, he would add a logo that I did marketing for him, which you saw above.

In addition to that, he would tell all of his venture capital friends what I did for him and share the results (so hopefully they would share it with their portfolio companies, which would help me make money) and write a blog post about me.

He didn’t end up writing the blog post, which is fine, but he

did the other two.

When he sent out emails to VCs showing a Google Analytics graph of his traffic growing at a rapid pace, I quickly got inundated with inquiries about my marketing services.

In addition to that, I was building up my brand… and my

social media following. I was gaining “social clout” because I was doing good

work for influencers.

One could argue that boosting traffic for someone like TechCrunch by 30% is worth millions and I should have charged for my services. Although I spent countless time doing free work, I wouldn’t trade it for any single dollar as it is what made me and helped build up my reputation.

And I didn’t stop there. Even today, I try to associate myself with other popular brands. Just like how I was lucky enough to work with Robert Herjavec, who has a popular TV show in the US along with Mark Cuban…

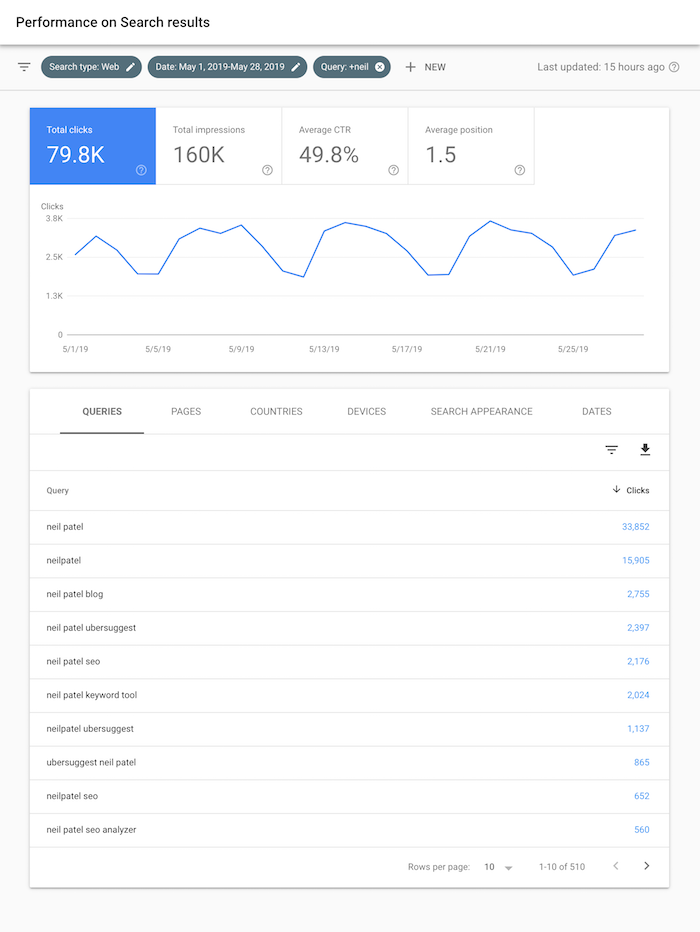

Here’s how many visitors I was getting for my name “Neil Patel” on a monthly basis before I started working with Robert.

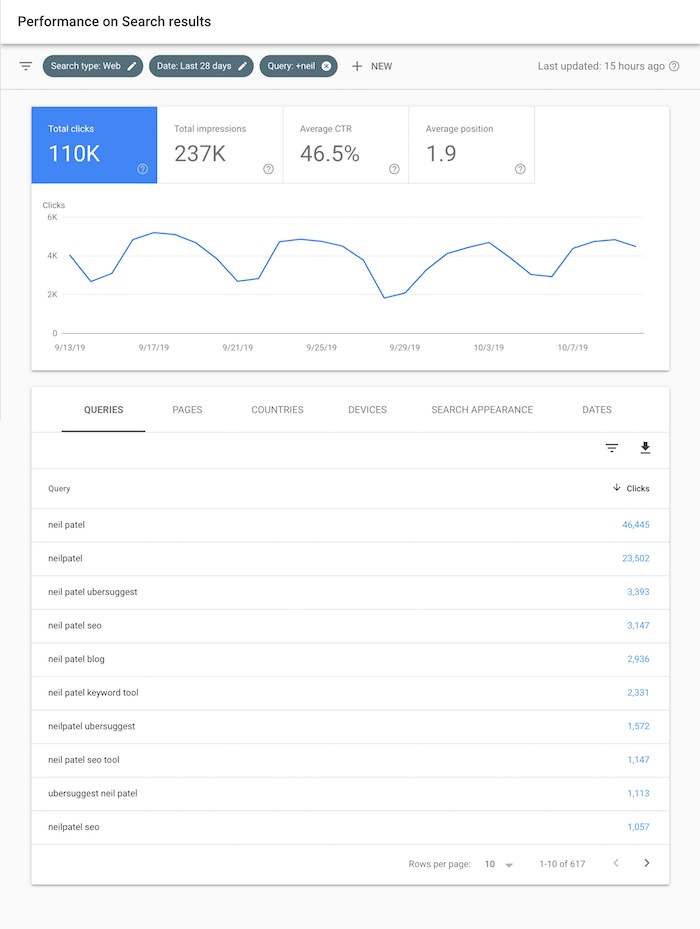

And this is how many visitors I get for my name on a monthly

basis a few months after I worked with Robert.

That’s a 37.84% increase in a matter of months!

By piggybacking off of popular brands, it doesn’t just help my website traffic but also helps to grow my social media following as well.

Just like as you can see below with my Instagram growth…

Now it isn’t just me who can do this, anyone can.

How can you piggyback off of other brands?

Just like how I piggybacked off of brands like TechCrunch, Eric is doing something similar to me at the moment.

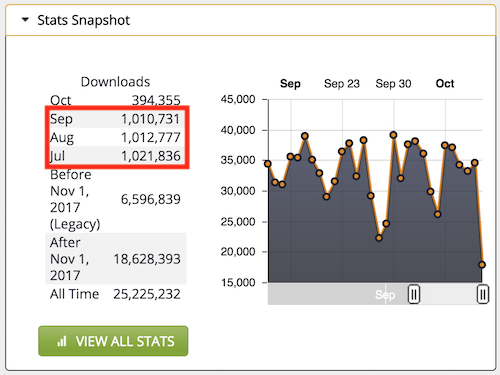

We have a podcast that generates over 1 million downloads a month.

Eric’s had a podcast for years, but the one he has with me has more than 10x the listeners. This has helped him grow his brand a lot over the last year.

Let’s just look at the data. According to Eric, due to the podcast, he has signed up 6 clients, which has generated 540,000 dollars in annual revenue.

Now when he goes to tech conferences, 3 to 4 people tend to come up to him and mention how they love Marketing School and his work. In addition to that, it has been easier for Eric to set up meetings (people respond back to him more now), and he is also getting advisory shares in companies due to his growing brand. And the best part is, he is getting more paid speaking gigs for up to $10,000 a pop because of the podcast.

The data shows it was a good move by Eric for partnering up with me. He pushed me to do a podcast years ago and I told him no because I was too lazy. He didn’t give up though. Eventually, he got me to say yes and flew to my house in Las Vegas to record our first episode.

He did all of the work and it has been a great mutual relationship as doing this podcast has also helped grow my brand at the same time.

Now you are probably thinking, why isn’t his follower count growing fast enough?

Well, he needs to do what he is doing with me with a few more influencers to really put fuel to the fire. Just like how I didn’t only piggyback off of TechCrunch… at one point the Gawker Media network was linking to me on every page of their sites, which was seen by over 100 million unique people per month.

That really gets your brand out there!

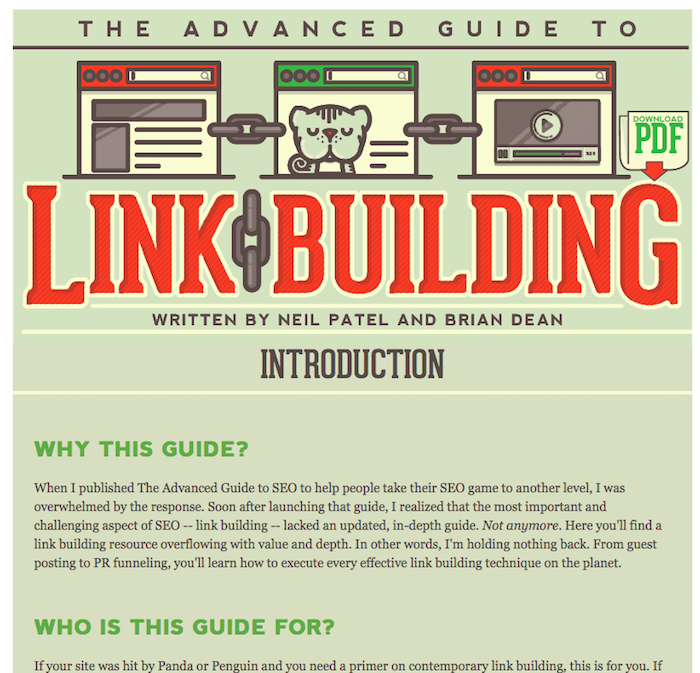

Another example is Brian Dean from Backlinko as he did something similar with me back in the day. Years ago I approached him to write a detailed guide on link building with him and he also created videos that were on my old marketing blog Quick Sprout, which helped him grow his brand.

I can’t take credit for “making” Eric or Brian successful. They would have done well without me… and in the grand scheme of things, I really didn’t do much for either of them.

It’s like saying TechCrunch made the Neil Patel brand. Of course, it helped, and helped a lot… but one partnership won’t make or break you.

And if I didn’t continually blog, create videos, speak at events, or do any of the other stuff that I did, the TechCrunch partnership wouldn’t have been as effective.

Eric and Brian would have grown their brand in other ways because their work stands for itself, hence they would have been successful on their own. I just helped provide a little boost, just like how TechCrunch provided me with a boost.

And once more people get to know you, you’ll naturally do

better on the social web.

For example, when Will Smith created his Instagram account, he didn’t have to buy ads or anything. Everyone just knows him already and that’s why his Instagram account blew up really quickly.

And you can do what Will Smith did on a smaller scale. Similar to what I did.

But don’t expect it overnight. Will Smith has been on television for over 20 years. It’s multiple shows, movies, and connections with other famous people that have really helped grow Will’s brand.

Of course, we won’t get on TV as Will has, but you can piggyback on other popular brands multiple times to create a similar (smaller) effect.

All you have to do is help these influencers out for free.

If you are a web designer, offer design services. If you are

a marketer, offer marketing services. If you are selling a product or service,

keep giving it away for free and maybe someone will talk about your company.

If you don’t have anything you can offer that has value, just look at whatever influencer you want to associate with, see where they may need help, learn that skill, and offer it for free.

It’s the easiest way to become popular on the social web.

Conclusion

That’s my secret to being popular on the social web.

It’s also how I built a decent size company… purely by

leveraging other popular brands in the early days.

You can do the same, but you have to be patient. Don’t expect it to happen overnight.

For example, Eric’s brand has been growing but we have been

doing a podcast together for over 2 years now.

Plus, he continually pushes on his own and doesn’t just rely

on leveraging other influencers.

Remember, nothing worthwhile happens overnight.

You have to be persistent with your emails, your direct messages, your text messages, and whatever else you can do to get a hold of these influencers. Most will ignore you but it is a numbers game and, eventually, you’ll be able to associate your brand with someone popular, which will grow your brand.

And last but not least: Don’t expect an influencer to make you successful. Sure, multiple influencers are better than one, but that’s not what I meant.

If Brian Dean from Backlinko wasn’t good at link building, creating content, SEO, and educating, he wouldn’t do well… no matter who he associated himself with. The same goes for Eric.

Your skills, your abilities, your product… whatever you are

trying to brand needs to stand on its own.

So, what do you think about my secret? Are you going to

copy it?

The post The Real Secret to My Social Media Success appeared first on Neil Patel.

Check Out 0 APR Business Credit Cards

The Absolute Best 0 APR Business Credit Cards

We took a look at a ton of 0 APR business credit cards, and did the research for you. So here are our top picks.

Per the SBA, company credit card limits are a whopping 10 – 100 times that of personal credit cards!

You can get a lot more funds with small business credit cards. And it also means you can have personal credit cards at stores. So you would now have an additional card at the same retailers for your company.

And you will not need collateral, cash flow, or financials in order to get business credit. 0 APR business credit cards can be yours.

0 APR Business Credit Cards: Advantages

Benefits vary. So, make sure to pick the perk you would prefer from this selection of alternatives.

0 APR Business Credit Cards – Pay Nothing!

Bank of America® Business Advantage Travel Rewards World Mastercard® Credit Card

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card has no annual fee and comes with a 0% introductory APR on purchases for the initial nine months. Afterwards, the card has a 13.24 – 23.24% variable APR

Earn 3 points/dollar spent when you book travel with the Bank of America Travel Center and 1.5 points/dollar on all other purchases. You can earn unlimited points and points never expire.

Details

There is a 25,000-point sign-up bonus when you spend $1,000 within the initial 60 days of opening up the account. Cardholders get travel accident insurance, and lost luggage reimbursement.

They also get trip cancellation coverage, trip delay reimbursement and other benefits.

There is no introductory rate for balance transfers. Also, bonus categories are limited.

Get it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Capital One® Quicksilver® Card

Take a look at the Capital One® Quicksilver® Card. It features flat-rate rewards of 1.5% on all purchases. There are no limits how much in cash back rewards that cardholders can attain. Also, the card has a $0 annual fee.

This is one of the better 0 APR business credit cards in terms of the length of its introductory rate period.

Details

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. And then they have a 14.74 – 24.74% (variable) APR after that. A cash bonus of $150 is available for those who make at least $500 on purchases in 3 months of account opening.

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

In addition, there is a cash bonus of $150 is offered to cardholders who make a minimum of $500 on purchases within 3 months of account opening.

The card also offers travel accident insurance. And you can get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And then there’s the higher APR after the initial 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get 0 APR business credit cards and more.

Discover it® Student Cash Back

Also, make sure to have a look at the Discover it® Student Cash Back which has a 0% APR for an introductory six-month period.

It has no yearly fee. And there is an APR of 14.99 – 23.99% variable on all purchases after the introductory period.

One special feature is that it provides an incentive for students to maintain good grades with a $20 statement credit. If students get a GPA of 3.0 or better each academic year, the card will award the $20 statement credit every year for up to five years.

Given its many benefits, this is one of the best 0 APR business credit cards we have found online.

Details

Use the card to build personal credit. While this is a personal card rather than a business card, for new credit users, their FICO scores will be crucial.

And this card offers an excellent way to raise FICO while also getting rewards.

You can get 5% cash back at different places each quarter like grocery stores, filling stations, restaurants or Amazon.com up to the quarterly max. Thereafter, the card offers unlimited 1% cash back on all purchases.

In the very first year, all cash back rewards are matched 100%.

Downsides a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is more. And although they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Ink Business Cash℠ Credit Card

Have a look at the Ink Business Cash ℠ Credit Card. Companies can earn cash back with every purchase. Spend $3,000 in the first three months from account opening. And you’ll earn a $500 bonus cash back.

There is a $0 annual fee with a 0% introductory APR for 12 months on purchases and balance transfers. Afterwards, the APR is a 15.24 – 21.24% variable.

The credit card comes with travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Details

Earn additional cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this credit card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is greater. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

JetBlue Plus Card

Have a look at the JetBlue Plus Card for an additional offer of a 0% introductory APR

Get six points/dollar on JetBlue purchases, two points/dollar at eating establishments and grocery stores. And get one point/dollar on all other purchases.

Details

Spend $1,000 in the initial 90 days and pay the yearly fee, and earn 40,000 bonus points. New cardholders get a 12 month, 0% introductory APR on balance transfers made in 45 days of account opening.

After that, the variable APR on purchases and balance transfers is 17.99%, 21.99% or 26.99%, based on creditworthiness. Benefits include a free first checked bag and 50% savings on in-flight purchases.

There is a $99 annual fee for this card.

Get it here: https://cards.barclaycardus.com/cards/jetblue-card/

SimplyCash Plus Business Credit Card from American Express

Look at the SimplyCash Plus Business Credit Card from American Express. There is a $0 annual fee. And there is a 0% APR on purchases. So this is for the initial 15 months an account is open.

But when the introductory period expires, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

Details

This credit card has various benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, earn 5% cash back at US office supply stores and on wireless telephone services. So, these must be bought from United States service providers. But this applies to the initial $50,000 of yearly spending. Then, you earn 1% cash back.

You also earn 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of annual spending. Then, you get 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this credit card for balance transfers. There is a foreign transaction fee of 2.7%. The card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it kicks in if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Reliable Low APR/Balance Transfers Business Credit Cards

Discover it® Cash Back

Take a look at the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based on the Prime Rate.

Details

You can get 5% cash back at different places each quarter. So, these are establishments like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. In addition, automatically get unlimited 1% cash back on all other purchases.

You will earn an unlimited dollar-for-dollar match of all the cash back you have earned at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Extraordinary Business Credit Cards with No Annual Fee

Uber Visa Card

Check out the Uber Visa Card. Uber is the first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card provides 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, earn 3% back on hotel, airfare and vacation home rentals. And earn 2% back on online purchases.

So, this includes retailers and subscription services like Uber and Netflix. And earn 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly within the app.

By spending a minimum of $500 in the first 90 days, users can earn a $100 sign-up bonus. Cardholders spending at least $5,000 annually are eligible to receive a $50 credit toward online subscription services.

Details

If you pay your cell phone bill with this card, you are insured up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to specific events and offers. Uber expects the majority of these offers to be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits in the Uber app, accumulate a minimum of 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day.

Get it here: https://www.uber.com/c/uber-credit-card/

Costco Anywhere Visa® Business Card by Citi

Not taking Uber? Then you’ll need to fill your gas tank someway. Why not do so with the Costco Anywhere Visa® Business Card by Citi?

This card earns cash back with every purchase. Earn 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Earn 3% cash back at restaurants and on eligible travel purchases. Also, get 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Keep in mind: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus available with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get 0 APR business credit cards and more.

United MileagePlus Explorer Business Card

Get a good look at the United MileagePlus Explorer Business Card.

Earn 2 miles/dollar with United and at restaurants, gas stations and office supply stores. All other purchases earn 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the initial three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Details

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. Additionally, get early check-in and late checkout. And get an auto rental collision damage waiver.

And also, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get 0 APR business credit cards and more.

The Best 0 APR Business Credit Cards for You

Your outright best 0 APR business credit cards hinge on your credit history and scores.

Only you can choose which features you want and need. So make sure to do your homework. What is excellent for you could be disastrous for somebody else.

And, as always, be sure to build credit in the recommended order for the best, quickest benefits.

The post Check Out 0 APR Business Credit Cards appeared first on Credit Suite.

Zeus (YC S11) Is Hiring a VP of Engineering

Article URL: https://jobs.lever.co/zeus/51cba707-0bc1-43a9-aff8-2f4e0e03538a

Comments URL: https://news.ycombinator.com/item?id=20620642

Points: 1

# Comments: 0

The post Zeus (YC S11) Is Hiring a VP of Engineering appeared first on Get Funding For Your Business And Ventures.

The post Zeus (YC S11) Is Hiring a VP of Engineering appeared first on Buy It At A Bargain – Deals And Reviews.