QuantAQ | Somerville, MA, USA | Full Time | ONSITE | IoT / Electrical Engineer https://jobs.ashbyhq.com/quant-aq QuantAQ builds IoT Air Quality sensors and associated cloud platform to run large networks of distributed sensors to generate actionable air quality data. We sell mostly to governments and industry (Mining, construction, transportation, etc). We spun out of a … Continue reading New comment by dhhagan in "Ask HN: Who is hiring? (March 2023)"

Author: Lindsey Jenkins

Massive 21-car pileup in Montana leaves at least 6 dead: 'Mass casualty crash'

Severe winds and low visibility caused by a storm are believed to be the cause behind a 21-vehicle crash in Montana, killing at least six people.

Kamala Harris has become a 'glorified content moderator' for Twitter: Glenn Greenwald

Glenn Greenwald told “The Ingraham Angle” that Biden’s disinfo board is part of the sustained and systemic attempt on the part of the U.S. government and the Democratic Party to create regimes of censorship.

Aaronson latest on USMNT ruled out for qualifiers

Brenden Aaronson will miss the United States’ final three World Cup qualifiers after injuring a knee during pregame warmups with FC Salzburg.

The post Aaronson latest on USMNT ruled out for qualifiers appeared first on Buy It At A Bargain – Deals And Reviews.

New comment by julianbell in "Ask HN: Who is hiring? (February 2022)"

Hi HN! We’re the UPS Advanced Technology Group, a small, nimble, hands-on advanced R&D team within UPS. We’re building out a ML-centric hardware and software technology suite to solve a critical UPS operational challenge on a short time-frame, and are hiring for a number of positions across robotics, MLOps and ME. Open positions: – Research … Continue reading New comment by julianbell in "Ask HN: Who is hiring? (February 2022)"

Generally Intelligent Is Hiring Machine Learning Research Engineers (Remote, SF)

Generally Intelligent is an AI research company. Our mission is to build human-like general intelligence and make it safely accessible in order to foster a more abundant, unconstrained, and equitable society. We take a first-principles approach, starting from simple self-supervised architectures and evolving them to tackle human developmental milestones of increasing complexity.

If you’re remote, see the Machine Learning Engineer role: https://generally-intelligent.breezy.hr/p/37984490dd0f-machi…

If you want to be onsite in SF, see the Machine Learning Research Engineer role: https://generally-intelligent.breezy.hr/p/ed6849c074fb-machi…

Our YC jobs page is here: https://www.ycombinator.com/companies/generally-intelligent

Comments URL: https://news.ycombinator.com/item?id=28657485

Points: 1

# Comments: 0

Advantages of Working from Home Running a Business

Everyone knows there are advantages of working from home. In the post COVID-19 pandemic world, the disadvantages have become clear as well. However, working from home and running a business from home are two very different things. Do the Advantages of Working from Home Apply When Running a Business? The short answer to this question … Continue reading Advantages of Working from Home Running a Business

How Much Do Twitter Ads Cost?

With an advertising audience of 353 million, Twitter is an ultra-effective free advertising tool. Still, as you probably know, the social networking site also provides plenty of paid advertising opportunities that let you target your followers, automate your bids, and promote your business.

When used properly, these ads enable your brand to gain visibility and attract more followers, click-throughs, and app downloads.

But how much do Twitter ads cost? Are they worth the cost?

You’ll find it hard to find a definitive answer to this. Naturally, the cost of Twitter ads varies for every marketer. They’ll differ depending on the aims, strategies, types of ads you use, and the price you’re willing to pay per bid.

The good news is that Twitter has advertising solutions available for all business sizes and budgets.

I will explain the different Twitter advertising options below. These factors contribute to your Twitter ads costs and finish with the metrics you should track to measure your campaigns’ cost-effectiveness.

Let’s start with the factors that influence the cost of your Twitter ads.

5 Factors That Affect the Cost of Twitter Ads

Several factors contribute to the total costs of your Twitter ads. This includes the type of adverts you’re using, the billable actions, your marketing techniques, your bid amount, and of course, the budget you have available to you.

Let’s look at these elements in more detail, starting with ad type.

1. Ad Type

Twitter offers three different main types of ads: promoted tweets, trends, and accounts.

Promoted ads: if you use Twitter, then you’re likely to have noticed these. Promoted tweets appear in your timeline, and you’ll see them tagged as “promoted.” You can retweet, share, and like promoted tweets the same way you would with regular tweets.

Promoted tweets can increase visibility and engagement. These Twitter ads’ costs will depend on how much you bid, but prices vary from $0.50 to $2 per billable action.

Promoted Trends: at $200,000 a day, promoted trends aren’t for everyone, but if you’re a large corporation with established, engaged followers, these ads could prove worthwhile for you.

Twitter Promoted Trends ads combine video with Twitter’s Explore function and show on Android, iPhone, and TweetDeck, and Twitter displays these ads for 24 hours in its Trends list.

The purpose of these adverts is to spark conversations and reach Twitter’s considerable audience. Specifically, Twitter suggests using them for new launches and promotions to increase awareness.

Promoted Accounts: when you’re on Twitter, you might notice some suggestions of other accounts to follow. Typically, these ads are suitable for users who want to increase their followers or announce a product launch. Promoted accounts cost vary from $2-$4 per follower.

2. Billable Actions

When you advertise on Twitter, the ad costs will also depend on your billable actions. Naturally, every marketer will have different objectives for their campaigns, so the type of billable actions you want Twitter users to take won’t be the same as another marketer or business owner.

For instance, you may want to get more followers, encourage app installs, or get click-throughs to your website, while another business owner might want to focus on video views.

There’s no set rate for these actions. As a business, you decide how much you want to pay through Twitter’s auction model. Once a Twitter user clicks through to your website or installs an app, or takes another billable action, Twitter will charge you.

Billable actions include:

- followers

- installs

- engagements

- video views

- pre-roll views

3. Auction Bids

One of the biggest influences on your Twitter ads cost is the amount you bid. As with any other auction, the highest bidder wins. Even if you’re willing to pay just a cent more than your rival, your ad will get shown.

However, if winning auctions is your goal, don’t overlook one crucial aspect of success with your bids: focus on your ads’ quality, as Twitter will pay attention to this, too. What that basically means is the higher the quality of your ads, the better the engagement, and the lower your costs.

What does Twitter mean by “ad quality?” In Twitter’s own words, it means adverts that are:

- resonant

- relevant

- recent

In other words, make sure your ads are engaging, targeted, and up to date.

4. Bidding Types

You can choose three types of bids on Twitter: maximum, automatic, and target bidding. Each of these types can influence your total Twitter ad costs in different ways.

Maximum Bidding

With maximum bidding, you set your top bid in the same way you would for any other online auction. You won’t need to spend your maximum amount on every bid, just enough to win against your nearest competitor.

Automatic Bidding

Automatic bidding is Twitter’s default option. You decide your budget, and Twitter will make the bid for you. There’s just something to consider with automated bidding, though. Although it might seem a good idea to leave it all to Twitter, you’ll spend through your budget pretty fast this way.

Target Bidding

Target bidding allows you to select your target cost-per-link, but it’s not for every ad campaign. Twitter limits its target bidding for website visits and followers.

When you use target bidding, you’ll base your campaign around what you want to achieve. For example, if you’re a new business, you might choose to get clicks through to your website.

You’ll select the price you want to pay for your target bidding when you’re starting your campaign on Twitter. If you’re looking for guidance, Twitter will show you real-time pricing before you place your bid.

5. Advertising Campaign Types

Twitter gives you six campaign types to choose from. They are:

- followers

- websites clicks and conversions

- tweet Installs

- app installs and re-engagements

- video views

- leads on Twitter

Your Twitter ads cost will depend on which campaign you select and what you hope to achieve from your advertising. For a more precise idea, Strike Social gives an excellent example of what this could look like in practice:

- website visits campaign: $1.68–$10

- followers campaigns: $2.50–$3.50

- tweet engagements campaigns: $1.50–$2.50

- app installs or re-engagement campaigns: $1.95–$3.25.

- awareness campaigns: $6.00–$8.00

Metrics

As with any other advertising campaign, measuring your key metrics lets you understand your ROI. Only then can you work out whether you’re getting fruitful results and growing your business, or whether you need to make some changes.

However, not all metrics are equal when it comes to social media.

The metrics that you’ll want to focus on most are the ones that encourage engagement, increase conversions, and how much this costs you per click. That means concentrating on metrics like your CPCs, CPFs, and CPEs.

According to WebFX, you can expect your main metrics to look something like this:

Click-through Rate

The click-through rate is at the top of the list for many marketers. It lets you measure engagement and see what’s working. According to AdStage, Twitter has an average click-through rate of 0.86.

Engagement Rates

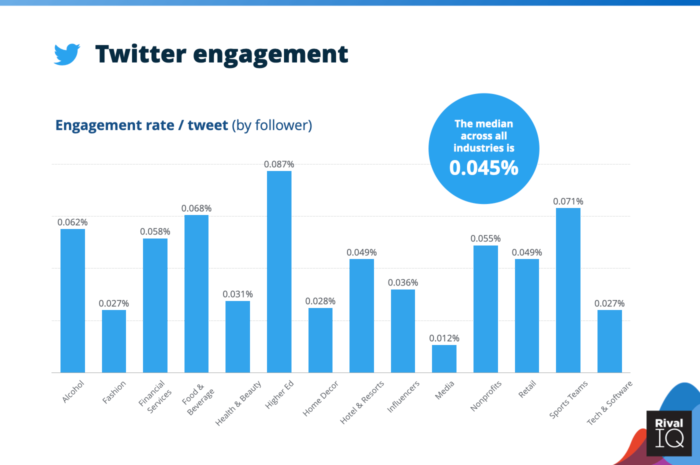

Engagements come in many forms including, comments, retweets, follows, and replies. In case you’re wondering what your engagement rate should be, this depends on your niche, according to recently published research by Rival IQ.

The research shows that higher education leads the way with a 0.087 percent engagement rate. This is followed by:

- 0.071 percent for sport teams

- 0.068 percent for the food and beverage sector

- 0.062 percent for the alcohol industry

There are a few surprises among this data, with tech and media, fashion, and media sectors among the industries with the lowest engagement rates.

Conversion Rate

Your conversion rates show you the return you’re making on ad spend. You can track this through your Twitter account. Just go to ads.twitter.com, login, then:

- Click “Tools” from the drop-down menu at the top of the page.

- Scroll down to “conversion tracking.” If you can’t see this, it might be because you don’t have a credit card on file with Twitter.

- Agree to terms and conditions.

- Select the “Generate a website tag for conversion tracking.”

- Copy the code into your website.

If you’re not sure how to use coding, Twitter talks you through it on its pages.

Twitter Analytics

Twitter has an analytics tool that will show you how your organic and paid-for tweets perform. Keep track of these. If your organic tweets perform better than your paid advertising, you will want to refine your campaigns.

To use Twitter analytics, just go to your Twitter account and click the “turn on analytics” option. This will show your:

- mentions

- new followers

- impressions

- profile visits

Other metrics you’ll want to concentrate on include your:

- Cost per follower. Your CPF needs little explanation: it shows you how much it costs you to gain a new follower.

- CPM is your cost per mile. It measures your rate per 1,000 impressions.

- Cost per download (CPD) or cost per install (CPI) shows you what each install costs. On Twitter, the average per install is $2.53.

- Cost Per Click /Cost Per Action: When you’re paying for billable actions like click-throughs, followers, or app downloads, you’ll want to know how much this costs you on average to manage your budget.

What Should You Spend on Twitter Ads?

There’s no set amount that you should spend on Twitter. The site offers a mix of advertising items at differing prices, and it’s all about considering which is best suited to your business.

However, before you can decide how much to spend on Twitter ads, you’ll need to consider what you’re trying to achieve with your advertising campaign.

For example, a small business trying to promote its craft products might find that promoted tweets are enough to get click-throughs and conversions. In contrast, larger companies building on their existing audience are likely to have a more significant marketing budget and want to take a different approach.

It will also depend on:

Industry: As the stats from Rival IQ shows, some sectors attract more engagement than others, meaning the types of campaigns you run may need to differ depending on what industry you’re in.

Audience: Knowing what you want from a campaign is just one side of the story. Your audience is something else you should consider. If you already have an audience on Twitter, you’ll know the kind of content that engages them and gains you the most conversions.

Budget: How much Twitter ads cost ultimately depends on what you have available in your budget. To best plan your budget, ensure you understand all there is to know about bids, auctions, and billable actions.

Ad score: Twitter combines your bids with your ad quality to come up with your ad score. A superior ad score may reduce how much you pay.

How Much Do Twitter Ads Cost?

Ultimately, the answer is, it varies depending on your goals, strategies used, and the budget available to you. As Twitter explains:

“How much you pay in your campaigns is up to you. By setting up your budget during the campaign setup, you can control your Twitter ads costs.”

With Twitter, you can customize your adverts to suit your individual needs, and there are no minimum costs.

When you’re setting up your adverts, Twitter will ask you to set your total budget and daily maximum. Twitter’s general guidance is to set your budget at a price you’re comfortable with, but even if you don’t have the marketing budget of a multimillion corporation, a little can take you a long way.

Conclusion

Your Twitter ads costs will vary depending on several factors, including the strategy you use, the billable actions, and the type of adverts you choose.

Depending on your brand’s size, not all Twitter’s advertising options are ideal for every business.

A small business with a limited budget isn’t likely to want to spend massive amounts. In contrast, a corporation will have a significant marketing budget at its disposal and be willing to spend much more.

However, with no minimum spend and the ability to target an audience, you may find Twitter ads are a useful tool for gaining visibility and promoting your brand.

Do Twitter Ads work for you? Which strategies do you use?

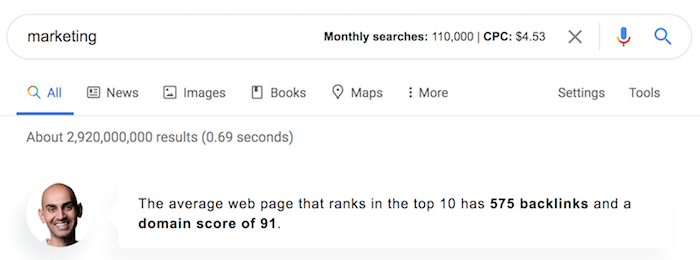

Ubersuggest Chrome Extension: The Ultimate Link Build Tool

Over the next few months, you are going to see a lot of updates in Ubersuggest, including new features.

But before I dive into what I’m going to release soon, let’s first talk about the new Chrome extension.

If you haven’t installed it, make sure you go and do so now…

No more Neil’s face

The biggest complaint we got about the extension was “my face” being in the search results.

You know, that speech bubble that looked something like this…

So, I removed it.

I know you don’t like it based on the reviews, so I tried to leave it in as long as possible because it’s branding.

Indirectly it keeps me and my agency top of mine so hopefully, it would eventually drive business.

Link building

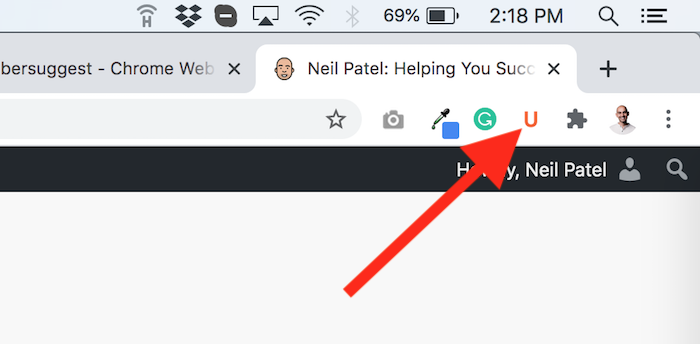

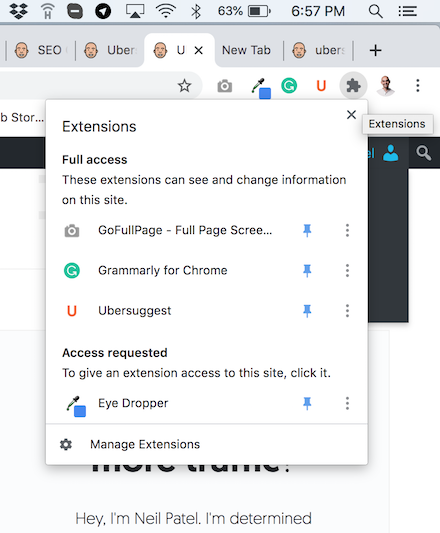

You may have noticed that there is a little “U” symbol within your browser bar once you install the extension.

If you don’t see it, just click on the extension icon…

And then click pin next to Ubersuggest…

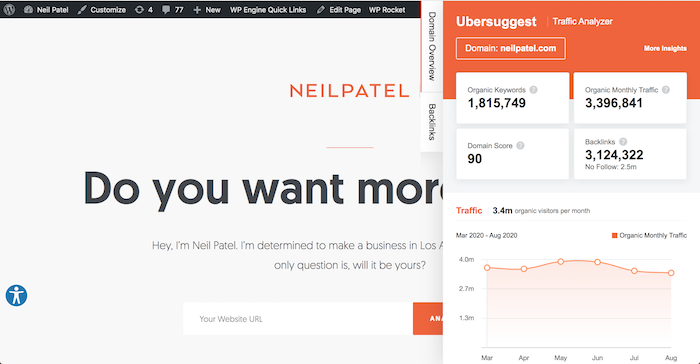

Now whenever you visit a site (other than Google) you can click on the “U” to see data.

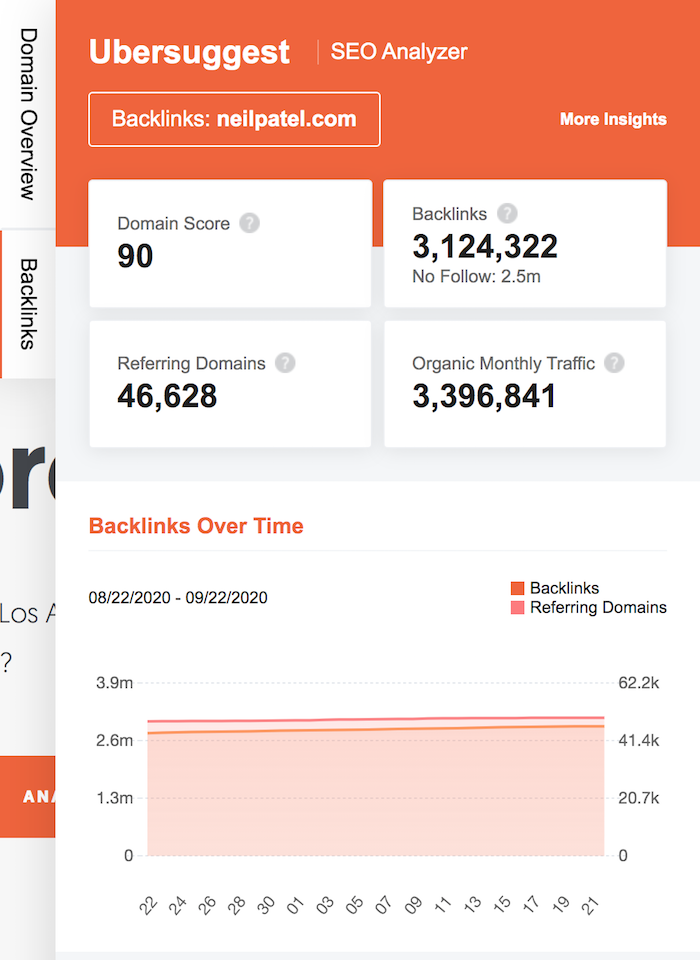

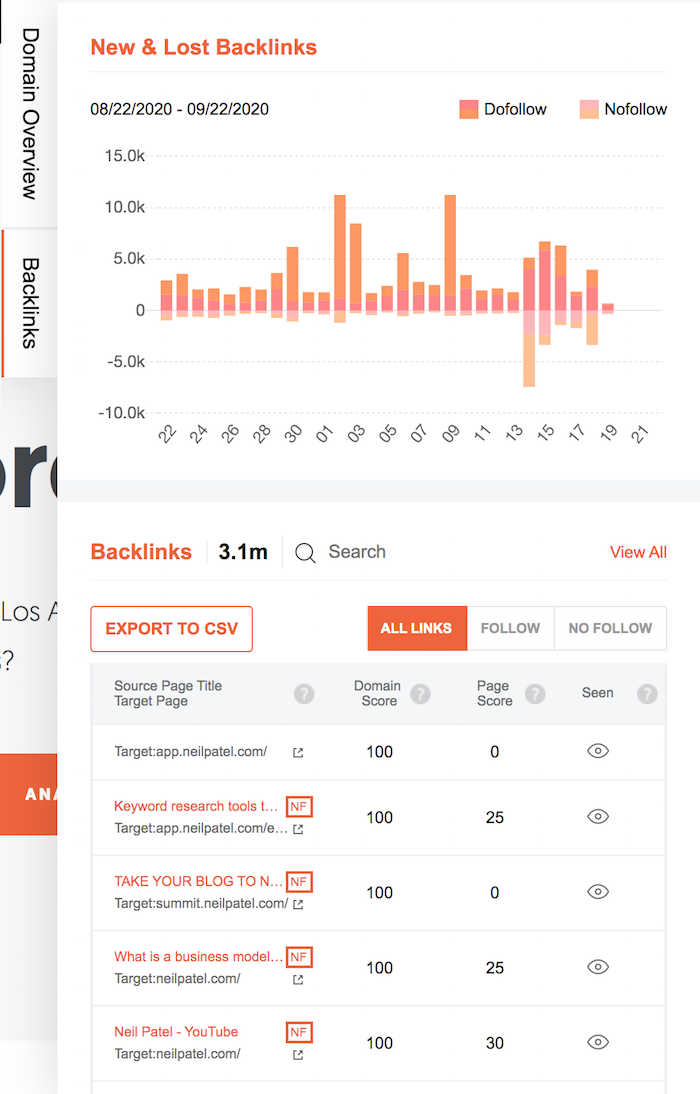

But what’s new is we have added link data. So when you click on “Backlinks” you’ll see link data on any given site.

You can see the domain score (our version of authority), the number of backlinks, referring domains and organic monthly traffic a website receives.

You’ll even see a chart of link growth (or decline) over time.

And as you scroll down you’ll even see more metrics…

The chart above breaks down how many new and lost links you are getting on a daily basis.

And beneath that you’ll see a list of links pointing to any given site. You can then search for a specific link using the search box or you can use the filtering options.

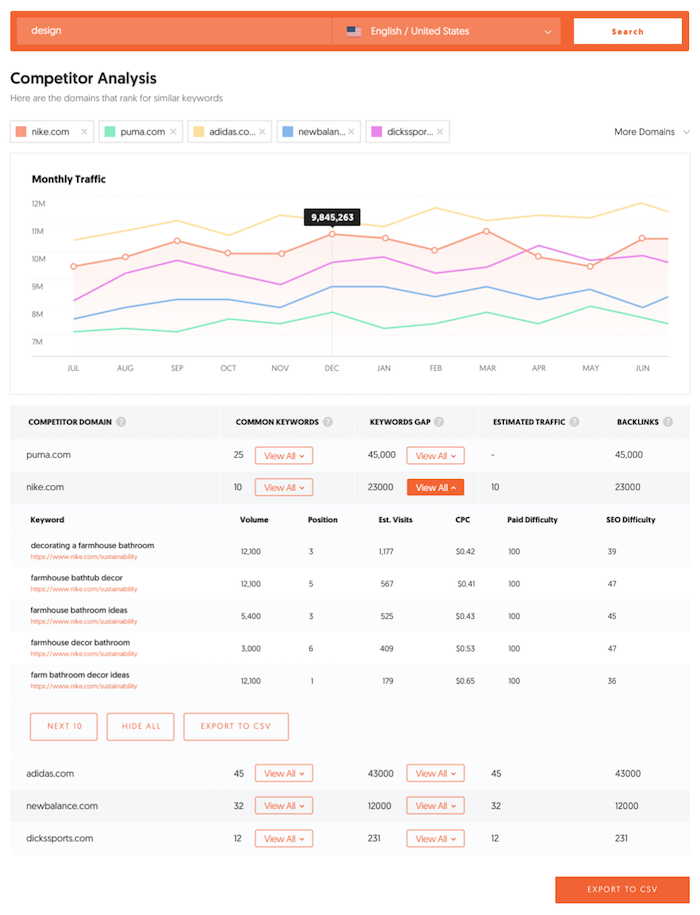

Keyword gaps

I know that I mentioned a while ago that I am releasing a feature that show competitive domains and gives you an overview of the keywords your competition ranks for that you don’t.

That way you can find more opportunities to go after if you want more traffic.

That’s still coming out soon. We are roughly a month or so away from releasing it. 🙂

But that’s not all

The biggest thing my team and I have been working on is data quality.

From fresher link index to even a bigger link index.

Or when you put in a URL it would be great to have even more accurate traffic estimations.

By the end of the year you’ll see drastic improvement in this. It’s our biggest focus.

And then comes a faster application

The last thing on our roadmap this year is speed improvement.

We have so much data in Ubersuggest that sometimes reports take longer to load than you would like.

We have been refactoring our code, which should fix this soon. So now reports will load faster, which is really important if you use Ubersuggest on a mobile device.

Conclusion

I hope you try out the new Ubersuggest extension. It’s easy to use and it offers more free data than any other Chrome extension.

In addition to the link feature, there will also be some other Chrome extension features that we are adding soon, but I have to save something as a surprise. 😉

Plus, there will also be a few other features that you’ll also see in the Ubersuggest app that is coming out this year that I didn’t mention above either.

So, what else would you like to see in Ubersuggest?

The post Ubersuggest Chrome Extension: The Ultimate Link Build Tool appeared first on Neil Patel.

Your Ultimate Get Started Guide to Recession Business Finance

First, with COVID-19 in the picture, you are likely in survival mode. If your business has been affected by the pandemic, you need to sign up for the SBA Paycheck Protection Plan, a Disaster loan, or both. Do it now, because funds are limited and the application process takes time. This will help your business keep going while you figure out the next steps for whatever the future holds for our economy, including recession business finance.

Everything You Need to Know About Recession Business Finance

During a recession, everything changes. There is less spending, less lending, and less cash moving period. Lenders are tighter with what they are willing to dole out, and that leaves many business owners wondering what to do about business funding. It makes recession business finance exceptionally tricky.

Some sources of funding that may work well during the good times are not reasonable to count on for recession business finance purposes. It is important to know what options are available and which ones will work best during harder economic times. Recession business finance can be a bit more difficult to navigate.

There are not as many options for recession business finance as there are for business funding during good economic times. Of the available options, the ones that will work best for you depends on a number of factors. You have to know more about each before you can make an educated decision. It is necessary to know the differences between them, what the qualifications are, and if you even have access to them before you can begin to think about making a decision.

We break it down for you here in our ultimate guide to recession business finance so you can make the best decision possible during the hard times of a recession.

Are Traditional Business Loans an Option for Recession Business Finance?

These are the loans that you go to the bank to get. As a business, your business credit score can help you get some types of funding even if your personal score isn’t awesome. That isn’t necessarily the case with this type of funding.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. That means they will check your personal credit. If it isn’t in order, you will likely not get approval.

What does it mean to have your credit score in order? If you have a personal credit score of at least 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be more inclined to offer a little more flexibility. However, your personal credit score will still weigh heavily on the terms and interest rate.

Of all of the available business funding types, this is the hardest to get. It is usually worth the trouble though if possible, because it often has the best rates and terms.

Term loans are not easy to get, and during a recession, it is even harder. Unless you have stellar personal and business credit with an already established, successful business, this is a long shot when it comes to recession business finance.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

SBA Loans

These are government secured term loans offered through traditional banks. The Small Business Administration, or SBA, works with lenders to offer small businesses funding solutions that they may not be able to get based on their own credit history. Because of the government guarantee, lenders are able to relax a little on the personal credit score requirements.

In fact, it is possible to get an SBA micro-loan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

The trade-off with SBA loans is that the application progress is lengthy. There is a ton of red tape connected with these types of loans.

During a recession however, the government works hard to build the economy. In light of this, SBA loans may still be a viable option.

Business Line of Credit for Recession Business Finance

This is basically the traditional lender’s version of a business credit card. The credit is revolving, meaning you only pay back what you use, just like a credit card. Rates are typically much better that a credit card. The application and approval process, however, is more similar to that of a traditional term loan.

If you need revolving credit and can qualify for a term loan, this is the best option. It is great for bridging cash gaps and covering short term expenses without the high credit card interest rates. If you already have this in place before a recession hits, even better!

There are no cash back rewards or loyalty points though. That makes some business owners prefer business credit cards in some cases, despite higher interest rates.

Since this is basically a revolving traditional loan, it could be as difficult to come by during a recession as a term loan from a traditional lender may be.

When you apply for financing from traditional lenders, they will always ask for certain information. This is regardless of whether you are applying for a line of credit, an SBA loan, or a traditional term loan. You will need to provide, at a minimum:

- A complete, professional business plan if you are a startup

- Complete company financial statements or tax returns for recent years

- A list of owners or officers

- Personal financial information, including bank account balances and credit history

While this list is not exhaustive, it is a good start for what you need to have together before you begin the application process if you plan to pursue this type of recession business finance.

Credit Line Hybrid

A credit line hybrid is basically revolving, unsecured financing. It allows you to fund your business without putting up collateral, and you only pay back what you use.

What are the Qualifications?

How hard is it to qualify? Not as hard as you may think. You do need good personal credit. That is, your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Also, in the past 6 months, you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

If you do not meet all of the requirements, all is not lost. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

What are the Benefits?

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, the funding is “no-doc.” This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

Invoice Factoring

An established business with accounts receivable can look to invoice factoring as a source of recession business finance. This is where the lender buys your outstanding invoices at a premium, and then collects the full amount themselves. You get cash right away, without waiting for your customers to pay the invoices.

For those businesses already up and running enough to have accounts receivable, this can be a viable option during a recession. If your customers cannot pay or are paying slowly due to the economic downturn, you can still get the funds you need to run your business, although not at full value of what you would get if your customer paid you.

The cash comes fast, which is also a bonus. Since the lender collects the funds directly from the customer, this can be a really good recession business finance option.

Because this type of funding is based on receivables, it is still a viable option if your business has them. The only problem is, during a recession, sales could go down. This would reduce the amount of funds you have available to you.

If you accept credit cards, you may be able to get a merchant cash advance. It is similar to invoice factoring, but instead of buying your open invoices, the lender advances cash based on expected credit card sales.

Break with Tradition: Look to Non-Traditional Lenders for Recession Business Finance

These are lenders other than traditional banks and credit unions that offer terms loans. Usually they operate online. Occasionally they will have a brick and mortar location as well. The difference between these and traditional lenders is that the loans have looser approval requirements and a much faster application process. Most often you can simply apply online, get approval in as little as 24 hours, and the funds are in your account within 24 to 48 hours after approval.

They are an option if your personal credit isn’t terrible and you need funding fast. In times of recession, these guys are a go-to source as they specialize in lending to those that may have trouble with traditional lenders.

There has been an explosion of non-traditional lenders onto the scene in recent years. Some are better than others. Be sure to research each one thoroughly. Check them out on the Better Business Bureau website and read online reviews to get a good start.

Grants: The Recession Business Finance Miracle

While there are not a lot of these out there, grants are a super source of recession business finance if you can get one. They are usually offered by professional organizations. There are some government grants available also. Competition can be fierce, but they are definitely worth a shot if you think you may qualify.

Requirements vary from grant to grant and most are only awarded to a certain number of recipients. More opportunities are available if you fall into one of the following categories.

- · Women owned business

- · Minority owned business

- · Businesses run by veterans

- · Businesses in low income areas

There are also some corporations that offer grants in a contest format that do not require much other than that you meet the corporation’s definition of a small business and win the contest.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Interested in a Government Small Business Grant? Start Here

Federal government small business grants run through the Small Business Administration, but they are rarely awarded directly to a business. Instead, they award the grant to local non-profits or governments to disburse to small businesses in their communities. To find these, check with local economic development agencies and governmental entities to find out what available business funding types they have.

Another place to look is the local Small Business Development Center, or SBDC. These offer support to local small businesses and are generally related to a local college, university, or economic development center.

As a general rule, they do not offer grants themselves. They can, however, point you in the right direction. They know where the money is, who qualifies, and how to start the application process. These agencies also offer many other services to small businesses, making them a great resource regardless.

Corporate grants are another great option if you live in an area where they are available. Companies like FedEx and LendingTree have grant contests each year.

Grants are a great possibility at any stage of business. They shouldn’t be counted on too heavily however. Funds are limited and competition is fierce. A backup plan is definitely necessary if you are planning to use the funds for a specific purpose.

Business Credit Cards: Can They Work as Recession Business Finance?

Credit cards as a whole get a bad reputation, but in lieu of another option, they can actually do the trick quite nicely. They are more readily even with a credit score that isn’t awesome, but the lower the credit score the higher the interest rate. Also, there are limits on how low they will go with a credit score.

Credit cards as a whole get a bad reputation, but in lieu of another option, they can actually do the trick quite nicely. They are more readily even with a credit score that isn’t awesome, but the lower the credit score the higher the interest rate. Also, there are limits on how low they will go with a credit score.

However, this is one of the available business funding types that most of the general public are eligible for at any given time. They do a credit check, but your credit doesn’t have to be as high as it would be to gain approval for a traditional loan.

The downside of business credit cards is that they typically have a high interest rate. The upside is that many of them offer rewards in the form of cash or points that can be helpful.

Credit cards are plentiful even during hard economic times. It may be harder to get approval if the recession has hit your credit score hard, but there are ways to fix that.

Apply for business credit cards with your business name and EIN to get them without a personal credit check. If you do not yet have a business credit score, you need to get one. Find more about how to establish and build business credit here.

Best Uses for Each Type of Recession Business Finance

Which type of recession business finance you should use in any given situation depends on many variables. The biggest piece of the puzzles is which types of funding you are eligible to receive. However, there really is more to it than that. Assuming you are eligible for all types of financing, here are some other factors to consider.

Startup During a Recession

In the startup phase, there are a couple of things to think about when determining which funding types might work best.

If you fall into one of those categories that make grants an option, that is the best first stop. Grants are free and clear. That money is yours, without repayment, to use in your business. They typically do not rely on success of the business or the credit worthiness of the owner. The business or proposed business only has to meet the requirements set forth to apply, and then win the grant.

Traditional term loans are a good idea for the startup phase also, if you qualify. The interest rates and terms are generally more favorable than other types of financing for those that meet the credit requirements. They are less of an option during a recession however.

If you do not meet the credit requirements for traditional term loans, then non-traditional lenders are the next best option. They may have higher interest rates, but they do the trick. Plus, they can help build your business credit score if you make your payments on time. That, in turn, makes you more eligible for other types of recession business finance.

While not impossible, it is not usually a good idea to start a business using credit cards if it can be avoided. Of course, invoice factoring is not an option here as you have to already be in business to have the invoices necessary.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Growth During a Recession

There are several different aspects of growth that can benefit from various types of business funding.

Inventory Increase

If you see the potential for higher demand and need to increase inventory to accommodate, a revolving credit line is going to work best.

If already in place, these are instantly available to meet the cash needs that a large inventory purchase creates. They also allow for taking advantage of special pricing when available, which can be huge during a recession.

A business line-of-credit works well due to the lower interest rate, but business credit cards will work in this situation also. In fact, if they have really great rewards attached to them, they could even be the better option. It can’t hurt to have both available if you have that luxury so that you have choices.

If available, grants work well for growth projects during a recession also.

Recession Business Finance for Equipment Purchase and Repair

For large equipment, it is best to use traditional term loans of some sort if possible. This is simply because they are typically longer-term loans for larger amounts. Lower interest rates and favorable repayment terms are key. However, we all know that isn’t always possible. Other types of recession business finance can be used if necessary.

Grants may be an option if there is not a time crunch. If time is of the essence, it is possible to purchase equipment on credit cards, but you could run in to problems with cost versus credit limit.

Recession Time Expansion

Expanding during a recession can be tricky, if not downright risky. However, if you want to add on to your current building or add an additional location, term loan financing is the best option. Whether it needs to come from a traditional or non-traditional lender will depend on your specific situation.

Recession Business Finance for Working Capital

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

Working capital can come from various sources. There are working capital loans available, but lines- of-credit and business credit cards can work in these situations as well. Unless you already have a working capital loan before the need arises, it is likely you are going to need to access business credit cards or some form of non-traditional financing for this.

In a pinch to cover a cash gap, a merchant cash advance or invoice factoring can work well.

Recession Business Finance Can Be a Delicate Dance: The More You Know About Each Option the Better

It doesn’t matter what type of business you own or whether or not you need funding at this moment. If you own a business you need to know what the available business funding types are, which ones you currently qualify for, and how to qualify for those that are not currently available to you.

You also need to know which types of funding work best in various situations. Once you know these things, you can make an informed decision about how to best fund your business during the recession.

The post Your Ultimate Get Started Guide to Recession Business Finance appeared first on Credit Suite.