Former MotoGP world champion Valentino Rossi says rookie Brad Binder’s win at the Czech Grand Prix is proof that KTM are title contenders. The post Rossi: KTM has a genuine shot at 2020 MotoGP title appeared first on Buy It At A Bargain – Deals And Reviews.

Author: Mirella Ballou

Google’s New Algorithm: Page Experience

Don’t worry… your traffic hasn’t gone down (or up) because of the Page Experience algorithm update hasn’t rolled out yet.

But it will in 2021 according to Google.

Due to the coronavirus, they decided to give us all a heads up on the future algorithm update and what it entails… that way you can adjust your website so your traffic doesn’t tank.

So, what’s the Page Experience update and how can you prepare for it?

Page Experience

In Google’s own words, here is what it means…

The page experience signal measures aspects of how users perceive the experience of interacting with a web page. Optimizing for these factors makes the web more delightful for users across all web browsers and surfaces, and helps sites evolve towards user expectations on mobile. We believe this will contribute to business success on the web as users grow more engaged and can transact with less friction.

In other words, they are looking for how usable your website is.

Here’s an example of what they don’t want…

As you can see from the graphic above, the user was trying to click on “No, go back”, but because an install bar popup up at the top, it pushed the whole page down and caused the user to accidentally click on “Yes, place my order.”

The purpose of this update is to make sure that sites that rank at the top aren’t creating experiences that users hate.

The simplest way to think about this update is that user-friendly sites will rank higher than sites that aren’t user friendly.

But this change is the start of a big shift in SEO.

Why is this update so important?

What sites do you think that Google wants to rank at the top?

Take a guess…

Maybe sites with the best backlinks?

Or sites with the buttoned up on page code?

It’s actually none of those.

Google wants to rank the sites at the top that users love the most.

Here’s what I mean…

When you want to buy athletic shoes, what brand comes to mind?

If I had to guess, I bet you’ll say Nike.

And if you were to get a credit card… I bet Visa, American Express, or Mastercard will come to mind.

This is why brand queries (the number of users who search for your brand name on Google and click on your website) impact rankings, which I’ve broken down as one of the most important SEO lessons I learned.

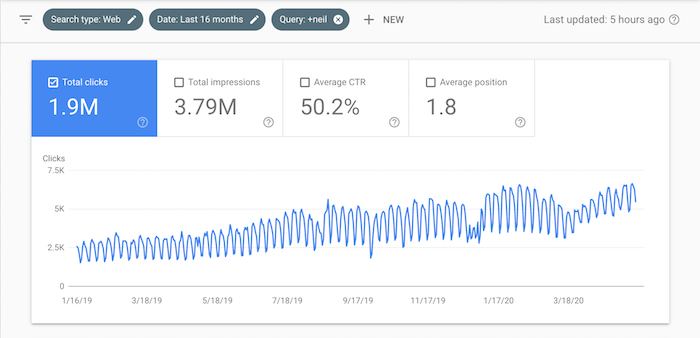

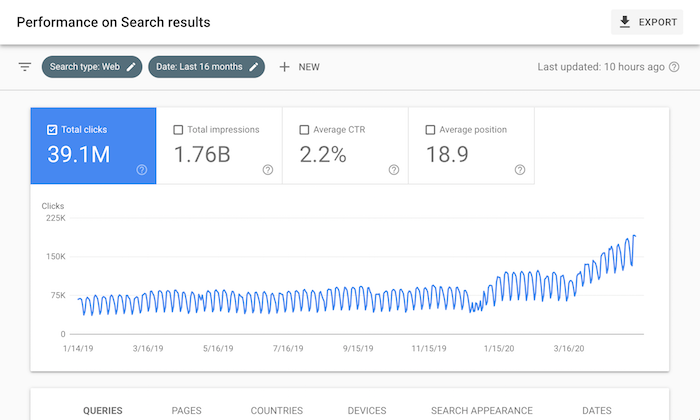

Just look at how the Neil Patel brand has grown over time… the graph below shows the number of people searching for my name over time:

And here is my SEO traffic over time:

As your brand grows so will your SEO traffic.

But that is old news, that’s been part of Google’s algorithm for years now.

Here is the thing though, most sites don’t have large brands and Google knows that. So, if you don’t have one, you can still rank.

At my ad agency, when we look at our clients and their growth over time, only 4% have large well-known brands. The other 96% are still seeing traffic growth.

What Google is doing is adapting its algorithm to more closely align with the mission of showing the sites first that users love the most.

And yes, brand queries are one of the ways they can do this, but user experience is another metric.

Over the next few years, I bet you will see many algorithm updates focusing on user experience.

So how do you optimize your user experience?

It’s starts with each page

If you look at the original article Google posted about the future algorithm change, they emphasize “page experience” or “website experience.”

It doesn’t mean that your whole website shouldn’t have a good user experience, but instead, I bet they are going to focus on their algorithm from a page-level basis.

Because if you have a few pages on your websites that have a poor experience, but the rest are good, it wouldn’t make sense for Google to reduce the rankings of your whole site, especially if many of your pages provide a much better experience than your competition.

Here’s how you optimize your user experience:

Step #1: Optimize your speed and reduce 400 errors

The faster your website loads, the better experience you’ll have.

Go to this page and enter in your URL.

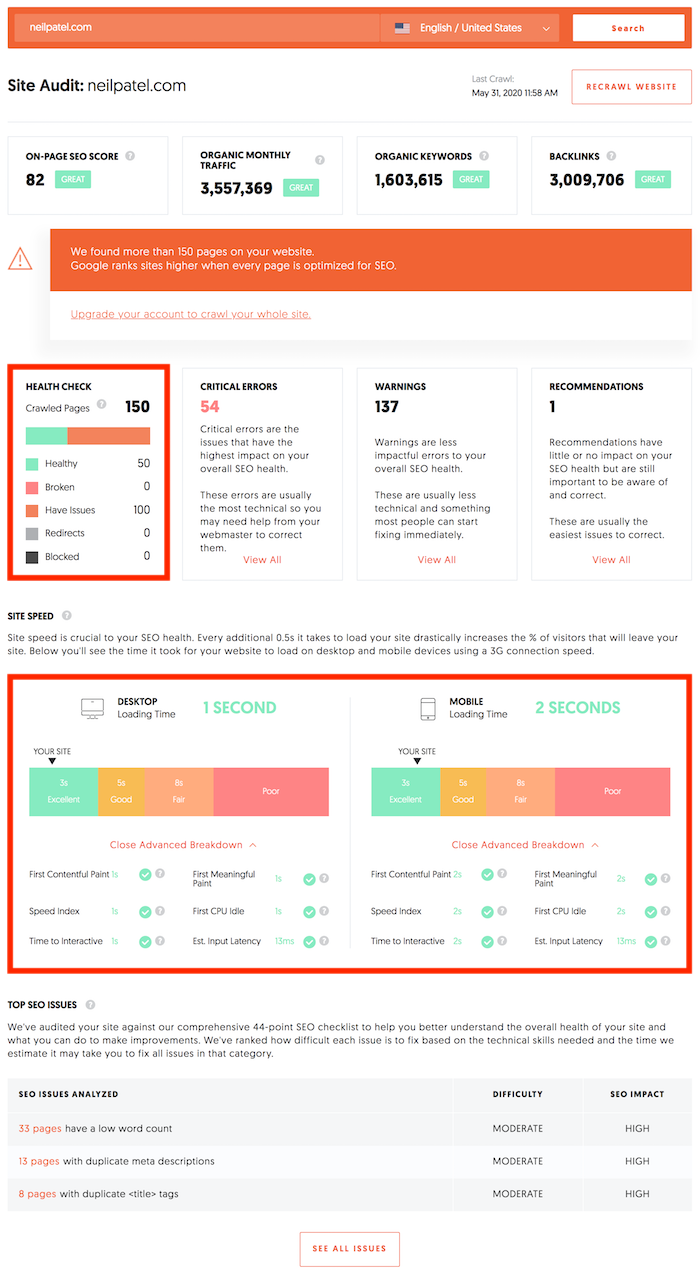

You’ll then see a report that looks like this:

You’ll notice two important aspects of that report that impact user experience that I’ve highlighted in the screenshot above.

In the health checkbox, you’ll want to make sure there are no broken pages. Broken pages create bad experiences.

In the site speed box, you’ll see the load time of your site. The faster your site loads the better. Try to get your website load time for both desktop and mobile under 3 seconds.

Ideally you should be in the 1-second range if possible.

Step #2: Compare your experience to your competitions’

You may think you have an amazing user experience, but how does it stake up to your competition?

So go here and type in your biggest competitor.

I want you to go into the navigation and click on “Top Pages.”

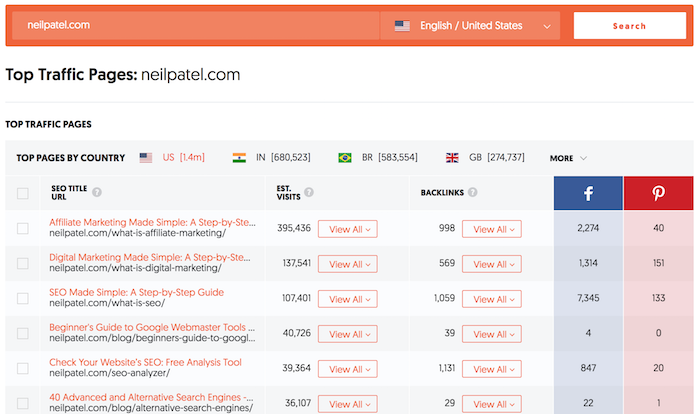

You should see a report like this:

The Top Pages report shows the most popular pages on your competition’s site from an SEO perspective. The pages at the top are the ones with the most SEO traffic, which means they are doing something right.

I want you to go through their top 50 pages. Seriously, their top 50 pages, and look at the user experience of each of those pages.

What is it that they are doing? How does their content quality compare to yours? What are the differences between their website compared to yours?

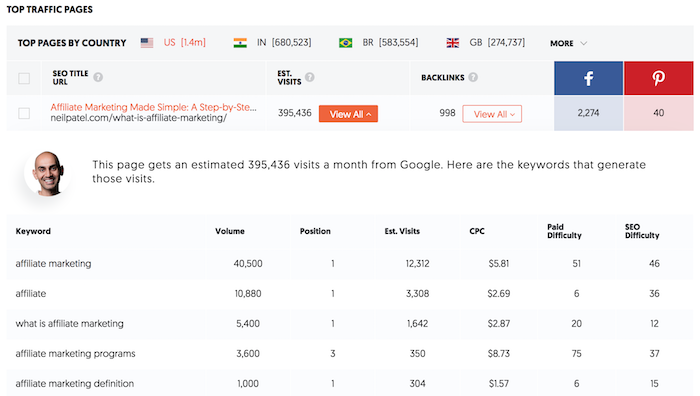

For each page that ranks, I also want you to click on “View All” under the “Est. Visits” heading. This will show you all of the keywords each page ranks for.

When evaluating your competition’s user experience, keep in mind how they are delighting people who search for any of those keywords. This will give you an idea of what you need to do as well.

But your goal shouldn’t be to match your competition, it should be to beat your competition.

Step #3: Analyze your design

Remember the graphic I showed above of what Google doesn’t want? Where the user tried to click on “No, go back” instead of “Yes, place my order” due to design issues.

In most cases you won’t have that issue, but you will have other usability issues.

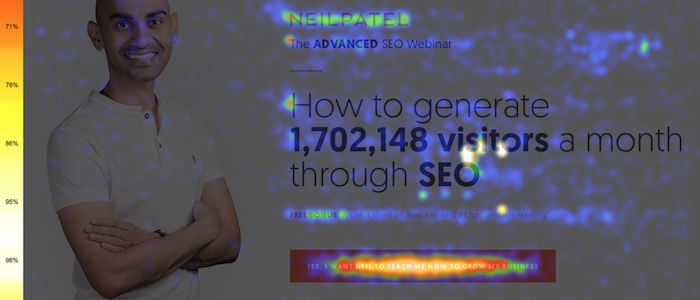

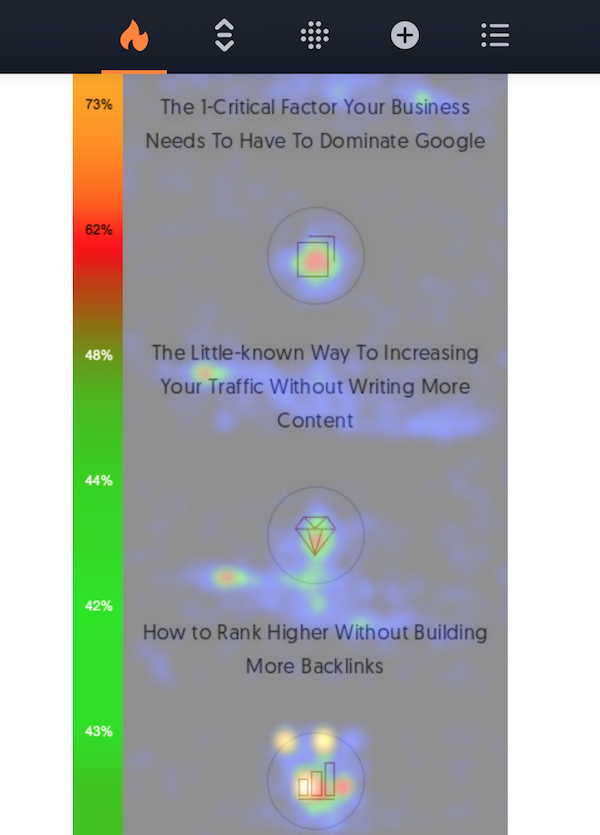

The way you find usability issues is through heatmaps. Just like this one:

What you can do to find usability issues is run a Crazy Egg test on your site.

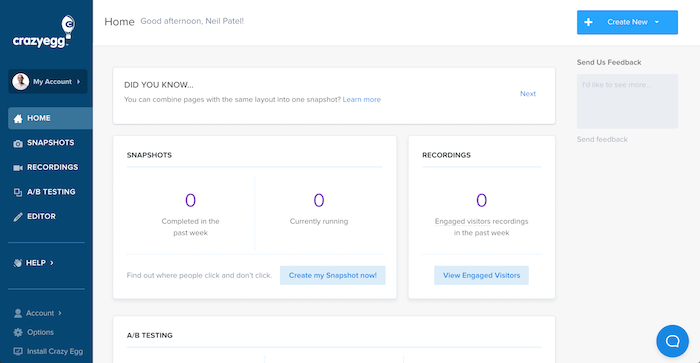

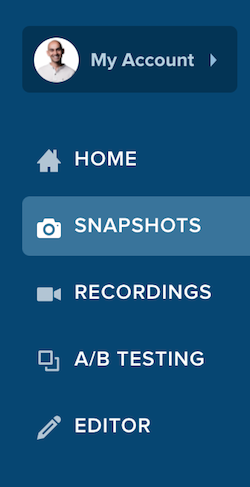

Once you log into Crazy Egg, you’ll see a dashboard that looks like this:

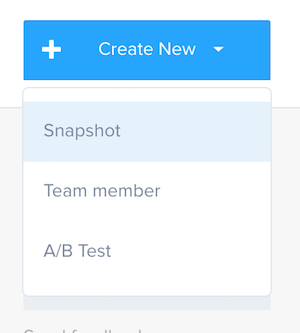

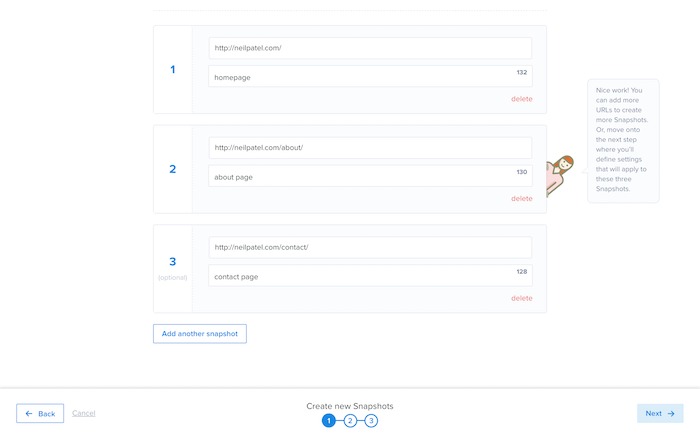

On the top right, I want you to click on “Create New” and select “Snapshot.”

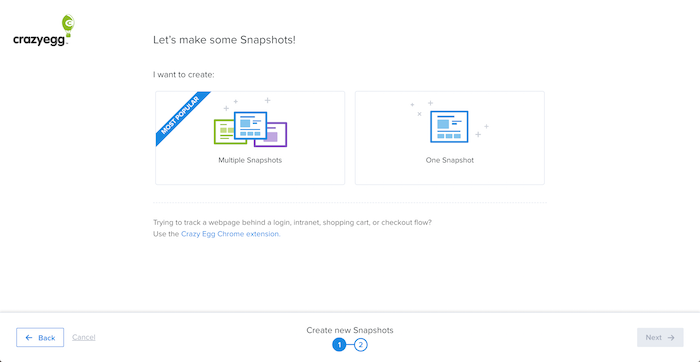

Then select “Multiple Snapshots.”

From there, you’ll want to add at least 3 popular URLs on your site. Over time you’ll want to do this with all of your popular pages.

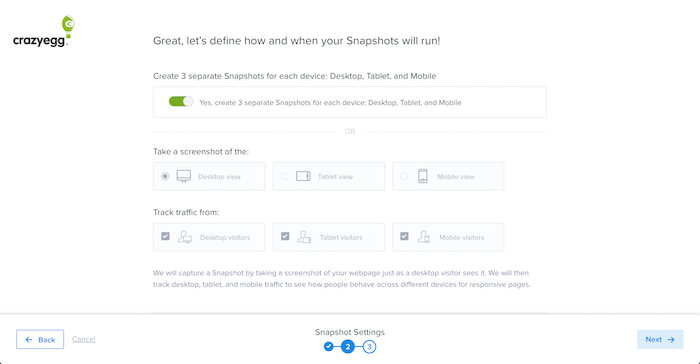

Then you’ll see settings like the image below, you don’t need to do anything here. Just click “Next.”

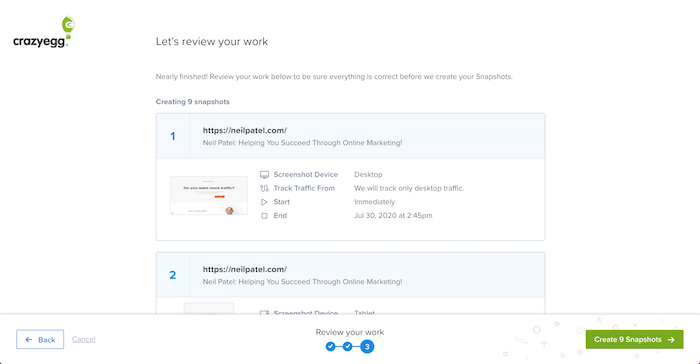

You’ll then be able to review everything. If it looks good, you can click the “Create Snapshots” button in the bottom right.

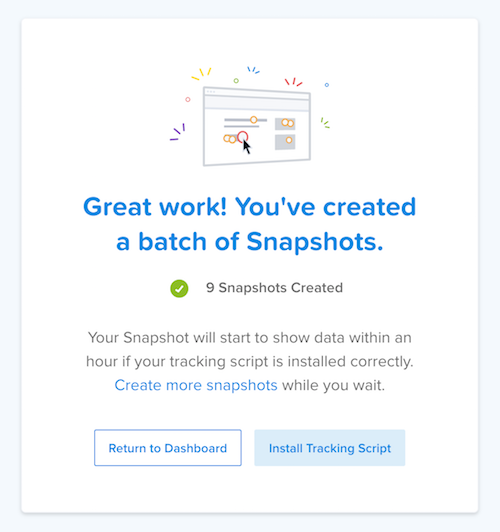

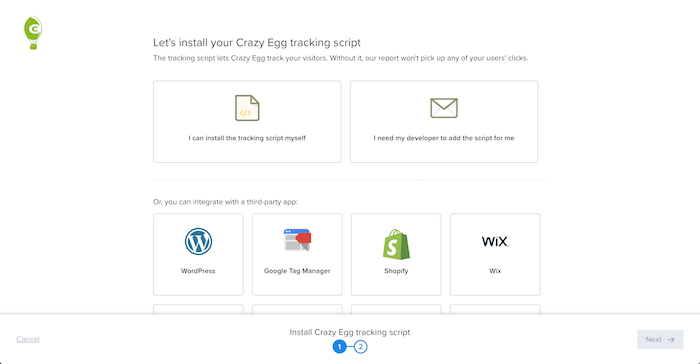

Last but not least, you’ll have to install your tracking script.

So, click on “Install Tracking Script.”

Select the option that works for you and then you are off and to the races. For example, for NeilPatel.com I use WordPress so I would select the WordPress option.

Once you are setup, it will take at least a day to see results, if not a bit longer. It depends on your traffic.

If you get thousands of visitors to your site each day you’ll see results within a few hours.

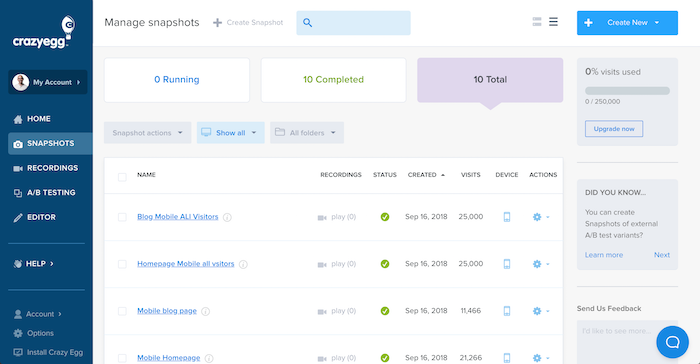

After you set up your test and it has been a few days, log back into Crazy Egg and click on Snapshots in the sidebar.

Once you are there you will see a list of snapshots you have created.

Click on any of your snapshots and you’ll see a heatmap of how people are engaging with your web page.

What’s cool about snapshots is they show you every single click, or even scroll that people take. Just look at this example from the NeilPatel.com site.

As you can see, people are clicking on those images above the text. But there is an issue… can you guess what it is?

If you click those images, nothing happens. But for all of those people to click on those images, it means that they believe they are clickable and that something should happen when they click on them.

An easy fix for me is to make them clickable and when a user clicks maybe I would take them to a page that goes into detail on each of those features. Or maybe I could expand upon each feature right there on that page.

Once you make the fixes to your page, you will want to re-run a new Crazy Egg snapshot on the same page to see if the changes helped improve the user experience.

Step #4: Install the Ubersuggest Chrome extension

If you haven’t already, install the Ubersuggest Chrome extension.

Here’s why…

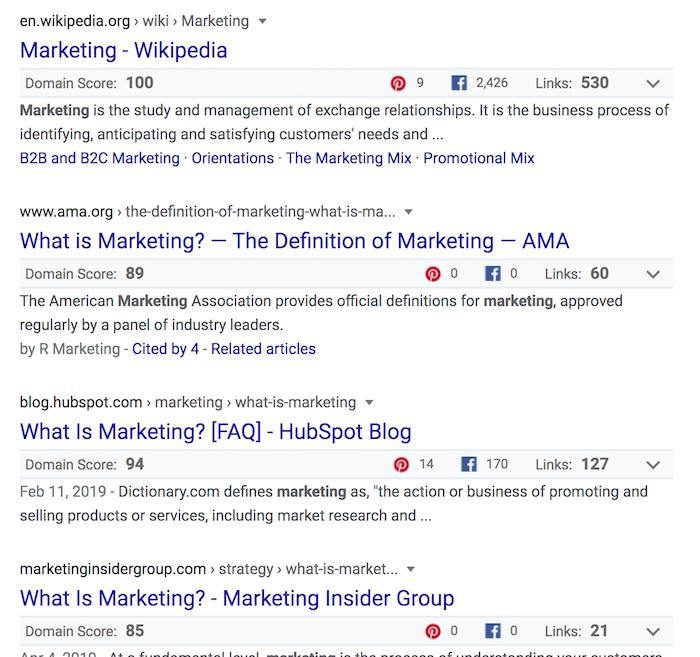

When you do a Google search, you’ll see data on each ranking URL.

When you are naturally using Google throughout your day and searching for keywords related to your industry, I want you to look at 2 main metrics in Ubersuggest:

- Domain score – the higher the number, the more authority a website has.

- Links – the more links a website has, usually the higher it will rank.

So, when you are doing searches, look for sites that have a lower domain score and fewer backlinks than the competition, but yet still rank high.

Chances are, they rank high because of things like user experience. Maybe their text is more appealing than the competition, maybe their bounce rate is lower… it could be a wide variety of reasons, but these are the sites you want to look at and analyze.

In the image above, you see that the result from the AMA ranks higher than Hubspot yet they have fewer links and a lower domain score. So, if you were trying to rank for that keyword, you would want to spend more time analyzing AMA because they are doing something right.

Conclusion

User experience is going to be more and more important over time.

If you love a site and everyone else loves that site, Google will eventually want to make sure that the site ranks high.

On the flip side, if everyone feels a website has a terrible user experience, then Google won’t rank that website as high in the long run.

Just like any algorithm update Google does, expect to see multiple revisions over time. As they learn, they adapt to make their algorithms more effective over time.

But what is unique about this update is you have advanced notice, which is nice. So, take the opportunity and fix any usability issues you may have.

What other ways can you make your website more usable?

The post Google’s New Algorithm: Page Experience appeared first on Neil Patel.

Pachama (YC W19) hires SW Engineer. Mission: restore forests, solve climate change

Article URL: https://jobs.lever.co/pachama/70f7cfc4-4d83-46c8-84ae-3f9c67aeb06f

Comments URL: https://news.ycombinator.com/item?id=23254286

Points: 1

# Comments: 0

CareRev (YC S16) Is Hiring a Head of Marketplace (Operations – Supply Side)

Article URL: https://grnh.se/1960239c3us

Comments URL: https://news.ycombinator.com/item?id=23082229

Points: 1

# Comments: 0

The post CareRev (YC S16) Is Hiring a Head of Marketplace (Operations – Supply Side) appeared first on Get Funding For Your Business And Ventures.

The post CareRev (YC S16) Is Hiring a Head of Marketplace (Operations – Supply Side) appeared first on Buy It At A Bargain – Deals And Reviews.

Decreasing Debt Before It’s Too Late … How To Avoid The Pitfalls Of Creeping Debt

Minimizing Debt Before It’s Too Late … How To Avoid The Pitfalls Of Creeping Debt

Decreasing financial debt typically isn’t a high top priority for individuals till they have actually currently entered difficulty with overspending. Utilizing a couple of standard standards, as well as financial obligation estimations, can assist you see when your financial debt tons is getting involved in the risk area.

Budgeting Guidelines

Off, financial institutions make use of budgeting standards when accepting and also assessing credit scores. You have a greater danger of debt applications being rejected if your financial debt goes beyond the economic neighborhoods suggested standards.

Obtaining, and also maintaining, your financial obligation according to advised budgeting standards, is a crucial action in financial obligation decrease. Utilize the adhering to advised budgeting standards (the exact same ones utilized by Financial Institutions) to assess the products in your budget plan:

Real estate 35% – Mortgage or rental fee, tax obligations, fixings, renovations, insurance coverage, as well as energies;

Transport 20% – Monthly repayments, gas, oil, repair services, insurance policy, car park & public transport;

Financial obligation 15% – Credit cards, individual financings, trainee financings & various other financial obligation settlements;

All various other expenditures 20% – Food, insurance coverage, prescriptions, physician & dental practitioner expenses, garments & individual;

Investments & Savings 10% – Stocks, bonds, money gets, retired life, rental realty, art, and so on

. Financial Obligation Income Ratios

The 2nd action is computing your financial obligation revenue proportion. You will certainly recognize simply exactly how essential financial obligation lots is to your total monetary image as soon as you recognize what your proportion is. Your financial debt earnings proportion is the percent of your regular monthly take-home income that mosts likely to paying financial debts.

You compute it by taking the quantity required to settle financial obligations monthly, consisting of rental fee or home loan, and also divide by your net income (your take-home pay after tax obligations). Keep in mind, this is “Debt” proportion, so just consist of real financial debt payment in the estimation.

Debt To Debt Ratio

Since you pay off a credit history card is no factor to shut your account, simply. One unknown reality concerning the Credit to Debt Ratio is the reverse result it carries your credit history. If you settle a bank card, as well as shut the account, you are really adversely influencing your credit report.

The factor for this unfavorable result remains in the computation of the Credit to Debt Ratio itself. This proportion is the connection of your financial debt total amount vs. your credit line.

You determine it by splitting the complete credit line of all charge card and also financing accounts by the total amount of the real financial debt (invested overall). Currently, if you repay a charge card, you are lowering the real financial obligation, which is terrific, however, if you shut the account, you are additionally considerably decreasing the credit line you have, as well as generally by a greater portion than the financial obligation decrease.

Pay Yourself

Vital to lasting economic success, as well as securing your future, is paying on your own. Financial obligations and also various other monetary responsibilities, cash for enjoyment, and also various other investing constantly appear to take a greater top priority. Assume concerning it, if you aren’t worth being paid initially, after that is?

Snowball The Credit Cards

Paying simply $10 added a month on a credit scores card, over the minimum necessary repayment, can reduce your settlement term in fifty percent, if not even more! Press out that added settlement, nonetheless little, every month, and also take benefit of the compounding impact of snowballing your financial obligation away.

Bear in mind, you do not need to be a monetary whiz to recognize what’s happening with your debt as well as financial obligation. Simply a couple of basic estimations, as well as an eye on the future, will certainly go a lengthy method to aid you do well economically as well as maintain your financial obligation controlled. Be secure, be clever, do the mathematics!

The 2nd action is computing your financial obligation revenue proportion. When you recognize what your proportion is, you will certainly recognize simply exactly how essential financial obligation lots is to your general monetary photo. Your financial debt revenue proportion is the percent of your regular monthly take-home pay that goes to paying financial obligations.

One little well-known reality regarding the Credit to Debt Ratio is the reverse result it has on your credit scores rating. Bear in mind, you do not have to be a monetary whiz to comprehend what’s going on with your credit report as well as financial obligation.

The post Decreasing Debt Before It’s Too Late … How To Avoid The Pitfalls Of Creeping Debt appeared first on ROI Credit Builders.

Financial Debt Loan Consolidation Home Loan – Disadvantages and also pros

Financial Obligation Consolidation Mortgage Loan – Cons and also pros

Financial debt combination home loan car loans can aid you decrease your passion prices as well as regular monthly settlements. You might likewise finish up investing much more on passion settlements by postponing repayments.

Conserving With Mortgage Interest Rates

Home loan rate of interest are a lot less than bank card or unprotected funding prices. Combining your financial debt with a re-financed home loan or residence equity will certainly minimize your repayments just by having a reduced price. By paying the exact same regular monthly repayments, you can settle your financial debt swiftly.

Your rate of interest is additionally tax obligation insurance deductible with a home mortgage or residence equity lending, where your bank card rate of interest isn’t. Trainee lending passion is likewise tax obligation insurance deductible as well as should not be settled for a greater price.

Decreasing Your Payments

Combining with a financing additionally enables you to lower your repayments by choosing longer terms. If your revenue is decreased or you have various other monetary responsibilities, extending your repayments can provide you some breathing area in your spending plan.

Paying More In Fees And Interest

The expense of a home loan can be even more than what you are paying in rate of interest fees if you have a little quantity of financial obligation. You might additionally have to pay personal home loan insurance policy costs if do not leave 20% of your equity in tack.

Postponing settlements can additionally build up rate of interest repayments, despite a reduced price. A lending quantity of $10,000 will certainly set you back $11,587.10 in rate of interest for a 30 year finance at 6%. That exact same quantity will certainly set you back $5,896.71 for a 5 year lending at 20%, which is what many charge card layaway plan resemble.

Choosing To Pay Down Debt

Combining your high passion credit history can assist pay off your financial obligation by supplying organized repayments. To obtain the most out of a combined funding, select brief terms to stay clear of making huge rate of interest repayments.

Financial obligation loan consolidation home mortgage financings can assist you decrease your rate of interest prices and also regular monthly settlements. Home loan rate of interest prices are a lot reduced than debt card or unprotected finance prices. The expense of a home mortgage can be even more than what you are paying in rate of interest fees if you have a tiny quantity of financial obligation. A financing quantity of $10,000 will certainly set you back $11,587.10 in rate of interest for a 30 year funding at 6%. To obtain the most out of a combined finance, select brief terms to prevent making huge passion settlements.

The post Financial Debt Loan Consolidation Home Loan – Disadvantages and also pros appeared first on ROI Credit Builders.

University Funds – The 529 Plan

University Funds – The 529 Plan

University Funds – The 529 Plan

Expanding up, whole lots of youngsters are left assuming that, put away in a financial institution someplace, securely snuggled away, there exists a considerable university fund simply waiting for the day they finish high college as well as obtain approved to university. There is currently an university cost savings intend called the 529 Plan, which is developed to aid moms and dads – or any person else – conserve cash for the future university experience.

The 529 Plan is a tax-advantaged financial investment. It was produced to urge moms and dads, grandparents, guardians, and so on, to start conserving cash for the future university education and learnings of their youngsters, grandchildren, are lawful wards. It gets its name from Section 529 in the Internal Revenue Code, as well as it is supplied by state firms as well as state companies.

Not all states supply the 529 Plan right now, yet those which do separately choose just how the strategy is developed as well as what type of financial investment alternatives they will certainly supply. Many strategies permit capitalists ahead from out of state. The benefits for in-state homeowners that look for the 529 university financial savings prepare within their state can consist of tax obligation reductions, matching give and also scholarship chances, security from lenders, and also exception from financial assistance financial debt.

The 529 Plan is used in 2 various types. There is a pre-paid strategy, occasionally likewise called an assured financial savings strategy, which permits the acquisition of tuition beforehand, based upon the present computations of what the tuition of a particular college is. When the recipient of the plan goes to an university or college, it is after that paid out.

There are likewise financial savings strategies, which are based around the market efficiency of underlying financial investment. An astonishing forty-eight states, plus the District of Columbia, supply the 529 financial savings strategy.

The 529 university cost savings strategies are a terrific method for moms and dads, grandparents, or lawful guardians to guarantee that their young enjoyed ones will certainly be able to manage to go to the extremely finest universities as well as obtain the really finest levels. They are perfect strategies for grownups that desire to offer university funds for their youngsters yet are incapable or uncertain to go regarding it in the method the films have actually constantly informed them they should.

There is currently an university financial savings prepare called the 529 Plan, which is created to assist moms and dads – or any person else – conserve cash for the future university experience.

Not all states supply the 529 Plan simply yet, yet those which do separately determine just how the strategy is made and also what kinds of financial investment alternatives they will certainly use. The benefits for in-state citizens that use for the 529 university cost savings prepare within their state can consist of tax obligation reductions, matching give as well as scholarship possibilities, defense from financial institutions, as well as also exception from monetary help financial debt.

There is a pre-paid strategy, in some cases likewise called an ensured cost savings strategy, which enables for the acquisition of tuition in advance of time, based on the present computations of what the tuition of a particular college is. The 529 university financial savings strategies are a wonderful method for moms and dads, grandparents, or lawful guardians to guarantee that their young enjoyed ones will certainly be able to pay for to go to the really finest universities as well as get the extremely ideal levels.

The post University Funds – The 529 Plan appeared first on ROI Credit Builders.

New comment by mflare in "Ask HN: Who wants to be hired? (December 2019)"

Location: Germany

Remote: Yes

Willing to relocate: No (but occasional travel/onsite is ok)

Technologies: Java (Android, SWT, Swing, JSF/PrimeFaces), C, C++, SQL (MySQL/MariaDB, PostgreSQL, SQLite), Linux

Résumé/CV: https://t1p.de/c8rx12

Email: in resume