Learn About Dun & Bradstreet Reports

Did You Want to Learn About Dun & Bradstreet Reports?

It’s time to learn about Dun & Bradstreet reports.

But let’s start with some definitions and background on business credit.

Business Credit

This is credit in a business’s name. It does not tie to the owner’s creditworthiness. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

Also, there are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. Also, there is no personal credit reporting of business accounts. Business credit utilization won’t affect your consumer FICO score. Plus the business owner isn’t personally liable for the debt the business incurs.

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive,and some of them are not.

Business Credit Reporting Agencies

There are three chief credit bureaus for business: Dun & Bradstreet, Experian, and Equifax.

In the business world Equifax and Experian are up there, but it’s Dun & Bradstreet which is the major player.

D&B has more than 10 times the records of the next closest reporting agency. See dnb.com/about-us/company.html.

What are in a Dun& Bradstreet Reports?

Do you have a copy of your Dun and Bradstreet report?

What is Dun and Bradstreet?

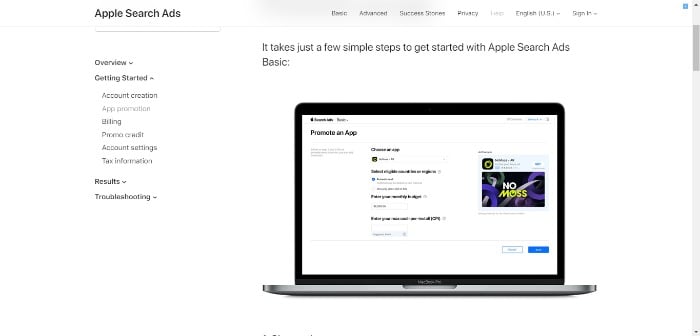

They are the oldest and largest credit reporting agency. You need a D-U-N-S number to start building business credit. Go to D&B’s website and look for your business, atdnb.com/duns-number. Can’t find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number and get into their system: dnb.com/duns-number/get-a-duns.html.

The main score is PAYDEX. But a business will not get a PAYDEX score, unless it has at least 3 trade lines reporting, and a D-U-N-S number. A business needs both to get a D&B score or report.

Dun & Bradstreet Reports

D&B offers database-generated reports. These help their clients decide if a business is a good credit risk. Companies use the reports to make informed business credit decisions and avoid bad debt.

Usually, when D&B does not have all of the information that they need, they say so in their reports. But missing data does not necessarily mean a company is a poor credit risk. Rather, the risk is unknown.

D&B’s database contains over 350 million companies around the world. It includes millions of active firms, and over 100 million companies which are out of business. But they keep these for historical purposes. This data goes into their reports.

D&B lists over a billion trade experiences. For as accurate a report as possible, give D&B your company’s current financial statements.

To see a sample Business Information Report, go to products.dandb.com/download/2019_BIR-Snapshot-Report.pdf

Predictive Models and Scoring

D&B takes historical information to try to predict future outcomes. This is to identify the risks inherent in a future decision. They take objective and statistically derived data, rather than subjective and intuitive judgments.

Dun & Bradstreet Reports: Sections

Here are the sections you could currently see in a typical Dun and Bradstreet business credit profile report.

Executive Summary

The report starts with basic company information, such as number of employees, year the business was started, net worth, and sales.

D&B Rating

This rating helps companies quickly assess a business’s size and composite credit appraisal. Dun & Bradstreet bases this rating on information in a company’s interim or fiscal balance sheet plus an overall evaluation of the firm’s creditworthiness. The scale goes from 5A to HH. Rating Classifications show company size based on worth or equity. D&B assigns such a rating only if a company has supplied a current financial statement.

The rating contains a Financial Strength Indicator. It is calculated using the Net Worth or Issued Capital of a company. Preference is to use Net Worth. D&B will show if a business is new or if they never got this information.

This section also adds a Composition Credit Appraisal. This number runs 1 through 4. Also, it reflects D&B’s overall rating of a business’s creditworthiness.

The scores mean:

- 1 – High

- 2 – Good

- 3 – Fair

- 4 – Limited

A D&B rating might look like 3A4.

Keep your business protected with our professional business credit monitoring.

D&B PAYDEX

This part shows two gauges. One is an up to 24 month PAYDEX. There’s also an up to 3 month PAYDEX. Hence you can see recent history and a firm’s performance over time.

Both gauges have the same scores. A 1 means greater than 120 days slow (in paying bills). A score of 50 means 30 days slow. One great score is 80, which means prompt. Also, 100 means anticipates. A 100 is the best PAYDEX score you can get.

PAYDEX Score

This is Dun & Bradstreet’s dollar-weighted numerical rating of how a company has paid the bills over the past year. D&B bases this score on trade experiences which various vendors report. The Score ranges from 1 to 100. Higher scores mean a better payment performance. PAYDEX scores reflect how well a company pays its bills.

Predictive Analytics

This next section shows likelihood of business failure. It also shows how frequently a business is late in paying its financial obligations. These are comparative analyses, the Financial Stress Class, and the Credit Score Class.

Financial Stress Class

Overall numbers range from 1 to 5. A 1 is businesses least likely to fail. Also, a 5 is firms most likely to fail. The Financial Stress Class measures likelihood of failure.

Financial Stress Class Score

These more granular scores range from 1,001 to 1,875. A score of 1,001 represents the highest chance of business failure. Also an 1,875 shows the lowest chance of business failure.

Credit Score Class

The Credit Score Class measures how often a company is late paying its bills. Overall numbers range from 1 to 5. A 1 is businesses least likely to be late. 5 is firms most likely to be late making payments. More granular scores run from 101 to 670. 670 is the highest risk.

Credit Limit Recommendation

It shows a spectrum of risk. Your risk category can be low, moderate, or high. Risk is assessed using D&B’s scoring methodology. It is one factor used to create the recommended limits.

D&B Viability Rating

This section contains:

- Viability Score – to show risk

- Portfolio Comparison – also a demonstration of risk

- Data Depth Indicator – descriptive vs. predictive

- Company Profile – this shows if financial data and other information was available

Credit Capacity Summary

This part repeats the D&B Rating above. It includes financial strength, the composite credit appraisal, and payment activity.

Business History and Business Registration

This section contains information on ownership. It also shows where a corporation is filed (i.e. which state). This includes the type of corporation, and the incorporation date.

Government Activity Summary and Operations Data

This section gives basic information on if a company works as a contractor for the government. It also shows the kind of business a company is in. It shows what the facilities are like, including general data on its location.

Industry Data and Family Tree

The section shows the business’s SIC and NAICS codes. It also shows where the branches and subsidiaries are. This list is just the first 25 branches, subsidiaries, divisions, and affiliates, both domestic and international. D&B also offers a Global Family Linkage Link to view the full listing.

Financial Statements

This section is for the financial statements D&B has on a business. It shows assets and liabilities, with specifics such as equipment, and even common stock offerings.

Indicators and Full Filings

This part shows public records, like judgments, liens, lawsuits, and UCC filings.

This part also breaks down where filings are venued, like the court or the county recorder of deeds office. It shows if judgments were satisfied (paid). It also shows which equipment is subject to UCC filings.

Commercial Credit Score

This part shows the Credit Score Class again. It also shows a comparison of the incidence of delinquent payments. It also includes key factors to help anyone reading the report interpret these findings. Also, it explains what the numbers mean.

Credit Score Percentile Norms Comparison

Here, D&B compares a company to others on the basis of region, industry, number of employees and time in business.

Financial Stress Score

This section shows a Financial Stress Class and a Financial Stress Score Percentile. The Financial Stress Class runs from 1-5, with 5 being the worst score.

Financial Stress Score Percentile

The Financial Stress Score Norms calculate an average score and percentile for similar firms. The norms benchmark where a business stands. This is in relation to its closest business peers.

It is a comparison to other businesses. The percentile contains a Financial Stress National Percentile. The Financial Stress National Percentile reflects the relative ranking of a company among all scorable companies in D&B’s file. It also contains a Financial Stress Score. The report shows the chance of failure with a particular score.

Keep your business protected with our professional business credit monitoring.

Financial Stress Score Percentile Comparison

The idea behind this score is to predict how likely it is a business will fail over the next 12 months. The Financial Stress Class shows a firm shares some of the same business and financial characteristics of other companies with this classification. It does not mean the firm will necessarily experience financial stress. The chance of failure shows the percentage of firms in a given percentile that discontinue operations with loss to creditors.

The average chance of failure comes from businesses in D&B’s database. It is provided for comparative purposes. The Financial Stress National Percentile reflects the relative ranking of a company among all scorable companies in D&B’s file. The Financial Stress Score offers a more precise measure of the level of risk than the Financial Stress Class and Percentile. It is meant for customers using a scorecard approach to determining overall business performance.

Advanced PAYDEX + CLR

This section repeats the 24 month and 3 month PAYDEX gauges. It also includes a repeat of the Credit Limit Recommendation. There is also a PAYDEX Yearly Trend. It shows the PAYDEX scores of a business compared to the Primary Industry from each of the last four quarters.

PAYDEX Yearly Trend

The PAYDEX Yearly Trend is a graph. It includes detailed payment history. with payment habits and a payment summary. This helps show if a business pays its bigger bills first or last.

Correcting Your Dun &Bradstreet Reports

Get your report from D&B at www.dnb.com/about-us/our-data.html. Update the relevant information if there are mistakes or the information is incomplete. At D&B, you can do this at: dnb.com/duns-number/view-update-company-credit-file.html.

Keep your business protected with our professional business credit monitoring.

Disputing Issues with Dun & Bradstreet Reports

None of the different business bureaus will change your scores without proof. They are also starting to accept more and more online disputes. Include proofs of payment with it. These are documents like receipts and also cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail. This is so you will have proof that you sent in your dispute.

Be specific about the concerns with your report. D&B wants you to go through their Customer Service. You can also go through D&B Customer Service to add payment experiences. D&B’s Customer Service contact number can be found at dandb.com/glossary/paydex.

Monitoring Dun &Bradstreet Reports

Business credit reports are not always perfectly correct. All of the major CRAs are committed to accuracy. But you won’t know there are errors unless you monitor your business credit reports.

For D&B only, you can monitor your reports via CreditMonitor. It currently costs $39/month. See dnb.com/products/small-business/credit-monitor.html.

Monitoring Experian, Equifax, and Dun & Bradstreet Reports

You can monitor your business credit at D&B, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see. So you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and also creditsuite.com/monitoring.

Dun & Bradstreet Reports: Takeaways

Dun & Bradstreet reports sport an impressive level of detail. The idea is to make it easier to decide if it’s a good idea to extend credit to another business. Also, your own company’s report can help show you where you can improve payment history. Also, you can see how your firm compares to similar businesses.

D&B is the largest business CRA. A D-U-N-S number is an absolute necessity for business credit building.

Monitoring all of your reports is expensive. But you can save 90% by monitoring your D&B, Experian, and Equifax scores through Credit Suite.

The post Learn About Dun & Bradstreet Reports appeared first on Credit Suite.