Article URL: https://recruiterflow.com/caper/jobs/11

Comments URL: https://news.ycombinator.com/item?id=24503532

Points: 1

# Comments: 0

Article URL: https://recruiterflow.com/caper/jobs/11

Comments URL: https://news.ycombinator.com/item?id=24503532

Points: 1

# Comments: 0

Article URL: https://www.workatastartup.com/jobs

Comments URL: https://news.ycombinator.com/item?id=24507084

Points: 1

# Comments: 0

Our NBA experts break down the West finals before Game 1 on Friday at 9 p.m. ET.

The post How the Lakers and Nuggets stack up in this surprising West finals matchup appeared first on Buy It At A Bargain – Deals And Reviews.

Location: Nairobi, Africa Remote: Yes Willing to relocate: No Technologies: Python, javascript, GCP(AutoML, CE, Firestore), docker, MongoDB, Postgresql Résumé/CV: https://kuria.dev/resume.pdf Portfolio: https://kuria.dev Email: josephkiurire@gmail.com Looking to be hired for a backend engineering role. Processing and managing tons of data and building robust systems is where i excel at.

The post New comment by codingsett in “Ask HN: Who wants to be hired? (September 2020)” first appeared on Online Web Store Site.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

In a world filled with different web hosting options, VPS hosting has become a popular choice for websites in various categories.

Upgrading to a virtual private server (VPS for short) will drastically improve your site performance if you’re currently on a shared hosting plan.

For those of you who are starting a new site from scratch and expecting tons of traffic from the beginning, getting a VPS hosting plan out of the gate is a viable option as well.

There are literally hundreds of thousands of web hosting providers on the market today. That’s why finding the right web hosting plan for your site can be such a tough decision. Fortunately, you’ve come to the right place—this guide will provide you with everything you need to know about VPS hosting.

As previously stated, the list of web hosting providers is seemingly a mile long. But in terms of actual contenders, there are a couple dozen at most. When it comes to VPS hosting, specifically, the list is even shorter.

But as you’re shopping around and evaluating different VPS hosting providers, these are the factors that you’ve got to take into consideration:

Site performance needs to be the top priority for everyone seeking a VPS plan. The term “performance” can be pretty subjective, but there are two metrics that matter the most:

Most people searching for a VPS are upgrading from a shared hosting plan that they’ve outgrown. Uptime and speed are the first two things to be affected when you’re sharing server resources with other sites.

You want to make sure that your VPS plan can accommodate your traffic needs. If performance is affected at scale, then you need to look elsewhere. Lots of web hosting providers will give you a guaranteed uptime rate. However, those offers typically come with some contingencies (like planned outages).

Some sites can’t afford any downtime or slow loading times. If you fall into that category, make sure you get a premium VPS plan. For those of you who would rather save some money, just know that your site performance might be affected.

Technically speaking, you’re still sharing server resources with other websites on a VPS hosting plan. However, the number of sites on the same main server is much lower compared to shared hosting. Plus, each virtual server will have its own dedicated resources.

As you’re evaluating plans, consider the following:

These resources will have a direct impact on your site speed and uptime (mentioned previously). If you’re maxing out your resources, you can’t expect your site to run at peak performance.

Not everyone needs root access. This feature only really matters if you’re a developer or need the ability to make custom changes to your virtual server at an advanced level.

If that’s the case, then you should be looking for a self-managed VPS plan. Most people will be better off with a fully managed plan (no need for root access here). It’s also worth noting that you can find fully managed VPS plans with optional root access, but that feature won’t really be utilized by the average user.

On the technical side, there are two main options for VPS hosting—Windows VPS and Linux VPS.

A Windows-based platform will provide you with access levels and performance that’s similar to a dedicated server. If you’re on a self-managed plan, you would be able to install common windows databases and applications like Microsoft SQL, ASP, SharePoint, and ASP.NET.

With a Linux VPS, your virtual servers will support web features like PHP, MySQL, and POP3. Since Linux is an open-source OS, these hosting plans are usually more cost-effective. You could eventually convert your Linux server into a Windows server, but doing the opposite would be much more complex.

Customer support piggybacks on our last point, especially true if you’re on a fully managed plan.

You want to make sure that your web hosting provider has your back. What happens if something goes wrong? Who do you contact if you have a problem or question? How do you resolve a time-sensitive issue?

If your site crashes at 10:00 PM on Friday night, waiting to contact a customer support representative at 9:00 AM Monday morning isn’t going to cut it. Look for a VPS provider with 24/7/365 support via phone and live chat.

Features like free migrations from another provider or hosting type to your new VPS plan would also fall into the support category. Some hosting providers are undoubtedly better than others when it comes to customer service.

The price for VPS web hosting varies significantly from provider to provider and plan to plan. We’ve seen VPS hosting plans starting as low as $6 per month. Other plans start at $250+ per month. Most of you will likely fall somewhere between these two extremes.

In many cases, you can expect to get what you pay for.

If you’re signing up for the cheapest VPS hosting plan that you can find, don’t expect to have extremely high uptime rates and fast page loading speeds. For those of you who want as many dedicated resources as possible, just know that they come at higher price points.

So you’ll have to weigh your performance and resource needs against your budget.

There are essentially two different types of VPS hosting—managed and unmanaged plans. I’ll explain the differences between these choices below, and I’ll also provide you with more information on alternative options for web hosting (to make sure a VPS plan is right for you).

If you’re not very technically inclined and don’t have a dedicated IT team, a managed VPS plan is definitely the best option for you. In short, you won’t have to really handle anything on your own. You’ll be able to just focus on running your website while the hosting provider takes care of the server behind the scenes.

Here are a handful of examples of what most VPS hosting providers will do for you on a fully managed plan:

Some providers will offer a little more or maybe even a little less, but this is generally what you should expect if you choose this type of VPS plan.

An unmanaged, or self-managed VPS, is just the opposite of a managed plan. You’ll be completely on your own when it comes to installing your software, control panel, security, maintenance, updates, and everything else listed above.

If you experience a hardware failure or an outage, don’t expect a ton of support from your hosting provider either. This type of VPS plan is really intended for those of you who need complete customization at the server level.

Self-managed plans are usually cheaper as well since the hosting provider doesn’t have to do nearly as much.

VPS hosting isn’t for everyone. So if you’re new to the world of web hosting, I want to quickly take a moment to explain your other options.

With all of this in mind, let’s dive into the top VPS hosting plans on the market today:

HostGator has been around for roughly two decades. The hosting provider powers 2+ million websites worldwide.

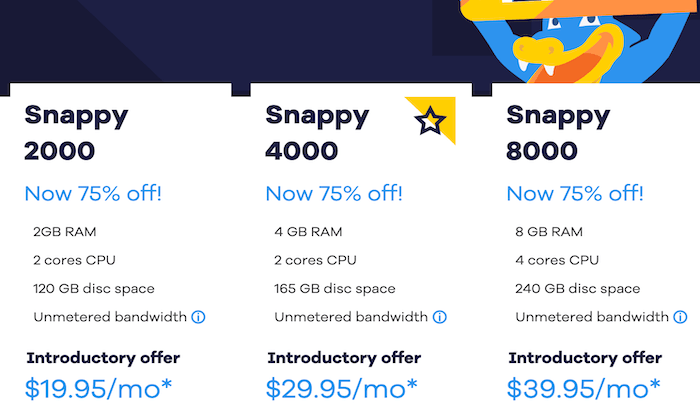

As one of the most trusted names in the web hosting industry, you really can’t go wrong with a HostGator VPS plan. Here’s a look at the different plans and price points:

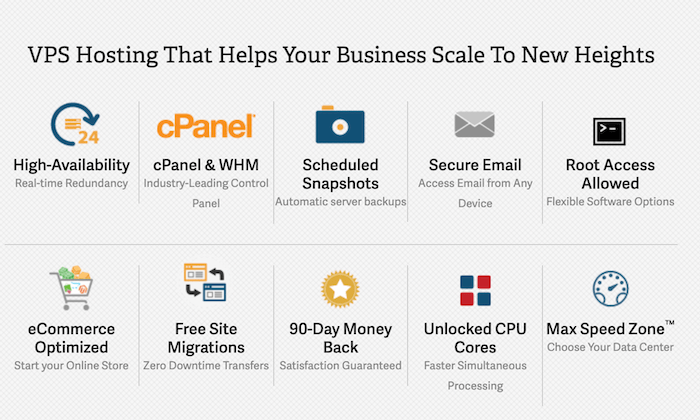

The VPS hosting plans from HostGator come with full root access and dedicated resources. You’ll also benefit from features like:

In addition to traditional web hosting, HostGator’s virtual private servers are commonly used for ecommerce sites, testing environments, gaming, and heavy application use.

All plans are backed by a 45-day money-back guarantee.

InMotion has a wide range of VPS hosting plans for you to choose from. They offer managed VPS hosting and self-managed cloud VPS hosting, both powered by Linux SSD servers.

Managed plans start at $29.99 per month, and the entry-level self-managed VPS starts at $5 per month.

Most of you will benefit from the managed plans, as these virtual servers are optimized for ecommerce out of the box. These plans are configured for speed and reliability with ecommerce platforms like WooCommerce, Magento, Prestashop, and more.

Other advantages of using InMotion for VPS hosting include:

Overall, InMotion’s virtual private servers are fast and reliable. Even the managed plans come with full root access. InMotion’s 90-day money-back guarantee is arguably the best in the hosting industry.

GoDaddy is a name that’s usually synonymous with domain registration and controversial marketing strategies.

But if you’re in the market for a self-managed VPS plan, this will be a top option for you to consider.

Standard RAM VPS plans from GoDaddy start as low as $4.99 per month. The high RAM plans start at $9.99.

The self-managed plans are perfect for developers and system admins. Features and benefits of using GoDaddy’s virtual private servers include:

These plans are great for testing environments, database servers, resource-heavy apps, email servers, and admins running multiple websites.

GoDaddy does have fully-managed VPS plans starting at $99.99, but the self-managed option is definitely the standout from this provider.

For businesses, ecommerce websites, agencies, and resellers, Media Temple is my top recommendation for managed VPS hosting.

The pros at Media Temple will handle all of the technical aspects of managing your server. So you can spend more time focusing on your website and business.

In addition to the best customer support team in the world of web hosting, your managed VPS plan comes with benefits like:

Media Temple’s servers are fast and reliable. These managed VPS hosting plans start as low as $55 per month.

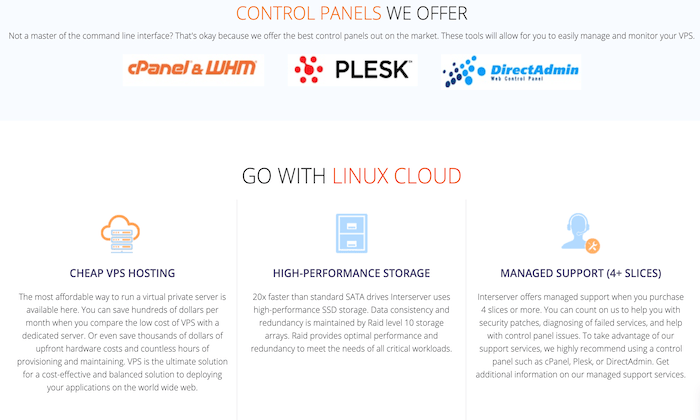

InterServer definitely isn’t the most well-recognized name in web hosting. But for those of you who want a cost-effective VPS plan, InterServer is worth taking a closer look at.

This hosting provider offers managed and unmanaged VPS hosting, starting at just $6 per month.

Let’s takes a closer look at some of the features, benefits, and highlights of using InterServer for VPS hosting:

Unlike other hosting providers on the market today, InterServer doesn’t offer a free trial or any money-back guarantees. However, they do offer month-to-month pricing, so you can cancel at any time.

The performance of these servers won’t be as high as some of the other plans on our list. But when you’re paying rock bottom rates, top of the line performance probably isn’t your first priority.

VPS (virtual private server) hosting is an excellent option for sites that have outgrown a shared hosting plan.

Which VPS is the best? Naming just one as the top pick is a tough call. But you’ll be happy with any of the options on this list. Just make sure you follow the methodology described earlier in this guide for choosing the best VPS plan.

For self-managed and managed plans alike, there’s something for everyone on my list.

The post Best VPS Hosting Plans appeared first on Neil Patel.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

The best VoIP phone services create exceptional customer experiences. And exceptional customer experiences work wonders for your bottom line.

Imagine this: a potential customer calls the sales number listed on your website. Six states away, a personal cell phone rings. Your sales person picks it up, answers a few questions, and closes the sale.

Within a matter of seconds, that potential customer turns into a paying customer rather than being transferred from employee to employee, wasting their time and testing their patience.

With the right VoIP service, you can streamline and automate the customer journey, resulting in more money for less work. Furthermore, these services are easy to set up, easy to use, and most of the leg work happens behind the scenes.

But choosing the right service feels like a daunting task. With countless options out there, how do you decide which one’s right for you?

If you’re not sure how to answer that question, you’re in the right place. In this article, I cover how to choose the right service for your needs, the different types of VoIP services, and my top recommendations.

Let’s dive in!

With countless VoIP service providers to choose from, finding the perfect solution for your business isn’t always easy. To make things easier, I want to share the criteria I considered when making this list and some must-haves regardless of the company you choose.

You can use these to help narrow things down as you go through the process.

Some VoIP phone services work with the hardware you already have, while others require proper installation. In some cases, you may need to buy an adapter or something else to enable the system.

But others are as simple as a mobile app you download on your phone.

So, carefully consider the amount of time and the level of support you have when making a decision. The simpler the system, the easier it is, and the less support you need to get things up and running.

Most VoIP phone service providers charge per user per month.

And while some offer discounts if you have a large team, those prices can quickly add up and get expensive.

So it’s essential to understand how many users you have and how to get the best deal with the features you need at a reasonable price point.

It’s important to consider the phone call capabilities you need because each provider offers different capabilities at different price points.

Do you need automatic call rejection, call forwarding, or caller ID? What about voicemail, voicemail transcription, and hold music?

You may also want to consider other capabilities like:

Make a list of everything you need so you can choose the right provider and the right plan.

Most VoIP providers also offer other forms of communication like SMS messaging, document sharing, online faxing, and video conferencing.

However, they may not all be available on basic plans.

With that said, you may not need all of them, either. So, carefully consider the additional forms of communication you need your team to have.

Your internet, VoIP provider’s uptime, and power source affect the quality of your phone calls.

With reliable, high-speed internet, you probably won’t have any issues. But what happens if the power goes out?

If you use your mobile device, you’re probably fine.

But desk phones aren’t. However, some come with battery backups that may last up to a few hours. So, make sure this is an option if you rent or buy hardware from your VoIP service provider.

Furthermore, some VoIP providers offer network monitoring that lets them switch to wireless backups if wired data links fail. And you should also expect nothing less than 99.99% uptime, as well.

For this type of service, you need to buy an adapter from the service provider and connect it to an existing phone (or a phone they provide).

These services are desktop programs. Skype and Google Talk are two good examples. You have to install the program and connect to the internet to use them.

However, most providers offer cloud-hosted and software-based systems.

Cloud-hosted VoIP, or “virtual private-branch-exchange” (PBX), services are available as well. The only hardware you need is a networking router or switch and the provider handles the rest

This includes mobile VoIP services, too. These mobile apps run on Android and Apple devices through cellular internet or a local Wi-Fi network.

All of the options on this list are a combination of cloud-hosted and software-based, with most offering both types of systems.

If you’re a small business looking for a reliable, no-contract VoIP phone service, Ooma is a great choice. They provide everything you need (i.e. hardware, software, and know-how) so you can start using their services in as little as 15 minutes.

Everything is ready to go straight out of the box. And you can keep your existing phone number or swap it out for a new one — for free.

Ooma offers 35 powerful features, including:

Furthermore, Ooma has an excellent customer service team ready to help you get up and running, navigate snags, and create a seamless experience for your customers.

However, the service is missing more advanced features. But it’s incredibly affordable and accessible for small businesses with a tight budget.

Plus, you don’t have to worry about complicated contracts. Ooma’s pricing is simple and straightforward with two business plans, including:

Ooma Office is suitable for most users. But you can upgrade to the Pro plan if you need a desktop application, call recording, or higher usage limits.

Remote teams face unique challenges. And they need a VoIP provider equipped with the tools and features required to conquer those challenges.

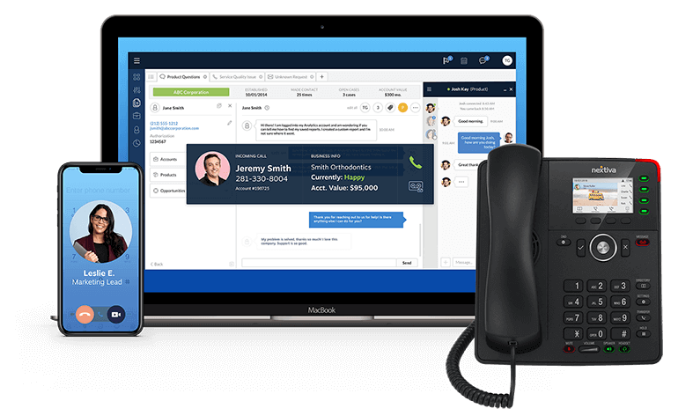

Nextiva is “made for business owners, not IT wizards” and built with remote teams of all sizes in mind. They offer solutions for small businesses, midsize businesses, and large enterprise companies alike.

Plus, their in-house customer service team is ready to help every step of the way.

Nextiva includes a wide variety of VoIP features, including:

Furthermore, you can make and receive business phone calls straight from your desktop, laptop, or mobile device. This service completely replaces an in-office phone system, empowering your remote team to stay connected.

Alternatively, you can use it in conjunction with your current phone system. So, it’s also a great fit for call centers and non-remote teams, as well.

Nextiva offers simple and affordable pricing. Their plans include:

Nextiva boasts an “ultra-high uptime of 99.999%,” with around-the-clock network monitoring and zero outages in 2019. With relatively reliable service, various essential features, and reasonable prices, their service is among the best.

RingCentral is an excellent option for fast-growth businesses. They’re the world’s #1 business communications platform with plans and features for business communications as well as customer support.

Plus, RingCentral offers discounts depending on the size of your team. So, as your team grows (regardless of how fast), your phone service affordably scales to match your needs.

They promise 99.99% uptime, and they maintain countless global data centers. This means you get excellent coverage and phone quality wherever you are on the globe.

Furthermore, installation and setup are a breeze, thanks to RingCentral’s step-by-step installation and intuitive admin panel.

You can set up new users from the admin panel, monitor service quality, and view your analytics all in one centralized place. Plus, you can even access it on the go.

Their services include features like:

RingCentral’s most affordable plan starts at $19.99 per user per month, making them a top contender for affordability.

Their paid plans include:

While their basic plans are suitable for smaller teams, their Premium and Ultimate plans allow teams to create custom-fit solutions, regardless of how fast they grow.

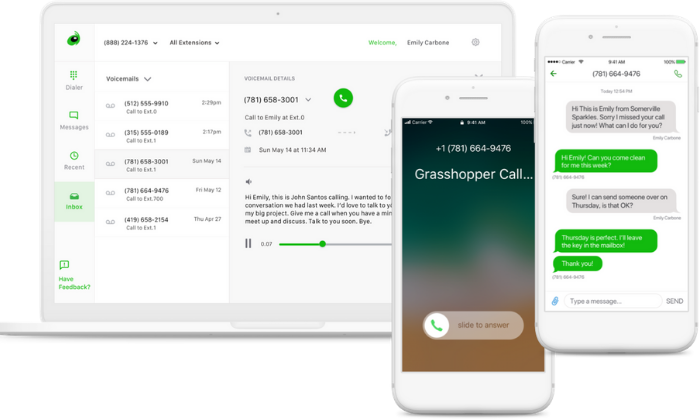

If your team works in the field, works from home, or works from anywhere in the world, Grasshopper is a smart choice.

It’s a mobile (or desktop) app that adds a business line and an integrated phone system to your employee’s phones. So, they don’t need to carry around two phones or be present in the office to message customers and accept business calls.

Plus, you can access and manage your entire phone system with mobile and desktop apps anywhere with an internet connection.

The best part is that Grasshopper integrates seamlessly with the phones you already have.

There’s no need to buy any fancy equipment or go through the hassle of messy and time-consuming installations. It’s as easy as picking a number and a plan, downloading the app, and configuring your settings.

Plus, with Grasshopper, you get access to intuitive, yet powerful, features like:

And while Grasshopper doesn’t automatically enable VoIP calling, you can quickly turn it on for free using the mobile app if you have poor cell service or prefer internet calling instead.

Their paid plans include:

Extensions can forward to any number you want. So, you can operate with three employees using Grasshopper’s solo plan.

This is a breath of fresh air instead of per-user pricing with the other services on this list.

Known for the stability of its network, Verizon provides VoIP business features for medium and large-scale businesses. However, it’s overkill for most small companies and very expensive compared to other options on this list.

Furthermore, it’s most suitable for businesses that need to be available for customer calls, route calls to the right teams/people, or respond quickly to customer requests.

Verizon’s VoIP phone service includes 45 features, including:

You can purchase or rent desk phones through Verizon or purchase a converter to continue using your current equipment.

Furthermore, you get free access to mobile and desktop apps to access or manage your phone system from anywhere in the world. However, Verizon’s services aren’t available everywhere, so you may not be able to use their services.

Verizon business phone plans start at $35 per user per month plus any additional fees, taxes, or equipment charges. However, their pricing is confusing when you start reading the fine print. And you have to commit to a two-year contract, as well.

So, keep that in mind as you’re making your final decisions.

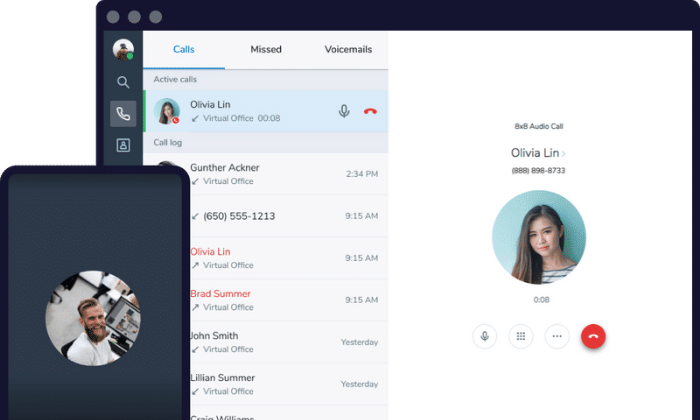

If you’re looking for a basic, affordable VoIP phone service, 8×8 is a smart choice.

Their 8×8 Express Business Phone System plan starts at $12 per user per month (with a free trial). This low pricing makes it the most affordable option on this list.

However, with that low price point comes limited features. The Express plan includes:

And to access their more advanced features, you have to pay between $25 – $45 per user per month. Which… is more expensive than some of the other options listed here.

So I don’t recommend it unless you go with the Express Plan.

My #1 recommendation for most small businesses is Ooma. It’s affordable, reliable, and easy to set up in about 15 minutes. However, if you’re looking for a large-scale solution, Verizon is your best bet.

Furthermore, Nextiva is perfect for remote teams, and Grasshopper is a simple, yet powerful, mobile app for small teams who are frequently out of the office.

If you’re on a tight budget, 8×8 is the cheapest VoIP phone service, starting at $12 per user per month. However, it’s features are limited.

Regardless of the route you go, don’t forget to consider your requirements, budget, and the criteria we talked about as you go through the process of choosing the best VoIP phone service for your business.

Have you used a VoIP service provider in the past? What was your experience like?

The post The Best VoIP Phone Services (In-Depth Review) appeared first on Neil Patel.

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. …

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. …

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on ROI Credit Builders.

Steven A. Cohen’s Point72 Asset Management recently reached a settlement with a female employee who sued the firm in 2018 alleging unfair pay practices and a pervasively sexist work environment.

The post Steve Cohen’s Point72 Settles With Female Employee in Gender Discrimination Arbitration first appeared on Online Web Store Site.

The post Steve Cohen’s Point72 Settles With Female Employee in Gender Discrimination Arbitration appeared first on ROI Credit Builders.

Our research dynamos can teach YOU how to build a business credit score in a recession! The economy doesn’t have to be perfect to build business credit quickly and effectively.

Building better business credit means that your small business attains opportunities you never assumed it would.

You can get new equipment, bid on real property, and deal with the company payroll. And you can do so even when times are a bit lean. This is specifically helpful in holiday businesses, where you can go for calendar months with simply negligible sales.

Because of this, you ought to tackle building your company credit. Enhance and maintain your scores and you will have these possibilities. Do not, and either you do not get these opportunities, or they will cost you a lot more. And no company owner wants that.

So you need to know what affects your business credit before you can make it better.

This is essentially the length of time your business has been using business credit. Obviously newer businesses will have short credit histories. While there is not too much you can particularly do about that, do not despair.

Credit reporting agencies will also consider your personal credit score and your own history of payments. If your consumer credit is good, and particularly if you have a fairly extensive credit history, then your individual credit can come to the rescue of your company.

So that is, you did not just get your first credit card recently.

Normally the converse is also right. Hence if your individual credit history is poor, then it will have a bearing on your business credit scores. And it will do so until your small business and personal credit can be split up.

Your credit utilization rate is just the amount of cash you have on credit. So it is then divided by your total available credit. Lenders in general do not wish to see this exceed 30%. Hence for every $100 in credit, do not borrow more than $30 of that.

If this percent is climbing, you’ll have to spend down and pay off your debts prior to borrowing more.

Late repayments will affect your company credit score for a good seven years. If you pay your company debts off, as fast as possible, then you can make a very real difference when it relates to your credit scores.

Ensure that you pay promptly. And you will enjoy the rewards of promptness.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

A substandard business year could end up on your personal credit score. And in case your business has not been around for too long, it will directly influence your company credit.

But don’t worry, you can separate them easily. Do so by taking measures to unlink them.

For instance, get credit cards exclusively for your firm. Or open business checking accounts and other bank accounts (or perhaps get a business loan). And then the credit reporting bureaus will begin to address your personal and small business credit independently.

Also, make sure to incorporate. Or at least file a DBA (doing business as) status. You can also pay for your company’s debts with your firm credit card or checking account. And make certain it is the company’s full name on the bill and not your own.

Just like each organization out there, credit reporting agencies like Equifax and Experian are only as good as their information. If your firm’s name is like another’s, there can possibly be some errors.

So check those reports, and your company report at Dun & Bradstreet, PAYDEX. Remain on top of these reports and contest charges with documentation and clear communications. Do not just let them stay incorrect! You can fix this!

And while you’re at, it you should also be overseeing the credit reporting agency which solely handles personal and not business credit, TransUnion. If you do not know how to pull a credit report, do not fret. It’s easy.

Business credit is credit in a small business’s name. It doesn’t attach to an owner’s consumer credit, not even if the owner is a sole proprietor and the only employee of the company. Consequently, a business owner’s business and consumer credit scores can be very different.

Since small business credit is independent from individual, it helps to secure a business owner’s personal assets, in the event of a lawsuit or business bankruptcy. Also, with two separate credit scores, a small business owner can get two different cards from the same merchant. This effectively doubles buying power.

Another advantage is that even new ventures can do this. Visiting a bank for a business loan can be a recipe for disappointment. But building business credit, when done the right way, is a plan for success.

Personal credit scores depend upon payments but also additional factors like credit usage percentages. But for business credit, the scores truly only hinge on whether a company pays its bills on time.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Growing business credit is a process, and it does not happen automatically. A business needs to actively work to establish business credit. Nevertheless, it can be done easily and quickly, and it is much more rapid than establishing personal credit scores.

Merchants are a big part of this process.

Doing the steps out of order will result in repetitive denials. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do you’ll get a rejection 100% of the time.

A business has to be genuine to lenders and merchants. For that reason, a business will need a professional-looking web site and email address, with site hosting bought from a merchant such as GoDaddy.

And company telephone and fax numbers ought to have a listing on ListYourself.net.

Likewise the company telephone number should be toll-free (800 exchange or comparable).

A business will also need a bank account dedicated solely to it, and it has to have all of the licenses essential for running. These licenses all have to be in the correct, correct name of the small business, with the same business address and phone numbers.

So bear in mind that this means not just state licenses, but possibly also city licenses.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Visit the Internal Revenue Service web site and acquire an EIN for the company. They’re totally free. Select a business entity like corporation, LLC, etc.

A company can get started as a sole proprietor. But they will more than likely wish to change to a kind of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it comes to taxes and liability in case of a lawsuit. A sole proprietorship means the entrepreneur is it when it comes to liability and taxes. No one else is responsible.

If you operate a small business as a sole proprietor, then at the very least be sure to file for a DBA (‘doing business as’) status.

If you do not, then your personal name is the same as the business name. As a result, you can wind up being directly responsible for all company debts.

Additionally, according to the IRS, by having this structure there is a 1 in 7 possibility of an IRS audit. There is a 1 in 50 chance for corporations! Steer clear of confusion and significantly decrease the chances of an IRS audit at the same time.

Begin at the D&B website and get a cost-free DUNS number. A DUNS number is how D&B gets a company in their system, to produce a PAYDEX score. If there is no DUNS number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this here. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

By doing this, Experian and Equifax will have something to report on.

First you must establish trade lines that report. This is also called vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can start getting revolving store and cash credit.

These types of accounts have the tendency to be for the things bought all the time, like coffee, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first off, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are commonly Net 30, instead of revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, like within 30 days on a Net 30 account.

Net 30 accounts have to be paid in full within 30 days. 60 accounts have to be paid in full within 60 days. In contrast to with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To kick off your business credit profile the right way, you should get approval for vendor accounts that report to the business credit reporting bureaus. As soon as that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with hardly any effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

But you may have to apply more than one time to these vendors, and you may need to purchase some things you don’t need, to confirm you are responsible and will pay promptly. Consider giving nonessential things to charitable organizations.

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, progress to revolving store credit. These are service providers such as Office Depot and Staples.

Use the small business’s EIN on these credit applications.

Are there more accounts reporting? Then move onto fleet credit. These are businesses like BP and Conoco. Use this credit to purchase fuel, and to repair and take care of vehicles. Make sure to apply using the small business’s EIN.

Have you been sensibly handling the credit you’ve gotten up to this point? Then move onto more universal cash credit. Keep your SSN off these applications; use your EIN instead.

These are usually MasterCard credit cards. If you have more trade accounts reporting, then these are feasible.

Know what is happening with your credit. Make sure it is being reported and deal with any mistakes ASAP. Get in the practice of checking credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less. Update the information if there are errors or the info is incomplete.

So, what’s all this monitoring for? It’s to dispute any errors in your records. Errors in your credit report(s) can be corrected. But the CRAs normally want you to dispute in a particular way.

Disputing credit report inaccuracies usually means you send a paper letter with copies of any proofs of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always mail copies and retain the original copies.

Disputing credit report mistakes also means you specifically spell out any charges you challenge. Make your dispute letter as clear as possible. Be specific about the problems with your report. Use certified mail so that you will have proof that you mailed in your dispute.

Always use credit sensibly! Don’t borrow more than what you can pay off. Keep an eye on balances and deadlines for repayments. Paying in a timely manner and in full will do more to raise business credit scores than pretty much anything else.

Establishing business credit pays. Great business credit scores help a business get loans. Your lending institution knows the business can pay its debts. They know the business is bona fide.

The small business’s EIN attaches to high scores, and lending institutions won’t feel the need to demand a personal guarantee.

Once you find out what influences your small business credit score, you are that much nearer to being able to build a business credit in a recession.

Learn more here and get started on how to build a business credit score in a recession.

The post It’s Science-backed With Our Foolproof Research: How to Build a Business Credit Score in a Recession appeared first on Credit Suite.