After Jan. 6, she follows her financial-crisis script, creating a panel to reach a foregone conclusion.

The post Pelosi’s Latest Partisan Commission appeared first on ROI Credit Builders.

After Jan. 6, she follows her financial-crisis script, creating a panel to reach a foregone conclusion.

The post Pelosi’s Latest Partisan Commission appeared first on ROI Credit Builders.

To understand fleet credit, you need to understand business credit first.

Business credit is credit in the name of a business. When built correctly, it has no relationship to an owner’s personal credit. This is the case even if a business has but one owner, and that person is also the business’s sole employee.

You can divide business credit into three separate categories. Vendor credit is credit you can get even if you have no other credit; often net 30 and similar terms. Store credit is often revolving terms; may require some time in business; and offered by major retailers. And cash credit is more universal credit from providers like Visa, MasterCard, and American Express; harder to qualify for; may require more time in business and more paperwork before approval.

Fleet credit has some things in common with both vendor and store credit. Terms can be either net 30 (or net 60, etc.), or they can be revolving. This is credit to buy fuel, and to repair and maintain vehicles of any type.

The kinds of vehicles a business needs to maintain can include taxicabs, trucks, vans (for deliveries or to transport workers or passengers), or company cars.

While any company can use vehicles, some industries solely depend on vehicles to deliver their services. Risk is denoted by SIC (Standard Industrial Classification), and NAICS (North American Industry Classification System) standards.

Normally, high-risk industries have some things in common. There can be high risks of injury on the job. Or an industry may engage in a lot of cash transactions. This is true regardless of the safety record of a particular business, or the majority of its transaction types. Trucking and many other vehicle-intense businesses come under the injury risk umbrella.

Over the road trucking is considered a high-risk industry. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Trucking-Except-Local.html. So is local transportation. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Local-Passenger-Transportation-Elsewhere-Classified.html. And so are taxicabs. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Taxicabs.html.

Small business credit is independent of the economy. But be aware that, as the situation continues, some of the requirements could change. Always be sure to check the links directly, to be sure to get 100% up to date information straight from the source.

Per the SBA, business credit card limits are high! They’re a whopping 10 – 100 times that of personal credit cards. You can get a lot more money with small business credit. And you will not need collateral, cash flow, or financials in order to get business credit.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Our Business Credit Builder is full of amazing business credit cards. And that includes gas cards! These cards are starter vendors. We know they report to business credit reporting agencies. Whether you’re new to business credit building, or have been at it for a while, it pays to get these cards.

Our Business Credit Builder is full of amazing business credit cards. And that includes gas cards! These cards are starter vendors. We know they report to business credit reporting agencies. Whether you’re new to business credit building, or have been at it for a while, it pays to get these cards.

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products, throughout the United States. Their comprehensive product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet, Experian, and Equifax. Before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying so they don’t red-flag your account for fraud.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

Your Social Security number is required for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee, if in business less than a year. You apply online. The terms are Net 15. Get it here: marathonbrand.com.

76 is owned by Phillips 66 Company. They sell gas in more than 1,800 retail fuel sites in the United States. This card reports to Dun & Bradstreet, Experian, and Equifax. And it can be used at any P66, 76, or Conoco fueling location.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

Your Social Security number is necessary for informational purposes. If concerned they will pull your personal credit, talk to their credit department before applying. If not approved based on business credit history or you have been in business less than 1 year, then a $500 deposit is needed or a personal guarantee (PG). You can apply online or over the phone. The terms are net 15. Get it here: 76fleet.com.

Wrights Express (WEX Card) offers universal fleet cards, heavy truck cards, and universally accepted business fleet cards. These cards have features that support small business, including a rewards program.

Before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying. This way, they won’t red flag your account for fraud. This card reports to Dun & Bradstreet, Experian, and Equifax.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

If you’re not approved based on business credit history, or have been in business a year or less, then a $500 deposit is needed or a personal guarantee. Apply online or over the phone. The terms are net 15 (WEX Fleet Card), Net 26, or Revolving (WEX Flex Card). Get it here: wexinc.com/solutions/fleet-management.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

All forms of business credit can help you build good business credit scores, as business credit is mainly based on your payment history. As a result, fleet credit can help your business eventually get funding, such as loans and other forms of financing.

Over 89% of business applications are denied by the big banks. High-risk industries are subject to stricter underwriting guidelines. It is possible to get loans from conventional sources, but it’s not easy. Alternative lenders are often your best bet. Here’s some great funding we’ve found.

You can get equipment financing for commercial truck leasing and financing. Up to $150,000 is available. Their requirements are 6 or more months in business, an equipment quote from a vendor, and a 575 personal credit score or better. See www.nationalfunding.com/industries/loans/trucking-business

Or get auto repair shop financing, via leasing. Their requirements are 6 or more months in business, an equipment quote from a vendor, and a 620 personal credit score or better. See nationalfunding.com/industries/leasing-financing/automotive-repair-equipment.

Kabbage offers loans specifically for truckers. Up to $250,000 is available. Their requirements are 1 or more years in business, and $50,000 or more in annual revenue. See www.kabbage.com/truck-driver-loans.

Get transportation equipment financing. Up to $750,000 is available. Poor credit is not a problem. You can get approval in as little as 24 hours. See https://crlease.com/transportation-equipment-financing.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

You can get a business line of credit. Up to $100,000 is available. No personal credit score is necessary. You must use online accounting software that can link to Fundbox. See creditsuite.com/fundbox and https://fundbox.com/truck-loans.

Got good personal credit? Then a hybrid credit line could be the perfect solution. You can get up to $150,000, even if your business is a startup.

To qualify, your personal credit score should be at least 685. You can’t have any liens, judgments, bankruptcies, or late payments. In the past 6 months you should have fewer than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s better if you have established business credit as well as personal credit. See creditsuite.com/business-loans.

Business credit is credit in the name of a business. Fleet credit is used by businesses to buy fuel, and to fix and maintain all sorts of vehicles. It can help you build business credit and qualify for loans and more forms of funding. Alternative lenders are one option. And the Credit Suite Credit Line Hybrid is even better if you’ve got good personal credit.

The post Get in the Fast Lane with Fleet Credit appeared first on Credit Suite.

When you think of business funding companies, you are probably thinking about traditional financing institutions. Large banks, community banks, credit unions and such definitely do offer business loans. However, if you are a small business, you may need to think outside of the traditional funding box a bit.

There are many different options when it comes to funding your business. There are private lenders, which you may have heard referred to as alternative lenders. There are cash advance options which are bad news on all fronts, but especially for funding a business. What you probably haven’t heard of however, is the small niche of business funding companies that do more than just offer business financing. In addition, they offer help improving fundability. This may include consultation, coaching, educational opportunities, and more.

These companies not only help you find the financing you need now, but they can also help you improve business credit and fundability so that you qualify for more and better funding throughout the life of your business.

Find out why so many companies use our proven methods to get business loans.

This is exactly what Credit Suite does. A business credit expert will consult with you to help determine where you currently stand in regards to fundability. Then, they can not only help you find the best business funding for you now, but they can help you improve your fundability to ensure you qualify for even more funding, with better terms!

A business credit expert can help you in ways you probably do not even realize. They have an inside track to what lenders are actually looking for. They can also help you steer clear of predatory lenders, which are all too prevalent in the world of business funding companies. These experts are also aware of which lenders report to business credit reports to help build business credit, which ones do not require a person credit check or guarantee, and more.

Working with a business credit expert will save you time, and in the long-term, money. The cost far outweighs the benefit, and you definitely get a bigger bank for your buck.

The vast sea of alternative lenders is hard to swim in. It is full of sharks that are searching for easy prey in the form of small businesses that need money. If you aren’t careful, you will get swallowed up quickly. Unfortunately, the industry is wrought with predatory lending practices.

The key is to find a legitimate business funding company that fits your current needs. A business credit expert is the best way to do this, but here are some good options from U.S. News and World Report to give you an idea of what is out there.

As with all loans, rate, fees, minimums, maximums, terms, and other details can change without notice Be sure to check with the lender directly for the most up to date information.

Loans are available from BlueVine up to $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Your personal credit score has to be 600 or above. It is important to note also, that BlueVine does not offer a line of credit in all states.

At Funding Circle, borrow up to$500,000. Decisions come in as little as 24 hours, and you can get funding in as little as 5 days. Repay on terms from 6 months to 5 years.

Funding Circle’s rates start at 4.99% per year. There are no prepayment penalties, there are also relatively fast decisions and funding.

They do have a ton of fees, including for origination, missing payments, and insufficient funds. Also, some maximum rates are high!

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan can be up to $500,000.

Find out why so many companies use our proven methods to get business loans.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least one year. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Rapid Finance offers a couple of different options. Which one is right for you will depend on a number of variables.

These range up to $1 million in funding, with terms from 3 to 60 months. Your business needs to be generating revenue to qualify.

You will need to supply a government-issued ID (like a driver’s license), a void check from your business banking account, and the last three statements from your business bank account.

You can get up to $500,000 in funding. In a merchant cash advance. This is funding based on your average daily credit card sales.

You will need to supply a government-issued ID (like a driver’s license), a void check from your business banking account, your last three credit card processing statements, and the last three statements from your business bank account to apply for this.

Bad credit is no problem with this type of funding because typically, repayment is taken directly from credit card sales.

In addition to the lines of credit, merchant cash advances, and invoice funding that many alternative lenders offer, you might also try a credit line hybrid. This is unsecured business financing. It is also no-doc financing. That means you need no collateral and you do not have to turn in any financial statement documents like bank statements or check stubs to qualify.

Find out why so many companies use our proven methods to get business loans.

You do need a 680+ credit score and there are a few other requirements. However, if you don’t meet them all you can choose to use a credit partner. This could be a friend, family member, or partner that does meet the requirements. You can use their good credit to apply for the credit line hybrid, but the payments would still be reported in the name of the business thus building business credit.

It’s not always about a bank or a credit union. You may need to think outside the box for a number of reasons. Maybe you want an option without collateral. Maybe you want to use non-traditional types of collateral such as invoices. Perhaps you do not qualify for a loan at a traditional bank.

Whatever the reason, there are a number of options, and sometimes alternative lenders are the answer. However, this industry has a fair share of predatory lenders. The best ways to avoid the sharks is to work with one of the business funding companies that can help with more than funding.

The business credit experts at a company like this offer not only help finding the perfect funding for your needs right now, but also can help assess and improve business credit and overall fundability.

The post Think Outside the Box When Choosing Business Funding Companies appeared first on Credit Suite.

Fernando Alonso is fit and ‘fully operational’ after jaw surgery and will be fine for Formula One’s pre-season testing in Bahrain, his Alpine team boss said on Tuesday.

The post Alonso 'completely fit' and fine for testing appeared first on Buy It At A Bargain – Deals And Reviews.

Becoming a third-party seller isn’t the only way to make money on Amazon. What if I told you there’s a way to get rid of the bulk of your seller admin and focus solely on helping a single customer who will sell your products for you? Well, that’s what you can expect from Amazon’s Vendor …

The post A Starter Guide to Amazon Vendor Central first appeared on Online Web Store Site.

Facebook might have started as a way to connect college students, but today it is a full-fledged search engine, much like Google or Bing. The social media giant’s rise to search engine status includes the addition of advanced features, like Facebook search operators.

What are Facebook search operators, and why should you care about them?

Search operators are a powerful tool for filtering search results, but they also have added benefits for marketers and business owners.

Before we get into that, let’s first talk about what search operators are and why they matter.

Search operators are advanced search commands that make it easier to filter search results based on what you do (or don’t) want to see in search results.

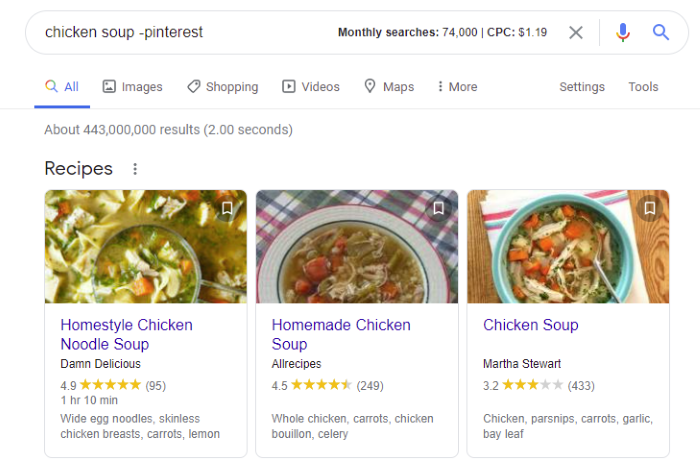

For example, if you were looking up recipes for chicken soup but didn’t want to see results from Pinterest, you could use a search operator to remove Pinterest results by typing in:

“Chicken soup -pinterest”

Google uses a wide range of these search functions that make it easier to use the search engine, including:

You can also combine these commands if you want to get fancy. For example, you could use “@ neil patel OR kelsey jones” to search for social accounts for both Neil Patel and Kelsey Jones.

Search operators make it easier to find the exact data you are looking for, but they also come in handy for marketers.

Facebook used to have a feature called the Facebook Graph Search, which allowed users to search for specific content on the platform by using sentences rather than just keywords. It also allowed you to find who liked a page or visited a specific city.

Facebook Graph was changed in 2019, making it much harder to search the platform. Search operators, however, fill that gap by allowing users to search for highly specific content.

How can Facebook search operators help marketers? Here are a few ways you can use those advanced search features:

Facebook search operators use Boolean operators, which are the basis of database logic. In layperson’s terms, Boolean operators are terms that allow you to broaden or tighten the search results. For example, you could use AND to search for two search terms at the same time.

Below, I’ll cover how to perform each type of Facebook search, explain what information it will help you find, and explore how to use the search operators to grow your business.

I know it might sound complicated, but I promise it’s pretty simple, and the results are worth the effort.

Boolean searches don’t work using Facebook search, so you’ll need to use Google to perform all the searches we’re about to cover.

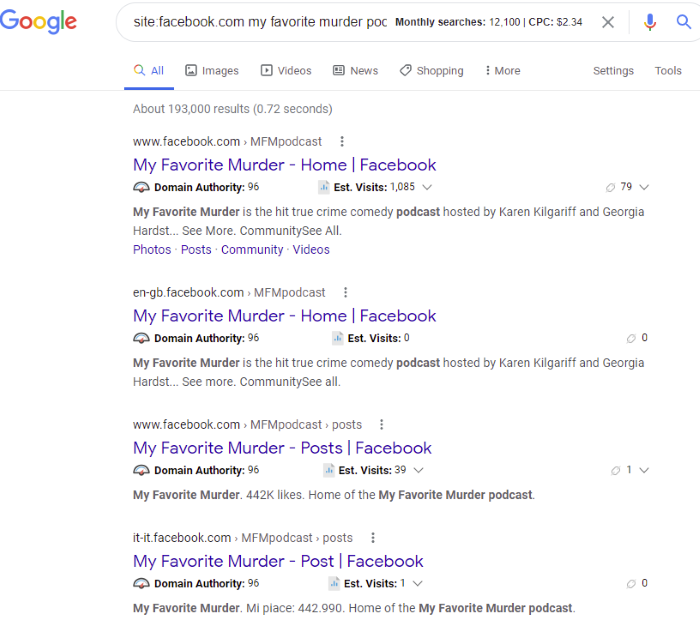

Using site: before the name of a site will display search results just for that specific website. Here’s how it works in practice. Type in site:facebook and then whatever search term you’re searching.

Example:

site:facebook.com my favorite murder podcast

This will display the results of groups or posts about the My Favorite Murder podcast.

Use this to find groups, pages, and users related to a specific topic. For example, if your target audience is small business owners, you could search for groups and pages for small business owners.

Pro tip: This search works for all websites, not just Facebook. Say you want to find a post from your favorite digital marketing blog or by a specific writer. Then you would perform a search for “site: <website URL> <the term you’re looking for>.”

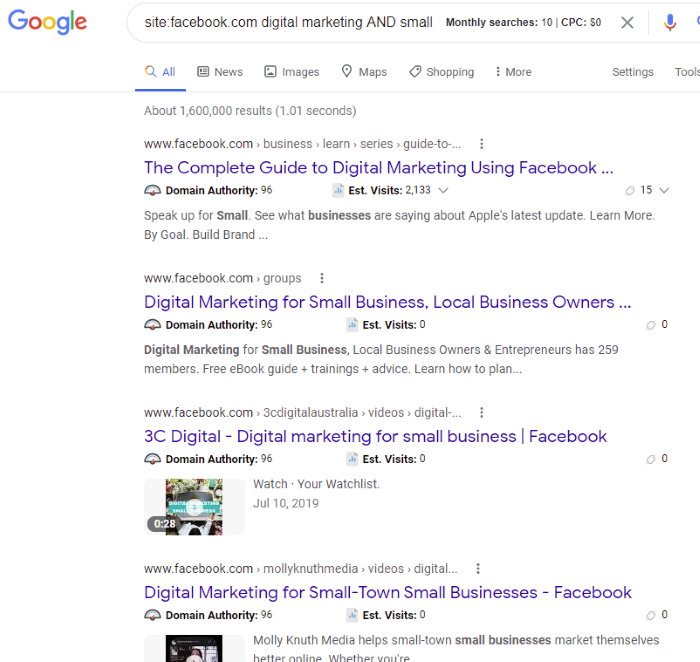

Using the AND Boolean search function, you can search for two terms simultaneously. For example, if you want to find information about digital marketing and small businesses, you would search:

site:facebook.com digital marketing AND small business

This will display search results related to both digital marketing and small businesses:

Perform competitive research for a specific niche or find groups your target audience belongs to on Facebook.

Similar to the AND function, this search operator allows you to find results for one term or another. Unlike AND, which requires both terms to be present, the OR function allows you to find results including either term.

Let’s say you have a software company that targets customers who have SaaS (software as a service) or those who have a membership site. You would search:

site:facebook.com SaaS OR membership sites

The results will display groups, pages, and posts related to SaaS or membership sites.

Research several competitors simultaneously or search for content related to your brand using both your official brand name and a misspelling or commonly used term.

For example, site:facebook.com Moz OR Hubspot would return terms related to both brand names.

What if you want to search for a specific term, but you keep getting unrelated results? The NOT Boolean function allows you to remove unrelated search terms.

For example, let’s say you are looking to hire a web developer, but you keep seeing results for designers. You would search:

site:facebook.com web developer NOT designer

The results will include videos, pages, and profiles related to web developers but not web designers.

Search for employees or more specific content related to your industry by excluding specific terms. You can also use it to narrow geographical areas with the same or similar names, such as Paris, Georgia NOT France.

Google and Facebook’s search features have gotten smarter in recent years, but sometimes they still don’t get it quite right. If you find your search results are slightly off, you can use the exact phrase match search operator.

This Boolean function tells search engines to only return matches that are precisely the same as your search.

To use this function, add quotation marks to the term you want to search.

Example:

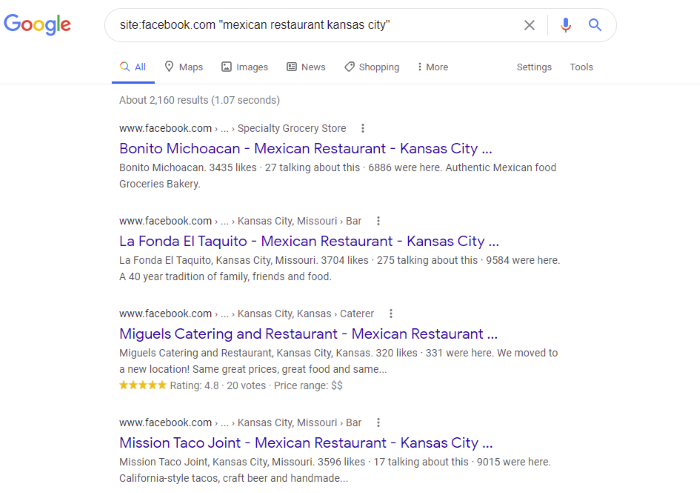

site:facebook.com “mexican restaurant in kansas city”

A list of Mexican restaurants’ Facebook pages will appear in the SERPs, like this:

Remember this is an exact match search. The search engine won’t return results that deviate even slightly. Search results for “mexican restaurant in kansas city” versus “mexican restaurants in kansas city” could be extremely different.

Find competitors in your area or look for groups or videos related to a specific key term. It might also help you find UGC if your brand name is very similar to another brand or phrase.

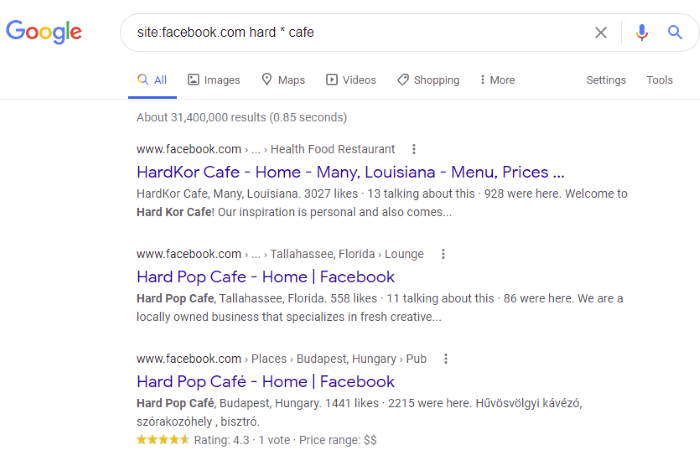

What if you don’t know exactly what you are looking for? The fill-in-the-blank function might come in handy. For example, if you’re looking for a specific person but can’t quite remember their name, you can use an * (asterisk) to tell Google to fill in the blank.

Say you work for Hardrock Cafe and are looking for UGC. Some users might type in Hard Rock Cafe, while others might use Hardrock Cafe. The fill-in-the-blank search operator will return results for both.

Here’s how to use it:

site:facebook.com hard * cafe

Note that this will turn up more than just Hard Rock and HardRock; it returns any results that include Hard and Cafe, no matter what is between them.

Use the fill-in-the-blank function to find information about terms that are often misspelled or formatted differently, or if you can’t remember the exact spelling. This search operator is ideal when users might not remember the exact format of your brand name. It can also help with competitive research by broadening searches.

Facebook is a powerful tool for local SEO, with more than 1.85 billion daily active users in the United States alone. Using a search operator for local searches can help marketers and business owners find local businesses.

Say you are considering opening a coffee shop in the Rogers Park neighborhood of Chicago. You could use this search:

site:facebook.com coffee shop rogers park chicago

This returns a list of all the coffee shops in that neighborhood.

Local businesses can perform competitive analysis or market research to find local businesses in their niche. It might also help you to find brands for a cross-promotion strategy.

Search algorithms have come a long way in recent years. However, they aren’t perfect.

Facebook search operators let you filter and refine search results for competitive analysis, find content to share with your users, and even locate groups where your target audience hangs out.

If you want to improve your Facebook marketing strategy, search operators are another tool in your toolbelt.

Have you used Facebook search operators before? Which one is most useful?

The post 7 Advanced Facebook Search Operators appeared first on Neil Patel.

One Medical | San Francisco, CA or Austin, TX | Full-time | https://www.onemedical.com/careers/

At One Medical, we are passionate about revolutionizing the healthcare industry by offering a new approach to primary care. We combine people-centered design, technology, and a team of talented healthcare providers to give our members an amazing experience (in-house developed apps, infrastructure focused on healthcare, medical records, and virtual care to name a few).

Security at One Medical: https://www.onemedical.com/careers/security/

– Senior Security Engineer, Logging and Automation – (SF or Austin)

– Senior Application Security – (SF or Austin)

Engineering and Corporate Roles: https://www.onemedical.com/careers/all-departments/

Our focus on technology and preventative healthcare has allowed us to help address aspects of the current covid crisis. We’ve been doing telemedicine for years, setting up outdoor covid stations across the nation, and as of last month we now offer antibody testing, outside of all of the other services we provide.

For a better understanding of One Medical, please check out our Instagram (https://www.instagram.com/onemedical), reach out to our Recruiting team (https://www.linkedin.com/in/sbunker) or me.

Location: Kenya, Africa

Remote: Yes

Willing to relocate: Yes

Technologies: HTML/CSS, Python, JavaScript, React JS, Express JS, Flask, MongoDB, BeatifulSoup, Selenium, Scikit Learn

Portfolio: https://jaden-lesuk.github.io/

Resume:https://drive.google.com/file/d/1IfJPgBwT3LPQZfxzUx71sKFsZtX…

Email: jaden.lesuk {at} gmail.com

Location: San Francisco Bay Area, CA Remote: Yes Willing to Relocate: No Technologies: Javascript, React, Redux, Ruby, Ruby on Rails, mySQL, PostgreSQL, HTML, CSS (Currently learning: Node.js, Express, MongoDB) Resume: https://scottespinosa.com/pdfs/Resume_SEspinosa.pdf Email: scottjames.espinosa@gmail.com LinkedIn: https://www.linkedin.com/in/scottespinosa/ Currently freelancing with a healthcare start-up, but looking for a long-term position in a dev team environment. My goal is … Continue reading New comment by sfespinosa in "Ask HN: Who wants to be hired? (March 2021)"

Getting a loan to buy and existing business is a somewhat different animal than getting a regular business loan. There are plenty of options, but it can take some careful consideration and research to figure out which option will work best for you. What’s your best option for a business loan to buy a business? … Continue reading 5 Ways to Get a Business Loan to Buy a Business