New Privacy Policy and also Terms of Service May 8, 2018 Dear Paper.li Community. The brand-new Privacy Policy gives far better quality on precisely just how your information is being refined and also shielded.

Category: Business News

Business News

Recently funded… $91,500.00 in Unsecured business cards!

Forge Your Fortress: Build a Company Credit Report You Can Be Proud Of

Build a Wall Around Your Business Kingdom with a Strong Company Credit Report

Similar to building a kingdom, a strong company credit report does not happen overnight. It takes years of hard work and dedication to build a business credit score and report you can be proud of. You have to start from the bottom, with basically nothing, and work methodically through a process. It isn’t a hard process, but it does take time, which means you need to start as soon as possible.

In the long run, it is completely worth the time and dedication necessary to build a solid company credit score, because once you do, your business and your personal assets are both protected. Your business has the power of strong business credit on its side. Your personal finances, on the other hand, will be unaffected by any enemy that may attack the business. It’s a win-win.

So how do you do it? Where do you start? What does it really take to build a company credit report you can be proud of?

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Conquer the Land: Business Fundability

Establishing small business credit is a process, and it does not happen automatically. A company will need to proactively work to establish business credit. Nonetheless, it can be done readily and quickly, and it is much more rapid than developing personal credit scores.

Before you can ever begin building a kingdom, you must first conquer the land for yourself. In company credit report terms, that means making your business fundable. There are a few things you need to do to make this happen.

- You need a professional-looking website and email address. The website address needs to be bought from a supplier such as GoDaddy. In addition, the email address needs to have the same URL. It shouldn’t be a from a free email platform like Yahoo or Gmail.

- The company telephone and fax numbers should be different from your personal numbers, and they need to have a listing on ListYourself.net.

- Additionally, the company phone number should be toll-free.

- A business bank account devoted strictly to the company is always a must.

- Visit the IRS web site and get an EIN for the company. It’s

- Formally incorporate. This means organizing as an LLC, S-corp, or corporation. You cannot operate as a sole proprietorship or partnership and build business credit properly. The option you choose should be based upon the level of protection and the tax benefits that you need. For company credit report purposes, they all work the same.

- Head over to the D&B website and obtain a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a small business into their system to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Gather the Loyal: Your Company Credit Report Fortress

Usually you have to have credit to get credit. When building a kingdom, you need your inner circle. There are always those few that are loyal to your cause before they have any reason to be. For building a strong company credit report, your inner circle is going to be composed of starter vendors. These are vendors from the vendor credit tier that will help you out before you even have a business credit score. They are your jumping off point once your business is fundable.

Terms are, in most cases, Net 30. This is in contract to the more common revolving credit. However, they will report your payments to the credit reporting agencies, which is what you need to start building a company credit report. If you have followed the fundability steps listed above, you will have a credit profile at the credit reporting agencies when these vendors report your accounts.

The vendors sell the things bought all the time in the normal course of business, including marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

Recruiting for Your Cause in the Vendor Credit Tier

To begin your business credit profile the proper way, you need to get approval for vendor accounts that report to the business credit reporting agencies. Once that’s done, you can make use of the credit.

But not every vendor can help like true starter credit can. It is important to work with those merchants that will grant an approval with marginal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You may have to apply more than one time to these vendors. Here are some great options to start with: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Uline Shipping Supplies is a true starter vendor. They sell shipping, packing, and industrial supplies, and report to D&B.

You must have a D-U-N-S number. They will request 2 references and a bank reference. The first few orders may need to be paid in advance to initially get approval for Net 30 terms.

Quill is also a true starter vendor selling office, packaging, and cleaning supplies. They report to D&B and Experian.

Place an initial order first unless you already have a business credit score with D&B. They require some initial purchases before approving net 30 terms for those that do not already have a score with Dun & Bradstreet.

Generally, they will put you on a 90-day prepayment schedule. If you order items each month for 3 months, they will usually approve you for a Net 30 Account.

Grainger Industrial Supply is another true starter vendor. They sell safety equipment, plumbing supplies, and more. They report to D&B. You will need to have a business license, EIN, and a D-U-N-S number.

For less than a $1000 credit limit they will approve virtually any person with a business license.

Accounts That Don’t Report

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to a minimum of one of the credit reporting agencies (CRAs), a trade account which does not report can be of some value.

You can always ask non-reporting accounts for trade references. Also, credit accounts of any sort should help you to better even out business expenses, thus making budgeting simpler. These are providers like PayPal Credit and T-Mobile.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Retail Credit Tier

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the CRAs, then move to the retail credit tier. These are service providers such as Office Depot and Staples.

One example of a company in this tier is Lowe’s. They report to D&B, Equifax, and Business Experian. They want to see a D-U-N-S and a PAYDEX score of 78 or better.

Fleet Credit Tier

Once you have 8 to 10 accounts reporting from the retail credit tier, you can move on to the fleet credit tier. These are businesses such as BP and Conoco. Use this credit to purchase fuel, as well as to repair and maintain vehicles.

Shell is an example of a company in the fleet credit tier. They report to D&B and Business Experian. They want to see a PAYDEX Score of 78 or higher and a 411-business telephone listing.

Shell might claim they want a particular amount of time in business or profits. However, if you already have enough vendor accounts, that won’t be necessary. You can still get an approval.

Cash Credit Tier

When you have enough accounts reporting from all the other tiers, you can start to apply for cards in the cash credit tier. These are business versions of standard Mastercard, Visa, and American Express cards. They will come with higher limits and lower rates if you have followed the previous steps and kept up with payments.

Why Is a Strong Company Credit Report Important?

Why build a strong credit kingdom in the first place? Is it really worth it, especially if you already have solid personal credit? Yes!

Company credit is credit in the business name. It doesn’t connect to a business owner’s consumer credit at all if things are set up properly. This means a business owner’s business and consumer credit scores can be very different.

Considering that company credit is independent from the individual, it helps to safeguard a small business owner’s personal assets in the event of a court action or business insolvency.

In addition, even if you make payments on time, running business expenses through personal credit can wreak havoc on personal credit scores. This is because business expenses are typically larger than personal expenses, but personal credit limits are much lower than business credit limits. As a result, business expenses can keep you close to personal limits consistently. That means your debt-to-credit ratio goes up, which can make your personal credit score go down.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Additional Tips for Building Your Company Credit Report

As you work through this process, here are some things to remember:

- Make all payments on time. If you do not do this one thing, the rest doesn’t matter. Bad business credit will not help you, and if you don’t pay on time, that is exactly what you will have.

- When applying for business credit, use your EIN. You may have to use your SSN for identification purposes, but not for the credit check.

- Use credit wisely. You do not have to use all you have. Don’t buy things you don’t need or use so much that you cannot make payments.

- Make sure your information is updated as needed. If your contact information changes, get that information to the credit agencies.

Once you build a company credit report you can be proud of, you need to keep it that way. Here’s how.

Stay in the Lookout Tower: Monitor Your Business Credit

Keep an eye on what is happening with your credit. Make certain it is being reported, and deal with any mistakes as soon as you can. We can help you monitor business credit at Experian and D&B for only $24/month. See: www.creditsuite.com/monitoring.

To monitor with D&B go to: www.dandb.com/credit-builder. For monitoring with Experian, visit: www.smartbusinessreports.com/Landing/1217/. At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business. Experian and Equifax cost about $19.99; D&B ranges from $49.99 to $99.99.

Take Down Enemies Before They Reach the Gate: The Purpose of Company Credit Report Monitoring

What are you looking for? You are looking for mistakes on your report. Your mission is to take down the enemy and repair any damage done. Errors in your credit report(s) can be corrected, but you have to dispute in a particular way. Generally, this means you mail a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always mail copies.

Itemize any charges you challenge, and make your letter as clear as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you mailed in your dispute.

Dispute your business’s Equifax report by following the directions here: www.equifax.com/small-business-faqs/#Dispute-FAQs

You can dispute inaccuracies on your or your company’s Experian report by following the directions here: www.experian.com/small-business/business-credit-information.jsp.

D&B’s PAYDEX Customer Service telephone number is here: www.dandb.com/glossary/paydex.

How Do You Build a Company Credit Report You Can Be Proud Of? Trust the Process

While it isn’t necessarily hard, it is a lengthy and specific process. Your company credit report doesn’t just appear when you open your first account. You must have things set up properly to separate your business from yourself.

Then, you must be intentional about finding accounts in the vendor credit tier. Patience is necessary to build accounts in each credit tier so that you can continue to move through the process. As you do, be certain you do not sabotage yourself by missing payments. Use your credit wisely and you will soon see that you have the credit you need to run a successful business.

Once you have your business credit report where you want it, keep it that way with credit monitoring. Stay on top of accounts reporting and ensure that your report is accurate and complete. Then, you will be able to access the funding you need for your business, when you need it. Your credit kingdom will be a solid fortress than no foe can penetrate.

The post Forge Your Fortress: Build a Company Credit Report You Can Be Proud Of appeared first on Credit Suite.

Quartzy (YC S11) is hiring a Sr SRE – remote and first of platform team

U.S. Stocks Fall Amid Trade Tensions, Weak Data

Ubersuggest 6.0: Track and Improve Your Rankings Without Learning SEO

I’ve been an SEO for roughly 17 years now.

And one thing that has remained constant, no matter how much

you know about SEO, there is just too much to do.

So much so, that most SEOs don’t even optimize their own websites anymore. And if they do, you’ll find that their site doesn’t rank for many competitive terms.

Why?

Because it is a lot of work!

That’s why I’m excited to announce Ubersuggest 6.0.

It now tracks and improves your rankings, even if you don’t have an SEO bone in your body.

So, what’s new?

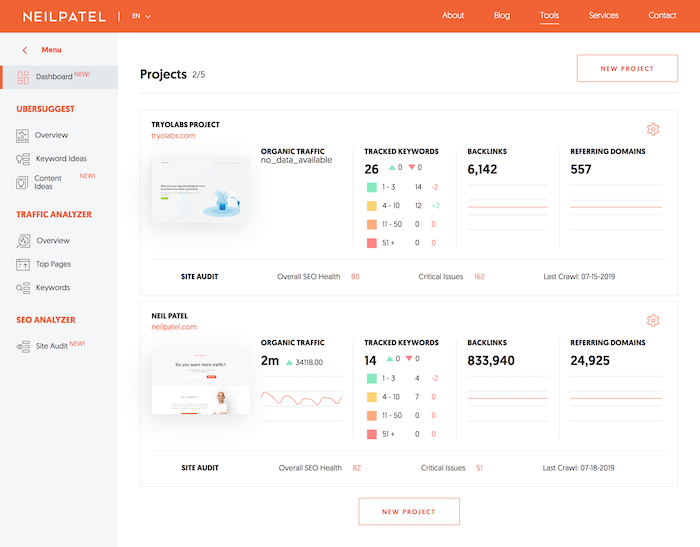

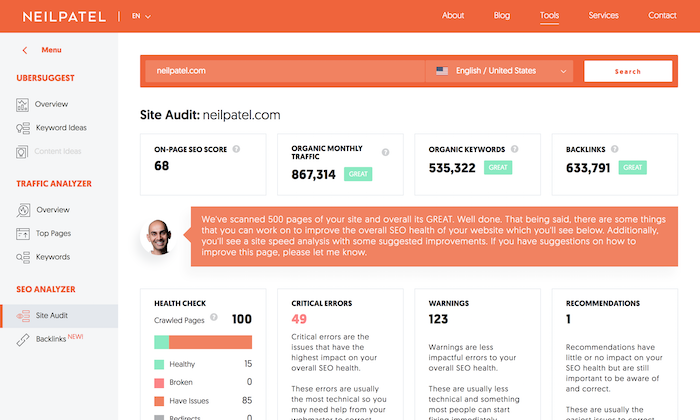

Dashboard and login

First off, you can now keep track of all of your websites.

You’ll have to register to

use this feature, but don’t worry, it’s free.

Once you register, you’ll be dropped into a dashboard.

Now for me, I’m already tracking a few websites. Which is why

my dashboard is already populated.

The dashboard will keep track of your SEO errors, link

growth (or decline), your monthly search traffic, your overall search rankings,

and any SEO errors that you need to fix.

Best of all, it crawls your website for you each and every week so you don’t have to worry about keeping up with Google’s latest algorithm changes.

And with the search rankings feature, you can automatically track how your rankings are changing on a daily basis.

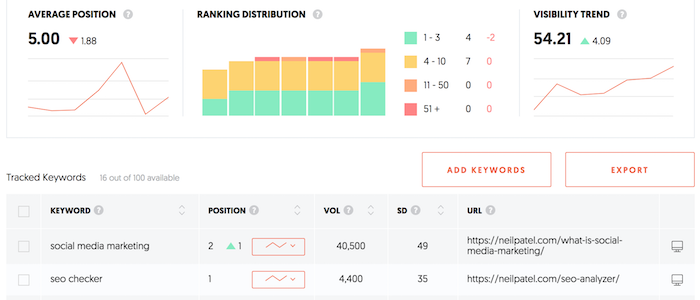

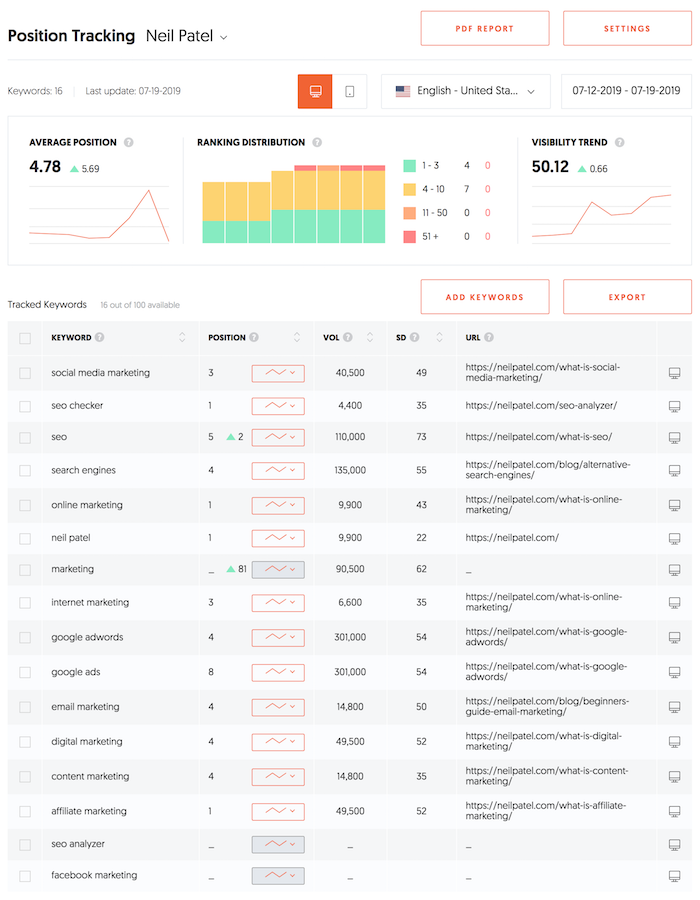

Rank tracking

Within each site you add to the dashboard, you’ll be able to

automatically track your rankings for any specific keyword.

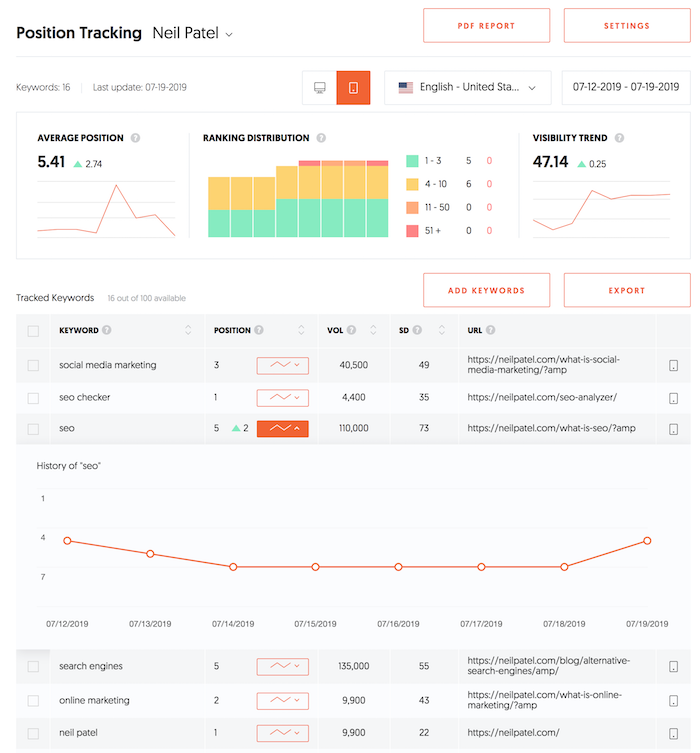

Not only are you able to track your rankings on desktop devices, but Ubersuggest also shows how you rank on mobile devices.

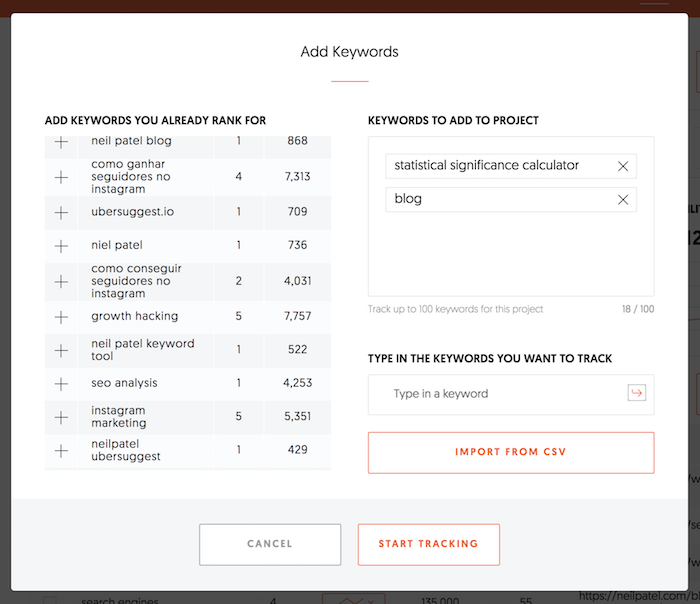

If you want to track specific keywords, all you have to do is click Add Keywords and it will pull a list of suggestion from your Google Search Console. Of course, you can also track any other keyword even if it doesn’t show up in your Search Console.

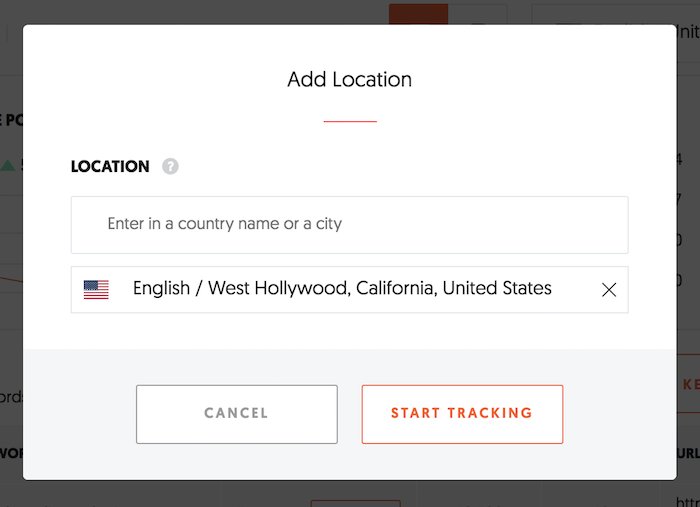

What’s also cool is that you have the ability to track your rankings in any country, city, or region. That means if you do local SEO or international SEO, you can see your rankings anywhere.

There’s also a date picker so once you’ve been using

Ubersuggest for a while, you’ll be able to see a nice chart of how your

rankings are improving over time.

Conclusion

What’s great about these changes is you can now directly see how Ubersuggest is helping you grow your search traffic.

It will automatically keep track of all of your changes and

notify you when it finds any new SEO issues to fix.

And over the next few months, you’ll see a few more features added that will make your life even easier.

One example is that I’ll introduce email alerts so that you don’t have to log into Ubersuggest anymore and it emails you when there is an issue that needs your attention.

I’ll also be adding in competitive analysis features. You’ll be able to track your competitors and be notified when they make an SEO or marketing change that you should look at.

And my long-term goal is to make it so you don’t even have to code or make any changes manually. Ubersuggest will eventually be able to go into your website and make these fixes for you. However, this feature won’t happen until next year sometime.

So, what do you think of the new Ubersuggest? Give it a try… make sure you create your free account.

PS: If you missed it, I released some cool features like local keyword research and a billion-plus keyword database last week. Click here to get the update on those new Ubersuggest features.

The post Ubersuggest 6.0: Track and Improve Your Rankings Without Learning SEO appeared first on Neil Patel.

Achievement in funding… $29,554.00 in Accounts Receivable financing!

The post Achievement in funding… $29,554.00 in Accounts Receivable financing! appeared first on Buy It At A Bargain – Deals And Reviews.

Financial Obligation Management Plans– Suggesting Ways to Survive the Quagmire of Debts

Financial Obligation Management Plans– Suggesting Ways to Survive the Quagmire of Debts

It is a false impression amongst lots of individuals that financial debt administration strategies can just be made use of for removing the existing pile of financial debts. As the name recommends, financial debt monitoring strategies might be utilized with benefit to take care of the financial debts to a specific degree. It should be recognized that an appropriate administration of financial debts makes financial debt loan consolidation as well as various other techniques utilized to combat the hazard of financial debts unnecessary.

The function played by financial obligation administration strategies in functioning with the financial obligations currently sustained might not be marked down. Lots of people owe their monetary survival to the financial obligation combination fundings that aided them counter insolvency and also various other financial debt associated troubles.

The writer has actually attempted to show the precautionary in addition to protective uses financial debt administration strategies via this post. Given that the protective component of the financial debt administration strategy is extra commonly utilized, we will certainly initially go over the numerous strategies to handle financial obligations that a private or company has actually currently sustained. The numerous financial obligation monitoring prepares that can be found in this group are as complies with:

– Debt loan consolidation lendings

The most traditional technique of dealing with financial debts is financial obligation loan consolidation financings. One facet that differentiates financial debt loan consolidation lending from various other financings is that the debtor obtains aid and also support from the financial obligation combination funding service provider in the negotiation of financial obligations.

– Debt debt consolidation home mortgage

Financial obligation loan consolidation home loan makes up a significant component of the financial obligation administration strategies. The benefit of the financial debt administration strategy is that money is offered for financial obligation combination at prices equal to a home loan, i.e. at low-cost price of rate of interest.

– Debt debt consolidation with remortgage

While financial debt combination home loan involves taking care of the exact same home loan provider, financial obligation loan consolidation with remortgage entails moving to a home mortgage lending institution that provides a far better interest rate. In this financial debt monitoring strategy, the debtor or the debtor demands the brand-new home loan lending institution to consist of numerous financial debts in addition to the overdue quantity on the initial home loan for dispensation. Once again, this will certainly aid the debtor obtain less expensive money for financial obligation combination at the prices of a home loan.

– Debt debt consolidation via bank card

Credit history card as a financial obligation monitoring strategy will certainly be specifically beneficial when the borrower desires a quicker negotiation of financial debts. As in home mortgages as well as lendings, a credit report card individual need not wait for the financial obligation monitoring strategy to be authorized as well as approved.

– Debt debt consolidation with house equity financings

Residence equity finance is a protected financing taken versus the equity in ones house. A residence equity financing is a multi-purpose financing that can be utilized with equivalent benefit whether in a financial debt administration strategy or for making house renovations.

– Debt debt consolidation via financial obligation negotiation.

This type of financial debt administration strategy entails relating to a financial debt negotiation business. The financial obligation negotiation business undertakes to pay off the financial obligations while the borrower pays off the quantity with little regular monthly instalments to the financial obligation negotiation firm.

As reviewed over, the precautionary approaches are similarly vital techniques used to prevent the event of financial debts. Financial debt coaching intends to convey financial debt monitoring training to people as well as companies.

The protective financial obligation administration prepares having actually paid back the financial debts, do not offer enough warranty of the threat of financial debts not elevating its head once again. There is a requirement to finish the cycle of the financial obligations, as well as the preventative component of financial debt administration strategies will certainly be specifically handy on this matter.

It has to be recognized that an appropriate administration of financial debts makes financial debt loan consolidation as well as various other approaches utilized to battle the threat of financial obligations unneeded. One element that differentiates financial debt combination financing from various other finances is that the consumer obtains aid and also advice from the financial debt combination financing supplier in the negotiation of financial debts. Financial debt consolidation home mortgage makes up a significant component of the financial obligation monitoring strategies. Debt card as a financial obligation monitoring strategy will certainly be particularly helpful when the borrower desires a quicker negotiation of financial debts. Financial obligation therapy intends to convey financial obligation administration training to people as well as organisations.

The post Financial Obligation Management Plans– Suggesting Ways to Survive the Quagmire of Debts appeared first on Buy It At A Bargain – Deals And Reviews.

Rapid Speed Student Loans Approval Even With Bad Credit

Rapid Speed Student Loans Approval Even With Bad Credit

Quick Speed Student Loans Approval Even With Bad Credit

If the trainee does not currently have a well-known debt, this might be a barrier to the trainee’s more education and learning. Negative credit score trainee finances are lendings which are particularly packaged for trainees with poor debt.

Bad Credit Student Loans

Poor credit history pupil financings are the following ideal choice if you can not certify for the basic trainee funding for any kind of factor. These poor credit report pupil fundings can likewise be made use of for the objective of fixing your credit score background. The very easy escape would certainly be to settle all your expenses as well as pay them off with the aid of a poor credit report trainee lending.

Poor credit score pupil lendings are offered to the pupils at a somewhat greater interest rate contrasted to the rates of interest on the typical pupil car loans. The loan provider reduces the rate of interest price on the funding if the pupil makes prompt settlements on the negative credit history finance for 2 years continually.

Locating The Right Lender

There are several means in which one can look for poor debt trainee financings. As well as there are likewise numerous pupil funding administration business that solely deal with various kinds of trainee fundings. Such car loans are normally temporary, like money advancement lendings as well as trainee incomes.

The finest component regarding using for poor debt pupil car loans online is the versatility of the time element and also the reducing of ranges. An appropriate study job as well as a contrast of various funding choices is needed prior to you use for a negative credit rating pupil lending.

Online Bad Credit Student Loans

These on the internet poor credit history pupil lendings are typically temporary fundings that do not call for any kind of credit report checks. A trainee requires to send out a post-dated check to the lending institution after the authorization of the finance application.

The details called for in the kinds for negative credit history pupil fundings is extremely standard: your address, some various other individual information, and also at times, your credit report scores. Expert aid can come in convenient at the time of application for trainee car loans. There are likewise lots of colleges as well as universities that supply working as a consultant and also assistance with concerns to the various pupil lendings as well as economic items.

Poor credit score pupil finances are financings which are particularly packaged for pupils with poor credit scores. If you can not certify for the basic trainee finance for any kind of factor, poor credit rating trainee financings are the following finest choice. As well as there are likewise several pupil finance monitoring firms that solely deal with various kinds of trainee car loans. An appropriate study job and also a contrast of various financing choices is needed prior to you use for a negative credit score pupil finance. These on-line poor credit report trainee fundings are normally temporary financings that do not call for any type of credit scores checks.

The post Rapid Speed Student Loans Approval Even With Bad Credit appeared first on ROI Credit Builders.

New comment by AdrianSalgado in "Ask HN: Freelancer? Seeking Freelancer? (August 2019)"

SEEKING WORK | Frontend Developer | Remote or Europe

Hello, I’m a Frontend Developer with 6 years of experience, working with React/Redux and VueJS for the past 2 years, I’ve also worked with React Native and would really love to keep working on something like that, really liked how it works.

I’ve also worked with NodeJS, Express, Postgres.

Currently have full time availability (40 hours a week),

Linkedin: linkedin.com/in/salgadoadrian

CV: https://docs.google.com/document/d/1rGhY4hH3SDGaPLWE34ZeOvv5…

Email: adriansalgadoa@gmail.com