Dagen McDowell and the panel on “The Five” Thursday discussed President Biden’s July call with former Afghan President Ghani to portray the situation in Afghanistan as better than the reality on the ground.

Tag: about

Colts' Darius Leonard on not getting COVID-19 vaccine: 'I want to get more educated about it'

Indianapolis Colts linebacker Darius Leonard spoke to reporters on Thursday about being unvaccinated. The three-time All-Pro said not getting the COVID-19 vaccine is a “personal decision” and he believes in getting “comfortable with something” before putting it into your body.

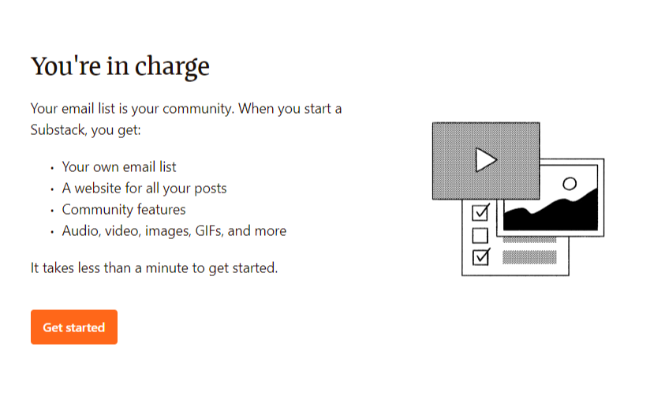

All About Substack: Competitors, Features, and Audience

Do you love to write? Draw? Create in any way? Do people tell you that you should try using your creative skills to make a living?

Do you shrug them off because you don’t know how to get started or because you don’t feel you have the time to commit to unpaid work? After all, many people get their journey started writing free content in newsletters and blog posts.

That’s where Substack comes in. You get to write and get paid—even if you don’t have a following yet.

If you’re curious to know more, stick around. I’m breaking down Substack and its many competitors to help you determine if this is the path for you.

What Is Substack?

In 2017, Substack took the market by storm by allowing creatives, journalists, and bloggers to make money from their own email newsletters. Substack provides a way to build an email marketing list, write newsletters, charge subscribers, and manage payments.

This platform offers an intuitive email creator that helps writers create interesting emails with links, images, content, and more. It lends itself towards all sorts of creators, including:

We will focus on writers and bloggers today, but you should keep this site in mind if you’re involved with comics or podcasting.

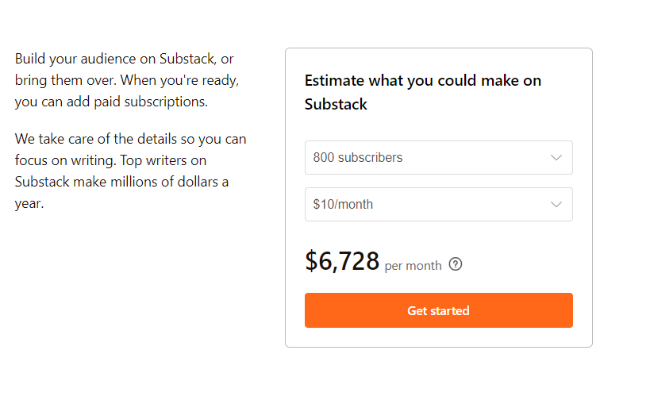

You can begin using Substack for free. However, as you begin to build a following, you could opt for a premium option, running $5 to $75 per month.

When you use a premium level, you can charge your readers. Substack only gets paid when you get paid, taking a 10 percent cut. Stripe takes an additional 2.9 percent plus 30 cents. As you can likely tell, you need to have a solid following to make a decent buck on Substack.

Even with that amount taken out, Substack has the potential to become a viable profit source.

Substack Features

At the core, Substack is an email marketing platform. Whether you choose to go the paid or free route, that’s up to you. Here are some of the ways that you can make use of Substack.

Free Newsletters

Using a free Substack newsletter is a great way to grow your brand, develop your voice, and build a name for yourself. If you don’t have a large following, this is a great place to start. Create valuable content for your small following and offer it for free.

Don’t use Substack in a vacuum; pair it with a website. This allows you to invite readers to your site using a CTA and potentially turn them into buyers.

Paid Newsletters

While a free newsletter has the potential to make you money on the backend, you can use paid newsletters to make money on the front end.

You can publish as many newsletters as you want, and there are little to no guidelines on what you can write. Remember that people will factor in how much value they’re getting based on how much you’re charging them. If you’re charging $75 per month but only publishing two newsletters, you may lose subscribers.

If someone is willing to pay to read your writing, it means they want to read it regularly. Therefore, getting in the habit of publishing consistently is the best strategy. This way, the readers know what to expect, and you can plan accordingly.

Who Is Substack’s Audience?

The best thing about Substack is the wide variety of subscribers for you to tap into. The writers on Substack include journalists, celebrities, political analysts, food writers, world travelers, and more. Most of the writing you’ll find on Substack would classify as personal writing, opinion, or research and analysis.

In the interest of transparency, Substack has experienced some controversy relevant to portions of its audience. Writers accused of transphobia, harassment, and other negative behaviors have found homes on the platform, as it isn’t heavily moderated. While your audience is your own and not tied to any other creator’s, this is something to factor in when considering how your particular audience may respond.

As for the audience, you have your choice of writing whatever it is you want because chances are, there is someone out there willing to pay to read your writing if it’s valuable. If you’re targeting a more niche audience, you may be able to charge more to a small set of subscribers because they need more resources. If you’re after a broader niche, you could charge less but reach more people.

You have the freedom to choose the direction you want to go with your Substack newsletters, but the options are nearly endless.

3 Tips Using Substack for Marketing

There is serious potential to make a lot of money and reach a lot of people on Substack, but you have to know how to do it. So, here are some tips for marketing on Substack.

1. Start With Free Newsletters

You can’t introduce yourself out of nowhere and expect them to subscribe for a monthly fee if they have no idea who you are. You have to provide something valuable.

Eventually, readers could become enticed by your content and want more of it. Once you get to that point, start thinking about charging people.

One of the biggest mistakes people make is moving from free to paid too soon. You need to be strategic, making sure your audience is genuinely engaged and would be willing to pay for your work.

Even if you wait until the perfect moment, you may still lose followers. People used to getting something for free may balk when asked to pay. But, if you provide excellent content, have a committed following, and charge a reasonable price, you increase your chances of keeping the majority of your subscribers.

2. Have a Strong Offer

Offer more than a newsletter; give your subscribers something they can’t turn down. For example, you could have an exclusive social media group for subscribers or even offer one-on-one conversations or coaching, depending on your field. You could also offer subscriber-only discounts for any products you may sell.

Write to your audience and include a CTA to get people to click on your offer. This could be an excellent way to convert these hot leads.

3. Consider Multiple Publications

Substack allows you to have as many newsletters as you want—meaning you could have a free and paid version. This strategy allows you to continue to engage with your entire audience.

To get readers to move to your paid option, you need to offer a little bit more. Make the content more exclusive, valuable, and personal.

You can also have multiple free publications if you want to spread yourself across a few different niches. For example, digital marketing is highly diverse with a variety of different subjects. So, you could have a newsletter about SEO and another about social media marketing, both driving readers to your website.

Substack Competitors

There are a ton of Substack alternatives, so making a decision can be challenging. Let’s take a look at some of their biggest competitors so you can choose the platform that’s right for you.

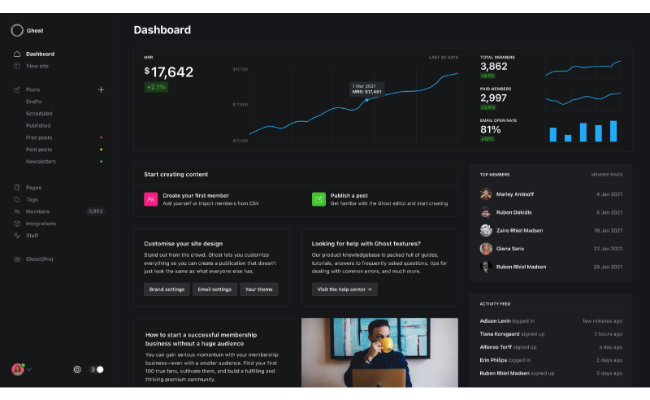

Substack Vs. Ghost

The goal of Ghost is to help you build a loyal following to generate income you can rely on. As with Substack, you charge subscribers a monthly fee in exchange for your content.

What separates Ghost from Substack is the way they take payment. Ghost charges nine dollars per month and takes none of your revenue. This makes the platform highly scalable. You also get custom email addresses, domains, and access to a referral program.

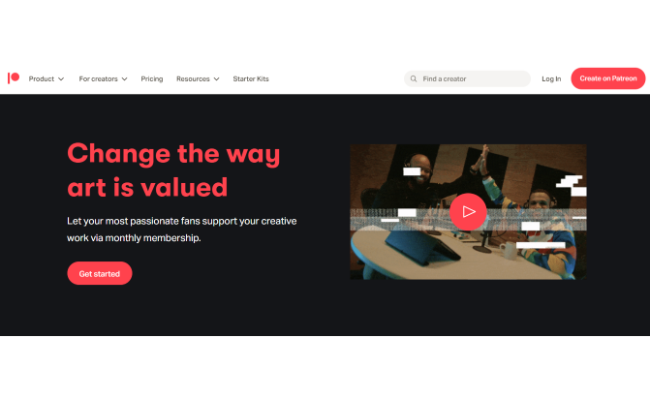

Substack Vs. Patreon

Patreon is a subscription platform allowing creatives to charge for their work. The platform looks like a social media feed to users, and they get to scroll through the work of everyone to whom they subscribe rather than trying to go from place to place.

Patreon’s biggest perk is its tiered package option. You can provide people with various options to appeal to their budget and how much they want from you, all from one location. For example, at a $1 level, you could send subscribers one newsletter per week. At a $5 level, you could send them two newsletters or a newsletter and access to a video.

Patreon plans range from five to 12 percent of your monthly income plus processing fees of 2.9 percent plus 30 cents.

Substack Vs. Medium

Medium is well-known for being a haven for creatives who simply want to make their voices known, and much of it is free to access. As a bonus, Medium articles often rank pretty well SEO-wise.

If you upgrade to a paid Medium profile, you can charge for some or all of your content.

Rather than any kind of flat fee or percentage, Medium pays based on “reading time.” The more time people spend reading your content, the more money you make. You can also get paid by referring people to the platform through your unique code.

Substack Frequently Asked Questions

Here are some of the most frequently asked questions about Substack.

Is it free to access Substack?

Substack is free to write newsletters and build a following on. It only costs money when you upgrade to paid and start to generate revenue from your subscriptions.

Can I advertise on Substack?

Substack does not run ads. The only way Substack makes money is through their cut of subscription fees.

Should I make a Substack?

Only you can answer this. Do you have great content ideas? Do you have a small following that you can nurture and grow? If yes, starting a Substack could be a great way to grow that following and eventually profit from it.

Does Substack own your content?

No. You retain ownership of everything published on Substack. While you cannot export content out of Substack once you publish it, you maintain ownership even if you use a different platform later.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Is it free to access Substack? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Substack is free to write newsletters and build a following on. It only costs money when you upgrade to paid and start to generate revenue from your subscriptions.

”

}

}

, {

“@type”: “Question”,

“name”: “Can I advertise on Substack? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Substack does not run ads. The only way Substack makes money is through their cut of subscription fees.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I make a Substack? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Only you can answer this. Do you have great content ideas? Do you have a small following that you can nurture and grow? If yes, starting a Substack could be a great way to grow that following and eventually profit from it.

”

}

}

, {

“@type”: “Question”,

“name”: “Does Substack own your content?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

No. You retain ownership of everything published on Substack. While you cannot export content out of Substack once you publish it, you maintain ownership even if you use a different platform later.

”

}

}

]

}

All About Substack: Conclusion

Building a following is not an easy task, and that’s why we offer assistance to marketers and creatives looking to build or grow their following quickly.

Whether you’re going it alone or getting help, you need to be consistent and patient as you grow the following. Of course, building an email list is easier said than done, but with some hard work and focus, Substack could help you get your writing career off the ground.

What advice do you have for new writers wanting to build a following on Substack?

Find Out About Equifax Reporting

Did You Want to Learn About Equifax Reporting?

It is time to learn about the business credit reporting agencies. More specifically, Equifax reporting.

But let us start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization is not going to affect your consumer FICO score. Plus the business owner is not going to be personally liable for the debt the business incurs.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you are going to get approval for business financing. Today, let us concentrate on Equifax reporting.

There are Three Different Credit Bureaus – But What Differentiates Equifax Reporting?

What distinguishes the three biggest credit bureaus? And can you use that information to your advantage?

There are three main credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. CreditSafe and FICO SBSS are also players in this space.

In the business world Equifax and Experian are up there, but it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. For more details, see dnb.com/about-us/company.html. Even when talking about Equifax reporting, it makes sense to start with Dun and Bradstreet. You are going to have to start the business credit building process with them anyway.

Dun & Bradstreet

Go to Dun and Bradstreet’s website and look for your business, at dnb.com/duns-number. What happens if you can’t find it? Then get a free D-U-N-S number. You are going to always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

D-U-N-S Numbers

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once you are in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Equifax Reporting

You can check out a sample of Equifax reporting at https://assets.equifax.com/assets/usis/small_business_sample_credit_report.pdf.

Keep your business protected with our professional business credit monitoring.

The company gets its data from a data sharing agreement with the Small Business Exchange, Net 30 type industry trade credit information, and from a wide variety of suppliers that provide products and services to businesses on an invoice basis.

Equifax combines financial data with industry trade credit data. They add in utility and telephone data and public record information (bankruptcies, judgments, and tax liens).

Here’s what that report says.

Company Identifying Information

The first section is devoted to identifying information about your company, namely your business name and address and telephone number. This section will also include your Equifax ID. An Equifax ID is how Equifax can tell your business from similarly-named businesses.

Credit Risk Score

The next section is about the Credit Risk Score. This score runs from 101 to 992. Higher numbers are better. This section also shows key factors.

Key factors are positives and negatives about your business, such as how old your oldest account is, and whether you have any charge-offs, and the size of your business.

Credit Utilization

The next section shows credit utilization. This is shown as a pie chart. It graphically shows which percent of your available credit line you are using. It also has identifying labels to show how much each percentage truly is. But it is only for your financial accounts.

Keep your business protected with our professional business credit monitoring.

Payment Index

The next part is your Payment Index. The score runs from 0 to 100. Higher numbers are better. It also shows Industry Median.

There is also a table explaining the numbers:

- 90+: Paid as Agreed

- 80-89: 1-30 days overdue

- 60-79: 31-60 days overdue

- 40-59: 61-90 days overdue

- 20-39: 91-120 days overdue

- 1-19: 120+ days overdue

Days Beyond Terms

This is a line graph. It shows the average days beyond terms by date reported. It is for non-financial accounts only. Plus it shows any recent trends, so if you’ve improved your payment habits, it will show up here.

Business Failure Score

The next piece is on your Business Failure Score. This score runs from 1000 to 1880. It shows its own key factors, like recent balance information.

Inquiries

The next section is devoted to inquiries. It shows the date, and whether it was an inquiry on a financial or non-financial account. This is a rather short part of the report.

Bureau Messages

The bureau messages part, appears to be a free form field. It seems its purpose is to add notes to a profile. These can be notes on the number of locations, or business aliases.

Bureau Summary Data

The bureau summary data section contains a wealth of information. It shows:

- The number of financial and non-financial accounts

- Date the credit became active

- Number of charge offs

- Total dollars past due

- Most severe status in 24 months

- Single highest credit extended

- Total current card exposure

- Median balance

- Average open balance

It also shows Recent Activity, which includes:

- The number of accounts delinquent

- New accounts opened

- Inquiries and

- Accounts updated

Public Records

The public records section has information on:

- Type Status:

- Bankruptcy

- Judgments

- Whether judgments are satisfied or not

- Liens filed and opened, or released

- Number

- Dollar and

- Most recent date filed

If there are none reported, then the date field will indicate as much.

Additional Information

The final section appears to contain somewhat miscellaneous information, which probably doesn’t fit in well anywhere else. such as alternate company Names and DBAs.

It also contains:

- Owners and Guarantor Names (name, type, date reported)

- Business and Guarantor Comments (seems to be another free form field) and

- Report Details (this shows the date the report was generated)

Improving Your Equifax Report

Now that you know what goes into it, you can see that some of the more important pieces of data Equifax looks into are:

- public records

- credit usage

- and how you handle your financial and nonfinancial accounts

Improve your Equifax score by:

- Clearing your debts as quickly as possible and not going delinquent

- Keeping credit utilization within reason, as that makes it easier to pay your bills

- And avoiding late payments

Whatever improves your Equifax report is bound to improve your reports at D&B and Experian. Paying off accounts pays dividends, as does avoiding bankruptcies.

Disputing Issues with Your Equifax Report

Equifax will not change your scores without proof. They are starting to accept more and more online disputes. Include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail so that you will have proof that you sent in your dispute. Correct Equifax issues at: equifax.com/small-business-faqs/#Dispute-FAQs. Be specific about the concerns with your report.

Monitoring Reporting

Use Equifax Complete. It currently costs $19.95 per month, after an offer of 30 days for $4.95. See equifax.com/equifax-complete/Equifax.

Monitoring Your Business Credit Scores and Reports at the Major Business CRAs

Add monitoring for all three big CRAs together for a year and it costs $468 for Dun and Bradstreet, $189 for Experian, and $224.40 for Equifax (with the special). So this is for a grand total of $881.40!

Monitoring Your Dun and Bradstreet, Experian, and Equifax Credit Scores and Reports

You can monitor your business credit at Dun and Bradstreet, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And this is all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see so you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and creditsuite.com/monitoring.

Equifax Data Breach

No blog post on Equifax reporting would be complete without at least mentioning the recent data breach. The company does seem to be better about making sure that consumers can get monitoring without having to jump through quite so many expensive hoops.

In addition, any pursuit of the company through Congress seems to have ground to a screeching halt. However, that may be due to the 2020 pandemic and election.

Will Equifax’s current and former management end up back in the hot seat again? Only time will tell.

Keep your business protected with our professional business credit monitoring.

Equifax Reporting: Takeaways

Equifax gets much of its data from the Small Business Financial Exchange.

Monitoring reports from all three of the bigger business credit reporting agencies is expensive. But you can save 90% by monitoring your Dun and Bradstreet, Experian, and Equifax scores through Credit Suite.

The post Find Out About Equifax Reporting appeared first on Credit Suite.

Find Out About Equifax Reporting

Did You Want to Learn About Equifax Reporting?

It is time to learn about the business credit reporting agencies. More specifically, Equifax reporting.

But let us start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization is not going to affect your consumer FICO score. Plus the business owner is not going to be personally liable for the debt the business incurs.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you are going to get approval for business financing. Today, let us concentrate on Equifax reporting.

There are Three Different Credit Bureaus – But What Differentiates Equifax Reporting?

What distinguishes the three biggest credit bureaus? And can you use that information to your advantage?

There are three main credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. CreditSafe and FICO SBSS are also players in this space.

In the business world Equifax and Experian are up there, but it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. For more details, see dnb.com/about-us/company.html. Even when talking about Equifax reporting, it makes sense to start with Dun and Bradstreet. You are going to have to start the business credit building process with them anyway.

Dun & Bradstreet

Go to Dun and Bradstreet’s website and look for your business, at dnb.com/duns-number. What happens if you can’t find it? Then get a free D-U-N-S number. You are going to always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

D-U-N-S Numbers

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once you are in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Equifax Reporting

You can check out a sample of Equifax reporting at https://assets.equifax.com/assets/usis/small_business_sample_credit_report.pdf.

Keep your business protected with our professional business credit monitoring.

The company gets its data from a data sharing agreement with the Small Business Exchange, Net 30 type industry trade credit information, and from a wide variety of suppliers that provide products and services to businesses on an invoice basis.

Equifax combines financial data with industry trade credit data. They add in utility and telephone data and public record information (bankruptcies, judgments, and tax liens).

Here’s what that report says.

Company Identifying Information

The first section is devoted to identifying information about your company, namely your business name and address and telephone number. This section will also include your Equifax ID. An Equifax ID is how Equifax can tell your business from similarly-named businesses.

Credit Risk Score

The next section is about the Credit Risk Score. This score runs from 101 to 992. Higher numbers are better. This section also shows key factors.

Key factors are positives and negatives about your business, such as how old your oldest account is, and whether you have any charge-offs, and the size of your business.

Credit Utilization

The next section shows credit utilization. This is shown as a pie chart. It graphically shows which percent of your available credit line you are using. It also has identifying labels to show how much each percentage truly is. But it is only for your financial accounts.

Keep your business protected with our professional business credit monitoring.

Payment Index

The next part is your Payment Index. The score runs from 0 to 100. Higher numbers are better. It also shows Industry Median.

There is also a table explaining the numbers:

- 90+: Paid as Agreed

- 80-89: 1-30 days overdue

- 60-79: 31-60 days overdue

- 40-59: 61-90 days overdue

- 20-39: 91-120 days overdue

- 1-19: 120+ days overdue

Days Beyond Terms

This is a line graph. It shows the average days beyond terms by date reported. It is for non-financial accounts only. Plus it shows any recent trends, so if you’ve improved your payment habits, it will show up here.

Business Failure Score

The next piece is on your Business Failure Score. This score runs from 1000 to 1880. It shows its own key factors, like recent balance information.

Inquiries

The next section is devoted to inquiries. It shows the date, and whether it was an inquiry on a financial or non-financial account. This is a rather short part of the report.

Bureau Messages

The bureau messages part, appears to be a free form field. It seems its purpose is to add notes to a profile. These can be notes on the number of locations, or business aliases.

Bureau Summary Data

The bureau summary data section contains a wealth of information. It shows:

- The number of financial and non-financial accounts

- Date the credit became active

- Number of charge offs

- Total dollars past due

- Most severe status in 24 months

- Single highest credit extended

- Total current card exposure

- Median balance

- Average open balance

It also shows Recent Activity, which includes:

- The number of accounts delinquent

- New accounts opened

- Inquiries and

- Accounts updated

Public Records

The public records section has information on:

- Type Status:

- Bankruptcy

- Judgments

- Whether judgments are satisfied or not

- Liens filed and opened, or released

- Number

- Dollar and

- Most recent date filed

If there are none reported, then the date field will indicate as much.

Additional Information

The final section appears to contain somewhat miscellaneous information, which probably doesn’t fit in well anywhere else. such as alternate company Names and DBAs.

It also contains:

- Owners and Guarantor Names (name, type, date reported)

- Business and Guarantor Comments (seems to be another free form field) and

- Report Details (this shows the date the report was generated)

Improving Your Equifax Report

Now that you know what goes into it, you can see that some of the more important pieces of data Equifax looks into are:

- public records

- credit usage

- and how you handle your financial and nonfinancial accounts

Improve your Equifax score by:

- Clearing your debts as quickly as possible and not going delinquent

- Keeping credit utilization within reason, as that makes it easier to pay your bills

- And avoiding late payments

Whatever improves your Equifax report is bound to improve your reports at D&B and Experian. Paying off accounts pays dividends, as does avoiding bankruptcies.

Disputing Issues with Your Equifax Report

Equifax will not change your scores without proof. They are starting to accept more and more online disputes. Include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail so that you will have proof that you sent in your dispute. Correct Equifax issues at: equifax.com/small-business-faqs/#Dispute-FAQs. Be specific about the concerns with your report.

Monitoring Reporting

Use Equifax Complete. It currently costs $19.95 per month, after an offer of 30 days for $4.95. See equifax.com/equifax-complete/Equifax.

Monitoring Your Business Credit Scores and Reports at the Major Business CRAs

Add monitoring for all three big CRAs together for a year and it costs $468 for Dun and Bradstreet, $189 for Experian, and $224.40 for Equifax (with the special). So this is for a grand total of $881.40!

Monitoring Your Dun and Bradstreet, Experian, and Equifax Credit Scores and Reports

You can monitor your business credit at Dun and Bradstreet, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And this is all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see so you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and creditsuite.com/monitoring.

Equifax Data Breach

No blog post on Equifax reporting would be complete without at least mentioning the recent data breach. The company does seem to be better about making sure that consumers can get monitoring without having to jump through quite so many expensive hoops.

In addition, any pursuit of the company through Congress seems to have ground to a screeching halt. However, that may be due to the 2020 pandemic and election.

Will Equifax’s current and former management end up back in the hot seat again? Only time will tell.

Keep your business protected with our professional business credit monitoring.

Equifax Reporting: Takeaways

Equifax gets much of its data from the Small Business Financial Exchange.

Monitoring reports from all three of the bigger business credit reporting agencies is expensive. But you can save 90% by monitoring your Dun and Bradstreet, Experian, and Equifax scores through Credit Suite.

The post Find Out About Equifax Reporting appeared first on Credit Suite.

The post Find Out About Equifax Reporting appeared first on Buy It At A Bargain – Deals And Reviews.

What is Your Experian Credit Report All About?

Did You Want to Learn About Your Experian Credit Report?

This is a terrific time to learn about your Experian credit report.

But first we should start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Rather, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

Also, there are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization won’t affect your consumer FICO score. Also, the business owner won’t to be personally liable for business debts.

Business Credit Details

Getting business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive. But some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are in your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you will get approval for business financing.

Lenders Use Data to Decide on Your Application

They check information from a variety of sources, and they do not tell you about any of them. Knowing what these secret sources measure can only help you. Understanding what matters the most makes getting a loan A LOT easier, because you know what to improve first. This information is the difference between getting an approval and getting a denial.

Records Congruency

Keep your records consistent! This includes your online records. Lenders and business credit bureaus are looking at everything, so it had better match.

Inconsistent records lead to a denial due to fraud because it’s how lenders interpret inconsistencies. Fixing this is in the business owner’s hands. You can change and correct this.

This means your business name, address, phone number – everything! – must look the same in these places and more:

- Every place your business has an online presence (your website, Yelp, SoTellUs, etc.)

- IRS records

- Records with Dun & Bradstreet, Experian, and Equifax

- All licenses needed to run your business

- Incorporation documents

Copy/paste this information; do not chance it with retyping.

There are Three Major Credit Bureaus – But What Makes Your Experian Credit Report so Different?

What distinguishes the three different main credit bureaus? Why is your Experian credit report such an outlier? And can you use this information to your advantage?

Business Credit Reporting Agencies

There are three different large credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. FICO SBSS and CreditSafe are also players.

In the business world Equifax and Experian are up there, but it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. In the business credit world there really is one major player, with two other much smaller ones. See dnb.com/about-us/company.html. It makes sense to start with Dun and Bradstreet when comparing the business CRAs. This is because you’ll have to start the business credit building process with them anyway.

Dun & Bradstreet

Dun and Bradstreet is the oldest and largest credit reporting agency. Go to Dun and Bradstreet’s website and look for your business, at dnb.com/duns-number. Can’t find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once you are in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Keep your business protected with our professional business credit monitoring.

Experian Business Credit

Business credit is in a business’s name, and it depends on how well a company can pay its bills. But Experian uses both consumer and business credit data to gauge risk.

“By combining personal and commercial credit information in one report, Experian provides a complete picture of the creditworthiness of small businesses”

You Will Need to Get Set Up with Experian

Get a BIN (Business Identification Number) from Experian. Experian’s BizSource assigns a BIN.

How Long Data Stays on Your Reports at the Different Credit Bureaus

Per Experian Business, bankruptcies stay for 7 to 10 years on your Experian credit report. Chapter 13 bankruptcy rolls off your credit report 7 years from the filing date. While Chapter 7 bankruptcy stays for 10 years from the filing date. Trade data stays on for 36 months. Judgments, collections, and tax liens stay on for 6 years and 9 months. UCC filings stay on for 5 years. See experian.com/small-business/how-long-credit-report. There are similar time frames for the two other main credit bureaus.

Let’s Look at an Experian Credit Report

We’ll look at a Typical Experian Business Credit Advantage SM Report. Experian provides a sample report where you can get an idea of what to expect. Experian changes its reports at times. So the best, most accurate and up to date source for this information is the Experian website. Find it online at https://sbcr.experian.com/pdp.aspx?pg=Sample-BCAI&hdr=report.

Business Background Information

The first part of a report contains:

- Name

- Address

- Main phone number

- Experian BIN

- Annual sales

- Business type (corporation, etc.)

- Date Experian file established

- Years in business

- Total number of employees

- Incorporation date and state

Experian Business Credit Score

Business Credit Scores range from 1 to 100. Higher scores indicate lower risk. This score predicts the chance of serious credit delinquencies in the next 12 months. It uses tradeline and collections data, public filings as well as other variables to predict future risk. This section of the report has a graph to visually indicate the score.

Key Score Factors:

- Number of commercial accounts with terms other than Net 1-30 days

- The number of commercial accounts that are not current

- Number of commercial accounts with high utilization

- Length of time on Experian’s file

Experian Financial Stability Risk Rating

Financial Stability Risk Ratings range from 1 to 5. Lower ratings indicate lower risk. A Financial Stability Risk Rating of 1 indicates a 0.55% potential risk of severe financial distress. So this is in the next 12 months.

Experian puts all businesses in one of the five risk segments. This rating predicts the chance of payment default and/or bankruptcy, in the next 12 months. This rating uses tradeline and collections information, public filings, and other variables to predict future risk.

Key Rating Factors:

- Number of active commercial accounts

- Risk associated with the business type

- Risk associated with the company’s industry sector

- Also, the employee size of business

Credit Summary

This section contains several counts of various data points. For the most part, the details are available further into the report.

The information outlined contains:

- Current Days Beyond Terms (DBT)

- Predicted DBT for a particular date

- Average industry DBT

- Payment Trend Indicator (stable, or not)

This section also contains:

- Lowest 6 month balance

- Highest 6 month balance

- Current total account balance

- Highest credit amount extended

- Median credit amount extended

- Number of payment tradelines

- How many lender consortium experiences

- Number of business inquiries

- Also, the number of UCC Filings

More on the Credit Summary

This part also contains:

- Number of Banking/Insurance/Leasing

- A percentage of businesses scoring worse than the company outlined in the report

- Number of bankruptcies

- How many liens

- Number of judgments filed

- Number of accounts in collections

- Also, the company background

Company background includes information on founding date, and where the company’s headquarters are. Also, there’s a basic background of what the business does.

Payment Trend Summary

This section starts with two graphs. They show the company in question versus its industry on Monthly payment trends and Quarterly payment trends.

These are the percentages of on-time payments by month and quarter, respectively.

This part then shows tables with recent payment information by month and quarter. Then there are three more graphs:

- Continuous Payment Trends: continuous distribution with DBT (days beyond terms)

- Newly Reported Payment Trends: newly reported distribution with DBT

- Combined Payment Trends: combined distribution with DBT

Trade Payment Information

This next part shows details on payment experiences (financial trades). There is also data on lender consortium experiences (financial exchange trades):

- Tradeline experiences (continuous trades)

- Aged trades

- Payment trend detail

- There is also a link to send any missing payment experiences

Keep your business protected with our professional business credit monitoring.

Inquiries, Collection Filings, and Collections Summary

The Inquiries part contains the industry making the inquiry and a total made during a given month. The Collection Filings sector has the date, name of the agency, and status (open or closed). If a collection is closed, the Collection Filing sector also contains the closing date. The Collections Summary shows: status, number of collections, dollar amount in dispute, and amount collected (even if $0).

Commercial Banking, Insurance, Leasing

For leasing, this section shows:

- Leasing institution name and address

- Product type

- Lease start date and term

- Original and remaining balances

- The scheduled amount due

- And the number of payments per year

- Also, the number of payments which are current, late, or overdue

Judgement Filings

This sector includes:

- Date and plaintiff

- Filing location

- Legal type and action

- Document number

- Also, liability amount

This sector includes cases where the company in the report is the plaintiff or the defendant

Tax Lien Filings

This part has:

- Date and owner

- Filing location

- Legal type and action

- Document number

- Liability amount

- Also, description

UCC Filings

This section has:

- Date

- Filing number

- Jurisdiction

- Secured party

- Also, Activity (filed, or not)

Keep your business protected with our professional business credit monitoring.

UCC Filings Summary

This part shows:

- Filing period

- Number of cautionary filings

- Total filed

- The total released

- Total continued

- Also, Amended/Assigned

Cautionary UCC Filings include one or more of the following collateral:

- Accounts

- Accounts receivable

- Contracts

- Hereafter acquired property

- Leases

- Notes receivable, or

- Proceeds

Score Improvement Tips

Experian offers suggestions on how to improve your reports, such as:

- Getting net-30 terms, if possible, from existing and future tradeline suppliers

- Paying accounts on time or working with the tradeline supplier to work out a payment plan so a business is not reported delinquent

- Lowering credit utilization

- Also, making sure all the information in the report is correct

Disputing Issues with Your Experian Business Credit Report

None of the different business bureaus will change your scores without proof. They are starting to accept more and more online disputes. But include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail. This is so you have proof you sent in your dispute. Also, be specific about the concerns with your report.

You can correct Experian issues at: experian.com/small-business/business-credit-information.

Monitoring Your Experian Credit Report and Scores

The costs of monitoring at all three big business credit reporting agencies can add up fast. At Experian, your best (least expensive) bet would be a Business Credit Advantage. Subscription Plan. It currently costs $189 per year. See sbcr.experian.com/pdp.aspx?pg=Sample&link.

Monitor Business Credit at D&B, Experian, and Equifax for Less

Experian’s reports are expensive! But did you know you can get business credit monitoring for all 3 of the big business CRAs, and all in one place – for less? Credit Suite offers monitoring through its Business Finance Suite (through Nav). See what credit issuers and lenders also see, so you can directly improve your scores and get the business credit & funding you need. See suitelogin.com and creditsuite.com/monitoring.

Improving Your Company’s Experian Credit Report

Make sure vendors are reporting your payments, and not just with Experian. Pay bills early or on time, in full. For Experian, historical behavior (payment history) = 5-10% of total score. Try to maintain your personal credit utilization at about 20 – 30% of your limits or less. Don’t close positive accounts even if you no longer use them. And try to avoid derogatories like liens.

Your Experian Credit Report: Takeaways

Experian has revamped their reports dramatically. Also, this major business credit reporting agency is committed to correct data, and to helping companies improve their reports. So to monitor Experian, Equifax, and Dun and Bradstreet for a lot less, monitor through Credit Suite!

The post What is Your Experian Credit Report All About? appeared first on Credit Suite.

Learn About Your Equifax Credit Report

Did You Want to Learn About Your Equifax Credit Report?

It is time to learn about your Equifax credit report.

But let us start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Instead, business credit scores are going to depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization is not going to affect your consumer FICO score. Plus the business owner is not going to be personally liable for the debt the business incurs.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you will get approval for business financing. Today, let us concentrate on your Equifax report.

Build Fundability on Business Credit Applications to Avoid Denials

Keep your business looking fundable (legit) with:

- A professional website and email address

- A toll-free phone number

- List your phone number with 411

- A business address (not a PO box or a UPS box)

- Get all necessary licenses for running your business

Fundability: Industry Alignment

If your business is over the road trucking, then it needs to be listed that way. Pro tip: when your industry can be called several different names, like long distance trucking, mention those other phrases on your website.

There are Three Main Credit Bureaus – But What Differentiates an Equifax Credit Report?

What distinguishes Equifax reports from reports from the other two main credit bureaus? And can you use that information to your advantage?

Business Credit Reporting Agencies

There are three different credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. FICO SBSS and CreditSafe are also players.

In the business world Equifax and Experian are up there, but it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. For more information, see dnb.com/about-us/company.html. It makes sense to start with Dun and Bradstreet, even when looking at your Equifax credit report. This is because you are going to have to start the business credit building process with them anyway.

Dun & Bradstreet

Dun and Bradstreet is the oldest and largest credit reporting agency. Go to Dun and Bradstreet’s website and look for your business, at dnb.com/duns-number. But what happens if you are unable to find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once you are in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Keep your business protected with our professional business credit monitoring.

Your Equifax Credit Report

But your Equifax credit report is going to be different. The company gets its data from:

- A data sharing agreement with the Small Business Exchange

- Net 30 type industry trade credit information from a wide variety of suppliers

- These suppliers provide products and services to businesses on an invoice basis

Equifax scores answer one basic question. How likely is a business to go severely delinquent in its payments? The score is an indication of whether a company is likely to make late payments.

You can check out a sample Equifax credit report for small business at https://assets.equifax.com/assets/usis/small_business_sample_credit_report.pdf.

Here’s what’s in that report.

Company Identifying Information

The first section is devoted to identifying information about your company, namely your business name and address and telephone number. This section will also include your Equifax ID. An Equifax ID is how Equifax can tell your business from similarly-named businesses.

Credit Risk Score

The next section is about the Credit Risk Score. This score runs from 101 to 992. Higher numbers are better. This section also shows key factors.

Key factors are positives and negatives about your business, such as how old your oldest account is, and whether you have any charge-offs, and the size of your business.

Credit Utilization

The next section shows credit utilization. This is shown as a pie chart. It graphically shows which percent of your available credit line you are using. It also has identifying labels to show how much each percentage truly is. But it is only for your financial accounts.

Payment Index

The next part is your Payment Index. The score runs from 0 to 100. Higher numbers are better. It also shows Industry Median.

There is also a table explaining the numbers:

- 90+: Paid as Agreed

- 80-89: 1-30 days overdue

- 60-79: 31-60 days overdue

- 40-59: 61-90 days overdue

- 20-39: 91-120 days overdue

- 1-19: 120+ days overdue

Days Beyond Terms

This is a line graph. It shows the average days beyond terms by date reported. It is for non-financial accounts only. Plus it shows any recent trends, so if you’ve improved your payment habits, it will show up here.

Business Failure Score

The next piece is on your Business Failure Score. This score runs from 1000 to 1880. It shows its own key factors, like recent balance information.

Inquiries

The next section is devoted to inquiries. It shows the date, and whether it was an inquiry on a financial or non-financial account. This is a rather short part of the report.

Bureau Messages

The bureau messages part, appears to be a free form field. It seems its purpose is to add notes to a profile. These can be notes on the number of locations, or business aliases.

Bureau Summary Data

The bureau summary data section contains a wealth of information. It shows:

- The number of financial and non-financial accounts

- Date the credit became active

- Number of charge offs

- Total dollars past due

- Most severe status in 24 months

- Single highest credit extended

- Total current card exposure

- Median balance

- Average open balance

It also shows Recent Activity, which includes:

- The number of accounts delinquent

- New accounts opened

- Inquiries and

- Accounts updated

Keep your business protected with our professional business credit monitoring.

Public Records

The public records section has information on:

- Type Status:

- Bankruptcy

- Judgments

- Whether judgments are satisfied or not

- Liens filed and opened, or released

- Number

- Dollar and

- Most recent date filed

If there are none reported, then the date field will indicate as much.

Additional Information

The final section appears to contain somewhat miscellaneous information, which probably doesn’t fit in well anywhere else. such as alternate company Names and DBAs.

It also contains:

- Owners and Guarantor Names (name, type, date reported)

- Business and Guarantor Comments (seems to be another freeform field) and

- Report Details (this shows the date the report was generated)

Improving Your Equifax Report

Now that you know what goes into it, you can see that some of the more important pieces of data Equifax looks into are:

- public records

- credit usage

- and how you handle your financial and nonfinancial accounts

Improve your Equifax score by:

- Clearing your debts as quickly as possible and not going delinquent

- Keeping credit utilization within reason, as that makes it easier to pay your bills

- And avoiding late payments

Whatever improves your Equifax report is bound to improve your reports at D&B and Experian. Paying off accounts pays dividends, as does avoiding bankruptcies.

Disputing Issues with Your Equifax Report

Equifax will not change your scores without proof. They are starting to accept more and more online disputes. But include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail so that you will have proof that you sent in your dispute. Correct Equifax issues at: equifax.com/small-business-faqs/#Dispute-FAQs. Be specific about the concerns with your report.

Monitoring Equifax Credit Report Scores

At Equifax, you would use Equifax Complete. It currently costs $19.95 per month, after an offer of 30 days for $4.95. See equifax.com/equifax-complete/Equifax.

Keep your business protected with our professional business credit monitoring.

Monitoring Your Equifax Credit Report and Other Business Credit Reports

But add together monitoring for the three biggest credit reporting agencies for a year and the cost is staggering. It costs $468 for Dun and Bradstreet, $189 for Experian, and $224.40 for Equifax (with a special). For a grand total of $881.40!

Monitoring Your Dun and Bradstreet, Experian, and Equifax Credit Report and Scores

You can monitor your business credit at Dun and Bradstreet, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see so you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and creditsuite.com/monitoring.

Your Equifax Credit Report: Takeaways

Equifax gets much of its data from the Small Business Financial Exchange.

Monitoring all of your business credit reports is always going to be expensive. But you can save 90% by monitoring your Dun and Bradstreet, Experian, and Equifax scores through Credit Suite.

The post Learn About Your Equifax Credit Report appeared first on Credit Suite.

Learn About Your Equifax Credit Report

Did You Want to Learn About Your Equifax Credit Report? It is time to learn about your Equifax credit report. But let us start with some definitions and background on business credit. Business Credit This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. … Continue reading Learn About Your Equifax Credit Report

What The Boy Scouts’ Settlement Says About Justice for Child Sex Abuse Victims

Child protection advocate Marci Hamilton on the Boy Scouts’ sexual abuse settlement and why she says justice has not been served.

The post What The Boy Scouts’ Settlement Says About Justice for Child Sex Abuse Victims appeared first on Buy It At A Bargain – Deals And Reviews.

Learn About Dun & Bradstreet Reports

Did You Want to Learn About Dun & Bradstreet Reports?

It’s time to learn about Dun & Bradstreet reports.

But let’s start with some definitions and background on business credit.

Business Credit

This is credit in a business’s name. It does not tie to the owner’s creditworthiness. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

Also, there are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. Also, there is no personal credit reporting of business accounts. Business credit utilization won’t affect your consumer FICO score. Plus the business owner isn’t personally liable for the debt the business incurs.

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive,and some of them are not.

Business Credit Reporting Agencies

There are three chief credit bureaus for business: Dun & Bradstreet, Experian, and Equifax.

In the business world Equifax and Experian are up there, but it’s Dun & Bradstreet which is the major player.

D&B has more than 10 times the records of the next closest reporting agency. See dnb.com/about-us/company.html.

What are in a Dun& Bradstreet Reports?

Do you have a copy of your Dun and Bradstreet report?

What is Dun and Bradstreet?

They are the oldest and largest credit reporting agency. You need a D-U-N-S number to start building business credit. Go to D&B’s website and look for your business, atdnb.com/duns-number. Can’t find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number and get into their system: dnb.com/duns-number/get-a-duns.html.

The main score is PAYDEX. But a business will not get a PAYDEX score, unless it has at least 3 trade lines reporting, and a D-U-N-S number. A business needs both to get a D&B score or report.

Dun & Bradstreet Reports

D&B offers database-generated reports. These help their clients decide if a business is a good credit risk. Companies use the reports to make informed business credit decisions and avoid bad debt.

Usually, when D&B does not have all of the information that they need, they say so in their reports. But missing data does not necessarily mean a company is a poor credit risk. Rather, the risk is unknown.

D&B’s database contains over 350 million companies around the world. It includes millions of active firms, and over 100 million companies which are out of business. But they keep these for historical purposes. This data goes into their reports.

D&B lists over a billion trade experiences. For as accurate a report as possible, give D&B your company’s current financial statements.

To see a sample Business Information Report, go to products.dandb.com/download/2019_BIR-Snapshot-Report.pdf

Predictive Models and Scoring

D&B takes historical information to try to predict future outcomes. This is to identify the risks inherent in a future decision. They take objective and statistically derived data, rather than subjective and intuitive judgments.

Dun & Bradstreet Reports: Sections

Here are the sections you could currently see in a typical Dun and Bradstreet business credit profile report.

Executive Summary

The report starts with basic company information, such as number of employees, year the business was started, net worth, and sales.

D&B Rating

This rating helps companies quickly assess a business’s size and composite credit appraisal. Dun & Bradstreet bases this rating on information in a company’s interim or fiscal balance sheet plus an overall evaluation of the firm’s creditworthiness. The scale goes from 5A to HH. Rating Classifications show company size based on worth or equity. D&B assigns such a rating only if a company has supplied a current financial statement.

The rating contains a Financial Strength Indicator. It is calculated using the Net Worth or Issued Capital of a company. Preference is to use Net Worth. D&B will show if a business is new or if they never got this information.

This section also adds a Composition Credit Appraisal. This number runs 1 through 4. Also, it reflects D&B’s overall rating of a business’s creditworthiness.

The scores mean:

- 1 – High

- 2 – Good

- 3 – Fair

- 4 – Limited

A D&B rating might look like 3A4.

Keep your business protected with our professional business credit monitoring.

D&B PAYDEX

This part shows two gauges. One is an up to 24 month PAYDEX. There’s also an up to 3 month PAYDEX. Hence you can see recent history and a firm’s performance over time.

Both gauges have the same scores. A 1 means greater than 120 days slow (in paying bills). A score of 50 means 30 days slow. One great score is 80, which means prompt. Also, 100 means anticipates. A 100 is the best PAYDEX score you can get.

PAYDEX Score

This is Dun & Bradstreet’s dollar-weighted numerical rating of how a company has paid the bills over the past year. D&B bases this score on trade experiences which various vendors report. The Score ranges from 1 to 100. Higher scores mean a better payment performance. PAYDEX scores reflect how well a company pays its bills.

Predictive Analytics

This next section shows likelihood of business failure. It also shows how frequently a business is late in paying its financial obligations. These are comparative analyses, the Financial Stress Class, and the Credit Score Class.

Financial Stress Class

Overall numbers range from 1 to 5. A 1 is businesses least likely to fail. Also, a 5 is firms most likely to fail. The Financial Stress Class measures likelihood of failure.

Financial Stress Class Score

These more granular scores range from 1,001 to 1,875. A score of 1,001 represents the highest chance of business failure. Also an 1,875 shows the lowest chance of business failure.

Credit Score Class

The Credit Score Class measures how often a company is late paying its bills. Overall numbers range from 1 to 5. A 1 is businesses least likely to be late. 5 is firms most likely to be late making payments. More granular scores run from 101 to 670. 670 is the highest risk.

Credit Limit Recommendation

It shows a spectrum of risk. Your risk category can be low, moderate, or high. Risk is assessed using D&B’s scoring methodology. It is one factor used to create the recommended limits.

D&B Viability Rating

This section contains:

- Viability Score – to show risk

- Portfolio Comparison – also a demonstration of risk

- Data Depth Indicator – descriptive vs. predictive

- Company Profile – this shows if financial data and other information was available

Credit Capacity Summary

This part repeats the D&B Rating above. It includes financial strength, the composite credit appraisal, and payment activity.

Business History and Business Registration

This section contains information on ownership. It also shows where a corporation is filed (i.e. which state). This includes the type of corporation, and the incorporation date.

Government Activity Summary and Operations Data

This section gives basic information on if a company works as a contractor for the government. It also shows the kind of business a company is in. It shows what the facilities are like, including general data on its location.

Industry Data and Family Tree

The section shows the business’s SIC and NAICS codes. It also shows where the branches and subsidiaries are. This list is just the first 25 branches, subsidiaries, divisions, and affiliates, both domestic and international. D&B also offers a Global Family Linkage Link to view the full listing.

Financial Statements

This section is for the financial statements D&B has on a business. It shows assets and liabilities, with specifics such as equipment, and even common stock offerings.

Indicators and Full Filings

This part shows public records, like judgments, liens, lawsuits, and UCC filings.

This part also breaks down where filings are venued, like the court or the county recorder of deeds office. It shows if judgments were satisfied (paid). It also shows which equipment is subject to UCC filings.

Commercial Credit Score

This part shows the Credit Score Class again. It also shows a comparison of the incidence of delinquent payments. It also includes key factors to help anyone reading the report interpret these findings. Also, it explains what the numbers mean.

Credit Score Percentile Norms Comparison

Here, D&B compares a company to others on the basis of region, industry, number of employees and time in business.

Financial Stress Score

This section shows a Financial Stress Class and a Financial Stress Score Percentile. The Financial Stress Class runs from 1-5, with 5 being the worst score.

Financial Stress Score Percentile

The Financial Stress Score Norms calculate an average score and percentile for similar firms. The norms benchmark where a business stands. This is in relation to its closest business peers.

It is a comparison to other businesses. The percentile contains a Financial Stress National Percentile. The Financial Stress National Percentile reflects the relative ranking of a company among all scorable companies in D&B’s file. It also contains a Financial Stress Score. The report shows the chance of failure with a particular score.

Keep your business protected with our professional business credit monitoring.

Financial Stress Score Percentile Comparison

The idea behind this score is to predict how likely it is a business will fail over the next 12 months. The Financial Stress Class shows a firm shares some of the same business and financial characteristics of other companies with this classification. It does not mean the firm will necessarily experience financial stress. The chance of failure shows the percentage of firms in a given percentile that discontinue operations with loss to creditors.

The average chance of failure comes from businesses in D&B’s database. It is provided for comparative purposes. The Financial Stress National Percentile reflects the relative ranking of a company among all scorable companies in D&B’s file. The Financial Stress Score offers a more precise measure of the level of risk than the Financial Stress Class and Percentile. It is meant for customers using a scorecard approach to determining overall business performance.

Advanced PAYDEX + CLR

This section repeats the 24 month and 3 month PAYDEX gauges. It also includes a repeat of the Credit Limit Recommendation. There is also a PAYDEX Yearly Trend. It shows the PAYDEX scores of a business compared to the Primary Industry from each of the last four quarters.

PAYDEX Yearly Trend

The PAYDEX Yearly Trend is a graph. It includes detailed payment history. with payment habits and a payment summary. This helps show if a business pays its bigger bills first or last.

Correcting Your Dun &Bradstreet Reports

Get your report from D&B at www.dnb.com/about-us/our-data.html. Update the relevant information if there are mistakes or the information is incomplete. At D&B, you can do this at: dnb.com/duns-number/view-update-company-credit-file.html.

Keep your business protected with our professional business credit monitoring.

Disputing Issues with Dun & Bradstreet Reports

None of the different business bureaus will change your scores without proof. They are also starting to accept more and more online disputes. Include proofs of payment with it. These are documents like receipts and also cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail. This is so you will have proof that you sent in your dispute.

Be specific about the concerns with your report. D&B wants you to go through their Customer Service. You can also go through D&B Customer Service to add payment experiences. D&B’s Customer Service contact number can be found at dandb.com/glossary/paydex.

Monitoring Dun &Bradstreet Reports

Business credit reports are not always perfectly correct. All of the major CRAs are committed to accuracy. But you won’t know there are errors unless you monitor your business credit reports.

For D&B only, you can monitor your reports via CreditMonitor. It currently costs $39/month. See dnb.com/products/small-business/credit-monitor.html.

Monitoring Experian, Equifax, and Dun & Bradstreet Reports

You can monitor your business credit at D&B, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see. So you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and also creditsuite.com/monitoring.

Dun & Bradstreet Reports: Takeaways

Dun & Bradstreet reports sport an impressive level of detail. The idea is to make it easier to decide if it’s a good idea to extend credit to another business. Also, your own company’s report can help show you where you can improve payment history. Also, you can see how your firm compares to similar businesses.

D&B is the largest business CRA. A D-U-N-S number is an absolute necessity for business credit building.

Monitoring all of your reports is expensive. But you can save 90% by monitoring your D&B, Experian, and Equifax scores through Credit Suite.

The post Learn About Dun & Bradstreet Reports appeared first on Credit Suite.