What is Business Credit and How Does it Affect Fundability?

There is a lot of talk out there about what is business credit. That’s an important question, but it cannot be answered without another question coming up. That is, how does it affect fundability? Then of course, the question can be asked, what exactly is fundability? All of these questions build on each other.

What is Business Credit? It’s the Cornerstone of Fundability

The truth is, business credit is a huge piece of overall fundability. It isn’t everything, but I’d venture to say if how you set up your business is the foundation of fundability, business credit is the cornerstone. Consider how a building is made of thousands of stones, but one crack in the foundation or chink in the cornerstone can bring it all crashing down. The same is true of business credit. You can lose a stone here or there and, while it will definitely cause trouble, as long as the foundation and cornerstone are solid you have something to work with.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

First, what is Fundability?

Before I can answer what biz credit is, I need to address fundability. In short, fundability is how a lender views a borrower in terms of credit risk. Most borrowers believe this has mainly to do with credit history. In part, this is true. It does have a lot to do with credit history. However, there is way more to it than that.

Pieces of the Fundability Puzzle

There are many things that affect fundability. Since it all connects to form a bigger picture, I like to think of it as a puzzle. The pieces of the puzzle can be named however, and it is easier to put them together if you work on them in order. If you work in order, the other pieces will usually fall into place pretty easily. You can still complete the puzzle if you work it differently, but it will be harder and take longer.

In the case of fundability, you should start with the foundation. Think of this as the corners and the edges of the puzzle. Everyone knows the puzzle goes faster if you start with those pieces, right?

Foundation of Fundability

There are many pieces that help a business form a fundable foundation. They are related to how your business is set up. It includes, among other things, being certain you incorporate your business. This is vital. Find out more about how to build a foundation of fundability, as well more about fundability in general, go here.

Next Comes Business Credit

After the foundation, business credit is one of the largest pieces of the puzzle. If you can get it into place, you will be able to start to see the bigger picture. It can take a while to build this piece however. It’s almost a smaller puzzle all on its own. More on business credit and how to build it later. For now, here are a few things that can affect your business credit that you might not realize.

Other Business Data Agencies

In addition to the business CRAs that directly calculate and issue your credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexus and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

Identification Numbers

In addition to the EIN, which is part of a fundable foundation, there are identifying numbers that go along with your business credit reports. You need to be aware that these numbers exists. Some of them are assigned by the agency. However, one of them you have to apply to get. It is important that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. You have to apply for it. You can do so on the D&B website.

Business Credit History

Your credit history has to do with everything related to your credit score, which is a huge factor in the fundability of your business. Many things affect your business credit history, but the more accounts you have reporting on-time payments, the stronger your credit score will be.

Business Information

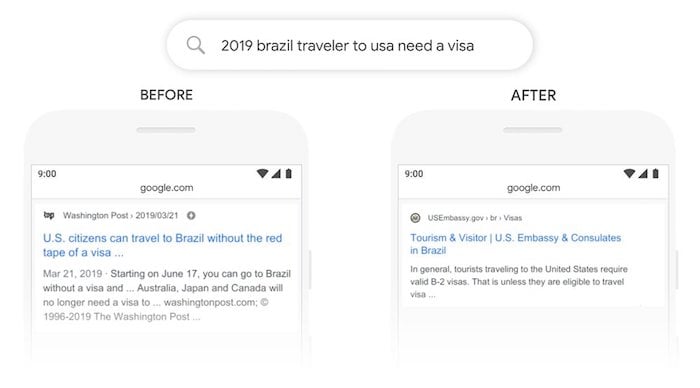

On the surface, it seems obvious that all of your business information should be consistent across the board. However, when you start changing things up you may find that some things get missed. This is a problem because a ton of loan applications are turned down each year due to fraud concerns simply of things not matching up.

Maybe your business licenses have your personal address but now you have a business address. You have to change it. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

The key to avoiding this problem is to monitor your reports frequently.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Business and Personal Financial Statements

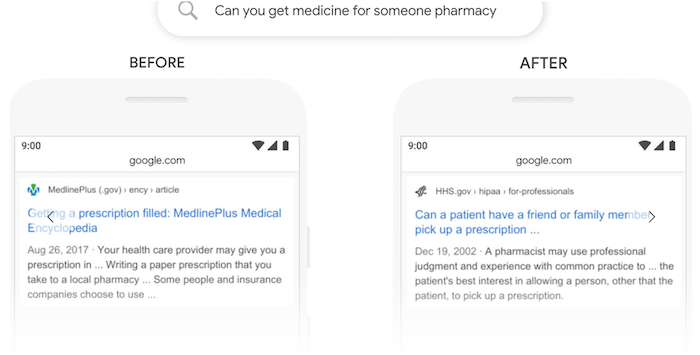

This encompasses a broad spectrum of things. First, both your personal and business tax returns need to be in order. Of course, you also need to be paying both your business and personal taxes.

Beyond that, it is best to have an accounting professional prepare regular financial statements. Having an accountant’s name on financial statements lends to the legitimacy of your business. If you cannot afford this monthly or quarterly, then at least have professional statements prepared annually. Then, they will be available whenever you need to apply for a loan.

Bureaus

There are several other agencies that hold information related to your personal finances. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. Almost all traditional lenders will look at personal credit in addition to business credit.

In addition to FICO reporting personal credit, there is ChexSystems. This keeps up with bad check activity. It can make a difference when it comes to your bank score. If you have too many bad checks, you will not be able to open a bank account. That will cause serious fundability issues.

For this point, everything comes into play. Have you ever been convicted of a crime? Do you have a bankruptcy or short sell on your record? How about liens or UCC filings?

Personal Credit Does Affect Business Fundability

Your personal credit score from Experian, Equifax, and Transunion all make a difference. You have to have your personal credit in order because it will definitely affect the fundability of your business. If it isn’t great right now, get to work on it. The number one way to get a strong personal credit score or improve a week one is to make payments consistently on time.

Also, make sure you monitor your personal credit regularly to ensure to stay ahead of mistakes.

Application Process

So much plays into this that you may not even think about. First, consider the timing of the application. Is your business currently fundable? If not, do some work first to increase fundability. Next, make sure that your business name, business address, and ownership status are all verifiable. Lastly, make sure you choose the right lending product for your business and your needs. Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choose the right product to apply for can make all the difference.

But What is Business Credit?

Now that you see how business credit is just a piece of the bigger picture of fundability, it is easier to put it into context. There is still the all-important question of what is business credit left to answer however. At its core, business credit is to your business what your personal credit score is to your personal finances. Lenders use it to help determine whether you are a good credit risk, or not.

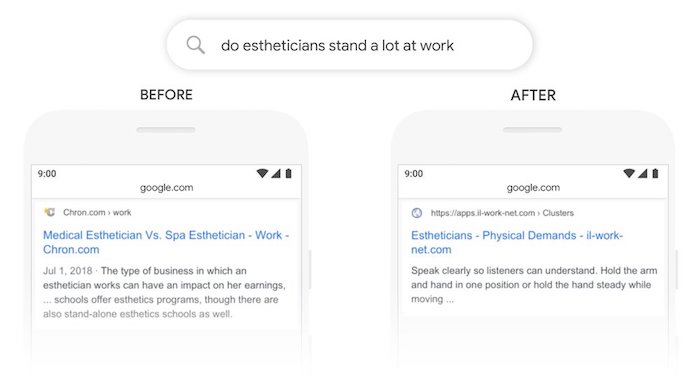

Here’s the thing. Business credit does not build passively like you personal credit does. You have to actively work to build it. The first step in this process has to do with how you set up your business. It is exactly the same as setting up your business with a foundation of fundability. You cannot build business credit without a fundable foundation.

Why Do You Need It?

As noted above, business credit is just a piece of what makes a business fundable. Another piece is the personal credit of the owner. That being the case, along with the fact that business credit simply builds as a result of your personal payment history, why do you even need business credit?

Here’s why. Having separate business credit can free up your personal credit from business transactions. If you have a ton of business debt on your personal credit report, it could make it hard for you to get a loan for things such as a home or a car.

What is Business Credit and How Do You Get It?

Now that we’ve answered the question of what is business credit, you need to know how to get it. There is a process for building business credit, and if you follow it, you will be successful. The first step is that foundation. The next step is getting accounts to report your on-time payments to your business credit rather than your personal credit.

This is trickier than you may realize at first. Similar to personal credit, it is hard to get business credit without already having business credit. We know how to get around this however.

Vendor Credit Tier

First you need to establish trade lines that report your payments to the business CRAs. This is also known as the vendor credit tier. Then you’ll have an established credit profile, and you’ll begin building a business credit score. With an established business credit profile and score you can begin to get credit in the retail and cash credit tiers.

These kinds of accounts are usually for the things bought all the time, like marketing materials, shipping boxes, outdoor workwear, ink and toner, and office furniture.

What is trade credit? These trade lines come from credit issuers who will extend credit in the form of net 30, 60, or 90-day invoices without checking your credit. This is not revolving credit, but since they report to the business CRAs, it serves the purpose anyway.

Of course, not all vendors will do this. You need merchants that grant an approval with very little effort. You also need them to be reporting to one or more of the big three CRAs. These are Dun & Bradstreet, Equifax, and Experian.

You want 5 to 8 of these to move onto the next step, which is the retail credit tier. Go here for more about the vendor credit tier and a list of a few starter vendors to get you going in the right direction.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Retail Credit Tier

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the CRAs, then move to the retail credit tier. These are businesses like Office Depot and Staples that issue credit cards for use at their stores only.

Fleet Credit Tier

Are there 8 to 10 accounts reporting? Then move onto the fleet credit tier. These include service providers like BP and Conoco. You can only use this credit to purchase fuel, and to fix, and take care of vehicles.

Cash Credit Tier

This is the top tier. If you have been using your credit in the other tiers responsibly, you should have a well-established credit score and be able to apply for credit in this tier. These are general Visa, Discover, and Mastercard options that are not limited by location or type of purchase. They also generally have better rates and rewards.

What is Business Credit? Vitally Important!

Business credit is hugely important to the success of your business. It can open opportunities to funding that you would not have otherwise. It does take some time and some work to build it, but your business will be better off for it.

The post What is Business Credit and How Does it Affect Fundability? appeared first on Credit Suite.