How to Create a Free Google Website For Your Business

A web presence is essential for getting found online, especially these days. According to Statista.com, nearly a third of consumers in the United States look online for a local business every day. It’s simple: websites are essential for attracting new customers.

A website proves invaluable in other ways, too, like showcasing your products and increasing leads. However, your website doesn’t need to cost a fortune and include the latest features. If you’re a small business that just wants to let customers know who you are and what you do, a free Google website may be just what you’re looking for.

What is Google’s Free Website Builder?

Google’s free website builder is part of Google My Business and helps customers discover you online.

When creating your website, Google takes the information in your GMB business profile and uses it for the building blocks of your website. Aside from some customization, you’re pretty much good to go from there.

Although there’s no cost, free Google websites are professional-looking and offer a selection of contemporary themes.

Google’s website builder is suitable for everyone, even for beginners. There’s no need for technical expertise with a free Google website and no worries regarding extensive backups.

Additional benefits with a free Google website are:

- You don’t need to rely on social media: Not every potential customer is on social media, and many may not be on the platforms you like best. Having a website of your own, where people can Google your name or what you sell and find your information without signing in to Facebook or Twitter, can bring in those customers.

- Ease of use: One of the main benefits of a free Google website is its simplicity, and it delivers great-looking websites. For instance, even the free version of WordPress can seem overwhelming for the absolute beginner, with menus, pages, sub-menus, etc.

- It provides the essentials: If you’re not looking for the whole e-commerce experience, then a free Google website is all you need for reaching out to a broader audience.

Here are some more reasons why you should use a free Google website for getting online.

Why Should You Build a Website Using Google’s Free Tool?

Only 64 percent of small businesses have websites. Meanwhile, 70 percent of potential customers are more likely to buy from a business with a website.

This means 36 percent of businesses may be missing out on 70 percent of buyers.

Websites make businesses seem more legitimate, particularly if the website looks professional. Google websites, which take almost no time to set up and require minimal maintenance, can look like you spent hours of time and thousands of dollars to make it look great.

If Google’s free website gets you found, why not take advantage of its ease of setup and free features?

Google Website Builder Features

The number one thing that sets Google’s business websites apart from others is that it automatically makes the site for you. You can alter things as you need, but if you have a Google My Business account and select the website option, it automatically populates the information on a site for you using a template you choose.

Don’t let its simplicity fool you. A Google My Business free website offers you plenty in the way of features.

For instance, it provides you with built-in optimization so customers can:

- contact or message you

- place orders

- get quotes for services

- book your services or arrange deliveries

Additionally, a free Google website allows you to “showcase what makes your business special” via:

- images

- stories

- posts

Other features worth mentioning are:

- integration with Google Maps and Calendar

- image carousel and video links

- connection with Google Drive

Besides the above, Google gives you automatic updates, advertising, and it’s mobile-friendly too.

As you can see, a free Google website offers a lot to the new business owner, but how does it compare with others?

Google Website Builder Versus WordPress and Other Similar Tools

The Google website builder one-page format beats many other options in the simplicity stakes.

Additionally, it creates a website with almost no effort on your side, which is where Google’s product stands out from similar tools. It also lets you import images with a few clicks, and you can track analytics, so all in all, it offers you the essentials.

The other main advantage over its rivals is you’re not starting from scratch, and you aren’t making all the decisions yourself.

Although it may seem basic to some, Google gives you a functional, great-looking website, and with some imagination, it delivers impressive results.

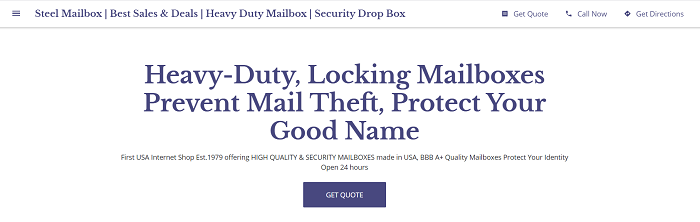

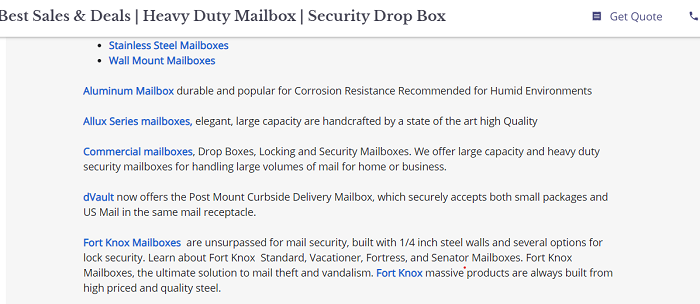

For inspiration, look at what Steel Mailbox did with theirs. This Google business website starts with the basics that could be pulled in from their business information (e.g., the directions function).

If you click the “hamburger” in the upper left, you see options the company chose to add, which jump you to different page areas. One cool feature they added was a list of mailbox types with brief definitions of each one. This allows people shopping for mailboxes to understand what type they need without having to dig through Steel Mailbox’s non-Google site.

If a customer clicked on one of those blue links, they would be taken directly to the type of mailbox they’re looking for. If they went through the main site—and you can have both a simple Google business site and a more in-depth one—they would likely have to do more digging to find precisely what they need.

What a great feature for customers on the go.

When it comes to this type of website, perhaps its weakest area is ongoing SEO optimization, but you can use a free or paid-for tool to find keywords and include them in your descriptions and posts.

WordPress

While bloggers, Fortune 500 companies, and small businesses use WordPress to build their websites, it’s actually a content management system.

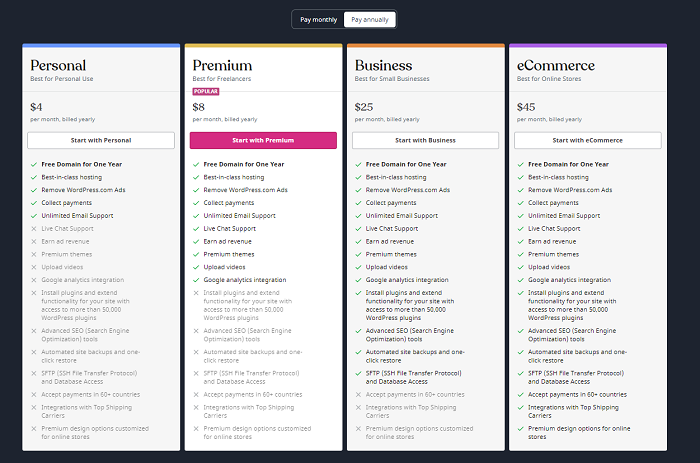

You’ve two options for getting started. WordPress.com gives you the free version, while WordPress.org offers a paid one.

At the free level, the most significant difference between Google and WordPress is that you can create multiple pages within your site, while Google has a one-page format.

When you get to the paid levels, you can add additional functions.

While WordPress offers many more functions than Google websites, no matter which level you use, you have to start from scratch. Nothing is auto-populated. Nevertheless, there are plenty of tutorials online if you’re just learning, and you won’t need to do any coding.

Wix

Wix is another free website builder, although it also offers premium and e-commerce plans too. Getting started is simple. Just sign up or log in with Facebook or Google to get started.

Like WordPress, the free level is relatively limited in functionality. If you’re willing to pay, though, you can access hundreds of templates, additional types of analytics, and more.

Wix provides 500 different templates, and its drag and drop feature means beginners can use it without needing technical expertise.

Other features include:

- media galleries

- mobile optimization

- unlimited fonts

- a personalized SEO plan

Wix also provides coding for visitor tracking, while its analytics tool shows your sales, traffic, and visitor behavior.

How to Customize Your Free Google Website

After you have set up your Google My Business page (detailed steps are in the next section), you’ll be able to see your site free google website in a standard setup. You can then start customizing from there.

The list nearest your sample site includes things you can do right now, like add photos, text, and themes. The one furthest left includes:

- home

- posts

- reviews

- messages

- products

- insights

Take some time to get to know these options and which each one does.

From the home page, you can also:

- finish your profile by adding opening hours, descriptions, and logos

- update customers on news and events

- create a custom @yourbusiness email address

- launch virtue tours and create adverts

You can see the themes, add pictures with a photo gallery, and edit your site’s categories from the other menu.

To best set up your site, follow these steps:

- Choose your theme: For customizing, the most obvious starting point is by looking at the themes. There are ten to choose from, all with different colors and styles of text. Click on them one by one to see which theme most closely matches your business’s style and the image you want to convey.

- Add Photos: Click on the top right-hand corner of the header picture, drag your photo, or upload one from your computer. To add other images, click on “photos” on the left-hand side.

- Editing: Edit text by clicking the blue “Edit” button under photos.

- Additional changes: Click “More” to change settings, publish, or for advice on getting customers.

It’s that easy! You’ve finished building your free Google website, and you should be ready to start getting noticed online.

How to Build Your Free Google Website

Before building your website, set up your Google my Business Page, if you haven’t already. Here’s how to do just that.

- Go to Google’s website builder.

You’re looking for the “website” heading. It’s the third one along at the top.

- Add your business name and click the blue arrow.

- Add your business category.

If your service or industry isn’t clear cut, add the class representing your company the best. Click “Next.”

- Select your location preferences.

Now, Google asks if you want your business location to appear on your website. Either select “Yes, I want it to appear on my website” or “No, I prefer not to.” Depending on the type of business, you may need to include an address. Choose the appropriate option and click “Next.”

- Choose if your business provides deliveries or services.

Choose if your business provides deliveries or services. This step is optional.

- Add your region and click “Next.”

- Add your phone number.

- Add your business address details, including country and zip code.

- Verify your accout.

- Do this by clicking on the “Home” page, which you’ll find at the top of the menu on the left, and following the “Verify” link.

You’re ready to start building your free Google website!

Create a Free Google Website FAQs

Unlike its rivals, you’re not starting from scratch, and you aren’t making all the decisions yourself. Although it may seem basic to some, a Google site gives you a functional, great-looking website, and with some imagination, you’ll get impressive results.

Google provides step-by-step instructions.

No, a free Google website creates a professional-looking website with minimal input from you.

While other options offer additional features, Google outshines its competitors regarding simplicity and ease of use.

Conclusion

Having an online presence is a necessity these days. If would-be customers can’t find your website, you’re likely missing out on clients.

However, building a website doesn’t mean spending a lot of money or needing technical expertise. Instead, you can begin by starting with a free Google website and set it up in a few easy steps.

Once you’re online, you can start benefiting from additional leads, more customers, and increased conversions—all the things you need for increasing your business success rate and growing a thriving enterprise.

How has using a free Google Business website affected your business?

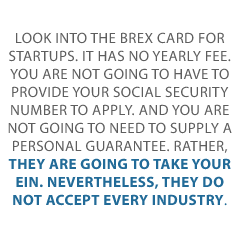

A business credit profile is different. You have to work intentionally to establish it and build your score. Just because you have a card that says “business credit card” on it does not mean it is in your business name. It isn’t necessarily reporting to your business credit report. It could, and in fact probably is, reporting to your personal credit if you haven’t taken some steps to separate your business from yourself.

A business credit profile is different. You have to work intentionally to establish it and build your score. Just because you have a card that says “business credit card” on it does not mean it is in your business name. It isn’t necessarily reporting to your business credit report. It could, and in fact probably is, reporting to your personal credit if you haven’t taken some steps to separate your business from yourself.  Hack #2: Add Accounts That Report

Hack #2: Add Accounts That Report

Graham Isador is a writer in Toronto. His work has appeared at GQ, VICE, and Men’s Health, among other places.

Graham Isador is a writer in Toronto. His work has appeared at GQ, VICE, and Men’s Health, among other places.