The legislation offered liability protections for good-faith actors.

The post Pennsylvania Vetoes Help for Business appeared first on ROI Credit Builders.

The legislation offered liability protections for good-faith actors.

The post Pennsylvania Vetoes Help for Business appeared first on ROI Credit Builders.

If you are considering equity crowdfunding for your business, then you are, by definition, considering equity crowdfunding sites. We take a look at the best out there and dig into their nuances and differences. Make a smarter choice – knowledge is power!

When you consider equity crowdfunding sites, you will need to take a number of factors into account. Crowdfunding is a way to get funds from a lot of people, versus one or two investors.

With equity crowdfunding, you raise cash through the sale of securities such as equity, debt, revenue share and more. These security sales would be coming from a company that is not listed on stock exchanges. Equity crowdfunding has been around for less than 10 years. It is not the same as rewards-based. Rewards-based crowdfunding comes from places such as Kickstarter.

What are the differences between equity crowdfunding and rewards-based crowdfunding? The major difference is what investors get for their investment. With reward based crowdfunding, investors generally receive some incentive for their donation. That incentive is not equity in the company. But with equity-based crowdfunding, the investor receives equity. That is, they get a share in the company.

Also, as a general rule, equity-based crowdfunding brings in larger amounts of money. This is because it draws a different type of investor. So, how come not everyone choose that? The key is some businesses are better suited for equity-based crowdfunding than others.

With equity crowdfunding sites, you raise capital from the crowd online. Potential investors visit a funding portal website. There, they can explore different equity crowdfunding investment opportunities. Note: there are limits on how much capital an individual can invest based on their income and net worth. Plus, investors must be 18 years old, or older.

The main purpose of equity crowdfunding is to sell securities in a business. Hence, this is also the main purpose of equity crowdfunding sites.

In contrast, with a platform such as Kickstarter, businesses make money by pre-selling their products. But on equity crowdfunding sites, companies sell securities, in the form of equity in the company. Or it can be in the form of debt, revenue share, convertible note, and more. Equity crowdfunding gives investors a stake in your business.

Equity crowdfunding investors are playing a long game. They stand to make a profit if they make a good investment, and the company they invested in grows. Here, the business can create hundreds of brand ambassadors who want to see you succeed. They are an audience the company can depend on to spread the word about their business and share the product with their own networks.

The ability to cultivate reliable brand ambassadors can be one consideration when trying to offset the cost of equity crowdfunding on a platform

The business owner gets to dictate terms. The entrepreneur raising capital has total control of the offering. So this is including what to sell, how much, and, at what price. The owner can set the terms, including their valuation and how much capital they hope to raise.

Companies can set a minimum funding goal along with their desired maximum. So if they do not fully reach their funding goal, the entrepreneur can still successfully raise capital. Those who want to invest can do so even if the market interest is not enough to reach the goal.

Businesses raising money via equity crowdfunding sites are private companies. A business using equity crowdfunding does not have to issue an IPO (initial public offering). The business does not have to become a fully reporting public company. this is helpful, as being a fully reporting public company is financially burdensome for most small businesses. Investors do not have to be accredited. A business can raise funds without having to turn to venture capitalists.

For more information, see forbes.com/sites/howardmarks/2018/12/19/what-is-equity-crowdfunding.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

Crowdfunder is an equity crowdfunding platform. With Crowdfunder, investors purchase equity in promising companies. They consider campaigns to be deals, and its donors are investors.

Starter listings are $299 per month. Premium listings are $499 per month. In their community, there are over 130,000 entrepreneurs and investors.

Crowdfunder does not work with every industry.

The following are prohibited industries:

For more information, see crowdfunder.com.

Fundable is a crowdfunding for business platform. It allows companies to raise funds via equity sales. Those funds come from investors, customers, and friends. They have over $80 million in funding commitments.

Fundable will charge $179 per month to raise funds. Fees on rewards are: 3.5% + 30¢ per merchant processing transaction. They do not charge success fees.

Fundable is one of the equity crowdfunding sites (such as Crowdfunder and Fundrise, below) which seem to be more accessible to regular folks.

They do not seem to focus on just one specific industry.

For more information, see fundable.com.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

What is so special about Crowdstreet?

The industry most likely to use equity crowdfunding is real estate. This is because real estate allows for a much larger asset to be there from the very start. For a startup company based upon an idea for a new product, there is extraordinarily little available to seize in case the investment goes south. Whereas with real estate, even if there is never any development, land has an intrinsic value no matter what.

Crowdstreet allows you to invest online in commercial realty. Investors can choose between direct investing, fund investing, or managed investing. Crowdstreet boasts over 101,000 investors and over 260 commercial real estate developers.

Direct investing has varied minimum investment amounts. The minimum for fund investing is $25,000. The minimum for managed investing is $250,000. Hence this is one of those equity crowdfunding sites that is more for professional investors.

For more information, see crowdstreet.com/marketplace/overview.

Real Crowd is another real estate investing platform, via equity crowdfunding. RealCrowd charges a technology access fee to the operating partner for their services. They do not charge investors any upfront fees, ongoing asset management fees or promote/carried interest in the investments.

You can browse offerings before you sign up. The information includes minimum investment and average returns. This allows for a lot of the decision making to happen before you even log in. Real Crowd offerings are open to accredited investors.

For more information, see https://www.realcrowd.com/how-it-works.

Fundrise is a great starter site for those that want to break into the world of equity crowdfunding. They do not require that you be an accredited investor. The minimum investment for the starter account level is $500. Minimum investment amounts go all the way up to $100,000 for the premium account level.

Fundrise will charge 0.15% in annual advisory fees for managing your account through the online platform. They do not charge any transaction fees, sales commissions, or additional fees for enabling features on an account, such as dividend reinvestment or auto-invest.

Fundrise will also charge 0.85% in annual management fees for managing a Fundrise portfolio. They could potentially charge other fees, such as development or liquidation fees, for work on a specific project. Dividends earned are net of any fund fees.

For more information, see: https://fundrise.com.

If you do not wish to give away any of your equity, then rest assured, you have other options. Build business credit is one option. And others include inventory financing, merchant cash advances (if you have sales coming in), and securities financing. With securities financing, you use your stocks, bonds, 401(k), or IRA as collateral for borrowing.

Another great option is our credit line hybrid.

A hybrid credit line could be just what you need.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

The gist of a credit line hybrid is you can leverage good personal credit in order to get business funding. Because a good personal credit score is the main thing the lender is looking for, it can be perfect for a startup venture. So, it is another option to consider. You do not necessarily have to give up business equity in order to finance your entrepreneurial venture.

Equity crowdfunding involves calling on a crowd to invest in your project. Rather than pre-selling products, you are selling pieces of your business.

The industry most likely to use equity crowdfunding is real estate. But other industries can use equity crowdfunding. Be sure to check the platform and see if there are any restrictions. Some industries will not do well at all and may even be shut out by a platform. Fees and investment minimum amounts will vary widely.

If you are interested in equity crowdfunding for your business, the best thing you can do is to shop around. Rates vary dramatically. But also check on success rates. Many equity crowdfunding platforms are expensive, or they have high minimum investment amounts, or both. Do not waste your time and money if you are not sure there is a good fit.

And, if you decide equity crowdfunding is not for you – or even if you do but want a fall back – then consider other forms of business funding. That should always include building business credit.

The post The Best Equity Crowdfunding Sites – and How Equity Crowdfunding Can Work for Your Business appeared first on Credit Suite.

COVID-19 threw our economy into a tailspin, and the resulting recession isn’t leaving anytime soon. However, even during a recession period funding is available. You just have to know how to get it.

In a recession period, if you need a loan you need it fast. There is no time to wait when the recession cloud looms. Business failure can feel imminent. There is hope however, and bad credit doesn’t have to get in the way.

Traditional business loans are rarely fast, and if you have bad credit, they usually aren’t even an option. Throw all these issues into a recession period and you may feel like you are sinking fast. There is hope however. There are a ton of options outside of the realm of traditional business loans, and many of them work even if you have bad credit.

Of course, the need for business loans during a recession may not mean you are growing. It could be a desperate last plea to simply make it through the troubled waters alive. Either way, bad credit can weigh you down like an anchor. You have to break free, which is even harder during economic downturns. To be able to cut off the anchor of bad credit however, you need to understand what its made of, and how you got tethered to it in the first place.

Find out why so many companies are using our proven methods to improve their business credit scores, even during a recession.

Sometimes you don’t even know you are sinking until you need financing and find that you cannot get it due to bad credit. When it comes to regular business loans, bad credit can be a major issue. Typically, a score of over 700 is good credit, but with a score over 650, you can still find financing. If your credit score is below 650, you may have some problems. A recession period can cause you to sink into bad credit before you know it’s happening.

If this is the case, you will need to look for alternative lenders to help you out. They can offer a life preserver so you can make it safely through until the waters calm down.

If you are a new business owner, you may find that it isn’t so much an issue of bad credit, but rather no business credit. This is easily enough remedied over time, but if you need business financing and have bad credit or no credit, it can be a real problem. You don’t have time.

You could try finding financing based on your personal credit. That is, if your personal credit is any good. If it is over 650, you can probably get a credit card that will keep you afloat until you can figure out something better. You may also be able to simply get a personal loan to bail you out, and then work to build business credit going forward.

The problem with this is that it puts even more stress on your personal finances during the recession period. In addition, if your business does end up sinking, you could very well go down with it if your personal credit is tied to it.

When it comes to your personal credit score, it’s easy to know what it is. Not only can you get a free copy of your credit report annually, but there are also a number of companies that will allow you to monitor your credit on a regular basis.

Business credit score monitoring is not as easy. There are no free business credit reports. You can, however, purchase your credit reports from Dun & Bradstreet, Experian, Equifax, and the lesser known business credit reporting agencies for between $50 and $250 each.

Credit Suite can help you monitor your business credit at Dun & Bradstreet and Experian for a fraction of what it costs with them directly. Go here to find out more.

However, if you are stuck with bad personal credit and bad business credit, you may have to pursue an alternate route. You may not have an obvious flotation device. That means you are going to have to grab onto whatever you can find and hold on tight.

It sounds brutal, but it may be worth it if it saves your business. What are your options? Essentially, the best option is invoice factoring. This only works if you have a significant amount in open invoices. It is the fastest of all the options other than a friend or family member just handing you cash. This would be similar to a large piece of drift wood conveniently floating by.

Not only is invoice factoring the fastest way to cash, it is also an option that depends very little on your credit, personal or business. It even works well in a recession period, though maybe not as well as at other times, as the ability to collect could decline somewhat. Sometimes though, there isn’t even a minimum credit requirement for invoice factoring. They may pull a credit score, but they make decisions based more upon the strength of your invoices.

Find out why so many companies are using our proven methods to improve their business credit scores, even during a recession.

The lender will gather information to help them determine the likelihood of the invoices being repaid. If they find that the invoices are strong, they will lend money based on the total amount of the invoices minus a premium. The borrower can usually either repay the loan or the lender can keep the invoices and collect from them.

Fundbox offers invoice financing for amounts less than $100,000. There is no minimum credit score, and there are options for a 12- week or 24-week repayment term. They collect 7% on a 12-week repayment and 15.7% on 24-week terms.

If you have a larger amount in open invoices, like up to $5 million, you can get invoice financing from BlueVine. They charge a weekly fee of .5% to 1%, but the fee drops a little if your clients pay their invoices on time.

If you really need funding fast, invoice factoring is your best bet. If you have a little more time you could seek out working capital loans from alternative lenders. This is also a good option if you do not have open invoices.

Some alternative lenders pull a credit report, but they have a low minimum score requirement. For example, Fundbox offers working capital loans to businesses that have been in operation for at least 3 months and have at least $50,000 in revenue. They lend amounts up to $100,000, and there is no credit check.

Kabbage offers something similar if you have been in business for at least 1 year and have $50,000 in revenue. They will lend up to $250,000. There is no minimum credit score here either, but most approvals have over 500. You also have to have either a business checking account or use an online payment platform.

Find out why so many companies are using our proven methods to improve their business credit scores, even during a recession.

Quarterspot will lend up to $250,000 if you have been in business for at least one year and have at least $200,000 in annual revenue. They will do a soft credit pull, but it does not affect your credit. The minimum score is 550.

Once you find something to keep you from sinking, whatever it may be, hold on tight until you can reach the shore. Be forewarned, if you handle things incorrectly you could end up in much worse trouble that you are already in. You have to use your credit wisely.

If you fail to do this, you may end up floating so far away you never see land again. Make certain you use the financing the way you need to, but that you also pay it back in a consistent and timely manner.

The way you do this is by establishing and building strong business credit. Not only will this keep you out of trouble, but it can make things even better in the long term. You will find that getting what you need to make it through another recession period is a cinch if you follow these tips.

Your business has to have its own identity, apart from yours, if it is going to have its own credit score. The first step in this process is to incorporate your business. You can choose from a corporation, S-corp, or LLC.

Then list your business in all the directories with its own name and contact information. After that, open a business bank account. Run all your business transactions through this account, so that business finances are separate. Pay bills, make purchases, and apply for credit using this account.

After your business has an identity all its own, it is all up to how well you manage whatever credit you can get. Whatever financing you are able to find, be sure you make your payments on time.

You might also consider looking into vendors that will allow you pay invoices net 30. This starter credit has a lot to offer. Sometimes you will have to prepay for a certain amount of time to get approval. If they give you 30 days to pay an invoice and report to the credit bureaus, this can fast track your credit score. That’s assuming you pay on time of course.

To be fair, an economic downturn is hard with or without bad credit. Things happen. The key is to be prepared with what you need to get through at all times. Then, you don’t have to worry about trying to scramble to find a business loan you qualify for. You can simply whip out what you already have and climb back on the boat.

What does this look like? Once you have a strong business credit score, you can apply for a business line of credit or a credit card. Find one with the best terms possible, and if it is a credit card, perks and rewards are nice too.

Tools such as these can help you over a rough patch. If you already have them in place, they will not cost you the same way bad credit business loans will. Bad credit can mean higher interest rates, seriously unfavorable terms, and much more. If you already have credit in place, you can simply access that and enjoy the terms and rates your good credit warrants you.

You do not have to sink during a recession, even if you have bad credit. There are options for financing without great credit. Do some research to determine which one is best for you. Once you find it, the real hard part begins.

This is when you have to figure out how to best use the money to move you into a better place. You must be sure to use the debt to build stronger credit. Handle it wisely and do not slip into the cycle of non-payment and further credit score trouble.

If you need the funds to bridge a cash gap, make sure you don’t have a cash leak. Are you relying on financing to handle daily activities that you can’t fund yourself? Figure out how to fix that problem. Are you growing and just need the funds to do so? Great! Don’t forget to pay your bills though. If you do that, you can be out of the water and back on the path to success before you know it.

Don’t stop there though. Once you are back on solid ground, take the time you need to prepare for future funding needs. Build credit, put a recession plan in place, and make sure that the next time there’s a storm, you don’t get knocked overboard.

Note: Lender information can change without notice. Be certain to check with individual lenders for the most up-to-date information.

The post Recession Period Business Loans: Don’t Let Bad Credit Stop You appeared first on Credit Suite.

Need to know how to get funding for your business? Of course, you do! There is so much to consider. For example, what stage your business is in and overall fundability each makes a difference. Most people know that though. The big question is, what exactly is fundability? More than that, what exactly affects fundability? … Continue reading How to Get Funding for Your Business

Need to know how to get funding for your business? Of course, you do! There is so much to consider. For example, what stage your business is in and overall fundability each makes a difference. Most people know that though. The big question is, what exactly is fundability? More than that, what exactly affects fundability? That’s getting a little ahead of things though. You have to know what types of funds are available, and you need to know your fundability makes you eligible for whatever you need.

The first step is to figure out what type of funding will work best for you at this current stage in your business. The next step? That would be to figure out whether you qualify, and if not, how to fix that. Here’s what you need to know.

Demolish your financing problems with 27 killer ways to get cash for your business.

Before you can figure out what type of funding you need, you have to know what type of funds are out there.

These are loans from traditional banks and credit unions. As a business, your business credit score can help you get some types of funds even if your personal score isn’t awesome. That isn’t necessarily the case with this type of cash however.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. This means they will check your personal credit. If your personal credit score isn’t in order, you’ll probably have trouble.

So how high does your credit score have to be? If you have at least a 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be willing to be more flexible. However, your personal credit score will still weigh heavily on the terms and interest rate.

These are the hardest types of funds to get, but they typically have the best rates and terms.

SBA loans are traditional bank loans, but they have a guarantee from the federal government. The Small Business Administration, or SBA, works with lenders to offer small businesses financing solutions that they may not be eligible for based on their own credit history. Because of the government guarantee, lenders are able to be more flexible with personal credit score requirements.

In fact, it is possible to get an SBA microloan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

The trade-off with SBA loans is that the application process is lengthy. There is a ton of red tape connected with these types of loans.

This is basically the traditional lender’s version of a business credit card. The credit is revolving, meaning you only pay back what you use, just like a credit card. Rates are typically much better than a credit card. The application and approval process, however, is more similar to that of a traditional term loan.

If you need revolving credit and can qualify for a term loan, this is the best of the available business money types for you. It is great for bridging cash gaps and covering short term expenses without the high credit card interest rates.

There are no cash back rewards or loyalty points, though. This makes some business owners prefer business credit cards in some cases.

If you are an established business with accounts receivable, invoice factoring is one type of financing that you have access to. This is where the lender buys your outstanding invoices at a premium, and then collects the full amount themselves. You get cash right away, without waiting for your customers to pay the invoices.

This is a good option if you need cash fast, or you do not qualify for other types of funds. The interest rate varies based on the age of the receivables.

These are lenders other than traditional banks and credit unions that offer terms loans. Usually they operate online. The difference between these guys and traditional lenders is that the loans have less strict approval requirements. In addition, the application process is usually much faster. Most often you can simply apply online, get approval in as little as 24 hours, and the funds are in your account within 24 to 48 hours after approval.

These are an option if your personal credit isn’t terrible and you need funds fast.

Demolish your financing problems with 27 killer ways to get cash for your business.

Crowdfunding is a newer option for finding investors. It is not always possible to find one or two large investors. With crowdfunding, you can literally have multiple investors fund your business $5 and $10 at the time.

There are many crowdfunding sites, but the most popular are Kickstarter and Indiegogo. The platforms are similar but there are some important differences. The most obvious is when they release the funds raised..

Kickstarter requires you to set a goal, and you do not receive your funds until that goal is reached. For example, if you set a goal of $10,000 when you start your campaign, you will not receive any money that investors offer up until you reach that $10,000.

Indiegogo requires a goal as well, but they offer the option to receive funds as you go if you want. They also have something called InDemand. This program allows you to continue raising funds after your original campaign is over without starting a whole new campaign. It is more of an extension of the first one.

There are other crowdfunding sites also. These are not the only two. Different ones work better for certain businesses and vendors. To figure out which one you might have the most luck with, you will have to research. Keep in mind your type of business and the specific business each one appeals too.

Generally, these are offered by professional organizations. There are some government grants available also. Competition can be stiff, but they are definitely worth a shot if you think you may qualify.

While requirements vary from grant to grant, and most are only awarded to a certain number of recipients, they are worth looking into if you fall into one of these basic categories.

There are also some corporations that offer grants in a contest format that do not require anything really other than that you meet the corporation’s definition of a small business and win the contest.

Business Credit Cards

These get a bad rap. However, if there isn’t another option, they can actually work well. The draw is that they are available much more readily even with a credit score that isn’t great. To be fair, the lower the credit score, the higher the interest rate. Also, there are limits on how low they will go with a credit score.

Still, most of the general public is eligible for this type of financing. They do a credit check, but your credit doesn’t have to be as high as it would be to get approval for a traditional loan.

The downside of business credit cards is that they typically have a high interest rate. The upside is that many of them offer rewards in the form of cash or points.

Which type of funds will work best for you depends on a lot of factors. The main two include which types you qualify for and what phase your business is in. Assuming you are eligible for all types of financing, here is what to consider at each stage.

In the startup phase, there are a couple of things to think about when determining which business capital type might work best for you.

If you fall into one of those categories that make grants an option, that is the best first stop. Grants are free and clear. That money is yours, without repayment, to use in your business. They usually do not rely on the success of the business or the credit worthiness of the owner. The business or proposed business only has to meet the requirements set forth to apply, and then win the grant.

Crowdfunding is also a viable option here, but there has to be a backup plan in case the goal isn’t met.

Traditional term loans are a good idea for the startup phase also, if you qualify. The interest rates and terms are more favorable than other types of financing for those that meet the credit requirements.

If you do not meet the credit requirements for traditional term loans, then non-traditional lenders are the next best option. They may have higher interest rates, but they get the job done. Plus, they can help build your business credit score if you make your payments on time.

While not impossible, it is not usually a good idea to start a business using credit cards if you can help it. Of course, invoice factoring is not an option because you have to already be in business to have the invoices necessary.

Demolish your financing problems with 27 killer ways to get cash for your business.

There are several aspects of growth that can benefit from different funding options.

If you see the growing demand and need to increase inventory, a revolving credit line is going to work best.

If already in place, these are available as needed to accomodate a large inventory purchase. They also allow for taking advantage of special pricing when possible.

A business line of credit works well due to the lower interest rate, business credit cards will work in this situation also. In fact, if they have really great rewards attached to them, they could even be the better choice. It can’t hurt to have both available if you can so that you have options.

If available, grants work well for growth projects as well.

For large equipment, it is best to use traditional term loans if available. This is because they are typically longer term loans for larger amounts. Lower interest rates and favorable repayment terms are key. We all know, however, this isn’t always possible. In a pinch, other types can work for this.

Grants may be an option if there is not a time crunch. If time is of the essence, it is possible to purchase equipment on credit cards, but you could run into problems with cost versus credit limit.

If you want to add on to your current building or add another location, term loan financing is the best option. Whether it needs to come from a traditional or non-traditional lender will depend on your specific situation.

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

It can come from various funding types. There are working capital loans available, but lines of credit and business credit cards can work in these situations too. Unless you already have a working capital loan before it is needed, you will likely have to access business credit cards or some form of non-traditional financing for this.

In a pinch to cover a cash gap, a merchant cash advance or invoice factoring can work well.

The main factor in whether or not you can get funding for your business is fundability. The fundability of your business includes many things. It has to do with how your business is set up, both personal and business credit, and even things you would never think about like parking tickets and outstanding liens. The most controllable part of course, is business credit. If you work hard to keep that strong, it is possible to get the cash you need.

The post How to Get Funding for Your Business appeared first on Credit Suite.

Do you want to apply for a business credit card with bad credit in a recession which you think will drag you down? Not to worry. And that is still true despite the emergence of COVID-19.

According to the SBA, business credit card limits are 10 – 100 times those of personal cards! This shows you can get a lot more cash with business credit.

And it also means you can have personal credit cards at retail stores, and now have an additional card at the same shops for your business. And you won’t need collateral, cash flow, or financial information to get company credit.

Take a look at the Brex Card for Startups. It has no annual fee.

You will not need to provide your Social Security number to apply. And you will not need to provide a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Also, there are some industries they will not work with, and others where they want more paperwork. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a business’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Also, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Check out the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can earn unlimited 1% cash back on every purchase for your business, with no minimum to redeem.

While this card is within reach if you have average credit scores, beware of the APR. Yet if you can pay in a timely manner, and completely, then it’s a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Check out the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the first one year. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on everyday company purchases like office supplies or client suppers for the first $50,000 spent per year. Get 1 point per dollar afterwards.

You will need great to exceptional credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also take a look at the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. However its rewards are in cash instead of points.

Get 2% cash back on all qualified purchases on up to $50,000 per calendar year. After that get 1%.

It has no yearly fee. There is a 0% introductory APR for the initial one year. Afterwards, the APR is a variable 14.74 – 20.74%.

You will need great to exceptional credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Have a look at the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which after that rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is fantastic for travel if your expenditures do not fall into common bonus categories. You can get unlimited double miles on all purchases, with no limits. Earn 5x miles on rental cars and hotels if you book via Capital One Travel.

Get an initial bonus of 50,000 miles. That’s the same as $500 in travel. Yet you only get it if you spend $4,500 in the first 3 months from account opening. There is no foreign transaction fee. You will need a great to excellent FICO rating to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

For a terrific sign-up offer and bonus categories, have a look at the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial 3 months after account opening. This works out to $1,250 towards travel rewards if you redeem through Chase Ultimate Rewards.

Get 3 points per dollar of the first $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel with Chase Ultimate Rewards. You will need a great to exceptional FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

For no annual fee while still getting travel rewards, have a look at this card from Bank of America. It has no annual fee and a 0% introductory APR for purchases during the initial 9 billing cycles. After that, its regular APR is 13.74 – 23.74% variable.

You can earn 30,000 bonus points when you make a minimum of $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Earn unlimited 1.5 points for each $1 you spend on all purchases, everywhere, every time. And this is no matter how much you spend.

Also get 3 points per every dollar spent when you reserve your travel (car, hotel, airline) with the Bank of America® Travel Center. There is no limit to the number of points you can earn and points do not expire.

You will need excellent credit to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Take a look at the Marriott Bonvoy Business™ Card from American Express. It has a yearly fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need good to outstanding credit scores to get this card.

You can get 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the initial three months. Get 6x the points for qualified purchases at participating Marriott Bonvoy hotels. You can get 4x the points at United States restaurants and gasoline stations. And you can get 4x the points on wireless telephone services purchased directly from US providers and on US purchases for shipping.

Get double points on all other eligible purchases.

Plus, you get a free night each year after your card anniversary. And you can earn another free night after you spend $60,000 on your card in a calendar year.

You get free Marriott Bonvoy Silver Elite status with your Card. Plus, spend $35,000 on eligible purchases in a calendar year and earn an upgrade to Marriott Bonvoy Gold Elite status through the end of the next calendar year.

Plus, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Check out the Ink Business Unlimited℠ Credit Card. Beyond no yearly fee, get an introductory 0% APR for the first year. After that, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your business. And get $500 bonus cash back after spending $3,000 in the first 3 months from account opening. You can redeem your rewards for cash back, gift cards, travel and more using Chase Ultimate Rewards®. You will need excellent credit scores to qualify for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Check out the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. And earn a one-time $200 cash bonus once you spend $3,000 on purchases in the first 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR afterwards.

You will need great to excellent credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 annual fee for the initial year. After that, this card costs $95 each year. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the initial 3 months from account opening. Get unlimited 2% cash back. Redeem any time without any minimums.

You will need great to exceptional credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Check out the Discover it® Business Card. It has no annual fee. There is an introductory APR of 0% on purchases for twelve months. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimum spend requirement.

You can download transactions| conveniently to Quicken, QuickBooks, and Excel. Note: you will need good to outstanding credit scores to get approval for this card.

https://www.discover.com/credit-cards/business/

Have a look at the Ink Business Cash℠ Credit Card. It has no annual fee. There is a 0% introductory APR for the first year. After that, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the initial three months from account opening.

You can get 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year.

Get 2% cash back on the initial $25,000 spent in combined purchases at filling stations and restaurants each account anniversary year. Get 1% cash back on all other purchases. There is no limitation to the amount you can earn.

You will need outstanding credit scores to get this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Take a look at the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the first 9 billing cycles of the account. After that, the APR is 13.74% – 23.74% variable. There is no annual fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Get 2% cash back on dining. So this is for the first $50,000 in combined choice category/dining purchases each calendar year. After that earn 1% after, with no limits.

You will need superb credit scores to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Check out the Plum Card® from American Express. It has an initial annual fee of $0 for the first year. After that, pay $250 per year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need good to exceptional credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Your absolute best way to apply for a business credit card with bad credit in a recession will hinge on your credit history and scores.

Only you can select which features you want and need. So make sure to do your homework. What is excellent for you could be catastrophic for others.

And, as always, make sure to develop credit in the recommended order for the best, speediest benefits. The COVID-19 situation won’t last forever.

The post Rock Solid: You Can Apply for a Business Credit Card with Bad Credit in a Recession appeared first on Credit Suite.

Studying how people use video search to find the content they want is an essential but often neglected area of marketing. When we understand how video search engines work, we can begin to devise marketing strategies around this traffic source. When you understand your audience’s search intent and properly optimize your videos, you unlock new … Continue reading What is Video Search and How Can it Help Your Business?

Studying how people use video search to find the content they want is an essential but often neglected area of marketing.

When we understand how video search engines work, we can begin to devise marketing strategies around this traffic source. When you understand your audience’s search intent and properly optimize your videos, you unlock new means of generating leads for your business.

In this guide, we break down video search engines and how you can use them to increase your traffic.

The first thing we need to think about is why people search for videos in the first place. What makes someone look for a specific video? Why are they searching for that video? What are they looking to accomplish?

All of these questions are important to answer, and we’ll address them, one by one.

According to Google, people look for videos for three different reasons. They either want to reflect, connect, or learn. So, what does that mean exactly?

Video in any form has provided us with a way of escaping reality. For many decades, it’s been in the form of television. Many people use video to see life through a different lens, which helps them reflect on their own life.

This could be one reason someone might search for a video.

Another reason someone may use video is to foster connections. 51% of people in a study completed by Google say they feel the need to connect with others through video content.

A great example might be someone struggling with addiction to alcohol. Their first response would be to retreat and hide from friends and family because that’s what they’re used to doing.

A quick video search displays hundreds of videos of people going through the same thing, and now they can relate to someone. We seek video to connect with our community and to meet on common ground.

Videos have become a way for us to learn about anything we might be interested in, and there are nearly no limitations to what we can find with a quick video search. Whether you’re looking to touch up on something you know already or dive into something completely new, there are millions of videos on the internet to help you accomplish your goal or explore your hobbies.

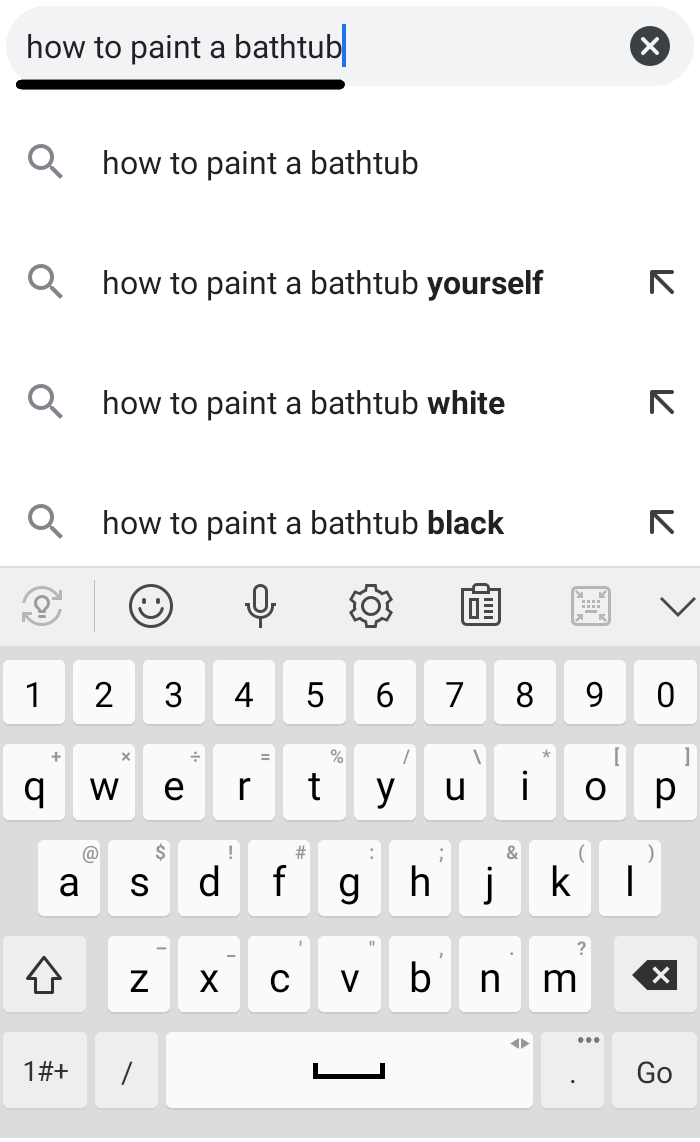

Now that we understand the “why,” let’s look at the “how.” How do people search for videos on the internet, and what does that tell us as marketers?

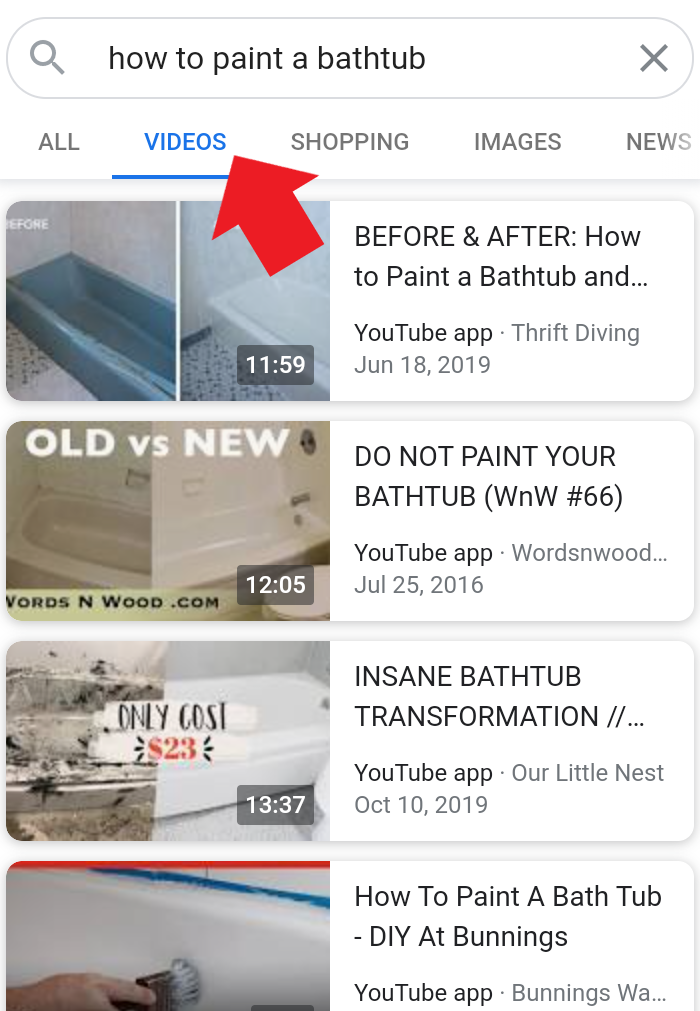

One very common way people search for videos is in traditional search engines. A quick Google search for something actionable will supply hundreds of videos revolving around that topic. For example, if someone wants to learn how to properly tape off a living room to use a residential paint sprayer, it might be easier for them to watch a video on how to do it rather than read up on it.

You can also go to the video section on the search result page to see just video results.

You can type your search into the Google search bar and then choose from the recommended videos, or you can click the videos tab and search strictly for video rather than text results.

Another popular method people use to search for videos is social media. Facebook, Instagram, Twitter, TikTok, and others all make it simple for you to search for videos in various ways.

For example, Instagram uses hashtags to tag videos. This feature makes it easy for people to come in and search the specific hashtag and find your video if you’ve optimized it correctly.

On Facebook, hashtags aren’t as popular, but you still have video descriptions and closed captions that can be searched.

As marketers, it’s our job to bring the right content to the right audience at the perfect time.

To do this, we need to have a firm understanding of a few things.

You need to understand who your target audience is, but this gets a little more advanced when talking about video search. This task isn’t as simple as optimizing a landing page for your organic search audience. We have to talk about a complete overhaul based on the platform you’re using.

There are a few levels to this.

The first level is choosing the platform you’re using to promote your videos. For example, the audience on Facebook is much different than the audience on TikTok. No matter how hard you try, you’re not reaching many seniors on TikTok, even if you have the perfect piece of video content for that demographic.

Once you understand the platform’s overall demographic, you need to break it down and learn who your specific audience is. What is your buyer persona? What types of videos do they like to watch? Are they looking for entertainment, information, connection, etc.?

The last level is, what types of searches are they making? Once you know where and who they are, how can you connect them with your video? What are they typing into the search bar, and how can you direct that to you?

The easiest way to understand all of this is to reverse engineer it the same we do with organic SEO. Put yourself in your ideal client’s shoes and search for a video within your wheelhouse. Figure out what search phrases lead where and what you need to do based on your competition to jump ahead of them.

This point piggybacks off the previous one, but it goes a little deeper. Connecting with the searcher means understanding what they’re looking for so you can be the one to provide it.

Attention spans are short, so you need to provide the right answer as soon as possible in your video; otherwise, people will turn somewhere else.

Another key to video search is giving the audience exactly what they want, right away. If the first few seconds of your video doesn’t pique the viewer’s interest, they’ll move on to the other hundreds of options available to them.

Another point to consider is the chosen platform you’re using from point one. How well do you understand how to use it? Do you know how the video search process works? Do you understand the basics of the algorithm and methods used to determine which videos show up and how they rank them?

In the same way that we try to understand everything about Google’s algorithms for SEO, we need to do the same with each platform, and if you don’t understand it, you might get left behind.

Timing is a huge factor. The length of your video will play a significant role in who chooses to watch it and how well it ranks. There isn’t an “end all be all” for video length because the ideal length depends on the platform.

That said, if someone is looking for a quick solution to a problem, throw that case out the window. For example, when someone is trying to figure out how to upload a featured image on WordPress, they don’t want to watch a 15-minute video because they’re going to know there’s a lot of fluff.

Your video would likely perform much better if it was only one minute because people will assume it is straight to the point.

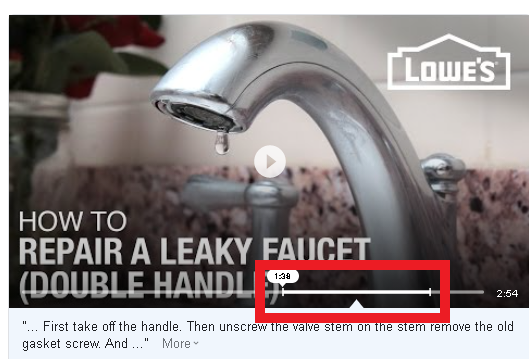

Google even pinpoints in many video searches where the result you’re looking for is in the video in their search results.

They pull a snippet out for you to get the answer you’re looking for without having to watch the whole thing.

Lastly, you need to optimize your videos. There’s a whole guide to video SEO here, but there are some important factors pertaining to video search specifically.

First, your thumbnail:

The thumbnail of your video is like the trailer for your upcoming movie. If the trailer sucks, chances are, no one is going to see the movie.

If your thumbnail sucks, fewer people will click through to your video. Your thumbnail needs to contain keywords, and it must instill confidence in the viewer that your video will solve their problem.

Second, you need to optimize your video descriptions on all platforms. Every video search platform uses keywords to determine how relative a video is to what the user is searching. You need to make sure you’re following fundamental SEO principles when it comes to video search as well.

Many people wonder what the top video search engines are but keep in mind, it’s unique to the individual. What’s a hit on Facebook might tank on TikTok and vice versa. When choosing from these top six video search engines, make sure you factor in everything we’ve discussed so far.

Video marketing on Facebook is all about interrupting patterns. If you’re targeting an older demographic, your content is a bit more serious, and you’re able to grab attention quickly, Facebook might be an excellent place for you.

The problem that I’ve seen with Facebook video is the implementation of intrusive ads. That’s why I recommend sticking to short, sweet, and direct videos on Facebook. If your primary purpose of creating the video is to sell something, keep it super short, ideally less than 60 seconds.

One area where Facebook has shined is in e-commerce. I see videos all the time of people using a product they purchased online, and they do such a great job of making the video appear organic.

The key to getting your video in front of your audience on Facebook is to make sure you include the right keywords in your description and have a very refined target demographic.

Understanding Youtube video search is all about understanding video SEO. There are also various tools and extensions out there to use alongside the manual work and knowledge you obtain.

One thing about YouTube is that they reward continuous creators. Consistency is essential, and if you plan on having success with YouTube, you need to create videos every week so the algorithm sees that you’re a consistent creator.

I see YouTube marketing as an excellent way for affiliates, content creators, and artists to display their work. If you produce something as a product or you’re an affiliate or something, YouTube is the place to show your stuff.

The platform also puts much more emphasis on longer videos. Plus, if you’re creating high-quality content, the longer videos will increase your watch time, which has a positive impact on ranking.

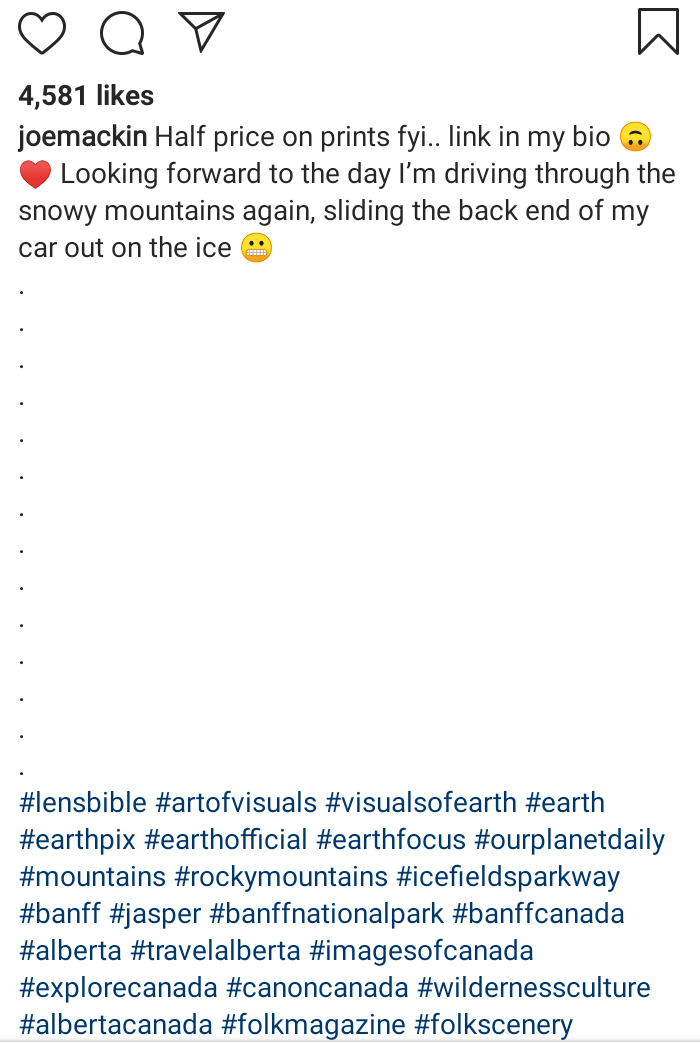

Instagram is built on discovery, and if you’re looking to go from nothing to something, Instagram seems like the place to be. Video search on Instagram is made possible through the use of hashtags.

When someone wants to find something specific or they want to filter content, they search using hashtags.

One great way to get discovered on Instagram is by capitalizing on trends. Throughout the year, Instagram has a plethora of hashtag trends that explode in terms of search volume, and if you find one that’s relevant to you and your audience, you may be able to create a viral video or “reel” (their version of TikTok) in no time.

Capitalizing on Twitter video search is similar to Facebook; it needs to be interruptive without being intrusive. You’ll want to have the proper key phrases in your video’s description because users will search for content relating to that phrase.

Also, keep in mind that platforms like Twitter choose which videos to display on users’ Twitter feeds, so having relevant keywords pertaining to the content in your video may end up on the feed of your ideal client.

Vimeo is very similar to YouTube, but Vimeo has an advantage with smaller boutique-style audiences. There’s less competition, the quality of videos is better, and viewers are more dedicated to the videos they watch.

Another recommendation for marketing on Vimeo is to stay on top of the engagement with your viewers. Because the audience is so much smaller, there’s a lot less spam and bots, which means more actual conversation from people who may have questions about whatever it is you’re selling or promoting.

Content is king on TikTok, and compared to all the other platforms, this app is the only place where you can post a video with no followers and get millions of views if you know what to post.

It’s essential to understand your audience and tap into their feelings, emotions, fears, and desires. Who are you looking to target, and what do you want them to feel when watching this video?

Once you’ve got that figure out, put in a proper description, add some hashtags, and see what happens. There’s no proven formula because the content is so important on this platform. If your content resonates with the right people, it will get likes and shares, and the sky’s the limit from there.

Now that you understand video search, how people search for videos, why they search, and how to reach them, how do you feel? Do you feel like any of the previous video platforms could work for your brand?

If this all sounds like a lot of work, consider learning more about what we’ve done to help other marketers get their videos in front of the right audience.

Which platform do you think is the best for video marketing going forward?

The post What is Video Search and How Can it Help Your Business? appeared first on Neil Patel.

Are you feeling inspired to change the name of your business? It’s understandable. Sometimes something just strikes you as perfect and you feel you need to take action right away. However, you might want to hold off on that for a minute. Don’t change your business name until you understand how risky it is.

Even if the name of your business is super boring right now and you have an idea for the catchiest name ever, it is a big risk to change your business name. The name of your business is incredibly far reaching. It is on all insurances, licenses, bank accounts, credit accounts, and it is tied to your EIN if you have one.

Imagine, every legal document and identification number that relates to your business has your business name on it. Furthermore, if you have a web presence, your social media accounts and website connect to that name. If your URL has your business name in it, that complicates things even further.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Of course, you’re thinking you’ll just change it in all the places and you’ll be good. That’s great, but what if you forget something random from a long time ago? What if your business name is on a document you forgot even exists? You may not think it matters much, but it does. Your business name can affect almost every aspect of fundability. Do you know why it’s risky to change your business name? Understanding exactly what fundability is and what affects it can go a long way toward helping you understand.

Fundability is the ability of your business to get funding. When lenders look at funding your business, they consider if it is a good idea to make the loan. What do they look at to make that determination? It’s a lot more than you may think, and I guarantee that it reaches further than you realize.

The first aspects of fundability have to do with how your business is set up.

This is your business phone number and address that is separate from your personal phone number and address. That may not mean you have a separate phone line, or even a separate location however.

Honestly, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. Then, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline. Whenever someone calls your business number it will ring straight to you.

You can use a virtual office for a separate business address. This isn’t what you may think. A virtual office is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

But imagine if your phone number and address are listed under one name, and then you change the business name. It is complex and time consuming to change your information everywhere. Something is almost certain to get missed, and customers are going to be confused.

This is an identifying number for your business that works in a way similar to how your SSN works for you personally. You can get one for free from the IRS. However, if you change your business name, you’ll have to make sure you have an EIN that is attached to the new name. Furthermore, you’ll have to ensure all the accounts that you have using that EIN are changed to reflect your new name.

Incorporating your business as an LLC, S-corp, or corporation is necessary to fundability. It lends credence to your business as one that is legitimate. It also offers some protection from liability.

Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. It’s best to talk to your attorney or a tax professional about that issue. However, when you incorporate you are going to lose the time in business that you already have. You essentially become a new entity. Basically, you have to start over. You’ll even lose any positive payment history you may have accumulated.

This is why it is important to incorporate as soon as possible. Is necessary for fundability and for building business credit, but so is time in business. The longer you have been in business the more fundable you appear to be in the eyes of lenders. That starts on the date of incorporation, regardless of when you actually started doing business.

If you want to change your business name and you are not yet incorporated, then when you do incorporate is the best time to make it happen. Do it sooner rather than later.

You should already have a separate bank account for your business transactions. If you don’t, you need to make that happen now. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

Now, here is how your business name, and the risk when you change your business name, comes into play. This account has to be in your business name. If you change that name, you’ll have to go through the hassle of changing the name on that account. Not only that, but if you have any drafts coming out, you will have to make sure information is updated with those accounts. Otherwise, you could end up with unpaid bills.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, warning signals are going blare. Do you know what else will set off some major red flags? If your business name and the name on your license do not match.

I am sure you are wondering how a business website can affect your ability to get funding. Think about it. These days, if you don’t have a website you may as well not even exist. Yet, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional or confusing it will not bode well for you with consumers or potential lenders.

Spending the time and money necessary to ensure your website is professionally designed and works well is vital. Paying for hosting is important too. Don’t use a free hosting service. Also, your business needs a dedicated business email address. It should have the same URL as your Website.

Now, imagine your URL and email are tied to your business name. If you change that, you have to redesign your whole site to reflect the new name. Changing those things takes time and money. That’s not even to mention how confused people will be when they do an internet search for your business using a different name, or when they get to your website and see a name they aren’t expecting.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

These are reports, like your personal credit reports, that detail the credit history of your business. It is a tool to help lenders determine how credit worthy your business is.

Where do business credit reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS.

Lenders see this report. They rely on it heavily when it comes to making lending decisions. Even if your business credit is stellar, seeing your business listed under a bunch of different names can cause a problem. They start worrying about things like fraud, and that can cause an automatic denial.

Even worse, if things aren’t taken care of properly, you could end up with accounts reporting to two different credit reports, wrong accounts on wrong reports, or some other confusing credit report fiasco simply from choosing to change your business name.

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

The same issues apply. If your business name doesn’t match across the board, lenders could get uncomfortable.

In addition to the EIN, there are identifying numbers that go along with your business credit reports. Some of them are simply assigned by the agency, like the Experian BIN. Some, like a D-U-N-S number, you have to apply for, of course using your business name.

Here’s another place where you have to follow through if you change your business name. You have to make sure your new name isconnected to your old D&B number, or get a new number. It can become very complicated.

Then other numbers, like your BIN from Experian, will need to be updated as well.

Your credit history has everything to do with everything related to your credit score, which is a huge factor in the fundability of your business.

Your credit history consists of a number of things including:

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

The more accounts you have reporting on-time payments, the stronger your credit score will be. I’ve already touched on this above. When you change your business name, this information can become very confusing unless you handle things very carefully. The less confusing things are for lenders, the better.

When you change your business name, you start a sort of domino effect. The problem is, the dominos weave in and out of a spider web formation that reaches further than you can probably imagine. If just one is out of place the whole thing can fall. Lenders hone in on discrepancies, and sometimes the result is simply denial. No questions asked, they just deny the loan based on too many inconsistencies.

The only really good time to change your business name is when you incorporate. Still, even then it is best not to. Consistency is key, and trying to backtrack and make changes everywhere they need to be made costs time and money. Trying to explain gaps and changes on a report and how everything ties together is even riskier. The more complicated things are, and the harder a lender has to work to see that you are fundable, the less likely approval becomes.

To make a long story short, you need to carefully weigh any benefit you think you may gain from changing your business name against all the costs. While there could be a few very specific situations where this isn’t the case, as a general rule the benefit doesn’t outweigh the cost.

The post Why It’s Risky to Change Your Business Name appeared first on Credit Suite.

Do you need business funding for bad credit? You may feel that – or you may have heard – that you can’t get business funding for bad credit. The best, easiest, and fastest way to do so is to build business credit. Because then your bad credit won’t matter quite so much. Any Small Business … Continue reading Is it Possible to Get Business Funding for Bad Credit?