Brand Perception: What is it & How Do We Measure it

Wondering why perception is so important in marketing? This quote sums it up nicely: “Facts matter not at all. Perception is everything. It’s certainty.” – Stephen Colbert.

You see, it doesn’t matter how good your product/service is, the value it offers, or the quality you provide. If consumers don’t perceive your brand the way you want them to, your business will struggle with loyalty and getting new customers.

Today, I’m covering brand perception in detail. What is it, and why does it matter? How do you measure it? Keep reading to find out more.

What Is Brand Perception?

In marketing, brand perception is how consumers see and feel about a company or product. It’s how customers interpret and react to messages, experiences, and interactions with a brand.

Obvious things like marketing, word-of-mouth, and customer service contribute to your brand perception, and less obvious areas like colors can also influence how customers perceive you. (I’ve written an article if you want to know the best colors for online conversions).

Brand Perception vs. Brand Equity

While both concepts are essential to businesses, they serve different purposes. As you know, brand perception helps you understand how customers see your company; in contrast, brand equity allows you to quantify the value of your business. It consists of multiple factors, like:

- Brand loyalty

- Name recognition

- Visibility

Essentially, brand equity is the difference between what a customer would pay for a generic product and what they would pay for the same product from a specific brand.

There are several ways to build equity in a brand. One is by offering high-quality products or services that customers can rely on. Another is positive customer experiences that leave people feeling good about the brand.

Creating an emotional connection with consumers can also help build equity, as people with a positive association with a brand are more likely to be loyal.

Why Do You Need Strong Brand Perception?

A brand isn’t merely a name or logo. It’s also the perception that consumers have of a company or product, and that idea can make or break a business.

Think about it – would you buy a product from a company you don’t trust? Or one whose values don’t align with your own?

Probably not.

That’s why brand perception is so important. It’s the difference between customers choosing your company over your competitors.

In addition, a strong brand perception:

- Helps build trust with your audience. We mentioned earlier how important trust is, and how it makes people more likely to do business with you.

- Lets you stand out from the competition. In a crowded marketplace, it’s important to have a unique and recognizable brand that people can easily identify and remember.

- Can lead to higher profits. Customers pay more for products and services from brands they know and trust; when you have a loyal customer base, they keep coming back, leading to even higher long-term profits.

If consumers perceive your business positively, it can put it on the map, and if you’re already established, a good impression can grow your brand exponentially.

Let’s use Apple as an example.

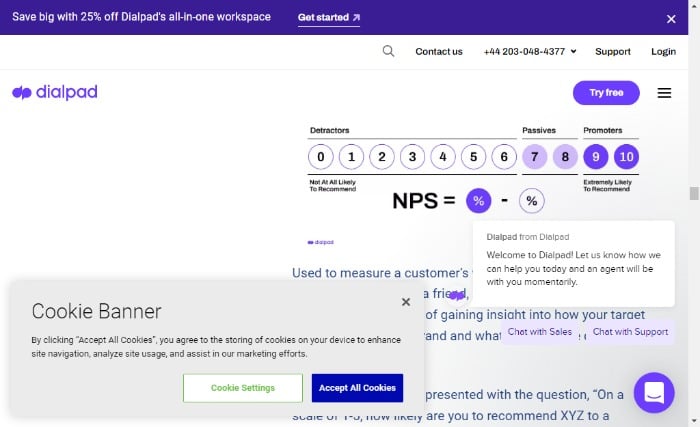

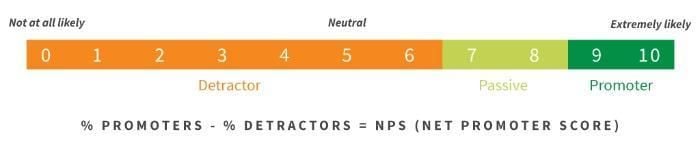

Although it’s had its ups and downs, customers’ brand perception of Apple is largely positive. Additionally, it has a Net Promoter Score (NPS) of 72. The NPS measures customer experience and potential business growth by using a simple one-ten scale:

Why the love for Apple? Well, it:

- doesn’t just sell tech products. It sells experiences and products that customers love.

- offers amazing products that millions of us want to own.

- provides exceptional customer service by offering full support so you can get the best out of your products.

All these factors give buyers confidence and, you’ve guessed it, give Apple a great brand perception.

On the other hand, what about Meta (formerly Facebook)? According to branding expert Rebecca Biestman, Facebook can’t repair its brand perception simply by changing its name.

Scandals like Cambridge Analytica significantly wounded the company’s reputation, and its user base is set to decline for the first time ever; although there are multiple factors behind Facebook’s falling user numbers, brand perception is among them.

Now that you see how consumers’ brand perception can influence your business’s fortunes, let’s discuss how you measure it.

How Do You Measure Brand Perception?

Fortunately, measuring brand perception is not as complicated as you may think. Below are some of the easiest ways to understand how buyers and prospects view you.

Customer Outreach

Email lists, online review platforms, and social media make reaching out to your customers easier than ever. Want to know what your buyers think of your product or service? Or how to make them better? Send them a survey and ask them what you could do to improve.

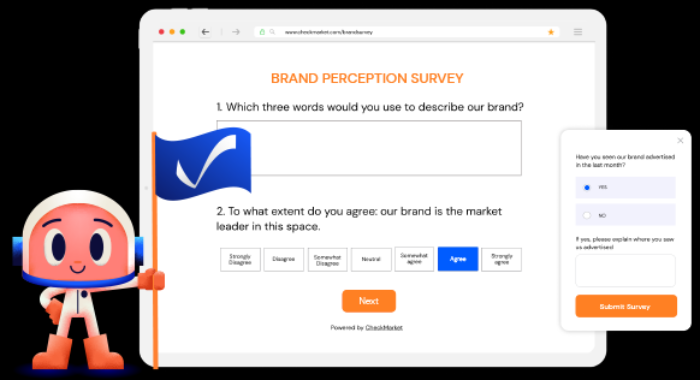

Brand Perception Surveys

If you’re a larger company with a decent budget, consider brand perception surveys or focus groups.

For more general answers on what your buyers value, you could ask them things like:

- How important is it for you that a brand aligns with your personal values?

- How much does a brand’s reputation affect your decision to purchase its products or services?

- How much does customer service influence your perception of our brand?

These questions can give you a better idea of what customers look for in a business and provide valuable and actionable feedback. For instance, if you believe you provide great customer service but your customers believe you could be more responsive, you can introduce measures to improve response times.

Then you might ask them questions like this:

- Does our brand make you feel more confident or stylish? Explain why.

- To what extent do you feel like you are a part of the brand’s community or “tribe”?

- Would you recommend our brand to your friends or family?

- Have you ever been disappointed by your experience with our brand? Why?

- What emotions do you associate with our brand?

- Describe our brand in three words.

- What are your favorite products/services and why?

Of course, the type of questions you ask depends on what you want to achieve. Here are some tips for creating a brand perception survey:

1. Decide what you want to measure. Do you want to know how customers feel about your brand overall? Or are you looking for feedback on specific products or services? Determine what you want to learn from the survey to create suitable questions.

2. Keep the questions focused. Too many questions can overwhelm respondents and make it difficult to get useful data. Stick to around 10-15 questions that are relevant to your goals for the survey.

3. Make sure the questions are clear and easy to understand. Use simple language and avoid jargon.

4. Ask open-ended questions to get detailed answers rather than ‘yes’ or ‘no’ responses.

Use Social Media

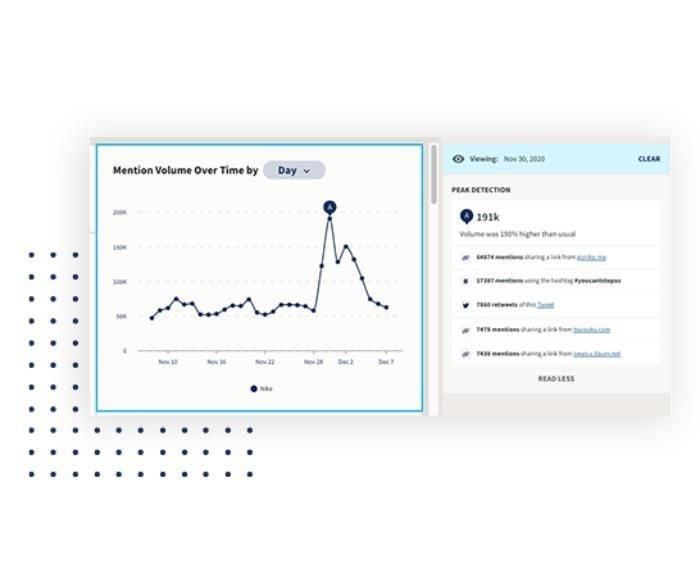

Yes, you can spend your time looking through your Twitter feeds and relevant tags, but you may find automating the task with social listening tools more efficient.

Social listening tools can track and measure brand perception across social media channels. By analyzing online conversations, businesses can get insights into how customers perceive your brand, what customers are saying, and what areas need improvement.

Many different social listening tools are available, each with unique features and benefits. Some of the most popular include Hootsuite Insights, Brandwatch, and Talkwalker.

Brand Audits

A brand audit is a detailed analysis of how customers and other stakeholders perceive a company’s brand, allowing businesses to identify areas where the brand is strong and where it needs improvement.

An audit usually involves:

- Conducting surveys and focus groups with customers and other stakeholders.

- Analyzing media coverage, social media activity, and other data sources.

You can then use this information to create a detailed report to help you understand your brand’s strengths and weaknesses.

Brand audits can be important for businesses looking to improve their brand perception. By understanding how customers and others perceive the company, businesses can make changes to improve their image.

In addition, brand audits help you understand:

- Consumer ratings of your brand and why your buyers/prospects view you that way.

- How you compare with your top competitors.

- How your customers would describe your brand; this helps you understand if your messaging is right.

- Your brand trajectory or where your customers see your business going.

Finally, check online review sites to see what your buyers are saying about their experience and address any shortcomings you discover.

Best Practices For Improving Brand Perception

There are some best practices every business can introduce to enhance its brand reputation. Here are some of them.

First, start with the basics. Ensure you deliver high-quality products and services and always exceed/manage customer expectations.

Next, use effective marketing to improve brand perception by communicating the right message/image about your company to the right audience. You can do this by using customer avatars or buyer personas to understand your ideal customers and the type of content that most likely resonates with them.

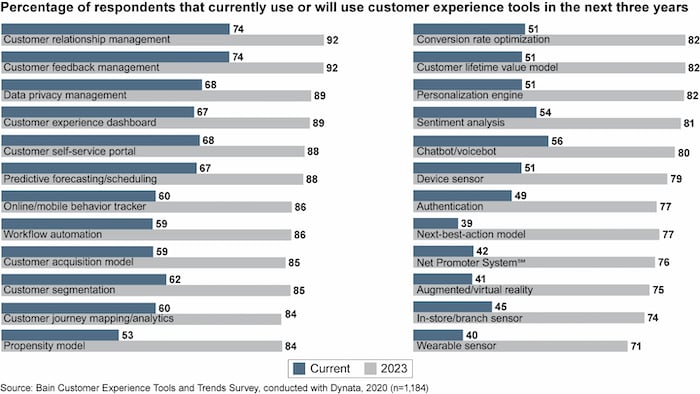

Then, focus on the customer journey. Complete customer journey mapping to see the purchasing process from your customer’s perspective. Doing this helps ensure each interaction along the customer journey leaves a positive impression.

Use Social Media to Your Advantage

I’ve already discussed social listening, but responding to what your consumers say is every bit as vital. It doesn’t matter if a buyer’s experience is positive or negative; they’re only too happy to share their views on social media. While you can’t do much about this, you can at least ensure you’re fast to respond and offer your customer a positive outcome.

Giving swift responses and addressing issues is more likely to improve your brand perception and get you noticed by potential buyers.

Don’t Underdeliver

Does your product do what it says on the label? Making bold claims in your advertising that you can’t deliver is guaranteed to underwhelm and frustrate your customers.

However, don’t just focus on your product descriptions, features, and benefits. Check your images, too. For instance, does your imaging suggest your product comes with accessories when it doesn’t?

Take Feedback On Board

You’ll never perceive your product or service the same way as your customers. Your buyers and prospects can often give you insights and suggestions you’ve never even dreamed of.

Whether it comes from social media, surveys, reviews, or niche-related forums, understanding your customer’s pain points helps you develop and refine products/services to meet their needs.

Train Your Staff

Training your staff ensures they feel empowered to answer consumer/leads questions accurately. When your staff are knowledgeable, it inspires confidence among buyers and enhances your brand perception.

Examples of Brand Perception Success

Changing times and consumer demand often mean companies must reposition themselves if they want to influence customers’ views.

Let’s look at two examples of brand perception.

Zoom

At first glance, Zoom might look like an overnight success, but that’s not the case. Eric Yuan founded Zoom in 2011. It had a public launch in 2013, with a mission of ‘making video communications frictionless and secure’.

However, it wasn’t until 2020 that it became more mainstream. As its popularity soared, the brand perception changed. ‘Zoom fatigue’ became a thing. Some employees spending lengthy periods on the app complained of exhaustion from the extra cognitive demands of video conferencing, irritability, and muscle tension.

Then, later, Zoom’s growth started to flatline.

Zoom’s answer to this problem? It repositioned itself to change users’ brand perception.

It launched a ‘How the World Connects’ campaign and expanded away from video with the Zoom phone. Online, the company stressed its highly successful track record, highlighting how half a million businesses use Zoom, including:

- 70 percent of the Fortune 100

- Over half of the Fortune 500

- 85 percent of the Forbes Cloud 100, the world’s top private cloud companies

That’s before you get to the ton of top finance, healthcare, and educational facilities that use Zoom and how the app helps them. For example, Zoom provides secure communications for hybrid working and allows better collaboration between teams. It sounds like a real success story, doesn’t it? And perhaps one you want to be part of.

Chipotle

Here’s a great example of how marketing can change brand perception.

Think of Chipotle, and the first thing that comes to mind is fast food. However, the company wanted to win new customers for its ‘Lifestyle Bowls Range’ for those following vegetarian, vegan, and keto diets.

To achieve this, Chipotle needed to change its brand perception and reposition itself as a healthier alternative. By working with a marketing agency, Chipotle highlighted the use of its natural, fresh ingredients in its made-to-order takeaway meals.

The agency:

- Divided potential consumers into different tribes like ‘Fitness Fanatics’ and ‘US Health & Nutrition’.

- Used the insights gathered from the different tribes to reach these audiences with targeted traffic and awareness campaigns.

- Applied geo-targeting to attract customers to new restaurants.

The results were impressive by anyone’s standards, leading to 10.7 million impressions and potentially 2.5 million new customers. In addition, click-through rates (CTRs) exceed standard benchmarks, averaging 1.24 percent.

This case study highlights the importance of:

- Tailoring your message to your target audience and mindset segmentation.

- Using bespoke segmentation analysis to create hyper-relevant and audience-centered campaigns instead of relying on generic advertising.

- Analyzing your audience to discover new target markets and ensure your new brand voice stands out.

If you want to change your brand perception or move into new market sectors, taking these measures can supercharge the impact of your advertising campaigns.

FAQs

What is an Example of Brand Perception?

Apple has an excellent brand perception, built on having high-quality products that are easy to use. Its positive brand perception has helped Apple become one of the most successful companies in the world.

How Do You Create a Brand Perception?

Brand perception starts with knowing your audience and understanding what they want and need. From there, you can create messaging and visuals that resonate with them.

How Do You Measure Brand Perception?

You can measure brand perception through audits, surveys, social listening, and reading reviews.

What Factors Influence Brand Perception?

Numerous factors influence brand perception, like your marketing, word of mouth, customer service, and color scheme.

What Is The Importance of Brand Perception?

Brand perception is essential to your business. The better consumers perceive your products/service, the more loyal your customers are likely to be, and you can charge a premium for your products.

Why Is Perception Important in Marketing?

Perception is important in marketing because it helps you understand how customers see your brand. This understanding is valuable when deciding how to position your brand and what messages to communicate to your target audience.

What Is the Difference Between Brand Perception and Brand Equity?

Brand equity is the value of a brand based on customer perceptions and associations. Brand perception is how customers perceive a brand in the present moment.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is an Example of Brand Perception?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Apple has an excellent brand perception, built on having high-quality products that are easy to use. Its positive brand perception has helped Apple become one of the most successful companies in the world.

”

}

}

, {

“@type”: “Question”,

“name”: “How Do You Create a Brand Perception?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Brand perception starts with knowing your audience and understanding what they want and need. From there, you can create messaging and visuals that resonate with them.

”

}

}

, {

“@type”: “Question”,

“name”: “How Do You Measure Brand Perception?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You can measure brand perception through audits, surveys, social listening, and reading reviews.

”

}

}

, {

“@type”: “Question”,

“name”: “What Factors Influence Brand Perception?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Numerous factors influence brand perception, like your marketing, word of mouth, customer service, and color scheme.

”

}

}

, {

“@type”: “Question”,

“name”: “What Is The Importance of Brand Perception?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Brand perception is essential to your business. The better consumers perceive your products/service, the more loyal your customers are likely to be, and you can charge a premium for your products.

”

}

}

, {

“@type”: “Question”,

“name”: “Why Is Perception Important in Marketing?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Perception is important in marketing because it helps you understand how customers see your brand. This understanding is valuable when deciding how to position your brand and what messages to communicate to your target audience.

”

}

}

, {

“@type”: “Question”,

“name”: “What Is the Difference Between Brand Perception and Brand Equity?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Brand equity is the value of a brand based on customer perceptions and associations. Brand perception is how customers perceive a brand in the present moment.

”

}

}

]

}

Conclusion

Let’s return to my original point: perception is everything. It doesn’t matter if the image customers have of your business is accurate or not; it only matters what their perceptions are.

The truth is that companies sometimes perceive themselves differently than their customers or prospects, which can make it difficult to attract new buyers.

Poor brand perception can hamper growth, limit customer loyalty, and ultimately means you don’t reach your core audience.

However, businesses can make better decisions about their marketing efforts by understanding brand perception and how to measure it. Additionally, companies can identify trends and adjust accordingly by tracking brand perception over time.

What brand perception are you trying to craft for your business?