The Best Website Builders (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

There is one decision in life that you simply cannot get wrong.

And no, it’s not choosing the right partner or career.

That life-changing decision comes down to what website builder you decide to use.

Whether you are setting up a small non-profit or are itching to take over the world with your handmade jewelry, the quality of your site will be a key factor in your success.

And to build a great site, you need a great web builder. Assuming of course you are like the vast majority of people with no technical skills. If you do have skills, what are you doing here? Get building!

But fret not. We’ve done the hard work and this article will guide you through the otherwise arduous process of finding the best website builder.

The Top 4 Best Website Builders

The Different Types of Website Builders

When choosing a website builder, your first consideration should be what your actual needs are. There are a multitude of reasons to want to start a website and they will affect the services and features you will need.

For instance, is your goal to set up shop as an eCommerce entrepreneur, dropshipping items from abroad?

Do you want to start a simple blog documenting your travel adventures?

Or perhaps you work in marketing and are looking for ways to test and optimize your sales funnels.

Regardless of your goals, the idea of “knowing thyself” applies here. Think deeply about what you want now, but also your roadmap for the future. Once you commit to a particular website builder, it can be difficult to change later on.

After getting a clear idea of your needs, you will then need to consider the different types of web builders available.

Keep in mind that many website builders fit multiple categories, serving each need to a different extent.

General-purpose website builders

There are thousands of reasons to create a website, and nowadays, it seems like every person and organization has one.

To service such great demand, some website builders have taken a holistic approach in terms of appeal and their tools.

For example, these sites typically have a lot of features that other types of website builders have, such as the ability to blog.

However, as they are multi-purpose in nature, you cannot expect these features to not be as in-depth and robust as more specialist platforms.

Some use cases for general website builders include:

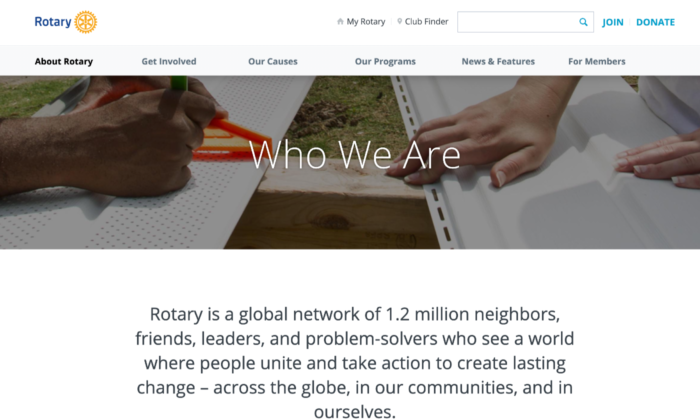

- Information websites – If your goal is to simply host information online, these general website builders can be quite useful. For instance, you may have a kitchen renovation company and want to start reaching potential customers online.

- Personal branding – Managing your personal brand is becoming more important every day. It is particularly important for independent workers and entrepreneurs as well as for employees applying for jobs.

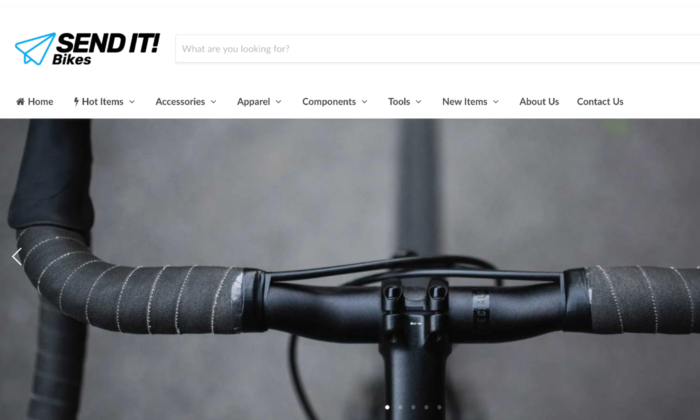

An example of an information website.

Content management platforms

Content is what drives the web, and one of the oldest yet still most relevant forms of content is the blog post.

Considering blogging is such a crucial part of the web, some website builders have been designed with a content management system in mind.

In the case that you want to get your thoughts out there; ideally, in a serious and sustained way, a blog website builder may be the right option for you. Use cases include:

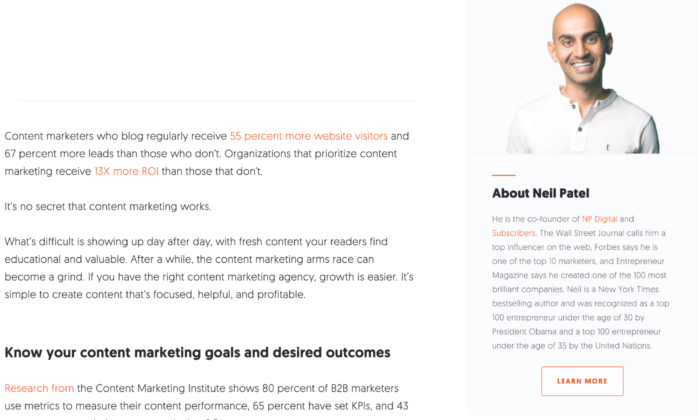

- Professional writing – This goes without saying, but if you want to be a writer, you actually have to write. Typically, you need a place where you can showcase your talent. Whether you are a business writer or journalist, maintaining a personal blog is important.

- Thought leadership – In many industries, it is useful for people of prominence to share their unique insights on a public platform. Setting up a blog with a strong content management system helps to get ideas out in a sustained way.

An example of a content-centric website.

Essentially, blog website builders are a good choice if you plan on writing long term and it is one of the things you focus on.

eCommerce platforms

Another type of website builder are eCommerce platforms. These platforms allow you to build and manage online stores through the ability to list goods, fulfill orders, and take payments.

These website builders are useful for:

- Side hustles – Perhaps you are interested in selling some goods in addition to your day job and don’t have the time to dedicate to the operational side of things. These website builders are great to solve this problem, as they handle the backend of your business.

- Digitizing your store – Maybe you already have a brick and mortar store and are looking to make your stock available online. In this situation, this type of website builder will take all the technical complications out of setting up online.

An example of an eCommerce website.

How to Choose The Best Website Builder For You

Now it is time to take a closer look at some of the specific features to consider when evaluating a website builder.

Remember that although some website builders may fall into the same category, each may suit your needs differently.

For instance, you may be setting up an online shop and your primary consideration may be a low learning curve, whereas somebody else may be thinking about a platform that can allow them to scale easily.

Here are some features you should consider.

Ease of use

Things to consider:

- Intuitiveness – Some website builders are easy to use and have simple interfaces with drag and drop functionality. This is useful as you won’t have to Google changes you want to make with the tool.

- Learning curve – If you are not great with technology, it is unlikely you will want to spend hours learning how to set up a website. Some website builders are much easier than others.

- Setup time – Similarly, you may want to get your site up and running immediately, particularly if it is an event you want to promote.

- Ongoing management – Needing external help to manage your site defeats the purpose of a website builder. It must be easy to manage in terms of updates.

If you are new to setting up online or are time-constrained, how easy it is to get started will likely be your primary concern.

Scalability

Things to consider:

- Custom code – Website builders use standardized code, which are the building blocks of a website. These allow you to easily create a site with various features. In some cases, however, you may need your own custom features and the ability to write your own code.

- Migration – At some point, you may want to host your website yourself. However, not all website builders allow you to easily make this move. In some cases, you may have to redevelop your site from scratch.

- Integrations – You will probably create new goals as your website grows, such as running ads or embedding social feeds. Some website builders are more compatible with other platforms and are easier to integrate.

You should think strongly about scalability if you are already an established business looking to create an online presence. This is particularly true if you are already selling products at scale in the real world.

Startups in the fundraising process and are looking to scale fast or even change core features of their product should also take caution here.

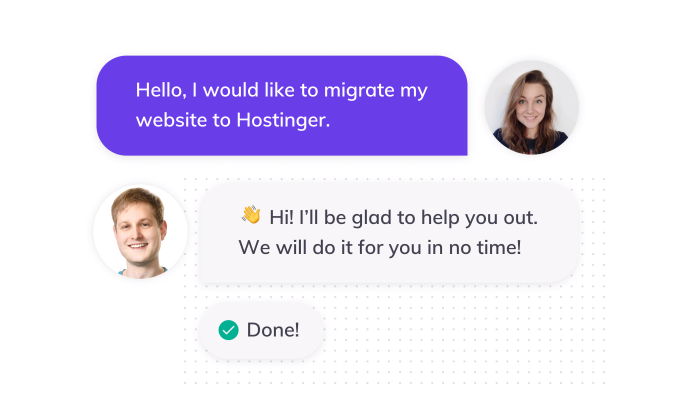

Support

Things to consider:

- Support channels – You will need to consider the different ways you can get in touch with support teams such as live chat, email, and phone. In-depth FAQ’s (frequently asked questions) are also important.

- Responsiveness – If your site breaks at 5 PM eastern time, but their support only works European hours, then you are in trouble. Some teams may also respond much quicker than others.

- Engagement – Unfortunately, some support teams are useless. Maybe they are being paid very little so they do not care, or they are overworked. Either way, you need support that can actually solve your problems.

If you plan on running a site with a lot of visitors and it happens to go down, the last thing you want is an unresponsive support team. This is especially true if you plan on driving a lot of traffic at a given time.

A website builder with a strong support team is also useful if you are just getting started online, considering you may still get stuck, even with simple interfaces.

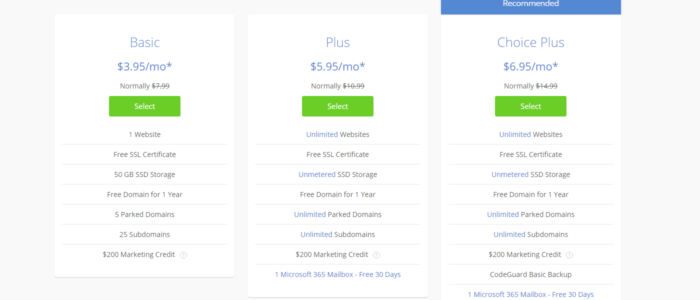

Price

Things to consider:

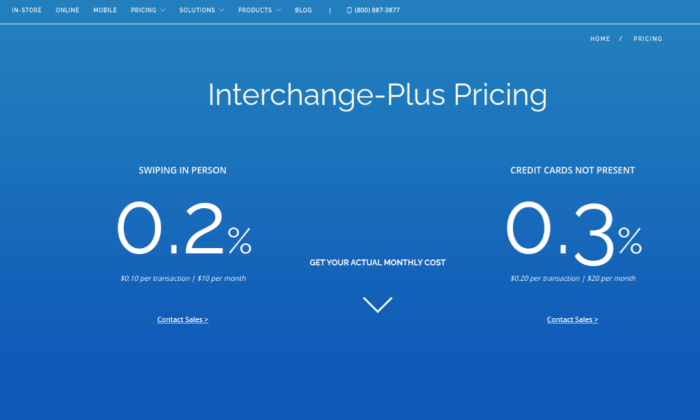

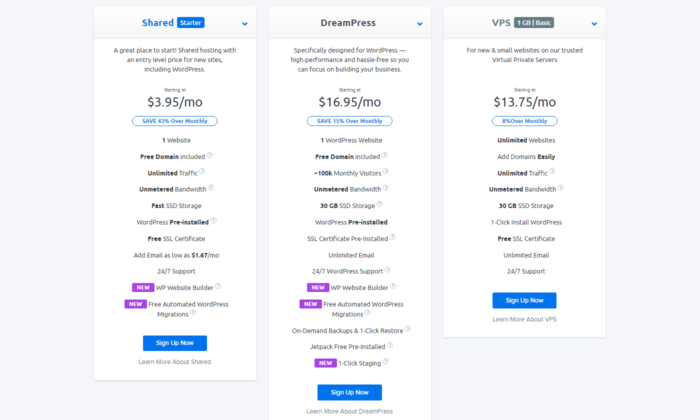

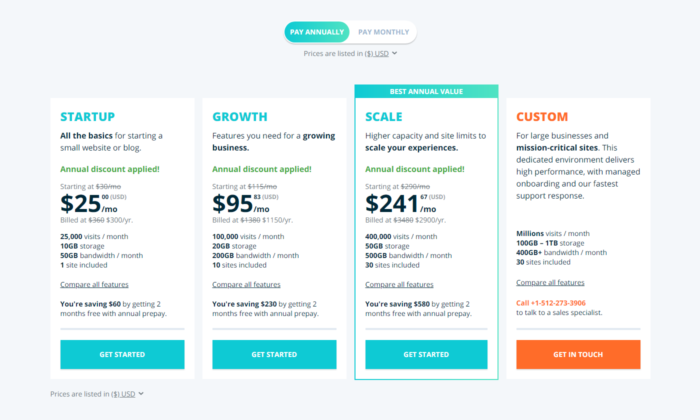

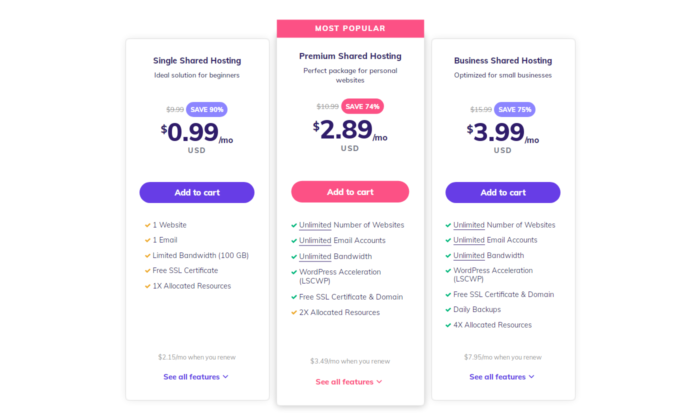

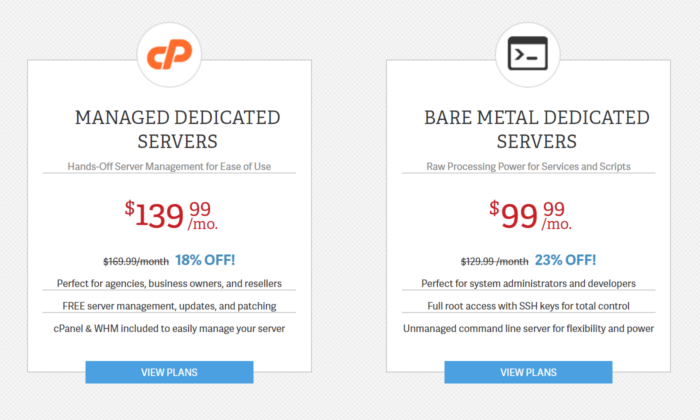

- Cost – Some website builders can be more costly, with some reaching upwards of $299 a month (for landing pages, for instance). Others are permanently free with the option to upgrade for a small monthly fee.

- Trial – Before you commit, it can be useful to take advantage of a trial offer to play around with the tools. You will likely find that some are a better fit than others.

- Hosting & domain – Most website builders will host your website on the web, which is typically included in the price. Some may also offer a domain as part of the package. Otherwise, you would have to purchase these yourself.

If you plan on making money from your website, either by selling products directly or to capture leads, then price should not be a key consideration for you. Make an investment in the best service for your needs.

However, if you just want to set up a small information site, then you could do with the cheapest options.

Generally, website builders that have feature depth are typically more expensive as they solve more specific problems.

Features

Things to consider:

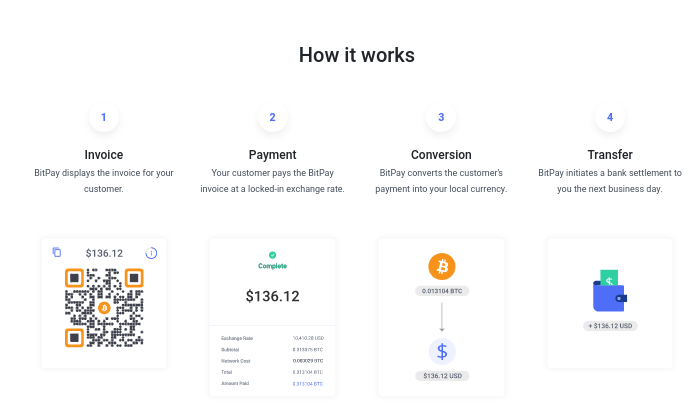

- eCommerce shop – If you plan to sell things online, you need a website builder that allows you to do so. Consider sub-features such as payment processing and product catalogs.

- SEO – Some website builders have tools that allow you to rank better in Google searches.

- Marketing tools – You may also need other marketing tools, such as forms, pop-ups, and chat boxes.

- Community – In some cases, you may want to expand your website into a community where people can communicate and network (otherwise known as a forum).

- Analytic tools – Website builders may also offer analytic tools that help track traffic on your website or at least integrate with other tools that do.

- Niche features – Perhaps there are some special features you are looking for such as the ability to set up a crowdfunding campaign in addition to having a standard website.

The features of a website builder are the main thing to consider when deciding which route to follow. This is because they will have the most impact on your specific goals.

For instance, if you want to set up a landing page for a specific product, trying to optimize with a generic site builder will be a pain. It will probably lack the in-depth analytic tools that a dedicated landing page builder would have.

Also keep in mind that there are some features that you may not need now, but you could need in the future, such as if you plan on running paid ads to your blog posts.

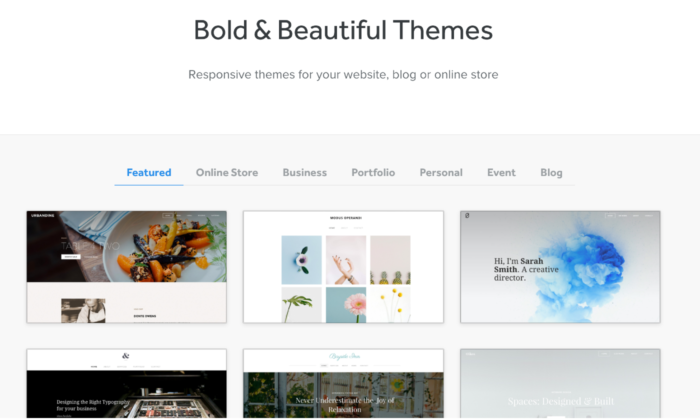

Design

Things to consider:

- Themes and templates – Website builders allow you to start with a predesigned website that is customizable to various extents. Some themes serve different purposes in terms of branding and utility.

- Mobile-friendliness – You will need to ensure that your website builder automatically makes your website easy for mobile users, typically with responsive design.

- Customization – It is likely you will want to make some changes to your template. You will need to consider the various customization tools available.

Regardless of your goal, you should always be concerned with providing a great user experience to the people who are visiting your site. It simply makes logical sense – if your site is hard to navigate, people won’t get the most out of it.

The actual design and branding are important too. For instance, some designs are more corporate while others are more welcoming. There may be a design template that really suits your particular brand.

And if you are selling something, you need to ensure that the design is optimized to increase conversions.

Now that you have a good understanding of the types of website builders and the features to look out for, it is time to take a look at some of the best website builders on the market.

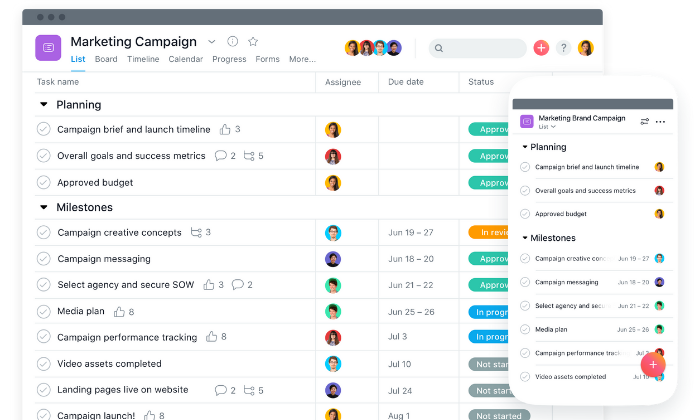

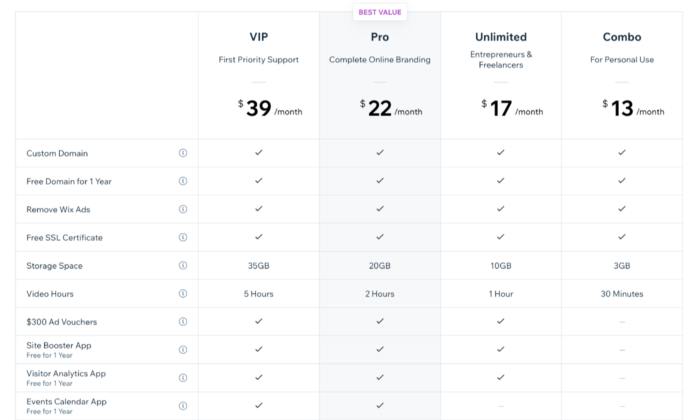

#1 – Wix / Website Builder — The Best For General Use

If there is one website builder that you have likely heard of, it is probably Wix. The effort that Wix puts into their marketing is phenomenal. Wix is so successful, in fact, that they have featured high profile celebrities like Jason Stratham in some of their campaigns.

Not only that, but Wix has results to show for it too, with over 160 million websites hosted by the company.

Wix is the best website builder if you don’t have a specific need in mind. Even in the opposite case, this is true, such as if you have broad needs and are aiming for different functionality.

Wix is truly the “jack of all trades” in the sense that it does everything well, but nothing is truly exceptional. However, it serves its purpose for the average person looking to set up a website.

Pros of Wix

Here are the best things about Wix:

- Powerful app market – Wix has an enormous amount of add on features that you can access through their app market. Want to book meetings directly on your site? They have got you covered. Want a live chat pop up box? Simply click and install it on your site.

- Covers every need – Wix covers most of the needs of people looking to set up a website. This includes setting up an eCommerce store, blog, or even just a simple information website.

- Lots of templates – Wix has a wide variety of templates that you can choose from to get your website up and running quickly. Their templates are well designed and take the user experience into consideration.

Cons of Wix

Here are the weaker parts about Wix:

- The user interface can be difficult – Although Wix is aimed at the mass market, the user interface can be quite tricky especially if you want to customize your site. You will often find yourself having to Google how to complete certain tasks. .

- No migration – A huge downside with Wix is that you’re locked in, so you cannot take the code of your website somewhere else later on. This can cause problems if you quickly need to scale your business.

- Jack of all trades, master of none – Wix’s main strength is also its weakness. Although it has many features, it cannot compete with the quality of niche website builders.

Who should use Wix?

- Small businesses – If you are offering a service such as legal advice or marketing, Wix is a solid website builder that will handle all of your needs. If your focus is selling products online, avoid Wix.

- Freelancers and professionals – In a similar manner, Wix is great for professionals who want to showcase their personal brand. It will allow you to cover all the potential bases of highlighting your portfolio, such as taking meetings and even blogging.

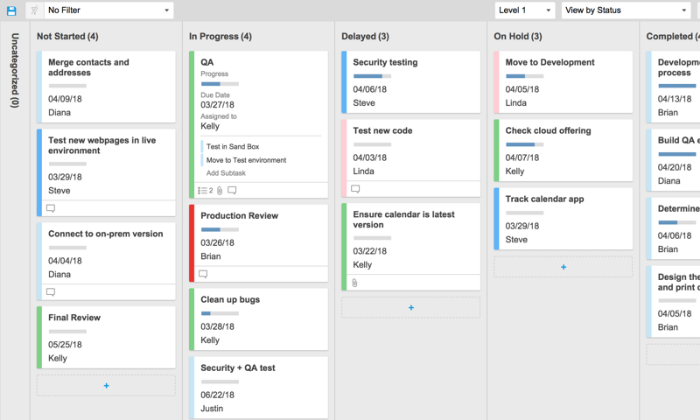

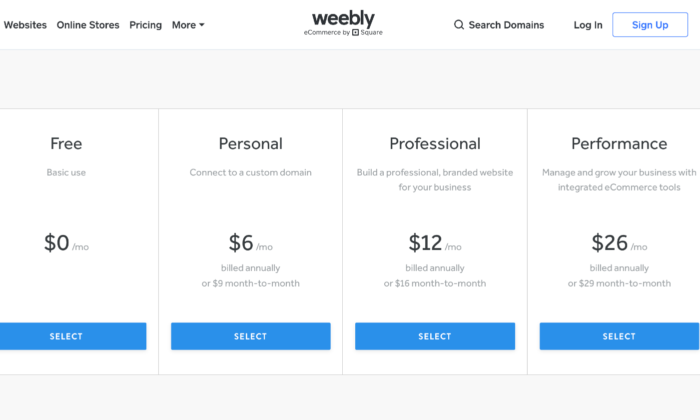

#2 – Weebly / Website Builder — The Easiest To Use

Next, we have Weebly, which is a drag and drop website builder that prides itself on its ease of use. Weebly currently powers over 50 million websites and has been around since 2006, which is a huge achievement and testament to how effective the platform is.

So, what has caused Weebly to be consistently favored among users? It comes down to the simple user experience and short learning curve. Weebly does not bombard you with features or a complicated interface.

Instead, it does not scare you away and allows you to get straight to the point of setting up your website.

Pros of Weebly

Here are the best things about Weebly:

- Simple and easy to use – Weebly has a simple interface with drag and drop mechanics that just work. Everything feels natural and intuitive. It also helps that they have an onboarding mechanic with email and popup explanations when you get started.

- Migration – If you decide you want to host your own website, Weebly makes it easy for you to take your site off their platform.

- Affordable – Compared to other generalist website builders, Weebly has one of the most affordable pricing structures.

- Great customer support – Weebly has a powerful customer support team who are active every day of the week. They typically reply within 1 day by email or even quicker via their live chat or phone lines.

Cons

Here are the weaker parts about Weebly

- Lacks diversity of function – The tradeoff of using Weebly is that it is not as powerful as Wix. For example, there are fewer features. In addition, some features such as their content management system and analytic tools are much weaker than competitors.

- Limited customization – As Weebly uses a drop and drop interface and themes, the customization can be quite limited. Wix also has this problem, but they have more tools at their disposal to solve this issue.

- Scaling problems – Weebly is simply not a great platform if you have plans to grow your website in a significant way: it is just a simple website builder for day to day users.

Who should use Weebly?

- People who need simple websites – As a rule, you should use Weebly if you are not very tech-savvy and want to set up a simple website quickly. One category of users would be associations or clubs who want to set up an information site about their group.

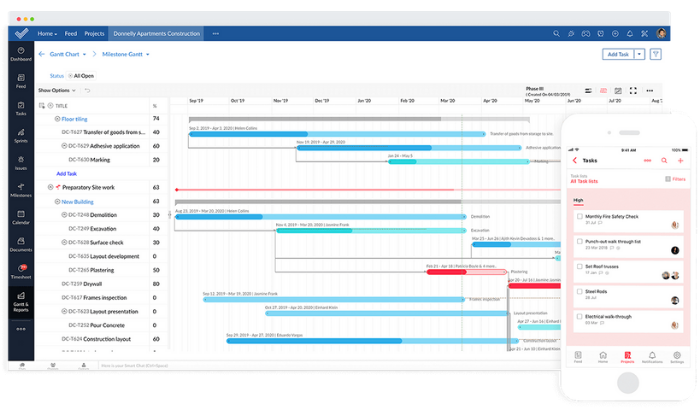

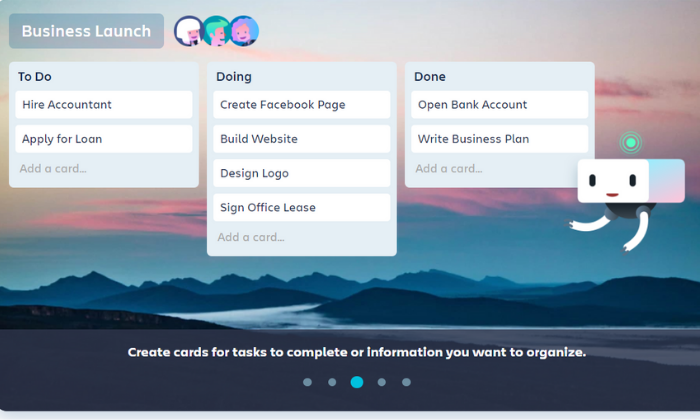

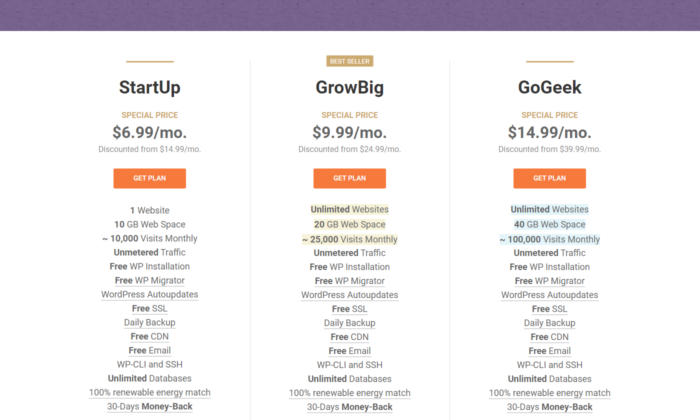

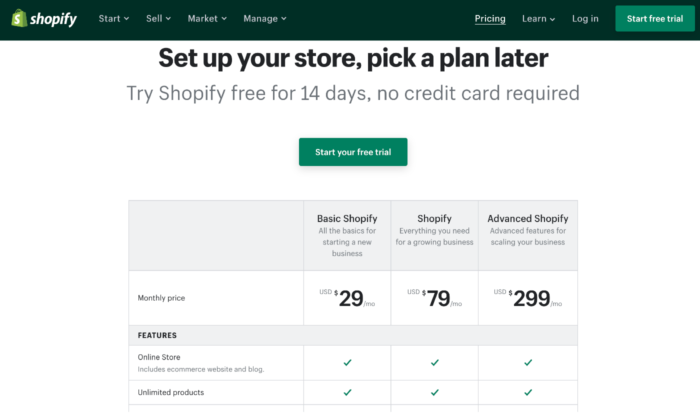

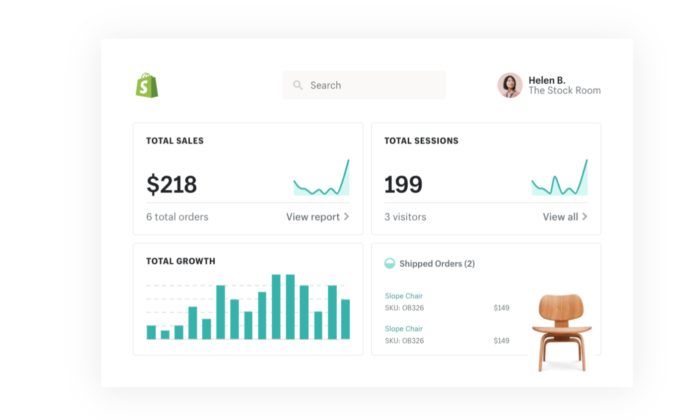

#3 – Shopify / Website builder — The Best For Online Stores

If you plan on selling any type of product online – from jewelry to electric scooters – then your best bet will be to use a dedicated eCommerce platform and website builder.

Without a doubt, the number one in this category is Shopify. The platform powers over 1 million merchants in 175 different countries, and is the third-largest online retailer in the US, trailing behind only Amazon and eBay.

The Shopify software represents a complete end to end platform that allows you to set up, manage, and promote a store online. You can easily list your goods for sale, take payments, and fulfill orders – all under one roof.

Pros

Here are the best things about Shopify:

- eCommerce specialty – The main draw of Shopify is that it is a niche website builder focused on setting up an eCommerce store. This means that all their features and processes are geared toward that end, resulting in a powerful platform that can help maximize sales.

- Security – If you are going to be handling transactions, you need ways to keep your site safe and customer data secure. Shopify stores have strong cybersecurity measures in place which a self-hosted website would typically lack.

- Integrated sales channels – Shopify has strong integrations with other platforms, such as Facebook and Amazon. This allows you to streamline your sales by managing your catalog on each platform under one roof.

Cons

Here are the weaker aspects of Shopify:

- Niche focus on eCommerce – Because the focus is on eCommerce, Shopify lacks some of the features and finesse of other website builders. For instance, their content management system is very limited compared to WordPress.

- Transaction fees + monthly fees – With each sale you make on Shopify, there is a transaction fee that ranges from 2.4% – 2.6%. Combined with payment provider fees, this can eat into your margin.

Who should use Shopify?

- Brick and mortar stores – If you have an in-person store and are looking to sell your products online, Shopify will offer you a solid footing into the digital world.

- eCommerce startups – Entrepreneurs that are starting new brands or drop shipping will also benefit from the quick end to end set up that Shopify offers.

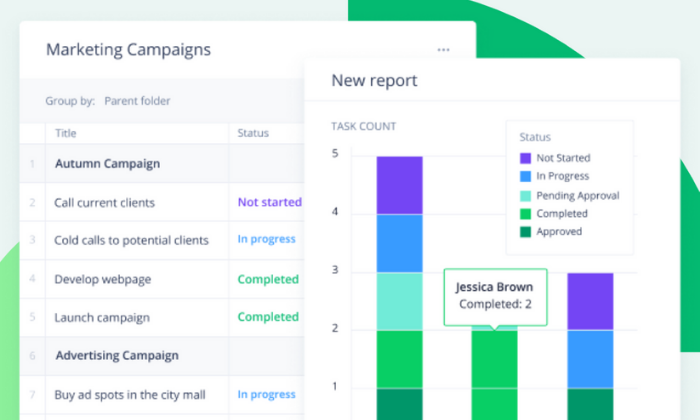

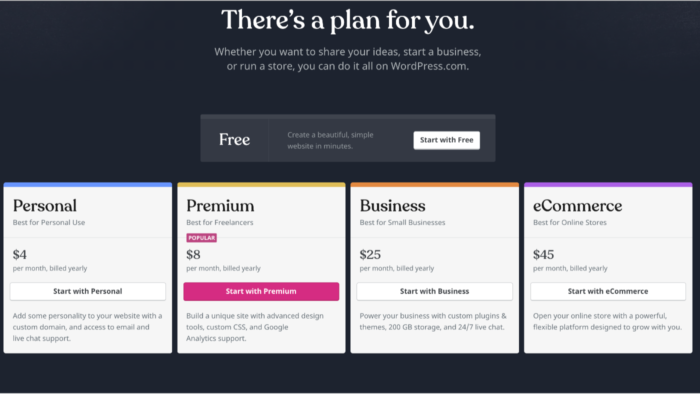

#4 – WordPress / Website builder — The Best For Content Management

One of the oldest and most reliable website builders is WordPress. The platform has come a long way since it launched in 2003 and is the most popular content management system on the web today.

In fact, WordPress powers a whopping 37.6% of all websites.

As WordPress was around during the earlier days of the web, its focus revolved around content, which was the most prominent form of website at the time.

It maintains that focus to this day, with WordPress having arguably the best content management system out of all the different website builders.

An important caveat is that WordPress is divided into platforms:

- WordPress.org – This is the open-source (free version) of WordPress that comes with greater flexibility, but is harder for non-technical users.

- WordPress.com – This is the paid version. You can get help with the installation of themes and management but is generally less customizable.

Pros

Here are the best things about WordPress:

- You have full control – Unlike other website builders, WordPress is fully customizable as the site is developed directly with code, as opposed to drag and drop interfaces. This means that you have much more flexibility in terms of design and function.

- Robust blogging and CMS – WordPress is built front the ground up with content in mind. It has some of the best tools for publishing and managing content including team management, advanced scheduling, and categorizations.

- Lots of plugins – There are over 52,000 plugins available for WordPress. You can measure and boost your SEO with plugins such as YoastSEO, or you could even add a new function such as a shopping cart.

Cons

Here are the weaker aspects of WordPress:

- You may need help – As your WordPress site is developed with code, you will likely need help to install and update your WordPress theme. This can come with a hefty cost, particularly if you want ongoing changes.

- Learning curve – If you want to manage and update your site yourself, it can take some time to learn how to do so. Managing and scheduling posts are relatively easy, but updating how your site looks or installing a plugin is much more difficult.

- Security issues – As your WordPress site is self-hosted, you are more vulnerable to cybersecurity issues. Some of the plugins for WordPress also can act as a risk as well.

Who should use it

- Bloggers – If writing is your main focus, then WordPress is a great choice. The platform is designed for bloggers, optimizing content management, and SEO. WordPress will allow you to scale and get the most out of your content.

- Content centric businesses – Likewise, if you are building a business that is content-heavy, such as a new website, WordPress will help you to manage the operational side of content production much easier.

Think about your goals

An important thing to keep in mind is that the website builders listed above can serve multiple functions, so this article has provided an overview for you, you will need to look into the details of each platform.

The best choice for you will come down to both your needs at the moment and where you plan on taking your website in the future.

After reading reviews like this one, make sure you take a step back and put your particular needs at the forefront of the decision before you commit.

The post The Best Website Builders (In-Depth Review) appeared first on Neil Patel.