Are you frustrated with email marketing? Does it seem like everyone simply hits send on a single email and rakes in the big bucks? Or maybe you have heard how for every $1 spent, email marketing generates $38 and that it has the broadest reach of all the platforms. Yet you have a non-existent list … Continue reading How to Win Customers’ Hearts and Pockets with These 7 Email Strategies [Free Webinar]

Tag: These

Could These Be the Best Intro APR Business Credit Cards?

Are There Good Intro APR Business Credit Cards Out There?

Are you looking for business credit cards with a 0% intro APR? We combed through several selections and weighed the pros and cons. The length of the introductory APR period was only one of our considerations. In fact, all of the cards we’re talking about today have no annual fee!

But let’s step back and look at some definitions first.

Annual Percentage Rates

APR is a yearly interest rate. It includes fees and costs paid on borrowed money (loans or credit). Lenders are required by law to disclose this. The rate comes from taking the periodic rate and multiplying it by the number of billing periods in a year. A credit card may have separate APRs for balance transfers, cash advances, or other special offers. If offers are subject to an expiration date, the relevant balance will usually revert to your default APR.

Variable Rate (or Variable APR)

This is an annual percentage rate that can change throughout the year. It can be an introductory APR that changes after a specific period of time. Variable APRs will likely change if the Prime Rate changes. So it makes sense to pay attenti0n to financial news. That way, you know if and when the Prime Rate changes.

Introductory APRs

There are a lot of business credit cards which have a 0% intro APR. The length of the introductory period can vary. So can the APR charged after the introductory period expires. Always check the fine print because there may be other charges that apply. They could negate the benefit of the introductory APR. Note: late payments can often be subject to the higher, post-introductory APR.

Honorable Mention: Get Product Savings

Regions Visa Business Enhanced Credit Card

First of all, consider the Regions Visa Business Enhanced Credit Card. You can earn Regions Relationship Rewards on qualifying purchases. You can redeem these for cash, statement credits, travel, and more. And you also get access to Visa SavingsEdge which provides an automatic savings of up to 15% on eligible purchases. Discounts appear in the form of statement credits. Pay no annual fee.

Get a 0% introductory APR through the end of the sixth billing cycle after account opening. Then pay a 11.49-22.49%, per creditworthiness. Pay a 11.49-22.49% balance transfer APR. This is a good card if you can wait for perks as the statement credits for both programs may take a cycle to show up on your account. But it’s also a decent card for interest rate – if you’ve got good personal credit scores.

Business Credit Cards with 0% Introductory APR for 12 Months and Cash Back

While these two cards had the longest intro APR period we found, their perks were … okay.

#10. Chase Bank Ink Business Unlimited®

With the Chase Bank Ink Business Unlimited® card, you get a $750 bonus cash back if you spend $7,500 in the first 3 months after account opening. Pay no annual fee. Get 1.5% cash back unlimited. Pay a 0% APR on purchases for the first 12 months after account opening. Then pay 13.24-19.24% per creditworthiness. Balance transfer APR is 13.24-19.24% per creditworthiness. If you have several computers or other expensive equipment to purchase, buy them fast to take advantage of the cash back bonus

#9. Chase Bank Ink Business Cash®

For somewhat decent interest rates, check out the Chase Bank Ink Business Cash® card. Pay 0% APR on purchases for the first twelve months. And then pay 13.24-19.24%. you pay no annual fee.

Get 5% cash back on the first $25,000 you spend on certain business products. These include office supply stores, internet, cable, and phone services. This works out to 4% added cash back rewards on top of 1% cash back rewards earned per purchase. The $25,000 flat spending limit resets every year. You can get $750 bonus cash back if you spend $7,500 in the first 3 months after account opening.

It’s pretty hard to hit the minimum spend. The agreement does not prohibit using your card to buy pricier items like plane tickets, vehicle repairs, or even heavy equipment. Still, you may find that using other means, like equipment financing or fleet credit, would make for a better deal for your business.

Score the best business credit cards for your business. Check out our professional research

Business Credit Cards with 0% Introductory APR for 9 Months and Triple Points on Gas

#8. Bank of Hope Business Rewards Visa® Credit Card

Take a look at the Bank of Hope Business Rewards Visa® Credit Card. Pay no annual fee. There is a 3% balance transfer fee with a minimum of $5. Earn 5,000 bonus points after spending $1,000 in the first three months. And earn triple points on gas. Get double points on travel and dining. Earn one point per dollar on all other purchases.

Pay a 0% intro APR for nine months. Then pay a variable APR 12.49%, 16.49% or 20.49% per creditworthiness. It should be easy for most entrepreneurs to meet the spend required for the points bonus. Triple points on gas are particularly helpful if yours is a business requiring a lot of time on the road. Say, trucking. If your credit is good enough to get the lowest APR after the introductory period ends, this could be a great card for you.

Business Credit Cards with 0% Introductory APR for 6 Billing Cycles and No Minimum Spend to Get a Bonus

#7. Mechanics Bank Visa Business Real Rewards

For no minimum spend, check out the Mechanics Bank Visa Business Real Rewards card. Pay no annual fee. Get 1.5 points per month per dollar. And get 2,500 bonus rewards points after your first purchase. Enjoy a 0% introductory APR for purchases and balance transfers for the first six billing cycles. Then pay 13.99-22.99% per creditworthiness. The bonus is decent. Since there’s no minimum spend, it begs the question. Can you get 2,500 bonus rewards points for buying a pen?

Business Credit Cards with 0% Introductory APR for 9 Billing Cycles and Travel Perks

#6. Bank of America Business Advantage Travel Rewards Credit Card Platinum + MasterCard

Take a look at the Bank of America Business Advantage Travel Rewards Credit Card Platinum + MasterCard. Pay no annual fee. Get 30,000 bonus points when you make at least $3,000 in new net purchases. They must post to your account in the first 90 days. Earn 1.5 points per dollar spent. Get triple points per dollar spent on travel. Pay a 0% intro APR for the first nine billing cycles. Then pay 12.24-22.24%.

The bonus points offer is generous. And the spend is relatively easily attainable. If your business requires a lot of traveling, this is a good card.

Score the best business credit cards for your business. Check out our professional research

Business Credit Cards with 0% Introductory APR for 6 Months and Get Points or Cash Back

These two cards are so similar, they came up as a tie. But if we had to choose, we would pick the cash card, as cash never expires.

#4. (tie) Zions Bank Visa Amazing Cash® Business Credit Card

For decent cash back rewards, check out the Zions Bank Visa Amazing Cash® Business Credit Card. Get 3% cash back on select business purchases. These include office supplies, cell services, internet, telecom, and cable TV. And get 2% cash back on select business travel purchases. These include airlines and vehicle rentals.

And get 1% cash back on everything else. Pay a 0% introductory APR on balance transfers for the twelve months after account opening. Then pay a 14.24% variable APR afterwards. Pay a 3% balance transfer fee for each transfer. A $10 minimum applies.

Get a credit limit up to $250,000. Pay no annual fee. There are no rewards fees. Pay a 0% introductory APR for the first 6 months after account opening. Then pay a 14.24% variable APR after.

The upper limit is good. And the varied cash back rewards are decent.

#4. (tie) Zions Bank Visa Amazing Rewards Business Credit Card

With the Zions Bank Visa Amazing Rewards Business Credit Card, you pay no annual fee. There is a 0% intro APR on balance transfers for twelve months. Then pay 14.24% variable. Get three points for every dollar spent on select business purchases. These include office supplies, cell services, internet, telecom, and cable TV.

Get two points for every dollar spent on business travel purchases. These include airlines and vehicle rentals. Get one point for every dollar spent on everything else. Pay a 0% introductory APR for the first six months. Then pay 14.24% variable. Enjoy limits to $250,000. The upper limit for this card is good, and the opportunity to earn points is decent.

Business Credit Cards with 0% Introductory APR for 6 Months and a Generous Points Bonus

#3. Union Bank Business Preferred Rewards Visa Credit Card

Consider the Union Bank Business Preferred Rewards Visa Credit Card. Get a 50,000 introductory reward points bonus when you spend $5,000 in the first three months. Enjoy quintuple points per dollar spent to $25,000 annually on select business expenses. These include office supplies, utility bills, and telecom services. And get one point per dollar spent above that. Get double points for each dollar spent up to $25,000 annually on gas stations and restaurants. And get one point per dollar spent above that. Plus, you get one point per dollar spent on everything else.

Pay a 0% introductory APR for the first six months. Then pay a 11.99-20.99% variable APR. there is no annual fee. This card has a great introductory points offer. And the amount you have to spend to get it isn’t bad.

Score the best business credit cards for your business. Check out our professional research

Business Credit Cards with 0% Introductory APR for 9 Billing Cycles and an Outstanding Post-Intro APR

#2. PNC Bank Cash Rewards® Visa Signature® Business Credit Card

Get a look at the PNC Bank Cash Rewards® Visa Signature® Business Credit Card. You can get a $200 bonus if you spend $3,000 in the first 3 billing cycles after account opening. Get 1.5% cash back on net purchases. There is no cash back limits. Pay no annual fee.

There’s a 0% APR for the first nine billing cycles after account opening. Then pay a 10.99-19.99% variable APR, per creditworthiness. With mostly lower post-intro period interest rates and an easy to meet spend, this card is can be a great choice.

Business Credit Cards with 0% Introductory APR for 6 Months and an Outstanding Post-Intro APR

#1. Zions Bank Visa Amazing Rate Business Credit Card

So the only card to beat PNC Bank’s lowest post-introductory APR was the Zions Bank Visa Amazing Rate Business Credit Card. You pay no annual fee. There is a 0% introductory APR for the first six months. Then pay 10.24% variable. Get limits to $250,000. This card has a good upper limit and the post-introductory APR is the best one we found.

Business Credit Cards with a Good Intro APR: Takeaways

Know the length of the introductory APR period, and the post-introductory rate. Those are over half the battle when deciding among business credit cards with an intro APR of 0%. Perks and annual rates should also play a part when you make your decision. And, no matter what, strive to pay your business credit card bills on time. Because if you do, then an introductory APR won’t matter to you.

The post Could These Be the Best Intro APR Business Credit Cards? appeared first on Credit Suite.

WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps …

Do business credit cards affect personal credit? They can, and in fact most do. But, they don’t have to. There are steps you can take to make sure they don’t. The key is to build your business credit score, and choose the right business credit cards.

Do Business Credit Cards Affect Personal Credit? It Depends

If you are asking yourself “Do business credit cards affect personal credit?” you are obviously trying to fund a business. And yes, most high limit business credit cards report to your consumer credit report. In fact, some report to both your personal credit and your consumer credit. There are even some business cards that will report negative payment information, but will not report anything if the account is in good standing. If you are trying to keep your business accounts from affecting your personal credit score, you need cards that will not report to personal credit bureaus.

Do Business Credit Cards Affect Personal Credit? Does it Even Matter?

Yes, it matters. Here’s why. You know that if an account, business or personal, is not in good standing, it can be detrimental to your personal credit if reported. Yet, did you know that even if an account is in good standing, it is possible that it may still damage personal credit.

Check out how our reliable process will help your business get the best business credit cards.

This is due to one of the fundamental differences in business credit vs. personal credit. Your personal credit score is affected by your debt-to-credit ratio. That’s a measure of how much debt you have, relative to how much credit you have available. A high debt-to-credit ratio can negatively impact your personal credit score. This is further complicated by the fact that many business credit cards stay at or near their limit, even if you are making regular payments. It is a function of the fact that business expenses are typically much higher than personal expenses.

As a result, if those accounts are on your personal report, they can bring your credit score down even if they are not delinquent. The question then becomes, how do you make sure this doesn’t happen? There are two key parts to this.

Do Business Credit Cards Affect Personal Credit? Make Sure They Don’t

First, if you are getting business credit cards with a personal guarantee, you have to make sure they will not report to your personal credit report. There are a handful that will not, even though they do ask for a personal guarantee. It is important to note that a personal guarantee means there will be a personal credit check. That will create an inquiry that may affect your personal credit for a bit. However, if the account does not report payment information to your personal credit report, the impact will be minimal.

A Few Examples of Business Credit Cards that Will Not Report to Personal Credit

If you have bad personal credit, the Wells Fargo Business Secured Credit Card is a good option.

You can get approved with a credit score as low as 580 currently, but that can change of course.

You do have to make at least a $500 deposit. Also, they do not report to consumer credit agencies, but they DO report to Dun & Bradstreet. That is, assuming you have your D-U-N-S number.

That means it can help you build business credit even with a bad personal credit score. They also report to the Small Business Finance Exchange. While the SBFE does not issue credit reports, they do share information with certain lenders, vendors, and credit agencies.

Wells Fargo will review your account periodically, and they may move you up to an unsecured account if you are eligible, based on a number of factors, including FICO.

If you have good credit, you have even more options for credit cards that will not report to personal credit. A few include:

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Costco Anywhere Visa® Business Card (have to be a Costco member)

Wells Fargo Business Platinum Credit Card

Remember, even though these cards do not report to your personal credit report, they do require a personal guarantee. That means they will do a personal credit check, and that inquiry will affect your score for a bit.

Do Business Credit Cards Affect Personal Credit? Business Credit Cards That Will Not Affect Personal Credit Scores Without a Personal Guarantee

Using a personal guarantee to begin building your credit portfolio is okay to start with. The goal, however, is to get as much as you can without a personal guarantee. To do this, you need to lay the groundwork before you apply for any cards. After all, they cannot report to your business credit profile if there is not one to report to.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Do if You Do Not Establish a Business Credit Profile

In contrast to a personal credit profile, you have to intentionally build a business credit profile. While a personal credit builds passively, business credit scores do not. With consumer credit, all you have to do is get credit accounts and they almost all end up on your consumer credit report.

How Do You Establish a Business Credit Profile?

First, you have your business up to be fundable. This includes a number of factors, some of which include:

- A business name that does not indicate you are in a high risk industry

- A physical business address, not a P.O. Box or UPS box

- Business phone number listed with 411

- A business bank account

- An EIN and a D-U-N-S number

You can get your EIN on the IRS website for free, and apply for the D-U-N-S number on the Dun & Bradstreet website, also for free. This is vital, because if you do not have that D-U-N-S number, accounts will not be able to report your payments to Dun & Bradstreet, because you will not have a profile there for them to report to.

The EIN is what you will use when you apply for business credit instead of your social security number. You may have to provide your SSN for identification purposes, but it will not be used to determine approval. This is one way you ensure your business credit accounts are not reporting to your personal credit report.

Do Business Credit Cards Affect Personal Credit? How to Get Business Credit Cards That Do Not Affect Personal Credit

Once your business is set up in the right way so that you have a business credit profile, you need accounts that report to that profile. However, if you start applying for high limit credit cards using your business credit profile right away, you are going to get denied.

You have to find accounts that will extend credit to your business without any sort of credit check. You don’t yet have a business credit score, and you are trying to avoid personal credit all together. To do this, you start with starter vendors.

These are accounts that will extend net terms and report payments, but they will approve you based on factors other than your credit score. These factors may include time in business, revenue, average balance in your business bank account, or other factors.

How to Find Starter Vendors

The trick is, these types of vendors are not easy to find. They do not advertise themselves as “starter vendors.” They do not make it easy to find out whether or not they report payments to business credit profiles. Business owners need help finding this information.

Here are a few options to get you started:

Grainger

Uline

Marathon

Still, you need more accounts than this reporting before you can build a strong enough business credit score to apply for higher limit accounts.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Don’t Have To

How to Build a Strong Business Credit Portfolio With Minimal Effect on Personal Credit

The secret to building a strong business credit profile as fast as possible and with minimal effect on your personal credit, is to work with a business credit expert. A business credit expert makes this whole process faster and easier.

They can help ensure you have your business set up the right way, and guide you toward those starter vendor accounts that will help you initially build your business credit score. They will help you know when you have enough accounts reporting to start applying for higher limit accounts and be approved.

In addition, our business credit experts have the knowledge and expertise to help you find the best accounts to flesh out your business credit portfolio. There is more to this than just building strong business credit with accounts that report. An expert can guide you toward the best vendor accounts for your specific business, whether they report or not.

The best way to start this process with no risk is to have a free consultation with a business credit expert. They can help you figure out where you stand now, and where you need to start so that you can build your business credit portfolio in the most effective and efficient way possible.

The post WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps … appeared first on Credit Suite.

Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path

These money and investing stories were popular with MarketWatch readers over the past week.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on Buy It At A Bargain – Deals And Reviews.

Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path

These money and investing stories were popular with MarketWatch readers over the past week.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on Buy It At A Bargain – Deals And Reviews.

Get Your MBA in SEO with These 10 Guides, 5 Courses, and 1 Tool

Are you interested in using SEO to build your brand? Or do you want to use SEO to get more leads and sales?

Most importantly do you want to avoid the common mistakes that hold back rankings?

Well today, I thought I would do something a bit different.

I wanted to break down how you can get a crash course in SEO.

Best of all I wanted to do so without you having to spend a dollar.

Today we are going to examine 10 guides and 5 courses that you can rely on to improve your SEO knowledge. Although some guides and courses have a similar title and focus, the information and advice provided in each one are both unique and valuable.

Let’s get started!

10 SEO Guides

1. SEO Made Simple (A Step-by-Step Guide) – Are you new to the world of SEO? In this case, a beginner’s guide is exactly what you need (more of these to come).

This is why I wrote this guide:

- It truly is for beginners, leaving advanced technical details out of the equation.

- It’s broken down into easily digestible sections, with each one providing a primary focus.

- It’s full of screenshots, videos, images, and infographics, all of which paint a clearer picture of what is needed to succeed.

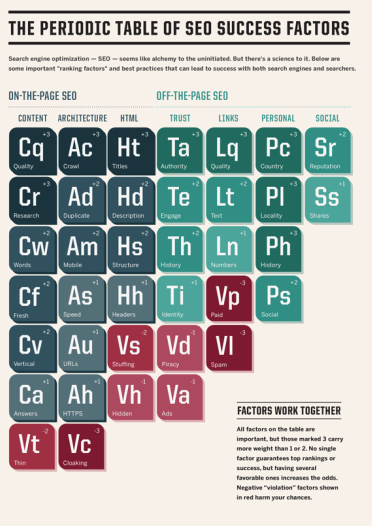

2. SEO Periodic Table – This guide is a little bit different than most. It’s more in a visual format where it breaks down the elements of SEO.

It’s important to know each factor that can impact SEO because every little bit adds up.

Unlike other marketing channels, SEO is one where you have to do a lot of little things right to get traction.

3. Search Engine Optimization Starter Guide – If you could learn SEO from one person or company who would it be? Most people will overlook the obvious answer: Google.

Everybody wants to rank higher in Google. After all, it’s the search engine of choice for the majority of the world.

If you are new to SEO and you want to learn from the top dog, this starter guide will be your new best friend.

The primary benefit of this guide is that you don’t have to worry about whether or not the information is accurate. You know that every point of advice is spot on, being that it comes from the master of all search engines.

With 32 pages of advice, ranging from SEO basics to mobile optimization, there is a reason why so many new marketers keep this guide close by at all times.

Just because you are new to SEO does not mean that you can afford to make mistakes. Google’s Search Engine Optimization Starter Guide helps you get up and running in a fast, efficient, and effective manner, all while avoiding common mistakes that have plagued millions before you.

4. The Beginner’s Guide to SEO – Moz created one of the first guides ever on SEO. And they tend to update it every year as well.

There are 10 chapters that make up this in-depth guide, starting with “How Search Engines Operate” and leading to “Measuring and Tracking Success.”

In between, you will pick up advice on why search engine marketing is important to your business, how to build links without being penalized, and common myths and misconceptions about SEO.

You can read the guide online or download the PDF.

The Beginner’s Guide to SEO deserves to be read from start to finish. Even if you have some knowledge of SEO, this guide can help sharpen your skills.

5. The Blogger’s Guide to SEO – No two people share the exact same goals for their website. For example, a blogger may not take the same approach to SEO as an e-commerce store.

And with over a billion blogs on the Internet you should know SEO when it comes to blogging specifically.

SEOBook goes above and beyond in providing information solely for bloggers.

Make sure you also read the section on “Why Blogs Are Different Than Static Websites.”

You may already know the difference, but those who are new to this may be confused. Here is an excerpt from the section, showing the targeted yet simplified nature of the guide:

SEO for a blog is different than SEO for most other websites, largely because of the social elements baked into blogging technology. SEO for blogs is more focused on giving people something to talk about and creating something worthy of attention.

As a blogger interested in SEO, you want to rely on advice that most closely matches your wants, needs, and goals. This is why this guide from SEOBook is a must-read. It’s meant to give your blog’s SEO a shot in the arm.

6. Everything You Need to Know About SEO – You won’t be an SEO beginner forever. When you are ready for the next step, this advanced SEO guide is a good place to start.

Here is how I describe the guide:

The Most Extensive and Detailed Guide of Advanced SEO Techniques That Exists Today.

Every guide on this list is solid. Every guide should be read, when you have time because the information is presented in a unique manner.

But when it comes to the most in-depth and actionable information on advanced SEO techniques, I think this guide takes the cake.

It’s not so much about the length (nine chapters), as it’s about the depth and use of examples. Here is what I mean:

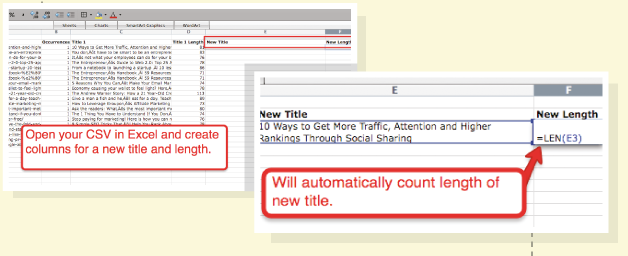

The guide doesn’t just tell you to create an SEO-friendly title. It doesn’t just tell you how long your title should be. It gives you actionable advice on how to make changes for the better. On top of that, the screenshots give you a “visual” on exactly how you can make this happen.

There is a lot to learn when you get into the advanced details of SEO. This guide makes sure that you don’t overlook something that could make or break your rankings.

7. The Complete List of Google’s 200 Ranking Factors – I mentioned above how in SEO you have to do every little thing to get rankings.

It isn’t enough to just build links.

It isn’t enough to just writing amazing content.

It isn’t enough to just optimize your meta tags.

See, everyone is doing the main aspects of SEO. But what most site’s aren’t doing is every little thing correctly.

Now just imagine if you did every little thing correctly? Your rankings would be much higher.

I recommend that you go through each of the 200 ranking factors.

8. The Ultimate Guide to Ecommerce SEO – ecommerce sites are very different than traditional sites.

The pages you want ranking high on Google typically are listing pages or product pages. Because these are the type of pages that will drive you sales.

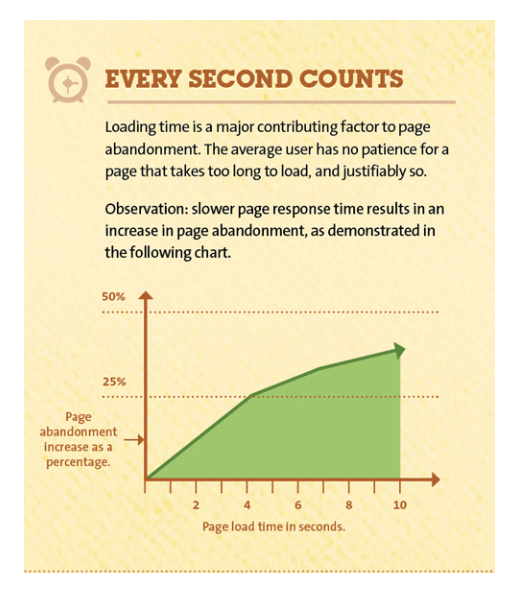

What’s unique about this guide is it teaches you everything you need to know about SEO for ecommerce sites. Because link building, content creation, schema markup, and even optimizing for load time are all different on ecommerce sites.

Also it works for all platforms. It doesn’t matter if you use Shopify or Bigcommece or even Wix, it works for all of them.

9. 19 Advanced SEO Techniques to Double Your Search Traffic – As I’ve mentioned above a few times, every little thing adds up with SEO, especially because it is so competitive now.

Just doing the basics isn’t enough. You have to go well above and beyond your competition.

That’s why I would read this guide that breaks down 19 advanced tactics.

Each of those tactics are very effective in increase your SEO traffic, but before you implement them you’ll want to consider doing the basics.

Because without doing the basics, the advanced tactics won’t have much use.

For example, if your URLs aren’t SEO friendly, which is a beginner’s tactic, Google may not be able to crawl your site. So no matter what advance strategy you use, it wouldn’t have much of an effect.

10. Link Building Resources That Work – links are the cornerstone of SEO. Think of them as votes.

The more votes someone gets, the higher they will rank.

But not all votes (links) are equal. Ones from authoritative sites like CNN or Yahoo have more effect. And the more related a link is to your site, the better off you are.

So how do you get links when you have little to no resources or money to spend on a big SEO firm?

Well, this guide breaks it down. It goes over all the different ways you can build links.

From creating free tools, to writing guides, to even doing manual outreach… There are many possibilities and you’ll be able to learn them all from this guide.

5 SEO Courses

1. SEO Unlocked – This is a 7-week course on SEO. But don’t be scared, by the 7-week number, each video is short and actionable.

You’ll find a total of 21 videos broken down over 7 weeks. Each video ranges in length from 5 to 15 minutes.

And accompanied with each video is cheatsheets, worksheets, and templates to make SEO easier to implement.

That way after you learn a specific SEO tactic or strategy, you’ll be given documentation on how you can use it and implement it.

2. Ecommerce SEO 101 Video Series – Here’s an SEO course from the largest ecommerce platform, Shopify.

This isn’t a course for just someone with a general interest in SEO. It’s a course for online store owners who want to improve rankings as a means of driving traffic to increase revenue and profit.

There are seven videos in the course, all of which are free to watch. Some of my favorites include:

- Why is Your Store Not on Google?

- How Does Google Rank Your Ecommerce Store?

- Keyword Research: Which Search Phrases Should You Rank For?

The videos aren’t so long that you get bored, but they are long enough to provide an inside look at the subject matter.

Online store owners understand that the difference between success and failure can rest solely on their ability to generate organic traffic. If you want to improve this area of your e-commerce business, the Shopify video series is a good jumping-off point.

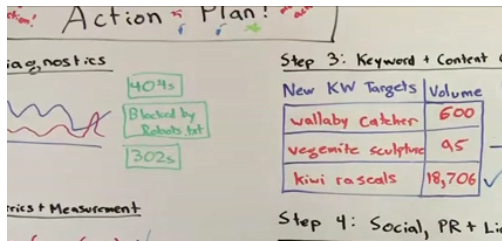

3. SEO Training Course by Moz – Moz once again finds itself on the list, this time with a training course offered through the Udemy platform.

This free training course teaches the tips and tricks that you need to implement a successful SEO strategy.

Think of this course as an extension of the company’s beginner’s guide to SEO. With five lectures and more than one hour of video content, you’ll leave the course feeling better about how to rank your website.

The titles of the lectures are as follows:

- Building a Monthly SEO Action Plan

- 5 Ways to Use Your Social Profiles for SEO

- Keyword Targeting gets Tough!

- Link Building with Twitter

- Mapping Keywords to Content

This course is designed for marketers of all levels, so take the time to sign up and dive in. It’s free, so you really have nothing to lose.

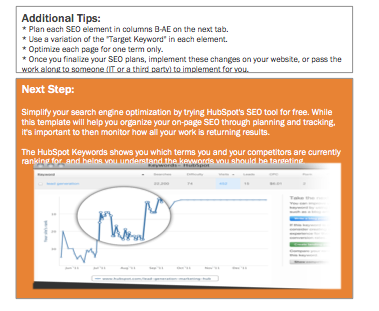

4. Free Download: On-Page SEO Template – It’s hard to categorize this as a traditional course, but it definitely fits the mold in some ways.

The On-Page SEO Template is available for free from HubSpot. It was designed with the purpose of helping marketers track on-page SEO elements.

With the template, you will have an easier time:

- Tracking changes in one place.

- Organizing your on-page SEO strategy.

- Implementing SEO elements that drive results.

- Coordinating keywords and pages without confusion.

As a free download, you should at least see if this template from HubSpot can provide you with any SEO value. You will probably find that it’s good to keep nearby as you make on-page changes.

5. Local SEO Unlocked – If you are a local business this course is perfect for you. It breaks down local SEO down into 2 weeks.

The course contains 6 videos as well as worksheets, cheatsheets and templates so you can implement what you have learned.

And similar to SEO Unlocked, each video is short and to the point.

Here’s an overview on what you’ll learn:

- Overview – an overview of local SEO.

- Local SEO signals – what impacts local rankings.

- Google My Business – how to use it to rank higher on Google.

- Content – how you can create local content that ranks.

- On and Off-Page SEO – the main elements of SEO that you need to optimize for.

- Secret Recipe – the key ingredient to ranking well on Google.

SEO Tools

There are a lot of SEO tools out there that can help with improve your rankings.

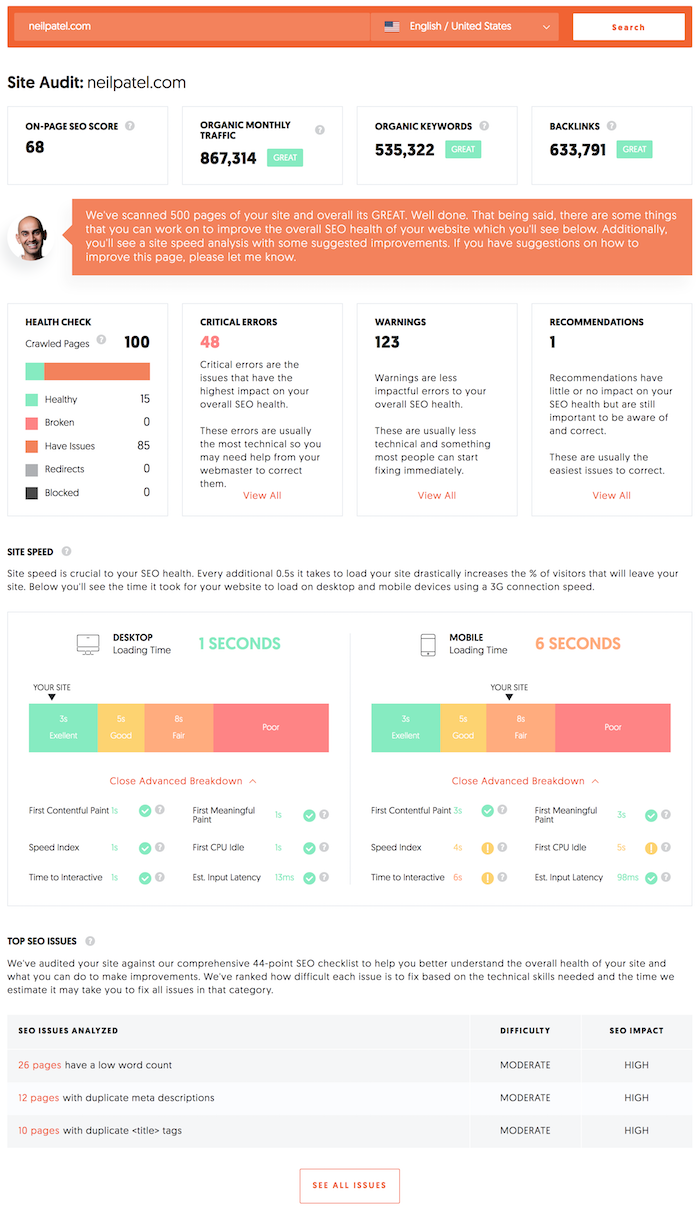

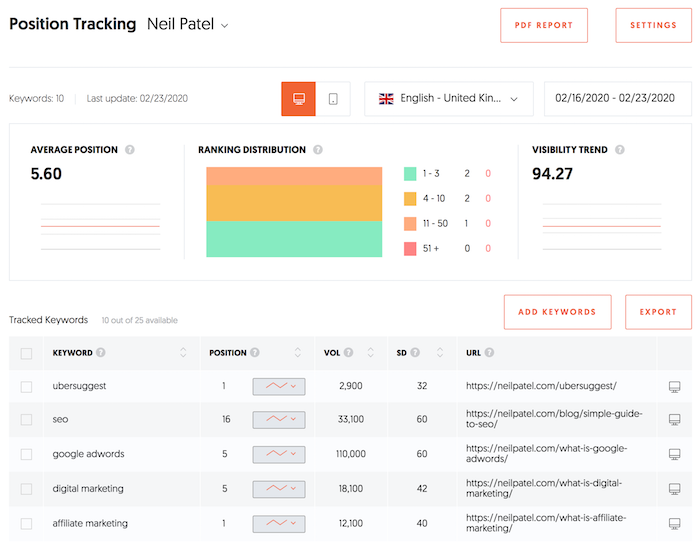

I maybe a bit biased because I created it, but I would start off with Ubersuggest.

The reason I would recommend it over other SEO tools because you can get started for free.

From rank tracking, to site audits to link building, to keyword research… you can do all the aspects of SEO for free.

Here’s a preview of the Ubersuggest site audit report.

I recommend that you get started with Ubersuggest by first running a site audit. Just put in your URL here.

And after that I recommend that you create a project so you can track your SEO progress. This will allow you to track your rankings and be notified when something good or bad happens with your SEO or even when your competition does something new.

If you want to get the most out of Ubersuggest you should read this guide.

Conclusion

Even if you don’t have the time to go through everything, just pick one or two courses or guides to start off with.

Something is better than nothing. And you don’t have to do everything in a day as that would be unrealistic.

If I were you, I would start off by creating an Ubersuggest project and then go over the SEO Unlocked training course.

From there you can go over the other courses and guides in any order. But that is where I would start.

There are also a lot of paid options on the web, but I would start with the free options above as it will give you enough to start getting results.

What are your thoughts on these guides and courses?

Stock Photos are Dead: Create These Blog Images Instead

The use of blog images in posts is a no-brainer.

Images are an easy way to break up chunks of text, add context, or give your readers a more accessible medium through which to digest your content.

With the growth of written content online, it’s harder to have your content be unique from others. Writers need to adapt to the changing landscape.

How can you continue to engage your audience when so many bloggers have written on the same topics—and will continue to do so?

The answer is original imagery.

Blog Image Trends: Why Stock Photos Are Dead

With more content available on the web every day, it’s more important than ever to stand out.

While finding ways to put a unique spin on your blog post topics is critical, there are only so many angles on one subject. You need other types of content, such as photographs and illustrations, to make your mark.

Unfortunately, stock photos just don’t cut it anymore.

This reason is in part because blog images don’t only live on your blog. They make the rounds on Twitter, Facebook, and Pinterest whenever your posts are shared.

Chances are, your users have seen similar stock photos many times already, and they’re bored with them.

With so many articles to read, videos to watch, and social media news to ingest, the average reader won’t spend hours looking for the best article on your topic. They’ll choose the most visually appealing option nearly every time.

So before you use stock photography in your next blog post, ask yourself:

Will my readers interact with the same stale image they’ve seen numerous times when researching this topic? Or will they choose to interact with an original image that more perfectly captures the content?

Why You Should Use Interactive and Original Images on Your Blog

Your goal as a digital marketer is to increase conversions.

So how do you do this even better than you already are, given the changing online landscape?

There are plenty of ways to drive traffic to your website. But what’s more important is driving the right traffic—the users who will engage with your content.

Images can help. According to BlogTyrant, images can up conversions by over 300%.

But keep in mind the kinds of images you use can have an impact on your conversions, too.

For years, stock imagery was the norm. But, it’s time to move away from those pictures.

Original images offer authenticity stock ones can’t provide. They offer your readers a peek behind the curtain, allowing them to see a deeper side of your content.

Unique blog image content can offer other benefits, including increased customer trust and brand recognition.

According to Brain Rules, a slogan alone only sticks in the minds of 10% of people. When related imagery is added, though, retention rises to 65%. That’s an increase you can’t ignore if increasing brand recognition is on your radar.

Original image content has an often-overlooked SEO benefit, too, and that’s the improvement of Google’s E-A-T score. The E-A-T score lets Google assess content quality based on these three standards:

- Expertise

- Authoritativeness

- Trustworthiness

How can original imagery improve your E-A-T rating?

Whether you shoot and edit photography on your own or you work with a digital illustrator, your unique imagery will have a personal spin. If done right, this will become a vital part of your personal brand strategy.

You show expertise by including images that clearly demonstrate you understand your content.

You show authoritativeness by having consistent, unique branding people recognize immediately.

You show trustworthiness by providing information through images that are accurate and increase user’s knowledge.

A strong personal brand will bump all three elements of an E-A-T rating.

Placing Images on Your Blog

Images, just like text, can also be perceived as “fluff.” Because of this, you need to know when to use pictures on your blog to optimize user experience and benefit your SEO.

You should use images to do three very specific things.

Break Up Large Chunks of Text

According to a study by Microsoft, the average attention span of heavy screen users is a mere eight seconds.

That means you have eight seconds to captivate your audience—and large blocks of text may make them click away pretty quickly.

However, you don’t have to write two sentence posts to make them take fewer than eight seconds to read. Instead, employ clever tactics to keep your readers engaged.

One tactic is to introduce other media, such as photos or digital illustrations. This creates a less intimidating reading experience while also making the post more visually appealing.

Explain a Concept

Some concepts are too abstract or complex to explain effectively in writing, especially if your audience isn’t strictly experts in your topic.

Custom diagrams and visuals can help readers understand the material.

Enliven the Content

As much as you like to think your content is witty and engaging, some topics just won’t interest readers for very long. You can use original visuals to add some life to otherwise “dull” content in these cases.

When Should You Use Custom Illustrations or Photos?

The cost of custom graphics may be prohibitive for some bloggers, but it is possible to find some middle ground.

Use custom illustrations and photography sparingly. Ask yourself where they make the most sense and insert them accordingly.

If you’re creating a landing page for a new product or service, for example, this would be the place to splurge. After all, you want this content to stand out from your competitors—what better way than with a custom graphic?

You can also utilize custom illustrations to drive a point home or explain data.

Whether a comic strip panel, a diagram, or a flow chart, you can use custom illustrations to share ideas with your readers in a way words simply can’t.

When Should You Create Interactive Graphics?

You can take your blog’s imagery one step further with interactive graphics.

Interactive graphics are custom graphics that support reader interactions like mouse pointer movement, clicks, or keyboard input.

This form of original imagery is commonly used in infographics, though other display types include side-by-side comparisons, flow charts, and graphs.

The most obvious use for interactive graphics is to catch the reader’s eye.

Perhaps more importantly, they can also be used to break complex information down into bite-sized chunks. For example, take a look at this nifty interactive graphic that shows users how Google search works without becoming overwhelmed.

Examples of Successful Blog Images

There are plenty of ways to use images on your blog.

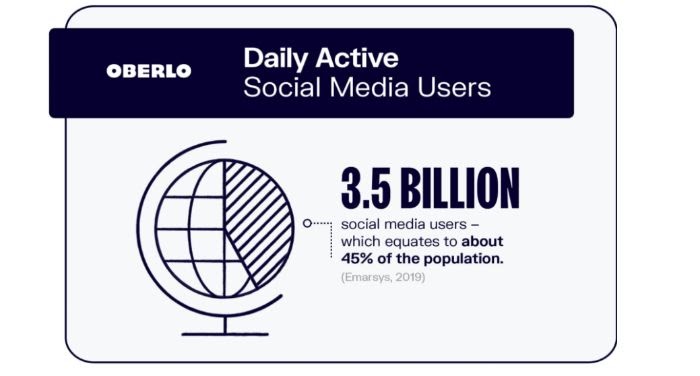

Here’s one creative example from Oberlo:

Instead of one lengthy infographic, the content creators chose individual infographic “slides” to answer each question on their post about social media statistics.

This use of graphics achieves two things:

- It makes the information easy to digest.

- It makes it simple for readers to share the information on social media.

As mentioned above, one of the benefits of original blog imagery is the personal branding aspect. When you use a particular style consistently, it becomes synonymous with your brand.

Copyblogger provides an excellent example of this:

Their featured images consistently use quotes overlaid on eye-catching images. They work as a watermark of sorts, as anyone who sees their imagery elsewhere will be able to identify them as belonging to Copyblogger immediately.

And what about interactive content? Your options are only limited by your imagination.

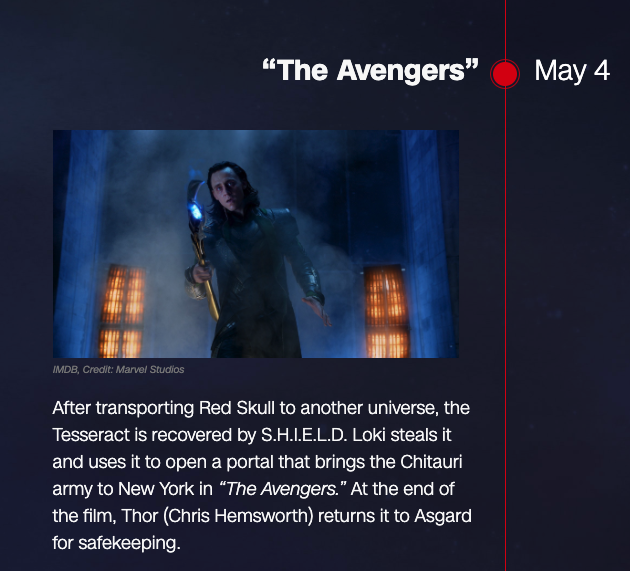

Take a look at this comprehensive timeline of the Marvel Cinematic Universe:

As you scroll through the timeline, new images and text content can be seen. This example tells a complex story in a linear, non-intimidating format.

How to Get Original or Interactive Blog Images

It’s never been easier or more affordable to get original and interactive blog images.

When it comes to hiring a professional, you have options. You can easily find freelancers on sites like Fiverr or Upwork or use a service like Design Pickle.

If you know of a digital artist with a style you like, you may be able to commission them. They are often more expensive than the freelancers you’ll find on the websites mentioned above, but they’re great if you need a specific style.

For bloggers strapped for time, there are services you can hire to do the heavy lifting. The service may be a creative agency or a blog content specialist. Either way, you provide details, and they’ll commission work on your behalf.

Do you have more time than money? You can also create blog images using tools like Canva, Pixlr, or PicMonkey. For a more professional finish, you can invest in a creative suite like Adobe Creative Cloud.

How Much Do Original Blog Images Cost?

As with most services, there are options for almost every budget.

If you hire a freelancer for a one-off gig, then the price varies based on the number of images, the complexity of the work, and how you plan to use the final product.

In some cases, you may be able to get a discount when you buy in bulk.

Commissioning a professional is likely to be the most expensive option. Unless you have money to burn, this should be reserved for high-impact projects, like illustrations for sales landing pages or campaign launches.

Tools to Create Blog Images

Whether you’re on a limited budget or just want to let the creative juices flow, you can opt to create your own images.

There are free and low-cost options, such as Canva and PicMonkey. These tools have limitations, including watermarks, if you don’t opt for premium memberships. You also need to be sure all assets used in your design are copyright-free.

For 100% original work, you may find creative suites like Adobe to be the best bang for your buck. With access to tools like Photoshop, InDesign, and Illustrator, you can create and edit various blog illustrations, diagrams, and original photography.

There are plenty of tutorials available online for creating graphics using Adobe Creative Cloud—so if you’re unable to pay a designer for their services, you don’t have to just guess about how to do this.

Conclusion

There’s no need to scroll through page after page of stock photos to find the right images for your blog post. You can create original blog images, whether by yourself or with the help of a professional.

Original blog imagery, including photography and graphics, can take your blog posts to the next level. It also helps build your overall brand and take your marketing to the next level.

With plenty of options at your fingertips, from free tools to freelance artists, there’s no reason not to use original images on your blog.

Which of the tools mentioned above are you most likely to use to create images for your blog? Or do you prefer ones we haven’t mentioned? Let us know!

The post Stock Photos are Dead: Create These Blog Images Instead appeared first on Neil Patel.

Brutal! 5 Ways You Can Get Denied for a Business Loan in a Recession –Your Banker Won’t Tell You About These!

Need a business loan in a recession? Beyond the SBA’s PPP program, you should also be looking at lenders outside the SBA’s purview. And you need to make it easier for them to approve your application.

We Smuggled out these Secrets: The 5 Ways You Can Get Denied for a Business Loan in a Recession – Your Banker Will Never Tell You About These

Did you know there are 5 ways you can get denied for a business loan in a recession? And let’s face it, your banker won’t tell you about ANY of them. It is, unfortunately, pretty easy to get a bank loan denial. This is particularly true in recessions. Bank loan money is always tighter.

And not everyone knows how it happens. So read on, and learn the secrets!

A Look at Bank Credit vs. Business Credit

Before going any further, do you know the difference between bank credit and business credit? Business credit is the full and complete amount of money that your small business can get from creditors. This includes leasing companies. It is also suppliers, under what’s called vendor credit.

Bank credit is the full amount of borrowing capacity which a small business can get from the banking system only.

What are Bank Credit Scores?

Even during a recession, a small business can get more business credit quickly, so long as it has two things.

One, it must have at least one bank reference. And two, it has to have an average daily account balance of at least $10,000. And that has to be for the most recent three month time period.

This set up will yield a bank rating of a Low-5. And that means it is an Adjusted Debt Balance of from $5,000 to $30,000.

Lower Ratings

A lower rating, like a High-4, or balance of $7,000 to $9,999 will not necessarily reject the small business’s loan application. However, it will slow down the approval process (in a recession, it could grind to a screeching halt). And a Low-5, we know, is far more likely to be necessary for an approval.

A bank credit rating is the average minimum balance a company maintains in a business bank account over a three month long period.

Hence a $10,000 balance will rate as a Low-5. And a $5,000 balance will rate as a Mid-4. By the same token, a $999 balance will rate as a High-3, etc.

A small business’s chief goal should always be to maintain a minimum Low-5 bank rating. So that means an average $10,000 balance. And they will need to do so for at least three months.

This is because, without at least a Low-5 rating, the majority of banks will operate under the assumption that the business has little to no ability to repay a loan or a business line of credit.

But here is one thing to keep in mind. You will never actually see this number. The bank will just keep this number in its back pocket.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business during a recession.

The Rating Ranges

The numbers work out to the following ranges:

- High-5 – account balance of $70,000 to $99,999

- Mid-5 –$40,000 to $69,999

- Low-5 –$10,000 to $39,000 (your small business needs this level bank score or better to get loans)

- High-4 – $7,000 to 9,999

- Mid-4 – $4,000 to $6,999

- Low-4 – $1,000 to $-3,999

Bank Credit Problems that can Get Your Business a Denial

There are several ways to get a denial when you want a business loan. Here are the top five.

#1 Way You Can Get Denied for a Business Loan in a Recession

You’ll get a denial if you don’t maintain a minimum balance for at least three months. Since every bank credit cycle is based on the previous three months, a continually seesawing balance should damage your bank credit.

How You Can Fix It

So, what is the remedy? Keep cash in your account, by any means you can. This can be tough in a recession, but it is not impossible.

#2 Way You Can Get Denied for a Business Loan in a Recession

Looking to get a denial? Then don’t bother to assure that your business bank accounts are reported exactly the same way all of your business records are. And they would also have to be with the exact same physical address and phone number.

Sow confusion in this area by changing one and not another, or not correcting an error if there is one. And use a post office box!

Wrong.

How You Can Fix It

So, what is the remedy? Keep your records consistent. Copy and paste whatever you can. Do not chance it by retyping. And as for your location, if you do not want or need a physical office, go with a virtual one. We particularly like Regus and Alliance.

Can’t find any virtual office space nearby or within your budget? Then talk to other area business owners. And find out who they work with.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business during a recession.

#3 Way You Can Get Denied for a Business Loan in a Recession

To go along with #2, you’ll get a denial if you don’t keep consistent, congruent records. That is, to make sure that every credit agency and trade credit vendor, every record keeper, lists the business name and address the exact same way.

These include record keepers for financial records, income tax, web addresses and e-mail addresses, directory assistance, etc.

No lender is going to stop to consider all of the ways that a business might be listed. That will not happen when they look into the business’ creditworthiness.

Therefore, if they are unable to find what they need easily, they will just deny the application. Or your carefully cultivated credit won’t report to the business credit reporting agencies. So if you want a denial, make sure your records are a mess!

No. Don’t do this.

How You Can Fix It

So, what is the remedy? Again, keep your records as consistent as possible. And if you need to hire someone to help you with this, then be sure to do so. It will be well worth it to get some peace of mind this area.

#4 Way You Can Get Denied for a Business Loan in a Recession

This one happens if you never manage your bank account responsibly. It means that your small business should not avoid writing non-sufficient funds (NSF) checks at all costs.

NSFs will decimate bank ratings.

Non-sufficient-funds checks are something which no business can afford to let happen.

But balancing checkbooks and accounts is so dull anyway. And you’ve got enough money without even making sure, right?

Wrong!

How You Can Fix It

So, what is the remedy? Carefully balance your books and make sure you have enough funds for your transactions.

So this might mean you hire someone with a bookkeeping or accounting background to help you. And that’s a great idea!

Beyond taking care of your business bank accounts, such an employee should be able to help you with the tax implications of pretty much everything that you do. All businesses will have to pay taxes. There are no exceptions to this rule! So why not legally and ethically pay less?

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business during a recession.

#5 Way You Can Get Denied for a Business Loan in a Recession

To add to #4, you’ll get a denial if you don’t add overdraft protection to your bank account as soon as possible, in order to avoid NSFs. But why bother thinking ahead or planning for the future? Everything is going to be great forever, right?

Wrong.

How You Can Fix It

So, what is the remedy? Overdraft protection is a valuable feature. So make sure you can get it. That might mean going to a bank that isn’t right around the corner from you. Or it might mean maintaining a specific minimum balance.

And if it does, then that’s even better. You’ll kill two birds with one stone and also address #1, above.

Bonus: #6 Way You Can Get Denied for a Business Loan in a Recession

Want to get a denial? Then don’t let your business show a positive cash flow. A positive free cash flow is the amount of revenue left over after your company has paid all of its expenses.

So if you really want to get a loan denial from your bank credit, go ahead and treat yourself. And buy whatever’s expensive for your business. And make sure your expenses outstrip your profits.

Because doesn’t every factory deserve plush carpeting in the loading dock?

How You Can Fix It

So, what is the remedy? The cash coming in and leaving your company’s bank account should reflect a positive free cash flow.

When an account shows a positive cash flow it indicates your business is generating more revenue than is used to run the company. That means the bank will feel your business can pay its bills.

Can’t afford to add a lot at a time? That’s okay – long as you are adding something.

In a recession, it’s obviously harder to keep adding to a business bank account. Just … try.

Bonus: #7 Way You Can Get Denied for a Business Loan in a Recession

Banks are highly motivated to lend to a business with consistent deposits. And a business owner must also make regular deposits. So this is in order to maintain a positive bank rating.

The business owner must make a lot of consistent deposits, more than the withdrawals they are making. This is the best way to have and maintain a good bank rating.

If they can do that, then they will have a good bank credit score.

But consistency is the hobgoblin of little minds, right?

Hence depositing whatever, whenever has got to be the best way to handle your company’s bank deposits, right?

Wrong.

How You Can Fix It

So, what is the remedy? Consistency! Showing your bank is dependably and regularly adding funds will go a long way to assuring your bank that your business is credible.

And it’ll assure them that if they loan you money, that you’ll be able to pay them back.

And you’ll maintain your ethics and do so.

There are Many Ways You Can Get Denied for a Business Loan in a Recession

Yes, you can wreck your bank credit these five seven ways. So don’t! If you wreck your bank credit, then you may as well throw in the towel. And in a recession, you just plain can’t afford that.

This is because you’ll also tank your business. And no one wants to see that happen.

Particularly now, in the age of COVID-19, you need to help your business in any way you can.

The post Brutal! 5 Ways You Can Get Denied for a Business Loan in a Recession –Your Banker Won’t Tell You About These! appeared first on Credit Suite.

Brutal! 5 Ways You Can Get Denied for a Business Loan in a Recession –Your Banker Won’t Tell You About These!

Need a business loan in a recession? Beyond the SBA’s PPP program, you should also be looking at lenders outside the SBA’s purview. And you need to make it easier for them to approve your application. We Smuggled out these Secrets: The 5 Ways You Can Get Denied for a Business Loan in a Recession … Continue reading Brutal! 5 Ways You Can Get Denied for a Business Loan in a Recession –Your Banker Won’t Tell You About These!

These Inspiring Entrepreneurs Are Crushing It On Instagram

We all have an entrepreneur inside of us. All it takes is daily inspiration and motivation to unleash it. Most especially, from those who have exciting success stories and are clearly passionate about what they …

The post These Inspiring Entrepreneurs Are Crushing It On Instagram appeared first on Paper.li blog.