Given how the world has changed due to the novel coronavirus, you might be busier than ever. Trucking and deliveries are essential services, no matter what. The US is sliding into what is looking a lot like an inevitable recession. So you could be sitting in the veritable catbird seat. This could be the perfect time to build business credit quickly in a recession.

Long Haul Truckers: Here’s How to Build Business Credit Quickly in a Recession

Who needs business credit for trucking? We can help you get it. Here’s how to build business credit quickly in a recession.

Why, exactly, do you need business credit for trucking? We’ve got the answers here – business credit works for all business and not just traditional companies!

Business Credit for Trucking: Why get Business Credit in the First Place?

If you’ve got an EIN, then the IRS says you’ve got a business. But if you only have personal credit, then you’ve got a problem. And you’ll be accountable for your business’s debts, its tax bills, and its bankruptcy, if that happens. You don’t want this. Separate business from personal credit and it won’t.

And specifically, fleet credit will precisely help your trucking business. And gasoline credit cards will, too. We all know how pricey it is to fill up these days.

Building Business Credit for Long Haul Trucking: The Benefits

Business Credit is credit obtained in a business’s name. With business credit the firm builds its own credit profile and credit score. With an established credit profile and score, the company will then qualify for credit.

Since the business gets approval for the credit, in some cases, there is no personal credit check necessary. The business can use its credit to get approval for retail credit cards.

These come from places like BP, Sunoco, Exxon, Shell, Ford, RGS Fleets, Walmart, even MasterCard, Visa, and AMEX. Additionally the company can use its credit to get approval for fleet credit for repair and maintenance of business vehicles including semis. And the firm can also qualify for lines of credit and loans.

How to Build Business Credit Quickly in a Recession: Start With Business Credit Profiles

A credit profile can be created for a business which is utterly independent from the firm owner’s personal credit profile. This offers firm owners two times the borrowing power as they have both personal and business credit profiles.

A business owner can get credit much more quickly using their business credit profile rather than their personal credit profile. Approval limits are much higher on business accounts as opposed to personal accounts. According to the SBA, credit limits on business cards are usually 10 – 100 times higher than for consumer credit.

How to Build Business Credit Quickly in a Recession: Get a PAYDEX Score

Dun & Bradstreet’s Business PAYDEX scores come from payment history.

But personal credit scores come from 5 factors:

- payment history (35%)

- utilization (30%)

- length of credit history (15%)

- accumulation of new credit (10%)

- and credit mix (10%)

When done right, business credit can be established without a personal credit check and irrespective of personal credit quality, without any personal credit reporting of business accounts. Most business credit may be obtained without having the owner assuming personal liability, or a personal guarantee.

How to Build Business Credit Quickly in a Recession: Defend Your Assets

Hence in the event of default, the company owner’s private assets can’t be attached. When a business owner applies for financing, their business credit is under review. Not having business credit built will get an owner declined for funding. There are no regulations requiring lenders to notify the business owner for their reason for rejection, so many never know.

Virtually any company can get business credit so long as it has an EIN number and entity set up. You do not need to have collateral or financials. Your firm can be a startup company. You simply need to understand the proper building steps. All highly-successful firms have business credit; it’s a “rite of passage” to ever attain real success.

A firm starts developing a brand new credit profile almost the same as a consumer does. The business starts off with no credit profile. The company gets approval for new credit which reports to the business CRAs. Then the company uses the credit and pays the bill promptly. A favorable business credit profile is established.

As the business continues using credit and covers bills promptly it will get approval for more credit.

How to Build Business Credit Quickly in a Recession: Developing Business Fundability

The understanding lending institutions, retail merchants, and creditors have of your company is important to your ability to establish strong business credit. Before making an application for business credit a firm must properly insure it meets or surpasses all lender credibility specifications. There are over 20 credibility points that are needed for your business to have a solid, reputable foundation.

It is essential that you use your exact business legal name. Your full firm name should include any recorded DBA filing you are using. Make sure your company name is precisely the same on your corporation papers, licenses, and bank statements.

How to Build Business Credit Quickly in a Recession: Corporate Entities and EINs

You can build business credit with virtually any type of corporate entity. If you truly wish to separate business credit from personal credit your business must be a separate legal entity. Hence it cannot be a sole proprietor or partnership.

Unless you have a separate business entity (Corporation or LLC) you might be ‘doing business’ but not truly ‘a business’. You need to be a Corporation or an LLC to differentiate personal from business.

Whether you have employees, your business entity must have an EIN. Your EIN is used to open your bank account and to establish your business credit profile. So take the time to verify that all agencies, banks, and trade credit vendors have your business on file with the exact same EIN.

How to Build Business Credit Quickly in a Recession: Business Addresses, Phone, and Fax Numbers

Your firm address must be a genuine brick-and-mortar location, with a deliverable physical address. It cannot be a home address, a PO Box, or a UPS address. Some lending institutions will not approve and fund unless these requirements are met.

Virtual Addresses

However, virtual addresses are terrific business address solutions. For address only, you will receive mail and packages at a dedicated business address. For a virtual office, you get a professional business address, and dedicated phone and fax numbers. And you also get receptionist services and part-time use of fully furnished offices and conference rooms.

And for a genuine office, you’ll have your own full-time private office with receptionist services, dedicated phone and fax, internet, full furnishings, conference rooms, and more.

Phone Numbers

You must have a dedicated firm phone number listed with 411 directory assistance, under the company name. Lenders, vendors, creditors, and even insurance providers will validate your business is listed with 411. A toll-free telephone number will give your company credibility. But you need to have a local business number for a listing with 411 directory assistance.

Lenders view 800 number or toll-free phone numbers as proof of business credibility. Even if you’re a solitary owner with a home-based business, a toll-free number makes you seem like an even bigger business. It’s very easy and affordable to set up a virtual local telephone number or a toll free 800 number.

A cell or home telephone number as your main business line could get you flagged as a non-established firm. And this is too high of a risk. Do not give a personal cell phone or home phone as the company phone number! You can forward a virtual number to any cell or land line number.

Fax Numbers

Lenders also feel a firm is more legitimate if it has a fax number. As a business you will need a fax number to receive important documents. You will also need it to fax in some of your credit applications. You can set up an e-fax going directly to your email.

How to Build Business Credit Quickly in a Recession: Business Websites

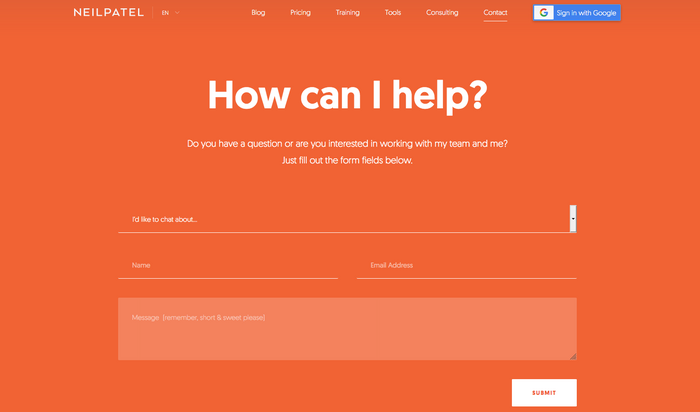

You will also need a business website. Credit providers will research your business on the net. It is best if they discovered everything directly from your business website. Not having a website will significantly damage your chances of getting business credit.

There are many places on the internet offering inexpensive company websites. That way, you can have an internet presence displaying an overview of your firm’s services and contact information.

Plus, it is critical to get a company email address for your company. It’s not only professional, but significantly helps your chances of getting an approval from a credit provider.

Setting up a business email address is just too simple and inexpensive to overlook. When it concerns your business email, never use free email services like Yahoo and Hotmail. The email address should be at yourcompany.com.

How to Build Business Credit Quickly in a Recession: Business Banking and Licensing

Your company banking history is important to long term success in getting more substantial business loans. The date you establish your business bank account is the day loan providers consider your company start date. So this is no matter when you incorporated or hit any other business milestone. The longer your business banking history, the better your borrowing potential is.

Having a high account balance is crucial in obtaining an excellent Bank Rating. And a good Bank Rating is essential for loan approval later on. Try to keep a bank balance of $10,000 or more for a 5 Bank Rating. In that way, you are more likely to get approval for loans eventually.

State Licensing

A common mistake when developing credit for a firm is non-matching business addresses on the business licenses. Even worse is not having the licenses necessary for a trucking company to operate legally.

Contact the State, County, and City Government offices. And see if there are any requisite licenses and permits to operate your trucking business. This includes your commercial driver’s license. Your business filings must be correct at state, county, and city levels. Plus your IRS filings must have correct listings.

How to Build Business Credit Quickly in a Recession: Company Listings

Also confirm main agencies (State, IRS, Bank, and the 411 national directory) list your company the same way. And with your precise legal name. Also make certain every single bill you get lists your business name correctly and comes to your company address.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit even in a recession.

How to Build Business Credit Quickly in a Recession: Get a D-U-N-S Number

Make sure your firm is listed with Dun and Bradstreet. If it isn’t, then get a D-U-N-S Number. This number starts the process of developing your business credit profile with them. Your D-U-N-S number will also play an important role in allowing your company to borrow without a personal guarantor. You can get your D-U-N-S number here: dnb.com. And you can also enroll for the DNBi SelfMonitor to monitor your credit. A subscription is $39-99/ month.

And check out the lowest-price monitoring – we can save you 90%!

How to Build Business Credit Quickly in a Recession: Get Your Other Business Credit Reports

Our business finance suite includes monitoring.

Don’t want to take the plunge yet? Then visit smartbusinessreports.com for a copy of your Experian Smart Business report. Learn how many trade lines are reporting and see if you have a business credit score assigned. See if you have an active Experian Business Profile and check on recent inquiries.

Buy a copy of your Equifax Small Business Credit Report here: https://www.equifax.com/business/business-credit-reports-small-business.

Business Credit for Trucking: Start with Vendor Credit

This is the beginning of business credit for trucking companies.

It is when a vendor extends a line of credit to your company on ‘Net 15, 30, 60 or 90’ day terms. This means you can buy their products or services up to a maximum dollar amount. And then you have 15, 30, 60 or 90 days to pay the bill fully.

So if you have Net 30 terms and buy goods today, then repayment is due in the next 30 days. Get products for your business needs. Then postpone payment on those for 30 days, thereby easing cash flow. Some merchants will approve a firm for Net 30 payment terms upon verification of as little as an EIN and a 411 listing.

True Starter Vendors

We have a great list of starter vendors here: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Be sure to apply first without using your Social Security Number. Some vendors will request it and may even tell you on the phone they need to have it. But submit first without it. Keep in mind: A Social Security Number is required for business loans but not for initial vendor credit building.

Some vendors require an initial prepaid order before they can authorize your firm for terms. Your first Net 30 account will report your trade line to Dun and Bradstreet. Then the D-U-N-S system will automatically activate your file if it isn’t already. This is also true for Experian and Equifax.

Uline

Uline is a true starter vendor. You can find them online at www.uline.com. They offer truck stops and ramps and more. And they report to Dun & Bradstreet and Experian. You MUST have a D-U-N-S number and an EIN before starting with them. They will ask for your corporate bank information. Your business address must be uniform everywhere. You need for an order to be $50 or more before they’ll report it. Your first few orders might need to be prepaid initially so your company can get approval for Net 30 terms.

Crown Office Supplies

Crown Office Supplies is an additional true starter vendor. You can find them online at https://crownofficesupplies.com. They sell a variety of office supplies, so be sure to use them for the inevitable paperwork you’ll need to generate. And they report to Dun and Bradstreet, Experian, and Equifax.

There is a $99.00 yearly fee, though they do report that fee to the business credit reporting bureaus. For other purchases to report, the purchase needs to be at least $30.00. Terms are Net 30.

Grainger Industrial Supply

Grainger Industrial Supply is also a true starter vendor. You can find them online at www.grainger.com. They sell hardware, power tools, pumps and more. They also do fleet maintenance. And they report to D&B. You need to have a business license, EIN, and a D-U-N-S number.

Your business entity must be in good standing with the applicable Secretary of State. If your company does not have established credit, they will require additional documents. So, these are items like accounts payable, income statement, balance sheets, and the like.

Apply online or over the phone.

Help Yourself with On-Time Payments

Repay all Net 30 vendor accounts in full and promptly. Be patient and allow time for the vendors’ reporting cycles to get into the reporting systems.

It commonly takes 3 cycles of Net accounts reporting to develop credit scores. Most merchants and major retailers offer business credit, but don’t publicize it. But there is no benefit to the merchant to promote credit without personal liability. So this is, if a business owner agrees to take on that liability. So they do not promote their business credit cards and frequently demand an SSN.

You must have a total of at least 3 Net 30 day pay accounts reporting, to move onto more credit.

Business Credit for Trucking: Get Store Credit

Store credit comes from a variety of retail service providers.

You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the business’s EIN on these credit applications.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit even in a recession.

Business Credit for Trucking: Getting Fleet Credit

Fleet credit is from companies where you can buy fuel, and repair and take care of vehicles. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Business Credit for Trucking: Going Beyond Fleet Credit

As you keep building more business credit, you’ll get approval for more high-limit accounts. Many loans will ask for a personal guarantee and credit check for approval. Being responsible with fleet credit will lead straight to getting vehicle financing and more universal cash credit.

These are businesses such as Visa and MasterCard. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are commonly MasterCard credit cards.

Business Credit for Trucking: Our Credit Line Hybrid

This is one more practical option. Unsecured credit is not secured with collateral. Good personal credit gets you unsecured credit cards with a personal guarantee; this normally means a 685 score or better. Good business credit gets you unsecured credit cards without any personal guarantee. The amount you can finance is often remarkably high. As in $10,000 – 50,000. And you can get it in 1 – 4 weeks.

You can also get cash flow-based lending; these are short term loans of 6 – 18 months, with amounts as much as $1 million. The loan amounts are equal to 8 – 12% of annual revenue, with rates of 10 – 45%. A 520 credit score is accepted, but good bank statements are required.

Our hybrid credit line could be perfect for you.

Business Credit for Trucking: Revenue Loans and Lines

A revenue loan (or revenue-based loan) is an alternative kind of loan. In contrast to a bank loan, it doesn’t require collateral or substantial assets. And unlike angel investing or venture capital, the money isn’t turned over for a portion of the business. Rather, the loan (or credit line) is repaid as a percent of incoming revenue. See: https://en.wikipedia.org/wiki/Revenue-based_financing.

Revenue-Based Financing Details

The lender (investors, really) will take an equity warrant. So this means they have a fixed price if they want to buy stock in the business. And that goes until an expiration date. And the business owner does not need to back the loan with their own personal assets. There is no valuation on the company’s assets.

All that is needed:

- The company needs to be producing revenue

- It needs to have good gross margins to be able to afford the payments

One way to get revenue-based financing is via crowdfunding platforms. The interest you pay is often a tax deduction for the firm. Costs tend to be more than for traditional bank loans. It’s not for early stage startups, by definition. But it may be a decent choice for a firm about 2 – 4 years old. So this is one with revenue coming in but banks still aren’t providing loans.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit even in a recession.

Fundbox

So our preferred provider is Fundbox. It’s a suitable option for short-term financing. The gist is you borrow on a line of credit to be repaid every week for up to 12 weeks. This is done via automatic deductions from your business bank account. $1,000 – $100,000 is available. There are no minimum credit score requirements.

Requirements:

- Six or more months in business

- Yearly revenue of $25,000 or greater

- The company must have business checking account

Find them online at: https://fundbox.com/lines-credit.

Business Credit for Trucking: Takeaways

You have a lot of options when it comes to getting business credit for trucking companies. The recession cannot last forever. And in the meantime, you can be helping yourself and your business right now.

The post How to Build Business Credit Quickly in a Recession: Tips for Long Haul Truckers appeared first on Credit Suite.