Ontario court freezes millions in trucker Freedom Convoy's crowdfunding account

A court in Ontario froze access to the millions of dollars in the GiveSendGo account of the Freedom Convoy 2022 on Thursday.

A court in Ontario froze access to the millions of dollars in the GiveSendGo account of the Freedom Convoy 2022 on Thursday.

For 76 minutes, Man United looked better than ever under Ralf Rangnick. Then Coutinho entered for Villa.

The post Philippe Coutinho's comeback halts Man United progress appeared first on Buy It At A Bargain – Deals And Reviews.

Sergio Perez says fighting seven-time world champion Lewis Hamilton and Red Bull teammate Max Verstappen on-track this season has already helped him to find a new level of performance.

The post Perez: Hamilton, Verstappen battles taking me to new level appeared first on Buy It At A Bargain – Deals And Reviews.

If you’ve spent any time learning about marketing analytics, you’ve probably come across the term “funnels.” What exactly are marketing funnels and why do they matter?

Marketing funnels are a useful tool to help you visualize the path customers take from first finding out about your brand to converting. Understanding them provides useful insight into why some customers convert — and some don’t.

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert. The most common type of marketing funnel is four steps:

The action can vary based on customer and industry — maybe you want them to make a purchase, sign up, or fill out a form. When someone does something you want them to do, it’s known as a conversion. The visitor converts from browsing to taking the action you want them to take.

Think about the Amazon purchase funnel. There are several steps a visitor has to go through before they can purchase a product. Here’s how it looks:

There are additional steps/actions that can be taken in between each of these steps, but they don’t matter in the marketing funnel unless they contribute to the final action. For example, a visitor may view Amazon’s Careers page, but we don’t need to count these in the funnel because they aren’t necessary steps.

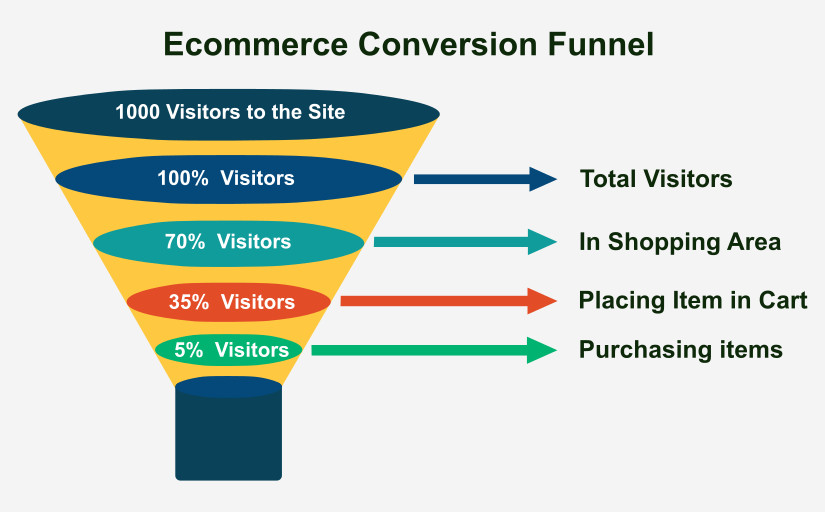

Why is the set of steps to conversion called a “funnel”? Because at the beginning of the process, there are a lot of people who take the first step.

As the people continue along and take the next steps, some of them drop out, and the size of the crowd thins or narrows. (Even further along in the process, your sales team gets involved to help close the deal.)

Losing customers might sound like a bad thing — but it’s not. The truth is, not everyone in your funnel will convert. The top of the funnel is where everyone goes in (visiting your site or viewing a marketing campaign). Only the most interested buyers will move further down your funnel.

So when you hear people say “widen the funnel,” you now know what they are referring to.

They want to cast a larger net by advertising to new audiences, increasing their brand awareness, or adding inbound marketing to drive more people to their site, thus widening their funnel. The more people there are in a funnel, the wider it is.

In this article, we’re focusing on marketing funnels, that is funnels that start with some sort of marketing campaign. That might be a PPC ad, content marketing campaign, white paper download, video ad, social media ad, or even an IRL ad. The point is the first step in the funnel is a marketing campaign of some sort.

Other types of funnels you might hear about include:

Despite the different names, these all track the same exact thing — the steps a prospective customer takes to conversion. (Sometimes they are even called conversion funnels!)

You aren’t limited to using a marketing funnel strictly for signing up and/or purchasing. You can put funnels all over your website to see how visitors move through a specific website flow.

You may want to track newsletter signup (Viewing newsletter signup form > Submitting form > Confirming email) or a simple page conversion (Viewing a signup page > Submitting signup).

Figure out what your goals are and what you want visitors to do on your site, and you can create a funnel for it.

Once you have the data, you’ll be able to see where roadblocks are and optimize your funnel. Let’s dig a little deeper into that.

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers. This is sometimes called a “leaky” funnel because it allows customers you want to keep to escape the funnel.

Let’s take your average SaaS business as an example. Here’s how a funnel may look for them:

Do people have to use the product before paying? They don’t, but it’s a good idea to track it so you can see if it’s a roadblock.

For example, if you are losing a lot of conversions after the trial stage, you might need to update your onboarding process so people understand how to use the tool or even adjust the top of your funnel so you aren’t attracting people outside of your target audience.

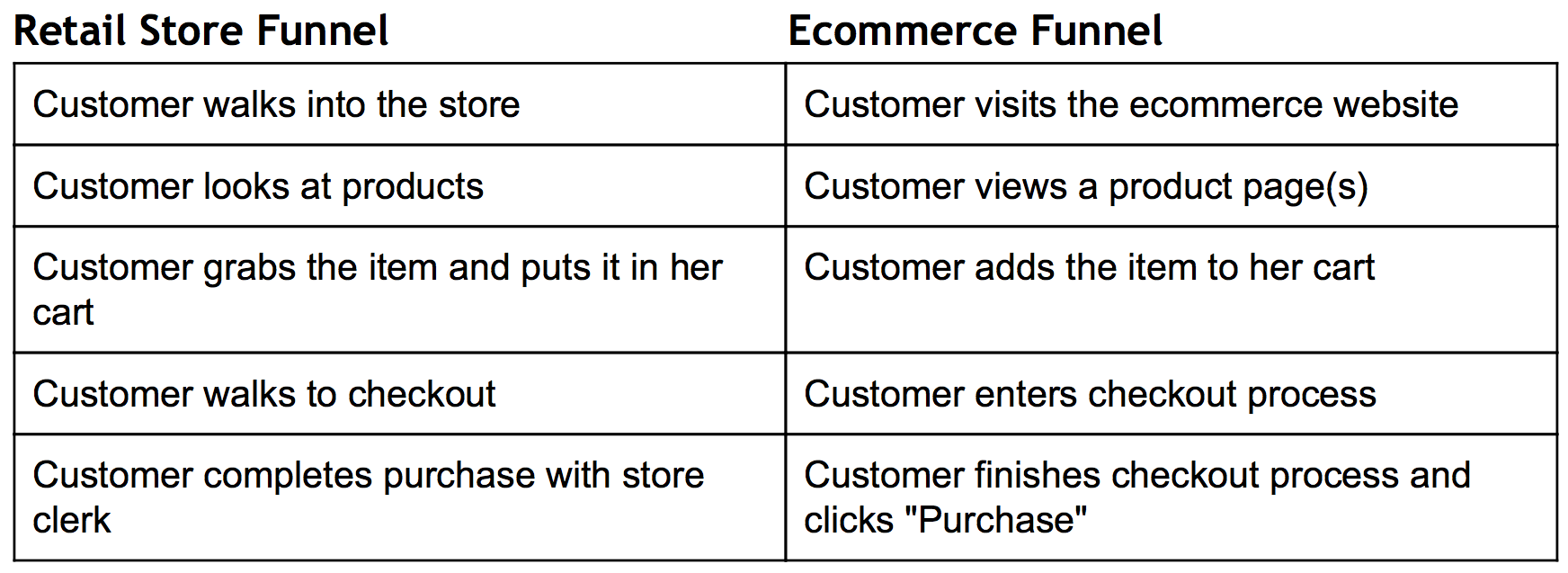

Let’s look at a funnel process for a retail store and see the corresponding steps in an e-commerce store. We’ll be tracking a purchase funnel.

The e-commerce store has the fortune of being able to see a funnel because they can track clicks, time on page, and other metrics. Their marketing would look something like this:

Okay, so now we have an understanding of what a funnel is and why it helps. Let’s take a look at a product that offers funnels – Google Analytics.

Google Analytics offers funnels, and I’ve written extensively about it in the past. This is an incredibly simple way to track the path prospects take before they convert. Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

Here are a couple of things you’ll need to know when creating funnels in Google Analytics:

Overall, if you are just getting started with marketing funnels, Google Analytics is a solid place to start. Learn how to set up a conversion funnel in Google Analytics.

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert.

Sales funnels

Webinar funnels

Email funnels

Video marketing funnels

Lead magnet funnels

Home page funnels

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers.

Visited site > Signed up for a trial > Used product > Upgraded to paying customers

Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

We’ve covered just about everything you need to know about marketing funnels. Here’s a quick recap:

Have you created a marketing funnel in Google Analytics? What did you learn?

Banks are in the business of judging your company’s creditworthiness. This has a direct relationship to several important issues. Ignore these at your peril! It pays to take the time to try to understand how your recession business banking rates will work.

The number of American financial institutions and also thrifts has been decreasing gradually for a quarter of a century. This is from consolidation in the market along with deregulation in the 1990s, decreasing obstacles to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets concentrated in ever‐larger banks is troublesome for local business proprietors. Big financial institutions are a lot less likely to make small loans. Economic recessions mean financial institutions become more careful with financing. For this reason, you need to understand your business bank ratings. It’s the only way you will be able to improve them.

But what’s that all about?

Did you know there are many ways you can ravage your bank credit score? It is, regrettably, quite easy to run a power saw through your bank rating. Your recession business banking rates can easily end up taking a hit.

But before going any further, do you know the difference between bank credit ratings and small business credit?

Business credit is the full and complete amount of cash that your small business can receive from all manner of lenders. That means credit unions, credit card companies, and also renting businesses. And it also means vendors, under what’s called trade credit or vendor credit or trade lines.

A bank credit score, on the other hand, is a measure of the full amount of borrowing ability which a company can get from the banking system only.

A company can get more business credit fast . That is, as long as it has at least one financial institution reference. Plus it must have an average day to day account balance of at the very least $10,000 for the most recent three months. This setup will generate a bank credit rating of a Low-5. So this means it is an Adjusted Debt Balance of from $5,000 to $30,000.

A lower score, like a High-4, or balance of $7,000 to $9,999 will not result in an automatic turn down of the small business’s loan application. But it will slow down the approval process.

A bank rating is a measure of the average minimum balance as kept in a business bank account over a 3 month long period. Hence a $10,000 balance| will rate as a Low-5, a $5,000 balance will rate as a Mid-4, and a $999 balance will rate as a High-3, etc.

A company’s chief goal ought to always be to maintain a minimum Low-5 bank rating (or, an average $10,000 balance) for a minimum of 3 months. This is because, without at the very least a Low-5 score, most financial institutions will assume a business cannot pay back a loan or a business line of credit.

Yet there is one point to keep in mind – you will never see this number. The financial institution will keep this number in its back pocket.

The numbers work out to the following ranges:

To get a High-5 rating, your business will need to have an account balance of $70,000 to $99,999. For a Mid-5 score, your business has to have an account balance of $40,000 to $69,999. And for a Low-5 score, your company should hold onto an account balance of $10,000 to $39,000. So your small business needs this level bank rating or better to get a bank loan.

For a High-4 score, your small business needs to have an account balance of $7,000 to $9,999. And for a Mid-4 rating, your company must have an account balance of $4,000 to $6,999. So for a Low-4 score, your company will need to have an account balance of $1,000 to $3,999.

And now, without further ado, here are 7 ways you can leave your bank score in tatters. These methods can all too easily hurt your recession business banking rates.

Don’t maintain a minimum balance for at least three months. Since every bank score cycle has a basis in the last 3 months, a seesawing balance will harm your bank score.

Don’t bother to assure that your company bank accounts are on report the exact same way as all your small business records are. And do not assume they are on report with the exact same physical address (no post office box) and contact number. Sow confusion here by editing one and not another, or not dealing with an error if there is one.

Have a look at our expert research on bank ratings, the obscure reason why you will – or won’t – get a bank loan for your company.

To support # 6, don’t make sure that each and every credit agency and trade credit vendor likewise lists the business name and address the precise same way. This is every keeper of financial records, earnings and sales taxes. It includes web addresses and email addresses, directory assistance, etc.

No loan provider is going to think of the myriad ways that a company may be listed, when they check out the business’s creditworthiness. So if they cannot find what they need fast, they will refute an application. Or it won’t be on the report to a company credit reporting bureau such as Experian, Equifax or Dun & Bradstreet.

For that reason, if they are not able to locate what they need quickly, they will simply reject the application. So make certain your documents are a mess!

Never handle your bank account responsibly. This means that your small business must not avoid writing non-sufficient funds (NSF) checks at all costs. Such is due to the fact that those decimate bank ratings. Non-sufficient funds checks are something which no company can afford to let happen.

Balancing checkbooks and accounts is so boring anyway. You’ve got adequate cash without even making sure, right?

To add to # 4, do not add overdraft protection to your bank account ASAP, to avoid NSFs. Why bother thinking in advance or preparing for the future? Everything is going to be terrific permanently, right?

Writing checks insufficient funds (NSFs) is a sure way to wreck your bank score.

Do not let your business show a positive cash flow. The cash coming in and leaving your business’s bank account should reflect a positive free cash flow.

A positive free cash flow is the quantity of revenue left over after a firm has paid all its expenses. According to Investopedia, it “represents the cash a company can generate after required investment to maintain or expand its asset base. It is a measurement of a company’s financial performance and health.”

When an account shows a positive cash flow it indicates your small business is generating more revenue than you use to run the firm. That means the bank will feel your small business can cover its costs.

So if you really intend to wreck your bank score, get whatever’s expensive for your company so your costs overtake your profits. Doesn’t every factory merit luxurious carpets in the loading dock?

Have a look at our expert research on bank ratings, the obscure reason why you will – or won’t – get a bank loan for your company.

Financial institutions have quite the motivation to lend to a small business with consistent deposits. And an entrepreneur must also make regular deposits to keep a positive bank rating. The business owner has to make a lot of regular deposits, greater than the withdrawals they are making, to have and maintain a great bank rating. If they can do that, then they will have a great bank credit score.

Consistency is the hobgoblin of little minds, right? So be a free spirit!

You, the entrepreneur must never make consistent deposits. And these deposits ought to never be more than the withdrawals you are making, to ruin your bank credit.

If you can do these things, then your company will have a horrible bank credit score. And then a bad bank credit score means your firm is much less likely to get small business loans. This is how you can truly muck up your recession business banking rates.

But your recession business banking rates are a thing of value. You should want to protect and nurture it. So, where do you go from here?

Probably the easiest way to achieve and maintain an excellent bank credit rating is to deposit at least $10,000 into your company bank account. And keep it there for as much as six months. While you will still have to make regular deposits, this one simple step will assist in 3 ways. One, you will have kept an excellent minimum balance for at the very least 3 months. Two, you will probably not overdraw with such a great balance. And three, you will be at the magic minimum for a Low-5 bank credit rating. Thus you will be dealing with our # 4 and # 7, above.

And you may even have the ability to get around our # 3. But we still highly recommend overdraft protection.

Have a look at our expert research on bank ratings, the obscure reason why you will – or won’t – get a bank loan for your company.

A 2nd thing you can do is make certain your small business account details are consistent across the board, everywhere. While it may take some work order to make certain every little thing is right, you will be dealing with our # 5 as well as # 6, above.

A 3rd thing you can do is make consistent deposits, as well as make sure they are greater than the quantities you are withdrawing each month. This will take care of our # 1 and also # 2.

Your bank score is not to be trifled with. The financial institutions maintain a mystery about them. Still, failing to keep your bank credit rating high will make it a whole lot harder to do well in business. In this way, you can defend and improve your recession business banking rates.

The post Raise Your Recession Business Banking Rates and Get Funding Even in a Bad Economy appeared first on Credit Suite.

Location: REMOTE | EUROPE | Remote preferred Willing to relocate: unlikely, but do contact me about it – Technologies: Javascript, Typescript, Node.js, graphql, Docker, kubernetes, jenkins, aws, cloud, devops, backend, agile, scrum, kanban, python, ruby, shell scripting, linux, chef, ansible, ci/cd – Résumé/CV: http://bit.ly/2HucTwp – https://www.linkedin.com/in/claudio-viola/

The post New comment by claudio-viola in “Ask HN: Who wants to be hired? (November 2020)” first appeared on Online Web Store Site.

The post New comment by claudio-viola in “Ask HN: Who wants to be hired? (November 2020)” appeared first on ROI Credit Builders.

With the ability to take a lot of guesswork out of conversion rate optimization, eye-tracking software and heat maps can reveal some startling insights into increasing conversions (and avoiding sales killers) that can benefit every business.

Here are 7 important eye-tracking studies that give a sneak peek into common browsing patterns and elements of human behavior that all marketers need to know.

You don’t have to be an expert in UX (user experience) to understand the importance of Fitts’s law.

While seemingly complicated at first glance, one of the fundamental lessons Fitts’s law communicates is that object “weight” (in the visual hierarchy) is a big determinant in what attracts eyes and mouse clicks.

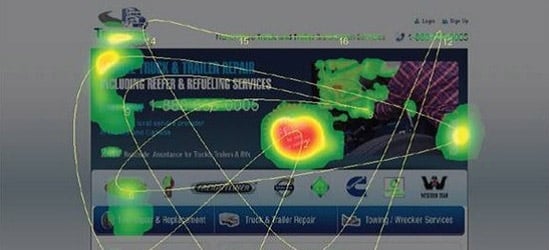

Consider this recent case study from TechWyse that examined the homepage of a truck service with a heat map:

As you can see from the first test, the non-clickable “NO FEES” button was hogging a lot of attention, but it is not a call-to-action and its information isn’t the most important on the page.

That’s no good.

Also, it is right next to one of the most important CTAs on the page (the phone number) and it stands out so much that it actually is drawing people away from other more important elements.

Take a look at the changes they made to alleviate this problem.

Much better!

The “Call Now” button clearly is getting a lot of attention over every other section on the page, which is great because it is how customers get started contacting the business!

Lesson learned: When you are assembling a persuasive landing page, be sure the elements that “pop” are the ones that matter, and that you aren’t giving too much weight to visuals that don’t encourage customers to take action.

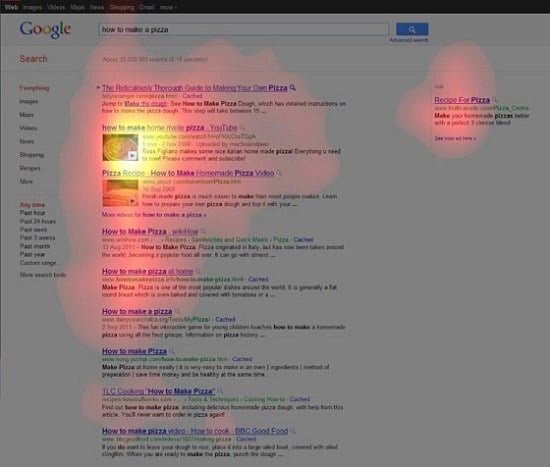

Most marketers have seen those SERP (search engine results page) heat maps that show the top 3 rankings hogging all of the action… But what role do visual elements play in holding visitor attention?

In an interesting heat map study published on Moz, videos were shown to be particularly powerful in capturing eyeballs through eye tracking, even when they weren’t the #1 result.

As you can see below, both direct video results (such as a hosted YouTube video) and embedded video results (videos embedded on a webpage) commanded more attention than a regular search listing, especially if they were near the top of the results.

Why video?

Video is usually is interpreted as a product video. However, instead of assuming, test to see if it impacts your search traffic for top keywords.

Lesson learned: If you want to stand out at the top of some competitive search results, you may want to test an embedded video rather than authorship for product pages.

Using visual cues to guide visitors to key areas of your site is nothing new, but just how effective is it?

According to studies such as the aptly named Eye Gaze Cannot be Ignored, it is incredibly effective. Human beings have a natural tendency to follow the gaze of others, and we have been coached since birth to follow arrows directing us to where we should be looking and going.

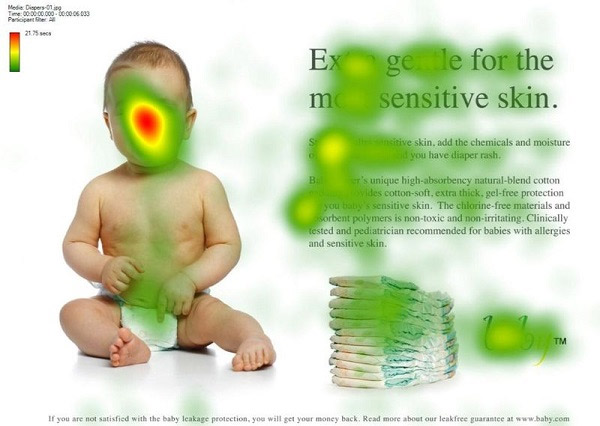

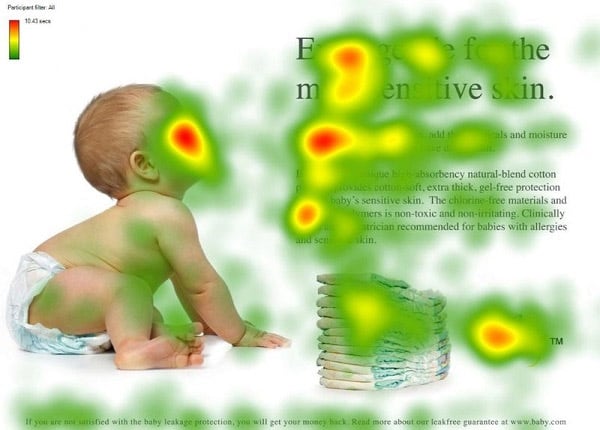

Consider the following eye tracking heat map example that included a page with a baby and a compelling headline for taking care of the baby’s skin.

It’s obvious that the baby’s face is drawing a lot of attention. (As a matter of fact, faces of babies and pretty women draw the longest gazes from all visitors.)

Unfortunately, from a marketing standpoint, this is a problem because the copy isn’t commanding enough attention.

Now look at the browsing patterns when an image of the baby facing the text was used.

As you can see from the eye tracking heat map, users focused on the baby’s face again (from the side) and directly followed the baby’s line of sight to the headline and opening copy. Even the area of text that the baby’s chin was pointing to was read more!

Lesson learned: Visuals are an important part of a site’s overall design, but most pages can be optimized by including images that serve as visual cues for where visitors should look next.

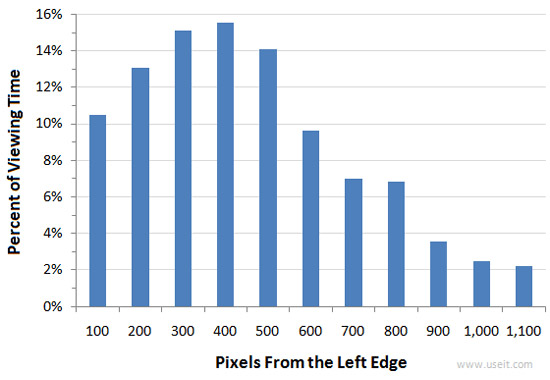

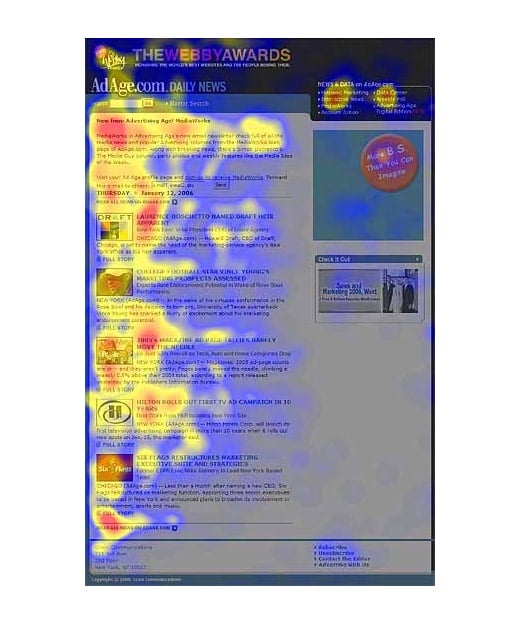

According to this study from the Nielsen Group, all across articles, e-commerce sites, and search engine results, people almost always browse in an F-shaped pattern that heavily favors the left side of the screen.

This coincides with additional research that shows people tend to view the left side of the screen overall far more than the right.

It is important to note all of these studies were conducted with English speaking (and reading) participants. The opposite was true for those users whose languages read from right to left.

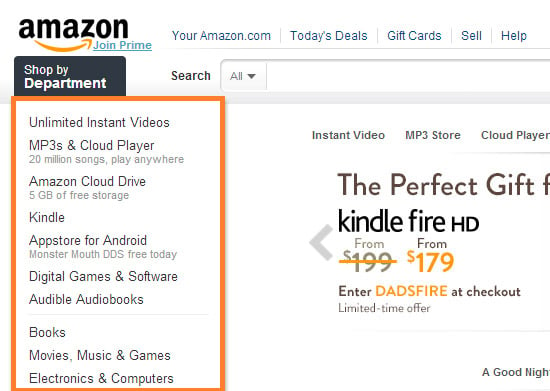

Is it any wonder that some of the most tested websites in the world (like Amazon) have placed a clear priority on the left sides of their homepages?

Lesson learned: Web users tend to browse sites based on their reading habits. For English speaking people (and languages with similar reading patterns), the left side of the screen is heavily favored, and all sites tend to be browsed in an F-pattern.

Relying on the screen above “the fold” to do all of the heavy lifting is one of the biggest usability mistakes you can make. The idea that it is the only place web users will browse is a complete myth.

Multiple tests (including this one and this other one) have shown that users have no problem scrolling down below the fold. Surprisingly, they will browse even further down if the length of the page is longer.

KISSmetrics conducted an interesting A/B test on his homepage and found that a page with 1,292 words beat a page with 488 words by 7.6%. And it didn’t end there. The leads from the long-form version of the page were higher in quality than the leads from the variation.

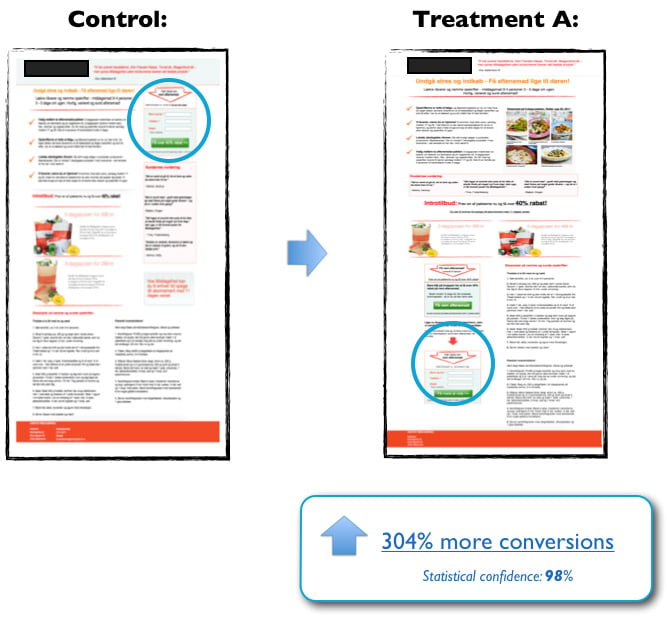

Another great test from the folks at ContentVerve showed that moving the call-to-action far below the fold actually boosted conversions by 304 percent.

Lesson learned: Although it’s dependent on the page you are testing, you shouldn’t be afraid of placing important elements below the fold (and testing them there), because it gives people time to read your copy before they take action.

Who’d have thought that eye tracking and email marketing could be best of friends?

According to this eye tracking study conducted by the Nielsen Group, people scan emails very quickly, and the only areas they give any appreciable amount of time to at all are the initial copy and headlines.

From the study:

Users are extremely fast at both processing their inboxes and reading newsletters. The average time allocated to a newsletter after opening it was only 51 seconds.

This means that you need to get to the point in your emails in under a minute. The message should be as compelling as that of an online article, but you don’t have as much time to capture attention as you might in an article.

This coincides with a study from MarketingSherpa that shows people prefer short, clear, and un-creative headlines for their emails. (Creative headlines can seem mysterious, and mystery in an inbox may equal spam.)

Truly a situation where the KISS principle applies!

Lesson learned: Once you’ve earned the right to appear in a prospect’s inbox, be sure to keep that privilege by crafting emails that are clear and get to the point quickly. You don’t have as much time to broadcast your message as you would in an online article.

If you’ve ever seen this video by Dan Ariely, you know that sometimes seemingly “useless” price points actually are quite important for increasing conversions.

One common pricing element that fits the bill here is the “pre-sale” price. It isn’t literally used by customers because they don’t pay that price… But is it still “used” to evaluate the new price?

In an effort to answer this question, Robert Stevens of THiNK Eye Tracking conducted a test that examined how people look at prices and products on shelves.

In the initial test, results weren’t too surprising. Most people spent time looking at prices and product packaging.

But if the pre-sale price was included, would people look at it?

They did!

Better yet, Stevens also tested perception of the sale price to see if viewing the pre-sale price played a role.

These were his findings:

After consumers selected the smoothie of their choice, I asked them if their purchase was a good value for the money on a 7 point “like” scale (with 1 being very good value for the money and 7 being not very good value for the money).

Consumers who saw only the promotional item gave a mean score of 2.4. Consumers who saw the promotional item next to a full-price premium offer gave it 1.7, even though they purchased the same item!

Basically, humans are pretty bad at evaluating price without contextual clues (as argued by Ariely in this TED talk). We find it much easier to make decisions when we have something to base them on.

That’s why people often view a sale price as a better value when they can see what they really are saving. Without that contextual clue, the sale price is hard to evaluate because they don’t know what the product usually sells for.

Lesson learned: Sometimes “useless” prices like pre-sale prices can be used by customers to evaluate the value of a potential purchase.

About the Author: Gregory Ciotti is the marketing strategist for Help Scout, a Zendesk alternative made for small businesses that want help desk software with a personal touch. Get more data-driven content from Greg by downloading his free guide on converting more customers (with psychology).

The post 7 Marketing Lessons from Eye-Tracking Studies appeared first on Neil Patel.

Personal privacy Trees The home I expanded up in had a personal privacy fencing that got to all around the boundary. Personal privacy fencings appear a little bit as well obvious for me. That is when I uncovered personal privacy trees. A great deal of individuals like personal privacy hedges as well as trees. Unless …

The post Personal privacy Trees first appeared on Online Web Store Site.

The post Personal privacy Trees appeared first on ROI Credit Builders.

Do you know how to get a recession business loan, even if your credit is less than stellar? We break down what’s out there, even if your personal credit is not so hot.

Poor credit does not need to be a dead weight around your company’s proverbial neck. Nevertheless, it does make it more difficult to get a small business loan. For a brand-new small business particularly, your business credit will be poor by definition.

This is because you just will not have the kind of background and seasoning which can make your commercial credit score go up.

And, for this reason, such seasoning would make lenders wish to loan your small business money.

As a result, lending institutions are not going to be too excited about granting your business a company loan. This is because they genuinely have no idea if your small business will be able to pay back the loan.

But you are still, not surprisingly pondering how to subsidize a company with bad credit.

The number of United States banks and thrifts has been decreasing slowly for a quarter of a century. This is from consolidation in the marketplace in addition to deregulation in the 1990s, decreasing obstacles to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets concentrated in ever‐larger financial institutions is problematic for local business proprietors. Big financial institutions are much less likely to make small loans. Economic slumps mean financial institutions come to be more careful with financing. The good news is, business credit does not rely upon financial institutions.

As a result of this, lenders will oftentimes obtain a UCC blanket lien in the event that they do give your company a loan. A UCC blanket lien is a note which is included with your credit report. It says that the creditor has an interest in all of your company’s assets until you pay off the loan completely. For that reason, there might be dire repercussions if you need to default.

Plus, many of these loans will also involve personal guarantees.

Having said that, if a loan does not require a personal guarantee, then your small business is typically going to be looking at unsecured business loans, and those are coupled with high interest rates.

These sorts of business loans can be short term. So, you must pay them back fast. Or they can be receivables financing. Hence this is where you are able to get a loan based on business you anticipate to be coming in. This is because you have pending bills which your own customers have not paid out to you yet. Or, it can be vendor cash advances.

These all come with lending rates which are often 40% or higher.

The main advantage is that you do not need to provide a personal guarantee or allow a UCC blanket lien. If you end up defaulting on the loan, then your house and any other private assets will not be seized, and neither will your inventory. However, this also implies that you normally must have strong revenue or a substantial amount of time in business. Generally speaking, your personal credit must be fair or better.

And that’s even in the absence of a personal guarantee requirement.

It’s all about the interest. As reported by Nerd Wallet, Kabbage can deliver an unsecured business loan – yet the APR can possibly be as high as 99%! If you think that’s usury, think again. In Ohio, the usury laws don’t apply to unsecured loans.

Another drawback (although not everyone will see it in that way) is that unsecured business loans often demand that your business has been in operation for at least six months. Or they may require that you have no personal bankruptcies. Another possibility is your business needs to show a minimal yearly revenue amount.

And that means opening your books to your creditor. If any one of these demands has already been met by you, then you possibly won’t see this as a real disadvantage.

Having said that, you can have issues. They can arise if your company is brand-new, and you do not as of yet have a regular clientele and profits. Another problem is if you have had personal bankruptcy problems. Then you may be shut out of your few remaining alternatives.

For all these alternatives, you will usually have a preferable rate of interest (and you will probably have more alternatives, so you can shop around and compare plans) if your credit score is better than bad. If your business can sit tight till your credit – either small business or private or both – develops, then your options will significantly improve, too.

Let’s look at more options.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

A credit line, or line of credit (LOC), is an agreement between a borrower and a financial institution or private investor which establishes a maximum loan balance which a borrower can access.

A borrower can access funds from their line of credit any time, as long as they don’t go beyond the maximum set in the agreement, and as long as they meet all other requirements of the finance institution or investor for instance, making prompt payments.

Credit lines provide many one-of-a-kind benefits to borrowers including versatility. Borrowers can employ their line of credit and just pay interest on what they use, in contrast to loans where they pay interest on the total amount borrowed. Credit lines can be reused, so as you acquire a balance and pay that balance off, you can use that accessible credit again, and again.

Credit lines are revolving accounts similar to credit cards, and compare to various other types of financing such as installment loans. In many cases, lines of credit are unsecured, much the same as credit cards are. There are some credit lines that are secured, and for this reason easier to get approval for

Credit lines are the most commonly requested loan type in the business world despite the fact that they are popular, legitimate credit lines are uncommon, and challenging to find. Many are also very hard to qualify for calling for good credit, good time in business, and good financials. But there are other credit cards and lines which few people know about that are available for start-ups, bad credit, as well as if you have absolutely no financials.

Most credit line types that most business owners picture come from traditional banks and standard banks use SBA loans as their primary loan product for small business owners. This is due to the fact that SBA ensures as much as 90% of the loan in the event of a default. These credit lines are the most challenging to get approval for because you must qualify with SBA and the bank.

There are two primary sorts of SBA loans you can normally obtain. One form is CAPLines. There are actually 4 types of CAPLines that can work for your company.

You can also acquire a smaller loan amount more quickly using the SBA Express program. The majority of these programs offer BOTH loans and revolving lines of credit.

From the SBA … “CAPLines is the umbrella program under which SBA helps business owners meet short-term and cyclical working capital needs”. Loan amounts are available up to and including $5 million. Loan qualification requirements are the same as for other SBA programs.

This one advances against anticipated inventory and accounts receivables. It was created to assist seasonal businesses. Loan or revolving are on offer.

This one finances the direct labor and material costs of performing assignable contracts. Loan or revolving kinds are available.

This one was made for general contractors or builders constructing or renovating industrial or residential buildings. This line is for pay for direct labor-and material costs, where the building project acts as the collateral. Loan or revolving kinds are on offer.

Borrowers must use the loan proceeds for short term working capital/operating needs. If the proceeds are used to acquire fixed assets, lender must refinance the portion of the line used to acquire the fixed asset into an appropriate term facility no later than 90 days after lender discovers the line was used to finance a fixed asset.

You can get approval for up to and including $350,000. Interest rates can be different, with SBA enabling banks to charge as high as 6.5% over their base rate. Loans above $25,000 will necessitate collateral.

To get approval you’ll need great personal and business credit. Plus the SBA specifies you must not have any blemishes on your report. An acceptable bank score requires you have at least $10,000 in your account over the last 90 days.

You’ll also need a resume showing you have market experience and a well put together business plan. You will need three years of company and personal tax returns, and your business returns should show a profit. And, you’ll need a current balance sheet and income statement, therefore showing you have the finances to pay back the loan.

To get approval you’ll need account receivables, but only if you have them. As for the collateral to make up for the risk, often all business assets will function as collateral, and some personal assets which also include your residence. It’s not unheard of to need collateral equivalent to 50% or more of the loan amount. You also need articles of incorporation, business licenses, and contracts with all third parties, and your lease.

Private investors and alternative lenders also offer credit lines. These are a lot easier to get approval for than conventional SBA loans. They also necessitate much less documentation for approval. These alternative SBA credit lines typically need good personal credit for approval.

Unlike with SBA, many of them don’t demand good bank or business credit approval. Nearly all of these sorts of programs require two years’ of tax returns. Tax returns need to show a profit. Rates can vary from 7% or higher and loan amounts extend from $25,000 into the millions. Loan amounts are typically based on the revenues and/or profits on tax returns. At times lenders may want other financials including a profit and loss statement, balance sheets, and income statements.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

Merchant cash advances have rapidly become the most popular way to get financing, in large part due to the easy qualification process. Companies with $10,000 in revenue can get approval, with the business owner having scores as low as 500.

Some sources have now even begun to offer credit lines that go with their loans. You must have at least $10,000 in revenue for approval. You ought to be in business for a minimum of one year, however three years is better. Lenders normally want to see a credit score of 650 or better for approval.

Loan amounts are generally about $20,000. Lenders routinely do pull your business credit, so you need to have some credit already and in some cases lenders will want to see tax returns.

Rates vary, due to the risk for this program, and there usually are not a lot of funding sources who offer it.

You can get financing irrespective of personal credit if you have some form of stocks or bonds. You can also get approval if you have someone wishing to use their stocks or bonds as collateral for financing.

Personal credit quality doesn’t matter as there are no consumer credit requirements for approval. You can get approval for as much as 90% of the value of your stocks or bonds. Rates are usually lower than 2%, making this one of the lowest rate credit lines you’ll ever see. You can still earn interest as you usually do on your stocks and bonds.

Credit cards typically offer 0% intro rates for up to two years. This is also very handy for startups in particular. And credit lines let you take out more cash at a much cheaper rate than do cards. These are the principal two differences that will have an effect on you between credit cards and credit line.

Investopedia even says that “lines of credit are potentially useful hybrids of credit cards.”

Both cards and lines are revolving credit. Credit lines are harder to get approval for as card approvals are frequently very quick, many times automated, while line require an in-depth underwriting review. Lines usually offer lower rates, per Bankrate card rates average 13% while lines average 4%.

The majority of these cards report to the consumer credit reporting agencies. They all need a personal guarantee from you. You can get approval typically for one card max as they stop approving you when you have two or more inquiries on your report.

Most credit card companies feature business credit cards including Capital One, Chase, and American Express. These have rates similar to consumer rates and limits are also similar.

Some report to the consumer reporting agencies, some report to the business bureaus. Approval requirements are similar to consumer credit card accounts.

Typically, when you apply for a credit card you put an inquiry on your consumer report. When other lenders see these, they will not approve you for more credit for the reason that they aren’t sure how much other new credit you have lately obtained.

So they’ll only approve you if you have less than two inquiries on your report within the last six months. Any more will get you refused.

With this form of business financing, you work with a lender who specializes in securing business credit cards. This is a very uncommon, only a few know about program which few lending sources offer. They can oftentimes get you three to five times the approvals that you can get on your own.

This is due to the fact that they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t decline you for the other card inquiries. Individual approvals commonly range from $2,000 – 50,000.

The end result of their services is that you generally get up to five cards that simulate the credit limits of your maximum limit accounts now. Multiple cards generate competition, and this means they will raise your limits, normally within 6 months or less of original approval.

Approvals can go up to $150,000 per entity for instance, a corporation. With a hybrid credit line they actually get you three to five business credit cards which report only to the business credit reporting agencies. This is huge, something most lenders don’t offer or promote. Not only will you get money, but you build your business credit as well so within three to four months, you can then use your new company credit to get even more money.

The lender can also get you very low introductory rates, typically 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the very best cards for points. So this means you get the very best rewards.

Just like with just about anything, there are huge benefits in teaming up with a source who focuses on this area. The results will be much better than if you attempt to go at it alone.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

You have to have excellent personal credit right now, ideally 685 or better scores, the same as with all business credit cards. You shouldn’t have any negative credit on your report to get approval. And you must also have open revolving credit on your consumer reports right now and you’ll have to have five inquiries or less in the most recent six months reported.

All lenders in this space charge a 9-15% success based fee and you only pay the cost off of what you secure. Bear in mind, you get a number of added benefits and about three to five times more cash with this program than you could get on your own, which is why there’s a fee, the same as all other lending programs.

You can get approval making use of a guarantor and you can even use several guarantors to get even more money. There are likewise other cards you can get utilizing this same program but these cards only report to the consumer reporting agencies, not the business reporting agencies. They are consumer credit cards versus business credit cards.

They supply similar benefits which include 0% intro APRs and five times the amount of approval of a single card but they’re a lot easier to get approval for.

You can get approval with a 650 score and seven inquiries (or fewer) in the most recent six months and you can have a BK on your credit and other derogatory items. These are much easier to get approval for than unsecured business cards.

With all earlier cards above, you should have good consumer credit to get approval but what happens if your personal credit isn’t good, and you don’t have a guarantor?

This is the time when building business credit makes a ton of sense even when you have good personal credit, improving your business credit helps you get even more money, and without having a personal guarantee.

Company credit is credit in a business name, in connection with the company’s EIN number, and not the owner’s Social Security Number. When carried out correctly, you can obtain business credit without a personal credit check and without a personal guarantee. This is something all other cards above can’t provide.

You can get three types of business credit cards. First is vendor credit, which offers net 30 terms to launch a business credit profile. Then is retail credit, where you will get credit cards with high limits at most stores.

Next is fleet credit. It’s credit to fuel, service, and maintain business vehicles. And then there’s cash credit, which includes Visa, MasterCard, and American Express cards that you can use anywhere. You can get these with no credit check or guarantee. Limits are normally $5,000 – $10,000 to begin, and can exceed $50,000.

A little patience is a virtue when you want to get a recession business loan.

The post Get a Recession Business Loan the Smart Way appeared first on Credit Suite.

Spire | Nano-Satellites/ Data Services | Full time | Onsite (remote during COVID) Spire Global is a space-to-cloud analytics company that owns and operates the largest multi-purpose constellation of satellites. We are growing our offices globally and are looking for engineers in many locations. Please visit https://spire.com/careers/job-openings/ to see the full list. Here are a …