The key factor in the “great seo game” is how well you optimize your site. No matter how brilliant a product or service you have, you’ll have a hard time making money if no one can find it. This guide will help you understand how to optimize your website—for free—without having to use paid tools, … Continue reading How to Optimize Your Website For Free

Author: Jamie Carpenter

How to Market a Book: 7 Strategies

It might feel like you’ve already done the hard work.

You’ve spent hours with a keyboard or notebook in your hands, writing away. You’ve edited, edited, and edited some more—and may have even struggled through the complicated process of self-publishing.

Now you have to go to the next step: marketing your book.

This entails getting your book “out there,” earning an audience, and generating sales. You just need to understand how to market a book.

With the right marketing tactics, there’s nothing stopping you from selling your book around the world and building the fanbase of your dreams—well, nothing but time and effort.

How to Market a Book

No matter how good a book is, no one will read it if it doesn’t have the right marketing.

International self-publishing websites like Amazon have brutal algorithms that punish the unaware. In order to get yourself that “best selling” tag, your best bet is to look away from the shops and start focusing on your audience.

In many ways, having a book is like having a website. It can be absolutely brilliant, but if it’s not presented to the right people, it won’t take off.

Luckily, with the help of modern technology, finding readers doesn’t have to be an impossible journey.

Strategy #1: Research Your Niche

Any good marketing starts with research.

For this reason, marketing shouldn’t just be an afterthought. It needs to be a part of your process from the very conception of your book.

If you fail in your market research, then you may find you’re writing a book that nobody wants to read. In some cases, this might not be a problem (such as you are writing for passion), but if you want to make sales and know how to market a book, then your writing has to be informed by your research.

Fanbase

I always talk about the importance of targeted content. No matter what you’re writing, it’s impossible to accommodate everyone.

Instead, you have to focus on the people who are most likely to enjoy your book.

This is where it’s helpful to create a reader profile. Ask yourself questions about what your ideal reader looks like and build a picture of their character. Understand the following about them:

- Demographics.

- How often do they read?

- How many books do they read?

- How fast do they read?

- What information are they looking for?

- How do they consume content?

Yes, your writing comes from you and is an expression of yourself, but it’s always important to keep your readers in mind. This will help you with the writing process, but it’s also going to help your marketing, and, eventually generating reviews.

Genre

If you tell someone you love reading, then what’s the next question they’re likely to ask?

“What genres do you read?”

Genres are one of the main ways we categorize books, so you should have a good picture of where your book fits into this. Each genre has unique characteristics that its readers look out for and your book is expected to follow certain tropes.

Understanding what works and what doesn’t in your genre is important information for your market research. For example, the blurb on a non-fiction book is going to be very different from the blurb on a romance novel.

The more information you have about your genre, the easier it is to understand how to market a book.

Competitors

Consider this: who are you competing with?

Are you competing with that out-of-reach New York Times bestseller, or are you competing with something a little more niche?

In an ideal world, there would be no competition. Your book should stand proud, and alone. Only, in the real world… that’s not the case.

Competition exists.

For example, if you’ve written a children’s book, you need to look at similar authors.

After all, marketing is always much easier when you know what the competition is doing. When you can see what they do well and what they don’t do so well, then it can give you ideas for your own marketing. You can look at what they’ve written, what the blurb is, what social media pages they run, and even do a deep dive into their website.

Take the aspects you like, and improve on them by adding your own touches (this is how we keep track of our competitors in online marketing.)

Strategy #2: Develop an Online Presence and Following

Sadly, books won’t just sell themselves. Wouldn’t it be nice if they could?

You can put them on Amazon, and in bookstores, but getting people to pick them up and buy them is a whole other thing.

To market a book, you’ve got to establish an online presence and be able to create a buzz about your work. It takes time to build this authority, so the earlier you set up an author website and build out your social media profiles, the better.

A big part of marketing is reaching people where they are and in modern times, we’re virtually all online.

We live in a world where we have instant access to information. When someone sees your book, they’re not just going to say “let’s give it a go,” they’re going to look online to learn more about it.

If there’s no information online about you or your book, then it’s not going to fill them with confidence.

There are lots of ways you can build your online presence:

- Create an author website.

- Engage with readers on social media.

- Offer extra content.

- Show “the person” behind the books through blogs or videos.

Your online presence is a fundamental part of marketing a book today. People want to feel a personal connection with authors, their books, and the characters in them, and your online presence is the way to give it to them.

As Paperback Kingdom says, “when you’re a writer, you’re a writer. But when you’re an author, you become a whole lot more than just a writer—you become a brand.”

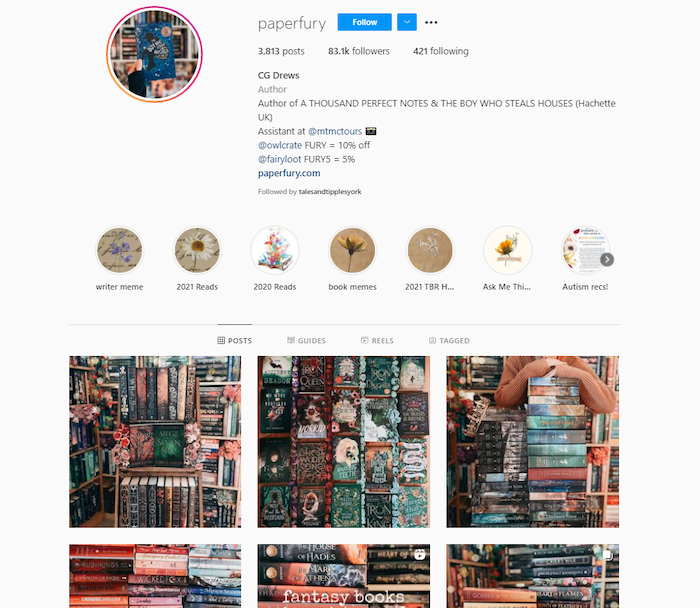

Take, for example, YA author C.G Drews:

Drews runs a popular blog, Paperfury, and has an Instagram account with thousands of followers. When her first book, “A Thousand Perfect Notes” was released in June 2018, it became an instant hit, with support from her friends, followers, and blog readers.

This just goes to show how vital an established online presence can be in understanding how to market a book.

Strategy #3: Create a Blurb and Press Kit

How much did a pirate pay for his hook? An arm and a leg.

That’s how much authors feel like they have to sacrifice when trying to become marketing experts. Sure, it’s difficult, but make no mistake: it’s not impossible.

Like with any great story, you need a hook for your marketing—something that will grab people’s attention and draw them into reading more.

In marketing, we use them all the time (just take a look at my first paragraph).

The equivalent to a hook when you market a book is a blurb. Think about the steps someone takes when they’re considering your book:

- Look at the cover page and title.

- Read the blurb.

- Look at the index to see chapter titles.

- Research online.

All in all, with worldwide shortening attention spans, you don’t have a huge amount of time to grab someone’s attention before they click onto the next page.

You need to combine your great writing ability and newfound marketing skills to create the perfect blurb. You can even trial different versions and see which resonates with your audience the most (this would be called A/B testing.)

Blurbs should draw people in, inspire their imagination, and demand that they read on.

Remember that a good buyer’s journey should finish with the delight stage. They should fall in love from the first sentence of your blurb, right to the end of your novel.

Powerful synopses are how you convince people to take a chance on an unrecognized author and build your brand evangelists for future organic marketing. When someone loves your work, (whether that be a newspaper columnist, blog owner, or casual reader) you want to provide them with all the tools they need to help you market your book.

This is when your press kit should come in (also known as a media kit). The more shareable images, videos, and other items you can put in your press kit, the easier it is for your fans to help market your book.

Writers Edit suggests that you should have the following on hand:

- Author bio, contact details, and a photo.

- Information about your book(s).

- Media release information.

- Ideas for interview questions or discussion topics.

Strategy #4: Design an Eye-Catching Book Cover

How many times have you been told not to judge a book by its cover?

The funny thing is, we all do it!

We’re naturally drawn to certain elements (such as human faces or different color combinations).

In fact, the human brain processes visual information 60,000 times faster than any text.

When it comes to marketing a book, this means your cover is going to be vitally important.

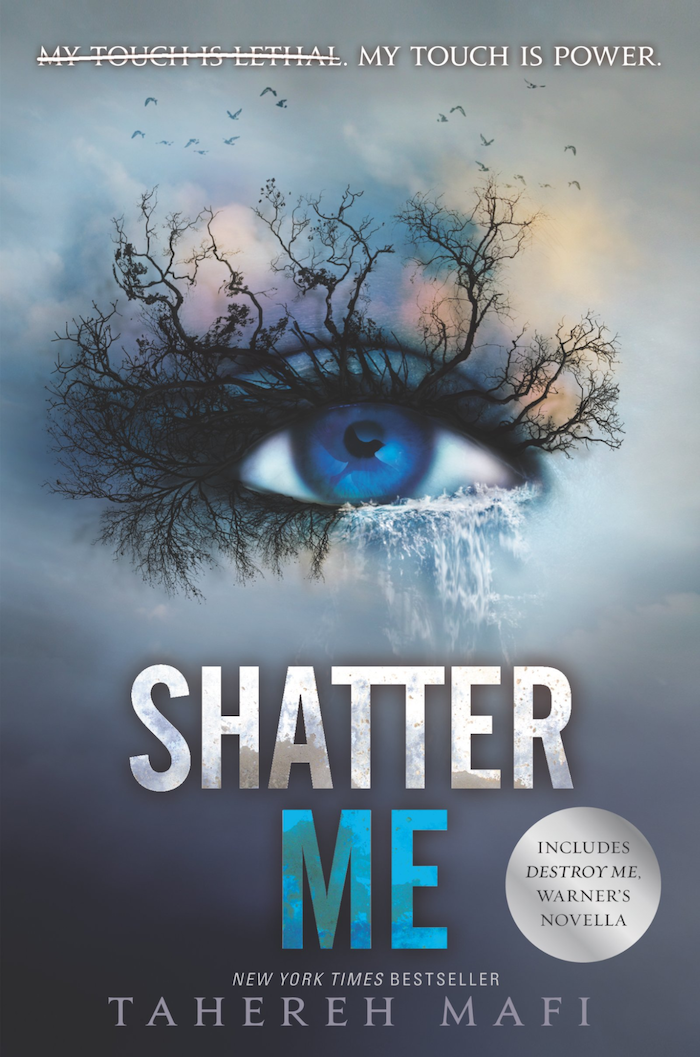

Take a look at the cover of Shatter Me by Tahereh Mafi, a bestselling YA dystopian novel. The color combinations, the typography, and the artwork are all cleverly designed to draw our attention. The light gradient as you move up the cover allows the main feature to stand out.

For the most part, book cover design is an area where market research can come in handy.

What do some of the most successful books in your genre have in common when it comes to the cover? Are they like Shatter Me, with one main piece of artwork as the focus? Or, like in non-fiction, do bold-colored, imageless covers with large text dominate the leaderboard?

Consider how you can incorporate the details you are noticing on multiple bestsellers. Walk the thin line between going with what works, and finding a way to add your own, refreshing twist to the market.

Remember that your book cover isn’t just for your physical book, it’s also going to play an important part in online stores like Amazon.

Unless you’re a writer and a high-quality artist, this is probably something you will want to outsource, but your input will still drive the project. Knowledge and feedback will influence some important decisions that can help your book succeed.

Strategy #5: Run Targeted Ads on Social Media

There are nearly four billion active social media users across the world. When you think the population of the world is just under eight billion, this figure is staggering.

When you run social media adverts, you have the ability to get your book in front of this massive audience.

The best part about it?

Social media ads allow you to be unbelievably targeted. Companies like Facebook, Twitter, Instagram, TikTok, and LinkedIn have so much information on their users, and you can use this to make sure you’re reaching the right people with your ads.

Here’s how to market a book through social media ads:

- use your market research to narrow in on your target audience

- utilize video to boost engagement

- build specific landing pages that reflect your ad copy

- explore different platforms

- keep an eye on your analytics and find ways to optimize

It’s much easier to advertise a book to people when you understand their interests, and, luckily that’s exactly what social media helps you to do.

Strategy #6: Create a Mailing List to Market Your Book

No matter what you’re selling, it often takes more than just one touchpoint for someone to make a purchase. People tend to research products, then go away, before coming back and making a purchase at a later date.

Books are often considered “lower value items,” with prices running from $12-$24 on average. This means that customers are more likely to make impulse purchases when in the decision buying process, but, often, there will still be some back-and-forth before clicking the buy button.

No matter how good your marketing approach or book cover, people are going to visit your website, look at your socials, view your book online, and, sometimes, simply leave without making a purchase (no matter how successful you are, this will still happen.)

Once someone leaves, you have no way of reaching them. However, if you’re focusing your efforts on building a mailing list, then you’ve got a way of creating more touchpoints.

Email marketing can be one of your best strategies for marketing your book. By engaging with your subscribers, offering valuable content, and building the relationship, you’re going to boost your sales.

If you use email to market your book, make sure to:

- respecting people’s privacy

- using segmentation to personalize your outreach

- offering value

- not just focusing on the sale

- driving people to your website

A good mailing list is a valuable commodity and it’s a perfect way to build interest in your future releases.

Strategy #7: Network With Other Authors in Your Niche

People often underestimate the power of networking. Modern technology allows us to reach our target audience so easily that we forget about building relationships.

There are lots of other authors going through the exact same thing as you, and they have lots of insights to share. They’ve also spent time growing their websites, mailing lists, and social media profiles just as you’re doing.

A great way to maximize your reach is by reaching out to other authors and seeing if they will help market your book. They can quickly shoot a message to their mailing list, and you could even pitch it as extra content they can use to share their own work. Perhaps you could organize a joint interview or review the other author’s book to share with your mailing list.

You will find you can build reciprocal relationships, and friendships, where you support each other through the process of marketing your books.

There is a strong writing community out there, and it can pay to get involved in it.

Similarly, you can build up a reputation for your key insight into the industry. Reviewing other books in your genre allows you to tag authors and get your name on their feed. It’s a way to become more visible.

Always be constructive, though, and never tag author’s in negative reviews. You can still post your honest thoughts and feelings online, but it can be hurtful to share critiques directly with them.

Your goal is to make connections with authors, not ruin them.

How to Market a Book: 3 Examples of Successful Book Marketing

Different authors will go about marketing their books in slightly different ways. You may find certain techniques work better than others, but it’s worth exploring every avenue.

Here are some examples of authors who have done an amazing job with their marketing.

Author Website

Chloe Gong is an NYT bestselling author who has only recently published her first book. As part of her marketing efforts, she set herself up on TikTok, where she has millions of views and likes from talking about books. She also has an up-to-date website with great copy, and even a meme page to appeal to her YA audience.

The website helps keep Chloe’s fans updated, whilst also allowing people to get to know the person behind the books. With regular updates, she keeps people coming back and has built a brilliant platform to market her upcoming book, Foul Lady Fortune.

Social Media

Reddit isn’t a social media platform that gets talked about a whole lot, but it can be an amazing platform to start discussions about books.

There are an endless number of Reddit threads on virtually every subject in the world, and often the people taking part are very passionate. This goes for the subject of books as well.

Some authors have found that hosting question and answer sessions on Reddit have been a great way to market their book. People are generally interested in getting to know authors and understand the work they do, and Reddit provides a good platform for this.

Mailing List

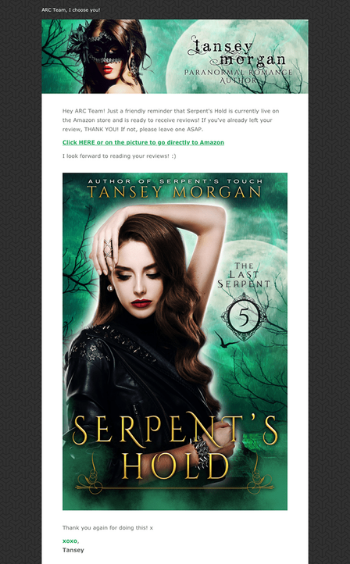

Don’t be afraid to do something a little bit different with your email communication. This email from Tansey Morgan is a great example of how you can create engagement with your subscribers.

Not only are the Amazon reviews very helpful for Morgan’s marketing, but the email also makes the recipient feel involved in the process.

There are lots of little ways you can do this, with sneak peeks at content, a behind-the-scenes view of the writing process, and other fun benefits for your subscribers.

How to Market a Book: Frequently Asked Questions

How do I self-market my book?

To self-market a book it’s important to start with market research. From there, you can build your online presence and reach your target audience.

How do I get my book noticed?

Your book cover is one of the best ways to get your book noticed. Look at other books in your niche to find out what they do well, and incorporate this into your book cover.

Can a self-published book become a bestseller?

There’s nothing stopping your self-published book from taking off. Great marketing can create a viral effect, taking you all the way to a bestseller (think 50 Shades of Grey).

How do I market my book on social media?

Targeted social media ads are a great way to reach your target audience and market your book.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How do I self-market my book? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “To self-market a book it’s important to start with market research. From there, you can build your online presence and reach your target audience.”

}

}

, {

“@type”: “Question”,

“name”: “How do I get my book noticed? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Your book cover is one of the best ways to get your book noticed. Look at other books in your niche to find out what they do well, and incorporate this into your book cover.”

}

}

, {

“@type”: “Question”,

“name”: “Can a self-published book become a bestseller? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “There’s nothing stopping your self-published book from taking off. Great marketing can create a viral effect, taking you all the way to a bestseller (think 50 Shades of Grey).”

}

}

, {

“@type”: “Question”,

“name”: “How do I market my book on social media? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Targeted social media ads are a great way to reach your target audience and market your book.”

}

}

]

}

How to Market a Book: Conclusion

There’s nothing stopping you from successfully marketing your book.

The online world has made it much easier to reach your target audience, and there are lots of ways to take advantage of this. By creating an author website, building out your social profiles, and engaging with the community, you can soon build momentum behind your book.

Lots of independently published books have had great success, but one of the key things is they’ve had good marketing behind them. If you can nail this part of the process, then it can make a huge difference to your book sales.

How do you market your book?

New comment by kmyung91 in "Ask HN: Who wants to be hired? (March 2021)"

Product Manager

Location: Berlin, Germany

Remote: Yes

Willing to relocate: Yes

Technologies: PM tools

Résumé/CV: www.linkedin.com/in/kmyung91

Email: kmyung91@gmail.com

Is it Possible to Get Business Funding for Bad Credit?

Do you need business funding for bad credit? You may feel that – or you may have heard – that you can’t get business funding for bad credit.

The best, easiest, and fastest way to do so is to build business credit. Because then your bad credit won’t matter quite so much.

Any Small Business Can Get Business Funding for Bad Credit

Company credit is credit in a small business’s name. It doesn’t connect to a business owner’s personal credit, not even if the owner is a sole proprietor and the sole employee of the small business.

Consequently, an entrepreneur’s business and consumer credit scores can be quite different.

The Advantages of Business Funding for Bad Credit

Considering that business credit is separate from consumer, it helps to secure a business owner’s personal assets, in case of court action or business bankruptcy.

Also, with two distinct credit scores, an entrepreneur can get two separate cards from the same merchant. This effectively doubles purchasing power.

Another advantage is that even startup businesses can do this. Going to a bank for a business loan can be a formula for disappointment. But building business credit, when done the right way, is a plan for success

Consumer credit scores depend on payments but also various other components like credit use percentages.

But for business credit, the scores really merely depend on if a small business pays its bills on a timely basis.

The Process

Establishing company credit is a process. It does not occur automatically. A company must actively work to build business credit.

Having said that, it can be done readily and quickly, and it is much swifter than developing personal credit scores.

Merchants are a big part of this process.

Accomplishing the steps out of order results in repetitive denials. No one can start at the top with business credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

Business Fundability

A small business must be fundable to loan providers and vendors.

Therefore, a business needs a professional-looking website and email address. And it needs to have website hosting bought from a vendor like GoDaddy.

In addition, business phone numbers need to have a listing on 411. You can do that here: http://www.listyourself.net.

In addition, the company phone number should be toll-free (800 exchange or the like).

A small business also needs a bank account devoted only to it, and it has to have all of the licenses necessary for running.

Licenses

These licenses all have to be in the identical, correct name of the small business. And they must have the same business address and telephone numbers.

So note, that this means not just state licenses, but possibly also city licenses.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Working with the Internal Revenue Service

Visit the Internal Revenue Service web site and get an EIN for the company. They’re free. Pick a business entity such as corporation, LLC, etc.

A business may get started as a sole proprietor. But they absolutely need to switch to a sort of corporation or an LLC.

This is to lessen risk. And it will maximize tax benefits.

A business entity matters when it involves tax obligations and liability in case of a lawsuit. A sole proprietorship means the owner is it when it comes to liability and tax obligations. Nobody else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Kicking Off the Business Credit Reporting Process

Begin at the D&B web site and get a cost-free D-U-N-S number. A D-U-N-S number is how D&B gets a company in their system, to produce a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

By doing this, Experian and Equifax have activity to report on.

Starter Vendor Credit

First you ought to establish tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit for numerous purposes, and from all sorts of places.

These sorts of accounts often tend to be for things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first off, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are in most cases Net 30, rather than revolving.

Therefore, if you get approval for $1,000 in vendor credit and use all of it, you need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts must be paid fully within 60 days. Unlike revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To start your business credit profile the proper way, you ought to get approval for vendor accounts that report to the business credit reporting bureaus. As soon as that’s done, you can then make use of the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Makes Sense

Not every vendor can help in the same way true starter credit can. These are merchants that grant approval with minimal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. This is to continue to validate you are trustworthy and pay promptly. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Accounts That Do Not Report

Non-reporting trade accounts can also be helpful. While you do want trade accounts to report to at the very least one of the CRAs, a trade account which does not report can also be of some value.

You can always ask non-reporting accounts for trade references. Additionally, credit accounts of any sort can help you to better even out business expenditures, thereby making financial planning less complicated.

Store Credit

Store credit comes from a variety of retail service providers.

You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the business’s EIN on these credit applications.

Fleet Credit

Fleet credit is from companies where you can purchase fuel, and fix and take care of vehicles. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the company’s EIN.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

More Universal Cash Credit

These are companies like Visa and MasterCard. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are usually MasterCard credit cards. With more credit, these are within reach.

Monitor Your Business Credit to Help Yourself Get Business Funding for Bad Credit

Know what is happening with your credit. Make sure it is being reported and fix any inaccuracies as soon as possible. Get in the habit of checking credit reports. Dig into the details, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs. See: www.creditsuite.com/monitoring.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update Your Records to Make it Easier to Get Business Funding for Bad Credit

Update the data if there are errors or the details is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So, for Equifax, go here: www.equifax.com/business/small-business.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Fix Your Business Credit to Increase Your Chances for Getting Business Funding for Bad Credit

So, what’s all this monitoring for? It’s to challenge any mistakes in your records. Errors in your credit report(s) can be fixed. But the CRAs typically want you to dispute in a particular way.

Get your small business’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Dispute Any Errors to Improve Your Chances to Get Business Funding for Bad Credit

Disputing credit report mistakes generally means you mail a paper letter with copies of any proofs of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always send copies and retain the originals.

Fixing credit report inaccuracies also means you precisely detail any charges you contest. Make your dispute letter as crystal clear as possible. Be specific about the problems with your report. Use certified mail to have proof that you mailed in your dispute.

Dispute your or your business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute inaccuracies on your or your small business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service telephone number is here: www.dandb.com/glossary/paydex.

A Word about Building Business Credit and How to Get Business Funding for Bad Credit

Always use credit smartly! Don’t borrow beyond what you can pay off. Track balances and deadlines for payments. Paying promptly and completely does more to boost business credit scores than almost anything else.

Establishing business credit pays. Excellent business credit scores help a small business get loans. Your loan provider knows the business can pay its debts. They recognize the company is for real.

The company’s EIN connects to high scores and lenders won’t feel the need to ask for a personal guarantee.

It is the simplest way to get business funding for bad credit.

Getting Business Funding for Bad Credit: Takeaways

Business credit is an asset which can help your small business for many years to come. It is the most surefire way to get business funding for bad credit. And, while you’re at it and improving your business credit, you may want to work on improving your personal credit. It is a similar process in the sense that you need to pay your bills on time, correct any errors, and add any missing information.

Because one way around trying to get business funding for bad credit is to stop having bad credit in the first place.

Learn more here and get started toward growing company credit.

The post Is it Possible to Get Business Funding for Bad Credit? appeared first on Credit Suite.

How to Grow Your Local Business During Uncertain Times

No doubt this is a hard time to grow a local business. Coronavirus has likely forced you to make big changes to the way you operate. It’s almost certainly hit your bottom line too.

However, it’s still absolutely possible to grow your local business at a time like this. You just have to be smart about it. In this article, I’ll talk you through how to do that. First, though, here’s a bit of detail on why this is such a challenging time for businesses like yours.

The Effects of the COVID-19 Pandemic on Local Businesses

You’re probably sick of reading and hearing the word “unprecedented.” I know I am. Unfortunately, it’s just the best word to describe the current climate for local businesses.

By the end of March, 32 states had locked down in response to the pandemic. Two in five small businesses across the US had temporarily closed by this point, with nearly all of those closures due to COVID-19.

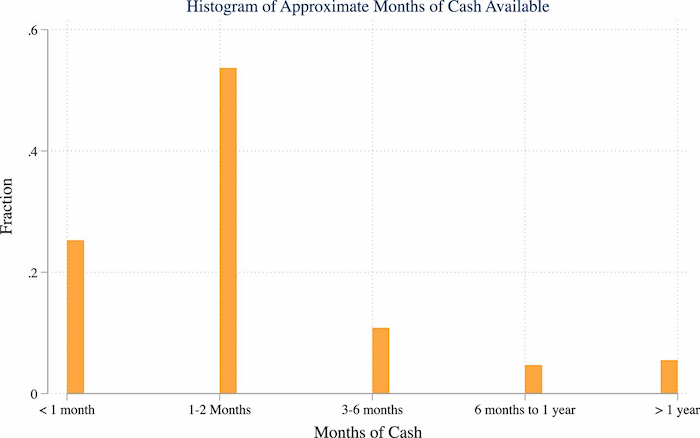

Closing your doors has big financial implications. It is concerning that the vast majority of local businesses aren’t in a position to handle even short-term pressure on their earnings, with around four-fifths only having up to two months of cash available to pay their expenses.

Because of this, it’s hardly surprising that the number of active business owners in the US plummeted by 3.3 million (or 22%) in the two months from February to April alone. That’s the largest drop on record, and it affected practically every industry.

Luckily, if you have access to the right strategies (like local promotions) and tools (such as messaging services like Podium), you may still be able to grow your business even in these uncertain times.

Six Strategies to Grow Your Business During the Age of Coronavirus

The pandemic might have affected your business growth in any number of ways. Maybe you’ve been forced to shutter your store(s) for a certain amount of time. Maybe your customers are buying less at the moment. Or maybe the industry you’re in means you’ve barely even got a “product” to sell, like cinemas and travel companies.

Whatever the case, if you’re going to grow your local business in the current climate, you need to adapt. Here are tips on how to do it:

1. Use the Right Tools

I know what you’re thinking: “I’m already worried about cash flow, now this guy’s telling me to invest in a bunch of tools!” Well, what if I told you that by choosing the right tools (some of which are free, by the way), you massively increase your chances of growing your local business?

You likely know that there are thousands of tools designed to drive small business growth, but I’ve focused on the areas where you can really shift the dial:

Issue: Customer Messaging

There are so many benefits to improving your communications with existing and potential customers.

You can generate more reviews, which act as a trust factor and make your business more credible. You can collect payments faster and with less hassle. You can issue more timely (and more effective) reminders, reducing the chances of no-shows.

To solve your customer messaging you can use a tool like Podium. Here’s how I use it:

- Set up one inbox to rule them all: What’s the biggest barrier to better communications? Trying to keep track of all your different platforms. Customers could be messaging you via Facebook, Twitter, phone, and your website (and maybe a bunch of others, too). Podium brings all those communications together in one place, ensuring you never miss a message.

- Connect remotely with website visitors: Ever wish you could get closer to the people on your website? Find out what stops them from buying or converting there and then? With Podium, you can. Add live chat to your site and every time they ask a question, they’ll automatically move to a text conversation, so you’re no longer tied to your computer (and nor are they).

- Enable on-the-go customer service: You likely don’t have a dedicated customer service team. In fact, you might be your whole customer service team. So what happens when you’re not at your desk or in the store? Stuff gets missed! Podium allows you to text quick responses when you’re out and about, so you never leave anyone hanging.

- Chat face-to-face: Texting is great. But sometimes it’s just not the best way to respond to a customer or prospect. Maybe they’ve got a complex question or require a nuanced response that’s hard to tap out on your phone’s keypad. Podium offers video chat software that makes connecting remotely with customers as easy as sending a text. Send your customers a link and you can be video chatting in seconds, making it super simple to show details, answer questions, and share your screen.

- Create tailored promotions: Say you own a coffee shop. You run a loyalty program and you’ve captured your best customers’ email addresses and phone numbers. Wouldn’t it be great if you could quickly send those customers targeted promotions? Maybe offer them a deal on a new single-origin coffee you’ve just started stocking? You can do that as well.

- Provide to-the-minute advice and updates: There are a lot of variables in the world right now. Customers might want to know how busy you are at a certain time, or what measures you’ve put in place during the pandemic. Or they might have product-specific questions. A customer messaging platform makes it easier for you to respond in real-time.

Oh and an easy way to get started is to just sign up for a free Podium account.

Issue: Scheduling Meetings

No one likes scheduling meetings at the best of times. Throw coronavirus into the mix and it becomes even more of a challenge. Should it be in-person or remote? Which platform should we use? What date and time work best?

Meeting schedulers are designed to handle the legwork for you. One of the best is Arrangr, which reserves tentative meeting times, automatically frees up untaken slots, and can even suggest the ideal location for all parties.

Another great option is Calendly. Integrating directly with your Google or Office 365 calendar, it gives you a personalized URL that allows customers to see your availability and schedule their preferred meeting time. Best of all, there’s a basic free plan available.

Issue: Email Automation

You can’t grow a local business at a time like this without doing some marketing.

Unfortunately, you likely don’t have time to build and execute complex campaigns.

That’s why you need email automation software! One of the most popular tools, Mailchimp, helps you send effective email marketing communications at scale. In fact, Mailchimp claims to boost open rates by 93% and click rates by 174% compared to the average bulk email.

Customer Relationship Management

Your customer relationships have never been more valuable than they are right now, so you need to manage them effectively. To do that, you need to invest in a customer relationship management (CRM) tool.

There are a bunch of CRMs aimed at local businesses, but HubSpot Sales Hub is one of the most popular. It’s loaded with sales engagement tools, pricing functionality to help you deliver complex quotes, and analytics software to measure what’s working (and what isn’t).

2. Improve Your Digital Marketing Strategy

In more “normal” times, you might not put a lot of thought into your marketing. Maybe you just write the occasional social post or send a couple of email promotions a month.

During times of uncertainty, that just won’t cut it. People have a lot on their minds right now, so that one baseball gif you tweeted isn’t going to have much impact.

You need a proper digital marketing strategy.

Let me give you an example: you sell business supplies to other local businesses.

Because you’re small and local, your big differentiator is your flexibility and bespoke approach. You can source whatever product your customer needs, your delivery times are rapid, and you’re easy to reach. That’s the sort of stuff you talk about in your marketing emails.

Well, wouldn’t it be good if you made that the foundation for a whole campaign?

Maybe you create a bunch of case studies and testimonials that show your unique selling point, (USPs), in action. You build a mailing list of local firms you’d love to do business with, and drip-feed your content to those prospects. Because you’ve built a whole strategy, you know the best times to reach those prospects, the platforms they use, and the sort of messaging that resonates with them.

That approach helps you strike up a conversation, which ultimately means you may close more deals.

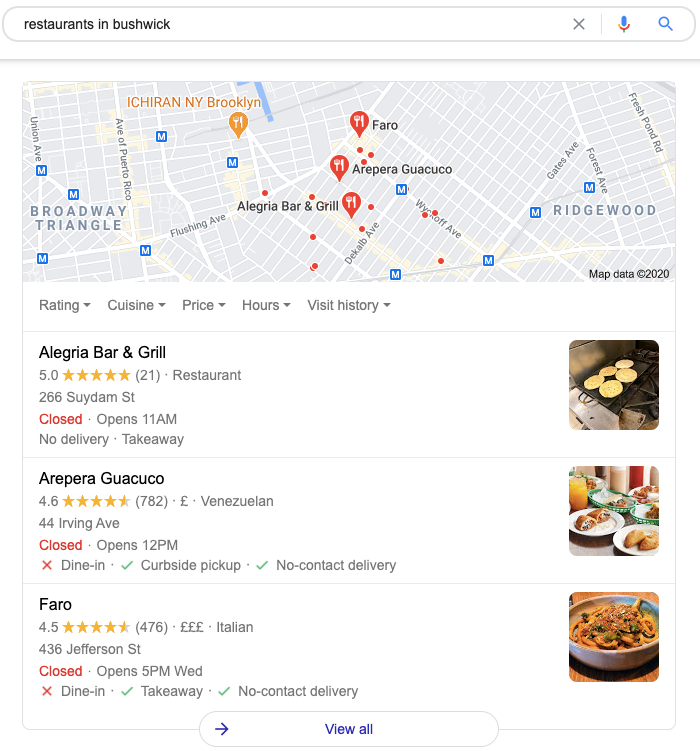

3. Make Your Google My Business Profile Shine

Want people to see your name when they search on Google for businesses like yours? If you’re reading this article, I’m guessing you do, and that means you need a (good) Google My Business profile.

Setting up a free profile makes it more likely that your business shows up in relevant searches, along with useful information like:

- The type of service you offer

- Your opening times

- Your address

Once you’ve set it up, optimize your Google My Business profile by:

- Ensuring your information is accurate and comprehensive

- Sharing business updates, like new opening hours or product launches

- Asking customers for Google reviews (and responding to them)

On that last point, I know it can be hard persuading customers to review your business. They’re busy. They don’t want to spend their valuable time seeking out your Google My Business profile or Facebook Business Page.

Podium makes it a lot easier, helping you provide social proof that demonstrates your brand can be trusted. Text customers asking them for a review and they’ll be linked straight to your Facebook, Google, and Tripadvisor pages, so there’s hardly any clicks (and hardly any work) for them. That’s why Podium has powered more than 15 million business reviews for its users.

4. Create and Execute a Local Paid Marketing Strategy

Sometimes it takes money to make money. If you’re serious about growing your local business right now, you’ll want to consider investing in some sort of paid activity.

Google Ads can be super effective for smaller firms, especially web-based businesses targeting online traffic and/or conversions. Local keyword phrases like “lawyers near me,” or “realtor in Denver,” are typically a lot less competitive than broader, non-geographic terms like “realtor.” That means you could get a lot of visibility and clicks with a relatively small outlay.

In addition to Google Ads, consider advertising on social platforms like Facebook and LinkedIn. Social ads are less intention-based than paid search because your audience isn’t actively looking for the thing you’re advertising.

However, ads on social media often cost less than Google Ads. For instance, if you’re a law firm, you’re paying on average $10.96 per click on Google Ads, but on Facebook, that figure drops to just $1.32.

5. Use Analytics to Track and Improve Site Performance

When times are hard, you need to squeeze every last dollar from your potential customers. Analytics software (like Google Analytics) can help you do that by allowing you to identify trends, plan new strategies, and measure the results of your current efforts.

Let’s say you’re a mechanic. You’ve just added a page to your site to promote a special offer on new tires. A month later, you click into Google Analytics and see that a bunch of people have landed on that page, but your conversion rate is low.

You compare it to other, similar pages on your site. They’re performing much better. Now you know there’s a problem, such as:

- Your current offer is priced too high

- Your new page isn’t engaging or persuasive enough

- You don’t make it easy enough for customers to convert, so they leave

- You don’t provide enough detail about the offer

By comparing against better-performing pages, you can tweak your approach and improve results.

6. Conduct Local Community Promotions

Now isn’t a good time to invite hundreds of people to a big party. But there are definitely opportunities for community engagement. You just need to get a little creative.

Say you’ve opened a new store in a location you haven’t served before. Maybe you target properties within a certain zip code, or on certain streets, with a special offer that encourages customers to visit your store.

Perhaps in the age of social distancing, you’ve introduced a new takeout service. Why not give customers in your area 10% off their first promotion, or combine it with a loyalty scheme? Tailor your offer to what your customers want right now, then promote it on Facebook, in the local press, via email marketing, or through direct mail.

7. Optimize Your Social Media Accounts

There are dozens of social platforms out there, but when it comes to growing a local business, you want to focus on those that give you the best reach, like:

- YouTube

- Tumblr

Finding the right platform will depend on the type of business you run. On a basic level, if you’re B2B, LinkedIn’s likely your best channel. Otherwise, almost everyone is on Facebook, but if your product is highly visual you might see more success on Instagram, Pinterest, or YouTube.

Whichever platform(s) you choose, you need to identify some tactics that ultimately help you sell more, like:

- Showcasing and/or auctioning your products on Facebook Live

- Starting conversations with new prospects in LinkedIn Groups

- Setting up Instagram Shopping so people can browse your products in photos and videos while in-app

Conclusion

Growing a local business is never easy, and it’s certainly a whole lot harder right now.

However, if you’ve set up your own business, you’re likely comfortable with hustling for results. You’re naturally entrepreneurial and you’re driven to make this work.

Combine that attitude with the right growth strategies, and execute them effectively, and there’s no reason why you can’t come out of the pandemic in a stronger position.

What plans have you put in place to grow your business? How’s it going for you so far?

The post How to Grow Your Local Business During Uncertain Times appeared first on Neil Patel.

The Muse (YC W12) Is Hiring a Director of Analytics and BI

Article URL: https://www.themuse.com/jobs/themuse/director-of-analytics-business-intelligence Comments URL: https://news.ycombinator.com/item?id=25095586 Points: 1 # Comments: 0 The post The Muse (YC W12) Is Hiring a Director of Analytics and BI appeared first on ROI Credit Builders.

The post The Muse (YC W12) Is Hiring a Director of Analytics and BI first appeared on Online Web Store Site.

The post The Muse (YC W12) Is Hiring a Director of Analytics and BI appeared first on ROI Credit Builders.

New comment by TJLeahy in "Ask HN: Who is hiring? (October 2020)"

Remote Go Developer We are looking for a backend engineer to help craft the future of Teamwork Desk. We are a self-funded and privately owned Irish company with employees all over the world. Check out our role here: https://careers.teamwork.com/jobs/backenddesk

The post New comment by TJLeahy in “Ask HN: Who is hiring? (October 2020)” first appeared on Online Web Store Site.

The 3 Best Analytics Companies of 2020

You likely already know how important creativity is when it comes to digital marketing.

However, coming up with great ideas – be that through content or ads – is only part of the story when it comes to driving results online.

Another significant factor that will amplify your marketing efforts is the collection and leveraging of data.

In other words, to truly succeed with your digital marketing campaigns, you must utilize the best of the machine and human worlds.

But perhaps you’re not a data kind of person, which is where hiring an analytics company comes into play – an option you may already be considering.

Before you make this important decision, equip yourself with the information we’ve outlined in this article so that you can make the best choice for your needs.

The 6 Characteristics That Make a Great Analytics Company

When choosing the right analytics company to work with, there are certain characteristics you need to take into consideration.

Not all agencies are built the same. It is safe to assume that most companies put their best foot forward for their clients, but there will always be variance in terms of what results you will get from each one.

Consider the following factors.

They offer a full suite of marketing services

You may already have your marketing strategy under control and may only need help to understand and leverage your data.

But how can a company help you leverage your data if they have no experience in what the data should be used for?

The point of data and analytics is to improve your decision making and inform your strategy. So, if you’re working with an agency to help you do so, they need to have some actual marketing chops.

Make sure that the agency you want to work with offers other services besides analytics. This is a good indicator that the insights they produce from your data will actually mean something.

They have a strong technology stack

It goes without saying, but if a company is promising to help you leverage data (technology), they will likely have the technology to do so.

At the very minimum, your analytics partner should have their own proprietary platform that will be used as the central point for your data.

But in the best case, the partners will leverage more advanced technologies, such as machine learning, that can help make better sense of the vast amount of data that you will have.

You will find that the best insights from your data come after the raw data is analyzed by a machine, and then made sense of by a human.

The quality of that initial analysis, however, will depend on the quality of the technology that your agency partner has built.

They have an all-star team

Making sense of your marketing data is no easy task. It requires breadth and depth of skills as well as experience, all working together in a harmonious way.

Make sure you check out the team on the about page and on LinkedIn, taking into consideration these factors:

- Skills diversity – Making sense of data requires a symbiosis between the human and machine side of business. A good agency will have social scientists (or marketing experts), data scientists, and statisticians.

- Years of experience – How long has the team been operating? What are their backgrounds? The more industries and businesses they’ve seen, the higher the chance their insights will be valuable.

- Founders – The founders set the tone for the culture of the company. Try to find information on the background of the founder to get a better understanding of how they conduct their operations.

They have a strong roster of clients

One of the most objective ways to evaluate a company is to take a look at the clients they’ve worked with – and, most importantly, what results they’ve gotten for them.

Keep these things in mind:

- Similar clients – If an agency mostly works with Fortune 100 clients and you’re a small startup, they probably won’t be a good fit. They likely will have their processes and expertise optimized for analyzing data at scale.

- Transparent results – Can the analytics agency demonstrate the results they’ve gotten in the past?

- Experience with your channels – It’s no use to you if the analytics company you want to work with specializes in advertising analytics and you have a content-focused strategy. Check to see if they have demonstratable results and insights into your specific channels.

They have a great communication style

If you’re a marketing leader or business owner, chances are you aren’t well trained in understanding and interpreting data.

In this case, the analytics company you work with has to be able to make sense of your data and also deliver it in a way that you can actually use.

To get an idea of this, take a look at how the company communicates with its audiences.

- Blog posts – Is the agency creating content and educating their customers? Do they do so in a clear and simple, yet value-driven way?

- Visualizations – Does the agency value data visualizations? Do they have any examples of how they visualize data in a user-friendly way?

They take a holistic approach to analytics

It is likely your business has a lot of data to work with. Oftentimes, insights come from unlikely places, such as comparisons between seemingly unrelated data sets.

To get the most out of your data, your analytics agency will need to map out and architect your entire data ecosystem.

They will need to consider aspects of your business such as:

- Customer profiles – Your customers will have data points in common, such as demographic information, which can then be used to inform PPC targeting, for instance.

- Marketing channels – Each marketing channel has its own set of data to be analyzed. Social media, for instance, has metrics such as engagement and likes, whereas email marketing focuses more on open rates and click-throughs.

- Website analytics – Your website will have metrics that can inform on everything from design to marketing. Data points such as website dwell time, page conversions, and heat map analytics come into play here.

What To Expect From a Great Analytics Company

Each analytics company has their own unique process when working with clients.

The best analytics companies, however, will ensure their process is tailored to your specific needs.

They will also go to great lengths to ensure that you are kept in the loop as much as possible.

Here’s what you can expect when working with a great analytics company.

Onboarding and integration

At the beginning of your working relationship, your analytics partner should guide you through an onboarding process.

Great onboarding sets the stage for future success, as it creates a solid foundation for your working relationship.

- Manage expectations – Both you and your analytics partner should clearly outline the roles and responsibilities of your relationship at the offset. Make sure you flesh out all the details, such as communication hours.

- Integrations and set up – Depending on your marketing channels, there may be different assets your analytics partner may need to access, such as your Facebook Pixel. You will also need to be onboarded to their analytics platform.

- Goal setting – If you haven’t already, you should have a strategy call with your partner and decide on a strategy and timeline for results.

Auditing of processes and assets

Before you start moving forward, the first thing your analytics partner should do is conduct an audit of your existing processes and data assets.

Depending on your company stage, it is likely that you already have existing data that could serve as a starting point.

- Existing data across all channels – Your analytics agency partner will consolidate all of your data across all channels, bringing them into a single platform.

- Setting up tracking – In some instances, you may not have been tracking certain things. For instance, if you did not have Google Analytics installed on your site, your partner will help you set this up.

- Problem solving – You may have attempted to leverage data and analytics before with limited effect. This could have occurred through your own means or another partner. A complete analysis of your previous attempts would need to be conducted to figure out what went wrong and how to get better results in the future.

Setting up marketing channels

The best analytics company will be able to offer you additional marketing services such as PPC, content and SEO.

The reason for this is simple: to better understand how to interpret the data and inform your strategy, your agency needs to have actual experience executing a marketing strategy.

Elements of your marketing strategy that your analytics partner should help on include:

- PPC – Performance advertising, such as Google or Facebook ads, requires a combination of analytics and creativity. Your partner will help you come up with winning ad ideas that are rooted in data.

- SEO – Analyzing the best keywords to target, as well as writing great pieces of content to rank in search engines, similarly reflects the importance of a holistic analytics partner.

Data management and reporting

Once your marketing campaigns are in full swing – and the appropriate tracking tools are in place – the fun part begins.

Now is the time to take a look at all the data you have been collecting.

If your agency partner is worth their salt, you should be looking at this data through their own proprietary software.

How this data is organized, analyzed and communicated is where you will really begin to see the difference in quality between different analytic agencies.

- Dashboard – When logging into your partner’s platform, you should be able to organize and navigate the different data sets for your marketing channels.

- Analysis – Depending on the technology used, you may be able to get instant insight into what your data means, or even compare it to other data sets in your industry.

- Visualization – A powerful way to understand data is when it is visualized. Charts, graphs and potentially even custom infographics should be provided by your partner.

Actionable Insights and Results

However, collecting raw data isn’t enough.

You need to make sense of that data so that it becomes useful.

Although your analytics partner may have sophisticated number-crunching technologies, there is still a need for a human to look over everything and create real insights.

At the end-stage of the process, your analytics partner will need to communicate to you the real meaning behind the numbers.

- Storytelling – Together, you will need to figure out what the data is really telling you. It is easy to point out that one advert is performing better than the other, but why? How do you find the logic behind the data?

- Strategy – Once you really understand the data, you will need to turn those insights into a strategy. You may realize, for instance, that your entire approach has been wrong, or that there is an opportunity for a new product offering.

- Execution – Finally, you need to put your new data-driven strategy into action – either through your own team or with the help of your analytics partner.

The Top 3 Analytics Companies in The World

With so many service providers to choose from, it can be difficult to narrow them down and finally choose one to go with.

We’ve broken down the criteria that makes a great analytics company and combed through dozens of companies to find the best agencies today.

Each have their strengths and weaknesses, but regardless of whoever you choose to work with, you will be in good hands.

#1 NP Digital – The Best for Marketing Execution

NP Digital is a marketing and analytics company founded by Neil Patel, and it is arguably the most recognizable and influential figure in the digital marketing space.

The company was founded in 2017 and has over 44,000 followers on LinkedIn and over 100 employees. NP digital offers a full range of digital marketing services in addition to analytics.

Here’s what makes NP Digital one of the best analytic companies in 2020:

- Founder expertise – Neil Patel is a rockstar in the digital marketing world, having started out in the space in 2001 as a teenager. The agency he founded has his fingerprints all over it, which means that you will be working with world class marketers and analysts.

- Marketing execution – NP Digital doesn’t just help you make sense of your data. They offer a complete suite of marketing services, from PPC to SEO. As digital marketing is the foundation of their operations, you can expect great results when combined with their analytics services.

- Great case studies – NP Digital often receives great reviews and has retained big clients as proof of their success. One client, for instance, has said that “NP Digital is one of the few consultant companies worth their fee”.

- Press coverage – Neil Patel himself has been recognized by Forbes, The Wall Street Journal and the United Nations as one of the most influential marketers of our generation.

- Education – NP Digital regularly produces educational content about all things digital marketing. This carries over to their customer relationships, where they position themselves as a teacher as opposed to just a partner.

Who should work with NP Digital?

If you need help with marketing execution in addition to data analytics, then you can’t go wrong with Neil Patel Digital.

The company was founded by one of the most reputable figures in the digital marketing world, so when you work with his agency, you’re tapping into his years of insight.

There is, of course, a cost to this, however, so Neil Patel Digital is best suited for clients with a larger marketing budget.

Some of their clients include companies such as Viacom, Facebook and even Google.

So, if you head up a marketing team at a large organization and need an end to end marketing and analytics partner, look into Neil Patel Digital.

#2 Artefact – The Best for Technology

Artefact describes themselves as “marketing engineers” and puts particular emphasis on the technology behind digital marketing.

In line with this identity, they have gone on to build a powerful suite of technologies, which they use to help their clients transform their data into business value.

Artefact’s works across the entire organization to leverage data, tapping into the entire value chain of operations, IT, and marketing.

Here’s what makes Artefact one of the best analytic companies in 2020:

- Technology stack – Artefact utilizes some of the latest advances in AI and machine learning to create custom algorithms that help businesses accelerate data transformation and optimize their business processes. Known as their “AI Factory”, Artefact also works with cloud service providers like Azure to ensure they have a robust infrastructure.

- Big, diverse team – Artefact lists over 1000 employees on LinkedIn, which are composed of data scientists, software engineers, and business consultants. This allows Artefact to solve a wide range of needs across different industries.

- Solid case studies – Artefact has worked with clients such as FMCG to improve their digital processes. In this particular case, they received an “extremely positive response from [the] client, internal stakeholders, Amazon and even the industry and other vendors on Amazon NL”.

Who should work with Artefact:

If you are a part of a large organization that is undergoing a digital transformation, then you should strongly consider Artefact.

The approach and technologies that Artefact uses are also beneficial for organizations that have a lot of data that needs to be optimized across the board.

For instance, companies that need to optimize their manufacturing processes or who need to react to market information.

#3 Adverity – The Best for Small Businesses

In some cases, you may not want to work with an agency partner. Particularly for small businesses that don’t have large marketing budgets, analytics software can bridge the divide.

Adverity is a platform that allows you to collect all your marketing data into a single place. Their analytics tools allow you to break down silos in your organization and uncover new insights so that you can improve your decision making.

Although the Adverity team will help onboard you onto their platform, you won’t get the tailored and guided expertise that you would get from an agency such as NP Digital.

Here’s what makes Adverity one of the best analytic companies in 2020:

- Cost – If you want to delve into the world of analytics but don’t have a significant budget, Adverity will have you covered (to an extent). Their pricing works on a custom quote which is influenced by your industry, the size of your business, and what data sources you want to tap into. Keep in mind however that you won’t be getting the expert guidance of an agency partner like NP Digital or Artefact.

- Holistic data analysis – Adverity has one of the largest data connector libraries on the market. You will be able to connect all of your data sources including your CRM, backend database, website analytics, and advertising. They’re always adding new integrations, so if you have a specific need they may be able to customize that for you.

- Great reviews – On the software review platform G2, Adverity currently has a 4.5/5 star rating, with over 100 reviews. The reviews reflect a variety of businesses and use cases – from marketing agencies to political scientists. One of the most common aspects that reviewers noted is how great the connectivity of the platform is.

Who should work with Adverity:

Adverity is best suited to small and medium-sized businesses who may not have the budget to work closely with an analytics partner.

Keep in mind that as you will not have expert guidance, your marketing team will have to figure out how to make sense of all of your data, which is no easy task.

Conclusion

If you leverage the research we’ve done for you in this article, you won’t have much trouble finding the right analytics company to work with.

Regardless of your choice, remember that the goal of analytics is to inform your marketing strategy.

But data alone won’t guarantee that your digital marketing strategy will be successful. It must always be paired with creative ideas and rigorous execution.

To ensure you can’t go wrong when picking an analytics partner, always keep the end goal of increasing conversions in mind.

The post The 3 Best Analytics Companies of 2020 appeared first on Neil Patel.

Where to Look for Startup Capital and How to Make Sure You Qualify

There is no startup capital genie that lives in a bottle. You can’t hope to find the magic lamp, rub it, and make all your entrepreneurial dreams come true. In contrast, finding startup capital is just the first hurdle in a line of many that you will have to jump over to get your business off the ground. Startup capital can come from a variety of sources. It takes hard work and some creativity, not to mention determination, to find the best start up capital option for you.

Startup Capital Doesn’t Come from a Genie in a Bottle

Don’t let that scare you though. Start up capital loans are highly attainable. However, your chances of success are much, much greater if you know exactly what to do, where to do it, and you have the right tools.

For example, you can’t build a house while sitting in a library with scissors and tape. When it comes to starting a business, especially in our current corona economy, you need the right tools. One tool you cannot do without is startup capital. However, you need to know where to look for startup business loans and what you have to do to get them. At least, that’s where you start.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Startup Capital: Self-Funding

For most, this seems like the obvious best option. If you have the means, it can be for sure. No debt is always good. Still, even if you have the means to fund startup capital yourself, you may not want to tie up all that cash. Alternatively, you may not want to dip into your retirement or savings, though those are definitely possibilities. Which leads us to the other options.

Startup Capital: Investors

There was a time when investors were simply that, traditional investors. There are two new players in the field these days however, and they are significantly less formal.

Angel Investors

Investopedia defines angel investors as those who “… invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital angel investors provide may be a one-time investment to help the business propel or an ongoing injection of money to support and carry the company through its difficult early stages.”

Investopedia defines angel investors as those who “… invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital angel investors provide may be a one-time investment to help the business propel or an ongoing injection of money to support and carry the company through its difficult early stages.”

Usually, they do not lend to the same person twice, even if that person pays them as agreed. That’s because they like to spread their risk over a lot of people and businesses to make sure they earn a profit. They are also usually a lot less formal than most types of funding. An angel investor can be anyone. Seriously, it could be your mom or someone you met through networking.

The best way to find these kinds of angel investors is to ask people you know. Also, you can try an angel investors website or network. For example, Gust keeps a database of investors, companies, and programs. Startups can search for business plan competitions and other opportunities.

Crowdfunding

This is an increasingly popular option for startup capital.

Basically, Crowdfunding is a type of investment option. The thing is, you get a lot of smaller investments from a lot of people. Hence the term, crowdfunding. This is in contrast to getting the bulk of your small business funding from one or two larger investors. Still, not every campaign is successful. Trully, few are.

First, you have to figure out which crowdfunding platform is best for your situation . Kickstarter and Indiegogo are two of the most popular.

Startup Capital: SBA Loans

These are small-business loans guaranteed by the Small Business Administration. Participating lenders, mostly banks, distribute the funds. They can guarantee up to 85% of loans of $150,000 or less, and loans that are more than $150,000 they will guarantee up to 75%. The maximum loan amount they offer is $5 million.

Since they have a government guarantee, financial institutions are able to offer these loans at lower interest rates.

To be eligible for SBA Loans, you must meet certain qualifications. These include:

- Your business must be for profit.

- Your business must be inside the US.

- Business owners must invest equity.

- You must have exhausted all other financing options.

- Your business must qualify as a small business.

- Your business must be in an eligible industry.

Best SBA Loan Programs for Startup Capital

There are a ton of loan programs available through The Small Business Administration. These are those that are best suited for startup capital.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

7(a) Loans

This is the Small Business Administration’s most popular loan program. For one, it offers federally funded term loans up to $5 million. Furthermore, the funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions, in partnership with the SBA, process these funds.

504 Loans

Loans are available up to $5 million. Funds can buy machinery, facilities, or land. Mostly, they are for expansion. Private sector lenders or nonprofits process and disburse these loans. They especially work well for commercial real estate purchases.

Microloans

Up to $50,000 is available through the microloan program. This money can be for starting a business, purchasing equipment, buying inventory, or for working capital. Community based nonprofits handle microloan programs as intermediaries. In contrast, financing comes directly from the Small Business Administration.

Startup Capital: Private Lenders

Generally, private lenders can be a little more relaxed with requirements. Yet, they also tend to have higher interest rates and less favorable terms.

They usually have options for all types of financings at varying rates. There are a ton out there, but here are a few to get you started if you need to go this route for small business funding.

Upstart

Upstart is an online lender using innovative new technology. They question whether financial information and FICO alone can really determine the risk associated with a specific borrower. Instead, they are using a combination of machine learning and AI to gather alternative data. They then use this data to make credit decisions.

This alternative data includes things such as phone bills, rent, deposits, withdrawals, and even other information that is not directly tied to finances. Software from the company learns and improves based on this data.

They offer various types of financing products to fit a wide variety of needs. This may include credit card refinancing, student loans, and pretty much anything in-between. Upstart has something for almost everyone.

StreetShares

StreetShares began as a service to veterans. Now, they offer term loans, lines of credit, and contract financing. In addition, they offer small business loan investment options. The maximum loan amount is $250,000. Pre-Approval only takes a few minutes. They use a soft pull on your credit so as not to affect your score.

StreetShares eligibility requirements include being in business for at least 12 months with annual revenue of $25,000. Exceptions do exist however. Loans to companies in business for at least 6 months that have higher earnings can be approved on a case by case basis.

Kabbage

Kabbage is a well known online lender. They offer a small business line of credit that can help businesses accomplish business goals quickly. The minimum loan amount is $500 and the maximum is $250,000. They require you to be in business for at least one year and have $50,000 or more in annual revenue. Alternatively, $4,200 or more per month in the previous 3 month period will meet the revenue requirement..

Kabbage is great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Fundation

Fundation provides both term business loans online and lines of credit. It is most known for its working capital funding options. These are funds meant to help cover the day-to-day costs of running a business rather than larger projects. Typically, these funds come in the form of a line-of-credit.

Their minimum loan amount Fundation offers is $20,000 while the maximum loan amount is $500,000. They require you to be in business for at least 12 months and have annual revenue of at least $100,000. To be eligible, your personal credit score must be no less than 600. Additionally, you must have at least 3 full time employees. That number can include yourself. Business owners cannot live or operate their business in North Dakota, South Dakota, or Nevada.

You Cannot Get Startup Capital Without a Business Plan

Not only is a business plan necessary when it comes to getting business loans, but it is necessary to the day to day operations of your business as well. Virtually all successful entrepreneurs will tell you that a major key to success is to plan to work and work the plan.

Most traditional lenders are going to need to see a business plan as part of the loan application process. Truthfully, it’s best to hire a professional business plan writer if possible. They can work with you to get all the necessary information and put it together in the traditional format.

If you cannot hire a business plan writer however, there are other options. The Small Business Administration offers a template. Furthermore, your local small business development center may also be able to help.

For a business plan to be taken seriously by a lender, it needs to include the following:

A Strong Opening

An Executive Summary

This is a complete summary of the business idea.

Description

The description goes into further detail than the summary, describing the business. This is where you work to build excitement about your business.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Strategies

Layout your plan for getting started. Do you have a marketing plan, area in mind for location, or idea of how many employees you will start with? What is your ramp up plan?

Market Analysis

What need will your business fill, and for who? Are you a child care facility filling a need for affordable child care for working moms? Are you an eatery filling a need for a lunch spot for those working downtown? How will your business fill the need? All of that information goes in this section.

Competitive Analysis

Is there already a business working to fill this need? Is there room for more? How do you plan to compete with them?

If you are not a new business, this will be a market analysis that supports your need for funding, or that shows your business is strong and growing.

The Plan

Plan for Design and Development

How is all of this going to play out, from start to finish. What steps are you going to take? This is more detailed than your strategies section.

Plan for Operation and Management

Who will own or does own the business and who will run or currently runs it from day to day. This could be as simple as stating that you are the sole owner and operator, or as complicated as laying out a complete partnership plan or board or directors’ format. It just depends on how your business works.

Financials

This section includes current financials, projections, and a budget plan for the loan funds you are applying for. Lenders need to see that you know how to handle the funds you get, and that you have a plan to pay them back.

Now is the Time to Build Fundability