Article URL: https://www.ycombinator.com/companies/roame/jobs/A2jJQvq-founding-backend-engineer

Comments URL: https://news.ycombinator.com/item?id=40430972

Points: 0

# Comments: 0

Article URL: https://www.ycombinator.com/companies/roame/jobs/A2jJQvq-founding-backend-engineer

Comments URL: https://news.ycombinator.com/item?id=40430972

Points: 0

# Comments: 0

Article URL: https://hioperator.breezy.hr/p/4cb3dcb4e6e5-vp-of-engineering

Comments URL: https://news.ycombinator.com/item?id=34013615

Points: 1

# Comments: 0

TCU won, and the dream of a spot in the playoff remains within reach. Oregon lost, and no matter how many times fate seemed to intervene on Washington’s behalf, that loss is all that ultimately matters.

The post Few true playoff contenders remain with TCU's win and Oregon's loss appeared first on Buy It At A Bargain – Deals And Reviews.

“Fox News Sunday” welcomed guests Julianne Smith, Rick Scott and Ro Khanna.

Video conferencing isn’t going anywhere. It’s been growing in popularity for years, and COVID basically caused the industry to explode. Now, everyone’s doing it and there are tons of options. The only question is, which video conference meeting option is right for your business.

When it comes to choosing a video conference meeting option for your business, you need to consider a number of factors. These are factors that all businesses need to think about, regardless of type or size. Consider the following:

Answering these questions before you start your search will make it much easier to decide. Let’s look at the top options.

Slack upped its game in the video conference meeting arena over the years. It’s pretty basic, but if you already have it and use it for other things, definitely give it a shot for video conferencing. There is no need to add something else if what you have will already work. However, if you find it just doesn’t fit the bill, you have plenty to choose from. Also, don’t get Slack just for video conferencing. That isn’t it’s main selling point.

Prices start at $8 per month for the standard plan that includes video calls along with unlimited chat archive and priority support.

Now part of Verizon as of April 2020, the cute name is still hanging on. It bills itself as “the meetings platform for the modern workplace,” and the name comes from the desire of the founders to make it as comfortable and casual as possible. They focus on instant connections. The platform uses a mobile or desktop app straight from the browser. There is no download requirement.

After the acquisition, Verizon lowered prices and added a lot of new features. There is background noise cancellation, integration both with conference room systems that are hardware based and options like Microsoft Teams, Slack, and Facebook Workplace. There are also plenty of collaboration tools including screen sharing and whiteboarding.

There’s a free trial. After that, there are 3 plan options that you can pay monthly or annually if you want a 20% discount. The standard plan is $12.49 per meeting host per month and supports up to 50 in attendance. It also supports 5 hours of meeting recording, but does not integrate with message apps like Slack. Prices and features go up from there.

The big pull for Webex is the virtual whiteboard feature. It also has crisp audio, but is known for usability issues. It can be a good fit, but with options like the virtual whiteboard Miro that you can use while you are on a call, it’s really not necessary for most to use Webex solely on the basis of the whiteboard option.

Prices start at $14.95 per host per month for up to 50 people per meeting and 5GB of cloud storage.

This option is top notch for Google users. Its deep integration with other Google apps can be useful. Just create a meeting in Google Calendar and get a link that you and other attendees can click to join the call instantly.

Live captioning is also a big plus on the accessibility side. It works well for English, but not so much for any other languages that may be on a call.

It’s free for up to 100 participants for up to 60 minutes. For more than that, packages start at $6 per month as part of Google Workspace Basic.

Zoom is arguably the best known video conference meeting option in this post-COVID era. It was making headway before, but when the world was sent home to work where possible, Zoom was thrust into the spotlight virtually overnight.

It boasts a wealth of features, including free 1:1 calls with no time limit. Group calls are free for up to 100 people for up to 40 minutes. Then, the paid plans allow up to 1,000 on a call at one time. The best part is that Zoom is super reliable. Even with a bad connection, it can usually keep the video going.

Those on a call can text chat with the whole group or talk individually. Screen sharing, call recording, and advance scheduling are also part of the package.

Zoom is free for up to 40 minutes if you have 100 people or fewer on the call. The pro plan is $14.99 per month per host.

One thing you do not want, if you can help it, is to get everyone used to one option then have to switch. Also, don’t think about which one is best for just right now, but which one works now and will keep working into the future as your business grows. Consider each one carefully in light of the questions above, do your own research, then take the leap. And remember, if you are already using video conferencing, you may already have what you need. Don’t fix it if it isn’t broken.

The post Top 5 Video Conference Meeting Options for Your Business appeared first on Credit Suite.

Location: Los Angeles, California

Remote: Yes

Willing to relocate: No

Technologies: JavaScript, TypeScript, Java, Kotlin, Python, Nodejs, React, Express, Nextjs, Spring Boot, Flask, Redis, Postgres, MongoDb

Resume: https://docs.google.com/document/d/1NbwrILs-zlD7J8s8xnJ_c75W…

LinkedIn: https://www.linkedin.com/in/nsuarez22

Email: nathaniel(dot)lee002(at)gmail(dot)com

A web presence is essential for getting found online, especially these days. According to Statista.com, nearly a third of consumers in the United States look online for a local business every day. It’s simple: websites are essential for attracting new customers.

A website proves invaluable in other ways, too, like showcasing your products and increasing leads. However, your website doesn’t need to cost a fortune and include the latest features. If you’re a small business that just wants to let customers know who you are and what you do, a free Google website may be just what you’re looking for.

Google’s free website builder is part of Google My Business and helps customers discover you online.

When creating your website, Google takes the information in your GMB business profile and uses it for the building blocks of your website. Aside from some customization, you’re pretty much good to go from there.

Although there’s no cost, free Google websites are professional-looking and offer a selection of contemporary themes.

Google’s website builder is suitable for everyone, even for beginners. There’s no need for technical expertise with a free Google website and no worries regarding extensive backups.

Additional benefits with a free Google website are:

Here are some more reasons why you should use a free Google website for getting online.

Only 64 percent of small businesses have websites. Meanwhile, 70 percent of potential customers are more likely to buy from a business with a website.

This means 36 percent of businesses may be missing out on 70 percent of buyers.

Websites make businesses seem more legitimate, particularly if the website looks professional. Google websites, which take almost no time to set up and require minimal maintenance, can look like you spent hours of time and thousands of dollars to make it look great.

If Google’s free website gets you found, why not take advantage of its ease of setup and free features?

The number one thing that sets Google’s business websites apart from others is that it automatically makes the site for you. You can alter things as you need, but if you have a Google My Business account and select the website option, it automatically populates the information on a site for you using a template you choose.

Don’t let its simplicity fool you. A Google My Business free website offers you plenty in the way of features.

For instance, it provides you with built-in optimization so customers can:

Additionally, a free Google website allows you to “showcase what makes your business special” via:

Other features worth mentioning are:

Besides the above, Google gives you automatic updates, advertising, and it’s mobile-friendly too.

As you can see, a free Google website offers a lot to the new business owner, but how does it compare with others?

The Google website builder one-page format beats many other options in the simplicity stakes.

Additionally, it creates a website with almost no effort on your side, which is where Google’s product stands out from similar tools. It also lets you import images with a few clicks, and you can track analytics, so all in all, it offers you the essentials.

The other main advantage over its rivals is you’re not starting from scratch, and you aren’t making all the decisions yourself.

Although it may seem basic to some, Google gives you a functional, great-looking website, and with some imagination, it delivers impressive results.

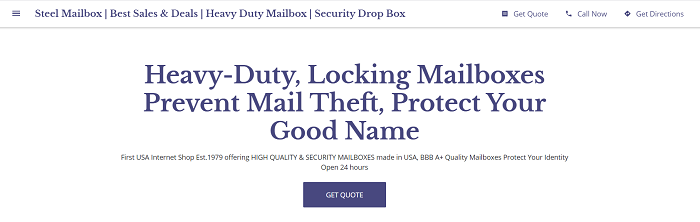

For inspiration, look at what Steel Mailbox did with theirs. This Google business website starts with the basics that could be pulled in from their business information (e.g., the directions function).

If you click the “hamburger” in the upper left, you see options the company chose to add, which jump you to different page areas. One cool feature they added was a list of mailbox types with brief definitions of each one. This allows people shopping for mailboxes to understand what type they need without having to dig through Steel Mailbox’s non-Google site.

If a customer clicked on one of those blue links, they would be taken directly to the type of mailbox they’re looking for. If they went through the main site—and you can have both a simple Google business site and a more in-depth one—they would likely have to do more digging to find precisely what they need.

What a great feature for customers on the go.

When it comes to this type of website, perhaps its weakest area is ongoing SEO optimization, but you can use a free or paid-for tool to find keywords and include them in your descriptions and posts.

While bloggers, Fortune 500 companies, and small businesses use WordPress to build their websites, it’s actually a content management system.

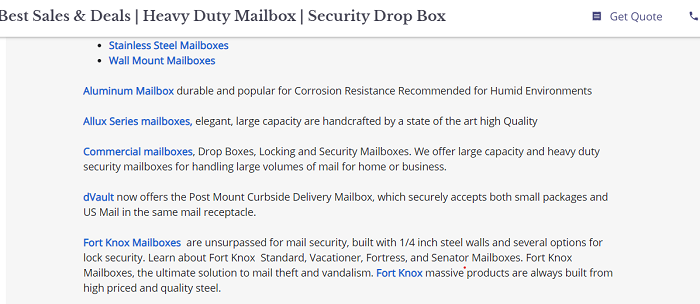

You’ve two options for getting started. WordPress.com gives you the free version, while WordPress.org offers a paid one.

At the free level, the most significant difference between Google and WordPress is that you can create multiple pages within your site, while Google has a one-page format.

When you get to the paid levels, you can add additional functions.

While WordPress offers many more functions than Google websites, no matter which level you use, you have to start from scratch. Nothing is auto-populated. Nevertheless, there are plenty of tutorials online if you’re just learning, and you won’t need to do any coding.

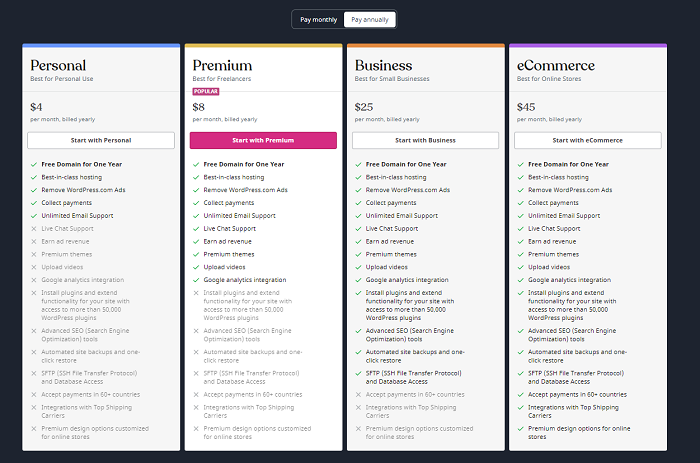

Wix is another free website builder, although it also offers premium and e-commerce plans too. Getting started is simple. Just sign up or log in with Facebook or Google to get started.

Like WordPress, the free level is relatively limited in functionality. If you’re willing to pay, though, you can access hundreds of templates, additional types of analytics, and more.

Wix provides 500 different templates, and its drag and drop feature means beginners can use it without needing technical expertise.

Other features include:

Wix also provides coding for visitor tracking, while its analytics tool shows your sales, traffic, and visitor behavior.

After you have set up your Google My Business page (detailed steps are in the next section), you’ll be able to see your site free google website in a standard setup. You can then start customizing from there.

The list nearest your sample site includes things you can do right now, like add photos, text, and themes. The one furthest left includes:

Take some time to get to know these options and which each one does.

From the home page, you can also:

You can see the themes, add pictures with a photo gallery, and edit your site’s categories from the other menu.

To best set up your site, follow these steps:

It’s that easy! You’ve finished building your free Google website, and you should be ready to start getting noticed online.

Before building your website, set up your Google my Business Page, if you haven’t already. Here’s how to do just that.

You’re looking for the “website” heading. It’s the third one along at the top.

If your service or industry isn’t clear cut, add the class representing your company the best. Click “Next.”

Now, Google asks if you want your business location to appear on your website. Either select “Yes, I want it to appear on my website” or “No, I prefer not to.” Depending on the type of business, you may need to include an address. Choose the appropriate option and click “Next.”

Choose if your business provides deliveries or services. This step is optional.

You’re ready to start building your free Google website!

Unlike its rivals, you’re not starting from scratch, and you aren’t making all the decisions yourself. Although it may seem basic to some, a Google site gives you a functional, great-looking website, and with some imagination, you’ll get impressive results.

Google provides step-by-step instructions.

No, a free Google website creates a professional-looking website with minimal input from you.

While other options offer additional features, Google outshines its competitors regarding simplicity and ease of use.

Having an online presence is a necessity these days. If would-be customers can’t find your website, you’re likely missing out on clients.

However, building a website doesn’t mean spending a lot of money or needing technical expertise. Instead, you can begin by starting with a free Google website and set it up in a few easy steps.

Once you’re online, you can start benefiting from additional leads, more customers, and increased conversions—all the things you need for increasing your business success rate and growing a thriving enterprise.

How has using a free Google Business website affected your business?

To understand fleet credit, you need to understand business credit first.

Business credit is credit in the name of a business. When built correctly, it has no relationship to an owner’s personal credit. This is the case even if a business has but one owner, and that person is also the business’s sole employee.

You can divide business credit into three separate categories. Vendor credit is credit you can get even if you have no other credit; often net 30 and similar terms. Store credit is often revolving terms; may require some time in business; and offered by major retailers. And cash credit is more universal credit from providers like Visa, MasterCard, and American Express; harder to qualify for; may require more time in business and more paperwork before approval.

Fleet credit has some things in common with both vendor and store credit. Terms can be either net 30 (or net 60, etc.), or they can be revolving. This is credit to buy fuel, and to repair and maintain vehicles of any type.

The kinds of vehicles a business needs to maintain can include taxicabs, trucks, vans (for deliveries or to transport workers or passengers), or company cars.

While any company can use vehicles, some industries solely depend on vehicles to deliver their services. Risk is denoted by SIC (Standard Industrial Classification), and NAICS (North American Industry Classification System) standards.

Normally, high-risk industries have some things in common. There can be high risks of injury on the job. Or an industry may engage in a lot of cash transactions. This is true regardless of the safety record of a particular business, or the majority of its transaction types. Trucking and many other vehicle-intense businesses come under the injury risk umbrella.

Over the road trucking is considered a high-risk industry. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Trucking-Except-Local.html. So is local transportation. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Local-Passenger-Transportation-Elsewhere-Classified.html. And so are taxicabs. See referenceforbusiness.com/industries/Transportation-Communications-Utilities/Taxicabs.html.

Small business credit is independent of the economy. But be aware that, as the situation continues, some of the requirements could change. Always be sure to check the links directly, to be sure to get 100% up to date information straight from the source.

Per the SBA, business credit card limits are high! They’re a whopping 10 – 100 times that of personal credit cards. You can get a lot more money with small business credit. And you will not need collateral, cash flow, or financials in order to get business credit.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Our Business Credit Builder is full of amazing business credit cards. And that includes gas cards! These cards are starter vendors. We know they report to business credit reporting agencies. Whether you’re new to business credit building, or have been at it for a while, it pays to get these cards.

Our Business Credit Builder is full of amazing business credit cards. And that includes gas cards! These cards are starter vendors. We know they report to business credit reporting agencies. Whether you’re new to business credit building, or have been at it for a while, it pays to get these cards.

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products, throughout the United States. Their comprehensive product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet, Experian, and Equifax. Before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying so they don’t red-flag your account for fraud.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

Your Social Security number is required for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee, if in business less than a year. You apply online. The terms are Net 15. Get it here: marathonbrand.com.

76 is owned by Phillips 66 Company. They sell gas in more than 1,800 retail fuel sites in the United States. This card reports to Dun & Bradstreet, Experian, and Equifax. And it can be used at any P66, 76, or Conoco fueling location.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

Your Social Security number is necessary for informational purposes. If concerned they will pull your personal credit, talk to their credit department before applying. If not approved based on business credit history or you have been in business less than 1 year, then a $500 deposit is needed or a personal guarantee (PG). You can apply online or over the phone. The terms are net 15. Get it here: 76fleet.com.

Wrights Express (WEX Card) offers universal fleet cards, heavy truck cards, and universally accepted business fleet cards. These cards have features that support small business, including a rewards program.

Before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying. This way, they won’t red flag your account for fraud. This card reports to Dun & Bradstreet, Experian, and Equifax.

To qualify, you need an entity in good standing with the applicable Secretary of State, and an EIN number with the IRS. You will need to have a business address matching everywhere. Plus you need a D-U-N-S number, and all applicable business licenses. You will need to have a business bank account, and a business phone number listed on 411.

If you’re not approved based on business credit history, or have been in business a year or less, then a $500 deposit is needed or a personal guarantee. Apply online or over the phone. The terms are net 15 (WEX Fleet Card), Net 26, or Revolving (WEX Flex Card). Get it here: wexinc.com/solutions/fleet-management.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

All forms of business credit can help you build good business credit scores, as business credit is mainly based on your payment history. As a result, fleet credit can help your business eventually get funding, such as loans and other forms of financing.

Over 89% of business applications are denied by the big banks. High-risk industries are subject to stricter underwriting guidelines. It is possible to get loans from conventional sources, but it’s not easy. Alternative lenders are often your best bet. Here’s some great funding we’ve found.

You can get equipment financing for commercial truck leasing and financing. Up to $150,000 is available. Their requirements are 6 or more months in business, an equipment quote from a vendor, and a 575 personal credit score or better. See www.nationalfunding.com/industries/loans/trucking-business

Or get auto repair shop financing, via leasing. Their requirements are 6 or more months in business, an equipment quote from a vendor, and a 620 personal credit score or better. See nationalfunding.com/industries/leasing-financing/automotive-repair-equipment.

Kabbage offers loans specifically for truckers. Up to $250,000 is available. Their requirements are 1 or more years in business, and $50,000 or more in annual revenue. See www.kabbage.com/truck-driver-loans.

Get transportation equipment financing. Up to $750,000 is available. Poor credit is not a problem. You can get approval in as little as 24 hours. See https://crlease.com/transportation-equipment-financing.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

You can get a business line of credit. Up to $100,000 is available. No personal credit score is necessary. You must use online accounting software that can link to Fundbox. See creditsuite.com/fundbox and https://fundbox.com/truck-loans.

Got good personal credit? Then a hybrid credit line could be the perfect solution. You can get up to $150,000, even if your business is a startup.

To qualify, your personal credit score should be at least 685. You can’t have any liens, judgments, bankruptcies, or late payments. In the past 6 months you should have fewer than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s better if you have established business credit as well as personal credit. See creditsuite.com/business-loans.

Business credit is credit in the name of a business. Fleet credit is used by businesses to buy fuel, and to fix and maintain all sorts of vehicles. It can help you build business credit and qualify for loans and more forms of funding. Alternative lenders are one option. And the Credit Suite Credit Line Hybrid is even better if you’ve got good personal credit.

The post Get in the Fast Lane with Fleet Credit appeared first on Credit Suite.

If you have bad credit, it can be hard to find small business loans regardless of gender. If you are a female business owner, with bad credit, it may help to look for lenders that offer certain types of loans, rather than small business loans for women with bad credit specifically.

There are certain types of funding that work well for all business owners with bad credit, including women.

The credit line hybrid is unsecured business financing. It is available to pretty much anyone for any type of business expense. You can use it for real estate, equipment, working capital, and even startup expenses. Not only that, but there is no security required. Furthermore, there is no down payment, and you do not have to provide income documentation. It is completely no-doc financing.

Now, you do have to have strong personal credit. A credit score of 680+ is necessary. Also, there cannot be any late payments in the past 12 months, there can be no open collections or bankruptcies, and there should be less than 4 inquiries in the past 6 months on your consumer credit report. There also has to be at least 2 open credit cards with a $2,000 limit or higher with 2 years of good payment history.

Where does the part about bad credit come into play? Here it is. If you do not meet these requirements, you can take on a credit partner that does meet them. The payments will still be reported on the business’s credit report, so business credit will build whether you get the financing yourself or through a credit partner.

The best part is, amounts can range up to $150,000, and often interest rates are as low as 0% for the first 6 to 18 months.

Find out why so many companies use our proven methods to get business loans.

If your business has consistent revenue of $120,000 per year or more, you may qualify for this type of funding. Lenders verify revenue using bank statements. There can be no recent bankruptcies, but the minimum credit score to qualify is as low as 500.

A business must also be in operation for a year or more, and they must do over 5 small transactions each month to get business revenue financing.

If your business accepts credit card payments and you have at least a 500 FICO, you could get up to $750,000 in a merchant cash advance. Credit rates are usually lower compared to traditional financing as well.

Your business must bring in $100,000 or more per year in credit card sales, and typically you can get approval equal to one months credit card financing volume.

Outstanding account receivables can also be a source of funding for your business. Get as much as 80% of receivables advanced in less than 24 hours. You get the rest of the accounts receivable amount once you collect full payment for the invoice. Closing takes 2 weeks or less.

Receivables should be with the government or another business. Getting financing with receivables from individuals is not as easy. If you also have purchase orders, then you can get financing to have those filled. You won’t need to use your cash flow to do so.

You can secure this type of financing by using existing equipment or new equipment you want to purchase as collateral. Funding is available up to $10 million. Terms range from 5 to 60 months, and you need a minimum 550 FICO.

The equipment must be new, and most types of equipment are acceptable, including software.

You’ll need to provide details on the equipment to be financed and, depending on the loan amount and certain risk factors, you may need to show 2 years corporate and personal tax returns.

Find out why so many companies use our proven methods to get business loans.

For these loans you have to have collateral worth up to at least 50% of the loan amount, but you only need a FICO of 620. There also can be no bankruptcies in the past 4 years. Only for profit companies qualify, and they must have positive trends in sales growth. Generally amounts are available of up to $12 million with terms up to 25-years.

Likewise, you probably will not be financing real estate with business credit cards, even if it is 0 interest. You can get real estate financing in amounts up to $10 million with terms from 6 to 60 months and interest rates as low as 6%. You will need a 500 minimum credit score, and there are a few other requirements.

If you are looking for business loans for women with bad credit, it’s fair to say you aren’t that confident in your credit score. A business credit expert can help you not only determine which of these options is best for your business, but also help you build fundability so you don’t have to worry about finding funding for your business. If your business is fundable, you can get all the business financing you will ever need.

One area where you will find funding specifically for women, and credit isn’t an issue, it grants.

Find out why so many companies use our proven methods to get business loans.

In addition to helping with loans, the SBA Women’s Business Centers also help women entrepreneurs get access to other types of funding. Some lend money or award grants directly, while others help connect women entrepreneurs with financial institutions. Take a look at their website to find out more on how to apply for women owned business grants through this network.

Eileen Fisher Women Owned Business Grants

The clothing brand Eileen Fisher hands out $100,000 per year to 10 women-owned businesses. To qualify, a woman must have at least 51% ownership, and the business must be in operation for at least three years. Also, it must bring in less than $1 million per year in revenue and have a focus on environmental or social change.

The Amber Grant awards $500 to $1,000 per month to a woman-owned business. One of the recipients also receives an additional $10,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee.

Specifically for woman-owned businesses in fashion, music, and art, the #GIRLBOSS small business grant awards $15,000. They also offer exposure via the Girlboss website and social media platforms. Judges rate those applying on creativity, business savvy, planning, innovation in the field, need, and where they plan to work.

The Cartier Women’s Initiative Award is $100,000 for first place and $30,000 for second place. They award the grant to 18 female business owners from around the world each year. Women business owners who are just getting started may qualify.

Business Loans For Women With Bad Credit Do Exist

They really do. They just aren’t necessarily for women exclusively. Still, if you find something that will work with bad credit, you’ve found gold. It’s even better if it can be used to build business credit at the same time.

It does no good to find funding for bad credit once. You need to work on the bad credit so you can eventually get the best terms and rates. This is where a business credit expert can be exceptionally helpful.

The post 7 Types of Small Business Loans for Women with Bad Credit appeared first on Credit Suite.

With a net worth of $1.7 trillion, Amazon has dominated the e-commerce sector for years, leaving many of its competitors in the shade. But are there alternatives to Amazon?

With an audience as vast as Amazon, small business start-ups and solo entrepreneurs flock to the site to sell the products, get established, and build their enterprises. Despite the audience Amazon offers, you may want to look for other online venues to list your items.

There are many good reasons to broaden your e-commerce horizons.

First, it makes little sense to put all your eggs in one basket. Second, selling on a wider range of marketplaces gets your products in front of a larger audience. And finally, looking at the other choices available could save you money on fees, or get you closer to your target buyers.

Below are some viable alternatives to Amazon. We’ll look at their advantages, their fee structures, and what makes them different.

We already touched on one of the main reasons to seek other venues: the perils of depending on one sales platform.

It’s not unheard of for sellers to have their accounts blocked. If you haven’t already established yourself on one of the alternatives to Amazon, your business could tank.

However, by setting up multiple accounts with different marketplaces, you’ve got greater flexibility if things go wrong. Plus, you can use other online platforms to test out which ones are the best for your products.

And there are other benefits in finding additional marketplaces, like:

All e-commerce sales platforms have some measure of control over your business. They determine:

These terms might not be suitable for your business. So, If you’re looking for greater flexibility, then seeking alternatives to Amazon is a good idea.

Perhaps you feel the vendor or customer support is lacking. Amazon provides useful resources for sellers, like its university. But some sellers feel seller support is sometimes thin, especially when things go wrong.

Amazon has changed its fee structure over the years, bringing frustration to some.

Amazon sets its professional selling plan at $39.99, with individual plans available free. And referral fees differ, depending on which category you’re selling in.

Shipping is a further reason to consider seeking alternatives as individual sellers on Amazon lack flexibility over their shipping costs.

If you’re looking to cut fees or branch out, then signing with some alternatives to Amazon may allow you to further scale your business while reducing costs.

If you’re a seller on Amazon, you’ll know it makes payment via ACH or electronic funds transfer. Amazon distributes these payments to your bank account every two weeks, and they can take up to five days to clear.

But that doesn’t always work for everyone. If you’re a small business and cash is tight, signing up to e-commerce platforms with a broader range of payment options can improve your cash flow.

Before you search for alternatives to Amazon, you need to decide what you want from your business. You’ll need to consider the products you’re selling and your target customer, too.

For example, if you’re selling printable products, Etsy could be an excellent choice. Or, if you’re looking for consumers who understand tech, you may find Newegg works well for you.

Other areas you’ll want to think about include:

Marketplaces that allow you to add items efficiently mean you can list more products in less time. But you’ll want to view any alternatives to Amazon from your customer’s perspective too.

How important is the ease of use? Well, if you note some recent research from Digital Commerce 360 and Bitrate, you’ll see this is a significant factor in the buying decision.

When researching new platforms, perhaps test them out for yourself and consider areas like:

Think about your ideal consumer and the type of users the platform attracts. For example, eBay is huge, with 182 million active buyers. It’s great for snapping up limited-time deals, brand name products, and pre-loved items.

However, it’s not always the first place shoppers think of when looking for handmade goods or unique items. They’re more likely to head somewhere like Etsy.

Fees can take a considerable chunk of your profits if you’re not careful. Depending on the fee structure, some sites may not be suitable if you’re selling smaller, lower value items.

If you need some help in this area, fee calculators are helpful. Here’s a list of the well-known ones.

What are some of the best Amazon alternatives when you’re looking to sell your products online? Let’s look at some of the top options, in no particular order.

Established in 2007, Bonanza has built itself a loyal following, with a vast range of categories. Sign up is free, and fees are straight forward. Final offer value fees are 3.5 percent for sales under $500. Sales over $500 attract an additional 1.5 percent fee.

Although it’s much smaller than Amazon, Bonanza has some advantages over its larger rival. They include a greater emphasis on building customer relationships and developing a sustainable business through repeat customers.

Equally appealing to sellers is the marketing tools Bonanza provides. These give you access to valuable data about product performance, allowing you to spot trends, optimize listings, and better market your items.

Other features include:

But what makes Bonanza stand out is its focus on unique items. It’s not trying to be another Amazon. As Bonanza puts it, it’s a site where you’ll find “everything but the ordinary”.

One of the most prominent alternatives to Amazon is eBay. Like Amazon, eBay has made considerable changes since its launch back in 1995. Over the years, eBay’s focus has moved away from the collectibles market it used to cater to, and it’s now more product-based.

Many famous brands like Rolex, Hasbro, and Microsoft make their goods available via ebay.com brand outlet site, enabling consumers to bag a bargain. But that doesn’t mean there isn’t still a place for more unusual or collectible items.

On eBay, listing fees and final value fees vary, but it sets many of its final value fees at 10 percent or less. If you need to calculate fees before listing, use an eBay fee calculator.

Some advantages of selling on eBay are:

What makes eBay stand out, though, is its auctions. Auctions may not be ideal for every business. However, sellers who specialize in collectible or rare items may find the bidding pushes their final sales price up higher than they could’ve imagined.

If your business primarily sells printable products or art and craft items, then Etsy might be for you. Of the many alternatives to Amazon, Etsy has perhaps one of the most affordable and straightforward pricing approaches.

Each listing costs just 20 cents, and the listing is good for four months. Then there’s a five percent transaction fee for goods that sell. Payment processing fees are variable and depend on location. If you want to grow your business further, Etsy Plus is available at $10 a month.

Re-listing is simple, too. Just select the auto-renew option, and there shouldn’t be anything else to do on your part.

Advantages of selling on Etsy are:

That’s the advantages, but there are a couple of possible disadvantages worth mentioning. First, Etsy is much smaller than Amazon, which means there’s intense competition, so your products need to stand out.

Second, although fees are cheaper, you may make more sales on Amazon Handmade because of its larger audience share.

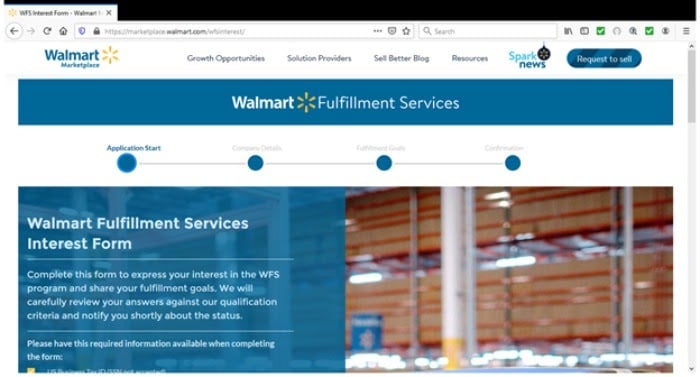

Amazon dominates e-commerce, but Walmart is gaining ground. Recent sales figures show Walmart’s e-commerce sales have soared by 74 percent. This stat means if you’re looking for alternatives to Amazon, Walmart could be promising.

Like Amazon, Walmart now offers a fulfillment service. Although storage and fulfillment fees apply, Walmart’s fee structure is less complicated than Fulfillment by Amazon, and referral fees are competitive.

In addition, with Walmart’s marketplace, there’s no start-up or ongoing monthly fees. However, you’ll want to factor in other costs, like unique product codes (UPCs).

Advantages of selling on the Walmart marketplace include:

What makes the platform different? Unlike Amazon, Walmart’s marketplace is only open to invited brands. You can’t just register and start selling. But you can sign up.

To register your interest in selling, Walmart asks businesses to fill out the interest form.

Newegg has gained a reputation as the top global tech marketplace online. But it also sells apparel, home and lifestyle products, sports/health-related items, TVs, and plenty more.

As for fees, non-elite membership is free. Elite membership has two tiers ranging from $29.95-$99.95 a month. Commissions vary, with the highest being 12 percent.

Advantages of selling on Newegg include:

But it’s the multi-channel fulfillment option that may interest sellers the most. If you’re selling from various platforms, Newegg provides a central point to manage all your orders.

When you sell on a third-party platform, you have limited control. Many online sellers favor setting up their stores the Shopify platform.

The site offers new sellers a 14-day free trial to get them started. After that, a basic Shopify store will cost you $29 a month. Online credit card rates are 2.9 percent + 30 cents. And you should find it easy enough to start selling.

Once you’ve signed up for the free trial, the next steps are to:

The benefits of Shopify include:

There are a variety of reasons you might be looking for alternatives to Amazon. Maybe you want a platform that provides a wider range of payment options, a site that’s more niche, or you just want a more extensive selection of online marketplaces to sell your wares.

As you can see, there are many venues available, and they all have their advantages. Sites like Bonanza have established a loyal audience, and Walmart’s e-commerce presence is growing strong.

Niche sites such as Etsy and Newegg are ideal for specialist items, and eBay offers greater customization and various selling methods, including auctions.

If you want to go it alone, there’s always Shopify, where you can set up and market your own e-commerce business.

Are you an online seller? Tell us about your favorite platform and your experiences below.

The post 6 Alternatives to Amazon For E-commerce appeared first on Neil Patel.