Comments URL: https://news.ycombinator.com/item?id=38572504

Points: 0

# Comments: 0

Washington Commanders tight end Armani Rogers suffered a noncontact Achilles injury Tuesday and likely is lost for the season.

The post Commanders TE Rogers suffers Achilles injury appeared first on Buy It At A Bargain – Deals And Reviews.

Police discovered the bodies of three missing girls in a Texas pond on Saturday, hours after they had been reported missing.

The three girls, 9-year-old Zi’ariel Oliver, 8-year-old Amanda Hughes, and 5-year-old Temari Oliver were staying with a family friend while their mother was working. The friend reported the sisters missing at roughly 10 p.m. on Friday.

Police began searching the area and came across a pair of shoes sitting on the edge of a pond on a neighbor’s property. Investigators discovered the bodies of all three girls at the bottom at roughly 2 a.m. Saturday, according to the Cass County Sheriff’s Office.

Circumstances of the girls’ deaths are under investigation, but police have not announced a criminal inquiry. The sisters’ bodies have been sent for autopsy to determine the cause of death.

TEXAS REPAIRMAN DISCOVERS HUMAN REMAINS INSIDE BACKYARD GRILL, CALLS POLICE

TEXAS ESCAPED KILLER GONZALO LOPEZ TATTOOS SEEN IN NEW PHOTOS; MANHUNT REACHES DAY 20

The law enforcement search included elements of the local police, fire department and game wardens. Authorities say they discovered footprints in the mud near where the shoes were found.

The girls’ mother, who remains unnamed, confirmed that the shoes belonged to one of her daughters.

Authorities have indicated the girls’ deaths may have been an accident.

“That is unknown, whether they were swimmers or not. None of them had life jackets on, so I don’t know how strong of swimmers they were or if were swimmers at all,” Lieutenant Game Warden Jason Jones told KTAL.

What is an EIN? EIN stands for Employer Identification Number. As a result, referring to it as an EIN number isn’t exactly correct. Despite the redundancy however, the terms EIN and EIN number are used interchangeably by the general public. The important thing is, having one for your business is vital to building a Fundable Foundation. It’s like a Social Security Number for your business. You can get one for free from the IRS. But, what exactly does this entail? Here is how to get an EIN, step-by-step.

Foundation. It’s like a Social Security Number for your business. You can get one for free from the IRS. But, what exactly does this entail? Here is how to get an EIN, step-by-step.

Here’s a quick and dirty rundown.

Sounds easy enough, right? Still, sometimes walking through the process and actually seeing it is a little easier.

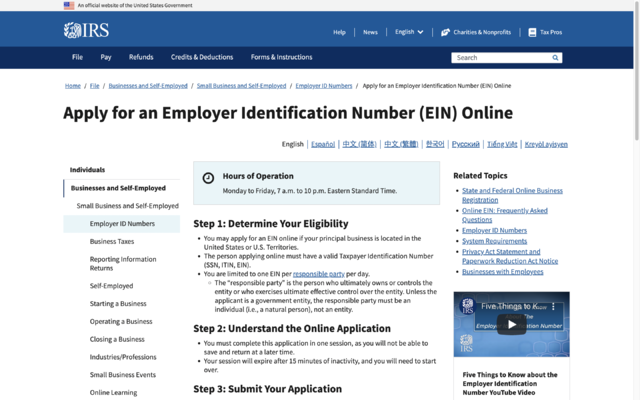

It’s easy to say “go to the IRS website.” However, it is a big site with links to what seems like an endless number of topics. So, specifically the first step to getting an EIN is to go here. You’ll see this:

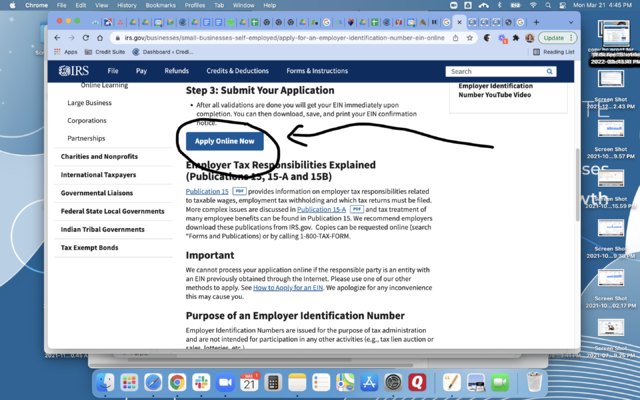

Read this page closely. Make sure you are eligible. If you are, you can continue to the online application by clicking the “Apply Online” button.

After you click the button you’ll go to the application. It starts like this.

Read it, and if you are continuing, click “Begin Application.”

Next, you’ll see a screen asking you to choose your legal structure.

For Fundability purposes, you’ll want to incorporate. Hopefully, by this point you have already done so and you’ll choose “corporation.”

Then, you’ll be asked which type of corporation your business is.

Before you apply for an EIN, discuss with your attorney or tax professional which type of corporation is best for the specific budget and liability needs of your business.

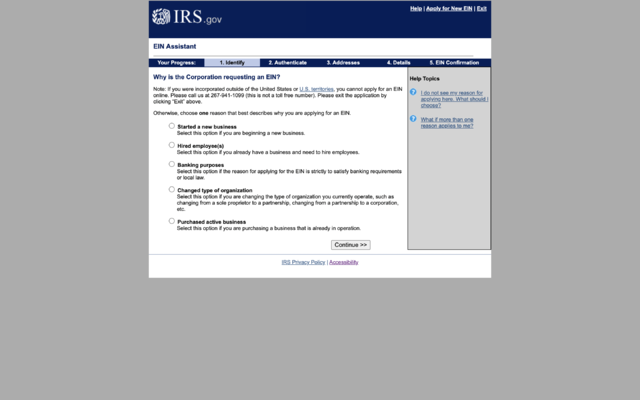

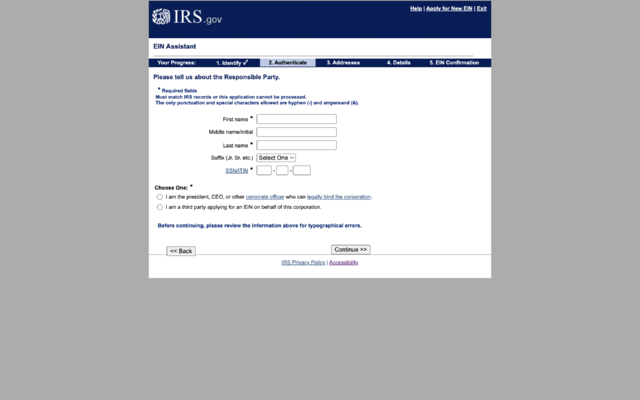

After choosing, you will be asked to confirm what you just entered. Then, the next screen will ask why you are requesting an EIN. If you enter “starting a new business,” you’ll be taken to a screen to enter your personal information.

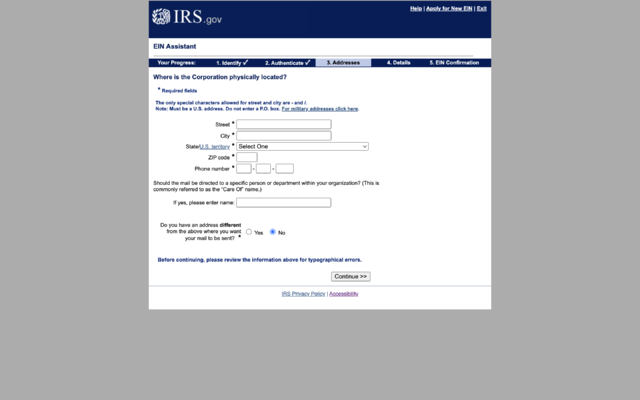

Enter Your Business Address

Enter Your Business AddressAfter you enter your personal information and your affiliation to the business, you’ll have to enter your business address.

Let’s pause here for a minute. This is important. For Fundability , you MUST have a consistent, physical business address where you can receive mail. That may be your home, a virtual office, or another location. However, It should not be a P.O. Box or an UPS box. Consequently, if you ever change it, be sure you update the business address your EIN is linked to. The address needs to be consistent in all places.

, you MUST have a consistent, physical business address where you can receive mail. That may be your home, a virtual office, or another location. However, It should not be a P.O. Box or an UPS box. Consequently, if you ever change it, be sure you update the business address your EIN is linked to. The address needs to be consistent in all places.

The next screen asks for address verification. Sometimes, they will find your address listed slightly different in the database. Just choose how you want it listed. If the database is correct, I suggest using that one for the consistency mentioned earlier.

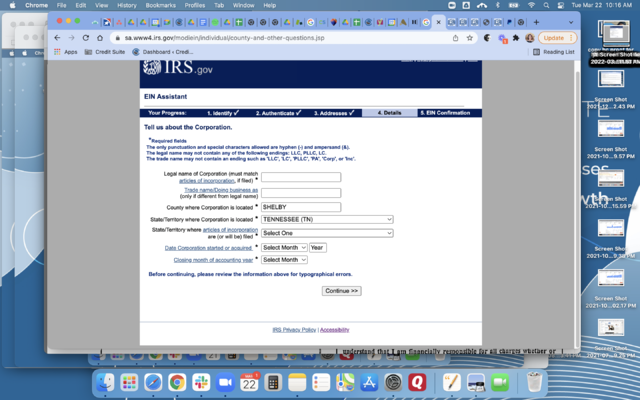

Lastly, enter the rest of your business details.

After that, you will get your EIN confirmation, if everything checks out.

According to the IRS it can be used immediately for most of your business needs. These include:

Yet, it will take up to two weeks before it is part of the IRS’s permanent records. Until then you cannot:

As you can see, the online process of applying for an EIN is pretty straightforward and fast. If you do not want to do it online, for whatever reason, there is a paper application that you can download, fill it out, and send in.

Of course, you can apply for an EIN anytime, but there are a few things that you can do first to make it easier to build fundability. For example:

If something changes, just be sure you change it everywhere. Want to know more about the steps to building Fundability , starting with a Fundable

, starting with a Fundable Foundation? Get a free business finance assessment now!

Foundation? Get a free business finance assessment now!

The post How to Get an EIN Number appeared first on Credit Suite.

Commit | https://commit.dev/ | Remote-First | Senior & Staff Software Engineers | Hiring within Canada We hire you directly into Commit AND – Pay you to find the right startup from a pool of vetted opportunities – Let you skip the traditional interviewing processes – Let you explore startups three months at a time until … Continue reading New comment by rammeya in "Ask HN: Who is hiring? (March 2022)"

Article URL: https://boards.greenhouse.io/atomicvest/jobs/4378312004 Comments URL: https://news.ycombinator.com/item?id=30566738 Points: 1 # Comments: 0

Article URL: https://www.ycombinator.com/companies/unflow/jobs/xY3DJ1O-ios-engineer

Comments URL: https://news.ycombinator.com/item?id=29982031

Points: 1

# Comments: 0

You may have noticed some small changes to Ubersuggest recently, but now it is time for another major release.

In the last few months, you have seen the application get faster, we are slowly (but surely) working on increasing data quality, and we have even made multiple updates to our Chrome Extension.

But today, we are announcing a new feature that will make finding lucrative keywords even easier.

So, what is it?

It’s a competitor analysis report!

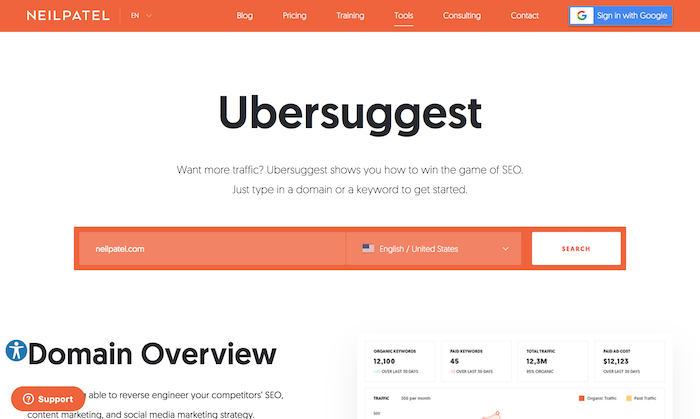

I want you to head to Ubersuggest and type in the name of one of your competitors.

Ideally, you’ll add a popular one. The more popular the competitor the more keywords it will show you.

If you don’t know of a competitor, just perform a Google search for any keyword that you are trying to rank for and grab the top site.

Or you could just use “neilpatel.com” to see how it works.

At this point, you should see a report that looks something like this.

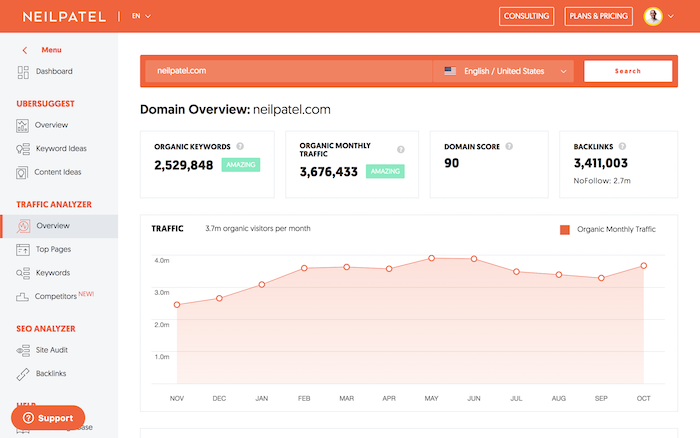

I want you to go to the sidebar and click on “competitors.”

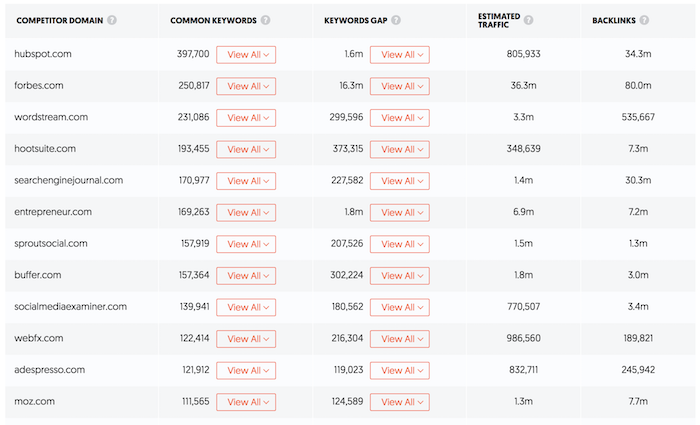

From there you should see a report that looks something like this.

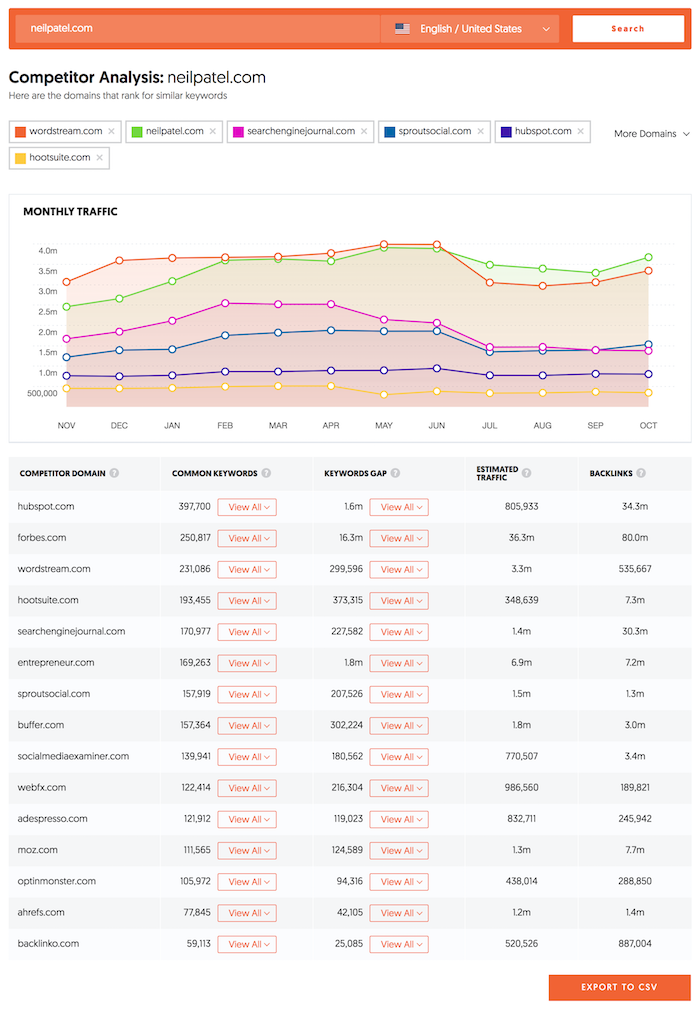

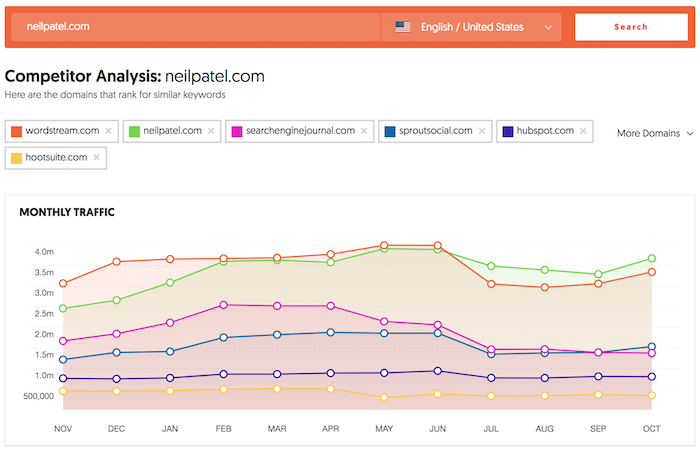

The top part of the report shows your main competitors in a graph.

You can easily see who is getting more traffic (keep in mind subdomains are counted as separate sites).

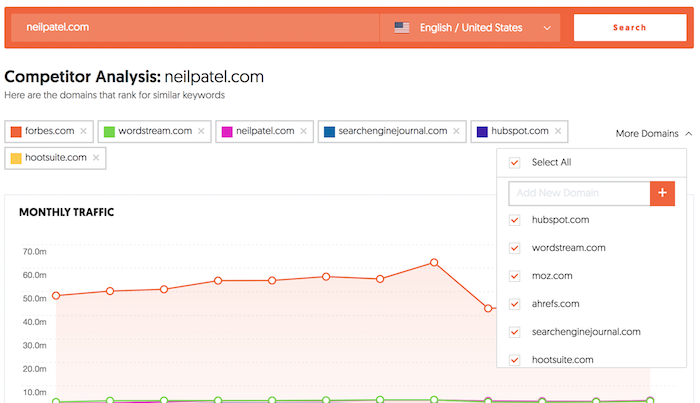

And, if you want, you can click on the “more domains” drop-down and unselect some of the competitors or even add more that may not be listed.

As you scroll down you’ll also see a long table.

In the table, you’ll see the competitor domain, the number of common keywords you rank for, keyword gaps (the keywords they rank for that you don’t rank for – this is your main opportunity), their estimated traffic, and the number of backlinks that you have.

So, let’s dive into the keywords.

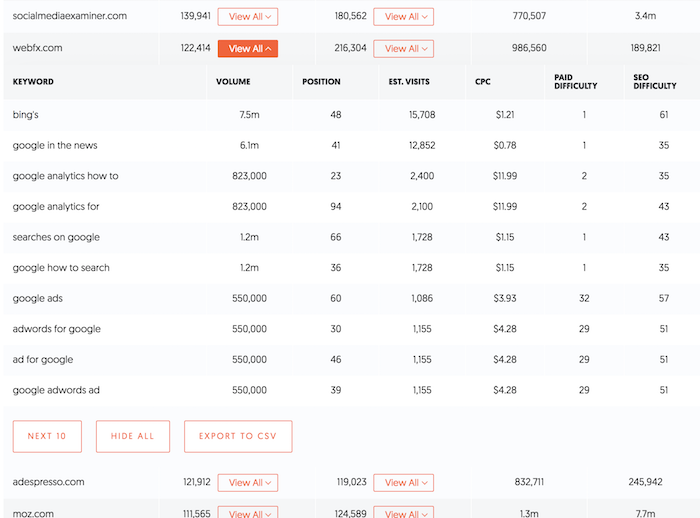

Within the table you can drill down on the common keywords. All you have to do is click the “view all” button under that table column and you’ll see something like this.

It breaks down the common keywords that both you and your competition are ranking for.

This is useful because it shows you which keywords you are focusing on that they may also be focusing on.

When drilling down on this table, pay attention to volume, position, estimated visits, and CPC.

Generally, you want to make sure you rank higher than your competition for keywords with high volume and high CPC. Ideally, they need both. That way you know a keyword can not only drive traffic but also sales.

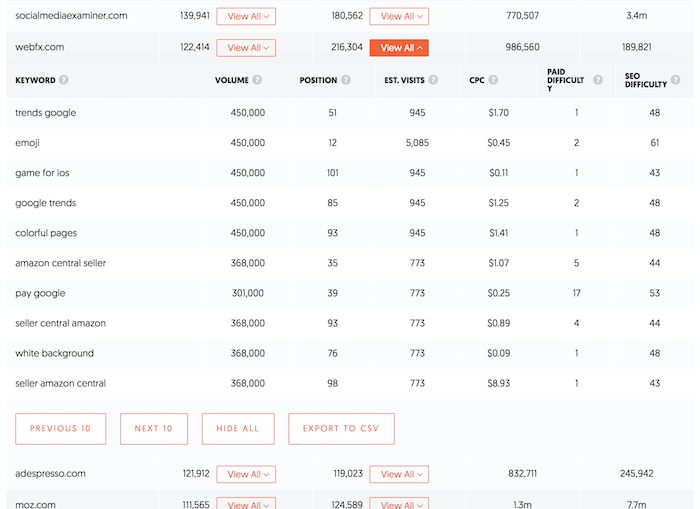

And my favorite part about this report is the keywords gap. This shows you the keywords that your competition ranks for that you don’t.

To see those keywords, you just have to click on “view all” and you’ll see a list.

Again, you’ll want to pay attention to the same metrics and you’ll want to look for keywords that have a high volume and high CPC.

It means those keywords drive traffic and typically drive conversions as well.

I highly recommend that you go through all of the keywords that each of your competitors rank for that you don’t.

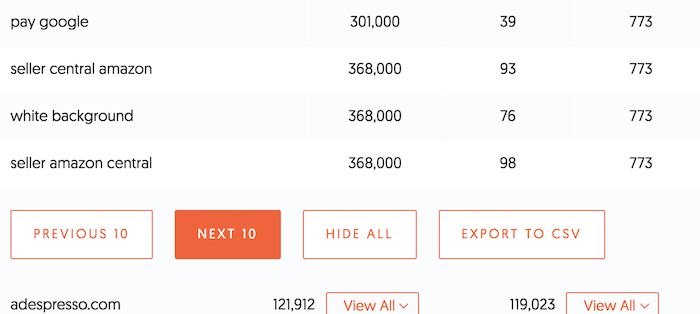

Within the table just keep clicking the “next 10” button to keep seeing more keywords.

Or you can just click “export to CSV” if you want to download all of the keywords.

Now head to Ubersuggest and give it a try to find more keyword opportunities.

Well, hopefully you’ll start using the Competitors report because it will give you more keywords.

But over the next few months you’ll see some big changes that will make all of the reports more useful.

You’ll see big improvements in the accuracy of our data by the end of the year if not in January, worst-case scenario.

We are already starting to slowly roll out the changes over the next few weeks and it will continue until the end of January.

And after that we even have a few cool new features coming out that you haven’t seen on any competing tools yet, which will help you get more SEO traffic faster. 😉

So, what are you waiting for? Go give Ubersuggest a try.

What do you think about the new feature?

The post Ubersuggest 8.0: The Ultimate Competitor Analysis Tool appeared first on Neil Patel.

Want to learn how to get approved for a business credit card?

We researched a ton of company credit cards for you. So, here are our preferences.

Per the SBA, small business credit card limits are a whopping 10 – 100 times that of consumer credit cards!

This demonstrates you can get a lot more cash with small business credit. And it also shows you can have personal credit cards at retail stores. So, you would now have an extra card at the same shops for your small business.

And you will not need collateral, cash flow, or financials to get company credit. But you do need to be fundable.

The best way to get approved for a business credit card is to build fundability. But what does it mean to be fundable?

Fundable: of or capable of being funded; deserving of being funded. Fundable also suggests – able to be funded by a lending institution or a credit issuer.

Lenders and credit providers want to see if your corporation is a good credit risk. Firms which are fronting your business cash, they wish to know that you can pay them back. They want to be sure you’re not committing fraud. It all starts with your industry.

Some industries are believed to be high risk or restricted. These industries, by definition, are going to have a more difficult time getting financing of any kind. There may be high risks of injury at work. Or the industry might engage in a lot of cash transactions.

This is the idea of congruency, and it turns up repeatedly. Business credit reporting bureaus and lenders will analyze your corporation carefully. Among the major ways they do this is by strictly looking for matching records.

Because of this, if your records do not all match, it will show up as if they are missing. Missing records will trigger a rejection, as a loan provider will assume fraud on its face.

Therefore, it is crucial to make sure that every record, anywhere, is identical.

Copy/paste this info; do not chance it with retyping.

Including a risky business type in your corporate name will cause funding rejections. Listed corporate ownership must be the same any place you list it. It is best practices to keep a record of every place where your corporation has a listing.

A business needs a professional-looking site. And it must have site hosting from a provider like GoDaddy. Do not use Weebly or Wix. It needs to be your domain, not domain.wix.com. Use Upwork to employ people who can help you get set up. Get a professional logo from Fiverr.

A business address must be a real brick and mortar building. It must be a deliverable physical address. This can never be a home address or a PO Box. Do not use UPS mailing addresses.

Never use a home address on your application.

Your corporation must have its own phone number. Do not give a personal cell or residential phone as a business telephone number. But VOIP (voice over internet protocol) is fine.

Also, your corporate telephone number must be toll-free. This is 800 exchange or such.

You must list your company phone number on 411. You can do so on http://www.listyourself.net. Your phone number has to have a 411 listing for most credit issuers, lenders, vendors, and even insurance companies to approve you. Check your record to see if you’re listed. Make sure your information is accurate.

Incorporation date, the business license issue date, and the date you opened your business bank account all matter.

You need a business bank account, to keep funds separate from personal accounts. Keep a good, positive balance and avoid NSFs.

This defines issues of liability, and it makes a difference when it comes to taxes. The best business entity for fundability is a corporation.

Corporations are legally distinct from their owners. Whether you pick a C-corporation, an S-corporation, or an LLC is your choice.

A sole proprietorship means the business owner is it when it pertains to liability and tax obligations. Nobody else is responsible. Incorporating fixes this.

Any complete company name must include any recorded DBA filing you use. This necessary for document congruency.

But no matter what, if you run a small business as a sole proprietor, the best thing to do is to incorporate. If you have already filed a DBA, you will still need to move onto a corporate business entity. You ought to only look at a DBA as an interim step on the way to incorporation.

Check with your Secretary of State to guarantee they have all the needed details for your business. Make certain that you are in good standing with them, and that your entity is active. You must submit annual reports and pay a fee each year to stay active.

Go to the IRS website and get a free EIN for your business. This is also where you choose a business entity like corporation, LLC, etc. To open a business bank account, and file business taxes, you need an EIN, so get this out of the way first.

Corporate e-mail addresses must be professional. This means something like admin@yoursite or info@yoursite. Your business e-mail must be on the exact same domain as your business. Do not use generic free email services likes Gmail, yahoo, or msn.

A corporation must have all of the licenses necessary for running. These licenses all must be in the perfect, accurate name of the business. And they must have the same corporate address and telephone numbers.

This means not only state licenses, but potentially also city licenses. Check with your Secretary of State’s office.

The biggest and best-known business credit reporting agencies (also called CRAs or bureaus) are D&B, Experian, and Equifax.

These companies collect data and offer it to the business CRAs.

CreditSafe provides alternative credit, where they base some of their scoring on utility and rent payments. These payments are typically not considered by other CRAs unless they’re late. CreditSafe reports these payments whether positive or negative. Third-party payments like Credit Suite, CRM, and software can be included.

LexisNexis is where a number of lenders get their info from. They furnish info on likelihood to pay, or not. If the application and LexisNexis do not match, then loan providers will deny you funding. They will see the disparity as fraud.

The SBFE collects data on small businesses from its members, which are lending institutions. Lenders use this information to make credit decisions.

FICO uses its SBSS (Small Business Scoring Service) Score to combine consumer bureau, monetary, application, and business bureau information.

Business credit providers and the SBA use the FICO SBSS score as a tool to decide whether they should authorize a loan to your business.

CRAs use identification numbers to designate your business.

Experian’s BizSource assigns a BIN (Business Identification Number).

Begin at the D&B website and get a free D-U-N-S number. If there is no D-U-N-S number, then there is no record and no PAYDEX score. Your D-U-N-S plus three payment experiences gets you a PAYDEX score.

Your company credit history is the single most important driver of your business credit scores. In turn, this influences fundability profoundly.

Late repayments will impact your business credit score for years. If you pay your business financial obligations off, as swiftly as possible and as completely as possible, you can make a very real difference in your credit scores.

If the business owner has poor personal credit, lenders will typically secure a UCC blanket lien if they give your company a loan.

This is a note on your credit report. It says the financial institution has an interest in all your corporation’s assets till you pay off the loan in full. Therefore, there may be dire consequences if you default.

UCC filings are a matter of public record. Lenders and credit providers take them into consideration when determining if your business is fundable.

These are all a matter of public record, and they can all negatively impact fundability.

Together with UCC blanket liens are any other liens against your corporate assets. A lien is a credit provider’s right to retain possession of property belonging to until the debt owned by that person or business is discharged.

A lien isn’t quite the same thing as collateral – it’s the property which is subject to the lien is the collateral.

These come from credit issuers which give you starter credit when you have none. Terms are usually Net 30, versus revolving.

The more trade accounts, the better. But in general, a few high credit limit accounts do more to enhance business fundability than a large number of very low credit limit accounts.

By getting trade credit ASAP, your trade accounts are as aged as they can be.

Opening and responsibly using business credit accounts can help you increase your available credit and boost your credit rating. The key is to use your credit.

Closing accounts has a direct impact on overall credit history. If a card is closed and is in good standing, it will fall off a credit report at some point. And once it’s gone, the history which accompanied it is gone, too.

By closing accounts, you are tanking the average age of your accounts. It’s a part of fundability over which you have control – simply use your credit and pay it back quickly. In this way, your providers will not feel the need to close accounts for non-use.

Congruency is a requirement in your business CRA records, as in all other areas.

Financial statements include business tax returns. It’s best if these are prepared by an accountant or an accounting company, or at least audited by them.

Tax returns should be complete and up to date. Reported income and expenses should be commensurate with those anticipated from a corporation of your size, age, and industry.

In particular for newer businesses, credit issuers and lenders will want to see personal financials. This includes taxes and reported income and expenses. Banks will even look at child support and criminal records.

Just like there are business credit reporting agencies, there are CRAs for personal credit. In addition to reporting on business credit, Experian and Equifax also report on personal credit. TransUnion only reports on personal credit.

There are companies which collect data and provide it to the personal credit reporting agencies. Some banks and other credit issuers use ChexSystems to get more information on your personal credit habits. They also report on insufficient funds, closed accounts, and overdrafts.

Lenders use LexisNexis information to cross-check loan applications. Your FICO score comes from your payment history, amounts of owed, length of credit history, credit mix, and new credit.

Much like your business credit history matters for calculating fundability, so does personal credit history. Data points like accounts over limit, authorized users, and short sales loom large.

Lenders are looking at settled debt, foreclosures and late payments. They are checking opened accounts and history length. They want to see if there are any bankruptcies in your past.

More than two recent inquiries will be seen as proof of credit shopping. Credit Utilization Rate also matters. Credit Utilization Rate is credit in use, divided by total available credit. Keep this ratio at about 30% or less. Experian checks utilization rate both overall and per credit card.

Even the process of applying can have an impact on your fundability. This includes time, negotiations, and whether your application is being made in person. Choosing a lender familiar with your industry makes a positive difference.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Keep all records consistent to ensure fundability. Set up your business legitimately, with a domain, phone numbers, an address, and more. Get all ID numbers and register with the IRS. Set up your business bank account for fundability. Keep all business financials organized and have them prepared by a competent professional. Get your personal credit ‘house’ in order.

Being fundable means your business can get financing from a credit provider or lender.

Take a look at the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the initial 12 months. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on day to day company purchases like office supplies or client dinners for the initial $50,000 spent each year. Get 1 point per dollar afterwards.

You will need good to outstanding credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also take a look at the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. Yet its rewards are in cash as opposed to points.

Get 2% cash back on all qualified purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the initial one year. After that, the APR is a variable 14.74 – 20.74%.

You will need great to outstanding credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Consider the IHG ® Rewards Club Premier Credit Card. it earns hotel rewards worldwide. For each dollar spent at participating IHG hotels, earn 10 points. Earn two points per dollar spent at gas stations, grocery stores and restaurants.

Plus, all other purchases earn one point. New cardholders can get an 80,000-point sign-up bonus when they spend $2,000 in the first three months of account opening.

This card provides a free one-night hotel stay each year. Plus, there is a variety of benefits like travel and purchase coverage and an upgrade to Platinum Elite status with the IHG Rewards Club. The club offers complimentary room upgrades when available and guaranteed room availability.

The biggest issue is that the card does not have a zero percent APR introductory rate. And the standard APR is 17.99 – 24.99% variable. Also, the yearly fee is $89.

Get it here: https://creditcards.chase.com/a1/ihg/premiernaep

This credit card earns six points/dollar spent at participating Marriott and SPG hotels. And get two points/dollar on all other purchases.

Spend $3,000 in the initial three months from account opening and get two free night awards (each has a value of up to 35,000 points).

Cardholders get access to perks including a free one-night stay each year after account anniversary. Also get travel and purchase protection. So, this includes free standard in-room Wi-Fi and priority late checkout.

Perks include baggage delay reimbursement, and lost luggage reimbursement. There is also trip delay reimbursement. And there is purchase protection. Plus, there are concierge service and automatic Silver Elite status, which includes a 20% bonus on points.

Spend $35,000 each account year and get an upgrade to Gold Elite status. So, that includes a complimentary room upgrade, free daily breakfast and 4 PM late checkout.

There is an annual fee of $95. The APR is a 17.99– 24.99% variable.

Get it here: https://creditcards.chase.com/marriott/apply

Look at the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based on the Prime Rate.

You can get 5% cash back at different places every quarter. So, these are establishments like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. Plus, automatically earn unlimited 1% cash back on all other purchases.

You will get an unlimited dollar-for-dollar match of all the cash back you have gotten at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Be sure to look at the Discover it® Student Cash Back card. It has no annual fee. The card also has a six-month introductory period of 0% APR on purchases. And there is an APR of 14.99 – 23.99% variable on all purchases after that period.

One one-of-a-kind feature is that it offers an incentive for scholars to maintain good grades with a $20 statement credit. If scholars earn a GPA of 3.0 or better each school year, the card will award the $20 statement credit every year for up to five years.

Use this credit card to build personal credit. While this is a personal card versus a company credit card, for new credit users, their FICO scores will matter. And this credit card provides an outstanding way to raise FICO while also getting rewards. Better personal credit can also, often, be the key to unlocking online lending.

You can get 5% cash back at different places each quarter like grocery stores, gas stations, restaurants or Amazon.com up to the quarterly maximum. After that, this credit card offers unlimited 1% cash back on all purchases.

In the first year, all cash back rewards are matched 100%.

Downsides include a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is more. And although they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Look at the SimplyCash Plus Business Credit Card from American Express. There is a $0 yearly fee. And there is a 0% APR on purchases. So this is for the first 15 months an account is open.

But when the introductory period ends, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

This credit card has several benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, get 5% cash back at US office supply stores and on wireless phone services. So, these must be purchased from US providers. But this pertains to the initial $50,000 of annual spending. Then, you earn 1% cash back.

You also earn 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of annual spending. Then, you earn 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this credit card for balance transfers. There is a foreign transaction fee of 2.7%. The credit card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it applies if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Check out the Capital One® Quicksilver® Card. It offers flat-rate rewards of 1.5% on all purchases. There are no limits to the amount of cash back rewards that cardholders can earn. Also, the card has a $0 annual fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. And after that they have a 14.74 – 24.74% (variable) APR after that.

A cash bonus of $150 is on offer for those who make at the very least $500 in purchases in 3 months of account opening.

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

This credit card also offers travel accident insurance. And you get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And the higher APR after the first 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Check out the Ink Business Unlimited℠ Credit Card. Past no annual fee, get an introductory 0% APR for the initial twelve months. After that, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your business. And get $500 bonus cash back after spending $3,000 in the initial 3 months from account opening. You can redeem your rewards for cash back, gift cards, travel and more using Chase Ultimate Rewards®. You will need exceptional credit to qualify for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Take a look at the Brex Card for Startups. It has no annual fee.

You will not need to provide your Social Security number to apply. And you will not need to provide a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Additionally, there are some industries they will not work with, as well as others where they want more paperwork. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a corporation’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have poor credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Check out the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can get unlimited 1% cash back on every purchase for your business, without minimum to redeem.

While this card is within reach if you have average credit scores, beware of the APR. But if you can pay in a timely manner, and completely, then it’s a good deal.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Take a look at the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which after that rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is wonderful for travel if your costs do not fall under basic bonus categories. You can get unlimited double miles on all purchases, without limits. Get 5x miles on rental cars and hotels if you book with Capital One Travel.

Get an introductory bonus of 50,000 miles. That’s the same as $500 in travel. However you only get it if you spend $4,500 in the initial 3 months from account opening. There is no foreign transaction fee. You will need a good to superb FICO score to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

For a wonderful sign-up offer and bonus categories, have a look at the Ink Business Preferred℠ Credit Card.

Pay a yearly fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the first 3 months after account opening. This works out to $1,250 toward travel rewards if you redeem via Chase Ultimate Rewards.

Get 3 points per dollar of the initial $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel with Chase Ultimate Rewards. You will need a great to excellent FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

For no yearly fee while still getting travel rewards, check out this card from Bank of America. It has no yearly fee and a 0% introductory APR for purchases during the first nine billing cycles. After that, its regular APR is 13.74 – 23.74% variable.

You can get 30,000 bonus points when you make a minimum of $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Earn unlimited 1.5 points for each $1 you spend on all purchases, everywhere, every time. And this is no matter how much you spend.

Likewise earn 3 points per every dollar spent when you reserve your travel (car, hotel, airline) through the Bank of America® Travel Center. There is no limit to the number of points you can earn and points don’t expire.

You will need outstanding credit scores to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Have a look at the Marriott Bonvoy Business™ Card from American Express. It has an annual fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need good to outstanding credit to get this card.

You can get 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the first three months. Get 6x the points for qualified purchases at participating Marriott Bonvoy hotels. You can get 4x the points at US restaurants and gasoline stations. And you can get 4x the points on wireless telephone services purchased straight from US service providers and on US purchases for shipping.

Get double points on all other qualified purchases.

Plus, you get a free night each year after your card anniversary. And you can earn an additional free night after you spend $60,000 on your card in a calendar year.

You get Marriott Bonvoy Silver Elite status with your Card. Also, spend $35,000 on eligible purchases in a calendar year and earn an upgrade to Marriott Bonvoy Gold Elite status through the end of the following calendar year.

Plus, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Have a look at the Capital One® Spark® Cash for Business. It has an introductory $0 annual fee for the initial year. Afterwards, this card costs $95 annually. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the initial three months from account opening. Get unlimited 2% cash back. Redeem any time without any minimums.

You will need good to exceptional credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Check out the Discover it® Business Card. It has no yearly fee. There is an introductory APR of 0% on purchases for year. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimal spend requirement.

You can download transactions| easily to Quicken, QuickBooks, and Excel. Note: you will need good to superb credit scores to receive this card.

https://www.discover.com/credit-cards/business/

Check out the Ink Business Cash℠ Credit Card. It has no yearly fee. There is a 0% introductory APR for the initial 12 months. After that, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the first three months from account opening.

You can get 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on net, cable and phone services each account anniversary year.

Get 2% cash back on the initial $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Get 1% cash back on all other purchases. There is no limitation to the amount you can get.

You will need outstanding credit to get this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Check out the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the first 9 billing cycles of the account. After that, the APR is 13.74% – 23.74% variable. There is no yearly fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gasoline stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Get 2% cash back on dining. So this is for the first $50,000 in combined choice category/dining purchases each calendar year. After that earn 1% after, with no limits.

You will need exceptional credit scores to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Take a look at the Capital One® Spark® Cash Select for Business. It has no yearly fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. Also earn a one-time $200 cash bonus as soon as you spend $3,000 on purchases in the initial 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR after that.

You will need great to superb credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Your outright best business credit cards hinge on your credit history and scores.

Only you can select which features you want and need. So, make sure to do your homework. What is outstanding for you could be disastrous for other people.

And, as always, be sure to build credit in the recommended order for the best, speediest benefits.

The post How to Get Approved for a Business Credit Card appeared first on Credit Suite.