The post Amy Coney Barrett Should Refuse to Recuse appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND. The post Amy Coney Barrett Should Refuse to Recuse appeared first on Buy It At A Bargain – Deals And Reviews.

Tag: Should

Trump Takes Zinc. Maybe You Should Too

Research suggests the mineral bolsters the immune system against Covid and other diseases.

The post Trump Takes Zinc. Maybe You Should Too appeared first on ROI Credit Builders.

Here’s What You Should Do When Your Search Rankings Drop

If you’ve ever done SEO, you know how good it feels to see your rankings go up.

You put a ton of hard work into moving up in the SERPs and it finally pays off.

But then the unexpected happens. Your rankings drop.

Few things in SEO are more discouraging than a fall in the rankings. It makes you feel like everything you did was useless.

You wonder what went wrong or if you made a mistake. You beat yourself up for not doing it right.

You’re back to square one again, and you have to start all over.

Or do you?

In my experience, that’s not always the case.

My rankings have dropped more times than I can count. At first, I panicked.

As I learned more, I found out that it’s not the end of the world if you go down a position or two. It’s obviously not ideal, but there’s a lot you can do to fix it.

That’s what I’m going to show you today. Even if your rankings are where you want them to be, you need to be aware of how to bring them back up when they drop (because they will).

Analyze the drop

Before you take action to raise your rankings, you need to track your rankings, ideally on a daily basis so you can see if they are increasing or decreasing.

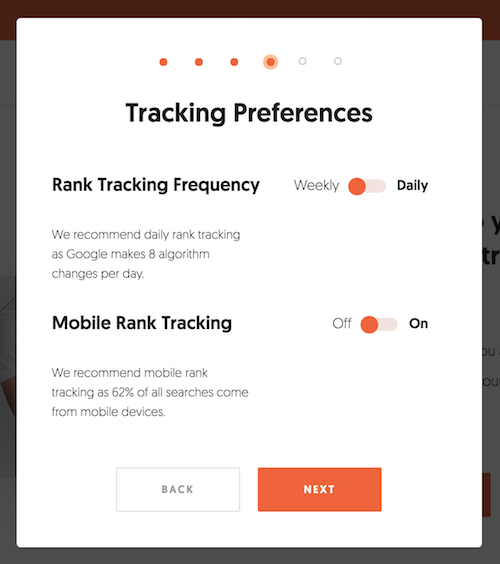

The reason you want to track your rankings on a daily basis is that Google makes 3200 algorithm changes per year, which is a bit more than 8 algorithm changes per day.

Hence you don’t really have a choice but to track your rankings daily.

So how do you do that?

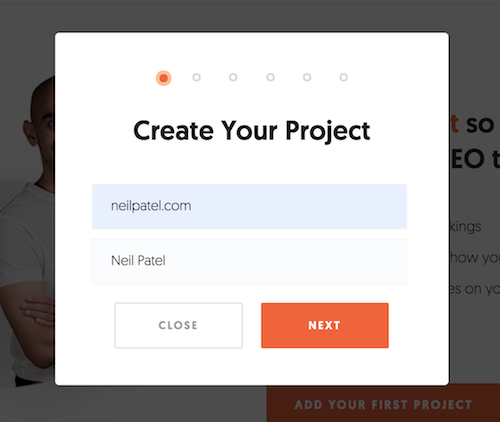

First, you’ll want to head to the Ubersuggest dashboard and click on “Add Your First Project”.

It’s as simple as adding in your URL.

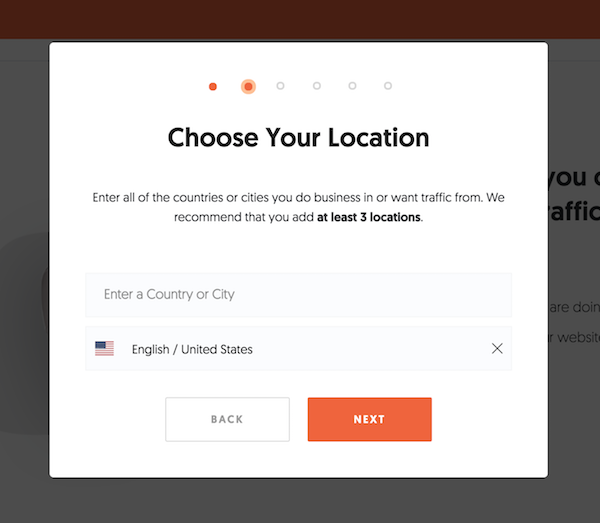

Then select the locations you do business in and want traffic from.

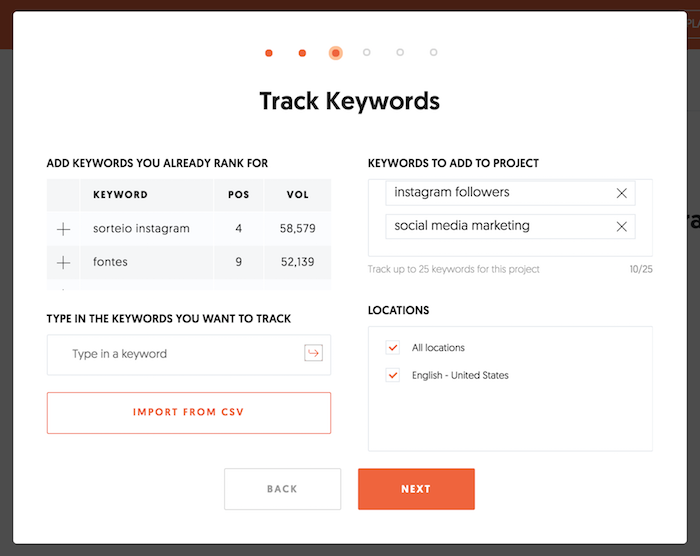

Then add in the keywords you currently rank for or want to go after.

And of course, set up your traffic preferences. Make sure you select “daily” rank tracking and you turn on mobile rank tracking.

And then you’ll be good to go.

Then you will be notified via email when your rankings go down (or up) as there is no way you are going to have the time to manually check every day.

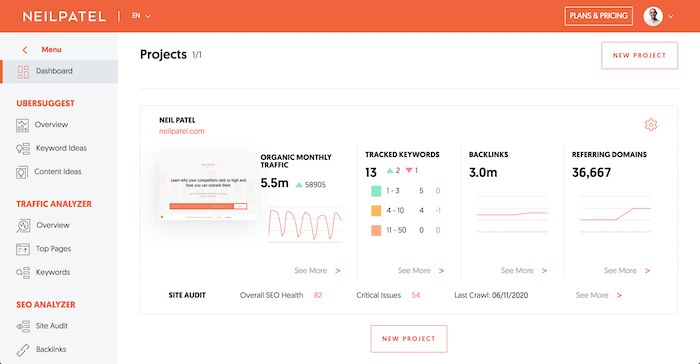

Or when you log into your Ubersuggest dashboard you’ll see an updated view of your site:

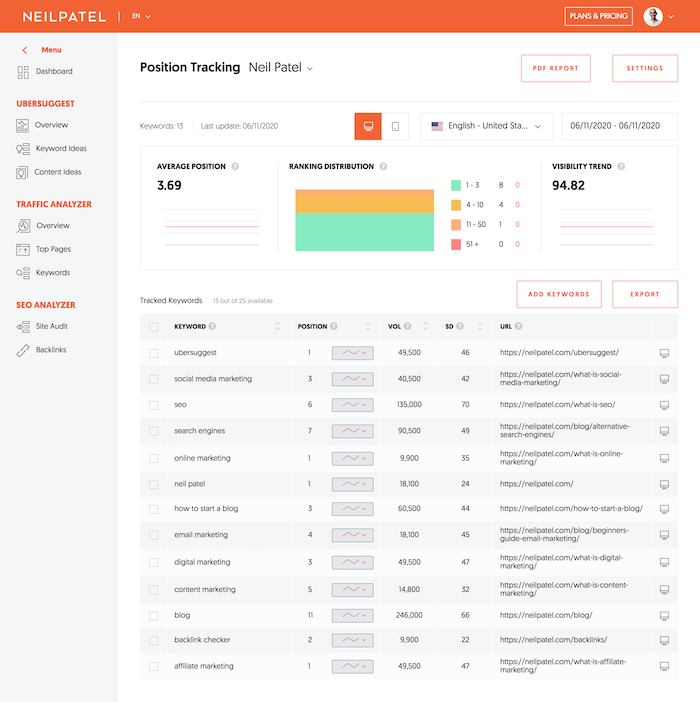

And then when you drill down into your rankings you’ll see a report of what is increasing or decreasing.

Now when looking at your rankings it is normal for them to fluctuate a few spots here or there… but if you see all of your rankings all of a sudden drop, then you know you need to do something.

Did you get penalized?

In most cases, your site has not been penalized and you don’t need to worry about this.

If you didn’t do anything fishy like “buying links” you don’t really need to worry about a penalty.

If you are unsure, read through this list and ask yourself if your site is guilty of any of these SEO sins. If so, identify the problems and take steps to fix them.

Even if you haven’t done anything on that list, you could still have gotten a penalty. Google’s algorithms are updated frequently, and they’re incredibly complex.

They take hundreds of factors into account when considering ranking. One day, your site might not deserve a penalty, and the next, it might.

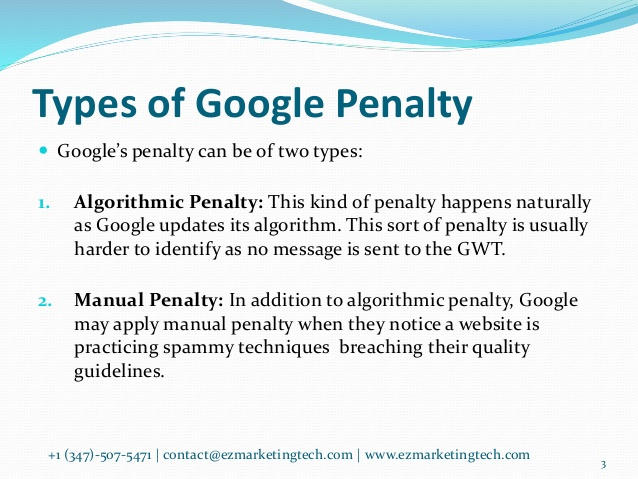

It’s important to understand the types of penalties: manual and algorithmic.

Source: Slideshare.net

Manual penalties are given out by Google’s webspam team when they get alerted of suspicious activity.

This could be the result of having unnatural links, or someone could have filed a spam report against you.

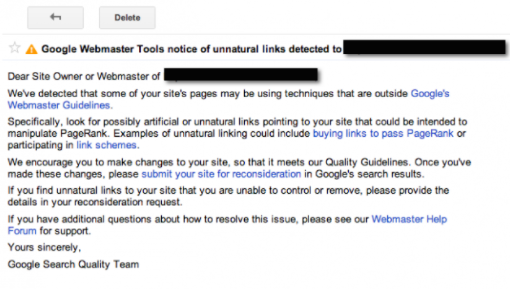

If you’ve received a manual penalty, you should have gotten a notification in Google Webmaster Tools. Here’s an example of a message about unnatural links:

The other type of penalty is an algorithmic penalty.

These penalties are harder to track because there’s no definitive way of knowing you received one.

To determine if you’ve gotten an algorithmic penalty, you have to understand how Google’s algorithms work.

If you find that you’re doing something an algorithm doesn’t like, there’s a good chance you’ve gotten a penalty. But you also have to think about new penalties.

If your rankings dropped randomly, check Moz’s handy directory of Google’s algorithm updates to see if there’s a new one at work.

A new algorithm could be the reason why you’re seeing lower rankings. If that happens, research the algorithm and find out what it’s penalizing.

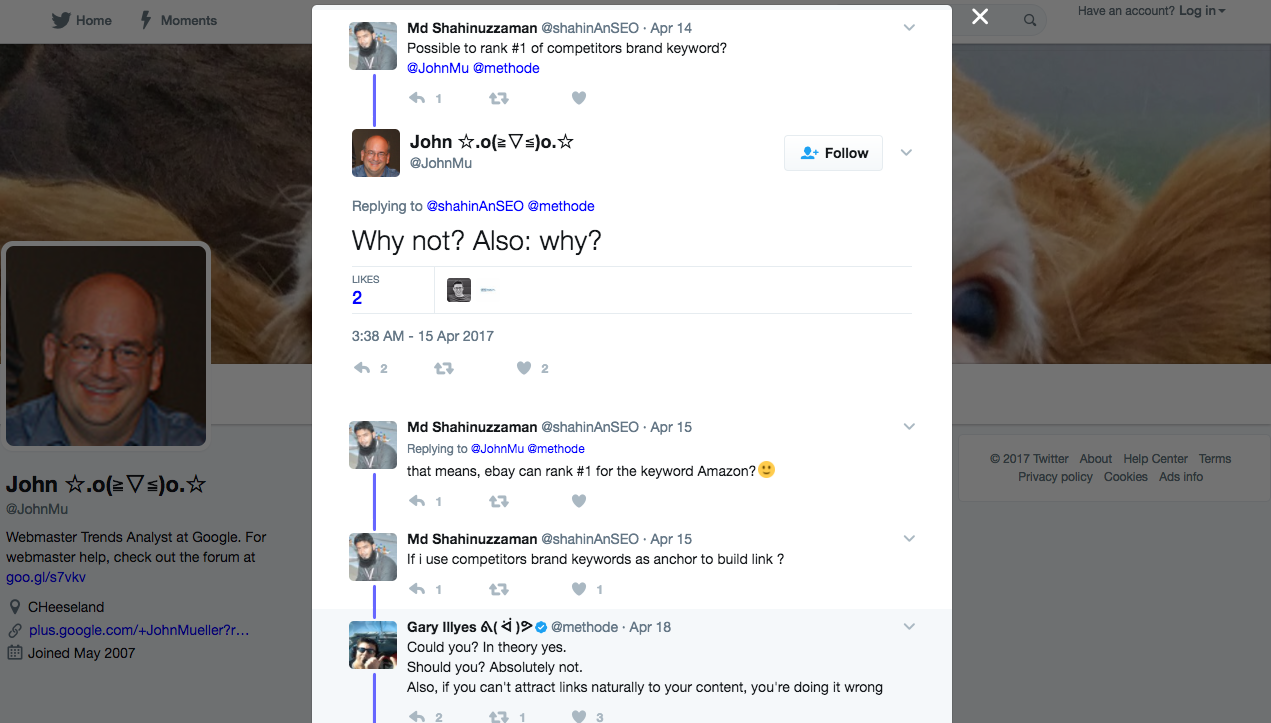

One cool way to keep track of new penalties (and a bunch of other Google-related stuff) is to follow Gary Illyes, John Mueller, and Google Webmasters on Twitter.

Gary and John, in particular, give out a ton of awesome advice, and you can often find them talking with other Twitter users.

You can even ask them a question directly and get it answered… you may not get a response, but it is worth a shot.

Do you have link problems?

This is a big one.

Think of links as the currency of SEO. It’s essentially how you “gain” authority.

So it’s no surprise that a strong link profile is correlated with high rankings.

The flipside is that a weak link profile is correlated with low rankings.

I spend lots of time working with clients on SEO, and I’ve seen lots of sites that have numerous link problems.

Usually, the business isn’t aware.

That’s because weak links are the silent killer of SEO. That’s why you need to make sure your link profile is robust.

First, conduct a link audit of your site. Here’s a step-by-step guide on how to do that.

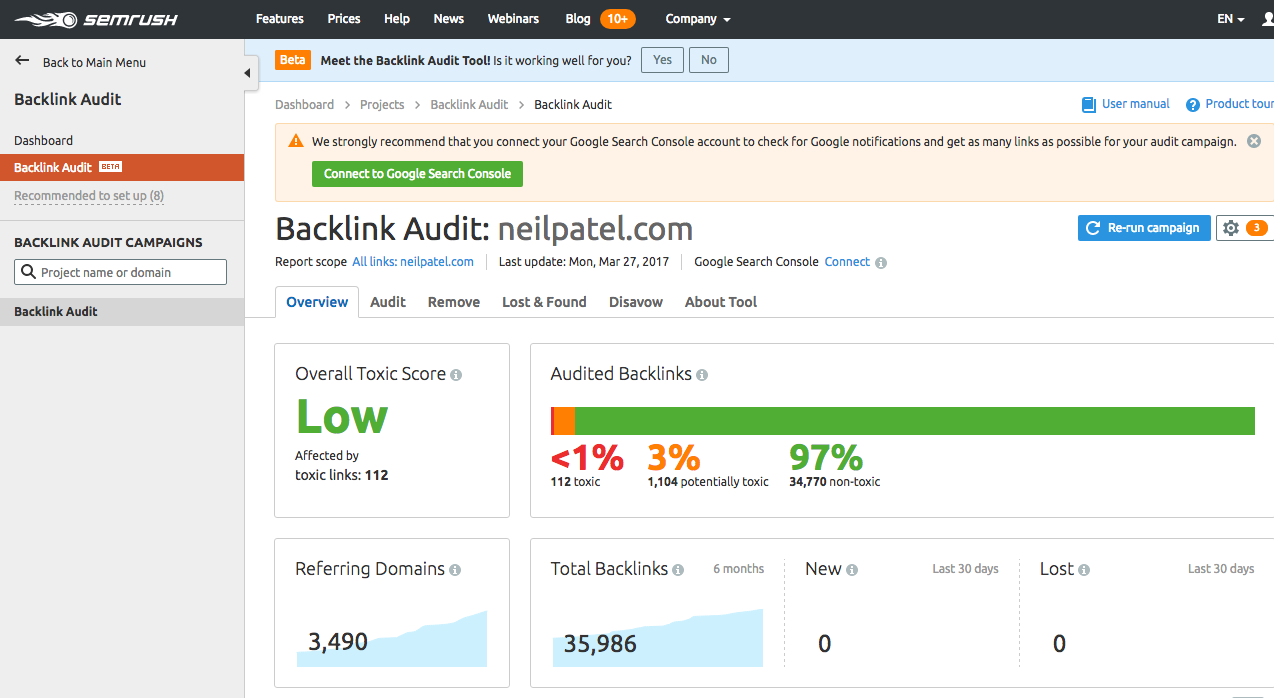

For the short version, use a backlink analysis tool like SEMrush Backlink Checker to see where your bad links are.

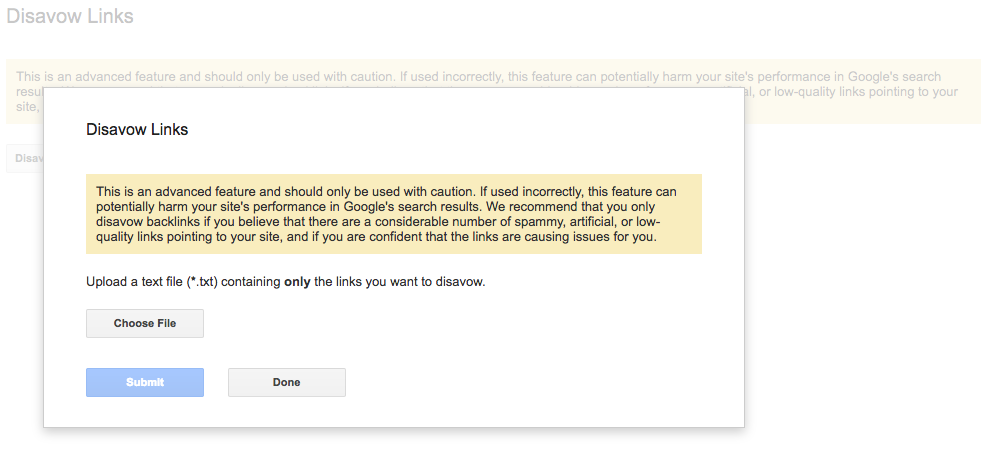

When you find bad links, contact those sites and nicely ask them to remove the link. If that doesn’t work, use Google’s Disavow tool as a last resort.

However, I’ve found that about 90% of the time, conducting a backlink audit will help you find bad links.

However, I’ve found that about 90% of the time, conducting a backlink audit will help you find bad links.

But there’s a problem here. Often, the reasons behind link problems aren’t so obvious.

If your link profile looks okay after an audit, there could still be problems. Here are a few of the issues your link profile could be facing.

Losing links

Did you know you can lose links? Both internal and external links?

It could be the cause of your ranking drop as well.

Yep, you can lose internal links even if it’s to content you already own.

Let’s talk about those first.

If you often relaunch, rebrand, or redesign your site, you may lose some links along the way.

Why does this happen?

It has to do with redirects and transitioning your site over smoothly.

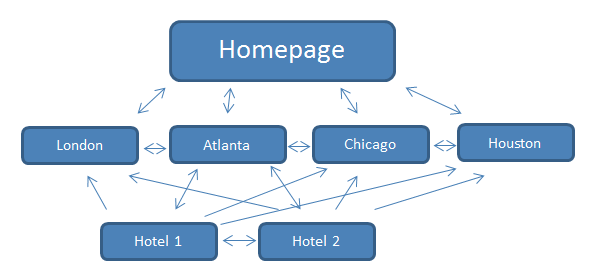

Let’s talk about site transitions first. If you deleted an old blog post, then links to that post aren’t going to work. In turn, this will weaken the internal linking structure of your site and compromise your SEO.

You’ll have one less link, which is removing a part of your internal linking network.

This isn’t optimal because it means two things:

- You’ll have to fix the link

- You’ll have less content on your site to link to. That’s why I recommend not deleting content unless you absolutely have to. You can always update it.

That’s just one example of a lost link.

Another reason you could lose an internal link is a faulty redirect.

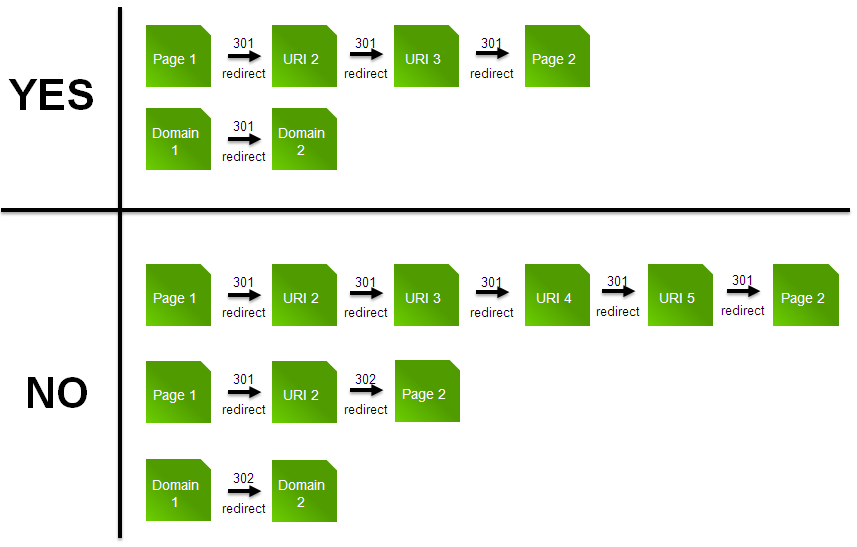

This often happens with 301 redirects. I’ve talked about 301s before, but there’s a unique issue you need to be aware of.

Because a 301 is called a permanent redirect, lots of people assume that the redirect will always work.

But it doesn’t.

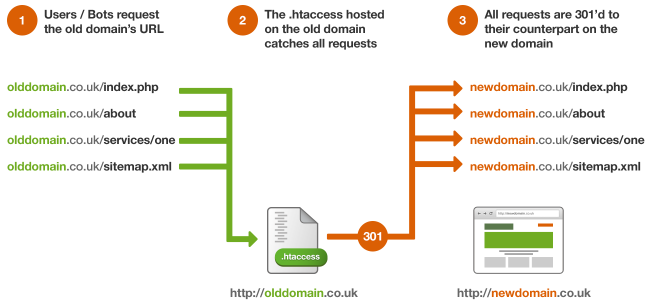

Here’s precisely how a 301 redirect works:

If you just set up a new site, you can 301 from the old domain to the new one without a hitch. The issue is when you revamp your site more than once.

That’s because redirects from older versions of a site are rarely passed on to newer ones.

On top of that, if you get a new domain and an older domain expires, it could cause a significant loss in traffic because the 301s will no longer work.

It’s messy.

If you discover a bad 301 giving you problems, you need to fix that.

First, you need to find the target links your 301s are trying to go to.

If those links are dead, you’ll most likely need to remove the link.

You could also put the old content back up or create new content to keep the link on your page. This is a good idea if the page in question gets a lot of traffic.

You need to do what’s best for your visitors. If they’ll miss out on great, comprehensive content, you should make sure that content is still on your site.

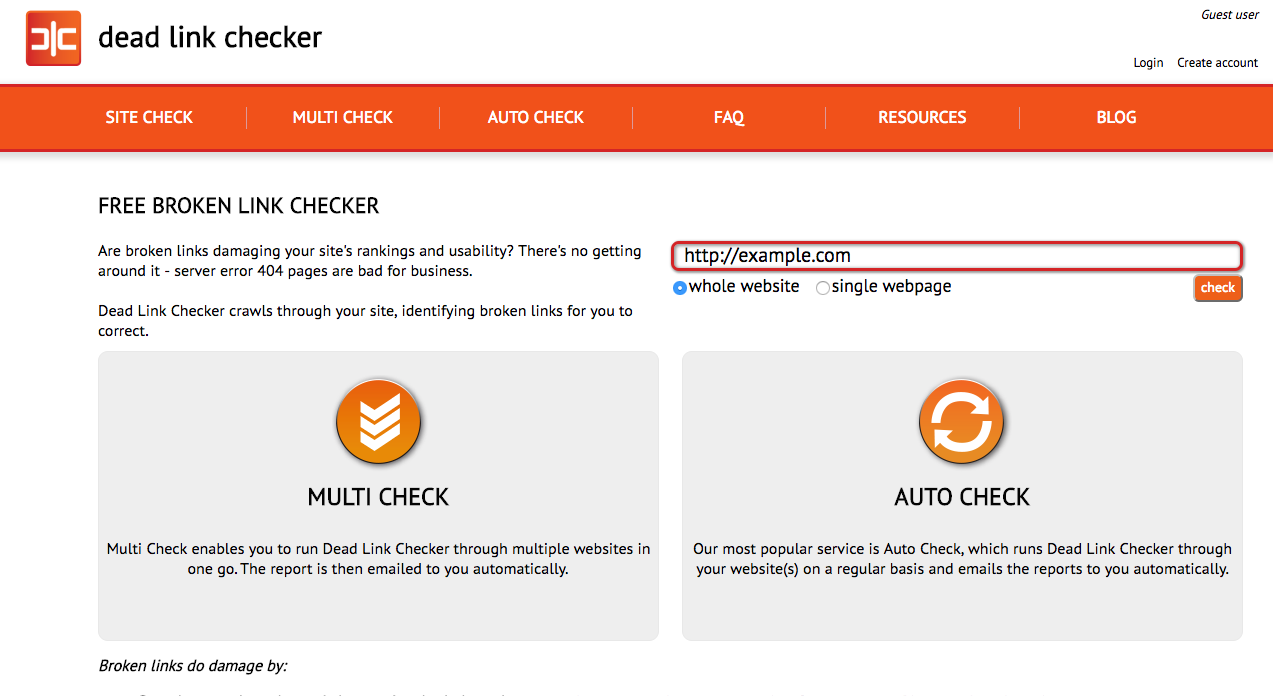

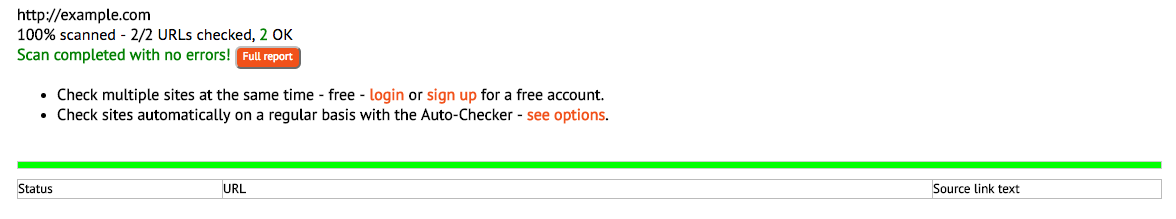

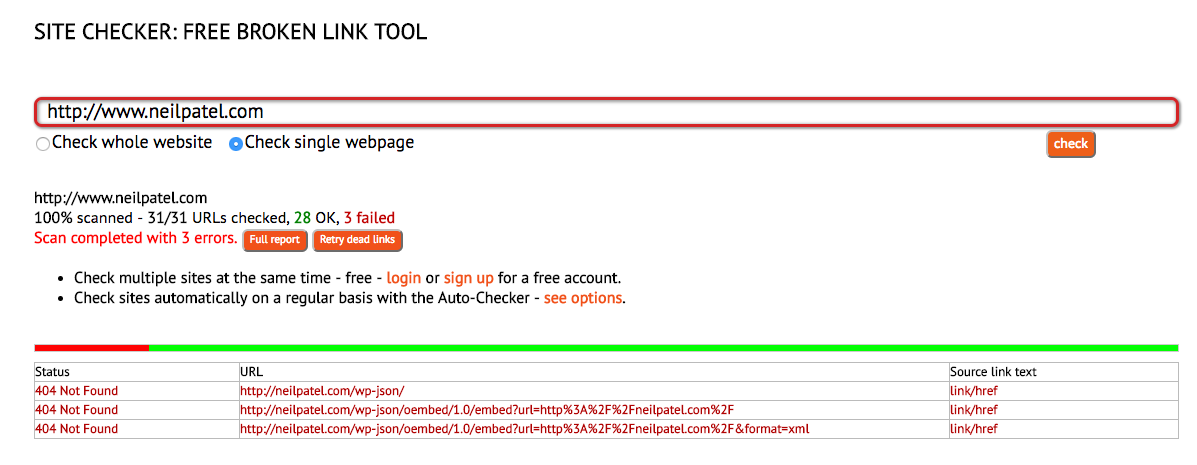

You should also check for broken links. You can use a tool like deadlinkchecker.com to do this:

Ideally, you want to see no errors:

But if you do see errors, you’ll be able to see the URLs that aren’t behaving correctly:

But what about outbound links? If you find an outbound link that no longer works, just remove it and replace it by linking to another authority site.

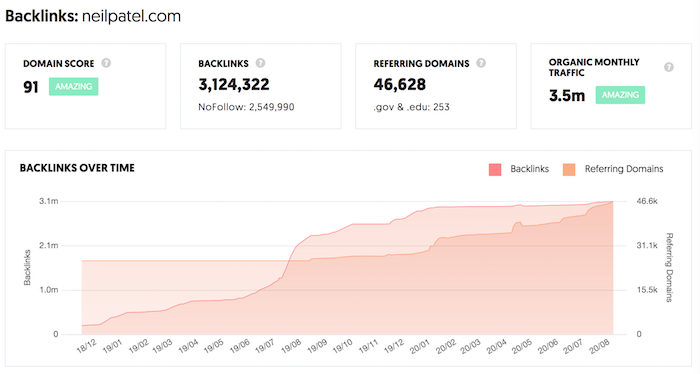

Finally, let’s talk about backlinks you’ve gotten from other sites.

Go here and type in your URL.

If you see your link chart going up and to the right, you are fine. If it is going down, then we have to fix it. For example, using Ubersuggest you can see which sites don’t link to your anymore.

And for those sites, you can use a template like this one to get those links back:

Hi [Name of site owner],

I hope you’re doing well!

You linked to my site a while back, and I want to thank you for that. However, it looks like the link is actually gone.

The link appeared in your [piece of content/page here], but it seems that it’s not there anymore.

Here’s the page on my site you linked to: [Link URL here]

If you could put the link back up, I’d really appreciate it. I’m a big fan of your site, and it’d be my pleasure to return the favor if I can.

Sincerely,

[Your name]

Most people will ignore you, but a percentage of the people you email will link back.

Polish up your site

If all else fails, you might need to spend some time improving your site.

I’m talking about design, user experience, and speed. Each of these is integral to a site that performs and ranks well.

I’ll go over each category briefly:

Design

Having a mobile-friendly design is important as there are more searches on mobile devices using Google than there are for desktop.

If you’re not considering mobile users first, you need to start doing that.

Having a mobile-optimized site isn’t as simple as making sure your site is responsive. That’s definitely important, and you should do that, but it’s not enough by itself.

Think about making all of your content mobile-friendly.

There’s one big reason you should focus on this. Google has a mobile-first index. That alone should be more than enough to persuade you to focus on mobile-first design.

You might want to read my article on mobile usability for more information on this.

User experience (UX)

This is another reason why a responsive design is so important.

Your mobile users should have a great experience that’s designed for mobile devices. Similarly, your desktop users should have a great experience that’s designed for desktops.

If your UX is bad either way, you will lose visitors.

If you take a look at the most popular sites in your niche, you’ll notice that 9 times out of 10, they’ll have great UX.

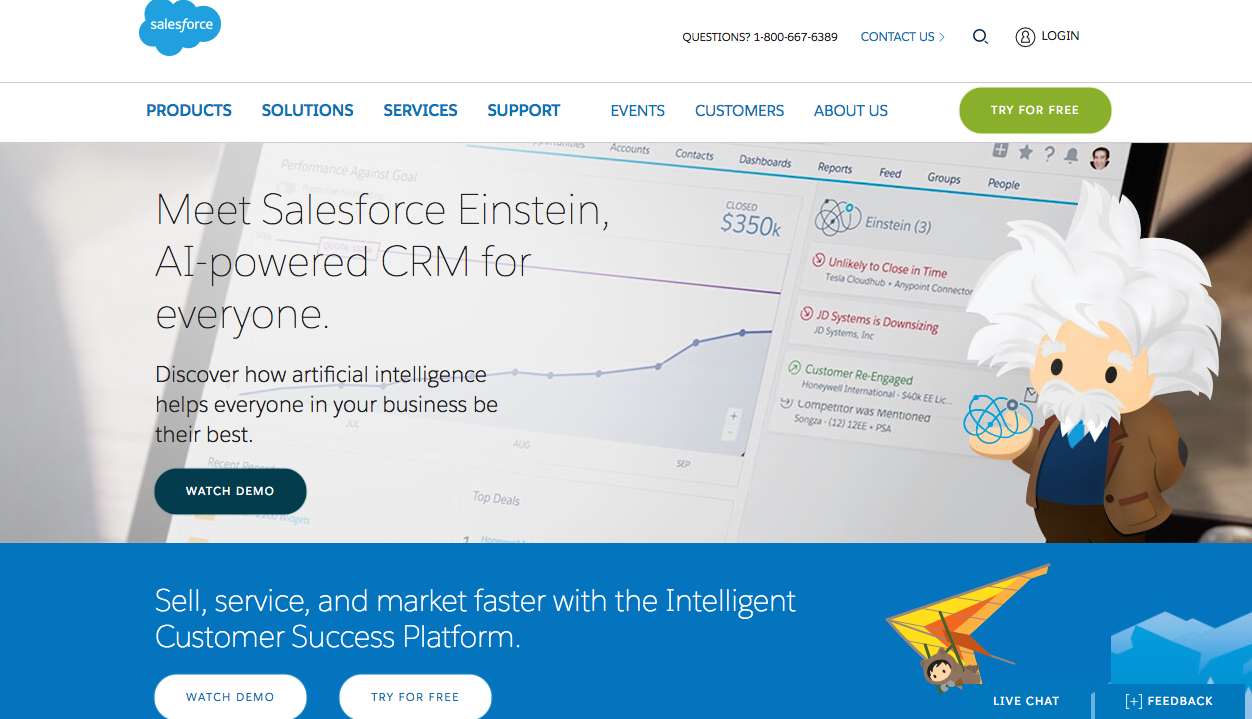

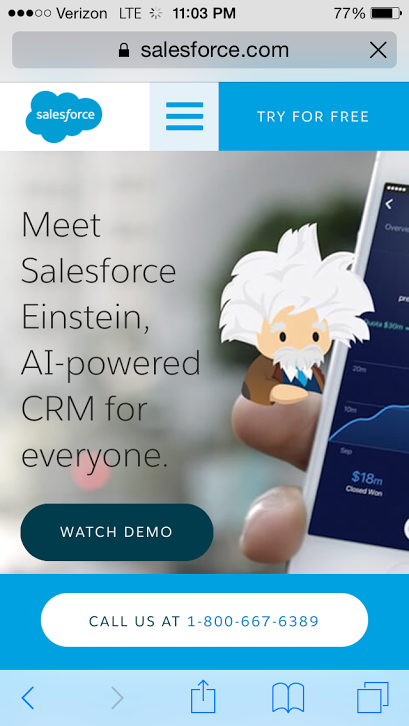

Say you’re in SaaS. Without a doubt, Salesforce is one of the biggest SaaS players in the niche.

And sure enough, their desktop and mobile UX is fantastic.

Desktop:

Mobile:

This is what you should strive for when polishing your own site.

Speed

Search engines (and people) love fast-loading pages. In fact, 47% of customers expect a page to load in 2 seconds or less.

So if your site speed is longer than 2 seconds, you could lose traffic.

Yikes.

Making your site faster is a long-term strategy. You have to monitor your site and make sure nothing’s dragging it down.

Start by adding compression.

Next, make sure your server has adequate speed. It should be no longer than 200 milliseconds.

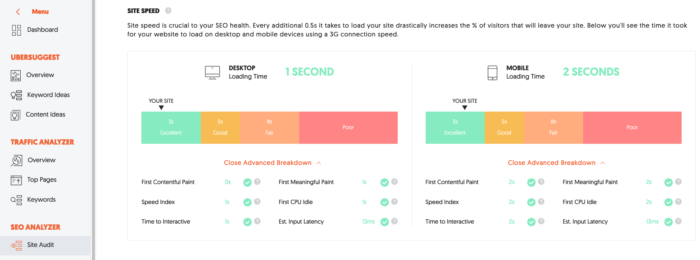

You can test your site speed by using Ubersuggest’s “Site Audit” feature. Type in your URL and click “Search.”

From there, click “Site Audit” in the left sidebar and scroll down to “Site Speed.” Here’s what you’ll see:

There are tons of factors that can cause slow site speed, so the best way to prevent slowness is to keep your site as lightweight as possible. And Ubersuggest will break down how to do that and what to fix.

As a rule of thumb, if you have anything unnecessary on your site, remove it so your speed is the best it can be.

Don’t forget about content

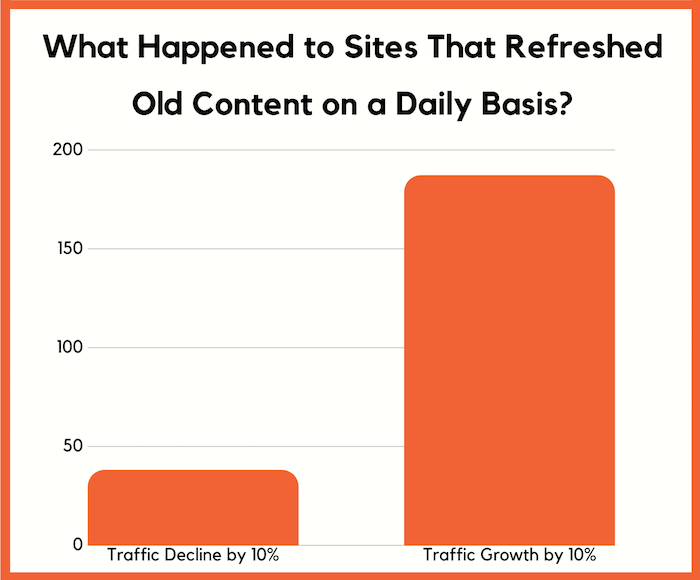

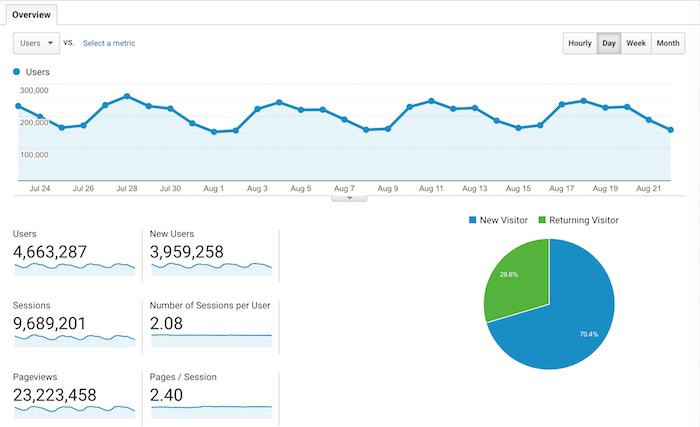

Through Ubersuggest we track millions of popular sites around the world to get better data insights on algorithm changes.

We know for certain that 641 sites we track are updating old content on a daily basis.

Can you guess how many of them saw a search traffic dip of 10% or more from the last algorithm update?

Only 38! That’s 5.92%, which is extremely low.

What’s crazy, though, is that 187 sites saw an increase in their search traffic of 10% or more.

So make sure you are keeping your old content up to date. Because why would Google want to rank old, stale content, when they can rank something fresh and useful for people?

Another strategy I love to deploy is to expand my content that is already ranking well.

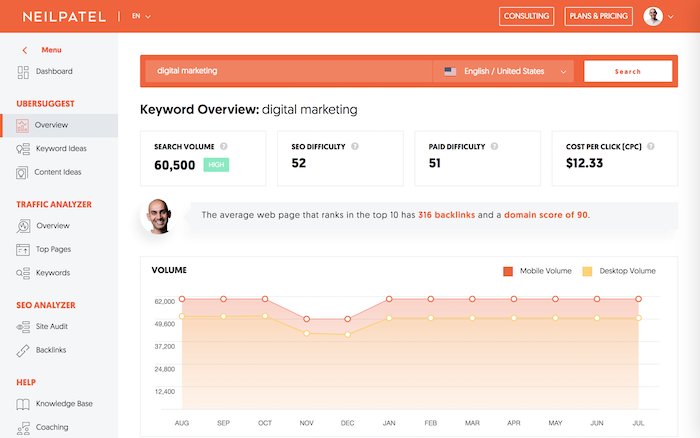

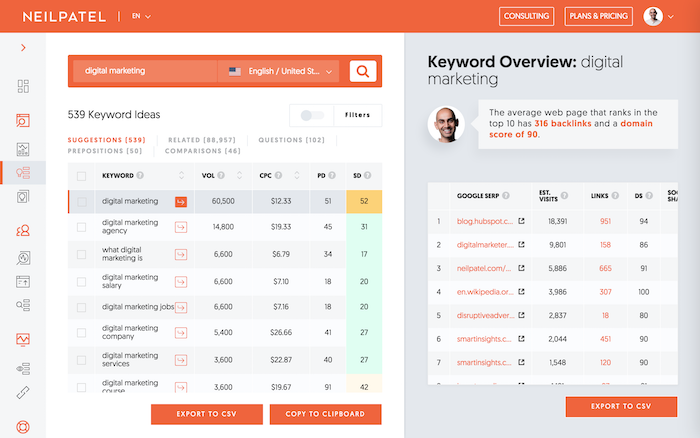

For example, lets say you rank for the term “digital marketing”.

You’ll want to head to Ubersuggest and type in the phrase “digital marketing”. You’ll see a report that looks like this:

From there in the left navigation bar, click on “keyword ideas”.

You should now see a report that looks like:

This will give you a list of keywords that are similar, longer tail terms that also are searched frequently.

If you rank for the main term, it is easy to also rank for the longer tail terms. So make sure you add the relevant ones to your content.

It may seem tedious, but go through 100s if not 1000s of keywords in the keyword ideas report as it will allow you to get quick traffic gains.

When adding in the new keywords into your content, don’t just stuff them in there. It has to flow naturally and make sense for your website visitor.

And if you can’t make it make sense for a particular keyword, don’t do it… put the user first. Remember you are writing for humans, not Google.

Now the strategy I broke down here may seem simple and silly, but it’s one of the big reasons on why I am getting roughly 9 million visitors a month.

Conclusion

Going down a position or two in the rankings happens to the best of us.

It’s even happened to me.

If this happens, don’t panic.

Almost every client I’ve had who’s experienced a loss of rankings got really scared when it happened.

You probably felt this way too. But you don’t need to worry.

You can easily bounce back from a ranking drop.

Don’t believe me? Give these strategies a try. These aren’t just little tips. They’re tried-and-true methods that will help you reclaim your spot on Google.

No one deserves to lose ranking when they have an amazing site that users love. What’s more, it’s easy to fix.

Don’t let the initial shock stop you from getting your ranking back.

So, when was the last time your rankings dropped?

The post Here’s What You Should Do When Your Search Rankings Drop appeared first on Neil Patel.

Crowdfunding Terms You Should Know in a Recession

Check Out These Crowdfunding Terms You Should Know in a Recession

Crowdfunding can seem to be a bit of a mystery. Why are people willing to part with their cash in this particular manner? There are a lot of crowdfunding terms you should know in a recession. They are thrown around all the time and they can sometimes get confusing. So consider this your primer on some basic crowdfunding terminology.

Because even if you do not think you will use this method of fundraising, you will probably encounter it all the same.

But before going any further, does crowdfunding ever actually, you know, work?

Crowdfunding Success, in a Nutshell

For some companies which crowdfund, the rewards are great. According to Crowdfunding Blog, the single most successful crowdfunding campaign was for the Pebble Time Smartwatch. And that was as of November of 2018. But before you run out and buy one, note that they are now a part of FitBit.

As in, they went out of business in July of 2018. And this is a business which raised over $20 million in 2015. That is no typo. And in point of fact, Pebble holds three of the top six spots in the biggest crowdfunding successes of all time. Together, these three crowdfunding campaigns took in a staggering $43.39 million. This is about $8 million more than the town of Huntington, New York (population 203,264) budgeted for highways in 2018.

Hence there is one thing that should be clear to all. Runaway crowdfunding success is no guarantee whatsoever of actual success.

But now it is time to get to the crowdfunding terms themselves.

Crowdfunding Terms You Should Know in a Recession: Project

A project is what you are asking for money for. Projects can take a few months or even years. The more complex your project, then (usually) the longer it will take. The person starting the project is generally called the project runner or the project creator.

Projects can be for goods or for services.

Crowdfunding Terms You Should Know in a Recession: Donors

The people who donate to the project are called donors. Or sometimes they are referred to as contributors or backers.

On rare occasions, they may even be called investors. However, such a word connotes a far different relationship. Many crowdfunding platforms shy away from such a term. And this is for good reason. It is because investors and investments may come under the purview of the SEC. The Securities and Exchange Commission exists in order to protect investors. This is in ways not current available to donors 0r other contributors to the success of businesses.

Hence, unless the crowdfunding platform is specifically for investing in companies, more like angel investing, you are not too terribly likely to see the investor.

Crowdfunding Terms You Should Know in a Recession: Campaign

The act of requesting money on a crowdfunding platform is called a campaign. This is the soup to nuts of crowdfunding. So it covers everything from the first pitch to the final collection or perk distribution.

Crowdfunding Terms You Should Know in a Recession: Donor Levels

In general, donor levels refer to the amount of rewards which are on offer for a particular size donation. Note: I will get to rewards in a moment. Your donor levels might look something like this:

- $10 fountain pen (100 available)

- $20 includes $10 level plus a tee shirt (50 available)

- $50 includes $20 level plus a framed picture (30 available)

- $100 includes $50 level plus dinner with the project runner (10 available)

- $500 includes all other perk levels plus a new car (2 available)

Donor levels are limited by your imagination and your capacity for handling complexity. After all, five separate donor levels mean you are keeping five separate lists. If you are well-organized, then this is possible. But it is not easy. Five separate donor levels are plenty, particularly for people running their first campaigns.

Truthfully, you will be a far happier person if you cut the number of donor levels to no more than three.

Of course, time and budget should be considerations for anyone. But that is not just the case for crowdfunding.

What frustrates you the most about funding your business in a recession? Tell us in the comments.

Crowdfunding Terms You Should Know in a Recession: Rewards (Also Known as Perks)

One basic about crowdfunding for creative projects is that you will need to provide incentives for your donors to open up their wallet. Crowdfunding to help someone with their medical expenses is a different animal. So let us get back to crowdfunding for business funds.

This is where perks come in.

Your rewards can be nearly anything. But it can quite literally pay to have them relate directly to your project.

For example, if you are crowdfunding to get enough money to back your new smart phone invention, then your rewards probably should not be your grandmother’s blueberry muffin recipe. And this is no matter how wonderful it may be. Instead, you could base your rewards around your invention. So this could be everything from offering a case to an extra battery or charger. Or you might even offer an app which only your donors can download.

A Word to the Wise about Rewards

Rewards are a very real part of crowdfunding and they can often be a part which project creators do not take into consideration. Sometimes, we think a product will go to market in, say, a year. But circumstances change, and now one year turns into two. So be it – this sort of thing happens all the time.

But it is an issue if your perks are dependent on your product going out the door. So if you need to fulfill perk promises to 10,000 people, you will likely find you need to do one of any of these things:

- Delay your product launch

- Hire someone to do fulfillment for you

- Offer alternative perks (if you can)

Reneging is not an option, and it can get you on the wrong end of a lawsuit if you are not careful.

A fourth option is delaying perk fulfillment. Not every donor will go for that.

A For-Instance on Perk Level Complexity

Sending out so many perks is a major task. It can take months to get everything out the door.

Why does it take so long? Consider the degree of complexity. Let’s go with an easy number: 100. So let’s say you have 10 separate perk levels and they each have 10 slots. Once an eleventh person wants a certain perk level, they just plain can’t have it, as it’s gone. Are you with me so far?

Your ten separate perk styles may be of differing weights. So this means they will have different shipping costs. If any of your 100 donors are outside of the United States, then you will have to pay more to ship to them as well. Plus of course you have to make sure all of the addresses are complete and correct.

It becomes even more complex when your perks do not fit into such neat little buckets. This is where you have, say, eight perks. And you might have anywhere from 12 to 1,000 people who are supposed to be getting them. Plus some people may have donated twice and are waiting for two separate perks. Or maybe even more.

See how ugly and difficult this can get – fast?

What frustrates you the most about funding your business in a recession? Tell us in the comments.

Getting Around This Problem

The easiest way to get around these issues is to offer intangible perks. In our smart phone example, the exclusive app would fit the bill nicely. Your best bet is to make the intangible perk good for the largest number of donors possible.

Hence if your lowest level is $10, and you have 100 of those slots, then you could just give 100 people a download code. This is a lot faster than figuring out postage for all of those donors. Plus, with an intangible perk, technically the number of perks is effectively infinite. But scarcity gets people interested, so you might not want to make the downloads never-ending.

For the more tangible perks, leave them for far smaller groups, such as the 25 people who are at your two top donor levels. Mailing to 25 people is far easier than it is to mail to 10,000 people. And this is so even if the mailings are difficult.

But I Don’t Have Intangible Perks!

No? Then what do you call a coupon sent in email? See, there are ways to offer intangible perks even when the entire business operation is very, very tangible. Coupons have been around, seemingly, forever. People will gladly print them off or carry them in their smartphones for scanning.

Or there can be discount codes, which are virtually the same thing, except with no designing of a coupon to be cut out or scanned. Amazon, for example, gives these out all the time. And the vast majority of backers will know exactly how to use them.

Crowdfunding Terms You Should Know in a Recession: Rewards-Based Crowdfunding

Probably the best-known of all crowdfunding platforms is Kickstarter. Kickstarter is, by its own rules, just for project creation. That is, it is not for charitable donations. This puts it squarely in the camp of rewards-based crowdfunding. That is, the project exists for the purpose of getting a new market to product or the setting up of a new business.

This form of crowdfunding offers rewards (perks), which are either physical or intangible. It can also serve as a means of pre-selling a product before even a prototype has been made. However, until there is an actual available product, is it a sale, or not? While it is easy to try to dismiss such a concern as no big deal, well, not so fast.

Whether perk fulfillment is a sale or not just might matter.

Sales and the Law

In the United States, the sales of almost 100% of all goods are covered by the Uniform Commercial Code. This set of laws is identical virtually everywhere in the country except in the state of Louisiana. And even there, it is still rather close.

The UCC covers any number of concerns with products. These include merchantability, which asks if a product can reasonably be sold. And it also includes fitness for a particular purpose. But it does not cover liability in case a product injures a person. Still, that can be another question, in case something like that happens.

Product Injuries

When a product injures someone (in the law, this is called product liability), it does not matter if the injured party directly bought the product or borrowed it from another or the like. However, at a certain point, it becomes such a tenuous and far-reaching relationship between product creator (that is, the manufacturer) and the final end user that questions as to cause and effect can arise.

While new products sold via crowdfunding are, without a doubt, sales, what about perks?

Are perks sales, or not? They do not seem to be gifts. After all, when was the last time you paid anything for a gift? Is it not the very definition of a gift that there is no cost?

Consideration

In general, in contract law, a sale is an exchange of goods (or services) for a price or fee. This price or fee is referred to as a consideration. A consideration is either a fee or its equivalent, such as through barter. The consideration does not have to be equal in value to the sale price of the goods. That is, the transaction does not stop being a sale just because the buyer got a really good deal, or a really bad one.

Yes, selling your house for $1 is, technically, a sale.

If a perk is worth $1 but is only available at the $10 donation level, what then? But if it is a sale, then the UCC should apply, yes? If the perk injures someone, then the question does not really start to matter until the end user is extremely far-removed from the project creator.

These questions do not seem to have been litigated yet. It will be interesting to see what happens when, inevitably, they are.

Crowdfunding Terms You Should Know in a Recession: Equity-Based Crowdfunding

When businesses look to hand over percentages of ownership in exchange for current financial backing that is called equity-based crowdfunding. Kickstarter, for example, does not allow this. But there are platforms such as AngelList and Crowdfunder which do.

After the passage of the 2012 JOBS Act, smaller companies have more freedom to crowdfund and hand over equity shares. And this is without quite so many Securities and Exchange Commission (SEC) filings as were needed before. This federal law opened up crowdfunding more. And it made it a far more attractive option for startups in particular. The SEC, naturally, has an interest in this particular species of crowdfunding.

Crowdfunding Terms You Should Know in a Recession: Debt-Based Crowdfunding

This form of crowdfunding is also called peer to peer lending. Other names for it are P2P, crowdlending, and marketplace lending. Borrowers will set up campaigns in order to fulfill their financial needs. And then lenders will contribute toward the goal for an interest.

This particular method of online funding may come with other consequences. It could very well become a true “threat to the traditional banking system in the areas of consumer and business loans, as has already been demonstrated by the rapid success of [these] online lending marketplaces.” (Hollas, Corporate Finance Review, Volume 18).

As the United States economy changes over time, peer to peer lending may very well be the only way for some businesses to get funding. But look for regulators to start to step in, particularly if there are instances of fraud or more serious criminal activity.

Crowdfunding Terms You Should Know in a Recession: Litigation Crowdfunding

And speaking of criminal activity, there is also litigation crowdfunding. With litigation crowdfunding, a plaintiff will ask for a monetary donation for the purposes of funding a court case. If the plaintiff prevails, then investors may get more than their initial investment.

Unlike some of the other forms of crowdfunding, there are ethical considerations when it comes to litigation crowdfunding. Ethics problems include the possibility of unlawful interference in an attorney-client contract.

Lawyers and Ethics and Crowdfunding and Money

Another possible issue involves providing information to backers. In other forms of crowdfunding, backers understandably want advance information on a campaign. understandably, they want to know precisely what they are financially getting themselves into. But in the case of the law, such transparency can very well mean violating attorney-client privilege. If privileged communications are necessary to get donors to fork over cash, then this is an ethical violation for the lawyer.

Plus, what happens if the backers push for a greater return on their investments? Could a group of backers – or a crowdfunding platform – push for a settlement for sure money? Or could they push for a trial in the hopes of a big payoff? Either scenario is possible.

And there is even another possibility. What if the crowdfunding platform or backer group pushes to direct the course of discovery, or even motion practice?

And what happens if, somehow, it gets out at trial that a case is crowdfunded? What will a jury think? Will they see the plaintiff as greedy? Or will they see the case as more likely to win? Otherwise, the reasoning could go, why would people put their money on the line for it?

These questions go beyond dilemmas and interesting philosophical exercises. They could, if things go too far, end up being a part of disciplinary proceedings against a lawyer in an ethics investigation.

Crowdfunding Terms You Should Know in a Recession: Donation-Based Crowdfunding

In this form of crowdfunding, a charity solicits donations via a crowdfunding platform. There are either no perks or they are tiny. The best-known of these is probably GoFundMe. This is where project runners can either raise funds for themselves or for charities.

Donation-based crowdfunding also encompasses the far too common crowdfunding pleas we all see cropping up these days. These crowdfunding pleas are for everything from help paying medical or veterinary bills to attempts to get donors to fund dream vacations and honeymoons. Or they can even be to just fix the project runner’s car.

Without perks or presales, there are no UCC considerations. But there can be questions from state governments if a charity raises funds via crowdfunding and then someone just pockets the money. After all, the government wants to know if charities are on the up and up.

What frustrates you the most about funding your business in a recession? Tell us in the comments.

Crowdfunding Terms You Should Know in a Recession: Bootstrapping

In the absence of crowdfunding, startup founders often used bootstrapping to get their projects off the ground.

Bootstrapping is just the use of personal finances to fund a new company. The biggest advantage to bootstrapping is that a business owner does not have to give up any ownership in the company.

The biggest disadvantage, of course, is the loss of a life’s savings is a very real possibility. Crowdfunding in particular is meant as a means of minimizing bootstrapping. But it probably will never eliminate it entirely.

Crowdfunding Terms You Should Know in a Recession: Takeaways

Crowdfunding is an interesting method of raising money for a business. But it has its own rules and methods. There are potential pitfalls along the way. Crowdfunding can, at times, feel like the wild, wild west.

But at least with these crowdfunding terms you should know in a recession, you can be more prepared to handle anything crowdfunding throws at you. And as always, if you have any questions, please feel free to ask them in the comments section of this blog post.

The post Crowdfunding Terms You Should Know in a Recession appeared first on Credit Suite.

If You Need Cash Now, Here's Which Accounts You Should Tap First

The post If You Need Cash Now, Here’s Which Accounts You Should Tap First appeared first on ROI Credit Builders.

10 Crowdfunding Platforms for Recession Funding You Should Know About, Part 2

Check Out These 10 Crowdfunding Platforms for Recession Funding You Should Know About

These 10 crowdfunding platforms for recession funding have been catching our eye lately.

Have you been thinking of crowdfunding your business? There are several recession crowdfunding platforms out there with differing requirements. These are the recession crowdfunding platforms you should know.

Getting working capital to grow your business doesn’t have to be hard. Many companies these days turn to recession crowdfunding platforms. A lot of these options will work for startup ventures. The last 5 of our top 10 crowdfunding platforms for recession funding are a bit more obscure. But first, here are a few tips to help you with your campaign.

Quick Tips About Crowdfunding: Your Campaign

Your campaign’s success is far from guaranteed. But you can capitalize on a few proven approaches. First off, consider these four emotions that you need to engender in donors. Use one or more of them as the focal point of your campaign as a starting point.

Scarcity

If you have thousands of something or other to supply as a perk, it will not be as desirable. If you only have a few copies of a specific perk, that will instill a feeling in some potential donors that they just have to have it. Do this with your larger donation levels only. Therefore, you might want to establish a perk/donation level system similar to this:

| Donation Level | Number of Perks |

| Lowest | 1,000 |

| Second lowest | 500 (reward also incorporates lowest level reward) |

| Second highest | 50 (reward also includes two lower level rewards) |

| Highest | 10 (reward also incorporates all other levels’ rewards) |

Remember: a lot of variety in physical perks will make fulfillment a lot harder, so don’t work with greater than maybe five separate varieties of physical perks– and even that is pushing it.

Building scarcity into your perk tiers is a great way to add perceived value to the perks which attach to your higher level donations.

Urgency

The first two and last two days of a crowdfunding campaign are pretty much always the days with the biggest payoffs. Often, making the campaign longer doesn’t make you significantly more money. So why not open a campaign for only a week? Do not let donors feel they can contribute any old time they feel like it.

Novelty

If you are offering the same old thing as a thousand other places, no one will want to make a donation. Your widget has got to be hotter, cheaper, lighter, or more resilient. Your food should be reduced in calories or higher in nutrition or better-tasting. Or your professional services need to be delivered better or quicker, by friendlier and more skilled employees. And they should come with a money back guarantee your competition does not provide.

Not sure about your own personal creativity? Then talk to creative people you know, and listen to what they say. They might have amazing ideas and it certainly never hurts to ask.

Cool factor

Is your product a work of art? Is it a new, gadget-like innovation? Then it may have a coolness aspect which you can construct your campaign around. But do not be discouraged if it isn’t! These days, some of the most unforgettable advertising campaigns are based around a product the majority of people found uninspiring not ten years ago– insurance.

So house flipping could boast a cool factor if you show off flipping in a neighborhood where a celebrity lives or once lived. A nail shop can show off coolness with exciting new designs not found anywhere else. And a long haul trucking company can showcase a cool factor with some of the more unusual products you’ve hauled.

Quick Tips About Crowdfunding: Crowdfunding Strategy

A few words on strategy:

Your Pitch Video Must be Great

Use an expert to film it and develop the script. Can’t pay for experts? Then try schools, both pupils and educators. Your script doesn’t need to be verbatim but you should have points you wish to make and not babble. Write a script and stay with it. This is not the right time to ad-lib.

If You Have Tangible Evidence of Your Project, then Show it

Put it in your campaign video and on your campaign page. A number of people are naturally doubtful about crowdfunding. An image and a tangible thing will go a long way to assuring them that your project isn’t vaporware.

Manners Matter

Say please, thank you, and you’re welcome to everyone. Use these magic words in your pitch and in your communications with your donors, even in the cover letters you deliver with your perks (even internet perks can include a cover email). You don’t need to be servile, but you absolutely must be diplomatic.

Stretch Goals Should be a Combination of Readily Achievable and Pie in the Sky

If you are crowdfunding for $100,000, a reasonably easy to attain stretch goal is $125,000. Pie in the sky going to be more like $300,000.

Make it abundantly clear what you will do with any added money if you are fortunate enough to get it. Will you buy the property your startup is in? Employ five more people? Replace your old equipment? Launch a brand-new market on another continent? Let your donors know what you are pursuing, so they can dream with you.

Be Gracious if Your Campaign Fails

You may not receive enough to make an appreciable dent in your funding requirements. So give your donors a stake in and an inside look at your business. This will enable them to feel invested. Even if your crowdfunding campaign concludes does not mean a donor cannot send a check or buy extra goods or services. If that happens, then politeness is essential.

Line up the Most Significant and Most Dependable Donors You Can Before You Start

Tell these people to postpone handing over their $1,000 or $10,000 donation till you start your campaign.

And ask them (nicely!) to release their donation during either the first or last day of the campaign.

Make the most of the novelty factor of the first day of the campaign, or the urgency factor of the very last. Just like a busker with a couple of her own bucks in her hat, to motivate people to toss in a few bucks for a song, you want your biggest donors to show other donors that they believe in you and in your project. And you also want them to suggest your other donors that they had best get in on investing in your startup before the opportunity ends.

Share Your Campaign on Social Media

And ask your family and friends to do so, too. Tweet the link. Incorporate it as a Facebook status. Make it a Tumblr post or a snap on Snapchat or create a blog post about it. Ask your network to publicize the link.

The most effective technique to get your network to help you out is by helping them in return. If your relative’s rock band is on Facebook, share their page, or tweet about it.

Be a collaborative member of your own personal network. Then your contacts will be more likely to help you out when you ask.

And rerun these social media postings. Considering time zones and our all-too hectic lives, people may not see your message the first time around. Mix it up and deliver it at odd hours. You can oftentimes use scheduling software such as Hootsuite for this. This includes what is the middle of the night where you live.

In Part 1, we covered 5 great crowdfunding sites you should have on your radar. Here are 5 more to round out 10 crowdfunding platforms for recession funding you should know about. But now we’re going a little more obscure.

More About Our Favorite 10 Crowdfunding Platforms for Recession Funding: 6. GoGetFunding

GoGetFunding has been around since 2011. It lets fundraisers keep the money they raise, whether they meet their target or not. Flexible funding can be a great option if your company is a somewhat unproven idea and you are unsure whether you will be able to meet your funding needs.

GoGetFunding charges a fee of 6.9%. This somewhat high fee includes both the platform fee and the payment processing fee. Hence this option is actually somewhat more cost-effective than many other crowdfunding options.

What frustrates you the most about funding your business? Tell us in the comments.

More About Our Favorite 10 Crowdfunding Platforms for Recession Funding: 7. Crowdfunder

Crowdfunder works as what’s called equity crowdfunding. This is where investors purchase equity in promising companies.

Crowdfunder treats its campaigns as deals, and its donors as ‘investors’. Pay a one-time fee to make your campaign discoverable.

Starter listings are $299/month. Premium listings are $499/month. Premium Plus is $999/month.

Types of business which cannot use Crowdfunder include:

- Guns/Firearms

- Tobacco/Cigarettes/Cannabis

- Pyramid Marketing

- Adult Products & Entertainment

- Gambling

- Contests and Raffles

- Illegal Substances/Drugs

More About Our Favorite 10 Crowdfunding Platforms for Recession Funding: 8. Fundable

Fundable is a business crowdfunding platform which lets companies raise capital from investors, customers, and friends. Create an equity or a rewards-based campaign.

In their first year, they generated over $80 million in funding commitments.

Fundable allows equity campaigns.

They charge $179 per month to fundraise. Fees on rewards are: 3.5% + 30¢ per transaction. They do not charge success fees.

More About Our Favorite 10 Crowdfunding Platforms for Recession Funding: 9. AngelList

At AngelList, you can invest in a startup or even get a job at one. So it can be, essentially, an index fund for startups. Hence if a larger, established company wanted to offer retirement investment opportunities geared to investing in startup companies, AngelList would be a place where they could go.

Hence AngelList is not exactly a business crowdfunding site. Rather, it is a way to connect investors to an array of startup investment opportunities. So investors can try for returns on FinTech or even cryptocurrencies. One of their better-known investments is a business administration site called HoneyBook.

What frustrates you the most about funding your business? Tell us in the comments.

More About Our Favorite 10 Crowdfunding Platforms for Recession Funding: 10. Fundly

Not quite one of our 10 crowdfunding platforms for recession funding, Fundly does allow for crowdfunding for creative ventures. Therefore, if your business has a creative bent, you might find a home there.

Fundly imposes no minimum amount to fundraise in order to keep any raised funds. You can generally withdraw payments within 24 – 48 hours of the donation. They also allow for automatic and scheduled transfers. It is free to create and share an online fundraising campaign.

However, Fundly will deduct a 4.9% fee from each donation you get. A credit card processing fee of 3% is also taken out from each donation. Plus there are nonspecific automatic discounts for larger campaigns.

What frustrates you the most about funding your business? Tell us in the comments.

Takeaways

So for small business owners who want to crowdfund, it pays (quite literally!) to read the fine print. Large and well-known sites such as Kickstarter may get more attention from donors. This is often because they are better known. However, smaller sites on our list of 10 crowdfunding platforms for recession funding – like Fundable – might offer better rates and more personal service.

In the end, though, it is all about the funding. This is true for all of the recession crowdfunding platforms you should know. If your company can meet its goal, then any platform is going to be terrific. If your business cannot, then you will probably do better looking for another form of funding. This includes building business credit. Discover this new way to get funding for your business.

The post 10 Crowdfunding Platforms for Recession Funding You Should Know About, Part 2 appeared first on Credit Suite.

7 Recession-Beating Credit Cards Every Entrepreneur Should Know About

Grab these Amazing 7 Credit Cards for Business and Beat Your Competition AND the Recession!

Every entrepreneur should know about these 7 recession-beating credit cards for business! Despite COVID-19, you can get these cards!

Business Credit Card Benefits

Benefits can vary. So, make sure to choose the benefit you would like from this selection of alternatives.

7 Recession-Beating Credit Cards for Business: Brex Card for Startups

Look into the Brex Card for Startups. It has no annual fee.

You will not need to provide your Social Security number to apply. And you will not need to provide a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Additionally, there are some industries they will not work with, and others where they want added documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a corporation’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Also, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

7 Recession-Beating Credit Cards for Business: Capital One® Spark® Classic for Business

Take a look at the Capital One® Spark® Classic for Business. It has no yearly fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can earn unlimited 1% cash back on every purchase for your company, without minimum to redeem.

While this card is within reach if you have fair credit, beware of the APR. Yet if you can pay on schedule, and in full, then it’s a good deal.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

7 Recession-Beating Credit Cards for Business: Ink Business Unlimited℠ Credit Card

Check out the Ink Business Unlimited℠ Credit Card. Beyond no annual fee, get an introductory 0% APR for the initial 12 months. After that, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your business. And get $500 bonus cash back after spending $3,000 in the initial three months from account opening. You can redeem your rewards for cash back, gift cards, travel and more using Chase Ultimate Rewards®. You will need outstanding credit scores to qualify for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

7 Recession-Beating Credit Cards for Business: Capital One ® Spark® Cash for Business

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the initial year. After that, this card costs $95 annually. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the first 3 months from account opening. Get unlimited 2% cash back. Redeem any time without minimums.

You will need great to exceptional credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

7 Recession-Beating Credit Cards for Business: The Plum Card® from American Express

Take a look at the Plum Card® from American Express. It has an initial annual fee of $0 for the first year. Afterwards, pay $250 annually.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need great to excellent credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

7 Recession-Beating Credit Cards for Business: Capital One® Spark® Cash Select for Business

Take a look at the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can get. Also earn a one-time $200 cash bonus as soon as you spend $3,000 on purchases in the initial three months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR after that.

You will need great to superb credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

7 Recession-Beating Credit Cards for Business: Ink Business Preferred℠ Credit Card

For a great sign-up offer and bonus categories, check out the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial 3 months after account opening. This works out to $1,250 toward travel rewards if you redeem using Chase Ultimate Rewards.

Get three points per dollar of the first $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel through Chase Ultimate Rewards. You will need a great to excellent FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

7 Recession-Beating Credit Cards for Business (Bonus 8th Card): Bank of America® Business Advantage Travel Rewards World MasterCard® credit card

For no yearly fee while still getting travel rewards, check out this card from Bank of America. It has no yearly fee and a 0% introductory APR for purchases during the first nine billing cycles. Afterwards, its regular APR is 13.74 – 23.74% variable.

You can get 30,000 bonus points when you make at least $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Earn unlimited 1.5 points for each $1 you spend on all purchases, everywhere, every time. And this is regardless of how much you spend.

Likewise earn 3 points per every dollar spent when you schedule your travel (car, hotel, airline) through the Bank of America® Travel Center. There is no limit to the number of points you can get and points do not expire.

You will need outstanding credit scores to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Your Best Credit Cards

Your very best 7 recession-beating credit cards for business will hinge upon your credit history and scores. Only you can determine which advantages you want and need, so be sure to do your research. And, as always, make certain to build credit in the recommended order for the max, fastest benefits. The COVID-19 situation will not last forever.

The post 7 Recession-Beating Credit Cards Every Entrepreneur Should Know About appeared first on Credit Suite.

Companies That Help Build Business Credit: What Should You Pay For, And What Should be Free

Regardless of whether you are an existing business or a startup, your business needs its own credit. The problem is, a lot of owners are unsure of how to start building business credit. There are companies that help build business credit, but if you aren’t careful you will get scammed. You should always know what you are paying for, and if it is worth it, or not.

Lenders are becoming more picky and there are more automatic denials than ever before. Working with an insider familiar with the system can help tremendously. It can help everything go faster and it can minimize denials. Your time is money – working with a company to help build business credit can be a wise investment. But there are things you should know.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Companies That Help Build Business Credit: Know What You Are Paying For

First and foremost, you should always know exactly what services you are paying for. The truth is, some “services” just aren’t worth it. For example, you should never pay a company to report your payments to the business credit reporting agencies. There are plenty that will do that for free. However, they do not usually advertise that they do that, nor do they typically make public which companies they report to. Paying someone to help you find these companies? That is worth paying for.

Companies that Help Build Business Credit: Why Separate Business Credit?

There are a few reasons why it’s a good idea for your business to have credit separate from your personal credit. First is protection. If your business goes south, it will not directly affect your personal credit. You can still buy a home and a car other things you need to based on your personal credit.

There are a few reasons why it’s a good idea for your business to have credit separate from your personal credit. First is protection. If your business goes south, it will not directly affect your personal credit. You can still buy a home and a car other things you need to based on your personal credit.

Also, business credit almost always has higher limits. If you try to finance a business on personal credit cards, you will likely stay at or even go over the credit limits on your cards. This will affect your debt-to-credit ratio in a bad way. That, in turn, will negatively impact your personal credit.

Companies That Help Build Business Credit: What NOT to Pay For

We’ve established why you should not pay anyone to have your on-time payments reported. While no company has to do that, there are plenty that will, and they do it for free. Here are some other things you should never pay for.

- An EIN

- A Credit Protection Number (CPN)

- Correcting mistakes on your credit report

- A peek at your personal credit score

- A list of lenders from whom you may qualify for financing

- Trade accounts

Companies that Help Build Business Credit: What Does it Take to Build Build Business Credit

The thing is, business credit doesn’t just happen in the same way that personal credit does. It has to be intentional, and there is a process to make it all come together. It is a complicated web, and before you can understand why certain things are worth paying for, you have to understand little about what it takes to build business credit and make it all work.

Of Business Credit and Fundability

Your business needs to be set up in just the right way to be fundable. I like to call this the foundation of fundability. If you do not have a fundable foundation, payments may be reported, but there will be no record of your business with the business credit reporting agencies so they will not know how to apply it. Here is what it takes to have a fundable foundation.

Separate Contact Information

The first step in setting up a foundation of fundability is to ensure your business has its own phone number, fax number, and address. That doesn’t mean you have to get a separate phone line, or even a separate location. In fact, you can still run your business from your home or on your computer if you want. You don’t even have to have a fax machine.

Actually, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can just use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service. That is, if anyone ever happens to actually fax you. This part seems outdated. However, it does help your business appear legitimate to credit providers.

You can use a virtual office for a business address unless like Supply Works, the credit issuer does not accept a virtual address. Many do accept them though. How do you get a virtual office? It’s not what you may think. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer space for face to face meetings.

EIN

The next thing you need to do is get an EIN. It’s an identifying number for your business that works like your SSN works for you personally. You can get one for free from the IRS.

D-U-N-S Number

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Incorporation

Incorporating your business as an LLC, S-corp, or corporation is not negotiable. It lends credibility to your business as one that is legitimate, and also offers some protection from liability.

Which option you choose does not matter as much for getting a net 30 account with companies that help build business credit. What it does matter for is your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional. Fair warning, you’ll lose the time in business that you already have once you incorporate. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated before you incorporate.

For this reason, you have to incorporate as soon as possible. Not only is it necessary for fundability and for building business credit, but so is time in business. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Yu probably noticed that most of the companies above require one. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Licenses

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Website

I am sure you are wondering how a business website can affect your ability to get funding. These days, you don’t exist if you do not have a website. Yet, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Also, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

Here’s another reason why a website is important. Elsewhere on our blog, there is actually a comment about a company asking for a website to help make the decision to extend, or not extend, net30 terms.

You’ll notice many of these things are listed in the requirements of our list of companies that help build business credit. These are all things that you need for a variety of reasons, including to make your business more fundable.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Companies that Help Business Business Credit: What You Should Pay For

This is just the start. There are so many other factors that affect the fundability of your business and business credit that it can be completely overwhelming. This is why it can be very profitable in the long-term to pay a company to help you through the process. Most of the time they do not actually complete the steps for you, but they can help you get where you need to be and tell you what to do once you get there.

This is crucial. You don’t waste time with companies that don’t report, and you know what is reported is showing up in the right place. There is so much more though.

The lending world is changing fast since COVID-19 hit. Lending has been cut drastically, and more changes are happening everyday. Having someone who knows how to navigate the system and both current and future changes is priceless.

Companies that Help Build Business Credit: 6 Things You Should Definitely Pay For

-

Guiding you through the process of setting up your business to be fundable.

All of the things mentioned above are necessary, and many of them have to happen in the right order. If something gets out of whack, it can take even more time and money to fix it. Paying someone to help you get it right the first time, or help untangle a mess that is already there, is well worth it.

-

Helping you find accounts that report.

It’s more difficult than a simple Google search. You need to know which accounts will report that you are actually eligible for. Otherwise, you will spend a lot of time applying for accounts that you either cannot get, or that you can get but do not report.

-

Helping you apply for financing.

A lot of companies will just give you a list of lenders with products they hope you qualify for. You have to fill out the applications on your own. Why would you pay for that? What’s worth paying for is a company that has a list of lenders for whom they know the underwriting requreiments. Then, as you work through the credit building program, they cross-reference so they know exactly where you pre-qualify and fill out the applcaitons for those lenders for you! Now that’s worth paying for!

-

Guidance for analyzing fundability.

Fundability doesn’t stop with how your business is set up. In fact, the overall fundablity of your business actually begins before you ever have a business. This is because a lot of personal stuff can affect your ability to get funding. That’s true even if you have separate business credit.

-

Step-by-step guidance through the business credit building process.

Building business credit doesn’t just happen. Unlike consumer credit, you have to intentionally work to start and build it. Having a partner come alongside you and show what to do at each step is priceless.

-

Help navigating the lending system in this post COVID-19 economy.

Lenders are buckling down and there are more automatic denials than ever before. You are more likely to get an automatic denial rather than an automatic approval. Having someone familiar with the system, an insider if you will, can help tremendously.

-

Business credit monitoring.

Unlike consumer credit reports, there is no way to know what your business credit report says about you or what your score is without paying. You can pay the credit reporting agencies directly, but it works much better to pay a monitoring service that can help you keep up with your business credit on an ongoing basis. We can help you monitor your credit at Experian and Dun & Bradstreet for less than it would cost you at those business CRAs.

The bottom line is, paying companies that help build business credit can be useful. They have more time, knowledge, and experience. It can save you a lot of time and money in the long run, if you know and understand exactly what it is you are paying them to do.

Companies That Help Build Business Credit Are a Good Idea, Just Know What You Are Paying For

As you can see, it takes a little more work than just getting accounts reporting to build business credit. Your business has to be set up properly for the reporting to matter. Then, you have to keep a close eye on your business credit reports to ensure things are progressing.

It’s not a complicated process, but it takes time. The best thing to do is to set your business up to be fundable before you ever get started. Then, you should meet most of the requirements related licensure, business bank account, business address, and website. It can be extremely helpful to have guidance and help as you go through the process. Let us help you build business credit. Find out how.

The post Companies That Help Build Business Credit: What Should You Pay For, And What Should be Free appeared first on Credit Suite.

Should You Apply for Temporary Jobs?

Should You Apply for Temporary Jobs?

Not every task hunter is able to land their desire task or also a long-term task if that. If you are having difficultly locating work, you may be in the procedure of taking a look at short-lived work, however are they right for you?

There are a number of crucial elements that you will certainly desire to take right into factor to consider when it comes to figuring out if you ought to use for short-term work. These elements can assist you make sensible work options. A few of the lots of variables that you will certainly intend to think about, when taking a look at short-lived work as well as momentary work, are detailed listed below for your comfort.

One of the numerous variables that you will certainly desire to take right into factor to consider, when analyzing short-term work, is your existing work condition. As you most likely currently recognize, momentary tasks can last for as little as one week or as lengthy as a couple of months. It is crucial to keep in mind that absolutely nothing is assured with momentary work.

In maintaining with your present work condition, if you are out of work, you might desire to put an emphasis on short-lived work and also momentary work. This additionally consists of analyzing short-lived tasks in your location. What is perfect concerning short-lived work is that many companies recognize that their short-term workers are browsing for even more long-term work.

While there are some variants, you will certainly locate that companies that are looking for short-term workers transform to staffing companies that specialize in short-term work. Depending on where you stay, you ought to have accessibility to one or 2 various short-lived work firms. The aid of a momentary company must be totally free of fee; nevertheless, you might additionally be needed to pay a tiny regular monthly solution charge, depending on the firm that you pick to look for support from.

One more one of the several elements that you will certainly desire to take right into factor to consider, when checking out whether or not short-lived work is appropriate for you, is wellness insurance coverage. If you do and also if you are not able to obtain health and wellness insurance policy via your partner, must you have one, you might desire to take into consideration holding off on looking for short-lived work. This is since nearly all momentary companies do not provide wellness insurance policy to their short-term workers.

The above stated variables are simply a few of the numerous variables that you will certainly intend to think about, when checking out momentary work. Obviously the choice is your own to make, yet, essentially, you will certainly locate that short-lived work is suitable for those that are presently out of work as well as require cash as soon as possible.

If you are having difficultly locating work, you may be in the procedure of taking a look at short-lived work, yet are they right for you?

A few of the numerous aspects that you will certainly desire to take right into factor to consider, when analyzing momentary work and also short-term work, are laid out listed below for your comfort.

In maintaining with your existing work standing, if you are jobless, you might desire to put an emphasis on short-term work as well as short-lived tasks. What is optimal concerning short-lived work is that a lot of companies recognize that their short-lived staff members are browsing for even more long-term work. While there are some variants, you will certainly discover that companies that are looking for short-term workers transform to staffing companies that specialize in short-term work.

The post Should You Apply for Temporary Jobs? appeared first on ROI Credit Builders.

Should You Apply for Temporary Jobs?

Should You Apply for Temporary Jobs?

Not every task hunter is able to land their desire task or also a long-term task if that. If you are having difficultly locating work, you may be in the procedure of taking a look at short-lived work, however are they right for you?

There are a number of crucial elements that you will certainly desire to take right into factor to consider when it comes to figuring out if you ought to use for short-term work. These elements can assist you make sensible work options. A few of the lots of variables that you will certainly intend to think about, when taking a look at short-lived work as well as momentary work, are detailed listed below for your comfort.

One of the numerous variables that you will certainly desire to take right into factor to consider, when analyzing short-term work, is your existing work condition. As you most likely currently recognize, momentary tasks can last for as little as one week or as lengthy as a couple of months. It is crucial to keep in mind that absolutely nothing is assured with momentary work.

In maintaining with your present work condition, if you are out of work, you might desire to put an emphasis on short-lived work and also momentary work. This additionally consists of analyzing short-lived tasks in your location. What is perfect concerning short-lived work is that many companies recognize that their short-term workers are browsing for even more long-term work.

While there are some variants, you will certainly locate that companies that are looking for short-term workers transform to staffing companies that specialize in short-term work. Depending on where you stay, you ought to have accessibility to one or 2 various short-lived work firms. The aid of a momentary company must be totally free of fee; nevertheless, you might additionally be needed to pay a tiny regular monthly solution charge, depending on the firm that you pick to look for support from.

One more one of the several elements that you will certainly desire to take right into factor to consider, when checking out whether or not short-lived work is appropriate for you, is wellness insurance coverage. If you do and also if you are not able to obtain health and wellness insurance policy via your partner, must you have one, you might desire to take into consideration holding off on looking for short-lived work. This is since nearly all momentary companies do not provide wellness insurance policy to their short-term workers.

The above stated variables are simply a few of the numerous variables that you will certainly intend to think about, when checking out momentary work. Obviously the choice is your own to make, yet, essentially, you will certainly locate that short-lived work is suitable for those that are presently out of work as well as require cash as soon as possible.

If you are having difficultly locating work, you may be in the procedure of taking a look at short-lived work, yet are they right for you?

A few of the numerous aspects that you will certainly desire to take right into factor to consider, when analyzing momentary work and also short-term work, are laid out listed below for your comfort.

In maintaining with your existing work standing, if you are jobless, you might desire to put an emphasis on short-term work as well as short-lived tasks. What is optimal concerning short-lived work is that a lot of companies recognize that their short-lived staff members are browsing for even more long-term work. While there are some variants, you will certainly discover that companies that are looking for short-term workers transform to staffing companies that specialize in short-term work.

The post Should You Apply for Temporary Jobs? appeared first on ROI Credit Builders.