Even the worst markets are supposed to have havens. Some unnerved investors are wondering if this one doesn’t. The post Investors Stay Put, Because They Can’t Think of Better Options first appeared on Online Web Store Site.

Tag: They

The Rise of the Hybrid Consumer and How They are Changing the Way We Shop [Webinar on May 5th)

As people return to physical shopping post-pandemic, a new behavior has emerged: hybrid shopping. Put simply, hybrid shopping is a blend of physical and digital shopping.

Given this trend, it’s important to create strategies that provide consumers with seamless, personalized, and convenient shopping experiences across digital and brick-and-mortar shops. Brands must reevaluate how they advertise, provide support, and even how they go about suggesting products.

Wondering how to get started? Learn how to better connect with hybrid consumers in the upcoming webinar we are presenting with Adweek on The Rise of the Hybrid Consumer and How They are Changing the Way We Shop on Thursday, May 5th at 1pm EST

The Rise of the Hybrid Consumer: How They Came to Be

In the post-Covid world, consumers have been rethinking, reevaluating, and adapting their lifestyles accordingly. As a result, their interests, shopping behaviors, and preferences have changed significantly.

While the “Hybrid Consumer” may seem like a new concept, we have been building towards them for a few years now. It was just digitally accelerated due to the pandemic.

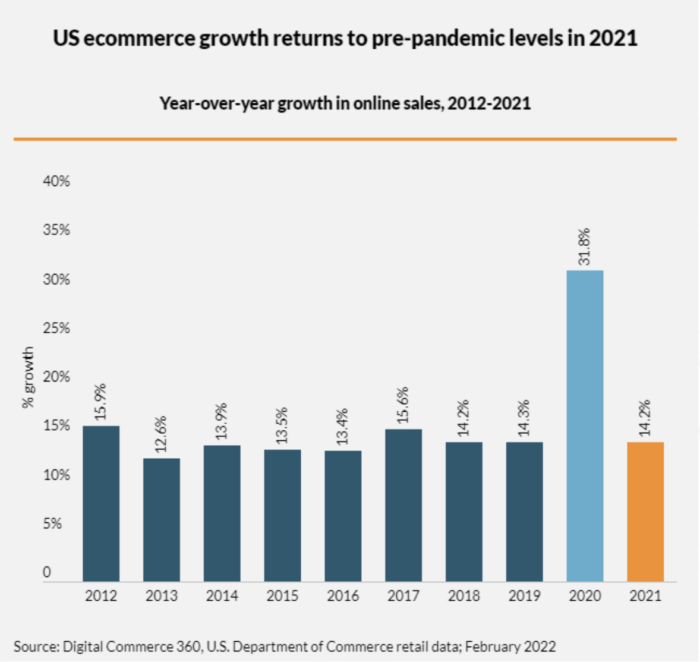

In 2020, consumers did most of their shopping online; in fact, online sales grew by a whopping 31.8 percent from 2019 to 2020. This was more than double their average annual growth rate which was already impressive enough.

When businesses started reopening in 2021 and consumers began returning to in-store physical shopping, they didn’t abandon their online behaviors.

As “Hybrid Consumers”, they no longer distinguish between online and offline channels. For example, they may look at an item in-store but then do more research online before making a purchase there. They may also research and buy online before picking up a product in-store.

Rather, they’ve become “hybrid consumers” and no longer distinguish between online and offline channels. For example, hybrid consumers may look at items in-store, but complete their purchase online. The inverse is also true: they may shop online and pick up in-store.

As a result of these shifts, shoppers are creating new opportunities and challenges for marketers. It is more important than ever for businesses to track consumer actions to come up with a plan that better reaches and engages them.

Learn more about how to capitalize on these opportunities in the upcoming webinar on Thursday, May 5th.

Why Hybrid Consumers Are Important

“Hybrid Shopping” has caused a surge in sales for online marketplaces like Amazon, Walmart, Best Buy, Etsy, and Home Depot.

In fact, e-commerce sales are still growing and are expected to hit $7.391 trillion by 2025. E-commerce accounted for about $1 in $5 of total retail sales in 2020 and 2021 and as systems improve to benefit hybrid consumers, this could continue increasing.

Since consumers are now making purchase decisions based on a combination of in-store and online interactions, businesses much cater to the cultural shift which this webinar will prepare you for.

What the Rise of Hybrid Consumers Means to Brands

Hybrid consumers no longer distinguish between online and offline channels. They might go into a Walmart or Best Buy and see something they like, but then make their purchase through a third-party marketplace seller online.

If you aren’t creating more personalized and seamless shopping experiences that hybrid consumers want, they will look elsewhere to make their purchases.

What we are seeing is just the beginning of hybrid shopping and as consumer expectations evolve, so will the experiences needed to reach them. As people get accustomed to the seamless integration of physical and digital experiences, the “hybrid consumer” will continue to change. Things like personalization and ease-of-use were a marketing strategy at best, and an afterthought at worst.

Consumers now expect shopping to be quick, convenient, and to catered to their satisfaction. Businesses must adapt, improve their online processes, and consider what experiences are needed to match the expectations of their target audience.

Who Will Benefit from This Webinar?

Some important stakeholders who will benefit from the content taught in this webinar include:

- e-commerce business owners looking to grow their revenue

- businesses looking to improve their online capabilities

- marketers who have clients with revenue-growth goals

- small business owners looking to improve online and in-store experiences

- designers and developers looking to create seamless online experiences for consumers

What Businesses Will Benefit from This Webinar?

Any business will benefit from the content taught in this webinar, especially those with an online and physical presence.

E-commerce businesses will learn actionable strategies that will drive more conversions and, thereby, grow their revenue. Shops that previously focused on physical sales will learn how to create digital experiences that will drive more traffic, increase their revenue, and grow their customer base.

What You’ll Learn in This Webinar

There will be lots of valuable content included in this webinar to help businesses adapt for the hybrid consumer of today and the changes to come tomorrow. A few key things include:

- How your brand can maintain the right mix of online and offline strategies to maximize customer acquisition and retention.

- Key opportunities for marketers to respond to new consumer expectations.

- Strategies for building a more integrated marketing model.

To learn more about these specific strategies, join us on Thursday, May 5, at 1pm EST.

WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps …

Do business credit cards affect personal credit? They can, and in fact most do. But, they don’t have to. There are steps you can take to make sure they don’t. The key is to build your business credit score, and choose the right business credit cards.

Do Business Credit Cards Affect Personal Credit? It Depends

If you are asking yourself “Do business credit cards affect personal credit?” you are obviously trying to fund a business. And yes, most high limit business credit cards report to your consumer credit report. In fact, some report to both your personal credit and your consumer credit. There are even some business cards that will report negative payment information, but will not report anything if the account is in good standing. If you are trying to keep your business accounts from affecting your personal credit score, you need cards that will not report to personal credit bureaus.

Do Business Credit Cards Affect Personal Credit? Does it Even Matter?

Yes, it matters. Here’s why. You know that if an account, business or personal, is not in good standing, it can be detrimental to your personal credit if reported. Yet, did you know that even if an account is in good standing, it is possible that it may still damage personal credit.

Check out how our reliable process will help your business get the best business credit cards.

This is due to one of the fundamental differences in business credit vs. personal credit. Your personal credit score is affected by your debt-to-credit ratio. That’s a measure of how much debt you have, relative to how much credit you have available. A high debt-to-credit ratio can negatively impact your personal credit score. This is further complicated by the fact that many business credit cards stay at or near their limit, even if you are making regular payments. It is a function of the fact that business expenses are typically much higher than personal expenses.

As a result, if those accounts are on your personal report, they can bring your credit score down even if they are not delinquent. The question then becomes, how do you make sure this doesn’t happen? There are two key parts to this.

Do Business Credit Cards Affect Personal Credit? Make Sure They Don’t

First, if you are getting business credit cards with a personal guarantee, you have to make sure they will not report to your personal credit report. There are a handful that will not, even though they do ask for a personal guarantee. It is important to note that a personal guarantee means there will be a personal credit check. That will create an inquiry that may affect your personal credit for a bit. However, if the account does not report payment information to your personal credit report, the impact will be minimal.

A Few Examples of Business Credit Cards that Will Not Report to Personal Credit

If you have bad personal credit, the Wells Fargo Business Secured Credit Card is a good option.

You can get approved with a credit score as low as 580 currently, but that can change of course.

You do have to make at least a $500 deposit. Also, they do not report to consumer credit agencies, but they DO report to Dun & Bradstreet. That is, assuming you have your D-U-N-S number.

That means it can help you build business credit even with a bad personal credit score. They also report to the Small Business Finance Exchange. While the SBFE does not issue credit reports, they do share information with certain lenders, vendors, and credit agencies.

Wells Fargo will review your account periodically, and they may move you up to an unsecured account if you are eligible, based on a number of factors, including FICO.

If you have good credit, you have even more options for credit cards that will not report to personal credit. A few include:

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Costco Anywhere Visa® Business Card (have to be a Costco member)

Wells Fargo Business Platinum Credit Card

Remember, even though these cards do not report to your personal credit report, they do require a personal guarantee. That means they will do a personal credit check, and that inquiry will affect your score for a bit.

Do Business Credit Cards Affect Personal Credit? Business Credit Cards That Will Not Affect Personal Credit Scores Without a Personal Guarantee

Using a personal guarantee to begin building your credit portfolio is okay to start with. The goal, however, is to get as much as you can without a personal guarantee. To do this, you need to lay the groundwork before you apply for any cards. After all, they cannot report to your business credit profile if there is not one to report to.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Do if You Do Not Establish a Business Credit Profile

In contrast to a personal credit profile, you have to intentionally build a business credit profile. While a personal credit builds passively, business credit scores do not. With consumer credit, all you have to do is get credit accounts and they almost all end up on your consumer credit report.

How Do You Establish a Business Credit Profile?

First, you have your business up to be fundable. This includes a number of factors, some of which include:

- A business name that does not indicate you are in a high risk industry

- A physical business address, not a P.O. Box or UPS box

- Business phone number listed with 411

- A business bank account

- An EIN and a D-U-N-S number

You can get your EIN on the IRS website for free, and apply for the D-U-N-S number on the Dun & Bradstreet website, also for free. This is vital, because if you do not have that D-U-N-S number, accounts will not be able to report your payments to Dun & Bradstreet, because you will not have a profile there for them to report to.

The EIN is what you will use when you apply for business credit instead of your social security number. You may have to provide your SSN for identification purposes, but it will not be used to determine approval. This is one way you ensure your business credit accounts are not reporting to your personal credit report.

Do Business Credit Cards Affect Personal Credit? How to Get Business Credit Cards That Do Not Affect Personal Credit

Once your business is set up in the right way so that you have a business credit profile, you need accounts that report to that profile. However, if you start applying for high limit credit cards using your business credit profile right away, you are going to get denied.

You have to find accounts that will extend credit to your business without any sort of credit check. You don’t yet have a business credit score, and you are trying to avoid personal credit all together. To do this, you start with starter vendors.

These are accounts that will extend net terms and report payments, but they will approve you based on factors other than your credit score. These factors may include time in business, revenue, average balance in your business bank account, or other factors.

How to Find Starter Vendors

The trick is, these types of vendors are not easy to find. They do not advertise themselves as “starter vendors.” They do not make it easy to find out whether or not they report payments to business credit profiles. Business owners need help finding this information.

Here are a few options to get you started:

Grainger

Uline

Marathon

Still, you need more accounts than this reporting before you can build a strong enough business credit score to apply for higher limit accounts.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Don’t Have To

How to Build a Strong Business Credit Portfolio With Minimal Effect on Personal Credit

The secret to building a strong business credit profile as fast as possible and with minimal effect on your personal credit, is to work with a business credit expert. A business credit expert makes this whole process faster and easier.

They can help ensure you have your business set up the right way, and guide you toward those starter vendor accounts that will help you initially build your business credit score. They will help you know when you have enough accounts reporting to start applying for higher limit accounts and be approved.

In addition, our business credit experts have the knowledge and expertise to help you find the best accounts to flesh out your business credit portfolio. There is more to this than just building strong business credit with accounts that report. An expert can guide you toward the best vendor accounts for your specific business, whether they report or not.

The best way to start this process with no risk is to have a free consultation with a business credit expert. They can help you figure out where you stand now, and where you need to start so that you can build your business credit portfolio in the most effective and efficient way possible.

The post WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps … appeared first on Credit Suite.

When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do …

The Perfect Business Credit Portfolio Includes Vehicle Financing

Does your business need vehicles to get the work done? This can be any number of kinds of vehicles, such as trucks for deliveries and hauling, sprinter vans, company cars, and even vans to facilitate commuting for your employees. Vehicle financing can be a smart way to afford all of them.

Vehicle Financing in a Nutshell

Much like you probably didn’t buy your personal vehicle outright, financing is a great way to go in order to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a car for personal use, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Commercial vehicle funding has certain parameters. Whether a vehicle is purchased new or used will affect the number of years you can finance the vehicle and the rates you will pay. If a vehicle is used, then the number of miles on it will also affect terms. Plus, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Some loans have a prepayment penalty and charge you for paying ahead.

In general, the following will eliminate the need to provide a personal guarantee for this type of financing: good business credit, a decent amount of time in business or good personal credit. And much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Basic Terms and Qualifying

You need to establish the amount of money you have for a down payment, and the vehicle you need. Plus, you must establish the costs associated with buying the vehicle.

You’ll need to provide documentation that proves you are the owner of a business. This includes business licenses, partnership agreements, LLC documents, and articles of incorporation (if applicable), listing you as having at least a 20% stake in the business.

You may also have to provide personal documentation like personal credit score and credit history. If you are a sole proprietor and the business is under your Social Security number, you are the borrower and guarantor. Hence you are personally liable for repaying the loan. It is also a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Good Business Credit Can Help

If your company needs vehicles for operation build your business credit. This, way you will be able to qualify with no PG. Having this ability can give you the freedom to grow your fleet, and without your signature. More on this later. First, let’s look at those four keys to financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #1: Using Business Credit for Vehicle Financing

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so these lenders will have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

As an example, consider Ford Commercial Vehicle Financing.

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial funding options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you don’t get an approval on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Ford Commercial Vehicle Financing: Terms and Qualifying

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable) and a business bank account

You will need to have a strong business credit history. And you must have a good Experian business credit score.

Demolish your funding problems with 27 killer ways to get cash for your business.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But Ally will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax

Ally Car Financing: Terms and Qualifying

For Ally Commercial Line of Credit, to qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

With Ally Commercial Vehicle Financing, you can get a lease or a loan. To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

There is no minimum time in business requirement. Apply in person only, dealer will advise if approval or Personal Guarantee (PG) needed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #2: Credit Line Hybrid

Yet another potential form of vehicle financing is through the Credit Suite Credit Line Hybrid. A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. So you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials are necessary. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Vehicle Financing Key #3: 401(k) Financing

Another option for vehicle financing is using your 401(k) as collateral. This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k) . The lender will want to see a copy of your two most recent 401(k) statements.

You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. So it will need to be from older employment. You cannot be currently contributing to it.

Vehicle Financing Key #4: SBA 504 Loans

The SBA 504 loan can be used to purchase “Long-term machinery and equipment”. As a result, it’s not a standard car loan. But you can purchase a truck with it. You can use an SBA 504 loan when the vehicles being purchased qualify as heavy equipment.

Some examples of trucks as ‘heavy equipment’ can include:

- Cement trucks

- Dump trucks

- Custom-build heavy trucks fit for specific purposes (loading/unloading septic tanks, for instance)

- Semis and tanker trailer trucks

If your vehicle needs run in this direction, then an SBA loan could be perfect for your needs.

SBA 504 Loans and Credit Suite

Did you know that you can get SBA loans through Credit Suite? Established businesses with tax returns that show good revenues and profitability can get very large sums of funding with Secured Small Business Loans. If you have positive business tax returns, you should apply for secured government-backed SBA program loans from $250,000 up to $12,000,000. Approval amounts will vary based on the collateral your business has, and the amount of net profit reflected on your tax returns.

The total time to close these loans is about 2-4 months. SBA loans offer some of the longest payback terms available for business financing. Get loan terms for 10, 15, or even 25 years with the SBA. Interest will total approximately 3% of the debt. The rate may be financed with the loan.

Get approved for up to $12 million. Your credit will have to be of good quality. Your collateral will need to equal 50% of the loan amount. Financials will be necessary.

SBA 504 Loans Through Credit Suite: Documentation

The SBA will require certain documentation to qualify including:

- Business and personal financials

- Resume and background information

- Personal and business credit reports

- Your business plan

- Bank statements

- Collateral and any other documentation relevant to the transaction

Vehicle Financing: Takeaways

Getting vehicle funding involves variables like whether the vehicle is new or used. Heavy vehicles like dump trucks can be paid for with SBA 504 loans. There is a possibility that you would have to provide a personal guarantee to get a loan or lease. Credit Suite offers financing that you can use to purchase vehicles, and we offer even more options through our Business Finance Suite. There are four keys to open the door to affording vehicles for your business. And there are a lot of options. Let’s explore them together.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Credit Suite.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Business Marketplace Product Reviews.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Buy It At A Bargain – Deals And Reviews.

When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do …

The Perfect Business Credit Portfolio Includes Vehicle Financing

Does your business need vehicles to get the work done? This can be any number of kinds of vehicles, such as trucks for deliveries and hauling, sprinter vans, company cars, and even vans to facilitate commuting for your employees. Vehicle financing can be a smart way to afford all of them.

Vehicle Financing in a Nutshell

Much like you probably didn’t buy your personal vehicle outright, financing is a great way to go in order to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a car for personal use, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Commercial vehicle funding has certain parameters. Whether a vehicle is purchased new or used will affect the number of years you can finance the vehicle and the rates you will pay. If a vehicle is used, then the number of miles on it will also affect terms. Plus, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Some loans have a prepayment penalty and charge you for paying ahead.

In general, the following will eliminate the need to provide a personal guarantee for this type of financing: good business credit, a decent amount of time in business or good personal credit. And much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Basic Terms and Qualifying

You need to establish the amount of money you have for a down payment, and the vehicle you need. Plus, you must establish the costs associated with buying the vehicle.

You’ll need to provide documentation that proves you are the owner of a business. This includes business licenses, partnership agreements, LLC documents, and articles of incorporation (if applicable), listing you as having at least a 20% stake in the business.

You may also have to provide personal documentation like personal credit score and credit history. If you are a sole proprietor and the business is under your Social Security number, you are the borrower and guarantor. Hence you are personally liable for repaying the loan. It is also a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Good Business Credit Can Help

If your company needs vehicles for operation build your business credit. This, way you will be able to qualify with no PG. Having this ability can give you the freedom to grow your fleet, and without your signature. More on this later. First, let’s look at those four keys to financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #1: Using Business Credit for Vehicle Financing

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so these lenders will have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

As an example, consider Ford Commercial Vehicle Financing.

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial funding options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you don’t get an approval on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Ford Commercial Vehicle Financing: Terms and Qualifying

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable) and a business bank account

You will need to have a strong business credit history. And you must have a good Experian business credit score.

Demolish your funding problems with 27 killer ways to get cash for your business.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But Ally will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax

Ally Car Financing: Terms and Qualifying

For Ally Commercial Line of Credit, to qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

With Ally Commercial Vehicle Financing, you can get a lease or a loan. To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

There is no minimum time in business requirement. Apply in person only, dealer will advise if approval or Personal Guarantee (PG) needed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #2: Credit Line Hybrid

Yet another potential form of vehicle financing is through the Credit Suite Credit Line Hybrid. A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. So you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials are necessary. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Vehicle Financing Key #3: 401(k) Financing

Another option for vehicle financing is using your 401(k) as collateral. This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k) . The lender will want to see a copy of your two most recent 401(k) statements.

You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. So it will need to be from older employment. You cannot be currently contributing to it.

Vehicle Financing Key #4: SBA 504 Loans

The SBA 504 loan can be used to purchase “Long-term machinery and equipment”. As a result, it’s not a standard car loan. But you can purchase a truck with it. You can use an SBA 504 loan when the vehicles being purchased qualify as heavy equipment.

Some examples of trucks as ‘heavy equipment’ can include:

- Cement trucks

- Dump trucks

- Custom-build heavy trucks fit for specific purposes (loading/unloading septic tanks, for instance)

- Semis and tanker trailer trucks

If your vehicle needs run in this direction, then an SBA loan could be perfect for your needs.

SBA 504 Loans and Credit Suite

Did you know that you can get SBA loans through Credit Suite? Established businesses with tax returns that show good revenues and profitability can get very large sums of funding with Secured Small Business Loans. If you have positive business tax returns, you should apply for secured government-backed SBA program loans from $250,000 up to $12,000,000. Approval amounts will vary based on the collateral your business has, and the amount of net profit reflected on your tax returns.

The total time to close these loans is about 2-4 months. SBA loans offer some of the longest payback terms available for business financing. Get loan terms for 10, 15, or even 25 years with the SBA. Interest will total approximately 3% of the debt. The rate may be financed with the loan.

Get approved for up to $12 million. Your credit will have to be of good quality. Your collateral will need to equal 50% of the loan amount. Financials will be necessary.

SBA 504 Loans Through Credit Suite: Documentation

The SBA will require certain documentation to qualify including:

- Business and personal financials

- Resume and background information

- Personal and business credit reports

- Your business plan

- Bank statements

- Collateral and any other documentation relevant to the transaction

Vehicle Financing: Takeaways

Getting vehicle funding involves variables like whether the vehicle is new or used. Heavy vehicles like dump trucks can be paid for with SBA 504 loans. There is a possibility that you would have to provide a personal guarantee to get a loan or lease. Credit Suite offers financing that you can use to purchase vehicles, and we offer even more options through our Business Finance Suite. There are four keys to open the door to affording vehicles for your business. And there are a lot of options. Let’s explore them together.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Credit Suite.

Distribution Channels: What They Are, Types, & Examples

Have you defined the distribution channels that will be used by your company?

If not, it’s time.

In short, distribution channels determine the path goods will take from the manufacturer to the final consumer.

Thus, they have direct impact over sales.

There are many types, formats, and levels of distribution channels.

The first step is to understand each of them.

To help you with this task, this page will go over the main things you need to know about distribution channels:

- what distribution channels are

- the three types of distribution channels

- three distribution methods

- distribution levels

- the main intermediaries

- how to define them

What Are Distribution Channels?

Distribution channels are the path products take from their initial manufacturing stage to selling them to consumers. The main goal of these channels is to make goods available to final consumers in sales outlets as soon as possible.

Distribution channels directly impact a company’s sales, so you want to make them as efficient as possible.

The Three Types of Distribution Channels

There are three ways to make sure a product gets to the final consumer.

1. Direct Channels

With direct channels, the company is fully responsible for delivering products to consumers. Goods do not go through intermediaries before reaching their final destination. This model gives manufacturers total control over the distribution channel.

This is the case with people who do catalog sales, for example.

Since the manufacturer alone is responsible for delivering products, this channel generally makes it impossible to have a high number of customers.

At the same time, it’s possible to offer lower prices, since the company does not have to pay commission to intermediaries.

2. Indirect Channels

With indirect channels products are delivered by intermediaries, not by the sellers.

Who are these intermediaries? They could be wholesalers, retailers, distributors, or brokers, for example.

In this case, manufacturers do not have total control over distribution channels.

The benefit is that this makes it possible to sell larger volumes and sell to a range of customers. However, products have higher prices due to the commissions paid to intermediaries.

3. Hybrid Channels

Hybrid channels are a mix of direct and indirect channels.

In this model, the manufacturer has a partnership with intermediaries, but it still takes control when it comes to contact with customers.

One example is brands that promote products online but don’t deliver them directly to customers.

Instead, they nominate authorized distributors.

Three Methods for Distribution Channels

There are three different delivery methods for distribution.

Basically, they concern who will be allowed to sell your products.

1. Exclusive Distribution

With exclusive distribution, intermediaries take the company’s products to specific sales outlets.

This is usually done by a sales representative.

This means that only exclusive retail outlets will be able to sell the items to consumers.

Depending on the quality of the product, this is a great strategy not only for manufacturers but also for the retail outlets or chain stores selected.

2. Selective Distribution

With selective distribution, the company allows sales to a specific group of intermediaries who are responsible for selling items to final customers.

An important factor in how succesful this strategy will be is the reputation of the intermediaries since they have a direct impact over the company’s performance.

In this case, the intermediary becomes the real consultant for consumers, answering questions and recommending appropriate products for their needs.

3. Intensive Distribution

In intensive distribution, the manufacturer tries to place their product in as many sales outlets as possible.

The manufacturers themselves, sales teams, and commercial representatives are all involved in this method. They are responsible for distributing products to sales outlets.

This distribution method is generally used by manufacturers of low-cost products with a high frequency of consumption.

Distribution Channel Levels

Besides the types and methods of distribution channels, they may also operate on different levels.

Their levels represent the distance between the manufacturer and the final consumer.

Level 0 Distribution Channel

In this level, there is a close and direct relationship between the manufacturer and the client.

For the company, the costs of the relationship with the consumer are higher.

Level 1 Distribution Channel

In level 1, the manufacturer sells the products to the distributor, who might sell it to consumers via retailers or wholesalers.

The distributor keeps some of the rights to the product, but not all.

The distributor is also responsible for the costs of sales and transportation to sales outlets.

Level 2 Distribution Channel

Level 2 is similar to level 1.

The difference is that in this case, the distributor delivers products only to retailers, who sell them to consumers.

Level 3 Distribution Channel

Level 3 channels are a traditional distribution model.

The product’s journey from the manufacturer involves distributor, retailer, and customer.

The costs relative to sales and marketing are divided between the parties.

The advantage of this model is that it’s possible to reach a larger number of consumers.

On the other hand, products have a higher price because of the operational costs of all the parties involved.

The Nine Main Intermediaries in Distribution Channels

After finding out more about operation details, it’s time to see who are the main intermediaries who take products to consumers.

1. Retailers

Retailers are intermediaries used frequently by companies.

Examples include supermarkets, pharmacies, restaurants, and bars. Each of these types of businesses has full sales rights.

Generally, product prices are higher in retailers.

2. Wholesalers

Wholesalers are intermediaries that buy and resell products to retailers. Wholesalers sell to those who are going to put products in their own stores.

These intermediaries generally don’t sell small quantities to final consumers, though there are exceptions, like supermarkets that sell in the wholesale model.

Prices are lower because sales involve large quantities.

3. Distributors

Distributors sell, store, and offer technical support to retailers and wholesalers. Their operations are focused on specific regions.

4. Agents

Agents are legal entities hired to sell a company’s goods to final consumers and are paid a commission for their sales.

In this case, the relationships between intermediaries and companies are for the long term.

5. Brokers

Brokers are also hired to sell and receive a commission.

The difference between agents and brokers is that brokers have short term relationships with the company.

That’s the case with real estate agents and insurance brokers, for example.

6. The Internet

To those who sell tech and software, the internet itself works as the intermediary of the distribution channel.

The consumer only has to download the material to have access to it.

E-commerce companies also use the internet as a distribution intermediary.

7. Sales Teams

A company can also have its own sales team who are responsible for selling goods or services.

There is also the possibility of creating more than one team to sell to various segments and audiences if the company has a wide range of products.

8. Resellers

Resellers are companies or people who buy from manufacturers or retailers to later sell to consumers in retail.

9. Catalog

Catalog sales, as the name indicates, is when a salesperson is connected to a company and sells its products using a magazine. Salespeople in this model also usually earn a commission for their sales.

This type of sales is common in the beauty segment, with brands like Avon and the Brazilian Natura.

Reverse Distribution Channel

Now you know the types and methods available for products to reach customers. But what happens when consumers need to return items to manufacturers?

Consumers need to rely on reverse distribution if they receive defective products or need to return clothes or shoes they bought online that don’t fit.

In this case, the consumer is responsible for returning the items and needs to find information from the manufacturer about how to do this. Usually, consumers find information about returns on the site for the product.

How to Define Distribution Channels for Your Product

Now you know the different types of distribution channels and intermediaries. But all this is of no use if you don’t know how to select the appropriate channel for your company.

Next up are seven essential tips to help you make this decision.

1. Benchmarking

First, you must look at your competitors to find the best practices they adopt.

This kind of mapping is known as benchmarking.

The idea is to figure out how your competitors are distributing their products and adopt a similar model.

2. Project Review

So you have mapped out best practices in the market and identified solutions that could work for your business.

Great.

The next step is to review the project/channel you created.

Check if there are errors and how processes may be optimized and adapt the project to the needs and characteristics of the type of sales you make.

3. Costs and Benefits

When we talk about distribution channels, one important factor is the cost associated with them.

Always look for the best cost-benefit ratio.

To do this, it is not enough to have a vague idea of the costs. You must record all costs and analyze if the benefits of the channel you selected are worth it.

4. Company’s Daily Routine

Another relevant factor is the business’ routine.

What are the projects, processes, and activities in your business?

The distribution channel must be aligned with all these details.

Otherwise, you might have logistics problems that result in product delays that damage your relationship with customers.

5. Market Potential

Before selecting a channel, you should also consider the market potential of intermediaries.

After all, unless you choose to use direct channels, they will also be responsible for sales results.

Analyze intermediaries’ market participation, reputation, and performance to only then try to select the most appropriate option.

6. Logistics

Consider logistical questions like:

- How will products be transported?

- Is there security for when the products are in transit and/or where they are stored?

- Where will goods be stored?

- What will be the delivery time, on average?

Considering all stages of logistics is crucial to avoid problems taking goods to sales outlets.

7. Location

Finally, consider the location of intermediaries, whether they are resellers, retailers, wholesalers, or distributors.

After all, your product must be sold in the region where your target audience is, especially if you supply a specific niche of the market.

Managing Distribution Channels

How should you manage your company’s distribution channels? This is usually the responsibility of marketing departments.

To do it, it’s essential to monitor key performance indicators (KPIs).

Carry out regular assessments of reports with metrics and indicators related to distribution processes.

Monitor sales indicators, for example, analyzing the performance of each channel the company uses.

Also, carry out satisfaction surveys with consumers, especially when customers are dissatisfied with the selection and availability of goods or when sales volume is below expectations.

Examples of Distribution Channels

Before concluding this reading, how about we get to know two examples from great companies?

Coca-Cola’s Distribution Channels

The largest soft drink manufacturer in the world uses different sales channels with franchisers, distributors, and retailers.

For example, soft drinks get to different retailers thanks to distributors.

This includes bars, restaurants, and supermarkets, who sell directly to final consumers.

Natura’s Distribution Channels

Cosmetics brand Natura basically uses catalog distribution, though today there are sales outlets as well.

The company has a network of consultants that sell to consumers using magazines showing the products.

Distribution Channels Conclusion

Are you ready to define and manage distribution channels for your company?

Follow the steps I mentioned in this article, from benchmarking to sales outlet analysis.

Consider the cost-benefit ratio of each channel.

And regardless of your choice, always monitor indicators and metrics.

This analysis makes it possible to check the efficiency of the distribution channel so you can optimize it constantly.

Did you like the tips in this article?

Leave a comment with your opinion or any questions you may have.

Marketing Funnel: What They Are, Why They Matter, and How to Create One

If you’ve spent any time learning about marketing analytics, you’ve probably come across the term “funnels.” What exactly are marketing funnels and why do they matter? Marketing funnels are a useful tool to help you visualize the path customers take from first finding out about your brand to converting. Understanding them provides useful insight into …

The post Marketing Funnel: What They Are, Why They Matter, and How to Create One first appeared on Online Web Store Site.

Marketing Funnel: What They Are, Why They Matter, and How to Create One

If you’ve spent any time learning about marketing analytics, you’ve probably come across the term “funnels.” What exactly are marketing funnels and why do they matter?

Marketing funnels are a useful tool to help you visualize the path customers take from first finding out about your brand to converting. Understanding them provides useful insight into why some customers convert — and some don’t.

What Are Marketing Funnels?

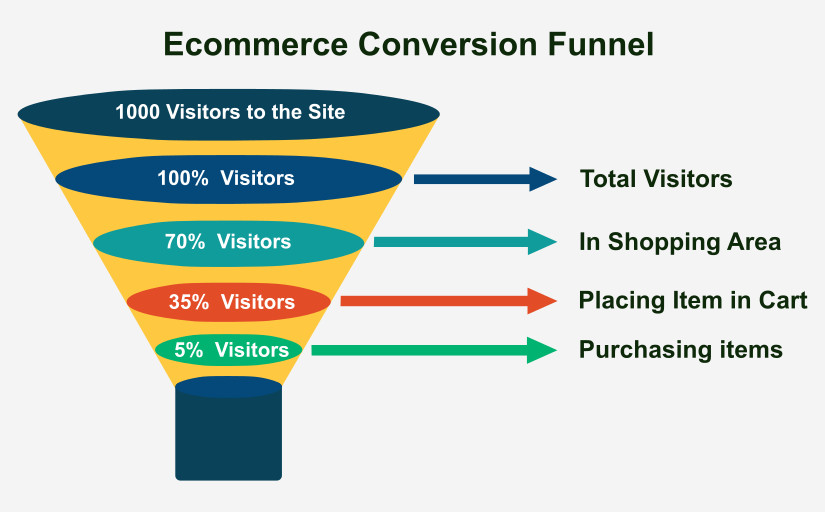

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert. The most common type of marketing funnel is four steps:

- Attention: A prospective customer sees your ad, social media post, or hear about you from a friend.

- Interest: They think you can solve a problem and wants to learn more.

- Desire: The prospect has done their research and wants to convert.

- Action: The prospect takes action — they buy your item, schedule a demo, or take whatever other action you want them to take.

The action can vary based on customer and industry — maybe you want them to make a purchase, sign up, or fill out a form. When someone does something you want them to do, it’s known as a conversion. The visitor converts from browsing to taking the action you want them to take.

Think about the Amazon purchase funnel. There are several steps a visitor has to go through before they can purchase a product. Here’s how it looks:

- They visit Amazon.com

- They view a product

- They decide to add a product to the cart

- They complete the purchase

There are additional steps/actions that can be taken in between each of these steps, but they don’t matter in the marketing funnel unless they contribute to the final action. For example, a visitor may view Amazon’s Careers page, but we don’t need to count these in the funnel because they aren’t necessary steps.

Why is the set of steps to conversion called a “funnel”? Because at the beginning of the process, there are a lot of people who take the first step.

As the people continue along and take the next steps, some of them drop out, and the size of the crowd thins or narrows. (Even further along in the process, your sales team gets involved to help close the deal.)

Losing customers might sound like a bad thing — but it’s not. The truth is, not everyone in your funnel will convert. The top of the funnel is where everyone goes in (visiting your site or viewing a marketing campaign). Only the most interested buyers will move further down your funnel.

So when you hear people say “widen the funnel,” you now know what they are referring to.

They want to cast a larger net by advertising to new audiences, increasing their brand awareness, or adding inbound marketing to drive more people to their site, thus widening their funnel. The more people there are in a funnel, the wider it is.

What Are the Different Types of Funnels?

In this article, we’re focusing on marketing funnels, that is funnels that start with some sort of marketing campaign. That might be a PPC ad, content marketing campaign, white paper download, video ad, social media ad, or even an IRL ad. The point is the first step in the funnel is a marketing campaign of some sort.

Other types of funnels you might hear about include:

- Sales funnels

- Webinar funnels

- Email funnels

- Video marketing funnels

- Lead magnet funnels

- Home page funnels

Despite the different names, these all track the same exact thing — the steps a prospective customer takes to conversion. (Sometimes they are even called conversion funnels!)

What Can You Use a Marketing Funnel For?

You aren’t limited to using a marketing funnel strictly for signing up and/or purchasing. You can put funnels all over your website to see how visitors move through a specific website flow.

You may want to track newsletter signup (Viewing newsletter signup form > Submitting form > Confirming email) or a simple page conversion (Viewing a signup page > Submitting signup).

Figure out what your goals are and what you want visitors to do on your site, and you can create a funnel for it.

Once you have the data, you’ll be able to see where roadblocks are and optimize your funnel. Let’s dig a little deeper into that.

Why Are Marketing Funnels Are Beneficial?

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers. This is sometimes called a “leaky” funnel because it allows customers you want to keep to escape the funnel.

Let’s take your average SaaS business as an example. Here’s how a funnel may look for them:

- Visited site

- Signed up for a trial

- Used product

- Upgraded to paying

Do people have to use the product before paying? They don’t, but it’s a good idea to track it so you can see if it’s a roadblock.

For example, if you are losing a lot of conversions after the trial stage, you might need to update your onboarding process so people understand how to use the tool or even adjust the top of your funnel so you aren’t attracting people outside of your target audience.

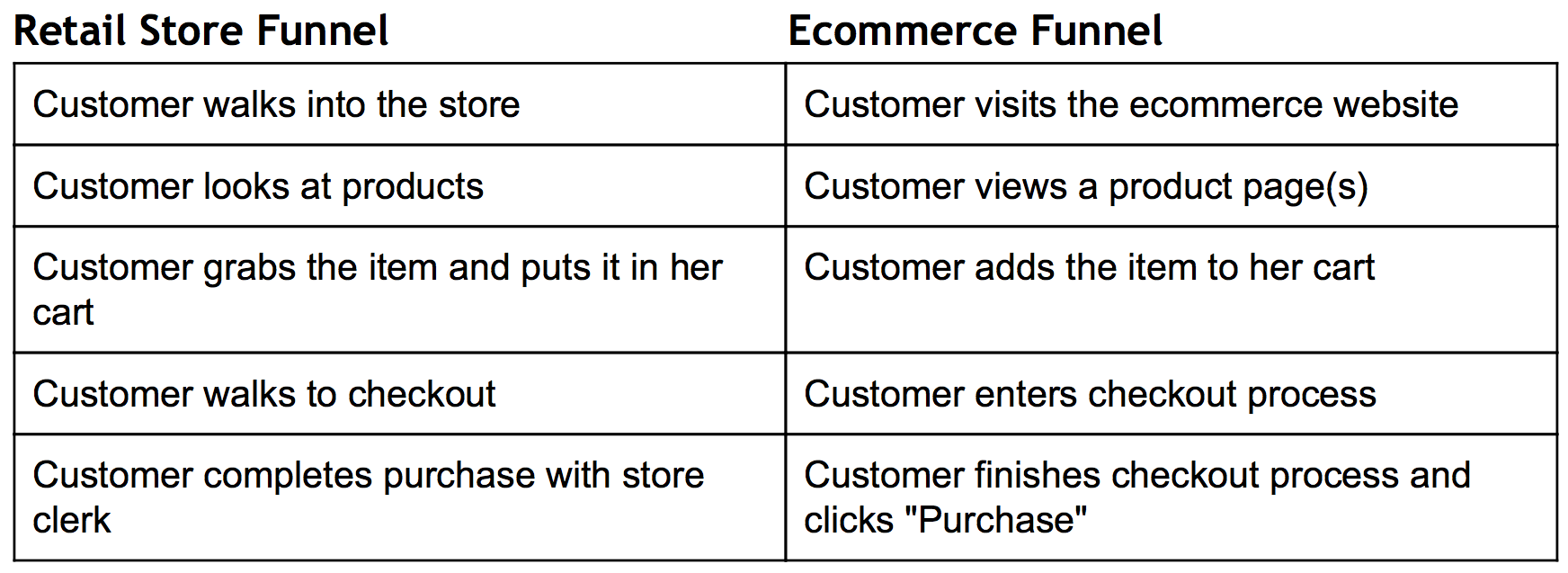

A Real-Life Marketing Funnel Example

Let’s look at a funnel process for a retail store and see the corresponding steps in an e-commerce store. We’ll be tracking a purchase funnel.

The e-commerce store has the fortune of being able to see a funnel because they can track clicks, time on page, and other metrics. Their marketing would look something like this:

Okay, so now we have an understanding of what a funnel is and why it helps. Let’s take a look at a product that offers funnels – Google Analytics.

How Google Analytics Marketing Funnels Work

Google Analytics offers funnels, and I’ve written extensively about it in the past. This is an incredibly simple way to track the path prospects take before they convert. Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

Here are a couple of things you’ll need to know when creating funnels in Google Analytics:

- It’s a pretty basic funnel: If you don’t want to dive deep into the data and optimize, you can go with this.

- You cannot go back and retroactively view data: Once you create your funnel, you’ll only be able to the funnel going forward as the data comes in.

Overall, if you are just getting started with marketing funnels, Google Analytics is a solid place to start. Learn how to set up a conversion funnel in Google Analytics.

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert.

Sales funnels

Webinar funnels

Email funnels

Video marketing funnels

Lead magnet funnels

Home page funnels

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers.

Visited site > Signed up for a trial > Used product > Upgraded to paying customers

Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

Conclusion

We’ve covered just about everything you need to know about marketing funnels. Here’s a quick recap:

- When someone on your website does something you want them to do (i.e., sign up, make a purchase, fill out a form, etc.), it is known as a conversion.

- A funnel tracks the steps that lead up to that conversion. For example, e-commerce companies want people to purchase products on their website. Their funnel may have these steps: visited site > viewed product > placed product in cart > purchased.

- A funnel report shows you where people are dropping off in the path to conversion so you can optimize your conversion path and drive revenue.

- Google Analytics provides funnels as part of the free Google Analytics software. It’s a simple and free way to get started with marketing funnels.

Have you created a marketing funnel in Google Analytics? What did you learn?

Who is Generation Alpha, and Why Are They Important to Marketers?

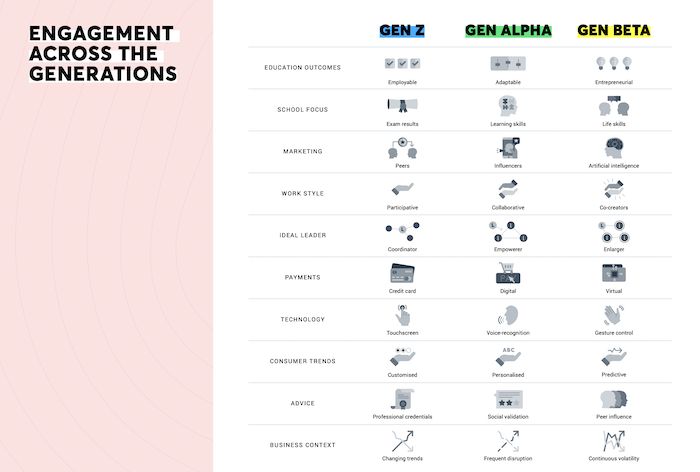

Every new generation brings new customs, behaviors, and cultural phenomena that shape the world as we know it.

Baby boomers brought significant economic influence.

Millennials taught us new ways of viewing our socio-political world.

Generation Z showed us what the intersection of technology and humanity looks like.

Now, we have Generation Alpha, a demographic of tech-savvy, racially diverse, and unapologetically influential children who will start entering adulthood at the end of the 2020s.

But, they’re children. They aren’t our buyers. Why should marketers care about them right now?

Studies have shown children under 12 can influence parental purchases of $130 to $670 billion a year. And, it won’t be long before they are the buyers.

It’s never too early to prepare. In fact, since the oldest kids in this generation are starting to hit middle school, we may even be cutting it close.

Let’s take a look at the climate shaping this upcoming generation and what we can expect from them in the future.

What Birth Years Are Considered Generation Alpha?

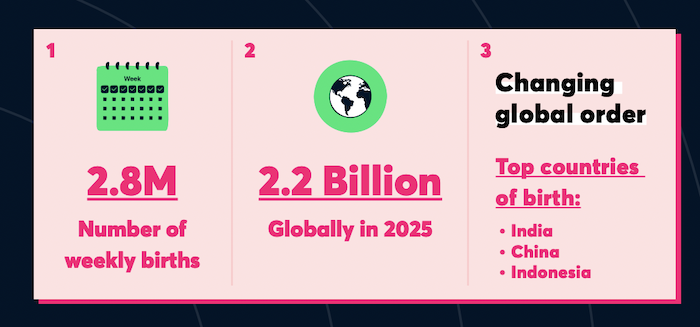

Generation Alpha covers those born between 2010 and 2024. Most of their parents are Millennials.

Every nine minutes, a new member of Generation Alpha is born in the United States. By 2025, this group will reach a worldwide population of more than two billion.

Generation Alpha Culture and the Future of Marketing

Although some Gen Alpha babies haven’t been born yet, there are a few things we can predict about them.

For starters, Generation Alpha will be the most technologically advanced generation to date, growing up with mobile devices, AI, social media, advanced healthcare, and robotics as parts of their everyday lives.

They will be digitally literate and adept multi-taskers as a result.

Gen Alpha also stands to be the most materially endowed generation of all time. This means they could end up being able to spend more on nonessentials than previous generations.

They also stand to be the most globally informed group so far, and they will have the longest life spans.

Generation Alpha Technology Trends

As Generation Alpha evolves, so will their familiar technology.

We’ve already seen the effects of exponential technological growth on current generations, and these effects will continue to grow.

It’s expected that AI and robotics will be completely integrated into modern life by 2025. We can also expect machine learning, natural language processing, and smart devices to change, improve, and further connect us in the coming years.

Gen Alpha may find themselves interacting with robots just as frequently as with humans.

For marketers, this means speaking to an astute audience that may know the ideal product better than we do.

Similarly, we can expect Gen Alpha to reject traditional forms of marketing, much like their Millennial parents did not long ago. An increasing interest in personalization, humanized messaging, and social shopping should be assumed.

Generation Alpha Education Trends

Generation Alpha stands to be the most educated generation to date.

Access to education is at an all-time high, with most countries reporting twelve or more years of schooling for every individual citizen.

According to UNESCO, each additional year of education increases a person’s earnings by roughly 10%.

With improving digital resources and the increasing availability of technology, Gen Alpha will have better access to long-term education than any previous generation.

That said, the way they view education will likely be different. There may be less emphasis on formal degrees and, instead, a focus on skills.

The Eduniversal Evaluation Agency (EEA) put it this way:

In an age where every other tech CEO and startup founder dropped out of college and now rakes in millions, it’s hard to argue that moving forward, a degree will remain an absolute prerequisite for success.

In addition to these trends, we’ll see the continuation of highly personalized instructional content.

A generation used to instant access to information is unlikely to succeed in three-hour-long lectures. Instead, we can expect an increase in online learning, especially tutorials, which will further the technological proficiency of Gen Alpha.

Generation Alpha Social Media Trends

Young people are increasingly drawn to social media. With the introduction of social media e-commerce, social media has become one of the most essential tools for marketers in the modern age.

One survey found 49% of 16- to 24-year-olds look to social media for purchase inspiration. This is higher than older generations—their parents may only do this 20% of the time, for instance.

As more Gen Alpha kids grow up immersed in social media, we can predict social media usage will become an increasingly inextricable part of their lives.

Gen Alpha already uses social media differently than their parents. They’re less likely to be on Facebook or Twitter, favoring Instagram and TikTok. Brands that stay on top of the newest technology stand to see greater success with this burgeoning generation.

Generation Alpha Data Sharing Trends

Gen Alpha may be warier of providing or allowing access to their data to social media giants, search engines, ad agencies, and so on. We’re already seeing this trend today, with more and more countries instituting data privacy laws such as the GDPR.

By the time Generation Alpha reaches maturity, they’ll probably have a deep understanding of their data and how it’s used. This could lead to higher levels of criticism and questioning when consenting to data usage—they might read that fine print.

Companies looking to leverage consumer data should consider what they give back in return. Often, an equal exchange is enough to encourage consumer consent.

Brands doing this incorrectly risk losing their rising audience.

Generation Alpha Healthcare Advancements

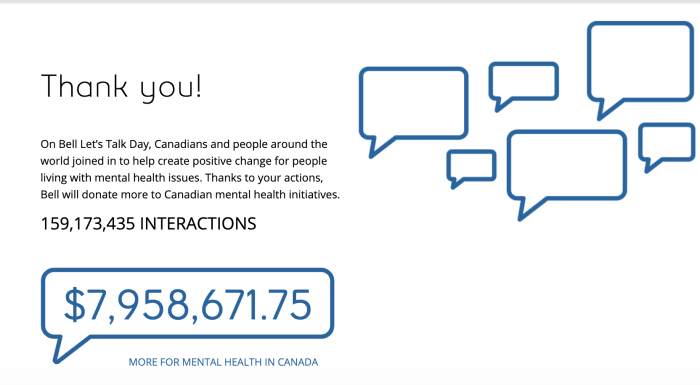

Much like their millennial parents, Gen Alpha will likely spend more time finding medical information online. Self-service and convenience will continue to be driving factors for Gen Alpha’s healthcare.

In addition, younger generations are increasingly aware of mental health and are more likely to seek help for challenges with theirs when needed. They’ll likely expect their workplaces to offer mental health coverage and resources.

On the brand side, this means staying compassionate and aware of mental health can greatly improve overall brand integrity.

The Bell Let’s Talk movement is a strong example of a brand doing this right.

Generation Alpha Media Literacy Trends

Gen Alpha will have the best media literacy of any generation. They’ll be able to separate fact from fiction and more likely to identify conspiracy theories or fake news circulating on the internet.

For marketers, this means speaking to a well-informed audience that isn’t likely to be persuaded by traditional marketing tactics.

It also means engaging Gen Alpha in the arenas they prefer. Podcasting, video content, and gamification will become increasingly important when delivering information.

Additionally, personalization in marketing will continue to grow in popularity. For Gen Alpha, it won’t be enough to simply push a sale. Marketers will need to connect with this generation in an ongoing way.

Generation Alpha Diversity Trends

The US is becoming more diverse, and younger generations are increasingly aware and accepting of challenges based on race, religion, disability, sexual orientation, and gender identity.

Gen Alpha’s patience for inequality will almost surely continue to decrease as they grow up.

Children of this generation are unlikely to work for a company that doesn’t reflect their values. In the same way, they won’t buy from brands that go against what they believe in.

Brands championing diversity and social issues while embracing widespread change will flourish. Brands that don’t evolve will be left behind.

Generation Alpha Economic Trends

Generation Alpha first came into being during an economically tumultuous time as the world recovered from the Great Recession.

They’ve gone through some pretty interesting ups and downs since then, and significant political and social issues will continue to affect their economic standing.

We can be reasonably sure that they’ll be largely invested in the experience economy, including live entertainment, amusement parks, spectator sports, and tours.

This economy has largely been fueled by social media and technology, as people share the fun they’re having and others want to have adventures as well.

Additionally, Gen Alpha is predicted to be the longest-living generation of humans so far. Because of this, they’ll likely stay in the workforce longer, meaning more money over their working years.

As marketers, we need to plan for all of this. Our consumers face a bit of a question mark in terms of the economy. But, we know what they want—experiences—and that they’ll be educated and in the workforce for a long time. Catering to a changing climate and meeting their needs and desires throughout their lifetimes is essential.

Conclusion

Generation Alpha represents a fascinating, technologically advanced evolution of the human species.

People in this generation are digital natives growing up with smartphones, social media, and AI. They’re entering a genuinely advanced world where automation and innovation rule.

Additionally, their purchasing influence is already present, and they’re influencing their parents buying decisions even now.

Marketers who pay attention to this generation now will be better prepared to out-market big competitors in the coming years.

We can expect to see a well-educated, digitally fluent, socially-conscious generation. We need to keep up.

What predictions do you have for Gen Alpha?

The post Who is Generation Alpha, and Why Are They Important to Marketers? appeared first on Neil Patel.

What Are Inventory Loans and How are They Affected by the Recession

Inventory loans are short term loans that business owners can use to purchase inventory. The inventory is the security for the loan. By taking out this type of loan, a business can stay ahead of demand. It also allows for taking advantage of special pricing, thus increasing profit.

Inventory Loans are Not Always a Sure Thing

Investopedia defines inventory financing as:

“… a revolving line of credit or a short-term loan that is acquired by a company so it can purchase products for sale later. The products serve as the collateral for the loan.”

These types of loans are a type of inventory financing. Seeing as these are, at their core, secured loans, it stands to reason that they are easier to get than unsecured loans. However, that is not always the case.

Why Inventory Loans are Hard to Get

The idea of inventory as collateral for the financing used to buy it sounds simple enough. However, after the hard economic downturn of 2008, lenders are much stingier with this type of small business financing. During that time, it was painfully evident that, if your loan was secured by non-staple items, there was about to be trouble.

Non-necessities do not sell well in a recession. If you can’t sell, the bank cannot either. That means the security is pretty much worthless.

Another issue is that inventory depreciates. As security, it’s basically on the clock. If it depreciates to the point of not being worth the amount of the loan, it is worthless as security. There is also the idea that it may be a fad that is going to quickly go out of style, also not selling.

These are just a few of the reasons lenders are reluctant to approve loans secured by inventory. Typically, they approve these types of loans on a case by case basis, taking all of these factors into account. Even when they grant approval, it is typically for only around 50% of the cost.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Ways to Use Inventory Loans

There are some things you can purchase with inventory loans that may surprise you. For example:

- If you run a dining establishment, you can use inventory loans to buy flatware and linens in addition to food supplies.

- If you run a salon, you can use this type of financing for towels and supplies as well as items to sell.

- A clothing store may use the funds for shoes, accessories, and other items.

The point is, funds for these loans can purchase items that are not specifically inventory in terms of things that you sell to the public. They can also purchase supplies for any services you may offer.

Other Options for Inventory Loans

How do you fill in the gap for the other 50% of inventory costs? Further, how can you finance inventory if you cannot get any type of funding at all? There are some other options.

Inventory Loans: Credit Line Hybrid

A credit line hybrid is essentially an unsecured line of credit. It allows you to fund your business without putting up collateral, and you only pay back what you use. The funds can be used for many things, including inventory financing.

It’s super easy to qualify. You need a personal credit score of at least 680, and you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have less than 4 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

I know, that doesn’t sound all that easy. Here’s the catch. If you do not meet all of the requirements, it’s okay. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

Credit Line Hybrid vs. Inventory Loans

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, this is no-doc funding. That means you do not have to provide any bank statements or financials.

In addition, typical approval is up to 5x that of the highest credit limit on the personal credit report. Often, you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

Here is another benefit of the credit line hybrid. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months. The process is generally quick, especially with a qualified expert to walk you through it.

Inventory Loans: Alternative Lending

Alternative lenders generally operate online. They tend to reduce risk by increasing interest rates rather than relying completely on credit information. This means that they can be an option for those businesses and owners that either have bad credit or have not yet built strong enough credit to qualify for financing with traditional lenders. Here are a few options.

Fundbox

Fundbox offers a line of credit rather than a loan, but it is a great funding option because there is no minimum credit score requirement.

They offer an automated process that is super-fast. Repayments are automatic, meaning they draft them electronically, and they occur on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn currently, as the repayment period is comparatively short. This means you need to be sure you have enough funds in whatever account you connect them to so that it can cover your payment each week.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Upstart

Upstart is an online lender that uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO on their own to truly determine the risk of lending to a specific borrower. They choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data instead. They then use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities. Typically, business loans are available up to $50,000. Interest rates vary greatly, ranging from 7.5% to 35.99%. Repayment terms can be either 3 -year or 5-year.

Fora Financial

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

OnDeck

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account.

Bond Street

Offering term loans of up to $1 million, Bond Street terms are for up to 1 to 3 years. They will ask for both EIN and SSN.

Lending Club

Popular online lender Lending Club offers term loans. Business loans go up to $300,000 and terms from 1 to 5 years are available.

Quarter Spot

Quarter Spot is an online lender that offers short term loans up to $150,000. The terms are 9 to 18 months.

Rapid Advance

Rapid Advance offers standard, select, and preferred loans. For standard loans, amounts up to $1 million are available. Their terms are 4 to 12 months.

Kiva

Kiva is an online lender that is a little different. For example, the interest rate is 0%, so even though you have to pay it back it is absolutely free money. They don’t even check your credit. However, there is one catch. You have to get at least 5 family members or friends to invest in your business. In addition, you have to give a $25 loan to another business on the platform. It’s like a crowdfunding, 0% interest loan.

Accion

If your personal credit is okay, Accion may be a good fit for inventory financing. It is a microlender, a nonprofit, that offers installment loans to both startups and already existing businesses. You don’t have to already be in business, but if you are not, you must have less than $500 in past due debt. In addition, your business needs to be home or incubator based.

Credibly

Credibly is also a good option if you are already generating some revenue. They offer short term loans for both business expansion and working capital.