The 5 Best Link Building Companies of 2020

What are backlinks to search engine optimization?

Short version: They’re signals Google uses to determine if your website is a reputable resource worthy of citation.

The long and sweet version?

The more quality backlinks pointing to your website, the higher your chances of ranking for profitable keywords and competitive search queries that drive sales.

You’ll generate more targeted traffic, leads, and customers.

TThe SEO research tool, SEMrush, revealed backlinks account for as much as five SEO top 10 ranking factors:

Due to how essential links are to rankings and traffic, you’ll find a host of companies promising to help you generate backlinks at the click of a button.

If only it were that easy!

Acquiring top-quality backlinks isn’t a stroll in the park.

Our team at Neil Patel Digital reviewed and listed the top companies for building links.

The 5 Top Link-Building Companies in the World

- Neil Patel Digital – Best for Linkable Content Marketing

- FATJOE – Best for Blogger Outreach

- Page One Power – Best for Strategic Links

- The HOTH – Best for Guest Posting

- RhinoRank – Best for Curated Link Building

1. Neil Patel Digital – Best For Linkable Content Marketing

The creation and distribution of linkable assets is the most reliable way to get people linking back to your website.

Called editorial links, Google and other search engines prioritize such links.

The reason for this?

They’re natural, and indeed a vote of confidence other sites show for the content resources on your own website.

Another name for this type of link-building strategy is linkable content marketing.

And Neil Patel Digital excels at this.

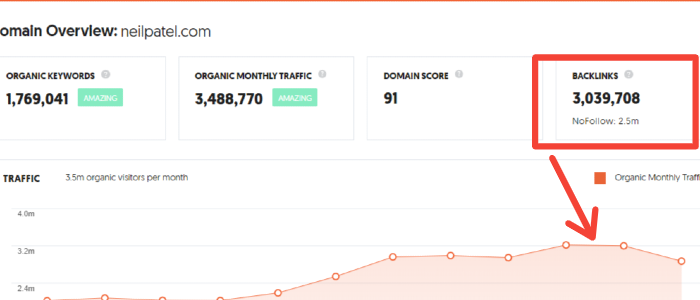

I’ve amassed millions of backlinks to this blog:

That’s over 3 million backlinks.

And they came from organic keywords (over 1.7 million), generating more than 3.4 million monthly organic traffic in the process.

The Neil Patel Digital experience spans over five decades to help you get similar results.

And we leveraged this experience and vast expertise to develop a holistic, battle-tested content marketing program that helps our customers generate high-quality backlinks.

It starts with auditing, optimizing, and creating new, high-quality content people would love to link to.

Then, promotion, so even influencers can find and reference them.

This proven program powers us to create and distribute content marketing assets that get high-quality backlinks, higher rankings, and qualified traffic.

In short, this is why our customers, from startup to grow-stage and enterprise companies, love working with Neil Patel Digital.

2. FATJOE – Best for Blogger Outreach

You may have linkable content resources on your site. What if other websites or bloggers don’t know those assets exist? No one would link to them, right?

Yup, that’s a problem.

To make people, especially bloggers, aware of your content, you need what SEOs call blogger outreach.

And this is what FATJOE excels at doing. They’re a reliable blogger outreach service even other agencies rely on for generating backlinks:

The experienced SEO expert, Joe Taylor, founded FATJOE. And they’ve been in business since 2012, helping over 5,000 clients worldwide get backlink placements via blogger outreach.

About 97% of those 5k plus customers rate FATJOE a 4.5/5.

However, FATJOE is best for acquiring links from websites with domain authority between DA10 and DA50. And prices per link placement range from $45 to $465.

3. Page One Power – Best for Strategic Links

Getting backlinks from higher domain websites (DA60+) needs a combination of linkable assets, outreach, and high-level strategy.

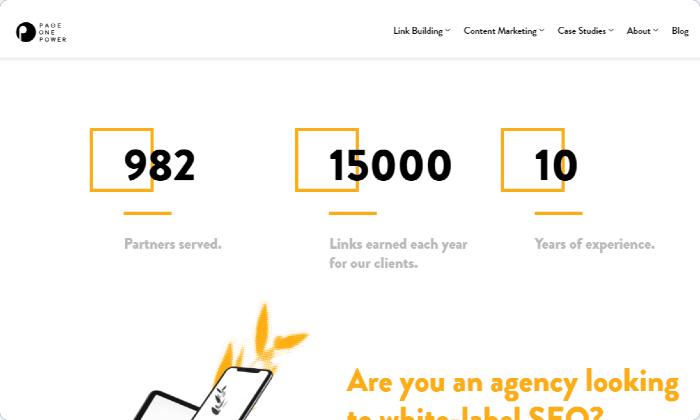

Page One Power, although more expensive and not a productized service like FATJOE, excels at this.

Yearly, this company is behind the acquisition of more than 15,000 strategic backlinks on average to its clients from higher domain websites.

And Page One Power achieves this, leveraging its 10 years of experience and 982 active partners:

If you have the budget that starts at $550 per link, with more for a monthly retainer, you should turn to Page One Power for their consistent, strategic link-building expertise.

And can you make this turn, knowing other businesses, such as QuickBooks, Healthline, BOTTSTICH, and several others, trust Page One Power’s strategic link acquisition services, too.

4. The HOTH – Best for Guest Posting

What if you’ve done everything possible, yet people still won’t link to your site?

The HOTH, a company successful for its guest posting services, can help, and they come highly recommended:

The HOTH’s guest post, backlinking service covers everything from manual outreach, securing guest post slots, and creating the guest content piece with links to your site.

Their industry experience and expertise have seen them work with or get mentioned on reputable websites such as Forbes, Inc. 5000 fastest-growing companies, Salesforce’s Dreamforce, and others.

The HOTH is a productized link-building service like FATJOE, allows you to purchase guest posts and backlinks with a few clicks.

With this company, you can get backlinks from websites with domain authority ranging from DA10-DA50. And prices are between $100-$500, depending on the quality of website you want links from.

5. RhinoRank – Best for Curated Link-building

Sometimes, other websites already have published content pieces with info relevant to assets on your own site.

In such a case, reach out to the webmasters of those sites and ask for a link, otherwise called curated link-building.

Based on our review, RhinoRank is the go-to company for this type of link acquisition tactic. They do all the hard labor, reaching out to several webmasters to secure backlinks for its clients in existing content on those webmasters’ domains:

Not only will RhinoRank reach out to webmasters, they’ll take it a step further by ensuring those links are weaved naturally with the right anchor text.

RhinoRank serves over 200 companies and SEO agencies globally.

The price of each curated link generated for customers by RhinoRank starts from $35.

5 Characteristics that Make a Great Link-Building Company

For each link-building strategy and company recommended above, you’ll find hundreds, if not thousands, of others promising the same things.

So, what characteristics make a great link-building company if you wanted to find an ideal company to work with and do your own due diligence?

Let’s look at the most significant ones.

1. A Holistic SEO Implementation Process that Includes Link-Building

Link-building is a crucial part of SEO, but it is not a silver bullet. On its own, it won’t drive traffic and help you generate leads.

You can amass links, but if the search engines don’t trust those links or the content being linked to, those efforts amount to nothing.

Thus, an essential characteristic of great link-building companies is to have a holistic SEO program with all the bolts and nuts, including content creation, promotion, and link acquisition.

2. An Impressive Client Portfolio

An excellent way to judge the processes and expertise of a company is via its client portfolio.

Thus, as other companies with hands-on experience would do, the top link-building companies have the characteristic of displaying their ability to generate backlinks by showing off a portfolio of clients they’ve helped to get backlinks.

3. Thought leadership

The best link-building companies aren’t just great at acquiring backlinks.

They also have the characteristic of sharing all their learnings on their way to helping themselves and other companies generate high-quality backlinks.

You want a team that knows the best strategies and tactics that work today.

For example, if you Google “link-building Neil Patel,” you’ll find my in-depth guides.

4. Real Life Testimonials

A good criterion for determining if a link-building company is among the very best is to look at their customer testimonials.

Thus, a characteristic you’ll find with the top link-building companies in the world are real-life testimonials, highlighting what customers say about working with them.

5. A Diversified Team

One person can write a guest post and send you a few links. But you’ll need a diversified team of experts to execute more strategic and extensive link-building campaigns.

As we’ve shown you, the best link-building companies excel at planning and executing these bigger, more effective link acquisition strategies.

And to do that, they usually work with a team of diversified experts, which you can look up to as one of their characteristics:

What to Expect from a Great Link-Building Company

If you take on the services of a link-building company, you judge them by their ability to get you links. It’s that simple.

However, there’s a wide gap between contacting a company and getting those juicy links.

So, what should you expect if you decide to work with any of the link-building companies reviewed above?

1. A discovery session

Your business needs are different from those of others, and so would your link-building needs. Thus, the link acquisition strategies that worked for one site won’t work for yours automatically.

The best link-building companies have experience generating links for different organizations. Thus, they don’t jump straight into sending you proposals.

Instead, they start the process of helping to customize a strategy for your business by allowing you to share your exact business needs over a discovery session.

2. Research & strategic recommendations

Once you’ve booked and discussed your business needs with a link-building company, the best ones take what you tell them and leverage their experience to conduct in-depth research.

After this research, you should receive a host of strategic link-building recommendations most suited to your business. Most companies would share this with you via email or over another discovery call.

3. A contract with project deliverables

Once everyone decides that the project is a good fit, it’s time to get a contract in place.

Deliverables, deadlines, resources required, and budget should all clearly be outlined in detail.

4. Client onboarding

The next thing to expect from a top link-building is an onboarding process. It sets the stage for working with you to achieve your link acquisition and related business goals.

Depending on your work scope, you’ll need to bring on your in-house staff and share your website, blog, analytics, etc. with the company.

This onboarding process also establishes an understanding of how the company would manage your project.

Link-Building Isn’t a One-Time Activity

Unfortunately, link building isn’t a one-off project. I wish it was.

But links decay, pages decay, and Google’s always looking for freshness.

You’ll need ongoing links to keep your site at the top of the rankings.

This is the main reason why companies try to get help. It’s exhausting trying to do it yourself all the time.

However you decide to do it, treat link-building as an ongoing, long-term activity that’s a core part of your SEO strategy.

Doing this is how you’ll get maximum results.

The post The 5 Best Link Building Companies of 2020 appeared first on Neil Patel.