The mainstream media appears to be waking up to the effects of President Biden’s border policies as reporters not often heard challenging the White House are suddenly interested in the topic, Rep. Jim Jordan, R-Ohio, said Thursday. Jordan told FOX news the turning point might have been New York City Mayor Eric Adams warning that … Continue reading Media 'waking up' to border deluge and pressing White House because they can't avoid it now: Jim Jordan

Author: Tristan Schick

Biden's 2025 Tax Agenda

The post Biden's 2025 Tax Agenda appeared first on Buy It At A Bargain – Deals And Reviews.

7 Strategies That Will Get Powerful Results for Your Marketing and Sales Teams [Free Webinar on May 24th]

Are your sales and marketing teams aligned? Or are they working in silos, with only a vague understanding of what the other team is doing?

If your sales and marketing teams aren’t working well together, you’re not alone.

According to LinkedIn, 93 percent of sales and marketing professionals say their company has issues with alignment, such as antagonism between teams, excluding others from planning, and challenges communicating.

Sales and marketing misalignment can result in lower sales, lost leads, and annoyed customers. Are you ready to improve the relationship between sales and marketing?

Join Neil Patel and the Pipedrive team for a free webinar on sales and marketing alignment on May 24th at 8 am PST.

Why is Sales and Marketing Alignment So Important?

When the left hand doesn’t know what the right hand is doing, you lose revenue, deliver a poor customer experience, and miss opportunities.

A lack of sales and marketing coordination costs businesses an estimated $1 trillion a year in the US alone.

For example, say marketing creates a campaign to drive what they think are qualified leads to a new landing page.

Unfortunately, sales redefined how they qualify leads a few weeks ago–but no one told marketing.

Now, that landing page is flooded with leads that sales will never follow up on. Marketing says “Look at all that traffic! Why isn’t anyone following up on all those leads?”

While sales sees low-quality traffic that will waste their time, so they focus on leads from a paid campaign instead.

Everyone’s frustrated, and no one wins–least of all your customers.

So how do you get everyone on the same page? By using strategies that bring sales and marketing together, increase communication, and play to everyone’s strengths.

What strategies should you use? That’s what we’ll cover in our next webinar, created in partnership with Pipedrive.

Who Should Attend Our Sales + Marketing Alignment Webinar

If you have a marketing and sales team of two or more people, you’ll want to attend this webinar.

Here’s why: setting up sales and marketing alignment from the beginning is the best way to prevent misalignment.

If you have a larger team and struggle to get everyone on the same page, this webinar will be crucial. We’ll cover a range of strategies, from automation to removing silos, to help both teams share data and strategies.

Remember, everyone is on the same team–and we’re all looking to drive growth. Making it easy (thank you, automation!) to share data and insights will improve everyone’s metrics–especially your bottom line.

What Types of Businesses Is This Webinar For?

Any business with a sales and marketing team (even if it’s only one person each!) will benefit from this webinar.

That includes organizations in industries like:

- B2B businesses looking to improve their sales and marketing metrics

- SaaS companies looking to increase sign-ups

- E-commerce businesses looking to scale.

- Brick and mortar companies struggling to grow online and in-person sales.

What You’ll Learn in Our May 24th Webinar

In our upcoming webinar, you’ll learn seven strategies to help your sales and marketing teams work together to drive leads, traffic, and revenue.

Neil will share strategies like using automation and integrations to eliminate data silos, aligning communciation cadences, and integrating call data so both teams can leverage it to improve customer experience.

For each strategy, we’ll share data points on why it matters, results in the form of case studies, and provide step-by-step instructions on how to implement our strategies for your business.

The webinar will wrap up with a Q+A session where you can ask questions and get advice on implementing these strategies in your own organization.

Want to join us? Sign up today and join us on May 24th. We look forward to seeing you.

Civil Society is Ukraine's Secret Weapon Against Russia

The actions of civilian volunteers are disproving Putin’s claim that Ukraine isn’t a real nation.

The post Civil Society is Ukraine's Secret Weapon Against Russia appeared first on #1 SEO FOR SMALL BUSINESSES.

The post Civil Society is Ukraine's Secret Weapon Against Russia appeared first on Buy It At A Bargain – Deals And Reviews.

About Those 300 Stolen Ballots…

This guy wasn’t aiming at election fraud, but that’s small comfort.

The post About Those 300 Stolen Ballots… appeared first on #1 SEO FOR SMALL BUSINESSES.

The post About Those 300 Stolen Ballots… appeared first on Buy It At A Bargain – Deals And Reviews.

Washington woman found 'beaten to death' in Cancun hotel room during vacation; boyfriend arrested

Jason Transue was trying to convince his daughter, 26-year-old Sativa Transue, to drive across Washington state for Thanksgiving last week, but she told him on Thursday morning that she was going on a last-minute trip to Cancun, Mexico, with her boyfriend of three years, 31-year-old Taylor Allen.

How to Ensure Your Business Financials Promote Maximum Fundability

There are 125 factors that affect the fundability of your business. They break down into more general core principles. One such area is business financials.

Business Financials and Fundability

It probably comes as no surprise that your business financials affect the fundability of your business. But, what are lenders looking for? Is it just income and expense? Do they want tax returns and financial statements?

Start With The Basics: What is Fundability?

Initially, it may help to remember exactly what fundability is. Put simply, fundability is the ability of a business to get funding. It encompasses a number of things. The business financial information is just one. Now, let’s break down each factor within this principle.

Business Tax Returns

For maximum fundability, lenders like to see at least 3 years of business tax returns. Some traditional lenders will not even consider an application without this.

Sometimes, these are the only financials they need to see. The longer your tax history, the better. Of course, all tax returns need to be up to date and taxes paid. If you aren’t paying your taxes, lenders will not believe you will pay a loan.

Mainly, they will want to see that you are solvent. That means, you can meet your obligations. Even if tax returns are enough, your fundability will be stronger if you can provide financial statements as well.

Business Financial Statements

A business financial statement includes a number of statements actually. At a minimum, most have a statement of income and expense, a balance sheet, and a statement of cash flows. Not surprisingly, they want to see that the business is profitable. With these reports, lenders can also make a number of calculations that will help them make decisions.

Typically, traditional banks have a credit analyst that does this. For new credit decisions, a credit analyst will compare financial statements for at least the past three years.

If they can get more financial history, that is even better. First, they will look for trends and patterns. Then, they will ask for explanations for major changes from one year to the next. For example, if there is a sudden increase in debts or expenses, or decrease in the bottom line, they will question that.

Audited Business Financial Statement vs. Company Prepared Financial Statement

This is why audited financial statements provide even stronger fundability. These statements will already have notes explaining any major fluctuation. Also, lenders view them as more reliable.

Of course, this makes it easier on credit analysts to make a recommendation and for underwriters to get their job done. Now, It does cost money to have financials audited. Yet, the fee is tax deductible.

Also, you can save money by making sure you are organized and prepared. Auditors typically bill by the hour, so the easier you make it on them, the less cost it is to you.

Business Financials: Ratios

Lenders also look at certain ratios to help determine creditworthiness. These are some of the most common ones used.

Current Ratio

First, the current ratio can help you understand whether a business will be able to meet obligations even if the unexpected happens. It is calculated as total assets divided by total liabilities.

Consider this example. If your business has $20,000 in assets and owes $10,000, the current ratio is 2:1. So, assets are double the amount of debt. As you might imagine, that looks good to lenders.

Quick Ratio

Another useful ratio is the quick ratio. This is similar to the current ratio, except it reduces total assets by total inventory. This is because you cannot turn inventory into cash immediately. It cannot really be used to pay obligations in the short term. If something happens and you need all the cash you can get from your assets immediately, inventory would not be part of that. For this ratio, a healthy number is 1 or more.

Debt-to-Worth Ratio

The debt to worth ratio is calculated as total liabilities divided by net worth. Net worth is simply total assets minus total liabilities. This ratio tells you, and lenders, how much you owe versus how much you own. In other words, how much of the business is really yours, free of debt.

The Big Picture of Fundability

The financials of the business, and all that goes along with them, are just a fraction of what affects fundability. In fact, when you consider out of 125 factors, 6 of them are related to business financials—a good 4.8 %.

Also, business financials are not the only financials that affect fundability. Other factors include:

- Personal financials

- Personal credit history

- Data Agencies

- And bureaus

If you take all of these into consideration, you end up at around 27%, or about one quarter. The Fundability Codex below gives a good visual.

It’s important to note that not all fundability factors are equal. Honestly, some do affect fundability more than others. Still, it’s easy to see that there is much more to fundability than just the business financial information. It’s true, having bad financials will get you denied by a traditional lender almost certainly. But, having good financials doesn’t guarantee approval. Really, you need strong overall fundability. Are you wondering about the fundability of your business? A free consultation with a business credit expert can help.

The post How to Ensure Your Business Financials Promote Maximum Fundability appeared first on Credit Suite.

CPA Marketing: 5 Actionable Strategies to Grow Your Accounting Firm

Are you struggling to get more clients for your accounting business?

You’re not alone.

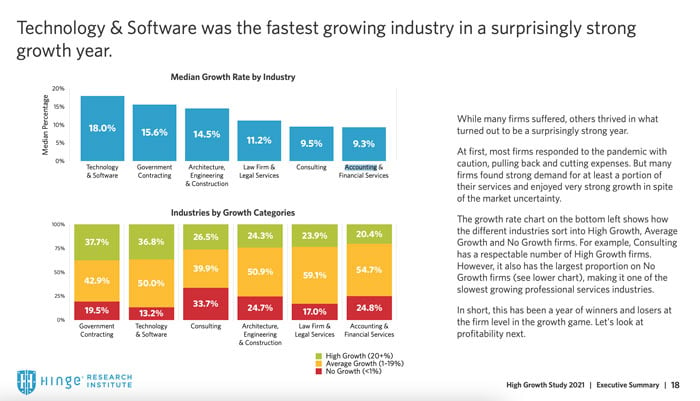

A study by Hinge Marketing found accounting and financial service firms were the slowest growing of all professions studied.

While the tech sector grows at an 18 percent median rate, accounting business slogs behind with a growth rate of 9.3 percent.

However, this doesn’t mean your accounting firm is doomed.

The difference between low-growth and high-growth businesses in any sector is marketing.

How so?

Marketing is what develops the all-important know, like, and trust factor. Clients can find you through social media or blog posts, learn more about you, and decide you’re the best accountant for the job.

In short, the better you get at marketing your services to the right people, the more you can squash industry-standard growth rates and boost your profitability.

Why Should Certified Public Accountants Advertise Their Services?

Shopping online isn’t only for eCommerce businesses.

Fifty-three percent of consumers conduct online research before making a purchasing decision. If you don’t have a digital presence, you’re leaving money on the table and creating a barrier between you and your potential clients.

With 2.14 billion digital buyers, there’s a huge pool of people you could tap into by having a digital presence for your CPA business.

Besides the earning potential, advertising your services online has other benefits like:

- Instilling trust: You set yourself up as an authority and expert by having a professional website with sales pages and blog posts.

- Brand awareness: Almost 92 percent of people use Google to answer their most pressing questions. By investing in SEO and getting your CPA business on the first page of search results, you can grow your brand awareness without a huge paid ad budget.

- First impressions count: In the digital age, your website is your first impression to potential clients. If it’s slow, outdated, or uninspiring, your site visitors will leave, and you’ll lose the sale.

6 Marketing Tips for CPAs

Ready to take your CPA marketing to the next level? Here are some of the best ways to grow your brand awareness, attract the right customers, and scale your accounting business.

1. Create an SEO-Friendly Website With a Strong CTA

Because so many buyers turn to Google to conduct online research before purchasing, a website is no longer a “nice to have.”

It’s a must.

An SEO-optimized website does three things:

Search Engines Send Organic, Qualified Traffic

Sick of cold emailing tactics or leads who have no intent on opting in for your services?

By going all-in on SEO and targeting keywords your potential clients are using, you can attract the right customers (who are ready to sign a contract) straight to your website.

Not sure what SEO is or how to do keyword research? Check out my ultimate SEO guide, which takes you through absolutely everything you need to know to get your CPA business on the front page of Google.

Turns Visitors Into Leads

When someone is knee-deep in research mode, a professional-looking website goes a long way in the decision-making process.

With a strong call-to-action (CTA) on your homepage, you can stop people from leaving your site without scheduling a call, or filling out a form to find out more.

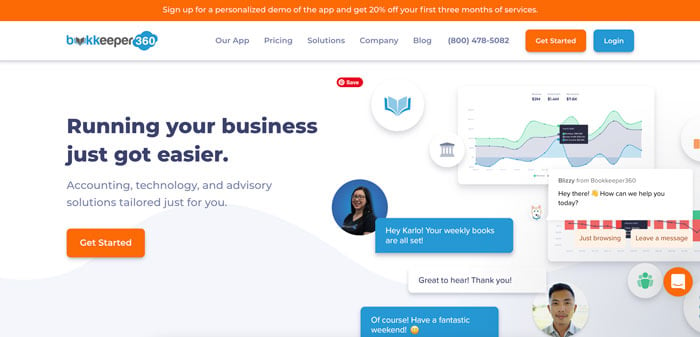

Here’s a good example:

Notice the “Get Started” button. It’s above the fold (meaning you don’t have to scroll to see it), and it encourages visitors to take action.

If you scroll to the bottom, you’ll see another CTA to schedule a call.

Want help setting up a CTA? Use one of my eight foolproof CTA tactics.

It Sets You Up as the Go-To Expert

Once your website ranks for the right keywords on Google (i.e., words and phrases your customers are using), it tells the user you’re an expert and creates brand awareness.

When someone sees you as an industry thought leader, it establishes trust. This sets up one of the natural laws of business: People do business with those they know, like, and trust.

2. Create a Blog for Your Website

When it comes to marketing for CPAs, creating a blog is an incredibly effective tactic.

Why?

Your blog posts will rank on search results.

When you’re ranking on the first page of Google, you get more visibility, website traffic, and qualified leads. For your customers, blogging is beneficial because it answers their questions, gives them quick wins, and helps them find solutions to their problems.

It’s a win/win for everyone.

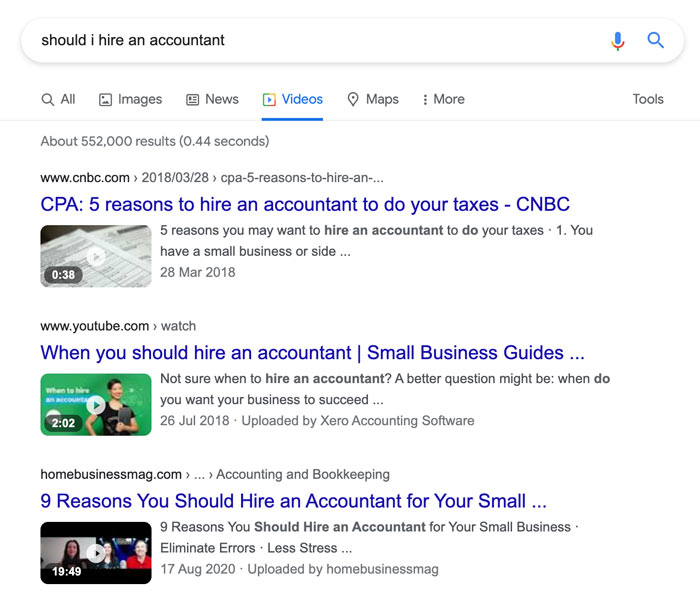

How do you start writing blog posts that end up on the first page of search results?

First, you need to do keyword research to understand what problems your audience is trying to solve.

Take the keyword “hiring an accountant for taxes.” Here are some blog posts from CPA firms on the first page of Google.

By using blogging like these CPA firms, you can identify the challenges your clients are facing and create blog posts that add value and convert visitors into clients.

Keyword Research Resources:

Next, you need to write your blog post and optimize it for search.

What does this mean?

According to a user’s query, there is a formula search engines use to understand the content and decide where it should show up in the results. By following basic on-page SEO principles, you can make sure your blogs are optimized for ranking on the first page of Google.

SEO Blogging Resources:

- How to Rank a Blog in Google’s Top 10 Search Results

- How to Write a Blockbuster Blog Post in 45 Minutes

- 7 Things First Time Bloggers can do to Create Industry-Leading Content

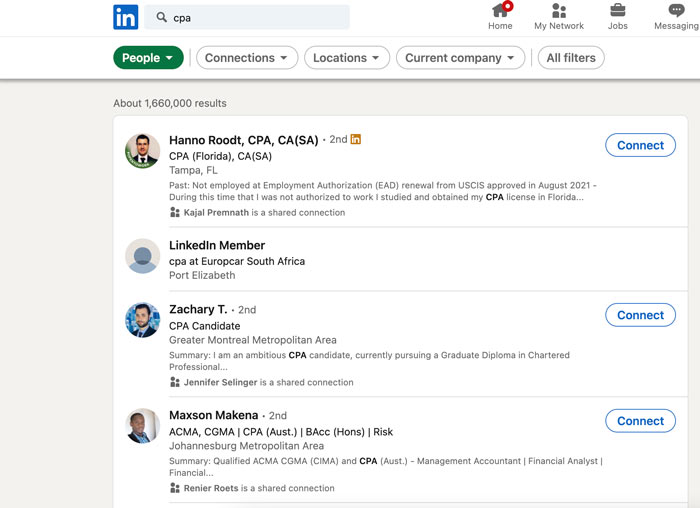

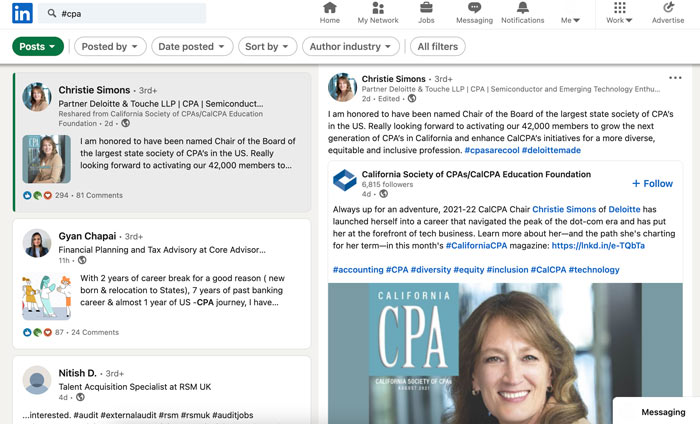

3. Start Using LinkedIn

Do you have a LinkedIn profile?

Out of the 774 million working professionals using the platform, you probably fall into two camps:

- Yes, you’ve created a profile, but it pretty much collects dust.

- No, and you don’t want to add another social network to your plate.

However, LinkedIn is more than a social media network. It’s one of the best places to connect with your potential clients and land work.

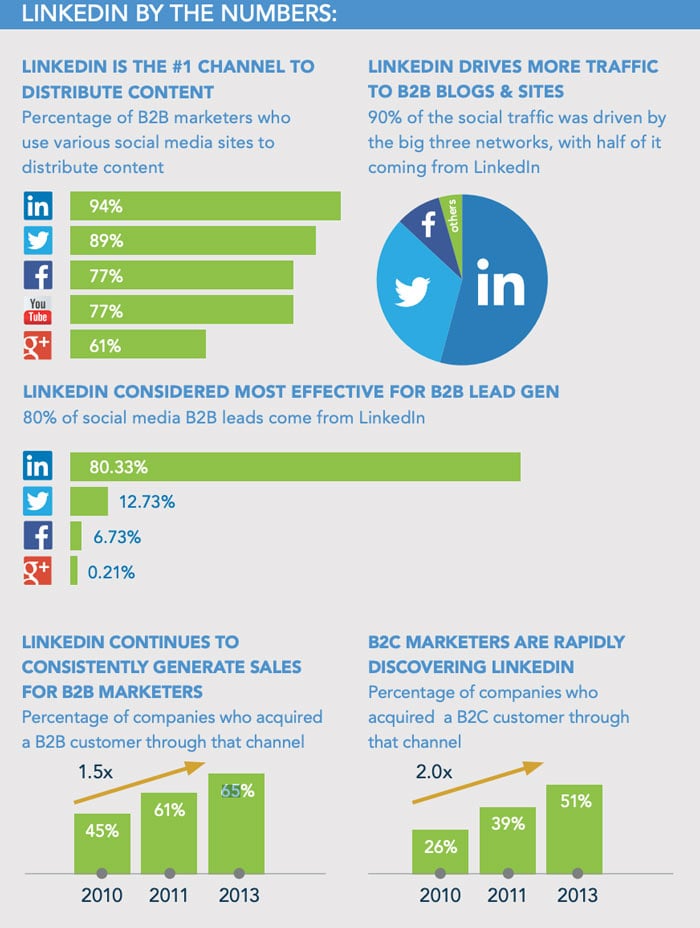

Eighty percent of B2B marketers say LinkedIn is the best place to find leads.

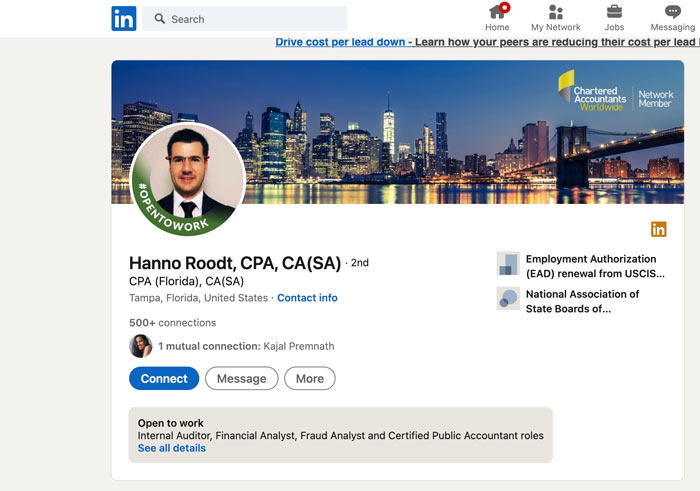

Follow these steps to spruce up your LinkedIn profile and start attracting paying clients to your CPA business.

Update Your Profile for SEO

Yup, SEO extends beyond search engines.

You want to make sure your profile is optimized with keywords your potential clients use to find you.

The better your LinkedIn SEO, the higher up you’ll appear on search results.

Post on LinkedIn

Whether it’s status updates, sharing business news, or writing thought pieces, creating content on LinkedIn is a powerful lead generation tool.

You can tag your posts with hashtags to boost your reach, and the more engagement it gets, the more the algorithm will push your content out to a wider audience.

By increasing the number of eyes on your posts, you increase your chances of leads finding your profile and reaching out.

LinkedIn Marketing resources:

- 9 Powerful LinkedIn Marketing Tips (That Actually Work)

- How to Create the Perfect LinkedIn Profile

- How to Get 200 Targeted Leads Daily on LinkedIn (Starting This Week)

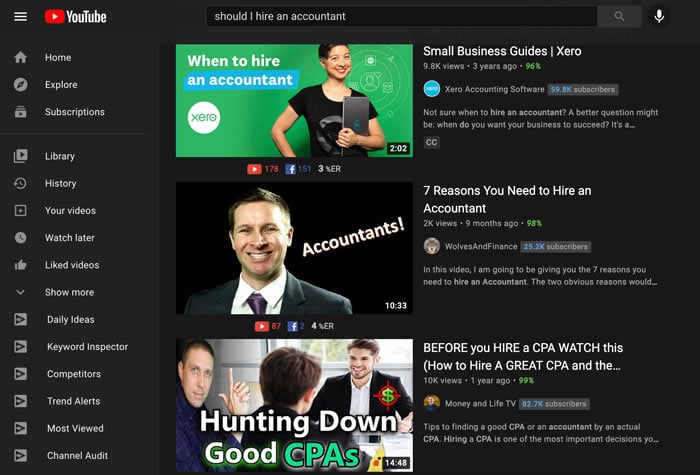

4. Create YouTube Videos

Writing not your style? Are you a better speaker?

Then create a content marketing strategy around YouTube. With over 2 billion monthly users, people come to the platform to learn, get inspired, or have fun. What makes YouTube such a lucrative platform is this: The content is searchable on Google.

In 2016, the search engine giant bought the video-sharing site and has integrated the platform with search results.

Like Google, SEO also plays a part on YouTube.

To see success on the platform, you need to use the same keywords your audience uses to search for you. Consider using keywords in these places:

- your speech (YouTube scans your words)

- video title

- video description

- tags

These views turn into leads and are an excellent way to grow your brand awareness and establish trust with your audience.

Bonus: Once you hit 1,000 subscribers and 4,000 hours of watch time, you can sign up for the YouTube partner program and start earning money from your uploads.

YouTube Resources:

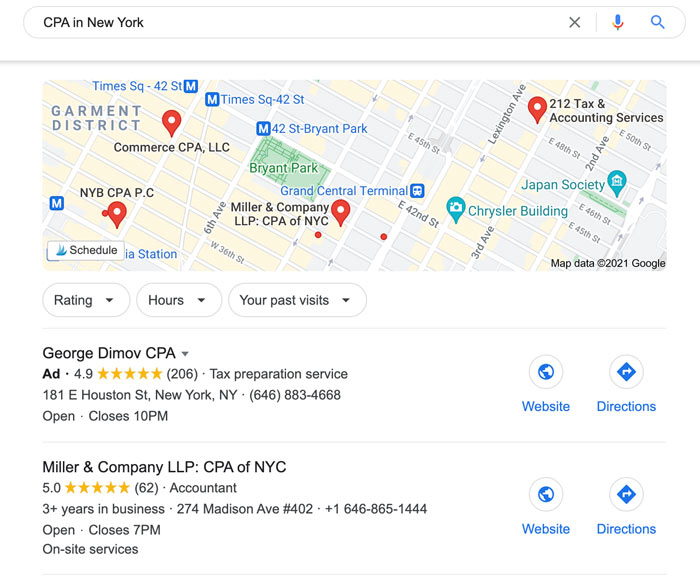

5. Claim Your Google Business Page

Google My Business can help your CPA business gain more visibility in local search results. According to a study by BrightLocal, 84 percent of searches are discovery.

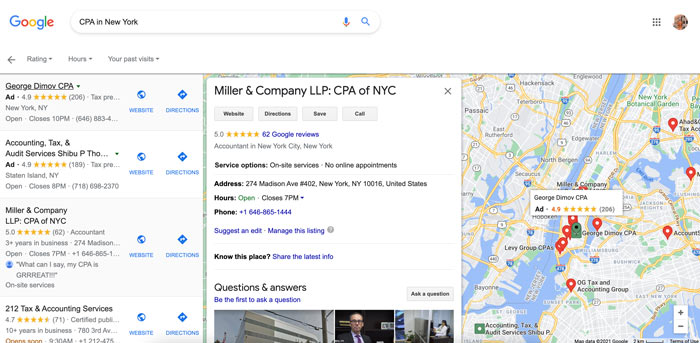

That’s a lot of opportunities for your next client to find you. Let’s say someone searches “CPA in New York.” If you’ve set up your Google My Business page correctly, it will show up in search results like this:

These cards make it easy for people in your area to find you, contact you, and become your next customer.

All you need to set up your profile is a business name, location, and category. Once Google authorizes it, you’ll start showing up on local search and Google Maps.

Your customers will be able to leave reviews, add photos, ask questions, save your listing, and see important information like your contact details.

In the above example, Miller & Company has put “CPA of NYC” in their title and made their description “accountant in New York City.”

Again, this is SEO. These keywords help Google understand your listing and show it for the correct search results.

To learn how to set up your Google My Business account, optimize it for local SEO, and what mistakes to avoid, check out these resources:

- How to Optimize Google My Business and Leverage It for More Sales

- How to Own Your Google My Business Rankings

6. Build Your Email List

While building a presence on YouTube and LinkedIn are solid marketing strategies for CPAs, those platforms could close down tomorrow.

If that happens, you’ll lose access to your audience.

The solution? Building your email list.

Create a lead magnet and use it to entice your website visitors to subscribe. Your lead magnet should focus on a problem your audience wants to overcome and present a quick win.

For example, if you help freelancers with their tax you could make a checklist for how to prepare for tax season. At the end of your lead magnet, include a call-to-action to hire you for those that want to skip the admin and let someone else handle it.

Other types of lead magnet ideas include:

- toolkits

- reports

- whitepapers

- ebooks

- case studies

- cheat sheets

Once you have people on your email list, you can nurture the relationship and promote your offers and tips via a weekly or monthly newsletter.

Marketing for CPAs Frequently Asked Questions

What's the best way to promote my accounting business?

The best way to market your CPA business is with digital marketing. It’s cheaper than traditional marketing and helps you attract your ideal clients with ease.

Should I hire a marketing firm to promote my accounting business?

If you don’t have the time to manage your marketing, yes. A marketing firm can help save time and tweak your marketing efforts to improve ROI.

Should I invest in digital marketing for my CPA business?

Yes! With most people turning to Google to answer their questions and find companies to solve their problems, a digital presence is necessary.

How much should I spend on marketing for my accounting business?

It depends on the size of your firm, location, and how much money you can allocate towards your marketing, as well as what platforms you want to use and the results you want to achieve. You can do it yourself and spend very little, or invest thousands (which may generate thousands more in revenue.)

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What's the best way to promote my accounting business?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The best way to market your CPA business is with digital marketing. It’s cheaper than traditional marketing and helps you attract your ideal clients with ease.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I hire a marketing firm to promote my accounting business?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

If you don’t have the time to manage your marketing, yes. A marketing firm can help save time and tweak your marketing efforts to improve ROI.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I invest in digital marketing for my CPA business? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes! With most people turning to Google to answer their questions and find companies to solve their problems, a digital presence is necessary.

”

}

}

, {

“@type”: “Question”,

“name”: “How much should I spend on marketing for my accounting business?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

It depends on the size of your firm, location, and how much money you can allocate towards your marketing, as well as what platforms you want to use and the results you want to achieve. You can do it yourself and spend very little, or invest thousands (which may generate thousands more in revenue.)

”

}

}

]

}

Marketing for Accountants: Conclusion

As you can see, digital marketing is no longer a “nice to have” for accounting firms.

The digital world is more important than ever before. Approximately 6 billion people have smartphones, which means your next customer will most likely come from Google rather than a traditional ad in the newspaper.

Follow these marketing tips for accountants, and you’ll learn how to create content that attracts your ideal client, creates value in their lives, and sets your firm up as the go-to expert.

Which of these accounting marketing tips are you going to implement in your business?

New comment by snakedoctor in "Ask HN: Who wants to be hired? (April 2021)"

Location: USA Remote: Yes Willing to relocate: Yes Technologies: C++, C#, MySQL, Python, Assembly, Java etc. Résumé/CV: On request Email: dude@member.fsf.org

DeepSource (YC W20) Is Hiring a Technical Lead (Language Engineering)

Article URL: https://deepsource.io/jobs/technical-lead-language-in/ Comments URL: https://news.ycombinator.com/item?id=26519802 Points: 1 # Comments: 0

The post DeepSource (YC W20) Is Hiring a Technical Lead (Language Engineering) first appeared on Online Web Store Site.