Comments URL: https://news.ycombinator.com/item?id=28378733

Points: 1

# Comments: 0

Article URL: https://www.workatastartup.com/jobs/15406

Comments URL: https://news.ycombinator.com/item?id=28382468

Points: 1

# Comments: 0

Dagen McDowell and the panel on “The Five” Thursday discussed President Biden’s July call with former Afghan President Ghani to portray the situation in Afghanistan as better than the reality on the ground.

Indianapolis Colts linebacker Darius Leonard spoke to reporters on Thursday about being unvaccinated. The three-time All-Pro said not getting the COVID-19 vaccine is a “personal decision” and he believes in getting “comfortable with something” before putting it into your body.

Paid ad costs are rising. In highly competitive industries, you can expect to pay $50 or more per click. As a result, many businesses are looking to lower paid ad costs by increasing ad relevance.

Dynamic keyword insertion is an ideal strategy to improve relevancy and lower paid ad costs. When used correctly, it can help deliver highly relevant ads with little extra work.

If you aren’t sure what dynamic keyword insertion is or how to make the most of it, you are in the right place.

Today, we’ll cover everything you need to know about dynamic keyword insertion, including what platforms offer it, how it works, and best practices to make the most of them.

Dynamic keyword insertion is a paid ad feature that uses machine learning or AI to customize online ads to match users’ search queries.

For example, if you create an ad for a shoe store, you could use dynamic keyword insertion to add “women’s running shoe” or “red women’s running shoe” to display ads that use the exact same words the user searched.

Using the same terms users type into a search engine assures users you have exactly the product they are looking for.

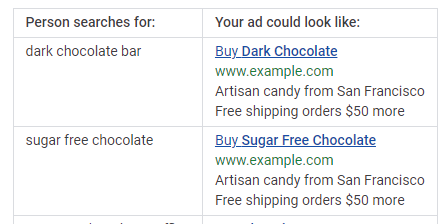

Here’s how Google text ads using dynamic keyword insertion might look:

Dynamic ads can change nearly every aspect of your ads, including the main keyword, images, CTA button, and even the landing page users are sent to.

Several ad platforms offer dynamic keyword insertions, including Google Ads and Facebook.

Figuring out how to set up PPC ad campaigns is hard enough. Should you worry about dynamic keyword insertion? There are definite pros and cons to this strategy. Here’s what you need to know.

The benefits of dynamic keyword insertion include:

Dynamic ads are easier to manage, more relevant, and can improve click-through rates. Sounds great, right? There are a few cons you should be aware of before diving in.

The cons of dynamic keyword insertion include:

Dynamic keyword insertion is an ideal strategy to stand out in a competitive PPC environment. By matching users’ search queries, your business can lower your cost per click, improve your quality score, and deliver highly targeted ads.

However, the process might seem complicated, especially if you are newer to the world of PPC. Here are four best practices to help you create effective dynamic ads.

Dynamic ads are used to create highly relevant ads, so using broad keywords isn’t effective.

For example, if you want to create an ad for a broad term like “body wash,” there’s no point in using a dynamic ad. On the other hand, if you want to target a precise term like “orange scented body wash for sensitive skin,” dynamic ads are a great choice.

There are two reasons for this: using broad keywords can create awkward ads, and it can also cause your ads to show up for terms that just aren’t relevant.

Instead, reserve dynamic keyword insertion for longer, precise keywords. Here are a few examples of keywords that would be a good fit for dynamic ads:

These are very precise terms that indicate buyer intent, making them ideal for dynamic keyword insertion.

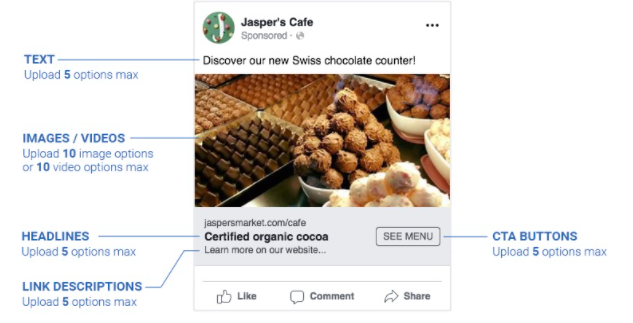

Dynamic ads allow you to create multiple versions of an ad, but they don’t just plug different keywords into the exact same ad. Instead, you can upload multiple assets for each part of your ad.

For example, Facebook allows you to add multiple text, headlines, images, link descriptions, and CTA options.

Options are great, but they can also cause issues.

Take a look at the ad example above. Let’s say the business decided to target Swiss chocolate, chocolate-covered cherries, and taffy in the same ad and uploaded a picture of each. Their chocolate-covered cherry image could end up displayed next to text promoting their Swiss chocolate.

Poorly designed dynamic ads can create awkward (and even funny) ads, but they also reduce trust in your brand and decrease conversions.

Ensure all assets make sense together, no matter which headline, image, or CTA is displayed.

You’ll also want to check grammar. For example, say you create an ad with the headline “Stop by to check out our top….” If your keyword list includes the term “Couch,” you could end up with an ad that reads, “Stop by to check out our top Couch.” Pay special attention to plural and singular words.

Dynamic ads allow you to create multiple versions of the same ad, but that doesn’t mean you should ignore A/B testing. In fact, dynamic ads enable you to test even more options.

For example, you could test:

To test dynamic ads, create multiple versions of the same ads targeting the same keywords, then change one element.

For example, you could create two versions of an ad targeting running shoes and use multiple images in one ad, and a single image with text overlay in the other. Run the ads for at least two weeks and see which version drives the most clicks and conversions.

This guide to A/B testing will help you get started.

Dynamic keyword insertions are designed to create highly relevant ads, so make sure each ad group is closely related. For example, you might create an ad for different colors of the same product, but you wouldn’t use different products in the same dynamic ad group.

A restaurant might use “bacon burger,” “double cheeseburger,” and “bleu cheeseburger” in the same ad group, but they wouldn’t want to use “bacon cheeseburger,” “wings,” and “onion rings” in the same ad group.

Instead, make sure each ad group targets one group of closely related products or services.

Several paid ad platforms offer dynamic keyword insertion, including Google and Facebook. While the exact process can vary by platform, this guide will help you get started no matter where you create your ads.

Create different ads for plural and singular search terms, so your ads are grammatically correct. Also, make sure that your ad text and headlines are within the character limit for the platform.

Once your ads are created and you’ve made sure all configurations make sense, it is time to launch your ad. Track KPIs that matter to your brand, such as click-through rates or conversions. Keep an eye on quality scores as well. A low-quality score can raise your CTR.

KI works by using machine learning or AI to insert terms that match users’ search queries to deliver more relevant ads. This allows businesses to deliver highly relevant ads without spending hours creating different ads for each possible search query.

If you are using paid ads, absolutely. They are relatively easy to set up and can increase click-through rates and conversions.

Dynamic ads are ads that change based on the users’ search queries. For example, a user searching for Nike shoes will see an ad for a Nike shoe, while a user searching Adidas will see an ad for Adidas. You might think they are different ads, but they might be the same dynamic ad that automatically replaces the text and image to match your search.

Static ads stay the same no matter what search the user types in. Dynamic ads change to match searchers’ queries. They may change their ad copy, image, or even the landing page.

Do not use dynamic keyword insertion for broad match keywords or unrelated search terms. Broad match terms (like shoes or couches) and unrelated search terms (think wings and burgers in the same ad) can create awkward ads and lack the relevancy that is important for dynamic ad success.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How Does Dynamic Keyword Insertion Work?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

KI works by using machine learning or AI to insert terms that match users’ search queries to deliver more relevant ads. This allows businesses to deliver highly relevant ads without spending hours creating different ads for each possible search query.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I Use Dynamic Keyword Insertion?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

If you are using paid ads, absolutely. They are relatively easy to set up and can increase click-through rates and conversions.

”

}

}

, {

“@type”: “Question”,

“name”: “What Are Dynamic Ads?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Dynamic ads are ads that change based on the users’ search queries. For example, a user searching for Nike shoes will see an ad for a Nike shoe, while a user searching Adidas will see an ad for Adidas. You might think they are different ads, but they might be the same dynamic ad that automatically replaces the text and image to match your search.

”

}

}

, {

“@type”: “Question”,

“name”: “What’s the Difference Between Static and Dynamic Ads?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Static ads stay the same no matter what search the user types in. Dynamic ads change to match searchers’ queries. They may change their ad copy, image, or even the landing page.

”

}

}

, {

“@type”: “Question”,

“name”: “When Should You Not Use Dynamic Keyword Insertion?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Do not use dynamic keyword insertion for broad match keywords or unrelated search terms. Broad match terms (like shoes or couches) and unrelated search terms (think wings and burgers in the same ad) can create awkward ads and lack the relevancy that is important for dynamic ad success.

”

}

}

]

}

Are you struggling to create successful paid ads? Dynamic keyword insertion might be the silver bullet you’ve been looking for. By matching ads to searchers’ queries, you can create highly relevant ads that cost less and are more likely to drive clicks.

Several ad platforms offer dynamic ads, including Google Ads and Facebook. If you have trouble getting your ads set up, our team would be happy to help.

Are you considering dynamic keyword insertion in your paid ads? What challenges are you facing?

There’s no hiding it, Instagram is one of my favorite social media channels. Not only is it a great way to share your life with friends and family and promote your business, but it’s also a great way to make a lot of money.

Best of all, you don’t need a big following and there are several different ways to earn an income. In this article, I’m going to show you how to make money on Instagram using seven of my favorite strategies:

Ready? Let’s get to it.

Instagram remains one of the most popular social media apps.

In fact, it was one of the top five downloaded apps in the App Store and Google Play in 2020. As of January 2021, it was second only to TikTok in download count. The platform’s active user numbers are equally impressive. At the end of 2020, Instagram surpassed one billion global users.

If the sustained growth of Instagram wasn’t enough to convince you that it’s a great platform to make money on, maybe the comments of Mark Zuckerberg may help. At the company’s first Creator Week in June 2021, he said of Instagram: “Our goal is to be the best platform for creators like you to make a living,”

That’s exactly what’s transpired.

Instagram accounts with over one million followers can make in excess of $1000 per post, according to influence.co.

That’s not all.

You don’t need to be a mega-celebrity to make money on Instagram. Plenty of micro-influencers with followers in the thousands make a decent income through our 7 strategies.

There are three things you need to make money on Instagram: reach, influence, and engaged followers.

The only reason businesses pay money to Instagram users is the exposure to the audiences they receive in return. They hope to make money from those followers. For it to be worth their time, these brands are only interested in influencers with large audiences. The bigger the audience, the more money they can make.

If you only have a few hundred Instagram followers to begin with then your potential audience size is low. With such a small sample space, your content won’t get seen by lots of people, let alone drive sales to your or a brand’s products.

To get started, you’ll definitely need at least a few thousand followers to be able to make money.

Sure, more followers will boost your ego. Mathematically, it increases your probability to appear in more Instagram feeds. However, a high follower count doesn’t necessarily mean high engagement, and shadow-banning on Instagram can leave you with little to no reach.

If everyone is cold to your posts, they probably won’t be inclined to buy anything you promote.

So on your Instagram account, if you rarely get people commenting, liking, sharing, and following you, then it doesn’t matter how big your following is, you probably won’t make much money.

On the other hand, even if you only have 1,000 followers and they are actively engaging with your posts, the potential to make money is there. Brands are willing to invest in you because of the profitable actions you’ll drive through your account.

Okay, so now you know why I think Instagram is a great platform to make money on and what you need to make serious bank. Now let’s look at my favorite ways of doing just that.

I’ll preface this first strategy by stating that this is the easily most common tactic to earn money on Instagram.

Again, it isn’t viable for people with a few hundred followers. You need a minimum following of about 5,000 followers and a high engagement rate.

People with this reach can earn up to six figures per post.

All you have to do is post pictures around your interests that show your personality, helping you build up a glamorous personal brand.

Sure, you can follow a planned marketing strategy, but Instagram followers love when you are being true to your authentic self. As you share pictures and build your influence organically, relevant brands are likely to approach you rather than the other way round.

Once you satisfy these criteria, here’s a simplistic version of how making money works:

There is one warning going into this though: don’t pursue sponsored posts simply to make money without believing in the brand you’re promoting. Taking too many of such posts will also burn your audience’s interest and lead to loss of trust in your brand. For example, if you’ve built a following based on visiting fast food restaurants and writing greasy food reviews—suddenly partnering with a weight-loss brand could damage your reputation.

Simple enough to remember, right?

Let’s look at a few people who do this well in real life.

Adam Gonon is a fashion and lifestyle influencer from New York. With a touch over 50,000 followers, he certainly doesn’t have the biggest audience in the world, but that doesn’t stop him from creating sponsored content every few days.

You don’t have to promote fashion or other lifestyle products to get paid for sponsored posts. Amanda Holtzer is a health, diet, and nutrition influencer who works with brands like Costco and Juice Press to create sponsored content.

Promoting affiliate offers is not dissimilar to getting paid for sponsored posts. The difference is that you only get paid if people buy the product or service you’re promoting rather than receive payment for your post.

This can be both positive and negative, depending on your audience. While sponsored posts have guaranteed income, you could make a lot more by promoting the right affiliate offer. On the other hand, you could also make a lot less.

Being an affiliate on Instagram is a lot harder than running affiliate ads on your website. Not only do you require a launch audience, but Instagram doesn’t allow clickable links anywhere except your bio. The only way to promote an offer and make sure you receive the affiliate income you’re due is by using promo codes. These are trackable and can be added to your post or story easily. Of course, you’ll still need your followers to visit the affiliate website on their own.

With an Instagram Shop, you can integrate your e-commerce store with your Instagram profile. This is the only way you can promote your products directly to Instagram followers through your posts, Stories, the Explore tab, and the Shop tab on your profile.

There used to be a lot of friction for e-commerce store owners who wanted to sell through Instagram, but not anymore. Instagram Shopping completely removes friction, letting customers easily check out products in the app and then head to your store at the click of a button.

Let’s say you’re a clothing store and you want to promote an outfit. Simply upload a picture of your model wearing your outfit, and Instagram will let you tag up to five products per post (you can tag up to 20 products per carousel.) You can also promote products in stories and videos, too.

I would like to show you one specific Instagram page that’s completely killing it.

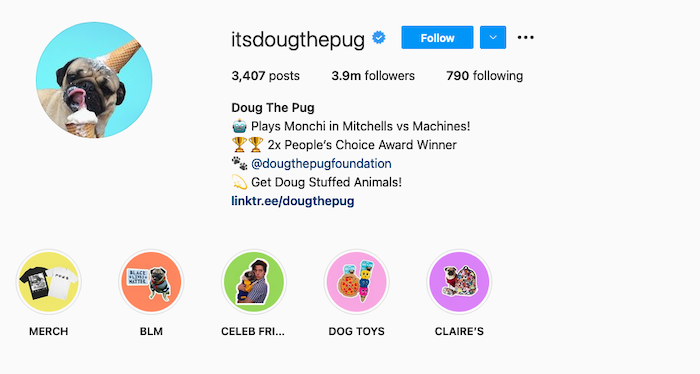

It’s called Doug the Pug. As the name implies, it’s all about the life of one of the Internet’s coolest and cuddliest pugs, Doug.

This page chronicles Doug’s life and takes followers along on his adventures. As of August 2021, Doug the Pug had 3.9 million followers. Doug has his own book entitled Doug the Pug: King of Pop Culture (which is pretty impressive considering that he can’t actually write.) He even does appearances all around the country.

In other words, Doug’s owner has created a massive brand.

Guess what? The popularity they’ve generated is centered around their Instagram page. With 3.9 million followers, you can bet that they’re driving plenty of high-quality traffic to the store and consequently getting paid handsomely for it.

This is a brilliant example of how Instagram can be used to build a brand from scratch. Doug the Pug is a template you could use to launch your own brand and sell from your online store.

Just use your creativity and come up with an interesting angle that will get people excited and eager to invest in your brand.

There’s no doubt that there is a significant time investment involved, but it can pay dividends if you’re able to establish a large and loyal audience. The best part is all of the different ways you can monetize your brand later on.

Just like YouTube, you can monetize your content directly on Instagram. Try one of the three ways below.

IGTV ads are a great way to monetize your Instagram content. In March 2021, Instagram made ads available to creators in the U.S., the UK, and Australia. They appear when you watch IGTV from a creator’s feed.

Instagram’s COO, Justin Osofsky, says creators receive 55 percent of the advertising revenue generated through IGTV. That’s the same rate as YouTube making it a great alternative.

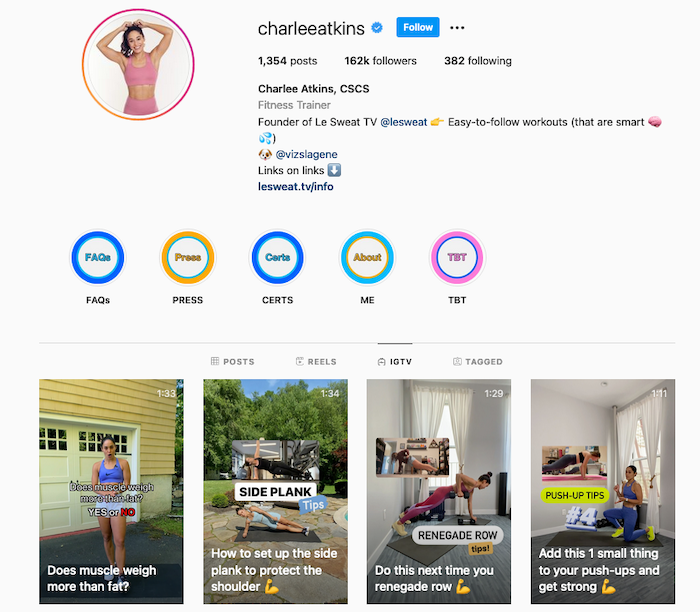

If you broadcast live on Instagram, Badges are a fantastic way for your followers to show their support. Think of them as tips your audience can give you when you broadcast. Your viewers can buy a badge during a broadcast, selecting from three levels of hearts that each have a different price point (one for $0.99, two for $1.99, or 3 for $4.99.)

Badges have gone down well with creators. Fitness influencer @charleeatkins said: “Badges in Instagram couldn’t have come at a better time for fitness creators like me. It’s an easy way to channel the love we already see in our Live feeds so we can continue building and creating for our fans.”

You don’t have to rely on Instagram’s in-platform features to pay your bills. Third-party sites like Patreon and Only Fans are another great way to make money from your content. In both cases, you’ll want to give away a ton of free value on Instagram before encouraging your audience to follow you on one of the two platforms for exclusive content.

If you are killing it on Instagram and have a massive, engaged following, why not make money by teaching others to do the same thing?

People want to know how to build a following on Instagram and monetize it—it’s why I’m writing this article, after all. If you know how to do it, and have done so yourself, you can make a lot of money.

Take a look at Foundr as an example.

Right now, they have built a massive audience to the tune of 3.3 million on Instagram. And since it’s their strong suit, Foundr founder Nathan now sells his Instagram marketing expertise in an online course called Instagram Domination at a whopping price of $1,997.

Given that businesses that are passionate about Instagram marketing follow them, Foundr has a great pool of potential qualified buyers in their audience with them on Instagram. Many of these prospects are likely to buy their course.

The best news? Anyone can do this if they have a big enough following.

Travel bloggers, food bloggers, marketing consultants—if people are active in your niche and are trying to grow a following doing what you do, launching a course could be highly profitable.

You don’t have to have a business that’s directly tied to Instagram in order to use the platform to generate sales. Thousands of canny entrepreneurs have leveraged their Instagram following to make money through a separate business. It really doesn’t matter what kind of business you operate; Instagram is a great way to get the word out and generate traffic and sales.

Instagram is particularly powerful if you have a physical product that you can show people using. Service-based businesses like travel agents also work incredibly well.

Hashtags will be particularly important here if you want to increase the reach of your Instagram account. The more followers you have, the more people will see your posts and consider using your business in the future.

My article on boosting Instagram followers will be a big help in this regard.

Promoting other people’s products via affiliate links or selling physical products through an online store are both great options to make money on Instagram. What if I revealed there was a way to earn more money than affiliate marketing without having to handle physical inventory?

There is, and it’s called selling info products.

Info products have become a bit of a dirty term, but you don’t need to sell dating advice or weird diets to make money on Instagram this way. If your Instagram account teaches your audience how to do something—whether that’s learning a foreign language, practicing yoga, or woodworking—you can create a premium info product that you can sell for upwards of $100.

There are hundreds of Instagrammers doing this right now.

One doing particularly well is Minimalist Baker, a food blogger who creates recipes with ten ingredients or less and sells a course on Food photography. As you can see, you don’t even need to sell something directly related to your niche. Minimalist Baker isn’t selling a cooking series or a recipe book—she’s teaching Instagrammers how to take pictures as well as she does—and raking in the cash.

It’s never easy to make money online, but making money on Instagram is easier than a lot of other methods.

The best way to make money on Instagram will depend on you and your following. Getting paid for sponsored posts, starting an Instagram shop, or getting paid to create content through IGTV ads are all great options.

Instagram influencers can get paid north of six figures for every sponsored post. The larger and more engaged your following, the higher the fee you can command.

You need at least a couple of thousand followers to make money on Instagram. The more engaged your followers are, the less you will need, however.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How easy is it to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

It’s never easy to make money online, but making money on Instagram is easier than a lot of other methods.

”

}

}

, {

“@type”: “Question”,

“name”: “2. What’s the best way to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The best way to make money on Instagram will depend on you and your following. Getting paid for sponsored posts, starting an Instagram shop, or getting paid to create content through IGTV ads are all great options.

”

}

}

, {

“@type”: “Question”,

“name”: “How much do Instagram influencers get paid?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Instagram influencers can get paid north of six figures for every sponsored post. The larger and more engaged your following, the higher the fee you can command.

”

}

}

, {

“@type”: “Question”,

“name”: “4. How many followers do you need to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You need at least a couple of thousand followers to make money on Instagram. The more engaged your followers are, the less you will need, however.

”

}

}

]

}

Instagram has been one of the most popular social media platforms for some time, and it’s continuing to launch new and engaging features. In other words, it’s well worth investing your time to make money on the platform.

If you can build an audience and establish trust, there are loads of ways to make money on Instagram. With so many potential business opportunities, anyone can earn money from Instagram.

Yes, even you.

Which tactic are you going to use to make money on Instagram?

Article URL: https://www.workatastartup.com/jobs/15406

Comments URL: https://news.ycombinator.com/item?id=28382468

Points: 1

# Comments: 0

The post Mednet (YC W17) Is Hiring appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Mednet (YC W17) Is Hiring appeared first on Buy It At A Bargain – Deals And Reviews.

So it should be obvious – when considering business credit and funding, you need a blueprint. Because traveling without a map won’t get you anywhere.

So, where do you see your business in five years or more?

All of these scenarios require funding! Even going concerns with stable, steady revenue can experience emergencies, or need to seize a business opportunity quickly and before they have the funds. All businesses can use business credit to achieve their aims – whatever they are

Instead of year by year, let’s go phase by phase since some of these will overlap in time.

But even if you’ve already been there, done that, checking out the earlier phases could help you see if you missed anything. And if you’re just starting out, checking out the later phases could show you your business’s future so you can be ready.

You’re at the starting line and the race official has just yelled, “Go!”

Setting up a business is a task with a lot of moving parts. It’s a lot more than just hanging out a shingle. The way your business is set up can directly affect the ability of your business to succeed

This first phase covers your first six to twelve months of existence.

Fundability is a business’s ability to get funding. A lot of the power to get business money is in your hands. A business starts with no credit profile. As a result, what’s on an application is all that’s reviewed for approvals. So your application must be very strong. Nearly half of all companies fail in their first 5 years, and about 2/3 in the first 10. As a result, new businesses don’t seem fundable to lenders. You can change that by building for fundability from the very start.

Check with your Secretary of State –a business name may have to be unique. Make sure your SOS has all the necessary information for your company, and it’s up to date and correct. Make sure that you are in good standing with them and that your entity is active. You will have to file annual reports and pay an annual fee to stay active. Keep the name of a high-risk or restricted industry out of your business name. Your business can be Rachel’s rather than Rachel’s Gas Station. There is nothing underhanded about this – it is completely above board and honest

A common reason for loan and credit card application denials is the lender can’t easily locate a business offline or online. So make it painfully easy for lenders and credit providers to find your business. Make sure the business name is exactly the same on corporation papers, licenses, utility statements, and bank statements. Also make sure the business name and all other information is the same on every online listing you can find.

This must be a real brick and mortar building, a deliverable physical address. This can never be a UPS box or a PO Box. Some lenders will not approve and fund unless this criterion is met

A virtual address can also be a good idea if you need to hold a meeting or an interview, and it’s a lot more professional than doing this at your kitchen table. We like Regus, Davinci, and Alliance Virtual Offices. But keep in mind that there are credit providers that will not accept virtual addresses.

Get a free EIN for your business and choose your business entity at IRS.gov. Use your EIN to open a bank account and to build a business credit profile. To truly separate business credit from personal credit your business must be a separate legal entity, not a sole proprietor or partnership. Only incorporating creates a new and separate entity which by default will reduce your personal liability. Other entities (like partnerships) don’t. File this with the Secretary of State for your state. Make sure your entity is set up in the same state as your business address.

The IRS website is also where you choose NAICS codes. These codes are for the purpose of collecting, analyzing, and publishing statistical data on the US business economy. Some businesses are considered to be risky by their very nature. Often higher risk comes from chances of injury or frequently engaging in cash transactions. Risk matters because there are several industries where lending institutions are hesitant to do business.

If more than one NAICS code can apply, you don’t have to choose the one that’s higher risk

And if only high risk codes apply, there’s nothing at all wrong with changing your business to match a related but lower risk code.

Contact State, County, and City Government offices to see if there are any required licenses and permits to operate your type of business. Licensing requirements differ depending on state, town, and industry. Always make sure you have the proper licensing for your corporation

Having licensing builds credibility in your business, and that can help you get more customers.

It’s very easy and inexpensive to set up a virtual local phone number or a toll free 800 number

A cell or home phone number as your main business line could get you flagged as un-established – but VOIP is okay. If you don’t want customers calling you at home all day, do not use a personal cell or residential phone as the business phone number. It also helps with fundability to have a dedicated business phone number. Your number must have a listing with 411 for most credit issuers and lenders to approve you. Check for your record to see if you’re listed and your information is accurate. No record? Then use ListYourself.net to get a listing.

Lenders and credit providers will research your corporation on the internet. It is best if they learned everything directly from your corporate website. Not having a professional website can hurt your chances of getting corporate credit. Buy web hosting from a hosting company like GoDaddy or HostGator. Your domain should be your business name, if possible. Add a company email address for your business on the same domain as your website. This often comes with a website domain provider. This is not just professional; it also greatly helps your chances of getting approval from a credit provider. Do not use Yahoo, AOL, Gmail, Hotmail, or similar kinds of email.

You must have a bank account devoted strictly to your business. The IRS does not want you commingling funds. Make accounting easier and reduce the risk of audit at tax time

Keep personal and business funds separate. Having a business-only bank account makes that easy.

Getting a business merchant account is a smart way to help out your business. Now your business will be able to accept credit and debit cards. Studies show that customers will spend more if they can pay by card. This also increases your finance options and is generally more secure.

Go to D&B’s website and look for your business. Can’t find it? Then get a free D-U-N-S number on the D&B site. A D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. You need a D-U-N-S number to start building business credit. Once you are in D&B’s system, search Experian and Equifax’s sites for your business.

Get the most favorable funding by paying all bills on time, to get:

Start with vendor accounts, a proven way to start building business credit. Vendor credit is generally not attached to a bank. So under federal law a Social Security number is not required. When not attached to a bank, there is no Social Security requirement for starter vendor credit

This is unlike bank loans and bank cards. You can legitimately leave the SSN field blank, which will force them to pull your business credit under your EIN.

Every step and every credit provider is designed to help your business

It’s designed to help you qualify for business credit cards that you will actually use. As you continue building, your time in business will help. But to get started, you may need to give a personal guarantee. That’s okay; that’s a part of the strategy.

If you already have good personal credit, then you’re all set. If not, you can work with a credit partner or guarantor. And never stop working on improving your personal credit, no matter what shape it’s in.

In Phase 1, it’s trickiest to get business credit and funding. But it’s not impossible! You will, though, need to think outside the box.

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs so you can build business credit at the same time. This will get you access to even more cash with no personal guarantee. You need a FICO credit score of at least 680 or a guarantor with good credit to get an approval. No financials required.

We also have an option for getting just personal credit cards with our Credit Line Hybrid.

Demolish your funding problems with 27 killer ways to get cash for your business.

This is not a loan and you will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program so you won’t lose your retirement funds. The IRS calls this a Rollover for Business Startups (ROBS), which is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. This financing isn’t a loan against, your 401(k), so there’s no interest to pay and does not use the 401(k) or stocks as collateral.

Instead, this is simply a movement or change of custodian. Your 401(k) must have more than $35,000 in it and cannot be from a business where you are currently employed. You can get 401(k) financing even with severely challenged personal credit.

Some lenders will make loans using securities as collateral. Securities-based lending provides ready access to capital. The only restrictions to this kind of lending are other securities-based transactions, like buying shares or repaying a margin loan. You continue to earn interest on stocks pledged as collateral. But you will have challenged personal credit.

Your business and its potential are assets. Talk to people you know about angel investing

Angels buy a smallish stake in your company. They usually don’t expect as big a return as venture capitalists do. VCs might also buy a stake, but they generally just want paradigm-changing businesses. Another way to sell a part of your equity is to take on another founder or partner.

Note: crowdfunding success isn’t guaranteed. Crowdfunding platforms like Kickstarter will take a percentage of any money you raise. But it can still be a way to get a cash infusion without having to give up equity. If you’re very good online and have a compelling product and story, then you’re more likely to succeed than most people. Grants can come from the government or private businesses. Expect a lot of competition, difficult entry requirements, and not a lot of money. But it’s another way to get some cash without having to sell a chunk of your business .

Right now, you have minimal Growth Monthly Revenue (GMR). This is a fast paced growth plan, throw it against the wall and take what you can get right now. Look at some short sighted daily and weekly goals for quick cash and growth. During this phase your focus is on the bare essentials to create a viable business. Your goal is to build your consistent revenue to $10,000 per month, and continue to work on improving your personal credit.

In Phase 2, you should start developing marketing. ow you’re at an aggressive sales pace adding nurture and longer sales cycles. Use medium term monthly growth planning (campaign to campaign). It’s time for software implementation and system development. You’re building the blocks of how your business is going to be, now and in the future. This phase should run somewhere between the first six to 24 months from launch.

Business credit and funding starts to get easier.

Your credit options will open up once you get to Phase 2, including:

As you continue to build exceptional business credit and pay your bills on time, credit providers trust you more and more. You can get higher limits and better terms. And you can start to get business credit cards with no PG.

There are many vendors that do not report to the business credit reporting agencies unless you default. They’re still a good idea, because credit can help you beyond business credit building

Not having to put up 100% of the costs of equipment or a building or anything else can help with budgeting. Credit can sometimes be the only way to take advantage of a limited time opportunity if you don’t have the money right now. And if your business credit cards offer rewards, cash back, or points, then using them is to your advantage.

Vehicle financing is a great way to get a business vehicle without having to wait until you can just pay cash and drive it off the lot. Note: business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report.

Some loans have a prepayment penalty and charge you for paying ahead. It is a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Managing small business finances can be overwhelming. There are a number of tools that can help streamline the process. Options like Brex, Divvy, Expensify, Lola, and more are growing in popularity. Which one is right for your business?

Brex is a business money management system that integrates with your accounting software

It allows you to track expenses and, depending on the level of service you choose, it can also help with paying bills and controlling spending. Brex has a partnership with the FDIC and your funds are secure. Everyone who opens a Brex cash account gets a corporate card. Brex reports any payments to Dun & Bradstreet

One thing to know: Divvy is very similar to Brex. Divvy reports to the Small Business Finance Exchange, which in turn provides data to all SBFE partners, including business credit bureaus. As of April 2021, they also report to Dun & Bradstreet directly.

Demolish your funding problems with 27 killer ways to get cash for your business.

In Phase 2, your funding options also open up, to:

An MCA technically isn’t a loan; it’s a cash advance based on the credit card sales of a business. A small business can apply for an MCA, and have an advance deposited into its account fairly quickly. So you can offer Net 30 terms but not have to wait a month to get paid. With an MCA you get funding based strictly on cash flow as verifiable per business bank statements. A lender mainly just wants to see consistent deposits.

You can technically qualify with only one year in business, but the annual revenue requirement is high enough that phase 2 may make more sense. You can raise capital from investors who get a percentage of the enterprise’s ongoing gross revenues in exchange for money invested until a predetermined amount is paid. Often this predetermined amount is between 3 – 5 times the original amount invested. Monthly payments will fluctuate with revenue highs and lows and will continue until you’ve paid back the loan in full.

Fundbox will connect directly to your online accounting software when deciding whether to fund your business. You can get revolving line of credit for up to $100,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a minimum personal credit score or a minimum time in business, but ideally you must have 6 months in business or more.

Use a loan or lease to purchase or borrow hard assets for your business. Physical assets can include items such as a restaurant oven or a company car. Pay predictable amounts every month. You can build business credit on a program like this.

Or lease equipment, rather than buy it outright. You will often put down less money than you would if you were buying the equipment. You may be able to negotiate flexible terms with an equipment lease, and it’s easy to upgrade equipment after your lease ends. This is helpful if your equipment is something like a computer which quickly becomes obsolete.

If you already own your equipment free and clear you can use that as collateral for financing

Sell equipment to a lender for cash. Then lease it back from them. You can unlock Section 179 tax savings, and depreciate your entire equipment purchase in the first year. You’ll need at least one larger piece of higher value equipment to qualify.

If you have open invoices and are extending credit to customers in some form, then you can get paid faster with factoring. Usually this involves invoices with net terms, like net 30, 60, or 90. To be paid faster, you turn those invoices over to a factoring company. They immediately give you an agreed upon percentage of the total of the invoices, like 80%. When your customer pays, the factoring company keeps their fee, and they send you the rest. But note – factoring only works if your customers pay.

Your goals should be:

Always develop business connections in your community and with potential lenders.

Successful growth…it’s working! It’s time to start optimizing systems and operations. You’ll be undergoing massive team and infrastructure development, and long term growth and planning for semi-annual to annual focus lifetime customer value. You’ll need to make some high level strategic hires (Managers, VP’s, Essential C levels). This phase will happen at about 24 months or more from launch.

Business credit and funding gets a lot easier now.

Your Phase 3 credit options put your Phase 1 and Phase 2 options on steroids, with:

Phase 3 opens your funding options up to:

Private lenders are generally funded by investors or by banks, or both. Private lenders are in the business of taking funds from private investors. They make private business purpose loans with those funds. This often involves real estate. These can be hard money loans with shorter terms.

Alternative lending also means online lending. But for certain industries, online lending is one of the only ways to get money. So let’s look at the cannabis industry, for example. Medical cannabis is legal is most of the country, yet more traditional lenders are still less likely to approve a loan. But lenders that specialize in cannabis industry lending are out there.

More time in business will make SBA loans a real possibility for your business. It’ll be easier to get an SBA loan in Phase 3 versus earlier. This is because you can more readily show your business is established and making money. Demonstrated profitability and responsible credit and bank account management will improve your chances of getting an approval for an SBA loan. Also – SBA loans have great terms! So there’s a reason why you should be striving to be eligible for one.

Banks are often the first place we think of when we thinking of financing. But big banks only sign off on about 25% of the small business loan applications that come their way. Still, term loans often have lower interest rates than many other funding options. They also tend to be for higher loan amounts. But you will most likely have to undergo a personal credit check and/or provide collateral.

Demolish your funding problems with 27 killer ways to get cash for your business.

In Phase 3, your mission is to take your business to the next financial level, so your goals are:

Retail credit comes from major retailers like Staples. You can buy everything from office supplies to power tools. Retailers will check whether your business information is uniform everywhere. They will also check whether your business is properly licensed. Terms can be revolving. You will need at least 3 (more would be better) accounts reporting to the business CRAs.

Fleet credit is used to:

These tend to be gas credit cards. But there may be a minimal time in business requirement.

Business credit cards are more universal-type credit cards, like MasterCard. So they can be used pretty much anywhere. These cards may even have rewards programs. Terms can be revolving. Often you will need to have at least 14 accounts reporting to the business CRAs. Also, there can be longer time in business requirements.

Consistent growth is key. You’re aiming for long term consistent and stable growth, and moving toward market domination (Competitor Buyouts and Acquisitions). Product development and expansion becomes critical for longevity. Because now it’s time for the big hire. You’re going to fill out C Level, Directors, and middle management. This phase will happen at around four to five years from launch.

Consistent growth is key. You’re aiming for long term consistent and stable growth, and moving toward market domination (Competitor Buyouts and Acquisitions). Product development and expansion becomes critical for longevity. Because now it’s time for the big hire. You’re going to fill out C Level, Directors, and middle management. This phase will happen at around four to five years from launch.

It should be no problem to get business credit and funding when you’ve hit this stage.

By Phase 4, the sky is pretty much the limit! You should be able to get:

You should be able to leverage reports for specific vendors. This includes asking for a credit line.

In addition to everything we’ve already talked about, your business can take full advantage of:

Private equity

Now you’re playing the long game. Your mission is to look to the future and help your business for decades to come.

Therefore, you need to:

And you should be maximizing leverage of cash flow with vendors and business credit.

By this time, your business should be very well established. At this phase, you want to cash in on all the work you have invested. This is where the funding and credit has the long game return. A Business Credit Portfolio is transferable and increases the value of your business.

Your proven track record with merchant cash advances or revenue lending pays off big time, since it can keep business cash flow moving through the ups and downs. Having a proven track record with the SBA, and a profitable banking relationship, will improve the value of your business as well. People want to buy something they can lend against if they need to.

Selling can mean you’re retiring, or maybe you’re exchanging one form of entrepreneurship for another, and want to change industries yet remain an entrepreneur.

In Phase 5, you can:

In essence, you should be prepared to sign for your own buyout. Because a profitable, seasoned business can be an exceptionally valuable legacy.

From startup to exit, your business credit and funding options will change. But navigating all the nuances can be tricky. Let’s walk that path together.

The post How to Create Your 5 Year Business Credit and Funding Blueprint appeared first on Credit Suite.