Can You Get Flexible Financing for Your Business?

Absolutely! Flexible financing exists for virtually any business – even startups! You just need to know your strengths.

The 3 Cs Capital Acquisition Formula

When you think like a lender, you realize they just want to be assured that you’ll pay them back. Lenders look at one of three things for loan approval: cashflow, collateral, and/or credit. The more of these “Cs” you have, the more funding options are available. For the many forms of funding we’re showcasing today, we show you exactly what you need to have for approval.

Flexible financing can absolutely be yours.

Fundability and Flexible Funding Options

Fundability is the ability of a business to get funding. It essentially covers all the points a lender or credit provider will be looking at when they’re trying to figure out if you’ll pay back a loan or credit extended to you. These include factors you probably haven’t thought about or might think aren’t so important. But they are!

The fundability of your business will affect your terms and how much you can get. For flexible financing, you want to be as fundable as possible.

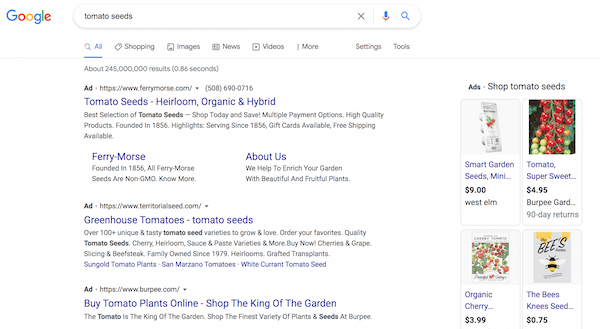

Flexible Funding with Good Personal Credit

When it comes to flexible funding, let’s look at what you can get with good personal credit. Good personal credit is always an asset and will always help you out. If you don’t have good personal credit, you can often use a credit partner or guarantor who does.

Credit Line Hybrid

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials required. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Traditional Term Loans

Traditional term loans are also looking for good personal credit.

Banks are often the first place we think of when we thinking of financing. But big banks only sign off on about 25% of the small business loan applications that come their way. Term loans often have lower interest rates than many other funding options. They also tend to be for higher loan amounts.

Term Loans: Terms and Qualifying

Generally speaking, the companies banks end up funding have very strong financials and near-perfect credit scores. You will most likely have to undergo a personal credit check. These kinds of loans may require collateral. Term loans tend to not be terribly flexible financing.

Demolish your funding problems with 27 killer ways to get cash for your business

Flexible Funding with Business Credit

Building business credit will always be a good idea. In particular, it can make your funding options far more abundant and flexible.

It should be your goal to build business credit, even if you can get funding elsewhere. Business credit will help your company for years to come. It is credit linked to your EIN and not your SSN.

This credit is available without a personal guarantee. It is available regardless of personal credit. You can get business credit immediately. Business credit is the only way to get money for a business when you don’t have collateral, cash flow, good personal credit, or a guarantor.

Vendor Credit

Starter vendors are open to working with most businesses, even startups. Make sure vendors report to the CRAs – not all do. When they do report, it’s within 60 days. They help you build your business credit profile and score.

Terms vary depending on the vendor, but they tend to be Net 30. And you will not need collateral, good personal credit, or cash flow.

Retail Credit

Retail credit comes from major retailers. Buy everything from office supplies to power tools. Retailers will check if your business information is uniform everywhere. They will also check whether your business is properly licensed.

There can be a minimum time in business requirement. There may even be a minimum number of employees requirement, or a minimum annual sales requirement. Terms can be revolving. You will need at least 3 (5 is better) accounts reporting to the business CRAs.

Fleet Credit

Fleet credit is used to buy fuel, maintain vehicles of all sorts, and repair vehicles. Even businesses which don’t have big fleets can still benefit. These are usually gas credit cards.

There may be a minimal time in business requirement. If your business doesn’t make the time in business requirement, you may be able to, instead offer a personal guarantee or give a deposit to secure the credit.

Cash Credit

Cash credit comes from universal-type credit cards like MasterCard. So they can be used pretty much anywhere. These cards may even have rewards programs.

Terms can be revolving. Usually, you need at least 14 accounts reporting to the business CRAs. There can be longer time in business requirements. And there may also be minimum number of employee requirements.

Flexible Financing with Collateral

Having collateral can help you get many types of financing.

401(k) Financing

This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Low rates, often less than 5%. Your 401(k) must have more than $35,000 in it . Can usually get up to 100% of what’s “rollable” within your 401(k). The lender will want to see a copy of your two most recent 401(k) statements.

Get 401(k) financing even with severely challenged personal credit. The 401(k) cannot be from a business where you are currently employed. You cannot be currently contributing to it.

Equipment Financing

Equipment financing is when you use a loan or lease to purchase or borrow hard assets for your business. It is a business financing option you can use to buy any physical asset. Physical assets can include items like a restaurant oven or a company car. You pay predictable amounts every month. You can build business credit on a program such as this.

Equipment Financing: Terms and Qualifying

All terms are for equipment financing through Credit Suite. Companies must have at least one year in business. You can get approved even with challenged credit. You won’t need financials to secure equipment financing. Approvals take as little as 24 hours.

Equipment Sale-Leaseback

If you already own your equipment free and clear you can use that as collateral for financing. Sell equipment to a lender for cash. Then lease it back from them. You can unlock Section 179 tax savings, and depreciate your entire equipment purchase in the first year.

Equipment Sale-Leaseback: Terms and Qualifying

Term lengths and the amount you can finance will vary. You’ll need at least one larger piece of higher value equipment to qualify. Funding can be in as little as 3 weeks. In general, a lender wants to be sure your equipment does not have any liens against it.

Demolish your funding problems with 27 killer ways to get cash for your business.

Inventory Financing

Inventory financing is a revolving line of credit or a short-term loan acquired by a company so it can buy products for sale later. The products serve as the collateral for the loan. There may be restrictions on the type of inventory you can use. This can include not allowing cannabis, alcohol, firearms, etc., or perishable goods. There can be revenue requirements. And there may also be minimum FICO score requirements.

Inventory Financing: Terms and Qualifying

Get approved for a line of credit for 50% of inventory value, regardless of personal credit quality. Rates are usually 5 – 15% depending on type of inventory. Get funding within 3 weeks or less. It can’t be lumped together inventory, like office equipment.

Shopify Capital

With Shopify Capital, you can get inventory financing with 12-month terms. Pay back with a percentage of daily sales. Borrow between $200 and $1 million. The total owed and daily repayment rate depend on risk profile.

OnDeck

OnDeck offers inventory loans and business lines of credit. Term loans runs $5,000 to $250,000, with 12-month terms paid back daily or weekly. Lines of credit run from $6,000 to $100,000. Pay back over 12 months, with automatic weekly payments.

Demolish your funding problems with 27 killer ways to get cash for your business.

Flexible Financing with Cash Flow

If you can prove your business has good cash flow, several options open up to you.

Cash Flow Financing

A loan made to a company is backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business, in a specific period. Cash flow financing (or a cash flow loan) uses generated cash flow as a means to pay back the loan.

Often you will need to have a few years in business. You may need to meet a certain minimum credit score requirement. You will need to prove historical cash flow. Present your accounts receivables and accounts payables. This way, the lender can determine how much to loan to your business.

Account Receivables Financing

Use outstanding account receivables as collateral for financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement. Receivables should be with the government or another business.

Use outstanding account receivables for financing. Get as much as 80% of receivables advanced ongoing in less than 24 hours. Remainder of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%. you can get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Amazon Bank of America

Amazon Lending launched in 2011 and partners with Bank of America Merrill Lynch. This allows Amazon to reduce its risk and access capital specifically to provide credit to more merchants so they can get inventory. Amazon Lending is an invitation-only program. Participants get exclusive price and quantity discounts on over 5 million products. See amazon.com/b?ie=UTF8&node=17906292011.

Eligibility is (in part) tied to cash flow). The program makes loans of $1,000 to $750,000. Its terms are for up to a year. These loans are for companies that may have difficulty landing traditional business loans. Within 5 days of being approved, you can get 20% off your first $500.

Amazon Marcus

Currently, lines of credit are offered by Marcus by Goldman Sachs. Get access to loan funds within 5 days. Goldman Sachs will check your creditworthiness. No prepayment penalty. See sell.amazon.com/programs/amazon-lending.html.

If your business is eligible, you will see funding options when you log into Seller Central. Loans come from Amazon Lending – specific terms are tailored to the business. Amazon may review your business credit history with one or more credit bureaus. Get 3-, 6-, 9-, or 12-month term loans for working capital needs.

Amazon Corporate Card

Got an online business? Then you can get a revolving credit line. Enjoy 24/7 Customer Service. For customers with over $100,000 annual spend on their accounts, they can work with an account specialist assigned specifically to the account. Amazon will proactively help you maximize the value of your line of credit and adopt new product features.

Get 55-day payment terms. Pay 12.99% purchase APR (minimum interest charge is $1). There is an option to apply as a personal guarantor to build business credit. You can make minimum payments or pay in full monthly.

Fundbox

Fundbox will connect directly to your online accounting software. That’s all you need to do. You can get invoice financing or a line of credit. See fundbox.com.

Get a revolving line of credit for up to $150,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a minimum personal credit score, and you don’t need to show a minimum time in business.

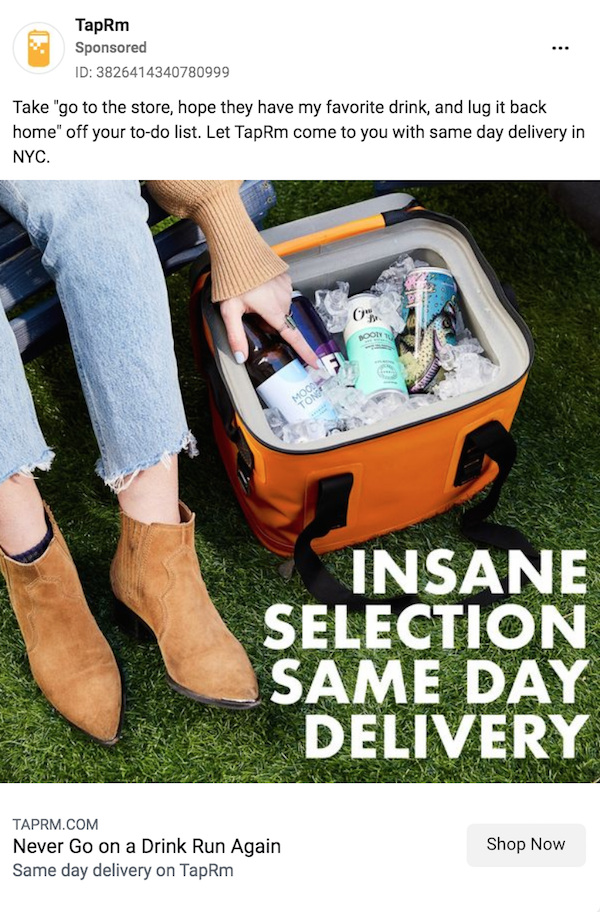

Merchant Cash Advances

An MCA technically isn’t a loan. Rather, it is a cash advance based on company credit card sales. A small business can apply for an MCA and have an advance deposited into its account fairly quickly. So you can offer Net 30 terms, but not have to wait a month to get paid.

A merchant financing program is ideal for business owners who accept credit cards and want fast and easy business financing. An MCA program is designed to help you get funding, based strictly on your cash flow as verifiable per business bank statements. Hence lenders in general will not ask for any burdensome document requests.

Merchant Cash Advances: Terms and Qualifying

A lender will review 3 months of bank and merchant account statements. They are looking for consistent deposits. And they want to see deposits showing revenue is $50,000 or higher per year. They will also verify time in business of 6 months or more.

Lenders are also looking to see that you don’t have a lot of Non-Sufficient-Funds (NSFs) showing on your bank statements. They want to see you don’t have a lot of chargebacks on your merchant statements. And they want to see that you have more than 10 deposits in a month going into your bank account.

In essence, they want to see that you manage your bank and merchant accounts responsibly. And they want to see that have a decent number of consistent credit card transaction deposits each month.

PayPal

Get a loan from PayPal. Loan amounts and eligibility depend on your sales via PayPal. You will need to be in business for at least 9 months. See paypal.com/us/webapps/mpp/paypal-business-loan.

PayPal Terms and Qualifying

Get from $5,000 to $500,000. The highest loan you can get goes up to 35% of your annual PayPal sales. If you apply for a PayPal loan, credit checks and other public records checks will be performed which may impact your credit score.

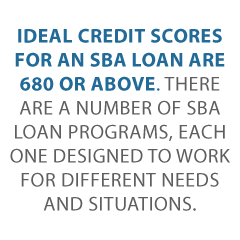

Funding from the SBA

The Small Business Administration has several options which could work for you. You usually need to show good cash flow, good personal credit, and have collateral. Having good business credit will also help your cause. But it’s not terribly flexible financing.

SBA 7(a)

This the SBA’s most popular loan. The SBA guarantees 85% for loans up to $150,000, and 75% for loans greater than $150,000. The SBA makes the lending decision, but qualified lenders may be granted delegated authority to make credit decisions without SBA review.

The maximum amount on offer is $5 million. You will have to provide Articles of Organization, business licenses, documentation of lawsuits, judgments and bankruptcy or other pertinent documentation. Lenders are not required to take collateral for loans up to $25,000. For loans over $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

SBA 504

This is an economic development loan program offering long-term, fixed-rate financing used to acquire fixed assets for expansion or modernization.

Use it to buy currently existing buildings, construct new buildings, and more. See sba.gov/offices/headquarters/ofa/resources/4049.

For corporations, anyone with a 20% ownership stake (or more) must fill out the application. In general, the SBA provides 40% of the total project costs, a participating lender covers up to 50% of the total project costs, and the borrower contributes 10% of the project costs. Under certain circumstances, borrower may have to contribute up to 20% of total project costs.

SBA CapLines

There are four kinds of CapLines: Contract, Working Capital, Builder’s, and Seasonal. For all of them, you can get a loan up to $5 million. Qualification requirements are same as with other SBA programs. Builder’s loans cannot exceed 5 year terms; the others can go up to 10 years. Holders of at least 20% ownership in the applicant business are required to guarantee these loans. Most loans can be revolving or non-revolving.

SBA Contract Line

This loan finances direct labor and material cost, associated with performing assignable contracts.

SBA Working Capital

Borrowers must use loan proceeds for short term working capital/operating needs.

SBA Builder’s Line

This one is for general contractors or builders who are constructing or renovating commercial or residential buildings. It finances direct labor-and material costs. The building project serves as the collateral.

SBA Seasonal Line

Advances against anticipated inventory and accounts receivables, or in some cases associated increased labor costs. It is meant to help seasonal businesses.

SBA Microloans

SBA microloan lenders are nonprofit community-based organizations with experience in lending as well as management and technical assistance. The SBA provides funds to specially designated intermediary lenders. These intermediaries administer the microloan program. It is to help small businesses and certain not-for-profit childcare centers start up and expand.

Get loans for up to $50,000. The average microloan is about $13,000. Generally, intermediaries require some type of collateral as well as the personal guarantee of the business owner. See sba.gov/loans-grants/see-what-sba-offers/sba-loan-programs/microloan-program%20

Grants

Grants are exceptionally competitive but there’s little wonder – you never have to pay them back! But they are also the antithesis of flexible financing – you will need to meet requirements and jump through a number of hoops.

Federal Grants

For urban projects, try HUD (Housing and Urban Development). For rural projects, try the USDA. But federal funding means paperwork. You often must show experience in what you are proposing. See grants.gov.

Grants have varying qualifications. Check information thoroughly, like due dates and any necessary paperwork. Some grants may offer preferences to businesses with minority, female, veteran, or disabled ownership.

Local, City, and State Grants

Your local government also provides grants. See grantwatch.com. Also try city and state websites. These are often less restrictive than federal grants. It helps if you can show you will help the community. Try to partner with a local business.

Just like with federal grants, check all requirements and other information carefully. You may need to be a resident of the state or city or county in question. Or your business may need to be headquartered there.

Funding from Giving Up Part of Your Business

Angel Investing

Angel investors invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital they provide may be a one-time investment to help the business get started, or an ongoing injection of money to support and carry the company through its early stages.

Angels are not covered by the Securities Exchange Commission’s (SEC) standards for accredited investors. Angels could be friends or colleagues sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you don’t know so well.

Angel Investing: Terms and Qualifying

Angels are informal investors so there really aren’t any terms. Technically, there is nothing done for qualifying, although investors may (probably should) insist on a valuation of your business. No matter what, it’s always a good practice to get everything in writing.

Angel investing can practically be the definition of flexible financing, seeing as it’s so informal.

Venture Capital

Venture capitalists give money to help build new startups, if the VCs believe a company has both high-growth and high-risk potential. These tend to be fast-growth companies with an exit strategy already in place. Venture capitalists often look to recover their investment within a 3-5 year time frame.

VCs will also, often, want to own a large piece of a company if not a controlling stake. They want game-changing businesses, so straightforward businesses won’t be on their radar unless it’s shifting the paradigm. VCs often want a larger share of your business than angel investors do.

Venture Capital: Terms and Qualifying

Since venture capitalists are more formal investors than angels, a valuation of your business is likely to be necessary. Specific terms will be spelled out in your agreement with them. The SEC will also have requirements. It is best practices to consult with a lawyer well-versed in business law before you sign anything.

Equity Crowdfunding

Equity crowdfunding is a stock offering from a company that is not listed on stock exchanges. It has been around for less than 10 years. It’s not the same as rewards-based (which comes from places like Kickstarter). Rather, potential investors visit a funding portal website. There, they can explore different equity crowdfunding investment opportunities. But note: there are limits on how much capital an individual can invest based on their income and net worth. Hence equity crowdfunding gives investors a stake in your business.

Equity Crowdfunding: Terms and Qualifying

Equity crowdfunding tends to be covered by numerous federal regulations. See: law.cornell.edu/cfr/text/17/227.100.

Federal law can be complex. It is best practices to consult with an attorney well-versed in federal law, specifically, securities and corporations, when it comes to interpreting terms and qualifications (and any changes that may be made to these aspects of the law in the future).

Flexible Financing: Takeaways

This is an enormous buffet of business funding choices! But how do you select the one(s) that’s best for your particular situation? This is where our Advisory Team comes in extremely handy. Or help yourself with our Business Credit Builder. It’s your choice.

There are all sorts of amazing ways to get business funding. You can find the one which fits your circumstances, including your strengths in areas like:

- Personal credit

- Collateral or

- Cash flow

Or build business credit for even more choices. Now that’s flexible financing.

The post Is it Possible to Get Flexible Financing for Your Business? appeared first on Credit Suite.

at the end of the first year. There is no minimal spend requirement.

at the end of the first year. There is no minimal spend requirement.