When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do …

The Perfect Business Credit Portfolio Includes Vehicle Financing

Does your business need vehicles to get the work done? This can be any number of kinds of vehicles, such as trucks for deliveries and hauling, sprinter vans, company cars, and even vans to facilitate commuting for your employees. Vehicle financing can be a smart way to afford all of them.

Vehicle Financing in a Nutshell

Much like you probably didn’t buy your personal vehicle outright, financing is a great way to go in order to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a car for personal use, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Commercial vehicle funding has certain parameters. Whether a vehicle is purchased new or used will affect the number of years you can finance the vehicle and the rates you will pay. If a vehicle is used, then the number of miles on it will also affect terms. Plus, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Some loans have a prepayment penalty and charge you for paying ahead.

In general, the following will eliminate the need to provide a personal guarantee for this type of financing: good business credit, a decent amount of time in business or good personal credit. And much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Basic Terms and Qualifying

You need to establish the amount of money you have for a down payment, and the vehicle you need. Plus, you must establish the costs associated with buying the vehicle.

You’ll need to provide documentation that proves you are the owner of a business. This includes business licenses, partnership agreements, LLC documents, and articles of incorporation (if applicable), listing you as having at least a 20% stake in the business.

You may also have to provide personal documentation like personal credit score and credit history. If you are a sole proprietor and the business is under your Social Security number, you are the borrower and guarantor. Hence you are personally liable for repaying the loan. It is also a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Good Business Credit Can Help

If your company needs vehicles for operation build your business credit. This, way you will be able to qualify with no PG. Having this ability can give you the freedom to grow your fleet, and without your signature. More on this later. First, let’s look at those four keys to financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #1: Using Business Credit for Vehicle Financing

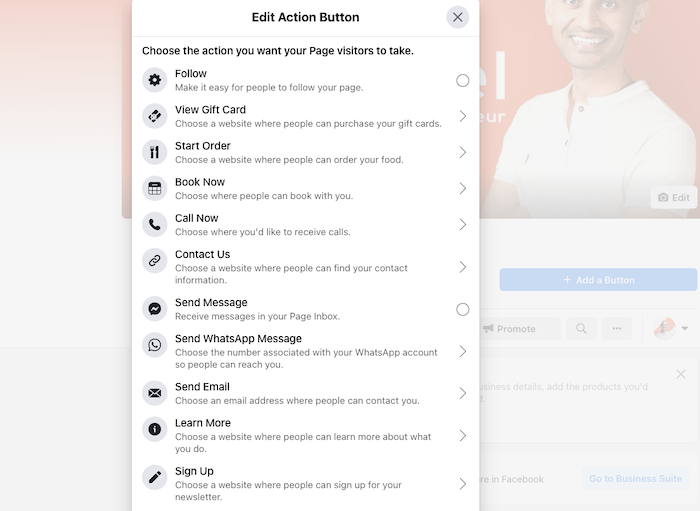

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so these lenders will have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

As an example, consider Ford Commercial Vehicle Financing.

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial funding options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you don’t get an approval on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Ford Commercial Vehicle Financing: Terms and Qualifying

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable) and a business bank account

You will need to have a strong business credit history. And you must have a good Experian business credit score.

Demolish your funding problems with 27 killer ways to get cash for your business.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But Ally will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax

Ally Car Financing: Terms and Qualifying

For Ally Commercial Line of Credit, to qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

With Ally Commercial Vehicle Financing, you can get a lease or a loan. To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

There is no minimum time in business requirement. Apply in person only, dealer will advise if approval or Personal Guarantee (PG) needed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #2: Credit Line Hybrid

Yet another potential form of vehicle financing is through the Credit Suite Credit Line Hybrid. A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. So you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials are necessary. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Vehicle Financing Key #3: 401(k) Financing

Another option for vehicle financing is using your 401(k) as collateral. This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k) . The lender will want to see a copy of your two most recent 401(k) statements.

You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. So it will need to be from older employment. You cannot be currently contributing to it.

Vehicle Financing Key #4: SBA 504 Loans

The SBA 504 loan can be used to purchase “Long-term machinery and equipment”. As a result, it’s not a standard car loan. But you can purchase a truck with it. You can use an SBA 504 loan when the vehicles being purchased qualify as heavy equipment.

Some examples of trucks as ‘heavy equipment’ can include:

- Cement trucks

- Dump trucks

- Custom-build heavy trucks fit for specific purposes (loading/unloading septic tanks, for instance)

- Semis and tanker trailer trucks

If your vehicle needs run in this direction, then an SBA loan could be perfect for your needs.

SBA 504 Loans and Credit Suite

Did you know that you can get SBA loans through Credit Suite? Established businesses with tax returns that show good revenues and profitability can get very large sums of funding with Secured Small Business Loans. If you have positive business tax returns, you should apply for secured government-backed SBA program loans from $250,000 up to $12,000,000. Approval amounts will vary based on the collateral your business has, and the amount of net profit reflected on your tax returns.

The total time to close these loans is about 2-4 months. SBA loans offer some of the longest payback terms available for business financing. Get loan terms for 10, 15, or even 25 years with the SBA. Interest will total approximately 3% of the debt. The rate may be financed with the loan.

Get approved for up to $12 million. Your credit will have to be of good quality. Your collateral will need to equal 50% of the loan amount. Financials will be necessary.

SBA 504 Loans Through Credit Suite: Documentation

The SBA will require certain documentation to qualify including:

- Business and personal financials

- Resume and background information

- Personal and business credit reports

- Your business plan

- Bank statements

- Collateral and any other documentation relevant to the transaction

Vehicle Financing: Takeaways

Getting vehicle funding involves variables like whether the vehicle is new or used. Heavy vehicles like dump trucks can be paid for with SBA 504 loans. There is a possibility that you would have to provide a personal guarantee to get a loan or lease. Credit Suite offers financing that you can use to purchase vehicles, and we offer even more options through our Business Finance Suite. There are four keys to open the door to affording vehicles for your business. And there are a lot of options. Let’s explore them together.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Credit Suite.