Business crowdfunding is a legitimate business funding option. Not only can it work well for startups, but it is an option for growth and expansion projects as well.

You Need Other Funding Options for When Business Crowdfunding Doesn’t Cut It

However, crowdfunding isn’t a sure thing by a long shot. In fact, it is pretty risky if it is all you have. Of course, you only lose what you put into the campaign, but you definitely need a backup funding plan. What do you need to know about business crowdfunding?

What is Business Crowdfunding?

While the average person that wants to start a business needs funding, it is not always possible to find one or two large investors. With crowdfunding, you can a lot of investors to fund your business $5 and $10 at the time.

There are many crowdfunding sites, but the most popular are Kickstarter and Indiegogo. The platforms are similar but there are some important differences. The most obvious is the timing of when you actually receive the funds that others invest in your company.

Demolish your funding problems with 27 killer ways to get cash for your business.

Kickstarter requires a preset goal, and you do not receive your funds until you reach your goal. For example, if you set a goal of $10,000 when you start your campaign, you will not receive any money that investors offer up until you reach that $10,000.

Indiegogo requires a goal as well, but they offer the option to receive funds as you go if you would rather. They also have an option called InDemand. This program allows you to continue raising funds after your original campaign is over without starting a whole new campaign, like an extension.

More Crowdfunding Sites

There are other crowdfunding sites out there also. Different ones work better for certain businesses and vendors. To figure out which one you might work best for your needs, you’ll have to do some research. Keep in mind your type of business and the specific business each one appeals too.

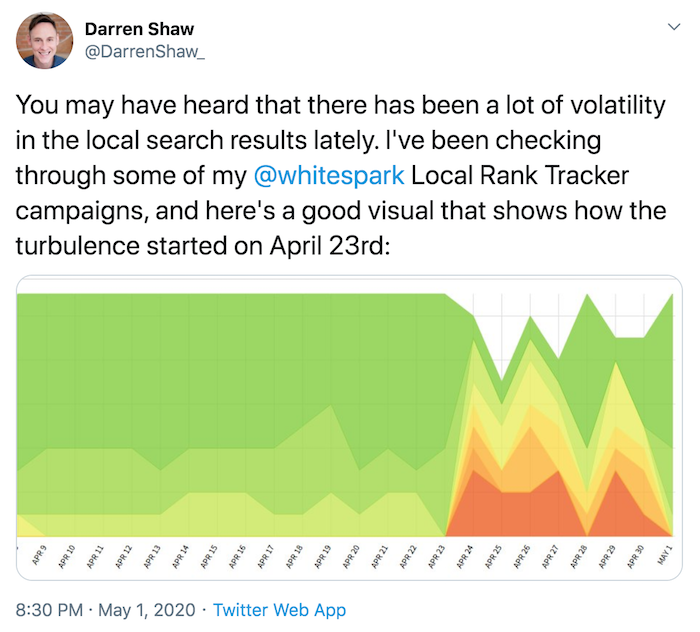

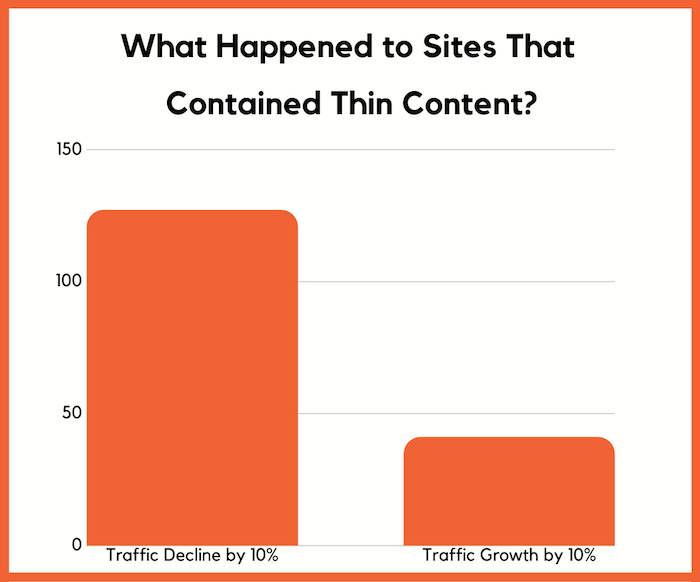

Crowdfunding is a good starting point for a new business, but it shouldn’t be relied upon completely. You need a backup plan. Only a small percentage of crowdfunding campaigns are successful. Furthermore, consider how the economy is doing before you rely too heavily on crowdfunding. If the economy isn’t strong, people will not be as likely to invest.

Examples of Successful Business Crowdfunding Campaigns

Though not all business crowdfunding campaigns are successful, some are incredibly profitable. Here are some of the most successful.

Pebble SmartWatch

Pebble actually has several of the top 10 campaigns ever on Kickstarter. Their 2nd campaign is one of the highest funded ever, reaching over $20,000,000. That’s not too shabby for a goal of only $500,000. They blew it out of the water!

Are they still successful? They are, but not in the way you may think. They actually sold to FitBit. So I call that success.

FlowHive

This one is not one that most would expect to be as profitable as it was. The FlowHive Indiegogo campaign was buzzworthy for sure. The idea was to find a way to get the honey from bees without harming the bees.

Traditionally, hives are simply broken open to get the honey. This process can kill the bees. FlowHive developed a fake hive, made from reusable plastic. Bees make honey in it, and the honey flows out through a spout. The bees are safe and fresh honey is readily available.

Apparently, beekeeping is growing in interest. This campaign raised $14,000,000. Though they won’t disclose exact numbers, those in charge say they are still in the black.

CoolestCooler

The coolest cooler was a super cool Kickstarter campaign that came in at over $13.000,000 raised. The cooler boasted bluetooth and a blender among other things. Investors received a cooler for their donation toward the cause.

This one did run into some trouble when it wasn’t able to deliver investment rewards as quickly as promised and there was actually a lawsuit. In the end, everything worked out and everyone got their rewards.

The cool gang at CoolestCooler says they are glad to put that behind them and get back to work. You can still buy one today.

Kingdom Death Monster 1.5

Strange name, huh? What do you say to that? Apparently a lot of people said yes. They said yes to the tune of $12,000,000 on Kickstarter.

It’s a board game, if you didn’t already know. It did take a while to get the get going, but investors finally got their copy. After production stopped, resale values went upwards of $1,000. A later campaign promising updated material did just as well. Seems like a lot people love horror games.

Demolish your funding problems with 27 killer ways to get cash for your business.

BauBox Travel Jacket

This jacket was set to be hot with 10 different design elements, like a drink holder and a neck pillow. They raised over $11,000,000 across 2 campaigns. While it had a bumpy start, including the jacket being available on retail sites before investors even got theirs, it is still selling today.

How to Launch a Successful Business Crowdfunding Campaign

There is no such thing as guaranteed success, but following these steps can help make sure you give your business the best chance possible.

You Have to Research

You need to know your market and what demand looks like. The only way to figure that out is to research. Find out how much you actually need before you set your goal. Many business owners have started business crowdfunding campaigns only to find the demand isn’t there or their goal fell short of what they actually needed to get started.

You Need a Prototype

If you are selling a product, you have a sample to show investors. This is key. People are much more likely to invest if they can see something tangible. This is so important that Kickstarter actually requires you to have a prototype to show potential investors

Consider Your Platform

Once you know who your target audience is, you can decide if you would be best served by Kickstarter, Indiegogo, or some other, lesser known yet equally successful platform. If your audience doesn’t frequent the platform you are on, it won’t matter how great your idea or product is. They will never see it.

Offer Good Rewards

Rewards are vital. However, be certain you can deliver. Also, don’t give away the company. But if someone one is going to help you get started, they deserve something pretty epic. Go beyond a thank you note. Be fearless with what you offer as a reward for their support, without harming your success.

Have Something to Reach For

Setting attainable goals is absolutely necessary to success. Make sure you look at the numbers in light of actual facts before you set a fundraising goal. Be certain you have production facilities on the line that can meet the timeline goals. Don’t set random goals with no clue what it will take to reach them, or if they are even realistic to reach.

Make Your Marketing Pop

You can’t just throw something together. If you do a video, it needs to be professionally edited. Any social media needs to be specifically geared toward your audience. If they are a cheesy, campy audience, then that is how your social media and videos need to come off.

If they are an audience is more sophisticated, your campaign needs to be as well.

Other Funding Options

Remember, you need a backup plan in case business crowdfunding doesn’t work out. Here are some options.

Traditional Term Loans

These are the loans that you go to the bank to get. As a business, your business credit score can help you get some types of funding even if your personal score isn’t awesome. That isn’t necessarily the case with traditional loans however.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. As a result, they will check your personal credit. If it isn’t good enough, you will not get approval.

What kind of personal credit score do you need to have to qualify for a traditional term loan? If you have at least a 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be more inclined to be a little more flexible. However, your personal credit score will still weigh heavily on the terms and interest rate.

Of all of the available business funding types, this is the hardest to get. It is usually worth the trouble however, because it often has the best rates and terms.

SBA Loans

These are traditional bank loans, but they have a guarantee from the federal government. The Small Business Administration, or SBA, works with lenders to offer small businesses funding solutions that they may not be able to get based on their own credit history. Because of the government guarantee, lenders are able to relax a little on the personal credit score requirements.

In fact, it is possible to get an SBA microloan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

Every rose has its thorn, and SBA loans are no different. The application progress is lengthy. There is a ton of red tape to get through due to the government affiliation.

Business Line of Credit

This is basically the traditional lender’s version of a business credit card. The credit is revolving, meaning you only pay back what you use, just like a credit card. Rates are typically much better than a credit card. The application and approval process, however, is more similar to that of a traditional term loan.

If you need revolving credit and can qualify for a term loan, this is a good option. It is great for bridging cash gaps and covering short term expenses without the high credit card interest rates.

Still, there are no cash back rewards or loyalty points. This makes some business owners prefer business credit cards in some cases, despite higher interest rates.

Invoice Factoring

If you are an established business with accounts receivable, invoice factoring is one of the available business funding types that you have access to. This is where the lender buys your outstanding invoices at a premium, and then collects the full amount. You get cash right away, without waiting for your customers to pay the invoices.

It is a good option if you need cash fast, or you do not qualify for other funding types. The interest rate varies based on the age of the receivables.

Private Lenders

Private lenders are lenders other than traditional banks and credit unions that offer terms loans. Generally, they operate online. The difference between these and traditional lenders is that the loans have less strict approval requirements and a much faster application process. Most often you can simply apply online, get approval in as little as 24 hours, and the funds are in your account within 24 to 48 hours after approval.

Grants

While there are not a lot of these out there, they are more common than you probably think. Usually, they are offered by professional organizations. There are some government grants available also. Competition can be tough, but they are definitely worth a shot if you think you may qualify.

Requirements

Requirements vary from grant to grant. Also, most are only awarded to a certain number of recipients. Still, they are a good option, especially if you fall into one of these basic categories.

Demolish your funding problems with 27 killer ways to get cash for your business.

- Businesses run by veterans

- Businesses in low income areas

There are also some corporations that offer grants in a contest format. They do not require much other than that you meet the corporation’s definition of a small business and win the contest.

Business Crowdfunding is a Legitimate Option

Business crowdfunding can be fabulous. You can get all the funds you need to start or grow your business. The best part is, you don’t have to pay any of it back. However, it doesn’t always work. Often campaigns do not reach goals, or they do, but it isn’t enough. It is definitely worth a shot, but you need to know your other options as well.

The post All You Need to Know About Business Crowdfunding appeared first on Credit Suite.