How to Create Search Engine Friendly Title Tags

One of the most frustrating things about SEO is getting everything to work together as it should.

If you’ve done SEO, you know exactly what I’m talking about. There are so many little elements in SEO that sometimes it seems impossible for everything to work out perfectly.

Even today! I know I talk a lot about how “smart” the search algorithms are and how it’s virtually impossible to game the system.

However, there are still a lot of elements you need to pay attention to for your SEO to succeed.

Case in point: Page title tags.

Before you yawn and find some more sexy SEO topic to jam on, hear me out.

Title tags are one of the cornerstones of SEO. They always have been, and as far as we can tell, they always will be.

Moz explains, “Title tags are the second most important on-page factor for SEO, after content.”

When it comes to low effort/big results, title tags take the cake. It’s such a small element, but has such a massive impact!

You know it’s important to create eye-catching headlines, but optimizing your titles also matters for SEO.

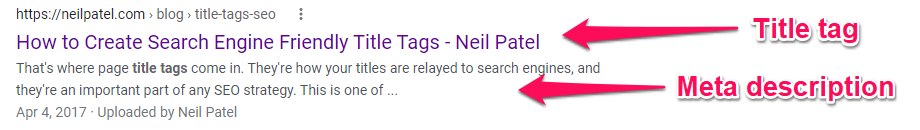

That’s where page title tags come in. They’re how your titles are relayed to search engines, and they’re an important part of any SEO strategy.

This is one of the few times when you need to write for both people and search engines, and that can be tricky. (Especially with headlines.)

In short, you have to create a clickable headline that also makes search engines happy.

Here’s the challenge: People have to like it. Search engines have to like it. Yikes!

Does that sound difficult?

Yes, it can be if you don’t know what to do. That’s why I’m going to break down my process step-by-step.

We’ll go through that process, but first, let’s look at why title tags are important for SEO.

What are Page Title Tags?

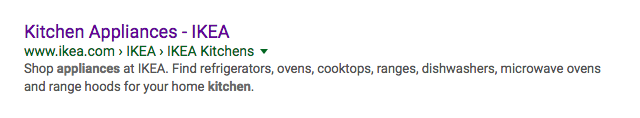

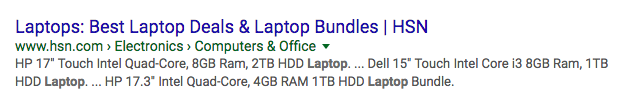

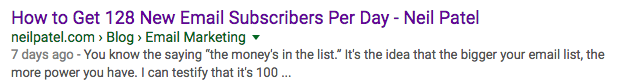

If you’ve ever used a search engine before (and I’m guessing you have), you’ve seen a page title tag whether you’ve realized it or not.

It’s simply the headline on the SERP (search engine results page).

For example, if you Google “kitchen appliances,” you’ll see that one of the top results is from IKEA.

In this case, the page title tag is “Kitchen Appliances – IKEA.”

This is what both people and search engines will see as the title of your page. Often, this is the first thing they’ll see, and that’s a big reason why it’s so crucial to put time and effort into your title tags.

The point you need to remember is this: real people are reading your title tag.

They are going to respond to it. They will judge it. They will be compelled by it. They will be put off by it. They will learn from it.

Basically, the title tag is your page’s message to the world!

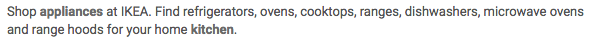

Title tags work with the meta description (the text below the title). In the case of the IKEA search result above, this is the meta description — a sentence or phrase that adds more information about the page.

I’ve written about meta descriptions before, but title tags are even more important.

Both the title and the meta description together give a brief idea of what your content is about, but the title tag stands out more.

There are two big reasons why page title tags are so important.

First, if you have a clear title that’s relevant to your page, both humans and search engines will see that as a sign of a good page.

If your title tag isn’t optimized, then people could skip right over your content, and search engines may determine that your page isn’t as good as it could be.

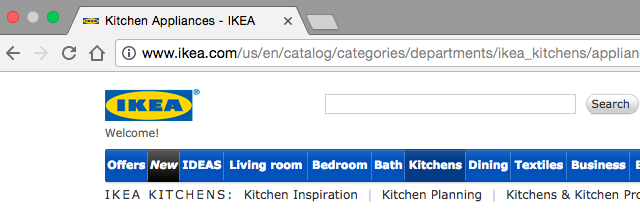

A second reason why title tags are important is they show up in browser tabs:

So when someone wants to find your page out of all their browser tabs, they’ll look for your title tag.

Title tags are often what people will see if your page is shared on social media. For example, here’s an example of a title tag on Facebook:

Can you see why title tags are so important? A good title tag means maximum visibility, while a bad title tag can sink your page.

There are three important steps to take to optimize your title tags.

- make sure your headlines make for good title tags

- create the title tag

- make sure the title tag is optimized for SEO

Let’s dive into all three.

Step 1: Write Your Title Tag

You might be wondering how writing a title tag is any different from writing a headline.

In some cases, your headline and title tag will be the same exact title. But there are some cases where they won’t be.

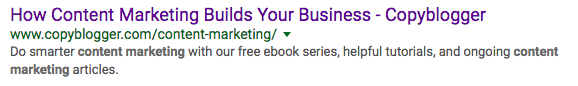

Check out this SERP result from Copyblogger:

It seems like the title for the page would be “How Content Marketing Builds Your Business,” right?

But when you go to the page, you’ll see a different title:

The title shown on the page is longer and more descriptive.

So why would Copyblogger do this? It’s most likely because the shorter title tag looks better on the SERP, and it takes less time to read.

The actual title that you see on the page goes into more detail, and that’s probably why they used it. They get the benefits of having both a streamlined title tag and a descriptive page title.

It’s a sneaky and useful tactic that’s the sort of SEO stuff I love.

With that in mind, here’s how to write a great title tag.

There are a few elements of title tags:

Title Tags Should Be Short

Shorter titles are easier for people to read and for search engines to crawl.

But there’s a better reason for shorter title tags.

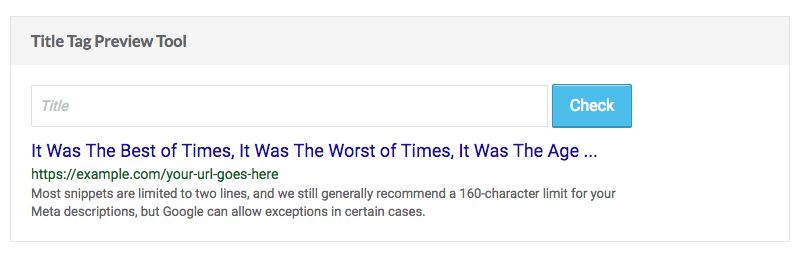

If your title tag is too long, search engines will cut off your title with an ellipsis (…):

Ideally, your readers and search engines should be able to see the entire title tag so they get the best idea of what the content is about.

Google typically shows no more than 60 characters of the title tag. So if your title tag is 60 characters or less, you can generally expect that the entire title will show.

If you want to make sure, Moz has a handy preview tool:

This is a great feature that I recommend you use. Remember, keep it short if possible.

Title Tags Should Contain Your Main Keyword

You probably expected to see something about keywords in an article about SEO.

For best results, try to put your focus keyword as close to the beginning of your title as possible. That’s so search engines (and people) will see the keyword early on.

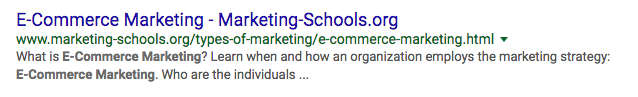

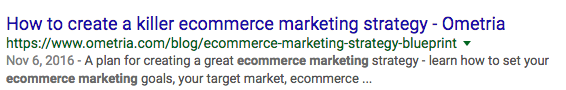

Here’s a title tag with the keyword right up front:

Contrast that with this result that has the keyword closer to the end of the title tag:

One tip: Make sure the keyword placement is organic. It’s preferable that the keyword is close to the beginning, but it’s not necessary for great SEO.

Title Tags Should Describe a Benefit

Much like a headline, a title tag needs to communicate a benefit to stand out.

This is one of many reasons Google warns against keyword stuffing and boilerplate titles.

Your title tags are representatives of your pages, and you want people and search engines to know that your pages have unique, valuable content.

Make sure your title tag is related to your content. It should read naturally and grab the reader’s attention.

Keep in mind, you’re not trying to trick people. All you need to do is clearly explain the benefit of clicking on the page.

Often, the “benefit” is nothing more than telling them what the page is about! At this point, you’re not trying to sell anything. You’re simply giving them information.

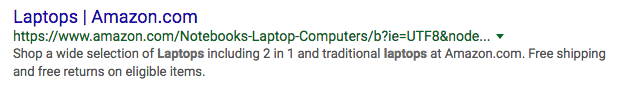

Here’s an example that clearly expresses a benefit (ignore the jargon-filled, not-so-great meta description).

On the other hand, this title tag is plain and doesn’t explicitly state a benefit (they did a nice job with the meta description, though).

(Sure, Amazon probably doesn’t need to state a benefit, but your site probably does.)

Stating a benefit probably won’t do anything for search engines, but it goes a long way for human users who come across your site with a search.

Step 2: Create Your Title Tag

Once you have your page title tag written, you need to set it as the title for your page.

The way you’ll do this will depend on what powers your website.

If you have a custom site, you’ll need to edit the HTML directly. (And it’s super easy to do.)

If you use WordPress, it’s also super easy.

If you use another CMS or host, it might look a little bit different for you.

Let’s take a look at each of these three different cases and how to create a title tag for each scenario.

Case 1: You Have a Custom Site Not Hosted on a CMS

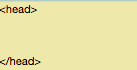

If your site isn’t hosted on a CMS, you can edit your HTML to add titles.

First, you access the HTML for your specific page. I recommend checking with your hosting service on how to do this.

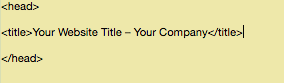

Once you’ve found the editable HTML, make sure you’re between the <head> tags.

(Note: This is an example code using Editpad.org. Your code will probably look different, and there might be extra code here. That’s okay––just make sure you’re only between the <head> tags and not any others.)

To create the title, use <title> tags. For example:

That’s it! Save your code, and your title will now show up correctly.

Case 2: You Use WordPress

If you use WordPress, you’ll be happy to know there’s a super simple solution — it’s actually way easier than editing the HTML.

In fact, this method uses something you’re probably already using: the well-loved Yoast SEO plugin.

This is a powerful plugin that you can get a lot out of. And it’s great for editing your title tags.

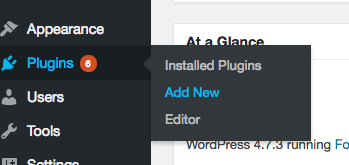

First, if you don’t have Yoast installed, go to Plugins > Add New.

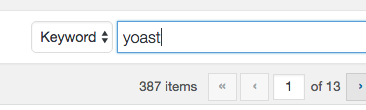

Type “Yoast” into the plugin search bar.

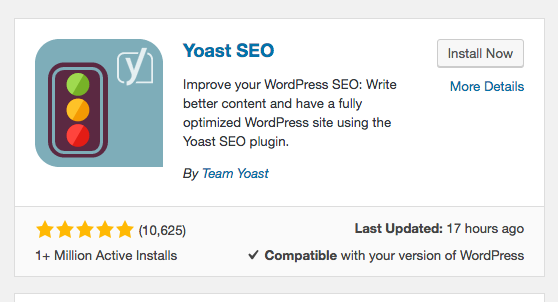

Look for “Yoast SEO.”

Click “Install Now.”

Next, click “Activate.”

Now the plugin is up and running.

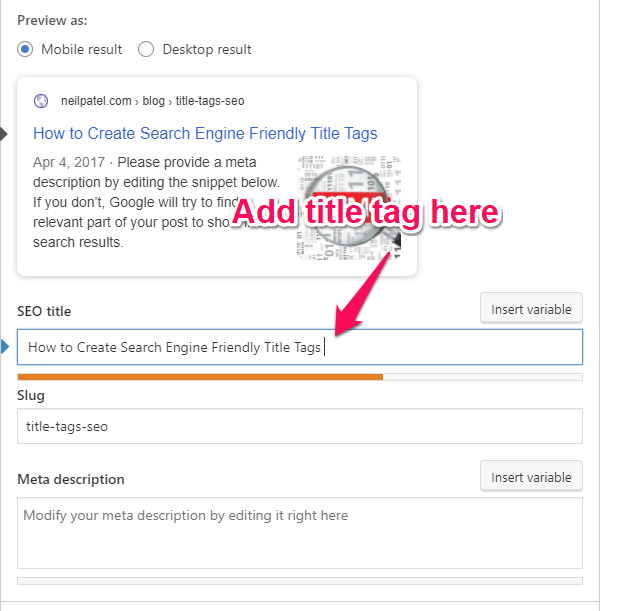

To edit the title tag for a page or post, navigate to that content and open the editor.

Scroll down to the bottom of your post or page, and you’ll see the Yoast box, where you can edit the title tag and meta description.

It’ll also give you a nice preview of both your title and meta description:

If your title tag (or meta description) turns out to display differently on the actual SERPs, you can always go back and edit it in this section.

Case 3: You Don’t Have a Custom Site or a WordPress Site

I know not all of you fall under these categories.

You might use a completely different kind of CMS, or your web host might have a different setup.

In those cases, I recommend contacting your CMS company or web host to find out how to access your HTML to edit your page title tags.

This is really a case-by-case scenario, so it will probably look different for a lot of you. However, you should be able to get an answer with a quick email to your web host’s support email.

So far, you’re two-thirds of the way done! Now you just need to make sure your title tag is the most SEO-friendly it can be.

Step 3: How to Optimize Your Title Tag for SEO

We’ve talked a little bit about this already, but there are a few more steps you can take to make sure your title tag is optimized.

This is the step that most people miss entirely!

They think, “Yay. I’m done with my title tag!” But they forget that one of the primary methods of marketing and promotion is through social sharing!

Here are my best tips for optimizing your title tags for social.

Use Your Brand Wisely

The title tag can be a great place to include your brand, but if you overdo it, you could face some consequences.

Google suggests using your homepage title tag to include the most branding. Their example: “ExampleSocialSite, a place for people to meet and mingle.”

For most of your pages, adding your brand to the end of the title tag will suffice (if there’s room, that is).

Here’s how I do that:

Prevent Search Engines from Rewriting Your Title Tags

You read that right: Sometimes Google will rewrite your title tags.

It’s crazy, I know! But why the heck would this happen?

According to Silkstream, “Google will automatically change how your title is displayed in the SERPs if their algorithm is under the impression that the page title doesn’t accurately represent the content on that page.”

So if your title tags don’t look good to Google, they’ll consider other factors, including:

- On-page text

- Anchor text

- Structured data markup

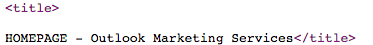

Take a look at this title tag:

If you go to the homepage and view the source code (right-click and select “View Source” or “View Page Source”), you’ll see the company set the title to be something else:

Google rewrote it because they felt their revised title tag would help people more than the original.

The good news: If you follow the steps outlined in this article, Google should keep your title tags as they are.

If you do see your title tags showing up differently, revisit them and try to identify how you can further optimize them.

Consider Making Your H1 Page Heading Different From the Title Tag

This is exactly like the Copyblogger example from earlier.

You can use two different sets of keywords in your title tag and H1, which organically enhances your SEO. Search engines will count the title tag as the “heading.” (Just make sure it’s optimized.)

Avoid Duplicate Title Tags

Google explicitly says that “it’s important to have distinct, descriptive titles for each page on your site.” So don’t copy and paste your title tags.

If you’ve done everything so far, you should now have an optimized title tag! Finalize it and send it out into the world.

Title Tag Frequently Asked Questions

Title tags are the title of a page users see in the search results. They serve as a first impression and can encourage — or deter– people from clicking on your pages.

Title tags are shorter and appear first in the SERPs.

Pay attention to the length, use the main keyword the page targets, and explain what benefit the user will get by clicking.

Between 50 and 50 characters. Any longer than that and Google may truncate your title.

Generally just one. You can add a second if it is closely related and makes sense. Don’t keyword stuff; the goal of the title tag is to explain what users can expect if they click.

Title Tag Conclusion

I know first-hand that SEO can be a headache., but it doesn’t have to be.

I’m all about demystifying SEO because I know it’s something anyone can do. Even if you’re a technophobe, you can do this!

It doesn’t take years of experience in digital marketing to get SEO right. You just have to learn the ropes and get used to it.

For example, creating page title tags is pretty simple. It might seem complicated at first, but once you take a peek behind the scenes, you see how easy it is.

If you’re not currently leveraging the power of optimized title tags, use this article to start doing that. It can be a game-changer and help your visibility on the SERPs.

Best of all, it only takes a few minutes.

What tips do you have for using title tags for maximum SEO power?