Sen. Tim Scott, R-S.C., laid out why he believes a $750 billion-dollar spending package won’t help the economy Monday on “The Five.” SEN. TIM SCOTT: If you have all four of those departments together, you will still have a bigger IRS and the scariest part for our viewers is there’s 87,000 new employees hunting for … Continue reading Sen. Tim Scott: Democrats' spending bill really the 'Inflation Seduction Act'

Tag: Really

Trump Really Was Spied On

Durham says techies linked to the Clinton campaign had access to White House and Trump Tower internet data. The post Trump Really Was Spied On appeared first on #1 seo FOR SMALL BUSINESSES. The post Trump Really Was Spied On appeared first on Buy It At A Bargain – Deals And Reviews.

Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox?

We all have tools. I’m not just talking about hammers and nails. We have kitchen tools, lawn care tools, tools we use in the office, even tools we use to care for our pets and our children. Business owners have tools they use for many things, including managing finances. Is Divvy a tool that business owners need in their toolbox? Let’s find out.

Find Out If Divvy Is Right For Your Business

There are a number of money management tools on the market. We’re digging in with Divvy to find the good, the bad, and the ugly so you can make an informed decision for your business.

What Divvy Is, and What It Isn’t

What is Divvy? At its core, it is an expense management system. In fact, it was recently acquired by Bill.com, due to the fact that Bill.com had an increasing number of customers looking for help with money management.

Check out how our reliable process will help your business get the best business credit cards.

It is designed to help businesses manage their business finances by integrating with accounting systems and helping them control spending in a streamlined manner. That is what Divvy is.

It is not meant to be a business funding option on its own. It does offer a charge card option that allows for business funding, and even helps build business credit. However, it’s purpose is to be another spending management tool. If it were a hammer, this card would be the backside that pulls the nails out. You buy a hammer to hammer nails. The other side is useful, but generally you don’t use a hammer simply to pull nails. It works for that, but that is not it’s main purpose.

Money Management Tool

They offer a lot of great money management products for managing spending, expenses, and accounts payable. The system allows you to see transactions in real time, and send funds in seconds via mobile or desktop.

You can also issue cards to employees, either virtual or physical cards, and give them direct access to funds with a spending limit you set. This not only cuts down on expense reports, but also helps with budget management. That is the main purpose of the card.

The system currently integrates with Quickbooks Online and Oracle Netsuite. Integration with Xero and Quickbooks Desktop is coming soon.

On the accounts payable side, you can seamlessly receive invoices, get approvals, and send payment by either ACH, check, or virtual card. It’s truly an easy and innovative way to streamline processes and manage spend. However, there is currently a waitlist for accounts payable services.

Building Business Credit

So, what’s the deal with Divvy and business credit? They do offer a business card. They have more than one way of underwriting so that if you do not qualify with traditional underwriting, they can look at other factors for approval. There is really no elaboration on what these may be. But, often it is monthly income, time in business, and the like.

So, if you do not qualify for other cards, you may qualify for this one. The main point of the card however, is that it is attached to the Divvy system. That means, if you distribute cards or virtual cards to employees, you can see their spending in real time. It offers business owners more control.

Check out how our reliable process will help your business get the best business credit cards.

They report positive payment history to the Small Business Finance Exchange. That means this card does help you build your business credit score, because the SBFE reports information to Dun & Bradstreet. Since only 7% of companies that offer credit to businesses actually report positive history, this is big. One of the largest obstacles to building business credit is finding accounts that will report positive history. Most only report missed payments.

The thing about business credit building is, one account reporting is just not enough. Your business has to be set up properly to be fundable to begin with. Also, you need a lot more accounts that will report before you have a business credit score at all. That in itself is a challenge. This is where a program like the Credit Suite Business Credit Builder can be helpful, because it walks you through the process of setting up to be fundable, finding accounts that will report, and applying for them at the right time so that you actually qualify.

Divvy’s Online Reputation

If you look at online reviews, you are going to get a mixed bag. Most of the negative reviews and complaints come from those looking for a business credit card. They are not looking for money management services. Those looking for money management services seem to be pleased.

It does appear that maybe they are not clear on a lot of things, or at least they do not make the information easy to find, pertaining to how the card works and rewards. For example, one complaint was that this is a charge card, not a credit card. That means the balance must be paid in full each month. This would explain why there is no interest rate information, as there is no interest since the card carries no balance.

After a lot of digging around I did confirm that the Divvy card is a charge card used to pull against a line of credit. It is not a credit card, and therefore you cannot carry a balance. This information was definitely not easy to find on the website, and they refer to the card as a credit card multiple times.

Check out how our reliable process will help your business get the best business credit cards.

Another complaint noted that card rewards are not earned unless you use at least 30% of the credit line. I could not verify this. There is no mention of it that I could find. That doesn’t mean it isn’t there, but it certainly is not out front information.

There were many positive reviews from those who were using the service mainly for money management.

They have a D+ rating at BBB.org. However, the fact that the business is only 3 years old and there are only a handful of reviews and complaints, skews this grade. People are much more likely to report negative experiences to the Better Business Bureau. Any negative report is going to bring the grade down very quickly.

It’s important to note also that the company did respond to the complaints and worked to make them right if they were in the wrong.

What’s the Final Word on Divvy?

This is a new company, and it appears to be making its way well among the new-ish niche of money management options. They offer what appears to be smooth integration with common accounting systems. Their charge card allows for spend control and options for managing cash flow. It is an added bonus that they report on-time payments to your business credit profile.

In conclusion, this is a great tool for money management. One major reason for this is that they can help you build credit for your business. If you are looking for a money management option for your business tool box, it’s a solid choice. Apply for Divvy now. If you are mainly looking for a business credit card, you may be better off with something else.

The Credit Suite Business Credit Builder can help you position your business to qualify for all the funding you will ever need, and help you find the best vendors for your business at the same time. Sign up for a free business credit consultation today.

The post Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox? appeared first on Credit Suite.

Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox?

We all have tools. I’m not just talking about hammers and nails. We have kitchen tools, lawn care tools, tools we use in the office, even tools we use to care for our pets and our children. Business owners have tools they use for many things, including managing finances. Is Divvy a tool that business owners need in their toolbox? Let’s find out.

Find Out If Divvy Is Right For Your Business

There are a number of money management tools on the market. We’re digging in with Divvy to find the good, the bad, and the ugly so you can make an informed decision for your business.

What Divvy Is, and What It Isn’t

What is Divvy? At its core, it is an expense management system. In fact, it was recently acquired by Bill.com, due to the fact that Bill.com had an increasing number of customers looking for help with money management.

Check out how our reliable process will help your business get the best business credit cards.

It is designed to help businesses manage their business finances by integrating with accounting systems and helping them control spending in a streamlined manner. That is what Divvy is.

It is not meant to be a business funding option on its own. It does offer a charge card option that allows for business funding, and even helps build business credit. However, it’s purpose is to be another spending management tool. If it were a hammer, this card would be the backside that pulls the nails out. You buy a hammer to hammer nails. The other side is useful, but generally you don’t use a hammer simply to pull nails. It works for that, but that is not it’s main purpose.

Money Management Tool

They offer a lot of great money management products for managing spending, expenses, and accounts payable. The system allows you to see transactions in real time, and send funds in seconds via mobile or desktop.

You can also issue cards to employees, either virtual or physical cards, and give them direct access to funds with a spending limit you set. This not only cuts down on expense reports, but also helps with budget management. That is the main purpose of the card.

The system currently integrates with Quickbooks Online and Oracle Netsuite. Integration with Xero and Quickbooks Desktop is coming soon.

On the accounts payable side, you can seamlessly receive invoices, get approvals, and send payment by either ACH, check, or virtual card. It’s truly an easy and innovative way to streamline processes and manage spend. However, there is currently a waitlist for accounts payable services.

Building Business Credit

So, what’s the deal with Divvy and business credit? They do offer a business card. They have more than one way of underwriting so that if you do not qualify with traditional underwriting, they can look at other factors for approval. There is really no elaboration on what these may be. But, often it is monthly income, time in business, and the like.

So, if you do not qualify for other cards, you may qualify for this one. The main point of the card however, is that it is attached to the Divvy system. That means, if you distribute cards or virtual cards to employees, you can see their spending in real time. It offers business owners more control.

Check out how our reliable process will help your business get the best business credit cards.

They report positive payment history to the Small Business Finance Exchange. That means this card does help you build your business credit score, because the SBFE reports information to Dun & Bradstreet. Since only 7% of companies that offer credit to businesses actually report positive history, this is big. One of the largest obstacles to building business credit is finding accounts that will report positive history. Most only report missed payments.

The thing about business credit building is, one account reporting is just not enough. Your business has to be set up properly to be fundable to begin with. Also, you need a lot more accounts that will report before you have a business credit score at all. That in itself is a challenge. This is where a program like the Credit Suite Business Credit Builder can be helpful, because it walks you through the process of setting up to be fundable, finding accounts that will report, and applying for them at the right time so that you actually qualify.

Divvy’s Online Reputation

If you look at online reviews, you are going to get a mixed bag. Most of the negative reviews and complaints come from those looking for a business credit card. They are not looking for money management services. Those looking for money management services seem to be pleased.

It does appear that maybe they are not clear on a lot of things, or at least they do not make the information easy to find, pertaining to how the card works and rewards. For example, one complaint was that this is a charge card, not a credit card. That means the balance must be paid in full each month. This would explain why there is no interest rate information, as there is no interest since the card carries no balance.

After a lot of digging around I did confirm that the Divvy card is a charge card used to pull against a line of credit. It is not a credit card, and therefore you cannot carry a balance. This information was definitely not easy to find on the website, and they refer to the card as a credit card multiple times.

Check out how our reliable process will help your business get the best business credit cards.

Another complaint noted that card rewards are not earned unless you use at least 30% of the credit line. I could not verify this. There is no mention of it that I could find. That doesn’t mean it isn’t there, but it certainly is not out front information.

There were many positive reviews from those who were using the service mainly for money management.

They have a D+ rating at BBB.org. However, the fact that the business is only 3 years old and there are only a handful of reviews and complaints, skews this grade. People are much more likely to report negative experiences to the Better Business Bureau. Any negative report is going to bring the grade down very quickly.

It’s important to note also that the company did respond to the complaints and worked to make them right if they were in the wrong.

What’s the Final Word on Divvy?

This is a new company, and it appears to be making its way well among the new-ish niche of money management options. They offer what appears to be smooth integration with common accounting systems. Their charge card allows for spend control and options for managing cash flow. It is an added bonus that they report on-time payments to your business credit profile.

In conclusion, this is a great tool for money management. One major reason for this is that they can help you build credit for your business. If you are looking for a money management option for your business tool box, it’s a solid choice. Apply for Divvy now. If you are mainly looking for a business credit card, you may be better off with something else.

The Credit Suite Business Credit Builder can help you position your business to qualify for all the funding you will ever need, and help you find the best vendors for your business at the same time. Sign up for a free business credit consultation today.

The post Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox? appeared first on Credit Suite.

The post Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox? appeared first on BUSINESS DEMO WEBSITES.

The post Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox? appeared first on Buy It At A Bargain – Deals And Reviews.

Surprise! Charitable Credit Cards Really Do Exist

Truly, charitable credit cards do exist. But, how do you find them? Furthermore, how do you use them to support causes you care about? Finally, how do you find the right one for you? Oh, and can you use them for your business? Let’s find out.

Top 3 Charitable Credit Card Options

Whether you want a card that donates to charities, community development, or the environment, you do have options. However, there aren’t a lot of them. Furthermore, it takes some research to find exactly what you are looking for.

Regardless, we’ve put together a list to help you get started. Remember, specifics such as interest rates and terms can change. So, you’ll need to check directly with the credit provider for the most up-to-date information.

Score the best business credit cards for your business. Check out our professional research.

Green America

According to the website, Green America uses a portion of each purchase to help to create a “more socially just and environmentally sustainable society.” Of course, Green American is a well known company. However, they do not make it clear exactly how using the card works to achieve this goal. As a result, you should contact them directly if you want more details.

Initially, for the first 12 months, there is no annual fee. Also, for this same time period there is no interest on purchases and balance transfers. After that, it varies between 9.99% and 19.99% based on how creditworthy you are.

They do offer a rewards program as well. In fact, you earn one point per dollar on net purchases. There’s no limit, and the points do not expire. You can use points for travel rewards or merchandise. This is a consumer credit card.

Aspiration

First, there is a waiting list for this card. Still, if it’s something you feel strongly about you may want to get on it. Here is how it works. Every time you make a purchase, they plant a tree. Even better, they let you plant one too. In addition, you can track your progress toward reducing your carbon footprint in the app. Then, you get cash back up to 1% of all your purchases for each month that you get to zero. This is also a consumer card.

Amalgamated Bank

Amalgamated Bank’s cards offer the chance to make a change. In fact, they call themselves “the bank for changemakers.” The company supports “sustainable organizations, progressive causes, and social justice.”

They aim for environmental and social responsibility. They are “net-zero.” Also, they use 100% renewable energy. Furthermore, they pride themselves on their history of supporting immigrants, affordable housing, and workers’ rights.

For example, they work with over 1000 unions to ensure teachers, steelworkers, firefighters and others get what they need to do their jobs.

As a result, when you use credit cards from Amalgamated Bank you are supporting these same causes.

Score the best business credit cards for your business. Check out our professional research.

Cards From Amalgamated Bank:

They offer a number of credit card options for businesses. Here’s a little about each one.

The Commercial Edition® Visa®

This card works well for travel, entertainment, and other spending. It helps companies keep control and improve cash flow. Additionally, it also helps them understand their spending patterns by offering specific reporting options. Furthermore, account holders have the ability to establish spending limits for individual card holders.

VOX® Business Card

Similarly, this card is great for travel, entertainment, and purchasing. Surprisingly, VOX changes and grows with the business to give flexibility when it comes to cash flow and minimum payment options. The credit limit also tends to be high. Terms and rates vary.

Purchasing Edition® Visa® Card

The Purchasing Edition® Visa® Card is the one to go with if you need to receive goods faster and negotiate cheaper costs with suppliers. You can also improve cash flow.

Amalgamated states that you need to speak with an account executive for details on each card and which one might be best for your business.

Other Resources For Help Finding Charitable Credit Cards

Another way to find options for charitable credit cards is to look for those that work with these agencies.

The Global Alliance for Banking on Values

The Global Alliance for Banking on Values (GABV) is a network of leaders from banks around the world. They are committed to positive change in the banking industry.

Their goal is to change the entire banking system to support environmental, social, and economic sustainability. The alliance is made up of a variety of banking institutions.

Score the best business credit cards for your business. Check out our professional research.

Community Development Financial Institutions (CDFIs)

According to Investopedia:

“Community Development Financial Institutions (CDFIs) are private sector financial institutions that focus primarily on personal lending and business development efforts in poorer local communities requiring revitalization in the U.S.”

Of course, working with CDFIs is another way companies can offer support to each other and their communities.

Charitable Credit Cards do Exist

As you can see, if you are looking for a charitable credit card, this is a good starting point. Depending on what you want, you may have to do more work however. For example, are you looking for a card that donates to a specific charity? Rather, are you more concerned with finding a company that holds to the same values you do? There is a card out there for you, but it may take some time to find it.

Credit Suite can help you find credit cards and other funding options for your business. Find out more today.

The post Surprise! Charitable Credit Cards Really Do Exist appeared first on Credit Suite.

How Google’s Search Engine Really Works (A Peek Under The Hood)

Google’s search engine is technically complex.

There are hundreds (maybe even thousands) of different factors taken into account so that the search engine can figure out what should go where.

It’s like a mysterious black box, and very few people know exactly what’s inside.

However, the good news is that search engines are actually pretty easy to understand.

We may not know every single factor (out of a hundred or thousand), but we also don’t need to.

I’ll bring it down to the basics with a simple method to please Google, rank higher, and bring in more website traffic.

I’ll also introduce some of the latest developments, like RankBrain, that help Google guess what you’re actually looking for (even if you don’t type it in).

First, I’m going to walk you through exactly how Google’s search engine really works so that you can see that it’s not as difficult to understand as you might think.

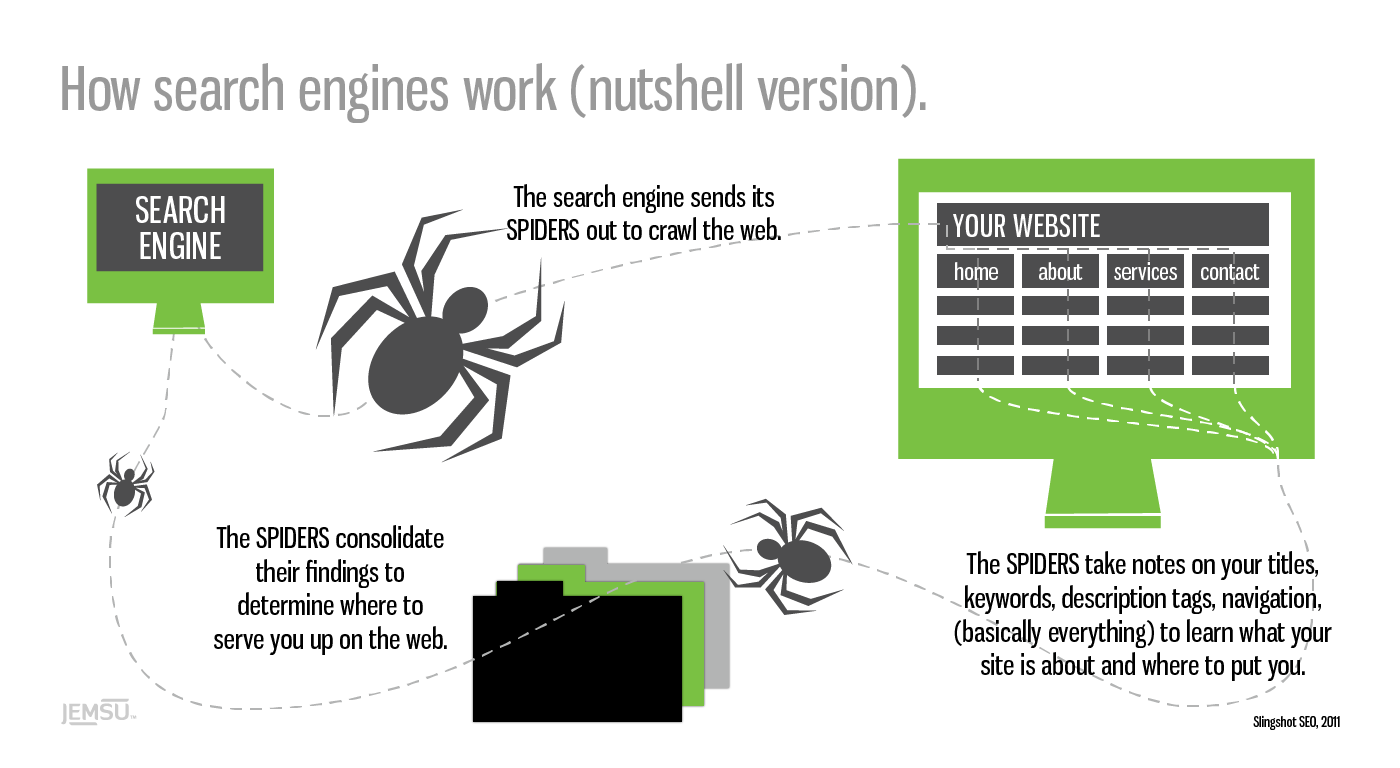

How Do Search Engines Crawl the Web?

Google’s first job is to ‘crawl’ the web with ‘spiders.’

These are little automated programs or bots that scour the net for any and all new information.

The spiders take notes on your website, from the titles you use to the text on each page to learn more about who you are, what you do, and who might be interested in finding you.

That may sound simplistic on the face of it.

Which is no small feat, considering there are more than 1.8 billion websites online today — with thousands of new sites popping up every day.

The first massive challenge is to locate new data, record what it’s about, and then store that information (with some accuracy) in a database.

Google’s next job is to figure out how to best match and display the information in its database when someone types in a search query. Scaling becomes a problem, though.

Google processes over 3.5 billion searches a day, and that number increases every year.

That means the information in its database needs to be categorized correctly, rearranged, and displayed in less than a second after someone expects it.

Time is of the essence here, because speed wins, according to Marissa Mayer back when she worked for Google over a decade ago.

She reported when they were able to speed up Google Maps’ home page (by cutting down on its size), traffic leaped 10 percent within seven days and 25 percent just a few weeks later.

Google won the search engine race because it’s able to:

- Find and record more information

- Deliver more accurate results

- Do both of those two tasks faster than any other search engine

One of the reasons Google is the front of the pack comes down to the accuracy of its results.

The information it displays is more likely to match what users are actually looking for.

Think about it this way.

When you type something into Google, you’re expecting something. It might be a simple answer, like the weather in your city, or maybe a little more complex, like “how does Google’s search engine really work?”

Google’s results, compared to other search engines, tend to answer those queries better. The information was the best of the best.

This breakthrough came from an initial theory Google’s co-founders actually worked on in college.

Why Do Links Matter to Google?

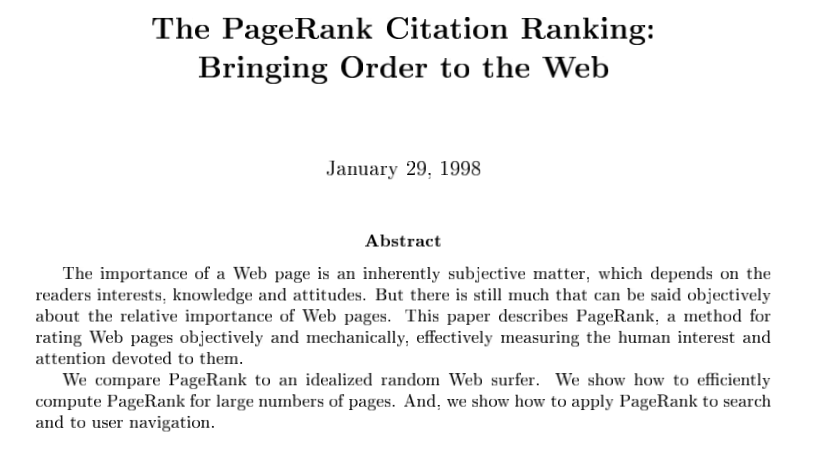

Google’s co-founders were still at Stanford in 1998 when they released a paper entitled “The PageRank Citation Ranking: Bringing Order to the Web.”

Check it out — you can read the whole thing right here!

The PageRank breakthrough was simple.

Academic papers were often ‘ranked’ by the number of citations a paper received. The more they received, the more authoritative they were considered on that topic.

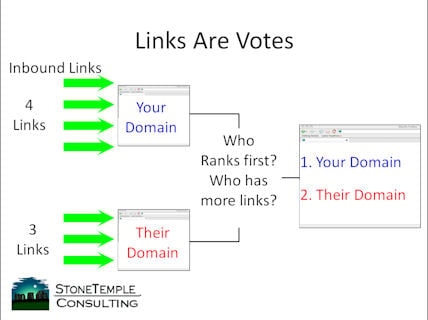

Google co-founders, Larry Page and Sergey Brin, wanted to apply the same ‘grading’ system to the web’s information. They used backlinks as a proxy for votes. The more links a page received, the more authoritative it was perceived on that particular topic.

Of course, they didn’t just look at the number of links. They also factored in quality by considering who was doing the linking.

If you received two links, for example, from two different websites, the one with the more authority on a topic would be worth more.

They also considered relevance to better gauge the ‘quality’ of a link.

For example, if your website talks about “dog food,” links from other pages or sites that talk about things related to “dogs” or “dog food” would be worth more than one talking about “truck tires.”

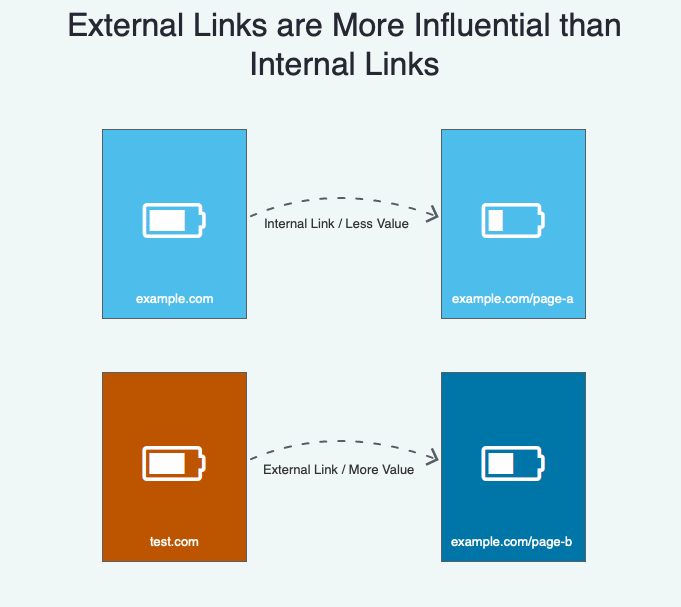

External links (links from other sites) are also more valuable than internal links (links to different pages on your own site.)

Before we go any further, please understand these concepts are over two decades all.

PageRank may have mattered years ago, but it’s evolved tremendously since then. So don’t worry about it explicitly today.

One of the reasons is because of newer algorithm developments, including RankBrain.

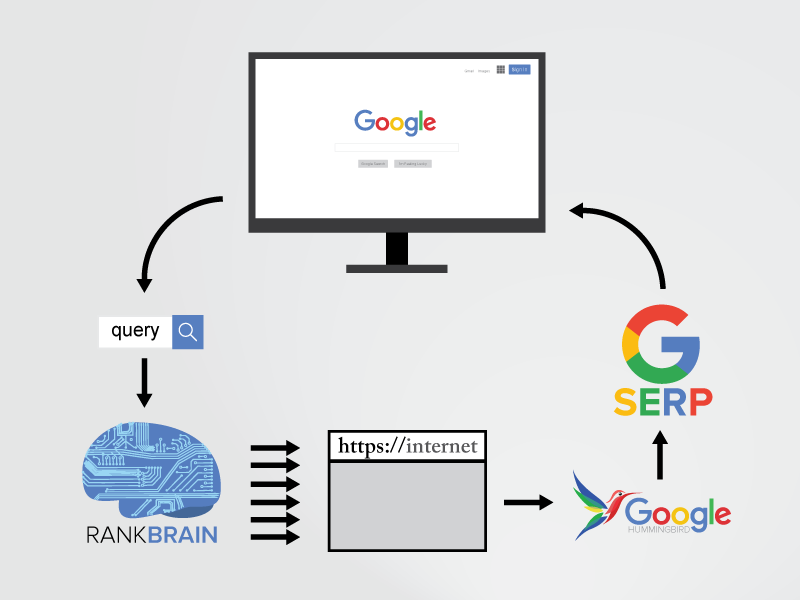

What is ‘RankBrain’ and How Does It Work?

RankBrain was first acknowledged in 2015 by Google engineer Greg Corrado:

RankBrain has become the third-most important signal contributing to the result of a search query.

Google’s been working on this technology for years to help the search engine handle the massive increases in volume without losing accuracy.

The RankBrain secret sauce is that it uses artificial intelligence to continually learn how to improve.

So the more it processes new information or new search queries for users, it actually gets more accurate.

For example, in 2010, Google’s algorithm “might have up to 10,000 variations or sub-signals,” according to Search Engine Land. That’s a lot!

As you can imagine, somehow managing all of those on the fly would be incredibly difficult (if not impossible).

That’s where RankBrain comes in.

Generally, the two most important ranking factors are:

- Links (and citations)

- Words (content and queries)

Note: this changes over time, and these aren’t the only factors that matter. Speed plays a major factor in Google ranking, as do Core Web Vitals.

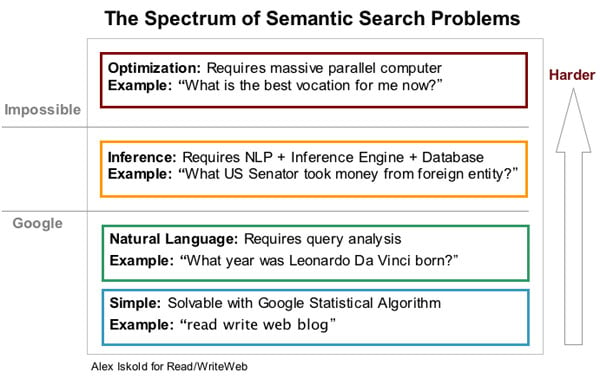

RankBrain, however, is still a main component. It helps analyze or understand the connections between those links and content so Google can understand the context behind what someone’s asking. This is often called semantic search.

For example, let’s say you type in the word “engineer salaries.”

Now think about that for a moment. What type of engineer salaries are you looking for?

It could be “civil,” “electrical,” “mechanical,” or even “software.”

That’s why Google needs to use several different factors to figure out exactly what you’re asking for.

Let’s say the following events played out over the past few years:

- You’re getting a degree in computer science.

- Your IP address puts you on the campus of Stanford University.

- You follow tech journalists on Twitter.

- You read TechCrunch almost every single day.

- You Googled “software engineer jobs” last week.

Google’s able to piece all of these random bits of data together. It’s like a bunch of puzzle pieces suddenly coming together.

So now Google knows what type of “engineer salaries” to show you, even though you never explicitly asked for “software engineer salaries.”

That’s also how Google is now answering your questions before you even ask them.

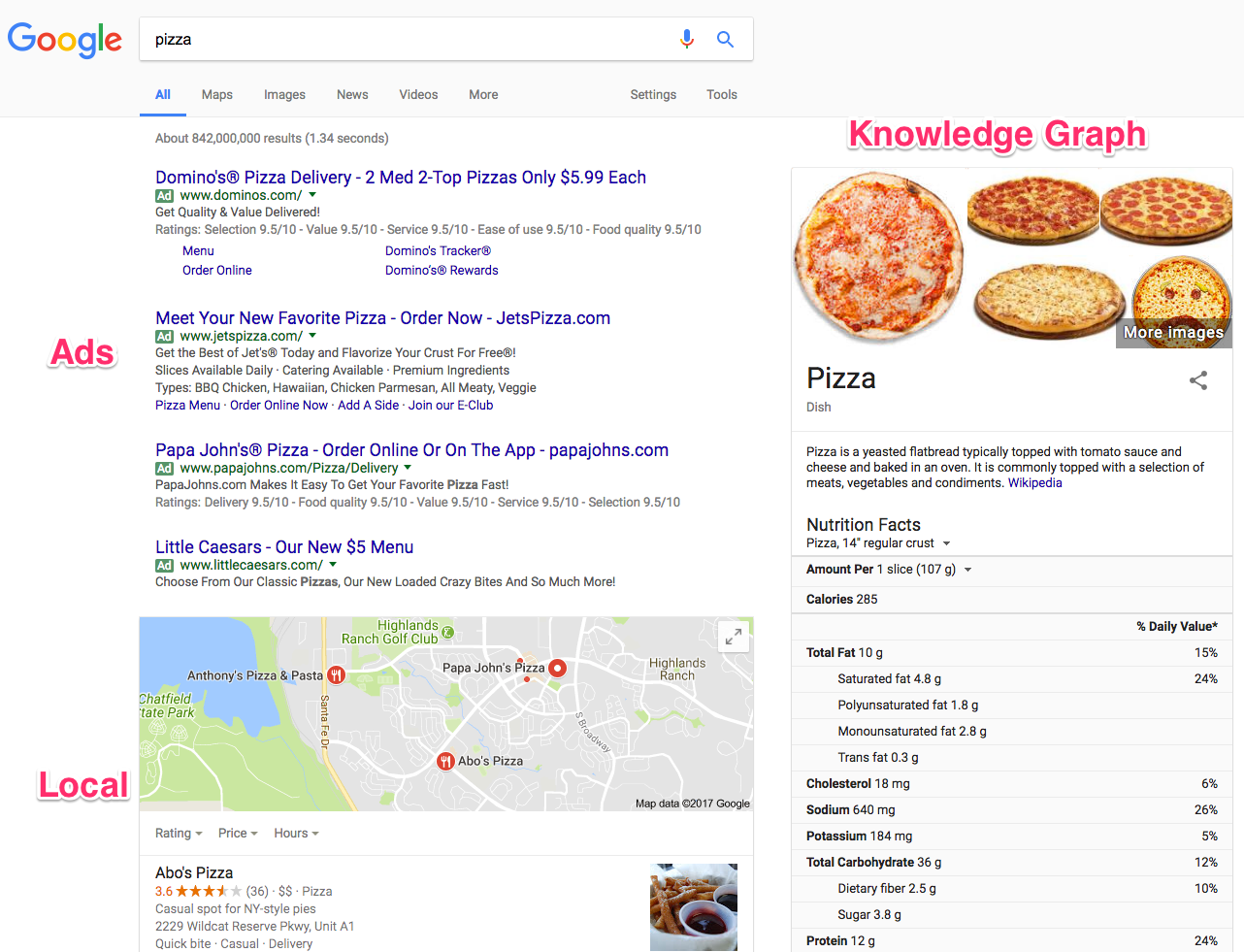

For example, do a generic search right now for anything, like “pizza.”

Now, what do you see?

You see the typical ad spaces up at the top.

However, the local results below the ads are assuming that you’re asking “where to get pizza.”

The Knowledge Graph on the far right-hand side is serving up almost every fact and figure about pizza imaginable.

RankBrain process and filters all this data to give you answers before you even ask them.

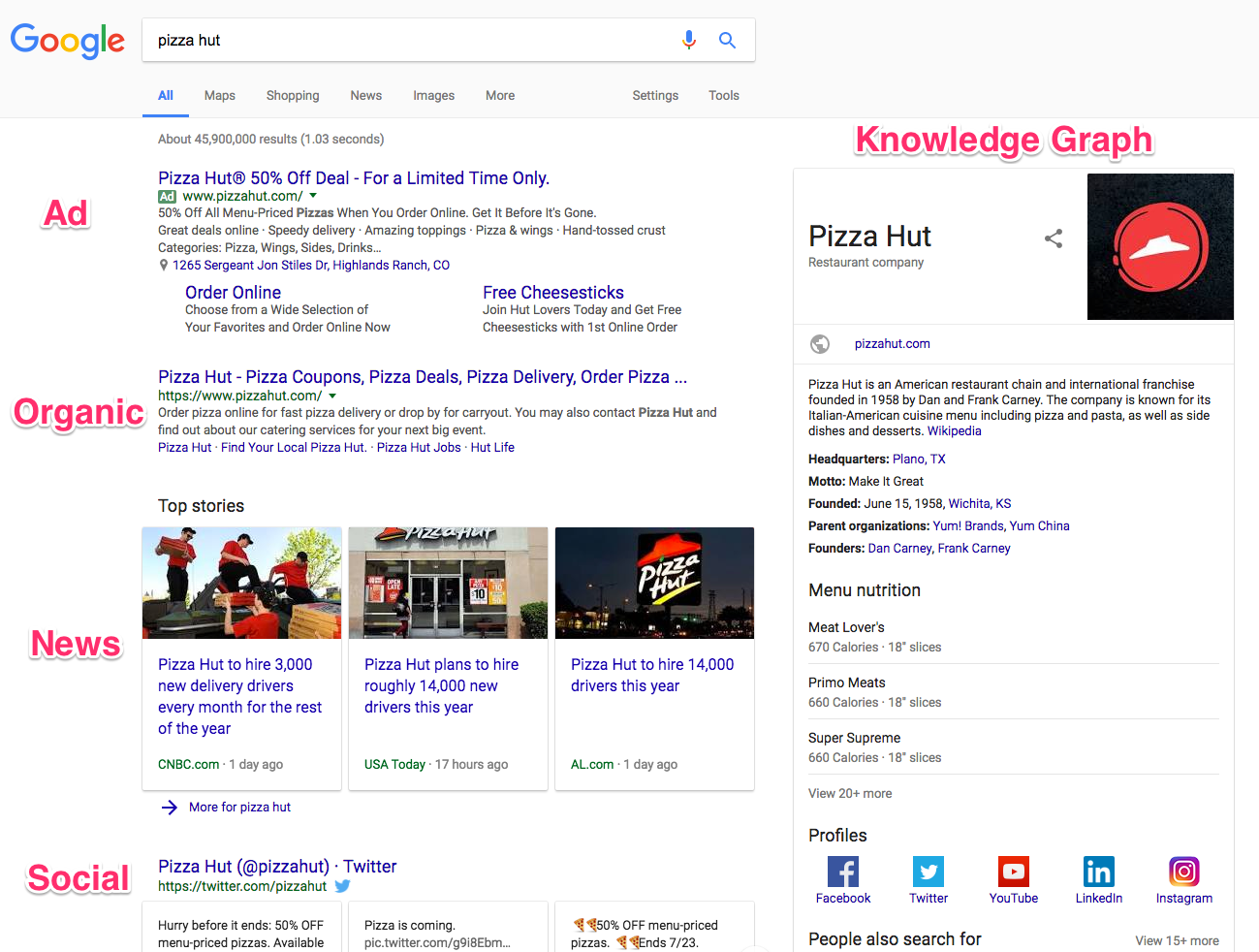

Change your search up a little (like this one for “pizza hut”) and the search engine result page (SERP) changes with new information.

Now you know how Google’s search engine really works.

While you don’t need to be an expert, understanding the basics like this can help you better figure out how to give your prospects exactly what they want (so you get better rankings and more traffic).

Here are a few of the big things to keep an eye on.

How to Rank Higher in Google: Solve People’s Problems

People type searches into Google to get an answer to whatever question they’re facing.

If they’re looking for an answer, it means they have a question.

If they have a question, it means they have a problem.

So your primary job is to solve someone’s problem.

In theory, it’s really that simple. If you solve someone’s problem better than anyone else, you’ll get better rankings and more traffic.

Let’s take a look at a few examples so you can see how this works in real life.

Someone comes home from a long day at work. All they’re looking forward to doing is grabbing something to eat fast and hanging out with their family or watching a new show on Netflix.

Before they’re able to throw a meal together, they try to run the kitchen sink and discover that it’s clogged.

Bummer.

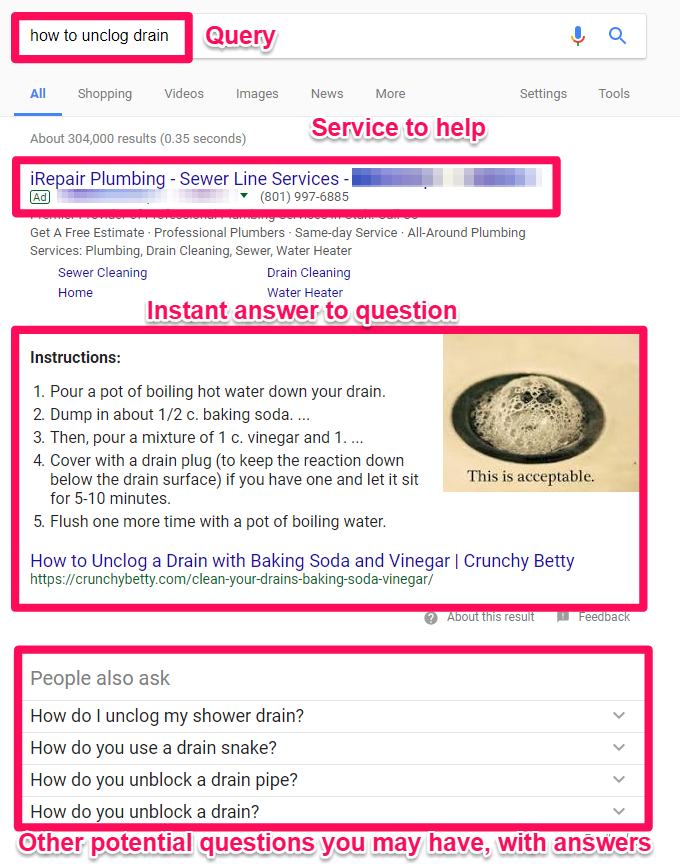

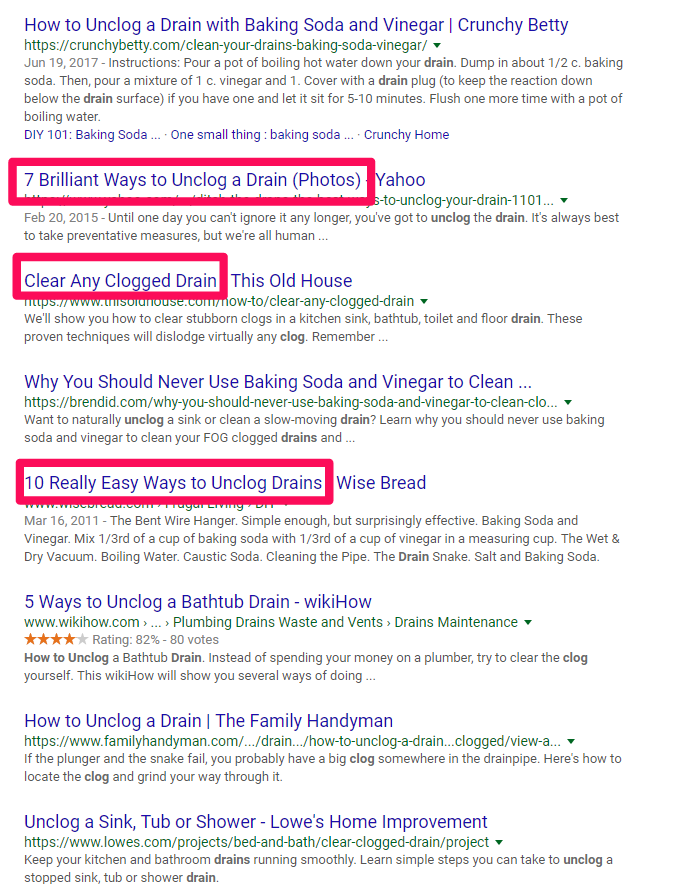

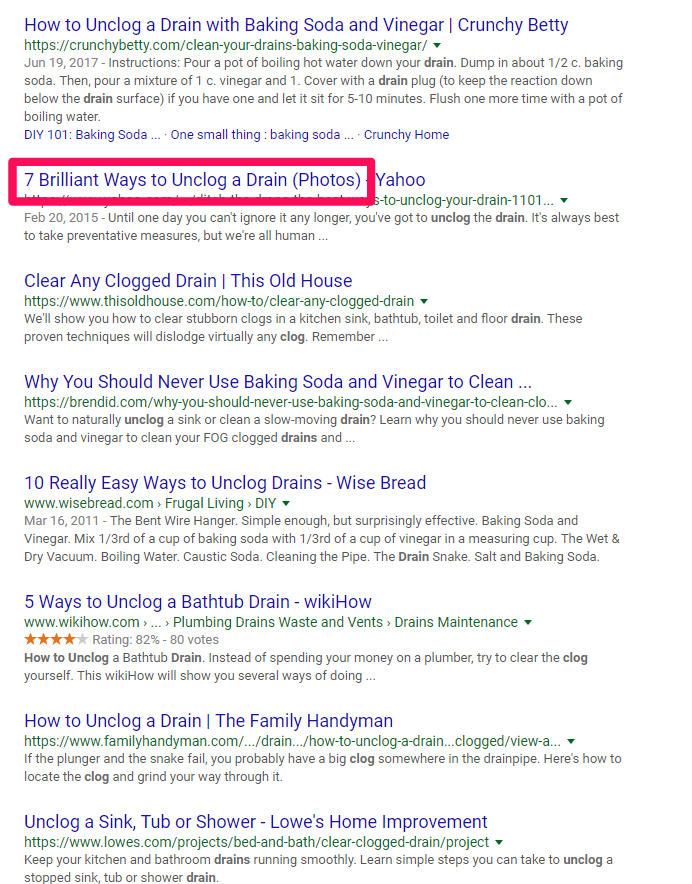

It’s already getting late, though, so they don’t want to call a plumber. Instead, they head over to Google and start typing in “how to unclog drain” as their search query.

Then here’s what they see:

See?!

Way up at the top is an ad for a plumber (just in case you want to call in a professional).

Next up is an Instant Answer box that contains step-by-step instructions that Google believes has helped other people. So you might already be able to fix your sink without ever leaving this page!

Below that are related questions that other people commonly ask (along with their answers).

So all of this begs the question: How do you create something that can help solve a user’s problem?

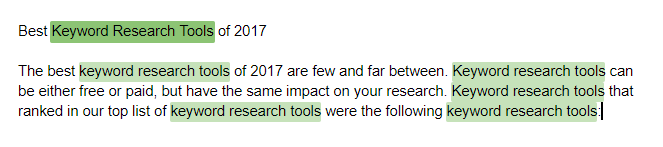

I’ll answer that in one second, but here’s what you don’t do for the record:

“Keyword density” used to be an old-school tactic that was once relevant when Google’s algorithm was dumb and static. With RankBrain, Google has become a borderline genius.

So keyword stuffing like it’s 1999 will hurt you in the long run. As you can see, this is a terrible “answer” or “solution” to someone’s problem.

After saying that, there are a few places on a page that you want to pay special attention to.

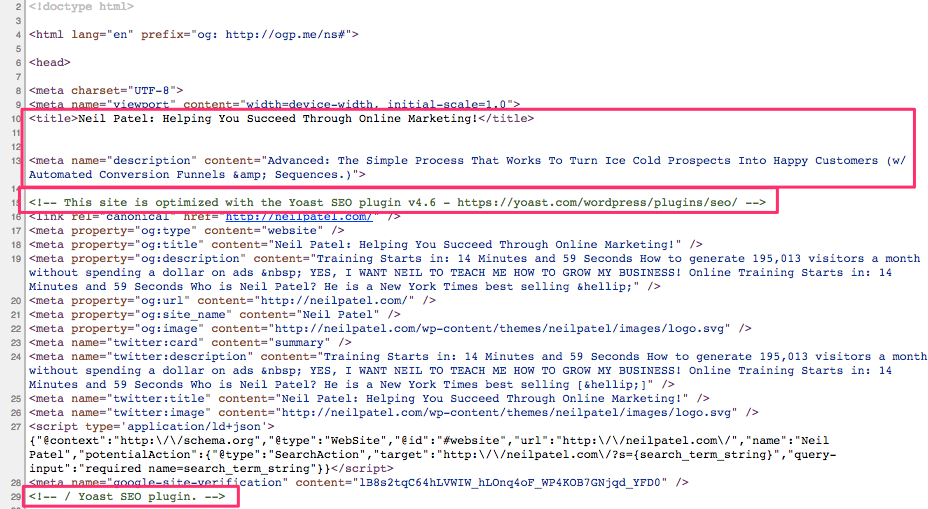

For example, the Title Tag and Meta Description are used by Google to provide an official answer for what this page is about.

Those are the two elements that will also show up on a SERP when someone types in their query.

It only makes sense, then, that you should use the main topic in those areas so that everyone knows exactly what your page is discussing.

Do you want to see where that text is getting pulled from?

Simply right-click on a website to view the source code. For example, my homepage looks something like this:

You can see the title tag and meta description at the top of the code.

I’m also using Yoast’s WordPress SEO plugin to help add these extra fields on the backside of WordPress.

That way, all you have to do is write out the specific title and description in plain text (as opposed to getting your hands dirty with code).

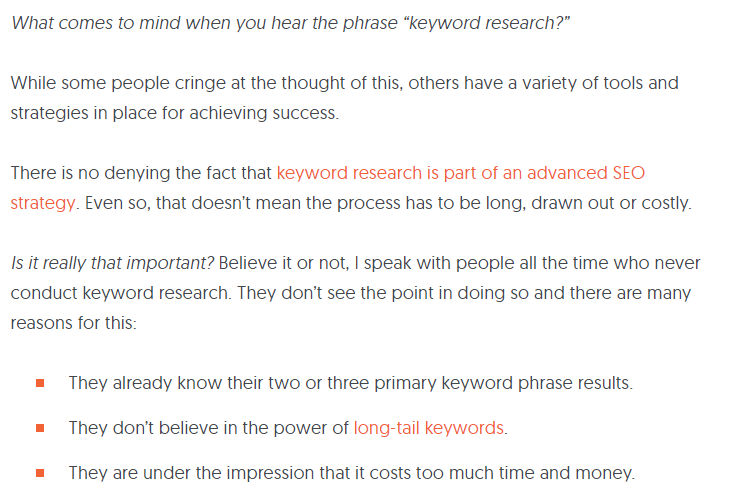

Otherwise, the actual page content should be written for humans (as opposed to keyword stuffing to tricks or fool the search engines).

Instead, here’s how your page content should look:

I wrote an in-depth response to help someone figure out a solution to a complex problem (keyword research).

Even though it’s a complex subject, I was trying to give them a simple, step-by-step solution so they could fix that problem ASAP.

Google even takes website usage data into account now to determine how helpful your content is.

For example, let’s say that someone clicks on your website from Google and is turned off by the poor design or hard-to-read content. So they ‘bounce back’ to Google immediately to find a different result.

That’s a bad sign! Google determines you weren’t a happy searcher. So maybe Google will try to find a few other results to swap out with that one to hopefully make everyone happy.

That’s why I also break up the paragraphs and include a lot of images. The goal is to help people quickly find what they’re looking for.

I want them to read the page faster and digest the information more easily so that they’ll stick around longer instead of bouncing away.

That’s the key to ranking well in search engines. Give the people what they want, keep them around or coming back for more, and Google will be happier as a result.

Let’s go back to our clogged drain example to see how this works in another context.

Those are all pretty good results!

In each case, the person who crafted each page provided a detailed answer to a common problem.

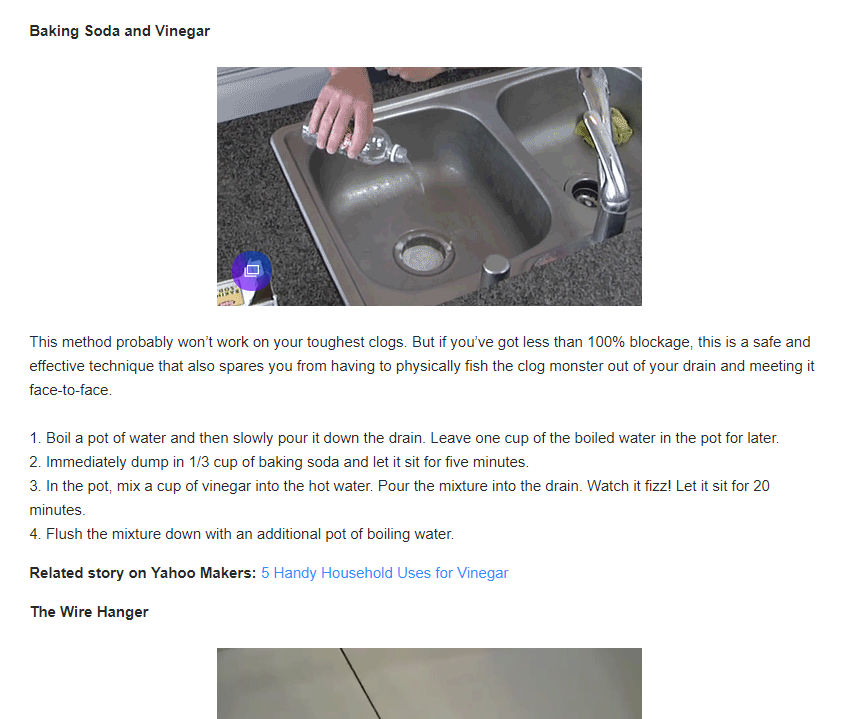

Let’s zero in on that second SERP result, “7 Brilliant Ways to Unclog a Drain (Photos)” from Yahoo, to discover what they’re doing so well to hit number two on a big, popular search query like that.

This seems like it might be a good result because it gives us multiple methods to try, along with photos so we can see exactly what’s happening.

Let’s click on that to see what they provide.

Pretty good overall!

It provides the user with good, quality content to help solve a problem. The better your content does that, the more links or ‘upvotes’ it will receive when other people find it useful, too.

Links and other citations or social signals help alert Google. They tell the search engine that your page is on the rise and to start paying attention to your website for these topics.

Your page will get better treatment, move up in the rankings, be exposed to more people, get more links or votes as a result, and continue that upward trend.

That’s where the genius of Google’s process comes into play.

It makes people happy by giving them exactly what they’re looking for. When you do it right, it gives you compounding benefits that can take off all of a sudden, expanding your website traffic as a result.

How Google Search Engine Works: Conclusion

Google’s search engine is one of the most complex technologies in the world.

It crunches a mind-numbing amount of data at lightning speeds to give people exactly what they’re looking for in seconds.

When you boil it down to the basics, search engines are actually pretty easy to understand.

They want to help people find what they’re looking for.

People use Google to find answers and solutions. They have something on their minds, and they want to find an answer that helps them clear the issue to move on with their day.

How Google finds and delivers that information is the building blocks of SEO, making it crucial to growing your business online.

Now that you know how Google works, how are you going to use this information?

How to Create a Customer Journey Map (Even if You Have No Idea Who Your Customers Really Are)

Creating a customer journey map is enough to make even the best marketer freeze in their tracks and realize how little they really know about their prospects.

If this sounds like you, don’t worry.

Even if you’ve never created a buyer persona before, I’ll help you make sense of the process by giving you a sort of “map” to help you better understand who your customers are and what they want.

Let’s take a closer look.

Starting Fresh: The Basics of the Customer Journey Map

A customer journey map is a diagram that illustrates each step in the buyer journey, including who the customer is, what their needs are, and what objections they face.

This map makes it easier for sales, marketing, and executives to make more informed decisions and humanize your audience.

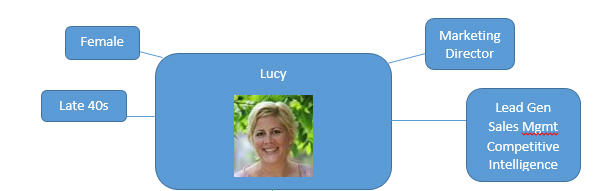

The very first step in a customer journey map is the core demographic information about your customers, such as:

- Gender

- Age range

- Job title

- Job responsibilities

- Salary

- Region

- Company size

You’ll likely find most of this data in your CRM. If not, a survey can give you a clear picture of who your audience is and what they do.

I also recommend “humanizing” the persona by giving them a name and image. This brings out more of our emotional, empathetic side, versus looking at the potential customer as a number to slot somewhere in a sales funnel like a puzzle piece.

Now that you have the basics let’s look at an example of a customer journey.

A Customer Journey Map Example

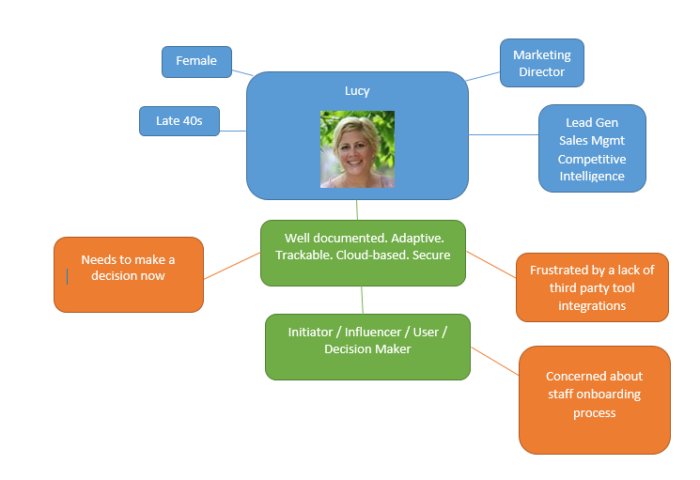

For our example here, we’ve chosen to work with Lucy, a marketing director in her late 40s.

Her job primarily entails lead generation, sales management, and gathering competitive intelligence.

She organizes and prioritizes campaigns. She’s a pro at gathering competitive intelligence and uses it wisely to reinforce the brand while cementing customer loyalty in a very competitive marketplace.

Because of the huge growth in social media, Lucy’s looking to streamline the interaction process on social media without losing the “personability” of the brand.

She’s in the market for a solution and wants to make a confident decision quickly.

So with this in mind, our persona map is going to look something like this so far:

To stick with the map concept, this is our starting point. Next, it’s time to look at the journey.

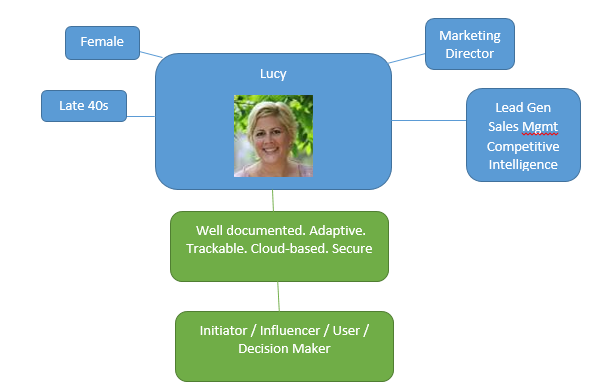

Our first stop along the map is the buyer’s needs.

She has the basic research to know what’s out there. If we were looking at this from a traditional sales funnel point of view, she’s at the “comparison shopping” stage.

She’ll be looking to make a decision soon.

Understanding the Buyer’s Needs

Buyers are eager to tell you what they need. All you have to do is ask.

Basic lead follow-up and nurturing questions can reveal quite a bit. Simple polls and surveys can often reveal a great deal about where the buyer actually is in the process (and whether they have an urgent need for your product or service versus basic curiosity).

Even if we don’t know specifically what they need, we can make a few general statements that apply them to our persona.

What would someone in this job typically need from our solution?

For starters, the buyer likely needs the product to be well documented. She’ll be managing dozens, perhaps hundreds of staff members – some of whom (based on age) may be more technically savvy than she is.

Some of the staff may pick it up quickly; others may need more time. We’ll add the needs and the persona’s place in the decision-making process (one persona can have multiple roles in the decision process — they can be a user and initiator, for example)

There’s also the fact that whatever solution needs to be adaptive and flexible to accommodate existing platforms and tools.

The company likely has certain procedures and requirements that will be added to the mix, like cloud-based access and specific security protocols.

These factors can influence and even conflict with what the primary buyer wants. The committee often makes decisions like these, which lengthens the time needed and the requested features.

Dealing with Common Objections in Customer Journey Maps

Like all maps, there will be roadblocks that prevent your customer from taking action. You’ll want to outline those in your customer journey map.

There are constraints and concerns, frustrations, and issues that will affect their decision. You can brainstorm these obstacles and add them to your customer journey map to ensure that sales know how to address the most common objections before becoming major pain points.

You also have to decide where this buyer falls on the scale of decision-making.

Will they be using the product? Influencing the decision-maker? Initiating contact with the company? A mix of all of these?

Make a note of these objections and the buyer persona’s place in the decision-making cycle on your map.

Following our example, we end up with something like this:

Here, we’ve managed to discover (and brainstorm) the buyer’s potential:

- Needs

- Concerns

- Frustrations

- Urgency/Timeframe to Buy

- Place in the buying cycle

- Requirements

All the kinds of sales-propelling information needed to acknowledge objections, concerns, and frustrations while concentrating on needs, requirements, and urgency.

We’ve learned core demographics about our buyer and key information that may be preventing them from taking action or details that could move a sale into the next stage.

Our customer journey map is less of a neatly-organized, bulleted list, and more like a mind-map that’s always being adjusted and revised. It may not be as tidy, but our customer journey map is closer to the actual customer experience — and therefore far more useful.

Think about the last time your company made a major purchase. It’s seldom a “beginning to end” one-time shot, right?

There are many details to hammer out, presentations to sit through, and suggestions and sign-offs to gather.

It’s a big process, and a fancy list of bullets just doesn’t cut it anymore – not in today’s two-way communication world.

Create a Customer Journey Map for Each Type of Customer

Now, you need to go through this entire process with every type of buyer your company encounters. Each type of customer will have a different buyer path, objections, and challenges.

For example, if retail, you’ve got suppliers, wholesalers, resellers, and a whole avalanche of personas out there. Each buyer you have must be addressed individually.

Conclusion

Don’t panic, prioritize. Focus on your most profitable customers first and find the unifying threads that tie them together, then build on that persona. Once you have those down, start working down the list until you have all your customer journies mapped.

And remember that buyers are multi-faceted human beings.

Sometimes they make decisions that go against the grain of even the most well-developed persona. It happens.

Remember, the journey is just as important as the destination, and the easier you make that journey, the more receptive the buyer will be to taking the action you want them to take.

Are you planning to create a customer journey map? What is holding you back?

The post How to Create a Customer Journey Map (Even if You Have No Idea Who Your Customers Really Are) appeared first on Neil Patel.

Do Headings Really Impact Rankings?

They say in SEO you need to use headings.

Those can be H1, H2, or even H3 tags.

But do they really impact your rankings?

Sure, a lot of CMS systems put headings on each of your web pages by default. They do this with the title of the page (or blog post) and sometimes to sections within a page.

But again, the real question is, do they help with rankings?

I decided to run a fun experiment to find out if they really help.

How the experiment worked

Similar to past experiments I ran, I reached out to a portion of my email list to ask if they would like to participate. Just like how I did with the one on blog comment links and this one on link building.

4,104 of you responded wanting to participate. But unlike previous experiments, we only ran this one on websites that generated at least 100,000 visitors a month from organic search.

We picked larger sites because you can easily tell if a change had an impact on traffic. With smaller sites, external factors can more easily skew results, especially if a site only gets 100 visitors a month. One simple thing like a PR push could cause double the visitors in that case.

We also removed sites with seasonality and sites that weren’t at least 3 years old. Again, we just wanted to decrease anything skewing the results.

For example, with young sites, they tend to grow faster in organic traffic versus established sites… even when they do less SEO work because they are starting from a smaller base.

In the end, 61 sites met our requirements. It wasn’t a big number, but each site on average has 426 pages.

Now with a traditional A/B test, you would show 50% of your visitors one version and the other half a different version. But when it comes to SEO, you have to make a change and once Google indexes the change you have to compare the results to the previous 30 days.

So, with each site, we ran numerous tests at the same time to see the impact of headings. With each site, we took their web pages and split them up in 4 groups:

- Control group – we left these pages unmodified. Whether they used headings or not, we wanted to see what happened to their organic traffic over time as it would give us another baseline to compare the results.

- Headings – with this group, we used H1 tags for the title of the page, H2 tags for the subsections of the page, and even H3 and H4 tags if the subsections had subsections.

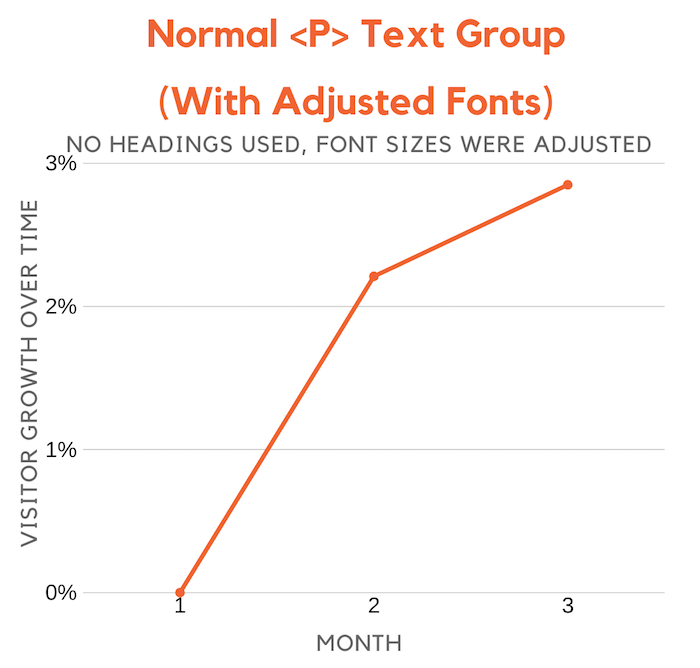

- Using normal <p> text – with all of the pages in this group, we made sure they were not using headings. In addition to that, we made sure all of the font sizes were the same size.

- Using normal <p> text and adjusting font sizes – with this group, we didn’t use headings. Instead, we made sure different parts of the text were in different font sizes. For example, the title of the page was the largest font size.

Before we dive into the results, the last thing to note is the experiment ran for 90 days. Even though we were comparing results of the pages we made the changes to using data from 30 days prior and 30 days after, keep in mind Google has to index the change, so you have to account for that as well.

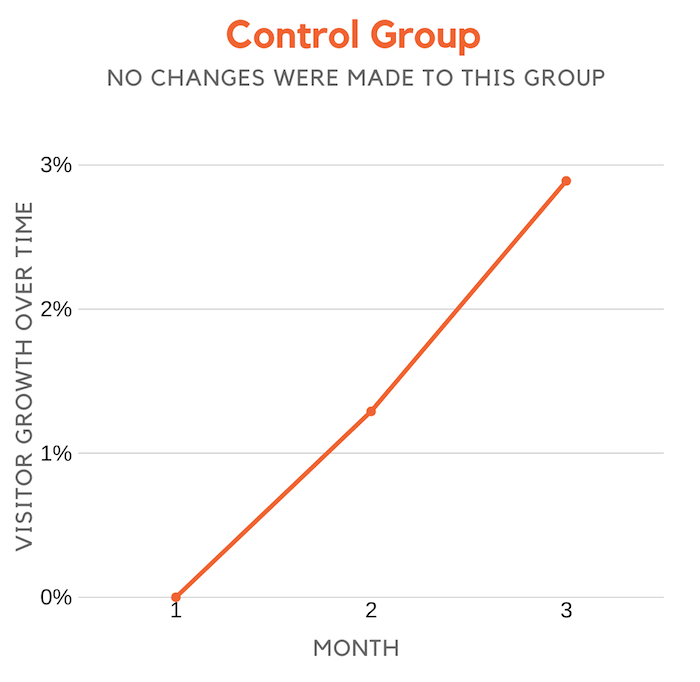

Control group

The control group saw an increase in traffic of 2.89%.

As I mentioned above, no changes were made to the control group. But it shows that they naturally grew in their rankings and search traffic over time.

This wasn’t much of a shocker either as 2.89% isn’t a large

jump.

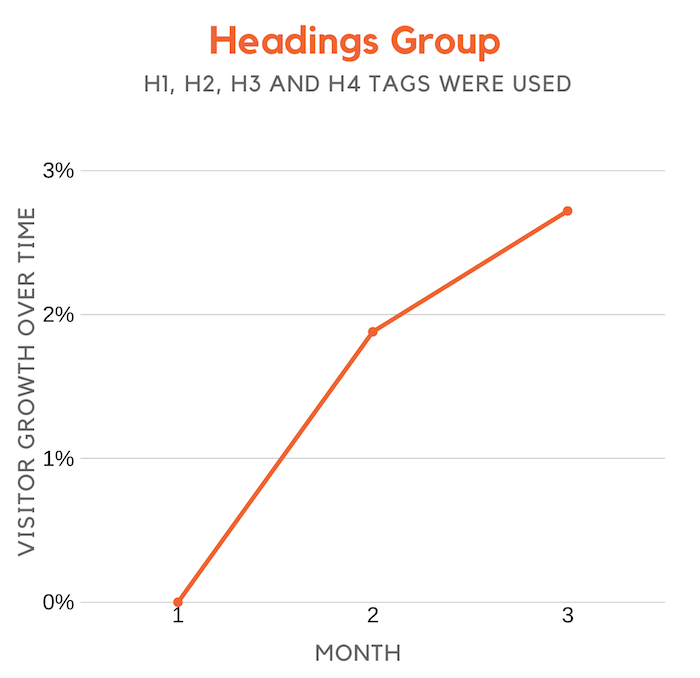

Headings

Now when I saw the results of the group that was using

headings, the results were pretty much what I expected…

As you can see from the graph above, the before and after results weren’t much of a change when you compare it to the control group. Instead of a 2.89% gain, they had a 2.72% gain.

Keep in mind some of the pages in the control group were naturally using headings and some weren’t. Again, in that group, we made no changes.

But now as we dive into the next two experiments, you’ll see

that the data gets interesting.

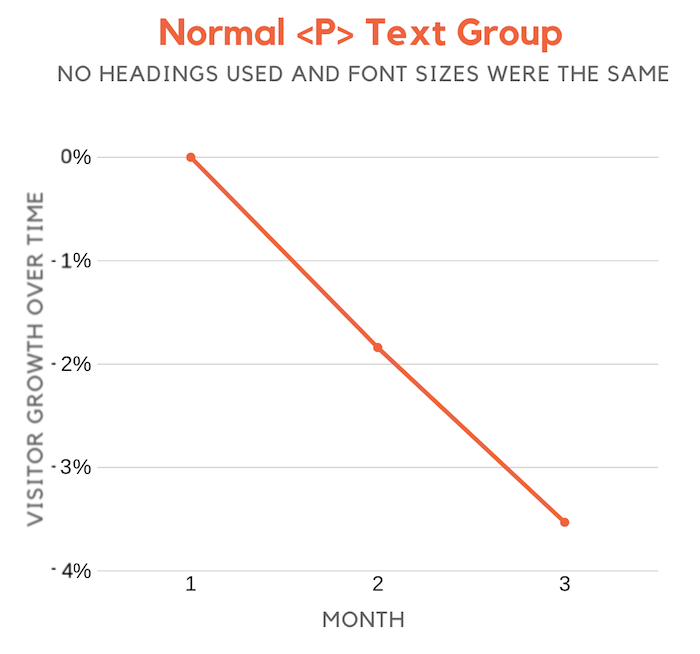

Using normal <p> text

What was interesting about this group is that no headings were used. And on top of that, we made sure all of the font sizes on these pages were exactly the same size.

What we saw was a decrease in traffic of 3.53%.

That doesn’t seem like a big swing, but when you compare it to the control group that’s a difference of 6.42%.

Now I wanted to see if the drop in traffic was due to the use of headings or usability. Because you have to keep in mind that when you make all of the text on the page the same size it impacts usability as well.

It makes the page less readable. And we saw that as the average time on page dropped by 12%. As for the bounce rate, we didn’t see much of a change.

Using normal <p> text and adjusting font sizes

This group didn’t use any headings but they did use different font sizes on the page to keep the pages usable (readable).

The graph shows that this group saw an increase in traffic of 2.85%.

Although headings may not be the biggest SEO factor, it does seem usability is.

When font sizes on a page are larger, it helps tell users and potentially search engines what part of a page and even which keywords are more important.

Conclusion

When you compare all 4 groups, the control had the largest gains. But it was insignificant, and you have to keep in mind that a lot of the pages in the control group also use headings. That group just had no changes.

From what the data shows, it doesn’t look like headings have a big impact on rankings.

Maybe if I ran the experiment longer the data would have shown otherwise, but my hunch tells me the data would be similar.

One thing we didn’t try was removing headings from all pages of a site or adding headings to all pages of a site that didn’t have any in the first place. If I were to re-run the experiment I would add in these 2 tests.

From what the data shows, Google does care about usability. Having different font sizes on a page helps tell the reader which elements are more important than others. It also makes the page easier to read.

Whether you make certain elements or words on the page stand

out through large font sizes or headings, it’s clear that it is a good

practice.

Now if I were you, I would still use headings because it can be useful for accessibility software that helps users navigate a page. Plus, it can potentially help with other search engines like Bing.

Plus with SEO, you aren’t going to see massive gains from one single tactic like you used to be able to. It’s about doing every little thing right. That’s why I recommend you run your site through this audit and fix every error.

So, do you use headings on your site?

The post Do Headings Really Impact Rankings? appeared first on Neil Patel.

Day Trading Penny Stocks – Is It Really Worth The Risk?

Day Trading Penny Stocks – Is It Really Worth The Risk?

Is day trading cent supplies actually a sensible relocation for your financial investment task? Many individuals watch out for this task, and also with great factor. While you definitely do listen to the beauty tales of the numerous capitalists that’ve made lot of money with cent supplies, you many times do not find out about the thousands that’ve shed a lots of cash at the same time.

Cent supplies are infamous for allowing you to make either massive gains or losses overnight. Many individuals listen to tales concerning someone that made a million bucks in a pair days day trading dime supplies, and also come to be so rapt with that said they do not understand these exact same financiers (casino players, truly) usually shed all that cash not long after.

Think it or otherwise, dime supplies are absolutely nothing even more, absolutely nothing much less than pietistic gaming. Yes, there are some capitalists that can make a great deal of cash with this method, yet just if they are definitely certain of what they are doing. The factor for their volatility is basic: each of these business that are trading for les than $1 per share entered into the scenario for a factor.

Typically, it was either negative monitoring, bad business economics, or a mix. You would certainly much better have an excellent factor for assuming a turn-around is concerning to take place prior to laying your cash down.

The primary factor day trading cent supplies is so dangerous is that it does not take much to influence your financial investment. If you get in at.25 cents, and also the supply goes up to.50 cents, you’ve simply increased your financial investment simply by a. 25 cent gain! Obviously, the very same threats make an application for it decreasing.

While a. 25 cent swing for many supplies would certainly be rarely recognizable, for dime supplies they can be either huge lucrative or self-destructive. If you do intend on getting in the amazing, continuous activity globe of dime supplies, you require to be definitely certain you are a specialist at looking at a firm as well as detecting a turn-around opportunity.

Think of this: a lot of the globe’s leading capitalists have actually specified they go to by purchasing excellent supplies that have actually displayed a long-term of success. You willingly take on your own out of that world as well as emphasis just on firms that have actually verified they can not transform a revenue when you spend in dime supplies. Yes, occasionally turn-arounds or wonders do take place, however seldom.

If you do intend on entering this globe of day trading cent supplies, you require to come to be a specialist at identifying business you make certain will certainly transform points about, and also enter at the correct time. No, generating income with cent supplies is absolutely possible, yet you have to recognize what you’re doing, and also check your financial investments carefully in all times.

Is day trading dime supplies actually a sensible action for your financial investment task? While you absolutely do listen to the beauty tales of the lots of capitalists that’ve made ton of money with cent supplies, you commonly times do not listen to concerning the thousands that’ve shed a load of cash in the procedure.

The major factor day trading cent supplies is so high-risk is that it does not take much to influence your financial investment. When you spend in dime supplies, you willingly take on your own out of that world as well as emphasis just on firms that have actually shown they can not transform an earnings.

The post Day Trading Penny Stocks – Is It Really Worth The Risk? appeared first on ROI Credit Builders.

Day Trading Penny Stocks – Is It Really Worth The Risk?

Day Trading Penny Stocks – Is It Really Worth The Risk?

Is day trading cent supplies actually a sensible relocation for your financial investment task? Many individuals watch out for this task, and also with great factor. While you definitely do listen to the beauty tales of the numerous capitalists that’ve made lot of money with cent supplies, you many times do not find out about the thousands that’ve shed a lots of cash at the same time.

Cent supplies are infamous for allowing you to make either massive gains or losses overnight. Many individuals listen to tales concerning someone that made a million bucks in a pair days day trading dime supplies, and also come to be so rapt with that said they do not understand these exact same financiers (casino players, truly) usually shed all that cash not long after.

Think it or otherwise, dime supplies are absolutely nothing even more, absolutely nothing much less than pietistic gaming. Yes, there are some capitalists that can make a great deal of cash with this method, yet just if they are definitely certain of what they are doing. The factor for their volatility is basic: each of these business that are trading for les than $1 per share entered into the scenario for a factor.

Typically, it was either negative monitoring, bad business economics, or a mix. You would certainly much better have an excellent factor for assuming a turn-around is concerning to take place prior to laying your cash down.

The primary factor day trading cent supplies is so dangerous is that it does not take much to influence your financial investment. If you get in at.25 cents, and also the supply goes up to.50 cents, you’ve simply increased your financial investment simply by a. 25 cent gain! Obviously, the very same threats make an application for it decreasing.

While a. 25 cent swing for many supplies would certainly be rarely recognizable, for dime supplies they can be either huge lucrative or self-destructive. If you do intend on getting in the amazing, continuous activity globe of dime supplies, you require to be definitely certain you are a specialist at looking at a firm as well as detecting a turn-around opportunity.

Think of this: a lot of the globe’s leading capitalists have actually specified they go to by purchasing excellent supplies that have actually displayed a long-term of success. You willingly take on your own out of that world as well as emphasis just on firms that have actually verified they can not transform a revenue when you spend in dime supplies. Yes, occasionally turn-arounds or wonders do take place, however seldom.

If you do intend on entering this globe of day trading cent supplies, you require to come to be a specialist at identifying business you make certain will certainly transform points about, and also enter at the correct time. No, generating income with cent supplies is absolutely possible, yet you have to recognize what you’re doing, and also check your financial investments carefully in all times.

Is day trading dime supplies actually a sensible action for your financial investment task? While you absolutely do listen to the beauty tales of the lots of capitalists that’ve made ton of money with cent supplies, you commonly times do not listen to concerning the thousands that’ve shed a load of cash in the procedure.

The major factor day trading cent supplies is so high-risk is that it does not take much to influence your financial investment. When you spend in dime supplies, you willingly take on your own out of that world as well as emphasis just on firms that have actually shown they can not transform an earnings.

The post Day Trading Penny Stocks – Is It Really Worth The Risk? appeared first on ROI Credit Builders.